Professional Documents

Culture Documents

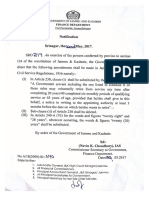

Special Allowances RULE 2BB

Uploaded by

Viraja Guru0 ratings0% found this document useful (0 votes)

10 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pagesSpecial Allowances RULE 2BB

Uploaded by

Viraja GuruCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Special Allowances [S.

10(14)]

Following prescribed special allowances are exempt:

Allowance, not in the nature of perquisite, granted to meet expenses wholly,

necessarily and exclusively incurred in the performance of duties, to the

extent to which actually incurred.

Allowance granted to meet personal expense at the place where duties of his

office are ordinarily performed or at the place where he ordinarily resides or

to compensate for increased cost of living as may be prescribed in Rule 2BB.

Nature of allowance prescribed under Rule 2BB

For cost of travel on tour or on transfer,

For ordinary daily charges on account of absence from normal place of duty

on tour or for journey in connection with transfer,

For conveyance in performance of duties, where free conveyance is not

provided,

For expenditure on helper engaged for performance of office duties,

For encouraging academic, research and training pursuits in educational

and research institutions,

For purchase or maintenance of uniform,

Special Compensatory Allowance in specified areas to extent specified,

Tribal Area Allowances in specified states up to Rs. 200 p.m.

For meeting personal expenditure of employee of transport system running

transport vehicle, up to 70% of allowance, maximum of Rs. 6,000 p.m.,

provided no daily allowance for the said duty is received.

Children educational allowance @ Rs. 100 p.m. per child, maximum of two

children,

Children hostel allowance @ Rs. 300 p.m. per child, maximum of two children,

Compensatory Field Area Allowance in specified areas, @ Rs. 2,600 p.m.

Compensatory modified field area allowance @ Rs. 1,000 p.m.

Counter insurgency allowance @ Rs. 3,900 p.m. to members of armed forces.

Transport allowance (TA) granted to meet expenses for commuting between

place of residence and place of duty is exempt up to Rs. 800 per month and

TA received by blind or orthopedically handicapped is exempt up to Rs. 1,600

per month.

Underground allowance granted to employee of underground coal mines: Rs.

800 per month.

Special allowance in the nature of high altitude to members of armed

forces: Rs. 1,060 per month for altitude of 9,000 to 15,000 ft. or Rs. 1,600 per

month for altitude above 15,000 ft.

Special compensatory highly active field area allowance to members of

armed forces Rs. 4,200 per month.

Island (duty) allowance to members of armed forces – Rs. 3,250/- per month.

Perquisites

Perquisites are benefits such as rent free accommodation, company’s car, etc

Perquisites may be provided in cash or in kind.

Reimbursement of expenses incurred during office work is not a part of

perquisites.

Unauthorized benefits obtained do not form part of Perquisites

Perquisites may be fully taxable, partially taxable or fully exempt.

Fully and Partially Taxable Perquisites

Perquisites not taxable in all cases

The following perquisites are not taxable under CBDT instructions or by virtue of the

Act/Rules:

The provision of medical facilities as per Para 4(i).

Free meals provided to all employees in office up to Rs. 50 per employee

provided by the employer through paid vouchers usable at eating joints.

Telephone including mobile phone provided to the employee.

Perquisites allowed outside India by the Government to a citizen of India for

rendering services outside India.

Sum payable by an employer to pension or deferred annuity scheme.

Employer’s contribution to staff group insurance scheme.

Actual travelling expenses paid/reimbursed for journeys undertaken for

business purposes.

Payment of annual premium on personal accident policy, if such policy is

taken to

safeguard the employer’s interest. See CIT vs. Lala Shri Dhar (1922) 84 ITR 192

(Delhi).

Rent-free official residence to a High Court or Supreme Court Judge.

Rent-free furnished residence to official of Parliament.

Conveyance facility to High Court/Supreme Court Judges.

Perquisites taxable in hands of all employees:

Value of rent-free accommodation.

Value of concession in rent.

Amount paid by employer in respect of any obligation which otherwise

would have been payable by employee.

Value of any security or sweat equity shares allotted or transferred by

employer/former employer as free or concessional cost.

An amount of contribution to an approved superannuation fund by the

employer, to an extent it excess Rs. 1, 00,000/-.

Any sum payable either directly or through a fund by employer (other than

recognized PF, approved superannuation fund etc.) to effect an assurance on

the life of the employee or to affect a contract for an annuity.

You might also like

- SHRMDocument62 pagesSHRMsuraj100% (1)

- Relationship Between Demand and SupplyDocument3 pagesRelationship Between Demand and SupplyViraja GuruNo ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- Industrial Disputes Types and FormsDocument14 pagesIndustrial Disputes Types and FormsViraja GuruNo ratings yet

- Economic Environment of International MarketingDocument4 pagesEconomic Environment of International MarketingViraja GuruNo ratings yet

- Module 4 International Marketing MixDocument4 pagesModule 4 International Marketing MixViraja GuruNo ratings yet

- The Role of Talent Planning Within The Organisation: People Management Processes RecruitDocument6 pagesThe Role of Talent Planning Within The Organisation: People Management Processes RecruitViraja GuruNo ratings yet

- 10 Principles of EconomicsDocument9 pages10 Principles of EconomicsViraja GuruNo ratings yet

- Introduction To EconomicsDocument1 pageIntroduction To EconomicsViraja GuruNo ratings yet

- CTPM ProblemsDocument31 pagesCTPM ProblemsViraja GuruNo ratings yet

- Perfect Competition in Short RunDocument20 pagesPerfect Competition in Short RunViraja GuruNo ratings yet

