Professional Documents

Culture Documents

Pension Age PWD April 26 2012

Uploaded by

super_spiritOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pension Age PWD April 26 2012

Uploaded by

super_spiritCopyright:

Available Formats

HelpAge International Pens

Version: 26 April 2012

www.pension-watch.net

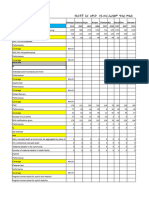

Population Poverty

Country Share 60+ Name of scheme

60+ rate

Antigua and no data no data no data Old Age Assistance

1 Barbuda Programme

Argentina 5,990,442 14.7% 3% Pensiones Asistenciales

2

Armenia 448,458 14.5% 4% Old Age Social Pension

3 This is an archived version of the Pension Watch database.

Australia 4,199,477 For19.5% no data

the latest Age

version Pension

please click here.

4

Austria 1,936,530 23.1% no data Ausgleichszulage (Austrian

5 Compensatory Supplement)

Azerbaijan 775,535 8.7% 2% Social Allowance (Old Age)

6

Bahamas 35,641 10.3% no data Old Age Non-Contributory

7 Pension (OANCP)

Bangladesh 10,158,189 6.2% 50% Old Age Allowance

8

Barbados 39,501 15.4% no data Non-contributory Old Age

9 Pension

Belarus 1,752,814 18.3% 2% Social Pension

10

Belgium 2,499,504 23.4% no data IGO/GRAPA (Income

11 Guarantee for the Elderly)

Belize 18,307 5.9% 13% Non-Contributory Pension

12 Programme (NCP)

Bermuda no data no data no data Non-contibutory old age

13 pension

Bolivia 720,986 7.2% 12% Renta Dignidad or Renta

14 Universal de Vejez

(previously Bonosol)

Botswana 117,057 5.9% 31% State old age pension

15

Brazil 19,840,394 10.2% 5% Previdencia Rural (Rural

16 Pension)

Brazil / / 5% Beneficio de Prestacao

17 Continuada (BPC /

Continuous Cash Benefit)

Brunei 23,695 5.8% no data Old Age pension

18 Darussalam

Bulgaria 1,838,116 24.5% 2% Social Old Age Pension

19

Canada 6,766,515 20.0% no data Pension de la Sécurité

20 Vieillesse (S.V.) (Old Age

Security Pension)

Cape Verde 27,665 5.4% 21% Pensão Social Mínima

21 (Minimum Social Pension)

Chile 2,253,880 13.2% 2% Pension Basica Solidaria de

22 Vejez (PBS-Vejez)

Colombia 3,974,689 8.6% 16% Programa de Proteccion

23 Social al Adulto Mayor

(PPSAM) (Social Protection

Cook Islands no data no data no data Programme

Old for Older People)

Age Pension

24

Costa Rica 438,970 9.5% 2% Programa Régimen No

25 Contributivo

Cyprus 161,504 18.4% no data Social Pension

26

Denmark 1,282,842 23.4% no data Folkepension (national

27 pension)

Dominican 896,581 8.8% 4% Programa Nonagenarios

28 republic (Nonagarians Programme)

Ecuador 1,302,786 9.5% 5% Pension para Adultos

29 Mayores (Pension for Older

People)

El Salvador 629,977 10.2% 6% Pension Basica Universal

30 (Universal basic pension)

Estonia 303,351 22.6% 2% National Pension

31

Finland 1,319,095 24.7% no data Kansanelake (Old Age

32 Pension)

France 14,518,155 23.2% no data ASPA (allocation de solidarité

33 aux personnes âgées)

Georgia 807,289 19.1% 13% Old Age Pension

34

Greece 2,714,385 24.3% no data Pension to uninsured elderly

35

Guyana 71,931 9.4% 8% Old Age Pension

36

Hong Kong 1,297,521 18.4% no data Normal/higher old age

37 allowance

Hungary 2,237,556 22.4% 2% Időskorúak járadéka (Old

38 Age Allowance)

Iceland 54,360 16.5% no data lífeyristryggingar

39 almannatrygginga (National

Basic Pension)

