Professional Documents

Culture Documents

SettlementReport

Uploaded by

Bhanuranjan S BOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SettlementReport

Uploaded by

Bhanuranjan S BCopyright:

Available Formats

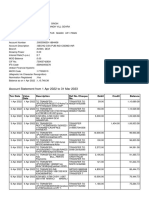

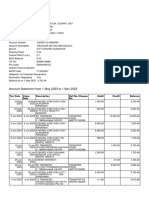

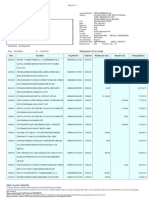

Schneider Electric IT Business India Private Ltd

187/3 & 188/3, JIGANI, , BANGALORE - 562106 - KARNATAKA

Settlement slip Nov-2020

FULL AND FINAL SETTLEMENT SLIP OF NOVEMBER 2020

Employee_Code :00160825 State :KARNATAKA

Employee_Name:Shailendra Bellakki Location :IND - Exora Business Park

Department :NRJ QSC NEW ECOS Leave Encash Days : 42.00 Bank/MICR :

Designation :Associate General Manager DOJ :24 Nov 2008 Notice Recovery Days: 0.00 Bank A/c No. :CHEQUE

DOL :30 Jun 2014 Arrear Days : 0.00 ENTITY NAME :Schneider Electric IT Business India Private Ltd

DOB :23 Jul 1970 Payable Days : 0.00 PAN :ACEPB9610R

PF No. :

ESI No. :

PF UAN :

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Basic 60159.00 0.00 60159.00 60159.00 PF 7219.00

House Rent Allowance 30080.00 0.00 30080.00 30080.00 PROF. TAX 200.00

Conveyance 800.00 0.00 800.00 800.00

Children Education Allowance 200.00 0.00 200.00 200.00

FBP Special Allowance 40141.00 0.00 40141.00 40141.00

Leave Encashment 0.00 183932.00 0.00 183932.00

Gratuity 0.00 208243.00 0.00 208243.00

Total 131380.00 392175.00 131380.00 523555 GROSS DEDUCTION 7419

Net Pay : 516136.00 (FIVE LAKHS SIXTEEN THOUSAND ONE HUNDRED THIRTY SIX ONLY)

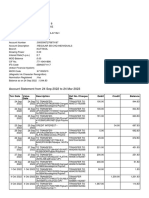

Income Tax Worksheet for the Period April 2020 - March 2021

*You have opted for Old Tax Regime

Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA Calculation

Basic 60159.00 0.00 60159.00 Investments u/s 80C Rent Paid 0.00

House Rent Allowance 30080.00 0.00 30080.00 Provident Fund 7219.00 From 01/04/2020

Conveyance 800.00 0.00 800.00 To 30/06/2014

Children Education Allowance 200.00 0.00 200.00 1. Actual HRA 30080.00

FBP Special Allowance 40141.00 0.00 40141.00 2. 40% or 50% of Basic 24064.00

Leave Encashment 183932.00 8151.00 175781.00 3. Rent - 10% Basic 0.00

Gratuity 208243.00 208243.00 0.00 Least of above is exempt 0.00

Taxable HRA 30080.00

TDS Deducted Monthly

Gross 523555.00 216394.00 307161.00 Total of Investments u/s 80C 7219.00 Month Amount

Deductions U/S 80C 7219.00 November-2020 0.00

Total of Ded Under Chapter VI-A 7219.00 Tax Deducted on Perq. 0.00

Standard Deduction 50000.00

Total 0.00

Previous Employer Taxable Income 0.00

Previous Employer Professional Tax 0.00

Professional Tax 200.00

Under Chapter VI-A 7219.00

Any Other Income 0.00

Taxable Income 249742.00

Total Tax 0.00

Tax Rebate u/s 87a 0.00

Surcharge 0.00

Tax Due 0.00

Health and Education Cess 0.00

Net Tax 0.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted on Perq. 0.00

Tax Deducted Till Date 0.00

Tax Deducted on Any Other Income 0.00

Tax to be Deducted 0.00

Tax/Month 0.00 Total of Income from Other Sources

Tax on Non-Recurring Earnings 0.00

Tax Deduction for this month 0.00

You might also like

- IDFCFIRSTBankstatement 10072945058 105209731Document26 pagesIDFCFIRSTBankstatement 10072945058 105209731anita vermaNo ratings yet

- Acct Statement XX4210 03092023Document16 pagesAcct Statement XX4210 03092023Maddie BlackberryNo ratings yet