- Theory of The FirmDocument44 pagesTheory of The FirmViraja GuruNo ratings yet

- Recruitment & SelectionDocument8 pagesRecruitment & SelectionViraja GuruNo ratings yet

- HR Practices and Organisation Strategies in Select IT Companies in India - SandeepDocument71 pagesHR Practices and Organisation Strategies in Select IT Companies in India - SandeepViraja GuruNo ratings yet

- Bangalore University - Mba 4 Semester Chapter - 1 Introduction To GSTDocument7 pagesBangalore University - Mba 4 Semester Chapter - 1 Introduction To GSTViraja GuruNo ratings yet

- Corporate Tax Planning and Management Module 1.Document46 pagesCorporate Tax Planning and Management Module 1.Viraja GuruNo ratings yet

- CUSTOMS DUTY - Module 3Document14 pagesCUSTOMS DUTY - Module 3Viraja GuruNo ratings yet

- Synopsis Sagar Project - A Study On The Need of CRM in OrganizatonDocument3 pagesSynopsis Sagar Project - A Study On The Need of CRM in OrganizatonViraja GuruNo ratings yet

- Demand Forecasting: - What Is Demand Forecasting? - "Demand Forecasting Is An Estimate ofDocument29 pagesDemand Forecasting: - What Is Demand Forecasting? - "Demand Forecasting Is An Estimate ofViraja GuruNo ratings yet

- GST 3Document18 pagesGST 3Viraja GuruNo ratings yet

- HRP Printout NotesDocument104 pagesHRP Printout NotesViraja GuruNo ratings yet

- Question Bank Module 1 Human Capital ManagementDocument2 pagesQuestion Bank Module 1 Human Capital ManagementViraja GuruNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Environmental Status ScaleDocument4 pagesEnvironmental Status ScaleElena Olmo ValderramaNo ratings yet

- Part A: PersonalDocument2 pagesPart A: PersonalvishwaNo ratings yet

- Chapter 8 - Deductions From Gross IncomeDocument36 pagesChapter 8 - Deductions From Gross IncomejohnNo ratings yet

- Gen Math Problems For Math MazeDocument1 pageGen Math Problems For Math MazeErika Roxanne ColeNo ratings yet

- SRO - 217 Dated 22.05.2017 Qualifying Service PeriodDocument2 pagesSRO - 217 Dated 22.05.2017 Qualifying Service PeriodZaid WaniNo ratings yet

- Project On LIC IndiaDocument73 pagesProject On LIC IndiaViPul86% (73)

- A Guide To Income Tax Benefits For Senior CitizensDocument18 pagesA Guide To Income Tax Benefits For Senior CitizensAshutosh JaiswalNo ratings yet

- KPTCL 2011 12 Annual ReportDocument142 pagesKPTCL 2011 12 Annual Reportamit77999No ratings yet

- Fmi Assignment Time Value of ValueDocument8 pagesFmi Assignment Time Value of ValuerajeshNo ratings yet

- Staff Retirement BenefitsDocument2 pagesStaff Retirement BenefitsEthan LynnNo ratings yet

- BSBFIM502 - Student Assessment v1.1Document19 pagesBSBFIM502 - Student Assessment v1.1Niomi Golrai100% (1)

- Annex 1: Monthly Remittance Return of Income Taxes Withheld On Compensation DescriptionDocument2 pagesAnnex 1: Monthly Remittance Return of Income Taxes Withheld On Compensation DescriptionAlbert BernardoNo ratings yet

- Jessica PayslipDocument2 pagesJessica Payslipdavd brebNo ratings yet

- Your Centrelink Statement For Parenting Payment: Reference: 207 828 705JDocument3 pagesYour Centrelink Statement For Parenting Payment: Reference: 207 828 705JLupe VakaNo ratings yet

- Acctg 22 - Chapter 10 Quiz 1Document1 pageAcctg 22 - Chapter 10 Quiz 1Jennifer Simone TinaganNo ratings yet

- Strategic Management: Types of PoliciesDocument2 pagesStrategic Management: Types of PoliciesSittie Hijara75% (4)

- Notice of ReassignmentDocument1 pageNotice of Reassignmentamy mary b. carbonellNo ratings yet

- Canada Life RCA BrochureDocument4 pagesCanada Life RCA Brochuremacsmith0007No ratings yet

- BCBS FEP Dental 2021 BrochureDocument56 pagesBCBS FEP Dental 2021 BrochureErdeli StefaniaNo ratings yet

- Cases 2Document13 pagesCases 2Alit Dela CruzNo ratings yet

- Contract Labour Act GistDocument4 pagesContract Labour Act Gistvikas2519No ratings yet

- Decision Tree (Withholding Tax)Document1 pageDecision Tree (Withholding Tax)Loudie Ann MarcosNo ratings yet

- 1234Document36 pages1234bindiyabinu123No ratings yet

- RSA Rules-Annex 1Document6 pagesRSA Rules-Annex 1Shaju Ponnarath100% (1)

- Gfal I and Ii With Top Up - Updated For Deped 01292020Document38 pagesGfal I and Ii With Top Up - Updated For Deped 01292020Joseph Christian Bangaoil AbaagNo ratings yet

- 5405-Aj 21Document4 pages5405-Aj 21crazybearNo ratings yet

- NPS Contribution Form PDFDocument1 pageNPS Contribution Form PDFratan203No ratings yet

- Syllabus of Divisional Accounts Officer ExamsDocument13 pagesSyllabus of Divisional Accounts Officer ExamsAshfaque Larik92% (12)

- Aibea Cir 518.13Document2 pagesAibea Cir 518.13Sai PkNo ratings yet