Professional Documents

Culture Documents

INVEST

Uploaded by

MK KodiaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

INVEST

Uploaded by

MK KodiaCopyright:

Available Formats

a demutualized ownership system are known as countywide national exchanges.

There are now

three such exchanges: MCX (Multi Commodity Exchange), NMCE (National Multi

Commodity Exchange), and NCDEX (National Commodity Exchange) (National

Commodities and Derivatives Exchange).

MCX has grown to become the country's largest exchange. MCX began operations on

November 10, 2003, and now has over 120000 registered members operating through over

100,000 trader work stations across India, with a market share of over 80% of the Indian

commodities futures market. In terms of the volume of contracts traded in 2009, the exchange

was the sixth largest and one of the fastest growing commodity futures exchanges in the world.

On its platform, MCX provides over 40 commodities in diverse divisions, including bullion,

ferrous and non-ferrous metals, and a variety of Agri-commodities. With respect to the number

of futures contracts traded, the Exchange is the world's largest in silver, the second largest in

gold, copper, and natural gas, and the third largest in crude oil futures.

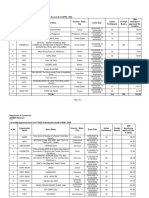

Even as reform attempts take shape, the Indian commodities futures market has seen a massive

surge in turnover. In recent years, the overall value of transactions in the Commodity Futures

Market has increased significantly (Table 1). From 2006 to 2020, MCX had the biggest value

of trading turnover, followed by NCDEX and NMCE.

On its platform, MCX has been accredited to three ISO contracts. ISO 9001:2008 Quality

Management System and ISO 14001:2004 Environmental Management NCDEX are among

the standards. The Exchange's headquarters are in Mumbai, and it provides services to its

members through sites spread throughout India. Contracts were available in 34 commodities

on February 9, 2012, including 23 agricultural commodities, 6 precious metals, 2 energy, 1

polymer, and 2 other metals. Soya oil, Gaur Seed, Chana, RM NCDEX seed, and Guar gum

were the top five commodities traded at the Exchange in terms of volume. Since the NCDEX

placed 32nd in 2010 and the Futures Industry Association's global ranking of top 53 derivatives

exchanges evaluated by volume, the country's second biggest commodity derivatives exchange

has been listing contracts, rising to become India's TOP National Multi-commodity Exchange

in 2011. (NMCE). The following are commodity exchanges: ACE, ACE, ACE, ACE, ACE,

ACE, ICEX stands for Indian Commodity Exchange. Exchange of Multiple Commodities

(MCX). Derivatives and Commodity Exchange ACE.

16 | P a g e

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bill of Lading 23Document1 pageBill of Lading 23Gora PribadiNo ratings yet

- Licensed Clearing Agents 2006-7 UgandaDocument8 pagesLicensed Clearing Agents 2006-7 UgandaKintu Munabangogo100% (1)

- TFC Day 2 (Maret 2017) PDFDocument31 pagesTFC Day 2 (Maret 2017) PDFacernam4849100% (1)

- IIBF Certificate FEDAI - IDocument55 pagesIIBF Certificate FEDAI - Isapnanrajput20025190100% (3)

- Chapter 2 Theories of International TradeDocument14 pagesChapter 2 Theories of International TradeRach BNo ratings yet

- Globalization NotesDocument3 pagesGlobalization NotesHeavy Gunner100% (6)

- Table 10: Mean and Standard Deviation (SD) of Investor's Behaviour Towards Commodities MarketDocument1 pageTable 10: Mean and Standard Deviation (SD) of Investor's Behaviour Towards Commodities MarketMK KodiaNo ratings yet

- PERCEPTIONDocument1 pagePERCEPTIONMK KodiaNo ratings yet

- HAVJJDocument1 pageHAVJJMK KodiaNo ratings yet

- PublichDocument1 pagePublichMK KodiaNo ratings yet

- Faculty of Commerce, University of MumbaiDocument1 pageFaculty of Commerce, University of MumbaiMK KodiaNo ratings yet