- Puja 101921Document41 pagesPuja 101921SpammersNo ratings yet

- Recurring Deposit ConfirmationDocument2 pagesRecurring Deposit ConfirmationMANISH KUMARNo ratings yet

- Acc PDFDocument4 pagesAcc PDFShakir MujtabaNo ratings yet

- T O7 BQR4 Eq BTULo 5 UDocument15 pagesT O7 BQR4 Eq BTULo 5 UMukesh ThakurNo ratings yet

- Chirag STDocument18 pagesChirag STchiragNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Aerish Paul100% (1)

- Acct Statement XX5070 27012023Document12 pagesAcct Statement XX5070 27012023Vedaant raghvanNo ratings yet

- IDFCFIRSTBankstatement 10116871316Document25 pagesIDFCFIRSTBankstatement 10116871316abrarkhan47792No ratings yet

- SESm 1 B 0 y LMNHTM1 ZDocument15 pagesSESm 1 B 0 y LMNHTM1 ZJithuHashMiNo ratings yet

- Acct Statement - XX3475 - 27042023Document65 pagesAcct Statement - XX3475 - 27042023RAVINDER PANJETANo ratings yet

- NLi 1 Uc 03 Ltyr 9 Wi ZDocument15 pagesNLi 1 Uc 03 Ltyr 9 Wi ZDhanush MenduNo ratings yet

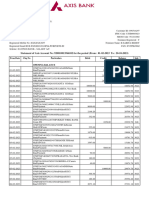

- Statement of Axis Account No:920010013566102 For The Period (From: 01-02-2023 To: 20-10-2023)Document39 pagesStatement of Axis Account No:920010013566102 For The Period (From: 01-02-2023 To: 20-10-2023)SAHADEO REDDYNo ratings yet

- o 5 So Bu 9 Fze JUXnrdDocument7 pageso 5 So Bu 9 Fze JUXnrdSouravDeyNo ratings yet

- Acct Statement - XX6002 - 22112023Document23 pagesAcct Statement - XX6002 - 22112023sanchitNo ratings yet

- Nagraj S/O Sidramappa Plot No:67 Kruneshwar Nagar Jewargi Road GulbargaDocument13 pagesNagraj S/O Sidramappa Plot No:67 Kruneshwar Nagar Jewargi Road GulbargaNagraj SidramappaNo ratings yet

- Acct Statement XX2856 09062023Document19 pagesAcct Statement XX2856 09062023debsudipto93No ratings yet

- PAYSLIP Aug 201926552204559Document1 pagePAYSLIP Aug 201926552204559Akshay ShindeNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument15 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancesrisailamsriNo ratings yet

- Acct Statement XX5033 07072023Document4 pagesAcct Statement XX5033 07072023Prosenjjit GhosalNo ratings yet

- MR Archan JainDocument43 pagesMR Archan JainAshwani KumarNo ratings yet

- 912010060239834Document2 pages912010060239834DrAmit Kumar ChandananNo ratings yet

- Acct Statement - XX6268 - 13062023Document11 pagesAcct Statement - XX6268 - 13062023Rishi AgarwalNo ratings yet

- Suraj STMTDocument30 pagesSuraj STMTVishal BawaneNo ratings yet

- Statement DEC2023 763439582Document28 pagesStatement DEC2023 763439582dubey.princesriNo ratings yet

- EMP1314Document1 pageEMP1314Laxmi JaiswalNo ratings yet

- 3 Months Account StatementDocument12 pages3 Months Account StatementshilpapanjwaniNo ratings yet

- Mansha VermaDocument24 pagesMansha Vermaharishankargolaverma123No ratings yet

- Acct Statement - XX6097 - 06042023Document5 pagesAcct Statement - XX6097 - 06042023SAGAR STATIONERYNo ratings yet

- Central Recordkeeping AgencyDocument3 pagesCentral Recordkeeping AgencyAnuj SoniNo ratings yet

- 7523XXXXXXXXX604306 10 2023Document18 pages7523XXXXXXXXX604306 10 2023mk2ubemoviesNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument20 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancersurao24No ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument24 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceiiMuddu creationii MudhuNo ratings yet

- Hqu VDZ FCD3 XM PVP7Document3 pagesHqu VDZ FCD3 XM PVP7Subbulakshmi VinothNo ratings yet

- Ack 261954020190623Document1 pageAck 261954020190623TANUJ CHAKRABORTYNo ratings yet

