Professional Documents

Culture Documents

Business Finance Exam 2

Business Finance Exam 2

Uploaded by

jelay agresorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Finance Exam 2

Business Finance Exam 2

Uploaded by

jelay agresorCopyright:

Available Formats

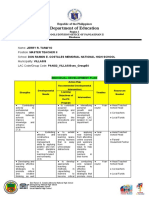

RJDAMA CHRISTIAN ACADEMY INC.

San Jose, Gonzaga, Cagayan

S.Y. 2021-2022

BUSINESS FINANCE

(ABM 12)

2nd SUMMATIVE TEST

Name: SCORE:

I. MULTIPLE CHOICE

Direction: Encircle the correct answer.

1. Money placed into a banking institution for safekeeping.

a. Bank account b. Bank deposit c. Savings account

2. Debt investments where an investor loans money to an entity which borrows the funds for

a defined period of time at a variable or commonly, fixed interest rate.

a. Bonds b. Loan c. Interest

3. The interest in the first compounding period is added on the principal, which will then be

the basis for the interest to be computed for the next period.

a. Compound interest b. Simple interest c. Bank interest

4. The number of times interest is computed on a certain principal in one year.

a. Present value b. Single amount c. Compounding frequency

5. An investment that is made up of a pool of funds collected from many investors for the

purposes of investing in stocks, bonds, and similar assets.

a. Unit Investment Trust Fund b. Trust Fund c. Mutual Fund

6. A basic good used in commerce that is interchangeable with other commodities of the

same type (example; gold, oil)

a. Commodities b. Real estate c. Currencies

7. General increase in prices.

a. Hedge b. Inflation c. Liquidity

8. A scenario when a single cash outflow is made and the total receipts will be at a single

future date.

a. Single amount b. Lump sum c. Annuity

9. It is the process of evaluating and selecting long-term investments that are consistent with

the firm’s goal of maximizing owners’ wealth.

a. Long-term investment b. Capital Budgeting c. financial budgeting

10. An asset or item acquired with the goal of generating income or appreciation.

a. Investment b. financial c. Unit Investment Trust Fund

II. TRUE OR FALSE

Direction: Write T if the statement is correct and F if it is not. Write your

answer on the blank.

_______ 1. The debtor must invest within his means.

_______ 2. The margin trading allows clients to trade more than their capital. It can magnify

both earnings and losses.

_______ 3. Real estate are the land and any improvements on it” (i.e., land, house and lot,

condominiums).

_______ 4. Mutual funds are debt investments where an investor loans money to an entity which

borrows the funds for a defined period of time at a variable or commonly, fixed interest rate.

_______ 5. Savings account earns interest but not that significant, but the most common among

individuals.

_______ 6. Short-term loan is a loan with scheduled periodic payments that consists of both

principal and interest.

_______ 7. Ordinary annuity is a cash flow occurs at the beginning of each period.

_______ 8. Simple interest is interest in the first compounding period is added on the principal,

which will then be the basis for the interest to be computed for the next period.

_______ 9. Stocks are type of security that signifies ownership in a corporation and represents a

claim on part of the corporation’s assets and earning.

_______ 10. Investment opportunities should be grabbed only when you have extra resources.

III. MATCHING TYPE

Direction: Match the advantage and disadvantage in column A with the different

types of investments in column B by writing the capital letter on the blank.

COLUMN A COLUMN B

________ 1. Riskiest of all assets (can lose even more than a. Unit Investment

50% of their money in one day) Trust Fund

________ 2. No shareholder rights for investors such as b. Insurance

dividends and voting rights. c. Bonds

________ 3. Known income based on outstanding principal d. Stocks

and current interest rate. e. Bank Deposits

________ 4. Largest market in the world in terms of trading f. Currencies

volume, so much liquidity.

________ 5. On some of traditional insurance plans, no

sickness/death until a certain age may mean not getting any

benefits at all (that’s why VUL’s are now very prevalent).

IV. JUMBLED WORDS

Directions: Arrange the jumbled letters to find the hidden word describe in each

number below. Write your answer on the blank.

