Professional Documents

Culture Documents

IDirect Sugar SectorUpdate Aug21

Uploaded by

Bharti PuratanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IDirect Sugar SectorUpdate Aug21

Uploaded by

Bharti PuratanCopyright:

Available Formats

Sugar

August 18, 2021

Global, domestic sugar prices surging ahead

Global sugar prices have crossed US cents 20/lb while simultaneously domestic

prices have also moved up to | 36/kg (UP). In our July 2021 sector report, we

reiterated our positive stance on sugar prices, distillery capacity expansion &

Sector Update

subsequent high earnings growth for next three years. Our view on sugar prices has

been materialising. We maintain our stance that the sugar industry would be able to

export 6-7 million tonnes (MT) of sugar in the 2021-22 sugar season without export

subsidy given global sugar prices are higher than cost of production for Indian sugar

companies. This would lead sugar inventory levels to come down to below 7 MT by

September 2022, keeping sugar prices firm (| 34-38/kg). The progress of the ethanol

blending programme is faster than our expectation. The current blending levels are

closer to 8.5% while OMCs have contracted to procure 318 crore litre of ethanol

between December 2020 and November 2021. We believe ethanol blending would

cross 10% by November 2022 given sugar companies are increasing distillery

capacity 2-3x in the next two years. With the commissioning of massive distillery

capacity by November 2022, blending levels would reach 20% levels by 2025.

Sugar prices moving up to rational levels

With further clarity on Brazilian sugar production, adversely impacted by drought &

frost, global raw sugar prices have moved to US cents 20.8/lb (| 32.5/kg ex-freight)

for March 2022 contracts. We believe sugar production in South-Central-Brazil would

be closer to 31 MT and 2022-23 sugar production could also be impacted by lack of

water availability. This would keep global sugar prices firm above US cents 20/lb.

Indian sugar millers have already contracted 1 MT (largely Maharashtra) of sugar

ICICI Securities – Retail Equity Research

under open general license (OGL) for the 2021-22 season. Domestic prices are

following global price trend moving to a four-year high of | 34/kg in Maharashtra and

| 36/kg in UP. We believe exports of 6-7 MT of sugar would be contracted for the

2021-22 season in the next three to four months, keeping domestic sugar prices firm

at | 34-38/kg. Average sugar realisation for sugar companies was | 32-33/kg in the

last three years. We believe margins in the sugar business would move up despite

expected hike (~6%) in sugarcane prices in UP.

Strong fundamentals lead to government measure withdrawal

The government has supported the sugar industry through temporary measures

(buffer subsidy, MSP, export subsidy) in the last three years. With an improvement

in fundamentals due to ethanol blending programme, reduction in sugar inventories, Recent event & key risks

the government has withdrawn the buffer subsidy in August 2020. Moreover, with

Global raw sugar prices have moved

global sugar prices inching up to above cost of production, it may not continue the

above US cents 20 /lb & Sugar prices

export subsidy in the 2021-22 sugar season as sugar millers can export without

government support. Further, we believe domestic prices would remain firm above in India have inched up to | 36 / kg in

| 34/kg, which makes minimum selling price (MSP) irrelevant in present context. UP & | 34 / kg in Maharashtra

However, it would continue to stay as floor above cost of production level.

Key Risk: (i) Any delay in distillery

Distillery capex, higher sugar prices to boost profitability capacity expansion, (ii) Any irrational

increase in sugarcane prices

Sugar companies under our coverage universe are undertaking 2-3x increase in

distillery capacities, which would improve profitability given B-heavy & sugarcane Research Analyst

juice route to produce ethanol is far more profitable compared to sugar & C-heavy Sanjay Manyal

ethanol at current prices (parity closer to | 40/kg). Moreover, we believe the uptick sanjay.manyal@icicisecurities.com

in sugar prices at a rational level would add to profitability. We maintain our positive

stance on the sugar sector and companies under our coverage. Sugar stocks are still

trading at 6-10x FY23E PE multiples & warrant higher multiples given strong &

sustainable profit growth (15-30% CAGR in FY21-24E) in the next three years.

