Professional Documents

Culture Documents

Capacity Management: Year Paul's

Uploaded by

Mahak GargOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capacity Management: Year Paul's

Uploaded by

Mahak GargCopyright:

Available Formats

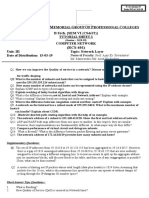

CAPACITY MANAGEMENT

1) Stewart Company produces two brands of salad dressings: Paul’s and Newman’s. Each is

available in bottles and single-serving plastic bags. Management would like to determine yearly

equipment and labor requirements for its packing operation for the next five years. The details

related to the exact weekly and monthly scheduling of the operations are done at different

levels in the planning process.

The demand for the two flavors and for each packaging options is given in the following table.

Year

Brand

1 2 3 4 5

Paul’s

Bottles (1000s) 60 100 150 200 250

Plastic bags (1000s) 100 200 300 400 500

Newman’s

Bottles (1000s) 75 85 95 97 98

Plastic bags (1000s) 200 400 600 650 680

The company has three machines that can each package 150,000 bottles each year (each

machine has two operators). It also has five machines that can each package 250,000 plastic

bags per year (each of these machines has three operators). These capacity numbers have been

adjusted for expected downtime and quality problems. Will the company have enough yearly

packaging capacity to meet future demand?

2) The owner of Hackers Computer Store is considering what to do with his business over the next

five years. Sales growth over the past couple of years has been good, but sales could grow

substantially if a major proposed electronics firm is built in the area. The owner sees three

options. The first is to enlarge the existing store, the second is to locate at a new sit, and the

third is to simply wait and do nothing. The process of expanding or moving would take little

time, and, and therefore, the store would not lose revenue. If nothing were done the first year

and strong growth occurred, then the decision to expand could be reconsidered. Waiting longer

than one year would allow competition to move in and would make expansion no longer

feasible.

The assumptions and condition are as follows.

a) Strong growth as a result of increased population of computer fanatics from the new

electronics firm has a 55% probability.

b) Strong growth with new site would give annual returns of $195,000 per year. Weak

growth with a new site would mean annual returns of $115,000.

c) Strong growth with an expansion would give annual returns of $190,000 per year. Weak

growth with an expansion would mean annual returns of $100,000.

d) At the existing store with no changes, there would be returns of $170,000 per year if

there is strong growth and $105,000 if growth is weak.

e) Expansion at the current site would cost $87,000.

f) The move to the new site would cost $210,000.

g) If the growth is strong and the existing site is enlarged during the second year, the cost

would still be $87,000.

h) Operating costs of all options are equal.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Emñìr (Ûvr'Df© - 2018: A (ZDM'© (DF'MDocument54 pagesEmñìr (Ûvr'Df© - 2018: A (ZDM'© (DF'MKarmicSmokeNo ratings yet

- TuteDocument3 pagesTuteSatyam SinghNo ratings yet

- DNV PubList2002Document16 pagesDNV PubList2002marquinameNo ratings yet

- Elections ESL BritishDocument3 pagesElections ESL BritishRosana Andres DalenogareNo ratings yet

- Shera Board Cladding FacadeDocument1 pageShera Board Cladding Facadevabegu9No ratings yet

- LEGAL AND JUDICIAL ETHICS - Final Report On The Financial Audit in The MCTC - AdoraDocument6 pagesLEGAL AND JUDICIAL ETHICS - Final Report On The Financial Audit in The MCTC - AdoraGabriel AdoraNo ratings yet

- William Reich HAbla de Freud PDFDocument32 pagesWilliam Reich HAbla de Freud PDFxtreme1981xNo ratings yet

- Just What Is It That Makes Allan Kaprow So New, So Appealing?: Early Work and Development of His Happenings Through Nineteen Fifty-NineDocument123 pagesJust What Is It That Makes Allan Kaprow So New, So Appealing?: Early Work and Development of His Happenings Through Nineteen Fifty-Ninemhines100No ratings yet

- Political Management of Islamic Fundamentalism: To Cite This VersionDocument32 pagesPolitical Management of Islamic Fundamentalism: To Cite This Versionsharif ibnshafiqNo ratings yet

- NSTP CM Week 6Document10 pagesNSTP CM Week 6dankmemerhuskNo ratings yet

- Shortcomings of The Current Approaches in TH Pre-Service and In-Service Chemistry Teachers TrainingsDocument5 pagesShortcomings of The Current Approaches in TH Pre-Service and In-Service Chemistry Teachers TrainingsZelalemNo ratings yet

- With A Healthy Heart, The Beat Goes On.Document4 pagesWith A Healthy Heart, The Beat Goes On.manish dafdaNo ratings yet

- Suggested Answer For Corporate Laws and Secretarial Practice June 09Document23 pagesSuggested Answer For Corporate Laws and Secretarial Practice June 09tayalsirNo ratings yet

- Analyzing The Legality of Mixed-Martial Arts (MMA) in India and The Strategic Options Available To Unveil The SportDocument20 pagesAnalyzing The Legality of Mixed-Martial Arts (MMA) in India and The Strategic Options Available To Unveil The SportLAW & POLICY REVIEWNo ratings yet

- VS VS: Duelo de TitanesDocument4 pagesVS VS: Duelo de TitanesArgenis LugoNo ratings yet

- A3002RU Datasheet V1.5Document3 pagesA3002RU Datasheet V1.5adadaNo ratings yet

- Ass Fucked by A GiantDocument5 pagesAss Fucked by A GiantSwetaNo ratings yet

- Unit 5 - Political Participation - TestDocument15 pagesUnit 5 - Political Participation - TestTejas RaNo ratings yet

- Qw-482 Welding Procedure SpecificationDocument2 pagesQw-482 Welding Procedure SpecificationAmanSharmaNo ratings yet

- Ta35 Ta40 Operations SafetyDocument150 pagesTa35 Ta40 Operations Safetyjuan100% (2)

- Cledus T. Judd InformationDocument34 pagesCledus T. Judd InformationjerrbearNo ratings yet

- List of Telugu Films of 2005 - WikipediaDocument1 pageList of Telugu Films of 2005 - WikipediaRa RsNo ratings yet

- Power Plant Economics 1 (UNIT-I)Document21 pagesPower Plant Economics 1 (UNIT-I)rahul soniNo ratings yet

- Sample Script For GraduationDocument15 pagesSample Script For GraduationRowena Lalongisip De Leon100% (3)

- Enlightened Despotism PPT For 2 Hour DelayDocument19 pagesEnlightened Despotism PPT For 2 Hour Delayapi-245769776No ratings yet

- Hosting Script - Dance Exercise Competition SY2019-2020Document3 pagesHosting Script - Dance Exercise Competition SY2019-2020Magelyn NB67% (3)

- Inalcik Za OdrinDocument11 pagesInalcik Za OdrinIvan StojanovNo ratings yet

- A.N. Ray, C.J., A. Alagiriswami, D.G. Palekar, P.N. Bhagwati and Y.V. Chandrachud, JJDocument20 pagesA.N. Ray, C.J., A. Alagiriswami, D.G. Palekar, P.N. Bhagwati and Y.V. Chandrachud, JJRishika AgarwalNo ratings yet

- Curriculum Development: 4 Major Educational PhilosophiesDocument26 pagesCurriculum Development: 4 Major Educational PhilosophiesMax GustinNo ratings yet

- Case Application 2 Who Needs A BossDocument2 pagesCase Application 2 Who Needs A BossIvan Joseph LimNo ratings yet