1. T A E D B I S N O K P (2 words)

2. I E D S I D N D V

3. D E H G E

4. L V U

5. V E T T N I E M N S

6. M I S I M C O D O T E

7. F D T U S U A N U L M (2 words)

8. I T E I S S P E M L N R E T (2 words)

9. N U Y A N I T

10. O G N M I R N O T I

1. Money placed into a banking institution for safekeeping.

2. Distribution of the company’s income to its shareholders.

3. Investment that reduces the risk of adverse price movement in an asset.

4. Variable Universal Life Insurance or a life insurance that offers both death benefit and

investment features.

5. An asset or item acquired with the goal of generating income or appreciation.

6. A basic good used in commerce that is interchangeable with other commodities of the

same type.

7. An investment that is made up of a pool of funds collected from many investors for the

purposes of investing in stocks, bonds, and similar assets.

8. The charging interest rate r based on a principal P over T number of years.

9. A periodic stream of equal cash flow at equal time intervals (annually, monthly, etc.).

10. Results are monitored and actual cost and benefits are compared with those that were

expected.

V. ESSAY

Direction: Read the passage carefully and plan what you will say. Write your

answer at the back or use yellow paper.

Based in your own understanding, explain why investments require additional risk-

taking.

“For with God, nothing is impossible” – Luke 1:37

Prepared by:

ALMA ANGELIE D. AGRESOR

Business Finance Instructor

You might also like

- 01 - Chance - Fletcher, Clinical Epidemiology The Essentials, 5th EditionDocument19 pages01 - Chance - Fletcher, Clinical Epidemiology The Essentials, 5th EditionDaniel PalmaNo ratings yet

- Fabm Summative 1Document3 pagesFabm Summative 1jelay agresorNo ratings yet

- Discipline and Punish Exploring The Application of IFRS 10 andDocument17 pagesDiscipline and Punish Exploring The Application of IFRS 10 andDiana IstrateNo ratings yet

- Interactive High School Locker by SlidesgoDocument52 pagesInteractive High School Locker by SlidesgoJanice Reyes HermanoNo ratings yet

- Chapter 1 OB 1Document17 pagesChapter 1 OB 1MUHAMMAD HASAN NAGRANo ratings yet

- Mothers' Perceptions About Daughters' EducationDocument58 pagesMothers' Perceptions About Daughters' EducationMuhammad Nawaz Khan AbbasiNo ratings yet

- The Success and Failure of Poverty Reduction in UgandaDocument49 pagesThe Success and Failure of Poverty Reduction in UgandaThe Bartlett Development Planning Unit - UCL80% (5)

- Interactive Bulletin Board by SlidesgoDocument35 pagesInteractive Bulletin Board by Slidesgojoan tomarongNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: Crisly Mae L. Villarin FABM 2 TeacherDocument54 pagesFundamentals of Accountancy, Business and Management 2: Crisly Mae L. Villarin FABM 2 TeacherKimberly andrinoNo ratings yet

- 001 The Nature and Purpose of Economic ActivityDocument6 pages001 The Nature and Purpose of Economic ActivityPratik DahalNo ratings yet

- FUN-da-BOOK 1Document160 pagesFUN-da-BOOK 1angel myles baltazarNo ratings yet

- Department of Education: Republic of The PhilippinesDocument7 pagesDepartment of Education: Republic of The PhilippinesJojam Carpio100% (1)

- CSFLC SurveyDocument12 pagesCSFLC SurveyDebasish Pahi100% (1)

- DLP DIASS Q2 Week E-F - Effects of Applied Social Sciences Structural ChangeDocument8 pagesDLP DIASS Q2 Week E-F - Effects of Applied Social Sciences Structural ChangeDarwin RonquilloNo ratings yet

- Acbt Hst2122d Final Assessment - Part 2 Online 2020 Tri1 - Atkdh193Document5 pagesAcbt Hst2122d Final Assessment - Part 2 Online 2020 Tri1 - Atkdh193Dilasha AtugodaNo ratings yet

