Professional Documents

Culture Documents

Reference:: Abeleda, N. S. (2012) - Simplified Accounting For Partnership and Corporation. Paranaque: Nelson Publications

Uploaded by

Marco AboyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reference:: Abeleda, N. S. (2012) - Simplified Accounting For Partnership and Corporation. Paranaque: Nelson Publications

Uploaded by

Marco AboyCopyright:

Available Formats

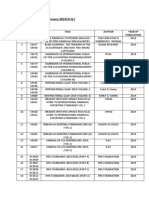

BM1705

Para: DATE: SCORE:

Luman:

Bobby:

Cobby:

Investments of Partners (14 points)

On April 15, 20AB, Para and Luman formed a partnership with the following investments:

PARA LUMAN

Cash P 55,000

Furniture 66,000

Equipment P 192,500

The market values of the non-cash assets were P44,000 for the furniture and P165,000 for the equipment. Para

and Luman’s profit and loss sharing ratio is 1:3, respectively.

Requirements:

1. If the capital of each partner is based on his/her contributions, give the entry to record the partnership

formation (5 points: 1 point for each correct amount and account used).

2. If the partners agree that their capital should be equal so that the partner with the lower capital will make

additional cash investment, who will make the investment and how much? (3 points)

3. Assuming that Luman’s agreed capital is P275,000, how much cash investment must he make? (3

points)

4. Assuming that Para’s investment is equal to 30% of the total capital, how much additional investment

should Luman make? (3 points)

Partnership Formation ()

Bobby and Cobby agreed to combine their businesses and form a partnership. The ledger accounts prior to

adjustments showed the following balances:

BOBBY COBBY

Cash P 84,000 P 126,000

Accounts Receivable 63,000 105,000

Inventory 157,500 52,500

Equipment 63,000

Accumulated Depreciation (21,000)

Accounts Payable (21,000)

The following adjustments are to be made for the purposes of establishing the capital credit of the partners:

1. Ten percent (10%) bad debts (impairment loss) should be provided on the outstanding accounts

receivable.

2. The market value of the inventory is 80% of cost.

3. The carrying amount of the equipment is only P33,600.

4. Bobby will recognize prepaid expenses of P8,400.

5. Cobby will recognize accrued expenses of P6,825.

Give all the entries necessary for the following scenarios:

a. Books of Bobby will be used (30 points: 1 point for each correct amount and account used).

b. Books of Cobby will be used (28 points: 1 point for each correct amount and account used).

c. New set of books will be used by the partnership (40 points: 1 point for each correct amount and

account used).

Reference:

Abeleda, N. S. (2012). Simplified accounting for partnership and corporation. Paranaque: Nelson Publications.

06 Activity 1 *Property of STI

Page 1 of 1

You might also like

- Reference:: Abeleda, N. S. (2012) - Simplified Accounting For Partnership and Corporation. Paranaque: Nelson PublicationsDocument1 pageReference:: Abeleda, N. S. (2012) - Simplified Accounting For Partnership and Corporation. Paranaque: Nelson PublicationsJanrey RomanNo ratings yet

- 06 Activity BADocument3 pages06 Activity BATyron Franz AnoricoNo ratings yet

- PARCOR HandoutsDocument15 pagesPARCOR Handoutsloise40% (5)

- 1.3.2.5 Buddy N SolDocument4 pages1.3.2.5 Buddy N SolJohn Clinton PeñafloridaNo ratings yet

- 1st Exam 1s2021Document6 pages1st Exam 1s2021Benjamin Jr VidalNo ratings yet

- Unit 1 ActvitiesDocument6 pagesUnit 1 ActvitiesLeslie Mae Vargas ZafeNo ratings yet

- Partnership & Business CombinationDocument32 pagesPartnership & Business CombinationJason Bautista100% (1)

- Afar I. Partnership FormationDocument4 pagesAfar I. Partnership FormationIrish SantiagoNo ratings yet

- ACCTG7 - 1st - 2ns TermDocument2 pagesACCTG7 - 1st - 2ns TermJessa BeloyNo ratings yet

- Topic 10 - Practice ProblemsDocument2 pagesTopic 10 - Practice ProblemsAnna Mariyaahh DeblosanNo ratings yet

