Professional Documents

Culture Documents

Assignment - Standard Costing & Variance Analysis - PECASALES

Uploaded by

Mhekylha's AñepoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment - Standard Costing & Variance Analysis - PECASALES

Uploaded by

Mhekylha's AñepoCopyright:

Available Formats

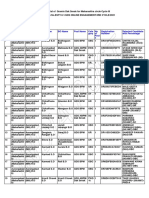

PECASALES, NINA SHRINE A.

P14-1

Geneva Corporation uses a standard cost system and produces a single product with REQUIRED #1 REQUIRED #2 REQUIRED #3

standard costs as follows: DIRECT MATERIALS VARIANCE

Actual price ₱10.50 a. Raw materials ₱95,000.00 - (9,500 pounds x P10) Sales (1,500 units x P500) ₱750,000.00

Direct materials 5 pounds at P10.00 ₱50.00 Less: Standard price ₱10.00 Materials price variance ₱4,750.00 Less: Cost pf goods sold - actual

Direct Labor 2 hours at P40.00 ₱80.00 Difference in price ₱0.50 Accounts payable ₱99,750.00 - ( 9,500 x P10.50) Cost of goods sold - standard

Variable overhead 2 hours at P30.00 ₱60.00 x Actual quantity purchased 9,500 Direct materials - standard (9,200 x P10) ₱92,000.00

Fixed overhead 2 hours at P15.00 ₱30.00 a. Materials price variance ₱4,750.00 UNFAVORABLE b. Work in process ₱90,000.00 - (1,800 units x 5lbs x P10) Direct labor - standard (3,700 x P40) ₱148,000.00

Total unit cost ₱220.00 Materials quantity variance ₱2,000.00 Variable overhead cost - standard ( 1,500 x P60) ₱90,000.00

Actual quantity used 9,200 Raw materials ₱92,000.00 - (9,200lbs x P10) Fixed overhead cost - standard ( 1,500 x P30) ₱45,000.00 ₱375,000.00

There were no beginning inventories. During the month 1,800 units were manufactured Standard quantity ( 1,800 x 5) 9,000 Standard cost variances

and 1,500 units were sold at a sales price of P500.00 each. Overhead rates are based Difference in quantity 200 c. Payroll ₱150,960.00 - ( 3,700 x P40.80) Materials price variance ₱4,750.00

on 2,000 units per month or 4,000 standard direct labor hours. Overhead is applied on

the basis of direct labor hours. x Standard price per wood ₱10.00 Accrued payroll ₱150,960.00 Materials quantity variance ₱2,000.00

b. Materials price variance ₱2,000.00 UNFAVORABLE Labor rate variance ₱2,960.00

Actual results for the month were as follows: d. Work in process ₱144,000.00 - ( 3,600 x P40) Labor efficiency variance ₱4,000.00

Direct materials purchased 9,500 pounds at P10.50 Total direct materials variance - unfavorable ₱6,750.00 UNFAVORABLE Labor rate variance ₱2,960.00 Variable overhead spending variance -₱1,000.00

Direct materials used 9,200 pounds Labor efficiency variance ₱4,000.00 Fixed overhead spending variance ₱5,000.00

Direct labor used 3,700 hours at P40.80 DIRECT LABOR VARIANCE Payroll ₱150,960.00 Variable overhead efficiency variance ₱3,000.00

Variable overhead cost incurred P110,000 Actual rate ₱40.80 Overhead volume variance ₱6,000.00 ₱26,710.00 ₱401,710.00

Fixed overhead cost incurred P65,000 Less: Standard price ₱40.00 e. Factory overhead control - v ₱110,000.00 GROSS PROFIT ₱348,290.00

Difference in rate ₱0.80 UNFAVORABLE Factory overhead control - f ₱65,000.00

REQUIRED: x Actual direct labor hours 3,700 Various accounts ₱175,000.00

1. Calculate the following and indicate if each variance is favorable or unfavorable. c. Direct labor rate variance ₱2,960.00

a. Material price variance based on quantity purchased f. Work in process ₱108,000.00

b. Material quantity variance Actual direct labor hours 3,700 Applied factory overhead - v ₱108,000.00

c. Direct labor rate variance Standard quantity ( 1,800 x 2) 3,600

d. Direct labor effeciency variance Difference in hours 100 UNFAVORABLE g. Work in process ₱54,000.00

e. Total overhead variance x Standard rate per hour ₱40.00 Applied factory overhead - f ₱54,000.00

f. Variable overhead spending variance d. Direct labor effeciency variance ₱4,000.00

g. Variable overhead efficiency variance h. Applied factory overhead - v ₱108,000.00