- Functions, Roles, and Skills of ManagersDocument18 pagesFunctions, Roles, and Skills of ManagersCeline DemanarigNo ratings yet

- Preparing A Bank Reconciliation: Fundamentals of Accountancy, Business and Management 2Document26 pagesPreparing A Bank Reconciliation: Fundamentals of Accountancy, Business and Management 2Arminda VillaminNo ratings yet

- ABMFABM1 q3 Mod1 Introduction-To-Acctg.Document31 pagesABMFABM1 q3 Mod1 Introduction-To-Acctg.feyNo ratings yet

- Causal Research Design and ExperimentDocument8 pagesCausal Research Design and Experimentitsmekaran123789No ratings yet

- Business Finance ReviewerDocument5 pagesBusiness Finance ReviewerVie CruzNo ratings yet

- Mapping and Analysis of Indigenous Gover PDFDocument205 pagesMapping and Analysis of Indigenous Gover PDFReuben Jr UmallaNo ratings yet

- Chapter 1 Introduction To Financial ManagementDocument22 pagesChapter 1 Introduction To Financial ManagementMikaella Adriana GoNo ratings yet

- Malinao Sharmaine Maed em Focus QuestionsDocument184 pagesMalinao Sharmaine Maed em Focus QuestionsShaiAbretilNieloMalinaoNo ratings yet

- SHS - Fundamentals of Accounting 2Document122 pagesSHS - Fundamentals of Accounting 2Carmina CarganillaNo ratings yet

- Chapter 1 Overview of EntrepreneurshipDocument45 pagesChapter 1 Overview of EntrepreneurshipJayson MatthewNo ratings yet

- 01 Introduction EntrepDocument28 pages01 Introduction EntrepChristian Carator MagbanuaNo ratings yet

- Table of Specification (Automated) v1Document1 pageTable of Specification (Automated) v1Ar WinNo ratings yet

- Understanding Culture, Society and PoliticsDocument72 pagesUnderstanding Culture, Society and PoliticsMichael ArdizoneNo ratings yet

- Fundamentals of Abm2: Statement of Financial Position (SFP)Document16 pagesFundamentals of Abm2: Statement of Financial Position (SFP)imeemagdangalNo ratings yet

- Distance Learning ... For Educators, Trainers and Leaders, Vol.-8-No.-1-2011-2Document94 pagesDistance Learning ... For Educators, Trainers and Leaders, Vol.-8-No.-1-2011-2Jesus PedrozaNo ratings yet

- Business Finance Q3Document52 pagesBusiness Finance Q3Leah Alexie CozNo ratings yet

- Chapter 1Document15 pagesChapter 1Rhodessa CotengNo ratings yet

- Instructional Planning: I. ObjectivesDocument3 pagesInstructional Planning: I. ObjectivesRaffy Jade SalazarNo ratings yet

- Fundamentals of Accountancy Business and Management 1pdf CompressDocument164 pagesFundamentals of Accountancy Business and Management 1pdf Compresskd.sapunganNo ratings yet

- Margosatubig Pax High School /kindergarten, Inc.: Grade 12-Understanding Culture, Society and Politics First SemesterDocument5 pagesMargosatubig Pax High School /kindergarten, Inc.: Grade 12-Understanding Culture, Society and Politics First Semesterfe jandugan0% (1)

- Statement of Comprehensive Income (SCI) : Lesson 2Document20 pagesStatement of Comprehensive Income (SCI) : Lesson 2Rojane L. AlcantaraNo ratings yet

- Exam EntrepreneurDocument2 pagesExam EntrepreneurGhianne Sanchez FriasNo ratings yet

- Weber DurkheimDocument9 pagesWeber DurkheimShivendra PrakashNo ratings yet

- Topic 13 Strategic EntrepreneurshipDocument43 pagesTopic 13 Strategic Entrepreneurship--bolabolaNo ratings yet

- Fabm2 Sce Week 6-8Document61 pagesFabm2 Sce Week 6-8mary rose aragonNo ratings yet