- Acc7 q1Document2 pagesAcc7 q1Jao FloresNo ratings yet

- ACC102 Partnership ProblemsDocument13 pagesACC102 Partnership ProblemsDana TajedarNo ratings yet

- Activity 1 PartnershipDocument4 pagesActivity 1 PartnershipJanet AnotdeNo ratings yet

- Comprehensive Review QuestionsDocument5 pagesComprehensive Review QuestionsJane Ruby JennieferNo ratings yet

- Prelim AFAR 1Document6 pagesPrelim AFAR 1Chris Phil Dee75% (4)

- Parcor Ho1Document20 pagesParcor Ho1Angerica BongalingNo ratings yet

- 06 Activity 1Document9 pages06 Activity 1Sol Luna100% (3)

- Vergil Joseph I. Literal, DBA, CPA: Page 1 of 3Document3 pagesVergil Joseph I. Literal, DBA, CPA: Page 1 of 3hsjhsNo ratings yet

- 1ST GRADING EXAM For StudentsDocument12 pages1ST GRADING EXAM For StudentsAndrea Florence Guy VidalNo ratings yet

- Partnership FormationDocument5 pagesPartnership FormationMary Elisha PinedaNo ratings yet

- AFAR-01 (Partnership Formation & Operation)Document6 pagesAFAR-01 (Partnership Formation & Operation)Jezzie Santos100% (1)

- Activity Partnership Formation and OperationDocument8 pagesActivity Partnership Formation and OperationSharon AnchetaNo ratings yet

- Basic Concepts of PartnershipDocument5 pagesBasic Concepts of PartnershipKyla DizonNo ratings yet

- Partnership Formation - ProblemsDocument4 pagesPartnership Formation - ProblemsMargielyn Umbao100% (3)

- Partnership Q3Document2 pagesPartnership Q3Lorraine Mae RobridoNo ratings yet

- HO1 Partnership Formation and OperationDocument3 pagesHO1 Partnership Formation and OperationChristianAquinoNo ratings yet

- Learning Task No.1Document3 pagesLearning Task No.1scryx bloodNo ratings yet

- ACC 110 - CFE - 21 22 With ANSWERSDocument25 pagesACC 110 - CFE - 21 22 With ANSWERSGiner Mabale Steven100% (2)

- Partnership Accounting Practical Accounting 2Document13 pagesPartnership Accounting Practical Accounting 2random17341No ratings yet

- Learning Task No. 1.2Document3 pagesLearning Task No. 1.2Carl Oliver LacanlaleNo ratings yet

- Partnership Formation ProblemsDocument3 pagesPartnership Formation Problemsai kawaiiNo ratings yet

- Second Quiz On FS Analysis PDFDocument2 pagesSecond Quiz On FS Analysis PDFRandy ManzanoNo ratings yet

- Partnership SBCDocument10 pagesPartnership SBChyosunglover100% (1)

- Partnership Formation ExercisesDocument8 pagesPartnership Formation ExercisesMarjorie NepomucenoNo ratings yet

- Accounting QuizDocument5 pagesAccounting QuizLloyd Lameon0% (1)

- Partnership Formation 001Document20 pagesPartnership Formation 001Ma Teresa B. Cerezo50% (2)

- Pamantasan NG CabuyaoDocument2 pagesPamantasan NG CabuyaoHhhhhNo ratings yet

- Chapter 1 - PartnershipDocument72 pagesChapter 1 - PartnershipJohn Lloyd Yasto100% (5)

- Partnership ReviewerDocument7 pagesPartnership RevieweryowatdafrickNo ratings yet

- Practice Tests Partnership FormationDocument10 pagesPractice Tests Partnership FormationClaire RamosNo ratings yet

- AFAR - 07 - New Version No AnswerDocument7 pagesAFAR - 07 - New Version No AnswerjonasNo ratings yet

- Handouts 1 Partnership AccountingDocument5 pagesHandouts 1 Partnership AccountingRozel MontevirgenNo ratings yet

- Chapter 1 Practice ProblemsDocument5 pagesChapter 1 Practice ProblemsChristine Joyce SalvadorNo ratings yet

- Cdee Worksheet #3Document4 pagesCdee Worksheet #3ሔርሞን ይድነቃቸው100% (1)