India 91,651,857 7.5% 42% Indira Gandhi National Old

40 Age Pension Scheme

Indonesia 20,784,233 8.9% 29% Program Jaminan Sosial

41 Lanjut Usia (Elderly Social

Security Programme) (Pilot)

Ireland 739,614 16.1% no data State Pension (Non-

42 Contributary)

Israel 1,060,531 14.6% no data Special old age benefit

43

Italy 16,015,985 26.6% no data Social Allowance

44

Jamaica 292,285 10.7% 2% The Programme for

45 Advancement through Health

and Education (PATH)

Kazakhstan 1,607,772 10.2% 2% State Basic Pension

46

Kenya 1,692,589 4.1% 20% Older Persons Cash Transfer

47

Kenya / / #VALUE! Hunger Safety Net

48 Programme, Pilot (universal

pension)

Kiribati no data no data no data Elderly pension

49

Korea, Republic of 7,563,710 15.6% no data Basic old-age pension

50

Kosovo no data no data no data Old age "basic pension"

51

Kyrgyzstan 404,436 7.3% 3% Social assistance allowance

52 (old age)

Latvia 504,569 22.5% 2% State social security benefit

53

Lesotho 145,844 7.0% 43% Old Age Pension

54

Lithuania 700,436 21.5% 2% Old age social assistance

55 pension

Maldives 18,744 6.0% no data Old-age Basic Pension

56

Malta 89,824 21.9% no data Age Pension

57

Mauritius 150,602 11.6% no data Basic Retirement Pension

58

Mexico 10,363,943 9.4% 4% Pensión Alimentaria

59 Ciudadana

Mexico / / 4% 70 y mas

60

Mexico no data no data no data Amanecer

61

Moldova, Republic 570,172 15.9% 2% State Social Allocation for

62 of Aged Persons

Mongolia 161,570 6.0% 2% Social welfare pension

63

Namibia 124,865 5.6% 49% Old Age Pension (OAP)

64

Nepal 1,846,387 6.2% 55% Old Age Allowance

65

Netherlands 3,650,535 21.9% no data Old-age pension

66

New Zealand 781,994 18.2% no data Superannuation

67

Nigeria 7,792,771 4.9% 2% Ekiti State Social Security

68 Scheme (Ekiti State only)

Norway 1,023,329 21.1% no data Grunnpensjon (Basic

69 Pension)

Panama 341,202 9.7% 9% 100 a los 70

70

Paraguay 494,814 7.7% 6% Pension alimentaria

71

Peru 2,567,828 8.7% 8% Pension 65

72

Philippines 6,241,568 6.7% 23% old age grant

73

Portugal 2,535,470 23.6% no data Pensao Social de Velhice

74 (Old Age Social Pension)

Saint Vincent and 10,414 9.5% no data Elderly Assistance Benefit

75 the Grenadines

Samoa 12,262 6.9% no data Senior Citizens Benefit

76

Seychelles no data no data 2% Old-age pension (social

77 security fund)

Slovenia 452,755 22.4% 2% State pension

78

South Africa 3,694,968 7.3% 26% Older Persons Grant

79

Spain 10,151,881 22.4% no data Non Contributory Pension for

80 retirement ( Pension no

Contributiva de Jubilacion)

Suriname 48,782 9.3% 16% State Old Age Pension

81 (Algemene Oudedags

Voorzieningsfonds (AOV))

Swaziland 63,638 5.3% 63% Old Age Grant

82

Sweden 2,321,450 25.0% no data Garantipension (Guaranteed

83 pension)