- PDFDocument6 pagesPDFDigvijay PrasharNo ratings yet

- HimanshiDocument31 pagesHimanshiitsmesahilshahhNo ratings yet

- 5 6307586346680583618Document4 pages5 6307586346680583618Rohit raagNo ratings yet

- SOVBXBPd 0 SCZGN6 IDocument4 pagesSOVBXBPd 0 SCZGN6 ISAYAN SARKARNo ratings yet

- Canara - Epassbook - 2023-11-14 191824.473849Document154 pagesCanara - Epassbook - 2023-11-14 191824.473849Rahul SamalaNo ratings yet

- SunilDocument1 pageSunilAmit KumarNo ratings yet

- FD ReceiptDocument2 pagesFD Receiptthetrilight2023No ratings yet

- FasDocument28 pagesFasicici bankNo ratings yet

- Account Statement PDFDocument12 pagesAccount Statement PDFSudip MukherjeeNo ratings yet

- mPassBook - 20230114 - 20230413 - 6005 UNLOCKEDDocument3 pagesmPassBook - 20230114 - 20230413 - 6005 UNLOCKEDAshish kumarNo ratings yet

- Account Statement: Rai Singh MeenaDocument9 pagesAccount Statement: Rai Singh MeenaPraveen SainiNo ratings yet

- Salary Slip For The Month Of: JUN 2018: Principle Security and Allied Services PVT LTDDocument2 pagesSalary Slip For The Month Of: JUN 2018: Principle Security and Allied Services PVT LTDBalram Singh JadounNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument42 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceAbhisek DasNo ratings yet

- 1599215034384b2ZER5wBrqu7jnlh PDFDocument14 pages1599215034384b2ZER5wBrqu7jnlh PDFKuldeep KushwahaNo ratings yet

- Sbi Statement 2 March 27 MarchDocument15 pagesSbi Statement 2 March 27 Marchjubin josephNo ratings yet

- Salary Slip Report SpecimenDocument1 pageSalary Slip Report SpecimenMuhammad Zeeshan HaiderNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument33 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceamika goyalNo ratings yet

- Canara - Epassbook - 2023-06-13 09:31:35.257798Document127 pagesCanara - Epassbook - 2023-06-13 09:31:35.257798Roopendra GowdaNo ratings yet

- 918010114626353Document10 pages918010114626353Anonymous n1cPSXdXNo ratings yet

- PDF 372591110310722Document1 pagePDF 372591110310722santy309No ratings yet

- OpTransactionHistoryUX307 11 2020Document4 pagesOpTransactionHistoryUX307 11 2020Ajay MauryaNo ratings yet

- PNBONE Mpassbook 150434 1-6-2023 6-9-2023 2097XXXXXXXX7325 UnlockedDocument9 pagesPNBONE Mpassbook 150434 1-6-2023 6-9-2023 2097XXXXXXXX7325 Unlockedraoedc84No ratings yet

- H2coms C001 Ani2387 202305Document1 pageH2coms C001 Ani2387 202305chagusahoo170No ratings yet

- SettlementReportDocument1 pageSettlementReportBhanuranjan S BNo ratings yet

- Lecture Notes On Design and Analysis Ofalgorithms 18Cs42: Module-4: Dynamic ProgrammingDocument27 pagesLecture Notes On Design and Analysis Ofalgorithms 18Cs42: Module-4: Dynamic ProgrammingBhanuranjan S BNo ratings yet

- Mod 3Document23 pagesMod 3Bhanuranjan S BNo ratings yet

- Module 2: Divide and Conquer: Design and Analysis of Algorithms 18CS42Document82 pagesModule 2: Divide and Conquer: Design and Analysis of Algorithms 18CS42Bhanuranjan S BNo ratings yet

- Lecture Notes On Design and Analysis of Algorithms 18CS42: Module-5: BacktrackingDocument29 pagesLecture Notes On Design and Analysis of Algorithms 18CS42: Module-5: BacktrackingBhanuranjan S BNo ratings yet

- Department of Computer Science and Engineering: A Mini Project ReportDocument32 pagesDepartment of Computer Science and Engineering: A Mini Project ReportBhanuranjan S BNo ratings yet

- 18CS42-Design and Analysis of Algorithms Feb-May 2020 1Document94 pages18CS42-Design and Analysis of Algorithms Feb-May 2020 1Bhanuranjan S BNo ratings yet

