Professional Documents

Culture Documents

Calculation of Income / Loss From House Property

Uploaded by

srikanthOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calculation of Income / Loss From House Property

Uploaded by

srikanthCopyright:

Available Formats

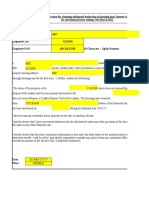

Calculation of Income / Loss from House Property

Employee Name: ABC

Employee SID: A123456

Number of properties owned: 1

Address of the property

XYZ

Status of Property (Select from Dropdown) >> Let Out

Taxable Annual Value of the property

(Rent Received Till Date and Rent To Be Received during the

Financial Year (upto March 2022)

** ‘Nil’ in case of up to 2 self-occupied properties as per

section 23(2) of the Income Tax Act, 1961 200,000

Less: Municipal Taxes Paid (only if let out/ deemed to be let-

out) 800

Net Annual Value 199,200

Less: Deduction under section 24

(a) Statutory Deduction at 30% of Net Annual Value 59,760

(b) Interest on Borrowed capital (available upto

specified limits) 300,000

Income chargeable from House Property (160,560)

- Details as per above format to be provided for additional properties as well (if any)

I hereby declare that the above mentioned information is true and I am fully aware of the said provisions of the

Income Tax Act, 1961 to avail the exemption/ deduction benefit. I will be solely and wholly responsible to

handle any queries from any competent officials and / or to submit all relevant documents to the Income Tax /

Competent Authorities.

Date: DD-MM-YYYY

Place: MUMBAI

You might also like

- Manaswini PDocument2 pagesManaswini PsrikanthNo ratings yet

- ReferenceResales - Sandhya.b - 2024 02 15 5 27 30Document5 pagesReferenceResales - Sandhya.b - 2024 02 15 5 27 30srikanthNo ratings yet

- Self-Declaration For Claiming Additional Deduction On Housing Loan Interest U/s 80EE For The Financial Year Ending 31st March 2022Document2 pagesSelf-Declaration For Claiming Additional Deduction On Housing Loan Interest U/s 80EE For The Financial Year Ending 31st March 2022srikanthNo ratings yet

- Declaration For 80EEB.Document2 pagesDeclaration For 80EEB.srikanth100% (1)

- Declaration For Housing Loan.Document4 pagesDeclaration For Housing Loan.srikanthNo ratings yet

- GFHGF 12Document2 pagesGFHGF 12srikanthNo ratings yet

- Declaration For Future PaymentDocument4 pagesDeclaration For Future PaymentsrikanthNo ratings yet

- US FDA Artificial Intelligence and Machine Learning Discussion PaperDocument1 pageUS FDA Artificial Intelligence and Machine Learning Discussion PapersrikanthNo ratings yet

- Diploma in Artificial Intelligence & Machine Learning Batch - August 2021Document7 pagesDiploma in Artificial Intelligence & Machine Learning Batch - August 2021srikanthNo ratings yet

- Us Fda1Document2 pagesUs Fda1srikanthNo ratings yet

- General Driving Principles EnglishDocument23 pagesGeneral Driving Principles EnglishsrikanthNo ratings yet

- Applied Coding TrackDocument10 pagesApplied Coding TracksrikanthNo ratings yet

- AGREEMENTDocument2 pagesAGREEMENTsrikanthNo ratings yet

- 1 MG 34Document1 page1 MG 34srikanthNo ratings yet

- Income Tax - Exemptions and Deductions Procedure For FY 2020-2021 FinalDocument16 pagesIncome Tax - Exemptions and Deductions Procedure For FY 2020-2021 Finalsrikanth100% (1)

- You Get Married. You Have Children. You Get Them Married. You Retire. Isn't Life Full of Certainties?Document35 pagesYou Get Married. You Have Children. You Get Them Married. You Retire. Isn't Life Full of Certainties?srikanthNo ratings yet

- You Get Married. You Have Children. You Get Them Married. You Retire. Isn't Life Full of Certainties?Document35 pagesYou Get Married. You Have Children. You Get Them Married. You Retire. Isn't Life Full of Certainties?srikanthNo ratings yet

- E-Term Plus Policy DocumentDocument25 pagesE-Term Plus Policy DocumentsrikanthNo ratings yet

- Claim FormDocument2 pagesClaim FormsrikanthNo ratings yet

- Declaration For Rent DueDocument1 pageDeclaration For Rent DuesrikanthNo ratings yet

- Claims Not Having Pre & Post Hospitalization Expenses Must Be Lodged WithinDocument3 pagesClaims Not Having Pre & Post Hospitalization Expenses Must Be Lodged WithinsrikanthNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)