h. Fixed overhead spending variance Total direct materials variance - unfavorable ₱6,960.00 UNFAVORABLE Variable overhead efficiency variance ₱3,000.00

i. Production volume variance Factory overhead control - v ₱110,000.00

Variable overhead spending variance ₱1,000.00

2. Prepare the necessary journal entries to record the following: FACTORY OVERHEAD VARIANCE

Total at 4,000 Overhead rate

a. Purchase of materials hours per hour i. Applied factory overhead - f ₱54,000.00

b. Issuance of materials to production Fixed ₱60,000 ₱15 Fixed overhead spending variance ₱5,000.00

c. To accrue payroll Variable (4,000 hours x P30) ₱120,000 ₱30 Factory overhead volume variance ₱6,000.00

d. To distribute payroll ₱180,000.00 ₱45.00 Factory overhead control -f ₱65,000.00

e. Incurrence of actual variable and fixed overhead costs

f. Applied variable overhead FOUR-VARIANCE ANALYSIS

g. Applied fixed overhead

h. Variable overhead variances Variable overhead:

i. Fixed overhead variances Actual variable overhead ₱110,000.00

Less: Budget variable overhead (3,700 X P30) ₱111,000.00

3. Calculate the gross profit based on standard costs f. Variable overhead spending variance -₱1,000.00 FAVORABLE

Budget variable overhead ₱111,000.00

Less: Applied variable overhead (3,600 x P30) ₱108,000.00

g. Variable overhead efficiency variance ₱3,000.00 UNFAVORABLE

Total variable overhead variance ₱2,000.00 UNFAVORABLE

Fixed overhead:

Actual fixed overhead ₱65,000.00

Less: Budget fixed overhead at normal capacity

(4,000 x P15) ₱60,000.00

h. Fixed overhead spending variance ₱5,000.00 UNFAVORABLE

Budget fixed overhead at normal capacity ₱60,000.00

Less: Actual fixed overhead (3,600 x P15) ₱54,000.00

Production volume variance ₱6,000.00 UNFAVORABLE

i. Total variable overhead variance ₱11,000.00 UNFAVORABLE

e. Total overhead variance ₱13,000.00 UNFAVORABLE

PECASALES, NINA SHRINE A.

P14-2

Copenhangen Company manufactures furniture and uses a standard cost system for

its production process. It applies overhead based on direct labor hours.

A. ONE- VARIANCE ANALYSIS

Standad: Actual factory overhead (430,000 + 900,000) ₱1,330,000.00

DLH per unit ₱10.00 Standard Overhead (3,100 x 10 x 12) + (3,100 x 10 x 30) -₱1,302,000.00

Variable overhead per DLH ₱12.00 Total overhead variance ₱28,000.00 UNFAVORABLE

Fixed overhead per DLH ₱30.00

Budgeted variable overhead ₱50,000.00 B. TWO-VARIANCE ANALYSIS

Budgeted fixed overhead ₱80,000.00 Actual factory overhead (430,000 + 900,000) ₱1,330,000.00

Less: Budgeted allowed on standard hours

Actual: Variable (3,100 x 10 x 12) ₱372,000.00

Units produced 3,100 Budgeted fixed cost ₱80,000.00 ₱452,000.00

Direct labor hours 24,000 Controllable variance ₱878,000.00 UNFAVORABLE

Variable overhead ₱430,000.00

Fixed overhead ₱900,000.00 Budgeted allowed on standard hours ₱452,000.00

Less: Standard Overhead (3,100 x 10 x 12) + (3,100 x 10 x 30) -₱1,302,000.00

REQUIRED: Compute the overhead variances using the following: Uncontrollable variance -₱850,000.00 FAVORABLE