Switzerland 1,768,630 23.3% no data Extraordinary pension

84

Tajikistan 354,796 5.0% 21% Old age pension

85

Thailand 7,867,505 11.5% 2% Old Age Allowance

86

Timor-Leste 56,684 4.8% 37% Support allowance for the

87 elderly

Trinidad and 142,149 10.6% 4% Senior Citizens' Pension

88 Tobago

Turkey 6,812,172 9.0% 3% Means-tested Old Age

89 Pension

Turkmenistan 317,140 6.1% 25% Social Allowance

90

Uganda 1,300,354 3.8% 52% Senior Citizens Grant (Pilot

91 in 14 districts)

Ukraine 9,494,434 20.9% 2% Social pension + social

92 pension supplement

United Kingdom 14,039,715 22.7% no data Pension credit (Guarantee

93 Credit)

United States of 57,782,011 18.2% no data Old age supplemental

94 America income benefit

Uruguay 619,975 18.4% 2% Programa de Pensiones No-

95 Contributivas

Uzbekestan 1,758,614 6.3% 46% Social pension

96

Venezuela, 2,507,091 8.6% 4% Gran Mision Amor Mayor

97 Bolivarian

Republic of

Viet Nam 7,777,295 8.7% 21% Social assistance benefit

98 (clause 3)

Viet Nam / / no data Social assistance benefit

99 (clause 2)

Zambia 632,235 4.8% 64% Social Cash Transfer

100 Programme, Katete (Pilot)

International Pension Watch Database

watch.net

Benefit level

% of

Local % of GDP

Year introduced Level US$ PPP $ poverty

currency per capita

line

1993 255 East 94 8% 131 344%

Caribbean

Dollar

1994 539 Pesos 122 14% 210 552%

no data 10,067 Drams 26 13% 52 137%

nsion Watch database.

1900 1,506 Australian 1558 28% 958 2521%

Dollars

1978 815 Euros 1077 27% 942 2478%

no data 60 New Manat 76 17% 122 322%

no data 245 Bahamas $ 245 12% 316 830%

1998 300 Taka 4 7% 10 26%

1937 598 Barbados $ 299 22% 421 1108%

no data 133,115 Belarusian 17 9% 107 280%

Ruble

2001 (current form) 916 Euros 1212 33% 1026 2699%

2003 100 Belize Dollars 51 14% 95 250%

no data 451 B$ 451 no data no data no data

1996 (Bonosol), 2008 200 Bolivianos 29 15% 60 158%

(Renta Dignidad)

1996 220 Pulas 29 4% 55 143%

1991 (extended) 622 Reais 331 33% 331 870%

no data 622 Reais 331 33% 331 870%

1984 250 Brunei Dollar 201 7% 268 706%

no data 101 Leva 68 13% 139 366%

1952 540 Canadian 547 13% 432 1137%

Dollars

2006 (consolidated 5,000 Escudos 60 22% 69 182%

scheme)

2008 78,449 Peso 158 14% 196 514%

2003 60,000 Peso 34 5% 45 119%

1966 400 NZ Dollar 325 no data no data no data

1974 70,125 Colon 141 20% 190 501%

1995 325 Euros 430 18% 430 1131%

no data 5,713 Danish Kroner 1015 23% 669 1760%

no data 3,071 Pesos 79 17% 133 350%

2003 (in current form) 35 US Dollars 35 12% 74 195%

2009 50 US dollars 50 17% 102 267%

no data 128 Euros 170 13% 220 578%

no data 609 Euros 805 20% 619 1628%

2004 742 Euros 981 27% 812 2136%

2006 80 lari 49 21% 87 228%

1996 330 Euros 436 19% 451 1187%

1944 (first scheme 7,500 Guyanese 37 14% 86 225%

introduced), 1993 Dollar

(scheme became

universal)

no data 1,090 HK$ 140 5% 197 518%

no data 22,800 Forints 104 10% 168 441%

no data 25,700 Iceland 204 6% 196 515%

Kronur

1995 (2007 in current 200 Rupees 4 3% 10 27%

form)