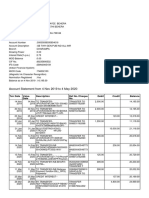

Exhibit 1: Valuation matrix

CMP TP M Cap EPS (|) P/E (x) EV/EBITDA (x) P/B RoCE (%)

Sector / Company

(|) (|) Rating (| Cr) FY21 FY22E FY23E FY24E FY21 FY22E FY23E FY24E FY21 FY22E FY23E FY24E FY21 FY22E FY23E FY24E FY21 FY22E FY23E FY24E

Balrampur Chini (BALCHI) 359 515 Buy 7,548 22.8 26.5 34.7 44.1 15.7 13.5 10.4 8.2 12.1 10.8 8.7 7.0 2.9 2.6 2.3 2.0 16.4 18.6 20.4 23.0

Dalmia Bharat Sugar (DALSUG) 428 650 Buy 3,465 33.4 39.2 46.7 55.5 12.8 10.9 9.2 7.7 9.1 7.9 6.9 5.8 1.6 1.7 1.4 1.2 13.3 14.7 15.5 16.8

Triveni Engineering (TRIENG) 179 270 Buy 4,335 12.2 16.7 21.4 24.9 14.7 10.7 8.4 7.2 9.2 8.4 6.6 5.6 2.8 2.4 2.0 1.7 19.4 19.8 23.3 25.1

Dwarikesh sugar (DWASUG) 72 110 Buy 1,348 4.9 7.0 8.5 13.0 14.7 10.2 8.5 5.5 9.4 7.2 5.9 4.0 2.3 2.0 1.7 1.3 14.4 18.7 19.6 27.2

Dhampur Sugar (DHASUG) 310 500 Buy 2,063 34.4 44.9 53.1 57.6 9.0 6.9 5.8 5.4 6.6 5.5 4.4 4.0 1.3 1.1 1.0 0.9 14.8 16.8 19.1 18.9

Avadh Sugar (AVASUG) 454 685 Buy 908 38.8 66.5 94.9 106.7 11.7 6.8 4.8 4.3 8.1 5.9 3.9 2.8 1.4 1.1 0.9 0.8 11.5 14.7 20.6 23.3

Source: Company, ICICI Direct Research

Sector Update | Sugar ICICI Direct Research

Price Chart Price Chart

450 18000 600 18000

400 16000 16000

500

350 14000 14000

300 12000 400 12000

250 10000 10000

300

200 8000 8000

150 6000 200 6000

100 4000 4000

100

50 2000 2000

0 0 0 0

Feb-19

Feb-19

Feb-18

Feb-20

Feb-18

Feb-20

Feb-21

Aug-18

Aug-20

Aug-17

Aug-18

Aug-20

Aug-17

Aug-19

Aug-19

Aug-21

Balrampur Chini NIFTY Dalmia Sugar NIFTY

Price Chart Price Chart

250 18000 90 18000

16000 80 16000

200 14000 70 14000

12000 60 12000

150 10000 50 10000

100 8000 40 8000

6000 30 6000

50 4000 20 4000

2000 10 2000

0 0 0 0

Feb-19

Feb-20

Feb-21

Feb-18

Aug-17

Aug-18

Aug-19

Aug-20

Aug-21

Feb-18

Feb-20

Feb-19

Feb-21

Aug-17

Aug-18

Aug-20

Aug-19

Aug-21

Triveni Engineering NIFTY Dwarikesh Sugar NIFTY

Price Chart Price Chart

450 18000 700 18000

400 16000 600 16000

350 14000 14000

300 12000 500 12000

250 10000 400 10000

200 8000 300 8000

150 6000 200 6000

100 4000 4000

50 2000 100 2000

0 0 0 0

Feb-19

Feb-19

Feb-18

Feb-20

Feb-21

Feb-18

Feb-20

Aug-17

Aug-18

Aug-20

Aug-18

Aug-20

Aug-19

Aug-21

Aug-17

Aug-19

Dhampur Sugar NIFTY Avadh Sugar NIFTY

ICICI Securities | Retail Research 2

Sector Update | Sugar ICICI Direct Research

RATING RATIONALE

ICICI Direct endeavours to provide objective opinions and recommendations. ICICI Direct assigns ratings to its

stocks according to their notional target price vs. current market price and then categorizes them as Buy, Hold,