a. One-variance analysis

b. Two-variance analysis Total overhead variance ₱28,000.00 UNFAVORABLE

c. Three-variance analysis

d. Four-variance analysis C. THREE-VARIANCE ANALYSIS

Actual factory overhead (430,000 + 900,000) ₱1,330,000.00

Less: Budgeted allowed on actual hours

Fixed ₱80,000.00

Variable (24,000 x 12) ₱288,000.00 ₱368,000.00

Spending variance ₱962,000.00 UNFAVORABLE

Budgeted allowed on actual hours ₱368,000.00

Less: Budgeted allowed on standard hours

Variable (3,100 x 10 x 12) ₱372,000.00

Budgeted fixed overhead cost ₱80,000.00 ₱452,000.00

Variable efficiency variance -₱84,000.00 FAVORABLE

Budgeted allowed on standard hours ₱452,000.00

Less: Standard Overhead (3,100 x 10 x 12) + (3,100 x 10 x 30) -₱1,302,000.00

Volume variance -₱850,000.00 FAVORABLE

Total overhead variance ₱28,000.00 UNFAVORABLE

D. FOUR-VARIANCE ANALYSIS

Actual overhead overhead ₱430,000.00

Less: Budget variable overhead (24,000 x 12) -₱288,000.00

Variable overhead spending variance ₱142,000.00 UNFAVORABLE

Actual fixed overhead ₱900,000.00

Less: Budgeted fixed overhead ₱80,000.00

Fixed overhead spending variance ₱820,000.00 UNFAVORABLE

Budgeted on actual hours ₱368,000.00

Less: Budgeted on Standard hours

Variable ₱372,000.00

Budgeted fixed costs ₱80,000.00 ₱452,000.00

Efficiency variance -₱84,000.00 FAVORABLE

Budgeted allowed on standard hours ₱452,000.00

Less: Standard Overhead (3,100 x 10 x 12) + (3,100 x 10 x 30) -₱1,302,000.00

Volume variance -₱850,000.00 FAVORABLE

Total overhead variance ₱28,000.00 UNFAVORABLE

PECASALES, NINA SHRINE A.

P14-3

Sweden Company uses standard cost system and gathered the following information for the period

ended October 31, 2015:

Direct labor

Amount hours Overhead rate REQUIRED:

Budgeted Variable overhead:

Variable overhead ₱600,000 25,000 ₱24.00 Actual variable overhead ₱588,800.00

Fixed overhead ₱800,000 25,000 ₱32.00 Less: Budget variable overhead (23,000 X P24) ₱552,000.00

Total ₱1,400,000 ₱56.00 a. Variable overhead spending variance ₱36,800.00 UNAVORABLE

Actual Budget variable overhead ₱552,000.00

Variable overhead ₱588,800 23,000 ₱25.60 Less: Applied variable overhead (23,000 x P24) ₱552,000.00

Fixed overhead ₱791,200 23,000 ₱34.40 Variable overhead efficiency variance ₱0.00

Total ₱1,380,000 ₱60.00

Total variable overhead variance ₱36,800.00 UNFAVORABLE

REQUIRED: Compute the following:

a. Variable overhead spending variance Fixed overhead:

b. Fixed overhead spending variance Actual fixed overhead ₱791,200.00

c. Idle capacity variance Less: Budget fixed overhead at normal capacity ₱800,000.00

d. Overall factory overhead variance b. Fixed overhead spending variance -₱8,800.00 FAVORABLE

Budget fixed overhead at normal capacity ₱800,000.00

Less: Actual fixed overhead (23,000 x P32) ₱736,000.00

c. Idle capacity variance ₱64,000.00 UNFAVORABLE

Total variable overhead variance ₱55,200.00 UNFAVORABLE

d. Overall factory overhead variance ₱92,000.00 UNFAVORABLE

Total actual factory overhead (588,800 + 791,200) ₱1,380,000.00

Total applied factory overhead

Applied variable overhead ( 23,000 x P24) ₱552,000.00

Applied fixed overhead (23,000 x P32) ₱736,000.00 ₱1,288,000.00

Total overhead variance ₱92,000.00 UNFAVORABLE

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Chapter 13 Alibanto SherwinDocument17 pagesChapter 13 Alibanto SherwinMhekylha's AñepoNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- CBA - Approved Module - Cost Accounting and Control v2021Document109 pagesCBA - Approved Module - Cost Accounting and Control v2021Mhekylha's AñepoNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Activity 2: Assignment ContentDocument2 pagesActivity 2: Assignment ContentMhekylha's AñepoNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Case Analysis #4Document1 pageCase Analysis #4Mhekylha's AñepoNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Learning Activity 1.1 - Due 8.10Document3 pagesLearning Activity 1.1 - Due 8.10Mhekylha's AñepoNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Activity 3: Assignment ContentDocument3 pagesActivity 3: Assignment ContentMhekylha's AñepoNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- 10.18 Simon 55Document21 pages10.18 Simon 55Mhekylha's AñepoNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Job Order Costing (2-1 To 2-11)Document8 pagesJob Order Costing (2-1 To 2-11)Mhekylha's AñepoNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Learning Activity 3.2Document2 pagesLearning Activity 3.2Mhekylha's AñepoNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Assignment - Accounting For Joint Cost & By-Products: Ailyn B. ToledoDocument7 pagesAssignment - Accounting For Joint Cost & By-Products: Ailyn B. ToledoMhekylha's AñepoNo ratings yet

- Assignment - Standard Costing & Variance Analysis - PECASALESDocument4 pagesAssignment - Standard Costing & Variance Analysis - PECASALESMhekylha's AñepoNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Determinants of EVADocument19 pagesDeterminants of EVAAbdulAzeemNo ratings yet

