Professional Documents

Culture Documents

(F) Il f6-z: Applied To Problems) Folkiiving Trytrg

(F) Il f6-z: Applied To Problems) Folkiiving Trytrg

Uploaded by

Amel Gp0 ratings0% found this document useful (0 votes)

7 views1 pageThis document contains 4 questions related to time value of money concepts applied to business problems for Dubois Inc. The questions involve: (1) choosing between two investment alternatives, (2) calculating the interest rate for a equipment purchase agreement with a down payment and semi-annual payments, (3) calculating the amount received from selling a note before maturity after receiving interest payments, and (4) determining the quarterly deposit amount needed to accumulate $1.3 million by 2020 with initial and quarterly deposits earning 10% interest compounded quarterly.

Original Description:

Original Title

LATIHAN-25-DIBOIS

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains 4 questions related to time value of money concepts applied to business problems for Dubois Inc. The questions involve: (1) choosing between two investment alternatives, (2) calculating the interest rate for a equipment purchase agreement with a down payment and semi-annual payments, (3) calculating the amount received from selling a note before maturity after receiving interest payments, and (4) determining the quarterly deposit amount needed to accumulate $1.3 million by 2020 with initial and quarterly deposits earning 10% interest compounded quarterly.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 page(F) Il f6-z: Applied To Problems) Folkiiving Trytrg

(F) Il f6-z: Applied To Problems) Folkiiving Trytrg

Uploaded by

Amel GpThis document contains 4 questions related to time value of money concepts applied to business problems for Dubois Inc. The questions involve: (1) choosing between two investment alternatives, (2) calculating the interest rate for a equipment purchase agreement with a down payment and semi-annual payments, (3) calculating the amount received from selling a note before maturity after receiving interest payments, and (4) determining the quarterly deposit amount needed to accumulate $1.3 million by 2020 with initial and quarterly deposits earning 10% interest compounded quarterly.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

[f]il f6-z (Time Value Concepts Applied to Solve Business Problems) Ansu'er the folkiiving questions

related to Dubois Inc.

(a) Dr&ois Inc. has 5600,000 to inr.est. The company is trytrg to decide bett,een tu'o alternative Llses

of the funds. One alternative pror.ides 580,000 at the end of each year for 12 years, and the other

is to receive a single lump-sr.un payr.nent of 51,900,000 at the end of the 12 years. Which alterna-

tir.e should Dr.rbois selcct? Assrrme the interest rate is constant over the entire irx'estment.

(b) Dubois Inc. has compieted the purchase of nen iPad computers. The fair value of the equipment

is 5824,150. The purchase agreelneilt specifies an imrnediate don,tr payment of 5200,000 and semi-

annual payments of 976,952 begir-rning at the end of 6 months for 5 years. What is the interest rate,

to the nearest percent, used in discounting this pr-rrchase transaction?

(c) Dubois Inc. loans mol"rey to John Krtik Corporation in the anrount of 5800,000. Dulrois accepts an

8olo r-rote due in 7 years u,ith interest pal,able semiannualil,. After 2 years (and receipt of interest

for 2 years), Dubois needs mone1, and tirerefore se1ls the note to Chicago Nationai Bank, rvhicl-r

demands interest on the note of 10o1, cornporu-rded semiannuail;r \{hat is the atnottut Dubois n'ill

receive on the sale of the note?

(d) Dubois Inc. rvishes to accurnulate $1,300,000 bv December 37,2020, to retire bonds outstancling.

Tl're compar"rl, deposits 5200,000 on Decernlrer 31,2010, rvhich u'i11 earn interest at 10ol) compotulded

quarterly, to help iu the retirernent of this debt. In addition, the company u'ants to knou'hol'

much shouid be deposited at the end of each r}-rarter for 10 1,9615 to enslrre that 51,300,000 is at'ail-

able at the end o12020. (The quarterly deposits u,i1i also earn at a rate of 10?o, compolrnded quar-

terlv.) (Round to even do1lars.)