- Social ScienceDocument35 pagesSocial ScienceJedidiah Daniel Lopez HerbillaNo ratings yet

- State and Non State InstitutionsDocument16 pagesState and Non State InstitutionsArianne Bandong CayabyabNo ratings yet

- LESSON 1 Introduction To Entrepreneurship HumssDocument93 pagesLESSON 1 Introduction To Entrepreneurship HumssSuzane De Los SantosNo ratings yet

- Final Diass ReportDocument40 pagesFinal Diass ReportYsa Ilustrisimo100% (1)

- Matatag AgendaDocument83 pagesMatatag AgendaNELLY L. ANONUEVONo ratings yet

- UCSP ReviewerDocument34 pagesUCSP ReviewerMa Jollie Mae BereNo ratings yet

- Social Institutions Group WorkDocument37 pagesSocial Institutions Group WorkjajajaNo ratings yet

- BiographyDocument32 pagesBiographyranarahmanNo ratings yet

- Bernoulli Differential EquationsDocument31 pagesBernoulli Differential EquationslordcampNo ratings yet

- Policy Paper Focsani GateDocument20 pagesPolicy Paper Focsani GateDaniel GyurissNo ratings yet

- Multiple Choice Question Digital CommunicationDocument44 pagesMultiple Choice Question Digital CommunicationShayaan PappathiNo ratings yet

- Personal Development ReportDocument10 pagesPersonal Development ReportPauline Ann DiazNo ratings yet

- Fundamentals of Accountancy, Business and Management 2 Accounting Books - Journal and LedgerDocument20 pagesFundamentals of Accountancy, Business and Management 2 Accounting Books - Journal and LedgerGeraldine EctanaNo ratings yet

- Business FinanceDocument30 pagesBusiness FinanceCelina LimNo ratings yet

- RightsDocument13 pagesRightsGenelyn DumangasNo ratings yet

- Answer Key Summative Exam 1 & 2 Business FinanceDocument5 pagesAnswer Key Summative Exam 1 & 2 Business Financejelay agresorNo ratings yet

- Student Guide Lesson TwelveDocument7 pagesStudent Guide Lesson Twelveapi-344266741No ratings yet

- Last Recitation For MF Mod 3 and 4 QUESTION AND ANSWERDocument5 pagesLast Recitation For MF Mod 3 and 4 QUESTION AND ANSWERTrinidad, Ma. AngelicaNo ratings yet

- Part 2-1 - Activities With AnswersDocument7 pagesPart 2-1 - Activities With AnswersKawthar LebibNo ratings yet

- COMR4E Feb 19 Investment Collaborative AssignmentDocument12 pagesCOMR4E Feb 19 Investment Collaborative AssignmentR WattNo ratings yet

- CashCourse Quiz Investing 2Document2 pagesCashCourse Quiz Investing 2Asma RihaneNo ratings yet

- The Learners Demonstrate An Understanding of . The Learner . The Learners Are Able ToDocument7 pagesThe Learners Demonstrate An Understanding of . The Learner . The Learners Are Able Tojelay agresorNo ratings yet

- Business Finance Module Mod6Document5 pagesBusiness Finance Module Mod6jelay agresorNo ratings yet

- Answer Key Summative Exam 1 & 2 Business FinanceDocument5 pagesAnswer Key Summative Exam 1 & 2 Business Financejelay agresorNo ratings yet

- Summative Exam I Answer Key (Fabm)Document5 pagesSummative Exam I Answer Key (Fabm)jelay agresorNo ratings yet

- Fabm Summative 2Document3 pagesFabm Summative 2jelay agresorNo ratings yet

- Business Finance Exam 1Document2 pagesBusiness Finance Exam 1jelay agresorNo ratings yet

- Difference Between Hedge Fund & Mutual FundDocument16 pagesDifference Between Hedge Fund & Mutual FundKanavNo ratings yet

- FAQ in KYC InterviewsDocument8 pagesFAQ in KYC InterviewsRuhan PrinceNo ratings yet