Reduce and Sell. The performance horizon is two years unless specified and the notional target price is defined

as the analysts' valuation for a stock

Buy: >15%

Hold: -5% to 15%;

Reduce: -15% to -5%;

Sell: <-15%

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICI Direct Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities | Retail Research 3

Sector Update | Sugar ICICI Direct Research

ANALYST CERTIFICATION

I/We, Sanjay Manyal (MBA Finance) Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect

our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s)

in this report. It is also confirmed that above mentioned Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve

months and do not serve as an officer, director or employee of the companies mentioned in the report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products.

ICICI Securities is Sebi registered stock broker, merchant banker, investment adviser, portfolio manager and Research Analyst. ICICI Securities is registered with Insurance Regulatory

Development Authority of India Limited (IRDAI) as a composite corporate agent and with PFRDA as a Point of Presence. ICICI Securities Limited Research Analyst SEBI Registration Number –

INH000000990. ICICI Securities Limited SEBI Registration is INZ000183631 for stock broker. ICICI Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank and has its

various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect

of which are available on www.icicibank.com.

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment

banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities and its analysts, persons reporting to

analysts and their relatives are generally prohibited from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.

Recommendation in reports based on technical and derivative analysis centre on studying charts of a stock's price movement, outstanding positions, trading volume etc as opposed to focusing

on a company's fundamentals and, as such, may not match with the recommendation in fundamental reports. Investors may visit icicidirect.com to view the Fundamental and Technical

Research Reports.

Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

ICICI Securities Limited has two independent equity research groups: Institutional Research and Retail Research. This report has been prepared by the Retail Research. The views and opinions

expressed in this document may or may not match or may be contrary with the views, estimates, rating, and target price of the Institutional Research.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly

confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or

reproduced in any form, without prior written consent of ICICI Securities. While we would endeavor to update the information herein on a reasonable basis, ICICI Securities is under no

obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate

that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where

ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness

guaranteed. This report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe

for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat

recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy

is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own

investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent

judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign

exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily

a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ

materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other

assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report

for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or

specific transaction.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did

not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI

Securities nor Research Analysts and their relatives have any material conflict of interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day

of the month preceding the publication of the research report.

Since associates of ICICI Securities and ICICI Securities as a entity are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various

companies including the subject company/companies mentioned in this report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such

distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such

jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are

required to inform themselves of and to observe such restriction.

ICICI Securities | Retail Research 4

You might also like

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Sugar Sector by Icici DirectDocument24 pagesSugar Sector by Icici DirectpradeepthiteNo ratings yet

- IDirect Sugar SectorUpdate Jun22Document6 pagesIDirect Sugar SectorUpdate Jun22fojoyi2683No ratings yet

- Dairy-Industry Outlook April 2023Document5 pagesDairy-Industry Outlook April 2023Adarsh ChamariaNo ratings yet

- Sugar Annual - Kingston - Jamaica - JM2022-0003Document8 pagesSugar Annual - Kingston - Jamaica - JM2022-0003HALİM KILIÇNo ratings yet

- Sugar Semi-Annual - New Delhi - India - IN2023-0069Document10 pagesSugar Semi-Annual - New Delhi - India - IN2023-0069fojoyi2683No ratings yet

- PC - Sugar Sector Update - Feb 2021 20210227004214Document16 pagesPC - Sugar Sector Update - Feb 2021 20210227004214VINAYAK AGARWALNo ratings yet

- Sugar Industry: Sugar Breaking Out of Bitter CyclesDocument53 pagesSugar Industry: Sugar Breaking Out of Bitter CyclesPrasun PandeyNo ratings yet

- Sugar: Sweetness FadingDocument6 pagesSugar: Sweetness FadingPradeep MotaparthyNo ratings yet

- Sharekhan Sees 11% UPSIDE in Balrampur Chini Mills Growth ProspectsDocument9 pagesSharekhan Sees 11% UPSIDE in Balrampur Chini Mills Growth ProspectsTarunNo ratings yet