- Part. AccountingDocument3 pagesPart. Accounting촏교새벼No ratings yet

- PacoaDocument18 pagesPacoaBianca VinluanNo ratings yet

- RawDocument5 pagesRawJenny MendozaNo ratings yet

- Reviewer From Prelim To FinalsDocument303 pagesReviewer From Prelim To FinalsRina Mae Sismar Lawi-an67% (3)

- AFAR 01 - Partnership FormationDocument2 pagesAFAR 01 - Partnership FormationSamantha Alice LysanderNo ratings yet

- Set A - Prelim Exam in COGM6Document5 pagesSet A - Prelim Exam in COGM6kaii 1234No ratings yet

- 2.2 - Lecture Notes - Partnership FormationDocument13 pages2.2 - Lecture Notes - Partnership FormationKatrina Regina BatacNo ratings yet

- Activity 1.1 PDFDocument2 pagesActivity 1.1 PDFDe Nev OelNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 10 Task PerformanceDocument3 pages10 Task PerformanceMarco AboyNo ratings yet

- Mobile GamingDocument2 pagesMobile GamingMarco AboyNo ratings yet

- Reaction Paper - Video Dubbing - BSA 301 - 'Document3 pagesReaction Paper - Video Dubbing - BSA 301 - 'Marco AboyNo ratings yet

- Task Performance Case DigestDocument1 pageTask Performance Case DigestJennilyn RoxasNo ratings yet

- Technology in The Educational Industry: Laboratory ExerciseDocument3 pagesTechnology in The Educational Industry: Laboratory ExerciseROSENDA BALINGAONo ratings yet

- 04 Task Performance 1Document6 pages04 Task Performance 1bryansalvatus100% (1)

- 5 Task Performance 1 Business LawDocument2 pages5 Task Performance 1 Business LawMarco AboyNo ratings yet

- Task Performance - BSA 301Document3 pagesTask Performance - BSA 301Marco AboyNo ratings yet

- 12TPDocument3 pages12TPMarco AboyNo ratings yet

- 09 Task PerformanceDocument14 pages09 Task PerformanceMarco AboyNo ratings yet

- 11 Task Performance 1Document3 pages11 Task Performance 1Marco AboyNo ratings yet

- 11LABDocument7 pages11LABMarco AboyNo ratings yet

- 12 Task Performance 1Document1 page12 Task Performance 1Marco AboyNo ratings yet

- 12 Seatwork 1Document1 page12 Seatwork 1Marco AboyNo ratings yet

- 11 Activity 1Document1 page11 Activity 1Marco AboyNo ratings yet

- 13 Quiz 1 Business LawDocument1 page13 Quiz 1 Business LawMarco AboyNo ratings yet

- 09 Quiz 1Document2 pages09 Quiz 1Marco AboyNo ratings yet

- Read The Following Items Carefully and Give What Is Asked. For Kant, What Is The Role of Reason in Living Morally?Document1 pageRead The Following Items Carefully and Give What Is Asked. For Kant, What Is The Role of Reason in Living Morally?Marco AboyNo ratings yet

- 04 Audio 1Document1 page04 Audio 1Marco AboyNo ratings yet

- Weeks 12-13: Social Issues - ARG: InstructionDocument2 pagesWeeks 12-13: Social Issues - ARG: InstructionMarco AboyNo ratings yet

- Prelim ExaminationDocument1 pagePrelim ExaminationMarco AboyNo ratings yet

- Task Performance Mariama Music Shop, Inc.: Assets Liabilities+ Stockholders' Equity TransactionDocument3 pagesTask Performance Mariama Music Shop, Inc.: Assets Liabilities+ Stockholders' Equity TransactionMarco Aboy100% (1)

- Name: Date: Score:: Property of STIDocument1 pageName: Date: Score:: Property of STIMarco AboyNo ratings yet

- 04 Audio 1Document1 page04 Audio 1Marco AboyNo ratings yet

- 06 Handout 1Document23 pages06 Handout 1Marco AboyNo ratings yet

- Jann: Date: Score: Jinn: Junn:: Property of STIDocument1 pageJann: Date: Score: Jinn: Junn:: Property of STIMarco AboyNo ratings yet

- Revised Course Outline-Corp LawDocument15 pagesRevised Course Outline-Corp LawErvin SagunNo ratings yet

- Ias 20 - Gov't GrantDocument19 pagesIas 20 - Gov't GrantGail Bermudez100% (1)