- Certificate: Faculty of Commerce, University of MumbaiDocument90 pagesCertificate: Faculty of Commerce, University of MumbaiMK KodiaNo ratings yet

- FORM-GST-RFD-08 Notice For Rejection of Application For RefundDocument2 pagesFORM-GST-RFD-08 Notice For Rejection of Application For RefundMK KodiaNo ratings yet

- Pricing GameDocument1 pagePricing GameSandorfreireNo ratings yet

- Shoppers' Stop CRM StrategyDocument2 pagesShoppers' Stop CRM StrategyLakshmi SrinivasanNo ratings yet

- E-Ticketing User Guide: Kiu System SolutionsDocument85 pagesE-Ticketing User Guide: Kiu System SolutionsALI ZAMZAMNo ratings yet

- Kel 09 - Pengaruh Struktur Modal Terhadap Profitabilitas PerusahaanDocument60 pagesKel 09 - Pengaruh Struktur Modal Terhadap Profitabilitas PerusahaanIhsan Faizal MalikNo ratings yet

- Tax CDocument18 pagesTax Calmira garciaNo ratings yet

- BSBA Major in Financial Management: Course Offering 1 Semester, SY 2021 - 2022Document11 pagesBSBA Major in Financial Management: Course Offering 1 Semester, SY 2021 - 2022Danica MarcosNo ratings yet

- Microeconomics 8Th Edition Perloff Solutions Manual Full Chapter PDFDocument42 pagesMicroeconomics 8Th Edition Perloff Solutions Manual Full Chapter PDFtwintervoodooaq2t9100% (9)

- Galvanized Iron Bathtubs Making PlantDocument22 pagesGalvanized Iron Bathtubs Making PlantFirezegiNo ratings yet

- AP宏观2016选择题Document12 pagesAP宏观2016选择题rogchen666No ratings yet

- 2019 - Resources and Energy Quarterly June 2019Document143 pages2019 - Resources and Energy Quarterly June 2019Izzul AzmiNo ratings yet

- BM Review Notes 4.6 - 5.6Document22 pagesBM Review Notes 4.6 - 5.6howard.chen0604No ratings yet

- GSTR Workings For March 22Document61 pagesGSTR Workings For March 22Sankar GaneshNo ratings yet

- PIPS30 Ultimate Forex GuideDocument76 pagesPIPS30 Ultimate Forex GuideadelowokanpelumijuliusNo ratings yet

- Roscamadalinastefania 3541001 Ac 1220Document6 pagesRoscamadalinastefania 3541001 Ac 1220Abdul Mohammad KarimNo ratings yet

- AssignmentDocument5 pagesAssignmentAditya SahaNo ratings yet

- Weekly Report 929 18-06-2021Document51 pagesWeekly Report 929 18-06-2021cpasl123No ratings yet

- Presented byDocument30 pagesPresented byRahul ParmarNo ratings yet

- Estmt - 2023 08 29Document8 pagesEstmt - 2023 08 29andreasarahi2011No ratings yet

- Business in A Global EnvironmentDocument17 pagesBusiness in A Global Environmentria fajrianiNo ratings yet

- Economics English Medium 2 Marks With Answer PDFDocument9 pagesEconomics English Medium 2 Marks With Answer PDFnagaveni ANo ratings yet

- Economics 2 0525 Cameroon General Certificate of Education BoardDocument3 pagesEconomics 2 0525 Cameroon General Certificate of Education BoardTheodore YimoNo ratings yet

- List of MAI Approved Projects For 2022 23Document31 pagesList of MAI Approved Projects For 2022 23Samveg MehtaNo ratings yet

- Libby 4ce Solutions Manual - Ch05Document55 pagesLibby 4ce Solutions Manual - Ch057595522No ratings yet

- 2a Marketing ChannelsDocument74 pages2a Marketing ChannelsMahbobullah RahmaniNo ratings yet