- Dairy and Products Semi-Annual - Beijing - China - People's Republic of - CH2022-0058Document16 pagesDairy and Products Semi-Annual - Beijing - China - People's Republic of - CH2022-0058Rodrigo Gallegos RiofrioNo ratings yet

- Sugar Industry Update - CareEdge ResearchDocument5 pagesSugar Industry Update - CareEdge Researchfojoyi2683No ratings yet

- Sugar Annual - Kingston - Jamaica - 04-15-2021Document8 pagesSugar Annual - Kingston - Jamaica - 04-15-2021Zineil BlackwoodNo ratings yet

- Market View - Sugar Market Shrugs Off India Export NewsDocument7 pagesMarket View - Sugar Market Shrugs Off India Export NewsJanaína CostaNo ratings yet

- GAIN Report: Pakistan Sugar Annual 2008 2008Document8 pagesGAIN Report: Pakistan Sugar Annual 2008 2008mirzayounus1000No ratings yet

- Indian Sugar Sector Embracing Clean Energy FutureDocument26 pagesIndian Sugar Sector Embracing Clean Energy FutureEquity Nest100% (1)

- 578 30120641 Sugar IndustryDocument8 pages578 30120641 Sugar Industryshankar gosaviNo ratings yet

- Dairy and Products Annual - New Delhi - India - 10!15!2021Document13 pagesDairy and Products Annual - New Delhi - India - 10!15!2021Saurabh NawaleNo ratings yet

- GAIN Report: Pakistan Sugar Annual 2009 2009Document7 pagesGAIN Report: Pakistan Sugar Annual 2009 2009AftabahmedrashidNo ratings yet

- Equity Research Report HMCDocument7 pagesEquity Research Report HMCyadhu krishnaNo ratings yet

- Sugar Annual Cairo Egypt EG2023-0006Document10 pagesSugar Annual Cairo Egypt EG2023-0006Dalia AshrafNo ratings yet

- Indonesia Sugar Annual Report 2017Document9 pagesIndonesia Sugar Annual Report 2017sachin kumarNo ratings yet

- Sugar Annual - New Delhi - India - IN2023-0035Document12 pagesSugar Annual - New Delhi - India - IN2023-0035Aditi NasareNo ratings yet

- Date: 2-4-2018 Gujarat Co-Operative Milk Marketing Federation (AMUL) Crosses Rs. 29,220 Crores Sales TurnoverDocument2 pagesDate: 2-4-2018 Gujarat Co-Operative Milk Marketing Federation (AMUL) Crosses Rs. 29,220 Crores Sales TurnoverAsanga KumarNo ratings yet

- Research On SugarDocument7 pagesResearch On SugarDivya AgarwalNo ratings yet

- Sugar Annual: Report NameDocument9 pagesSugar Annual: Report Namenusrat jehanNo ratings yet

- Fatty AcidsDocument29 pagesFatty AcidsRobel KefelewNo ratings yet

- Indonesia Sugar Annual Indonesia Sugar Annual Report 2019: Date: GAIN Report NumberDocument10 pagesIndonesia Sugar Annual Indonesia Sugar Annual Report 2019: Date: GAIN Report NumberRSTNo ratings yet

- Should India Export Sugar At The Risk of Fuelling Prices At HomeDocument23 pagesShould India Export Sugar At The Risk of Fuelling Prices At Homeusername0210No ratings yet

- Sugar Annual - Jakarta - Indonesia - ID2022-0012Document12 pagesSugar Annual - Jakarta - Indonesia - ID2022-0012kennethNo ratings yet

- Sugar Outlook For 2029Document12 pagesSugar Outlook For 2029ٍSahar AboudNo ratings yet

- MargarineDocument25 pagesMargarineyenealem AbebeNo ratings yet

- India Sugar SectorDocument4 pagesIndia Sugar SectorsonysajanNo ratings yet

- Group 3 SIDM ProjectDocument23 pagesGroup 3 SIDM Projectanany guptaNo ratings yet

- Sector Report Example (Sugar)Document5 pagesSector Report Example (Sugar)Jai DaveNo ratings yet

- Prabhu Sugars ReportDocument27 pagesPrabhu Sugars ReportPrajwal UtturNo ratings yet