- 1slider For APPDocument1 page1slider For APPYong BenedictNo ratings yet

- Agamata Chapter 6Document18 pagesAgamata Chapter 6Drama SubsNo ratings yet

- CG Extra SumsDocument19 pagesCG Extra SumsPruthil Monpariya0% (1)

- Ambika Cotton Mills LimitedDocument68 pagesAmbika Cotton Mills LimitedSriNo ratings yet

- Thelazypersonguidetoinvesting PDFDocument12 pagesThelazypersonguidetoinvesting PDFOussama ToumiNo ratings yet

- SUBJECT: Accounting 13 NC Descriptive Title: Auditing and Assurance Concepts and Applications 1Document12 pagesSUBJECT: Accounting 13 NC Descriptive Title: Auditing and Assurance Concepts and Applications 1Prince CalicaNo ratings yet

- CIMA F2 Advanced Financial Reporting Passcards 1 2 PDFDocument141 pagesCIMA F2 Advanced Financial Reporting Passcards 1 2 PDFZarina Gadit100% (2)

- Balance Sheet: Forever YoungDocument2 pagesBalance Sheet: Forever YoungJulie Ann BonNo ratings yet

- Statements 7576Document10 pagesStatements 7576Cathy CastyNo ratings yet

- Dr. Marasigan Journal EntriesDocument1 pageDr. Marasigan Journal EntriesNeilan Jay FloresNo ratings yet

- Null 5 PDFDocument620 pagesNull 5 PDFJames100% (2)

- CHAPTER-14: C I R P U I & B C, 2016: Orporate Nsolvency Esolution Rocess Nder Nsolvency Ankruptcy ODEDocument27 pagesCHAPTER-14: C I R P U I & B C, 2016: Orporate Nsolvency Esolution Rocess Nder Nsolvency Ankruptcy ODESrishti NigamNo ratings yet

- Insolvency Law in Kenya: A. What Is The Difference Between Insolvency and Bankruptcy?Document8 pagesInsolvency Law in Kenya: A. What Is The Difference Between Insolvency and Bankruptcy?Dickson Tk Chuma Jr.No ratings yet

- ABBA (Housing Loan)Document8 pagesABBA (Housing Loan)Nurul JannahNo ratings yet

- Reliance Industries Working Capital ManagementDocument21 pagesReliance Industries Working Capital ManagementSalkar NilamNo ratings yet

- 3Q23 Earnings Release Final 8 1 23Document18 pages3Q23 Earnings Release Final 8 1 23Albenis ReyesNo ratings yet

- Chapter 5 - Partnership Dissolution Part 2Document7 pagesChapter 5 - Partnership Dissolution Part 2Xyzra AlfonsoNo ratings yet

- WorldCom Fraud PPT (Accounting Learning)Document12 pagesWorldCom Fraud PPT (Accounting Learning)蒲睿灵No ratings yet

- Time Value of MoneyDocument10 pagesTime Value of MoneyRandy ManzanoNo ratings yet

- In Acc Chris Jean Paden BsaDocument6 pagesIn Acc Chris Jean Paden BsaJurie BalandacaNo ratings yet

- Mayr-Melnhof: A Dark Quarter Ahead in Q2Document10 pagesMayr-Melnhof: A Dark Quarter Ahead in Q2Camila CalderonNo ratings yet

- MFRS 140 Investment Properties - NOTESDocument5 pagesMFRS 140 Investment Properties - NOTESDont RushNo ratings yet

- RBS - Round Up - 070410Document9 pagesRBS - Round Up - 070410egolistocksNo ratings yet

- Case StudyDocument7 pagesCase StudyPayal PatelNo ratings yet

- Homework Week4Document6 pagesHomework Week4Baladashyalan Rajandran0% (1)

- Financial Report Unilever 1Document8 pagesFinancial Report Unilever 1Dora MahayaniNo ratings yet

- Name: Deborah Busayo Omoniyi Wallet Number: 9044909873Document8 pagesName: Deborah Busayo Omoniyi Wallet Number: 9044909873Omoniyi BusayoNo ratings yet

- Exercise 1 - Familiarization of AccountingDocument2 pagesExercise 1 - Familiarization of AccountingMichael DiputadoNo ratings yet