You might also like

- Time Value of MoneyDocument2 pagesTime Value of MoneyVaniamarie Vasquez100% (1)

- Debt Practice ProblemsDocument11 pagesDebt Practice ProblemsmikeNo ratings yet

- Time Value Concepts Applied To Solve Business Problems Answer PDFDocument1 pageTime Value Concepts Applied To Solve Business Problems Answer PDFAnbu jaromiaNo ratings yet

- CH15-16-17 Review Problems and SolutionDocument16 pagesCH15-16-17 Review Problems and SolutionJonathan OrrNo ratings yet

- Spring2022 (July) Exam-Fin Part1Document8 pagesSpring2022 (July) Exam-Fin Part1Ahmed TharwatNo ratings yet

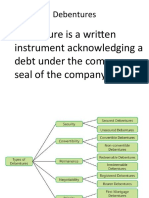

- DebentureDocument10 pagesDebentureLakshya GandhiNo ratings yet

- AL Financial Management Nov Dec 2016Document4 pagesAL Financial Management Nov Dec 2016hyp siinNo ratings yet

- February 2017 Subject: Financial Management 2 FM: 100 Program: BBA Semester V PM: 50 Subject Code: BBK2233 Time: 3hrsDocument3 pagesFebruary 2017 Subject: Financial Management 2 FM: 100 Program: BBA Semester V PM: 50 Subject Code: BBK2233 Time: 3hrsAditi JoshiNo ratings yet

- 2022 ND - FM QuestionDocument5 pages2022 ND - FM Questionmiradvance studyNo ratings yet

- HWCH 8Document3 pagesHWCH 8Victoria G. CrosswellNo ratings yet

- LEC104-C: Debt Restructuring Problem 1: Asset Swap (IFRS Vs US GAAP)Document1 pageLEC104-C: Debt Restructuring Problem 1: Asset Swap (IFRS Vs US GAAP)Miles SantosNo ratings yet

- 1 Problem Set 1Document6 pages1 Problem Set 1Kazi MohasinNo ratings yet

- CH 10Document3 pagesCH 10pablozhang1226No ratings yet

- Your Company Plans To Issue Bonds Later in The UpcomingDocument1 pageYour Company Plans To Issue Bonds Later in The UpcomingAmit PandeyNo ratings yet

- Exam 4Document2 pagesExam 4Deji LipedeNo ratings yet

- Fin103 LT2 2004 - JTA-1Document4 pagesFin103 LT2 2004 - JTA-1JARED DARREN ONGNo ratings yet

- Foundations in Financial ManagementDocument17 pagesFoundations in Financial ManagementchintengoNo ratings yet

- AFM (NEW) Fall. 2013Document3 pagesAFM (NEW) Fall. 2013Muhammad KhanNo ratings yet

- CH 14Document6 pagesCH 14Saleh RaoufNo ratings yet

- Chapter 14Document4 pagesChapter 14ks1043210No ratings yet

- Case Study Lyons DocumentDocument3 pagesCase Study Lyons DocumentSandip GumtyaNo ratings yet

- Ac413 Supp Feb20Document5 pagesAc413 Supp Feb20AnishahNo ratings yet

- HW On Sinking Fund CDocument2 pagesHW On Sinking Fund CCha PampolinaNo ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- Final Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems inDocument8 pagesFinal Exam Preparation Results: Answer All Questions in Part 1 and One of The Two Problems insafiqulislamNo ratings yet

- Famba6e Quiz Mod07 032014Document4 pagesFamba6e Quiz Mod07 032014aparna jethaniNo ratings yet

- SDO Imus City LeaP ABM Business Finance Week 7Document4 pagesSDO Imus City LeaP ABM Business Finance Week 7Kate Denzel ApolinarioNo ratings yet

- BFC 018 Key AnswerDocument6 pagesBFC 018 Key AnswerMariphie OsianNo ratings yet

- Net Working CapitalDocument8 pagesNet Working CapitalJoseph AbalosNo ratings yet

- DocDocument6 pagesDoctai nguyenNo ratings yet

- Financial Instrument CIMADocument5 pagesFinancial Instrument CIMAwaqas ahmadNo ratings yet

- ACT B861F - Tutorial Questions and SolutionDocument13 pagesACT B861F - Tutorial Questions and SolutionCalvin MaNo ratings yet

- The Hang Seng University of Hong Kong Bachelor Degree Programmes 2019-2020 Semester 2 ExaminationDocument8 pagesThe Hang Seng University of Hong Kong Bachelor Degree Programmes 2019-2020 Semester 2 Examination李敏浩No ratings yet

- Assignment 1Document4 pagesAssignment 1Motivational speaker Pratham GuptaNo ratings yet

- Chapter 6 Exercises (Bonds & Interest)Document2 pagesChapter 6 Exercises (Bonds & Interest)Shaheera SuhaimiNo ratings yet

- Section A Question 1 (Compulsory Question - 40 Marks) : Corporate Finance I Exam For Dec 2014 DR G MupondaDocument4 pagesSection A Question 1 (Compulsory Question - 40 Marks) : Corporate Finance I Exam For Dec 2014 DR G MupondaChristinaNo ratings yet