- J Component: PROF. Dr. Vijayaraj - KDocument29 pagesJ Component: PROF. Dr. Vijayaraj - KJasperNo ratings yet

- India Sugar 19apr21Document39 pagesIndia Sugar 19apr21fojoyi2683No ratings yet

- Process Costing SystemDocument5 pagesProcess Costing SystemSiraj AhmedNo ratings yet

- Sugar Sector Analysis: Background and Measures Taken by Govt in Sugar Season 2017-18Document3 pagesSugar Sector Analysis: Background and Measures Taken by Govt in Sugar Season 2017-18Achal MeenaNo ratings yet

- India's sugar industry exhibiting rapid growth through 20Document24 pagesIndia's sugar industry exhibiting rapid growth through 20Gurpreet ParmarNo ratings yet

- Indian Confectionery Market Analysis and Growth ForecastDocument8 pagesIndian Confectionery Market Analysis and Growth ForecastYash AgarwalNo ratings yet

- Wheat FlourDocument16 pagesWheat Flourmeftuhabdi100% (1)

- Consumer Sector - Best in ClassDocument30 pagesConsumer Sector - Best in ClassEry IrmansyahNo ratings yet

- IPO Market Nov-2023Document4 pagesIPO Market Nov-2023Deepan KapadiaNo ratings yet

- SKP Sec-Balrampur (Init Cov) - 2012Document12 pagesSKP Sec-Balrampur (Init Cov) - 2012rchawdhry123No ratings yet

- Lower Production Sweet For Sugar CompaniesDocument3 pagesLower Production Sweet For Sugar Companiessanghvi21No ratings yet

- Australian Sugar Production and Exports Forecast StableDocument4 pagesAustralian Sugar Production and Exports Forecast StableAlan TeeNo ratings yet

- Baking PowderDocument29 pagesBaking PowderTed Habtu Mamo AsratNo ratings yet

- Sugar Profile July 2019Document9 pagesSugar Profile July 2019Ahmed OuhniniNo ratings yet

- Sugar - Profile - July - 2019 ImportentDocument10 pagesSugar - Profile - July - 2019 ImportentMohit SharmaNo ratings yet

- Livestock and Products Semi-Annual Brasilia Brazil BR2022-0018Document35 pagesLivestock and Products Semi-Annual Brasilia Brazil BR2022-0018Douglas Gomes VieiraNo ratings yet

- Britannia Industries: Britannia Industries (BIL) Is A Dominant Leader in TheDocument6 pagesBritannia Industries: Britannia Industries (BIL) Is A Dominant Leader in Thetejas_dave85No ratings yet

- Oilseeds and Products Annual - Jakarta - Indonesia - ID2022-0007Document23 pagesOilseeds and Products Annual - Jakarta - Indonesia - ID2022-0007GabrielNo ratings yet

- Financial Plan of Chemical Industry: Amardeep PigmentDocument17 pagesFinancial Plan of Chemical Industry: Amardeep Pigmentsant1306No ratings yet

- Baking PowderDocument26 pagesBaking PowderTamene MatewosNo ratings yet

- Insights Reg PlantationsDocument69 pagesInsights Reg PlantationsNasya YenitaNo ratings yet

- Indian Econ SnapshotDocument21 pagesIndian Econ SnapshotAshish JainNo ratings yet

- Sugar Industry Market Research & ROCOL ProductsDocument30 pagesSugar Industry Market Research & ROCOL ProductsROCOL EGYPTNo ratings yet

- Coffee Report and Outlook April 2023 - ICODocument39 pagesCoffee Report and Outlook April 2023 - ICOsyifa amaliaNo ratings yet

- Fundamental Analysis (Industry, Economics & Company Analysis)Document4 pagesFundamental Analysis (Industry, Economics & Company Analysis)Bharti Puratan0% (1)

- Graduate Brochure 2020Document36 pagesGraduate Brochure 2020Bharti PuratanNo ratings yet

- Growth of PMS Industry and Why Choose Motilal Oswal PMSDocument71 pagesGrowth of PMS Industry and Why Choose Motilal Oswal PMSBharti PuratanNo ratings yet