- Investment Analysis & Portfolio Management - FIN630 Quiz 4Document286 pagesInvestment Analysis & Portfolio Management - FIN630 Quiz 4Ali RajpootNo ratings yet

- Risk and ReturnDocument7 pagesRisk and Returnshinobu kochoNo ratings yet

- FIN2004 - 2704 Week 4Document81 pagesFIN2004 - 2704 Week 4ZenyuiNo ratings yet

- Final Report: Designing Process Flows and Automation of Modules of FX Investigation ProcessesDocument47 pagesFinal Report: Designing Process Flows and Automation of Modules of FX Investigation ProcessesKaran GuptaNo ratings yet

- Financial Engineering and Structured FinanceDocument88 pagesFinancial Engineering and Structured Financevarun_kakkar76No ratings yet

- International Debt and Equity FinancingDocument38 pagesInternational Debt and Equity FinancingNGA HUYNH THI THUNo ratings yet

- Business Finance ReviewerDocument1 pageBusiness Finance ReviewerRhystle Ann BalcitaNo ratings yet

- Brown and Yellow Scrapbook Brainstorm PresentationDocument31 pagesBrown and Yellow Scrapbook Brainstorm PresentationReanne GuintoNo ratings yet

- Risk Management in BanksDocument10 pagesRisk Management in Bankssaurabh nadgireNo ratings yet

- BKF Investing School 3rd Edition Ebook JPLynn 2017Document262 pagesBKF Investing School 3rd Edition Ebook JPLynn 2017MICHAEL HOBBSNo ratings yet

- Amico Wealth Investor PresentationDocument11 pagesAmico Wealth Investor PresentationDee 2No ratings yet

- Final Sip - SuyashDocument37 pagesFinal Sip - Suyashshrikrushna javanjalNo ratings yet

- Security Analysis and Portfolio ManagementDocument8 pagesSecurity Analysis and Portfolio Managementnaved katuaNo ratings yet

- TVM and No-Arbitrage Principle: Practice Questions and ProblemsDocument2 pagesTVM and No-Arbitrage Principle: Practice Questions and ProblemsMavisNo ratings yet

- Mutual Funds - An Investment Option: Presented by Vineet Pal SinghDocument37 pagesMutual Funds - An Investment Option: Presented by Vineet Pal SinghVineet SinghNo ratings yet

- Kotak Mutual Fund - Suraj Makhija - ScrabbleDocument2 pagesKotak Mutual Fund - Suraj Makhija - ScrabbleNaman VasalNo ratings yet

- MGT201 Short NotesDocument14 pagesMGT201 Short NotesShahid SaeedNo ratings yet

- Hedge Fund Cover Letter ExampleDocument6 pagesHedge Fund Cover Letter Examplef5e28dkq100% (2)

- Capital Market and Intermediaries NotesDocument62 pagesCapital Market and Intermediaries NoteslavanyaNo ratings yet

- Fs SP 500 GrowthDocument7 pagesFs SP 500 GrowthDynand PLNNo ratings yet

- Cma Final - Book 1 - Portfolio Management and Mutual FundDocument97 pagesCma Final - Book 1 - Portfolio Management and Mutual FundadhishsirNo ratings yet

- Case Study Merrill LYnchDocument17 pagesCase Study Merrill LYnchSandeep YadavNo ratings yet

- 02 Performance Task 1Document1 page02 Performance Task 1Janrey RomanNo ratings yet

- Pasit PintabutDocument2 pagesPasit Pintabut0840328818zNo ratings yet

- Nike FInancial ResourceDocument2 pagesNike FInancial ResourceهانيNo ratings yet

- Kaushik Gupta - Task 2Document13 pagesKaushik Gupta - Task 2Sourav AgarwalNo ratings yet

- Viva Questions W AnswersDocument12 pagesViva Questions W Answersshaleen bansalNo ratings yet

- New Delhi Institute of Management: PGDM 2020-22 Semester-III Paper 2 (Set-B)Document2 pagesNew Delhi Institute of Management: PGDM 2020-22 Semester-III Paper 2 (Set-B)bhushanNo ratings yet