- CF Classwrok 1 TVMDocument2 pagesCF Classwrok 1 TVMfalconsgroupNo ratings yet

- ACF 103 - Fundamentals of Finance Tutorial 6 - QuestionsDocument7 pagesACF 103 - Fundamentals of Finance Tutorial 6 - QuestionsRiri FahraniNo ratings yet

- Leac 202Document34 pagesLeac 202Shreyas BansalNo ratings yet

- Quiz Week 1 QnsDocument7 pagesQuiz Week 1 Qnsesraa karamNo ratings yet

- Finance 100 PS 2Document3 pagesFinance 100 PS 2AJ SacksNo ratings yet

- Hw2 2020Document4 pagesHw2 2020AnDy YiMNo ratings yet

- Capital Budgeting: Key Topics To KnowDocument11 pagesCapital Budgeting: Key Topics To KnowBernardo KristineNo ratings yet

- Corporate Financing Decisions, Fall 2016Document4 pagesCorporate Financing Decisions, Fall 2016Ashok BistaNo ratings yet

- AB1201 Exam - Sem1 AY 2021-22 - QDocument9 pagesAB1201 Exam - Sem1 AY 2021-22 - QShuHao ShiNo ratings yet

- Accountancy QP (2023-24) For Classes XIDocument5 pagesAccountancy QP (2023-24) For Classes XIMahendra Kumar YadavNo ratings yet

- TVM Practice Questions Fall 2018Document4 pagesTVM Practice Questions Fall 2018ZarakKhanNo ratings yet

- Chapter 10 Question ReviewDocument11 pagesChapter 10 Question ReviewHípPôNo ratings yet

- Unit 4 - Numerical QuestionsDocument2 pagesUnit 4 - Numerical Questionskapil DevkotaNo ratings yet

- Working CapitalDocument2 pagesWorking CapitalLycka Bernadette MarceloNo ratings yet

- Current Liabilities: Redemption of Certificates Lapse of CertificatesDocument3 pagesCurrent Liabilities: Redemption of Certificates Lapse of CertificatesGrezel NiceNo ratings yet

- Revision Exercise - Question OnlyDocument6 pagesRevision Exercise - Question OnlyCindy WooNo ratings yet

- Chapter 2 Time Value of Money ANSWERS TO END-OF-CHAPTER QUESTIONSDocument9 pagesChapter 2 Time Value of Money ANSWERS TO END-OF-CHAPTER QUESTIONSSolutionz Manual67% (3)

- Quiz - Chapter 3 - Bonds Payable & Other Concepts - 2021Document2 pagesQuiz - Chapter 3 - Bonds Payable & Other Concepts - 2021Martin ManuelNo ratings yet

- FIN350 in Class Work No. 1 First Name - Last NameDocument8 pagesFIN350 in Class Work No. 1 First Name - Last Nameh1ph9pNo ratings yet

- Lahore School of Economics: Final Semester Exam May 2021Document6 pagesLahore School of Economics: Final Semester Exam May 2021Muhammad Ahmad AzizNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- 30-Year Bonds vs. Blue-Chip Dividends Stocks: Choose Your 4%Yielding Investment: Financial Freedom, #93From Everand30-Year Bonds vs. Blue-Chip Dividends Stocks: Choose Your 4%Yielding Investment: Financial Freedom, #93No ratings yet

- Lap keu-MNC INVESTAMA 31 December 2020-6-8Document3 pagesLap keu-MNC INVESTAMA 31 December 2020-6-8Amel GpNo ratings yet

- Do You Know What It Means To Miss New Orleans: Related PapersDocument23 pagesDo You Know What It Means To Miss New Orleans: Related PapersAmel GpNo ratings yet

- Amelia Putri Adinda 4b Lat 22Document3 pagesAmelia Putri Adinda 4b Lat 22Amel GpNo ratings yet

- Amelia Putri Adinda 4b Lat 21Document4 pagesAmelia Putri Adinda 4b Lat 21Amel GpNo ratings yet

- Pvfa. E+,, - (X+I) - ": Value of Value A SingleDocument2 pagesPvfa. E+,, - (X+I) - ": Value of Value A SingleAmel GpNo ratings yet

- Tabel-1-Future ValueDocument2 pagesTabel-1-Future ValueAmel GpNo ratings yet

- LATIHAN-39-BARADDOCK Inc.Document1 pageLATIHAN-39-BARADDOCK Inc.Amel GpNo ratings yet

- Latihan 37 Fortner CoDocument1 pageLatihan 37 Fortner CoAmel GpNo ratings yet

- LATIHAN-37-FORTNER CoDocument1 pageLATIHAN-37-FORTNER CoAmel GpNo ratings yet