- Department of Computer Science and Engineering: A Mini Project ReportDocument31 pagesDepartment of Computer Science and Engineering: A Mini Project ReportBhanuranjan S BNo ratings yet

- SettlementReportDocument1 pageSettlementReportBhanuranjan S BNo ratings yet

- Chap 11-13Document29 pagesChap 11-13K60 Triệu Thùy LinhNo ratings yet

- What Does Supply Mean Under GSTDocument5 pagesWhat Does Supply Mean Under GSTRohit BajpaiNo ratings yet

- IAS 12 Solutions PDFDocument74 pagesIAS 12 Solutions PDFrafid aliNo ratings yet

- Notice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäDocument4 pagesNotice of Assessment - Year Ended 30 June 2020: !Msî15U (P4 Î#BabäClaudia AttardNo ratings yet

- 1099 G 2018documentdownloadDocument1 page1099 G 2018documentdownloadKristine McVeighNo ratings yet

- ACCG924 Taxation Law: Lecture Notes Week 11 2018Document30 pagesACCG924 Taxation Law: Lecture Notes Week 11 2018Robin LiuNo ratings yet

- BAC103A-02a Income Tax For IndividualsDocument8 pagesBAC103A-02a Income Tax For IndividualsNovelyn Duyogan100% (1)

- Last Pay Certificate: Monthly Entitlement Amount@ Earning Amount Deduction AmountDocument3 pagesLast Pay Certificate: Monthly Entitlement Amount@ Earning Amount Deduction AmountpankajNo ratings yet

- Ashley Dixon-Harrison 293 Whittenton ST Apt 1Ft TAUNTON MA 02780-1305Document2 pagesAshley Dixon-Harrison 293 Whittenton ST Apt 1Ft TAUNTON MA 02780-1305ashcat227 DNo ratings yet

- Accounting Assignment 02A 207Document5 pagesAccounting Assignment 02A 207Aniyah's RanticsNo ratings yet

- Pro Forma Balance Sheet Template: Company NameDocument5 pagesPro Forma Balance Sheet Template: Company NamePhương ĐinhNo ratings yet

- xaxbshZBLb1lnizdKQJiTw PDFDocument2 pagesxaxbshZBLb1lnizdKQJiTw PDFshreveporttimesNo ratings yet

- Aguinaldo Industries V CirDocument1 pageAguinaldo Industries V CirChristine JacintoNo ratings yet

- ACT3301 19202 Assgmt Excel FS RealMax@1Apr20Document8 pagesACT3301 19202 Assgmt Excel FS RealMax@1Apr20Trick1 HahaNo ratings yet

- 51 GST Flyer - Chapter 47 - TDS On GSTDocument5 pages51 GST Flyer - Chapter 47 - TDS On GSTRanjanNo ratings yet

- Rae 3Document13 pagesRae 3SAS EXAMNo ratings yet

- Bernachtungsteuer Merkblatt Gast EnglishDocument3 pagesBernachtungsteuer Merkblatt Gast EnglishWojciech KosmaNo ratings yet

- Trash - CPDocument74 pagesTrash - CPgroup3 cgstauditNo ratings yet

- Instructions For Form GSTR-9Document8 pagesInstructions For Form GSTR-9param.ginniNo ratings yet

- Capital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsDocument6 pagesCapital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsCyrill L. MarkNo ratings yet

- Relic Spotter StatementsDocument6 pagesRelic Spotter StatementsArpit AgarwalNo ratings yet

- Compensation Income PDFDocument4 pagesCompensation Income PDFlena cpa100% (1)

- Solved Sanlucas Inc Provides Home Inspection Services To Its Clients TheDocument1 pageSolved Sanlucas Inc Provides Home Inspection Services To Its Clients TheDoreenNo ratings yet

- CorporationsDocument24 pagesCorporationsdarlene floresNo ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearVivek SinghNo ratings yet

- Temp Differences FlashcardsDocument11 pagesTemp Differences FlashcardsKatrina EustaceNo ratings yet

- 6.a Kunci Jawab Lks Bms 16Document101 pages6.a Kunci Jawab Lks Bms 16syahriniNo ratings yet

- Session - 1Document14 pagesSession - 1AARCHI JAINNo ratings yet

- M/S Maha Durga Charitable Trust: Techno Economic Viability Report ON Multispeciality Hospital (100 Beds)Document4 pagesM/S Maha Durga Charitable Trust: Techno Economic Viability Report ON Multispeciality Hospital (100 Beds)sandeepNo ratings yet