- Worlds Oldest BookDocument7 pagesWorlds Oldest BookBharti PuratanNo ratings yet

- Overview of Passive Fund in India - CIELDocument19 pagesOverview of Passive Fund in India - CIELBharti PuratanNo ratings yet

- Effective Credit Monitoring of Corporate and SME Advances: On Campus/Online Programme OnDocument5 pagesEffective Credit Monitoring of Corporate and SME Advances: On Campus/Online Programme OnBharti PuratanNo ratings yet

- Online Finance Certificate for BankersDocument5 pagesOnline Finance Certificate for BankersBharti PuratanNo ratings yet

- Brochure Technical AnalysisDocument4 pagesBrochure Technical AnalysisBharti PuratanNo ratings yet

- Business Analytics by Using R and Other Statistical SoftwareDocument5 pagesBusiness Analytics by Using R and Other Statistical SoftwareBharti PuratanNo ratings yet

- Molded Inserts in Aluminum Castings: Background & ApplicationsDocument1 pageMolded Inserts in Aluminum Castings: Background & ApplicationsBharti PuratanNo ratings yet

- CFA Institute Research Challenge: Buy Recommendation on Britannia Industries Ltd. (BRITDocument18 pagesCFA Institute Research Challenge: Buy Recommendation on Britannia Industries Ltd. (BRITBharti PuratanNo ratings yet

- COFFEEDAY 07092021163542 CDELAnnualReport2021Document327 pagesCOFFEEDAY 07092021163542 CDELAnnualReport2021Bharti PuratanNo ratings yet

- Covid 19 and Emergence of New Consumer Products Landscape in India PDFDocument36 pagesCovid 19 and Emergence of New Consumer Products Landscape in India PDFVickesh MalkaniNo ratings yet

- Paras Defence & Space Technologies LTD: UnratedDocument12 pagesParas Defence & Space Technologies LTD: UnratedBharti PuratanNo ratings yet

- Whirlpool of India: US Court Ruling Has No Impact On WHIRL, Prima FacieDocument12 pagesWhirlpool of India: US Court Ruling Has No Impact On WHIRL, Prima FacieBharti PuratanNo ratings yet

- IDirect Gokaldas Q2FY22Document6 pagesIDirect Gokaldas Q2FY22Bharti PuratanNo ratings yet

- Affle - Q2FY22 - Result Update - 15112021 Final - 15-11-2021 - 12Document8 pagesAffle - Q2FY22 - Result Update - 15112021 Final - 15-11-2021 - 12Bharti PuratanNo ratings yet

- MCX CCL GuidelinesDocument2 pagesMCX CCL GuidelinesBharti PuratanNo ratings yet

- NIFTY Next 50 Index Provides Diversified Exposure to Large-Cap Indian StocksDocument8 pagesNIFTY Next 50 Index Provides Diversified Exposure to Large-Cap Indian StocksBharti PuratanNo ratings yet

- Asian Paints Book of Colours 2016 Guide to Home Decor TrendsDocument148 pagesAsian Paints Book of Colours 2016 Guide to Home Decor TrendssandeepNo ratings yet

- NSE Factbook-2018 Final PDFDocument90 pagesNSE Factbook-2018 Final PDFkiranNo ratings yet

- WWW Sebi Gov inDocument26 pagesWWW Sebi Gov inSuvojit DeshiNo ratings yet

- SkylineDocument55 pagesSkylineBharti PuratanNo ratings yet

- SEBI circular on simplifying trading account openingDocument14 pagesSEBI circular on simplifying trading account openingBharti PuratanNo ratings yet

- Policies and ProgrammesDocument59 pagesPolicies and ProgrammesrakeshNo ratings yet

- SEBI circular on simplifying trading account openingDocument14 pagesSEBI circular on simplifying trading account openingBharti PuratanNo ratings yet

- SEBI & Depository GuidelinesDocument4 pagesSEBI & Depository GuidelinesBharti PuratanNo ratings yet

- Indian Financial MarketsDocument24 pagesIndian Financial MarketsNidhi BothraNo ratings yet

- Banking & Economy PDF - December 2021 by AffairsCloud 1Document153 pagesBanking & Economy PDF - December 2021 by AffairsCloud 1OK BHaiNo ratings yet