- The Political Economy of Trade PolicyDocument61 pagesThe Political Economy of Trade PolicyDeddy HarfeinzNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- US Market Recap November 29Document3 pagesUS Market Recap November 29eldime06No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- LR Copy of Inv No.925,926&927Document1 pageLR Copy of Inv No.925,926&927sampath pambalaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- International Trade Literature ReviewDocument7 pagesInternational Trade Literature Reviewafdtalblw100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Breaking Through Ingrained Beliefs Revisiting The Impact of The Digital Economy On Carbon EmissionsDocument13 pagesBreaking Through Ingrained Beliefs Revisiting The Impact of The Digital Economy On Carbon Emissionsivory11136999No ratings yet

- Maharashtra-14 Results1Document103 pagesMaharashtra-14 Results1Sandesh KaradNo ratings yet

- International Financial Management 9th Edition Jeff Madura Solutions Manual 1Document15 pagesInternational Financial Management 9th Edition Jeff Madura Solutions Manual 1eleanor100% (39)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Scholarship Form 2023-24Document2 pagesScholarship Form 2023-24Kiran ToplaniNo ratings yet

- Jayesh DMS Research ReportDocument49 pagesJayesh DMS Research ReportJayesh MunjalNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Heros Convent HR - Sec.School First Term Examination Class - 4 Maths M.M.80Document3 pagesHeros Convent HR - Sec.School First Term Examination Class - 4 Maths M.M.80sunny singhNo ratings yet

- Penawaran BerthaDocument2 pagesPenawaran BerthaTito AdiNo ratings yet

- Ichimoku Kinko Hyo - "A Glance at A Chart in Equilibrium."Document13 pagesIchimoku Kinko Hyo - "A Glance at A Chart in Equilibrium."Mian Umar RafiqNo ratings yet

- Santander Volatility Trading Primer PDFDocument123 pagesSantander Volatility Trading Primer PDFShawn TaiNo ratings yet

- Avrame Image Book A4Document24 pagesAvrame Image Book A4Raul AntonieNo ratings yet

- DD209 Running The Economy, Book 1 Running The EconomyDocument472 pagesDD209 Running The Economy, Book 1 Running The EconomyTre Walbrooke-RossNo ratings yet

- Lecture 04 - Currency DerivativesDocument10 pagesLecture 04 - Currency DerivativesTrương Ngọc Minh ĐăngNo ratings yet

- SK BirDocument2 pagesSK BirGem LarezaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Stock Exchange (20 Years)Document9 pagesStock Exchange (20 Years)ALISHA NAYAKNo ratings yet

- Pemanfaatan Teknologi Pascapanen Untuk Pengembanga PDFDocument15 pagesPemanfaatan Teknologi Pascapanen Untuk Pengembanga PDFKhairil HarahapNo ratings yet

- Role of NGO's in Micro FinanceDocument13 pagesRole of NGO's in Micro FinanceBalaji100% (1)

- Proforma Invoice: Total Amount To Be Paid Bank DetailsDocument1 pageProforma Invoice: Total Amount To Be Paid Bank Detailsrajend thakurNo ratings yet

- I-Kon™ Record Blast: Case StudyDocument1 pageI-Kon™ Record Blast: Case StudyRMRE UETNo ratings yet

- YORK VRF IDU Ceiling Duct Compact - JTDN (022-071) - Installation Manual - FAN-1700 201602Document22 pagesYORK VRF IDU Ceiling Duct Compact - JTDN (022-071) - Installation Manual - FAN-1700 201602Daniela BecerraNo ratings yet

- 45 Ways To Lose Money Trading ForexDocument4 pages45 Ways To Lose Money Trading ForexkomohiNo ratings yet

- Statement20undap20signing20ceremony 20by20j1Document3 pagesStatement20undap20signing20ceremony 20by20j1api-67201372No ratings yet

- Lucknow Seission Ending Project 2021-22 Name:Aditi Shukla Class:Xith-D Roll No:04 Submitted To: MR - Kush SrivastavaDocument24 pagesLucknow Seission Ending Project 2021-22 Name:Aditi Shukla Class:Xith-D Roll No:04 Submitted To: MR - Kush SrivastavaAdisha's100% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- E: G, I I: Mployment Rowth Nformalisation AND Other SsuesDocument23 pagesE: G, I I: Mployment Rowth Nformalisation AND Other SsuesHarpreetNo ratings yet

- 7 - 1-Market Risk PDFDocument15 pages7 - 1-Market Risk PDFVivek KheparNo ratings yet

- When Is The Best Time To Buy A StockDocument11 pagesWhen Is The Best Time To Buy A StockAnonymous w6TIxI0G8lNo ratings yet