- Hedge AccountingDocument8 pagesHedge AccountingDilip YadavNo ratings yet

- Power Point Presentation On Study of Sunrise BankDocument15 pagesPower Point Presentation On Study of Sunrise Bankarjun_niroulaNo ratings yet

- PNB 2015-AnnualReportDocument162 pagesPNB 2015-AnnualReportMarius AngaraNo ratings yet

- TC Report Annexures 28122021Document205 pagesTC Report Annexures 28122021manoharNo ratings yet

- Does PPP Eliminate Concerns About Long-Term Exchange Rate RiskDocument2 pagesDoes PPP Eliminate Concerns About Long-Term Exchange Rate RiskAriel Logacho100% (1)

- Macroeconomics 12th Edition Gordon Solutions ManualDocument15 pagesMacroeconomics 12th Edition Gordon Solutions Manuallouisbeatrixzk9u100% (30)

- Account Statement From 4 Nov 2019 To 4 May 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 4 Nov 2019 To 4 May 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceChiranjibi Behera ChiruNo ratings yet

- Capital Budgeting For Multinational FirmsDocument21 pagesCapital Budgeting For Multinational Firmskarim swillahNo ratings yet

- Functions of Central BankDocument3 pagesFunctions of Central Banknirav1988No ratings yet

- Screenshot 2023-08-27 at 11.56.55 AMDocument34 pagesScreenshot 2023-08-27 at 11.56.55 AMShajid HassanNo ratings yet

- ReviewerDocument3 pagesReviewergirlNo ratings yet

- Deposit Product, BACH, RTGS, AISER, SLR, Deceased AcDocument6 pagesDeposit Product, BACH, RTGS, AISER, SLR, Deceased AcRayhan AhmedNo ratings yet

- Sumit Kumar-117690592011 (B-04)Document108 pagesSumit Kumar-117690592011 (B-04)Sunil TankNo ratings yet

- Technical Paper AccrualsDocument33 pagesTechnical Paper AccrualszafernaseerNo ratings yet

- FET Economics Grades 10 - 12Document69 pagesFET Economics Grades 10 - 12mosianaledi742No ratings yet

- India's Banking Industry: Key Trends and FiguresDocument54 pagesIndia's Banking Industry: Key Trends and Figuressaikrishna lakkavajjalaNo ratings yet

- CRED AnalysisDocument20 pagesCRED Analysisharsh agarwalNo ratings yet

- Test 11 SolutionsDocument29 pagesTest 11 SolutionsNguyệt LinhNo ratings yet

- Commercial Account FormDocument19 pagesCommercial Account FormSimonNo ratings yet

- 1MCL FormIEPF 2 2013 2014 2020Document319 pages1MCL FormIEPF 2 2013 2014 2020Harsha ReddyNo ratings yet

- Tugas Akm Ii Pertemuan 13Document5 pagesTugas Akm Ii Pertemuan 13Alisya UmariNo ratings yet

- NISM Series XXII Fixed Income Securities Workbook May 2021Document182 pagesNISM Series XXII Fixed Income Securities Workbook May 2021Karthick S Nair100% (1)

- Chapter 2Document4 pagesChapter 2JavNo ratings yet

- The Pros and Cons of GrexitDocument4 pagesThe Pros and Cons of GrexitTanay ChitreNo ratings yet

- A Review of Lease Accounting 리스회계의 개관 및 IFRS 16의 시사점Document34 pagesA Review of Lease Accounting 리스회계의 개관 및 IFRS 16의 시사점Trang HuỳnhNo ratings yet

- Golden Gate Colleges Senior High School Department: The Problem and Its BackgroundDocument49 pagesGolden Gate Colleges Senior High School Department: The Problem and Its BackgroundKimberly BanuelosNo ratings yet

- Online Court Fee Payment SOPDocument10 pagesOnline Court Fee Payment SOPWWWEEEENo ratings yet

- QualsstructureDocument2 pagesQualsstructureJithin AbrahamNo ratings yet

- FM II Assignment 6 W22Document1 pageFM II Assignment 6 W22Farah ImamiNo ratings yet