2006 300,000 Rupiah 33 10% 42 110%

no data 949 Euros 1255 33% 1101 2896%

no data 1,481 New Shekel 395 15% 402 1056%

no data 412 Euros 544 20% 470 1237%

2001 930 J$ 11 3% 23 59%

no data 8,000 Tenge 54 6% 66 173%

Pilot began in 1,500 Kenya 18 25% 36 94%

2006/2007 budget Shillings

year

Pilot began in 2008 1,075 Kenya 13 18% 26 67%

Shillings

2003 60 Australian 62 47% 222 584%

Dollars

2007 91,200 Won 80 4% 115 301%

2002 45 Euro 59 38% 128 337%

no data 1,000 Som 21 30% 55 145%

no data 45 Lats 85 9% 111 292%

2004 300 Maloti 39 34% 59 156%

no data 85 Litas 32 3% 49 129%

2009 2,000 Rufiyaa 131 29% 195 513%

1956 431 Euros 570 34% 726 1909%

1950 (scheme first 3,146 Rupee 109 15% 187 491%

implemented), 1958

(scheme became

universal) 2003 897 Pesos 68 9% 104 273%

no data 500 Pesos 38 5% 58 152%

no data 550 Pesos 39 5% 64 168%

1999 90 Lei 8 5% 14 36%

no data 34,500 Tugriks 26 22% 65 170%

1992 (other social 500 N$ 64 16% 91 240%

pension previously)

1995 - first payment 500 Rupees 6 14% 15 40%

(Extended in 2008)

1957 1,034 Euros 1368 34% 1206 3171%

1898 (first scheme 1,512 New Zealand 1230 37% 877 2305%

introduced) Dollars

2011 5,000 Naira 32 23% 51 135%

no data 6,073 Norway 1061 14% 616 1621%

kroner

no data 100 Balboas 100 14% 166 435%

2009 376,000 Guarani 87 31% 139 364%

2011 125 Soles 47 9% 78 204%

2011 500 Ph Pesos 12 6% 20 53%

no data 195 Euros 258 14% 280 735%

2009 163 East 60 12% 112 293%

Caribbean

Dollar

1990 130 Tala 57 20% 94 247%

no data 2,400 Rupees 173 22% 433 1138%

1999 181 Euros 240 12% 291 764%

1927/8 first scheme 1,200 Rand 155 25% 225 592%

introduced for whites,

1944 scheme extended

to whole population,

1994 358 Euros 473 19% 473 1244%

1973 500 Surinamese 154 35% 251 661%

Dollar

2005 200 Emalangeni 26 10% 43 114%

no data 7,708 Kronor 1145 27% 840 2209%

no data 1,140 Swiss Franc 1254 19% no data no data

no data 40 somoni 8 13% 22 57%

1993 600 Baht 19 4% 34 89%

2008 20 US$ 20 9% 58 152%

1939 (first scheme 3,000 T&T$ 472 36% 594 1562%

introduced), 2010

(entitlement to a

pension legislated)1976 95 Turkish Lira 87 9% 87 230%

no data 59 Manat 21 7% 39 101%

2011 23,000 Uganda 9 26% 27 72%

Shillings

no data 695 Hryvnias 87 35% 195 512%

1909 (first scheme 595 Pounds 958 30% 892 2347%

introduced)

1935 (first national 674 US$ 674 17% 674 1773%

scheme introduced)

1995 (1919 first 4,767 Pesos 241 28% 297 780%

scheme introduced)

no data 59,690 Som 32 no data 83 219%

no data 1,548 Bolivars 360 41% 427 1124%

2004 (2007 in current 180,000 Dong 9 8% 21 56%

form)

no data 120,000 Dong 6 5% 14 37%

2007 60,000 Kwacha 12 10% 14 37%

Number of % population 60+ Total cost

Age Targeting Income

recipients covered (% of GDP)

77 Means-tested no data no data no data High income:

nonOECD

70 Means-tested 75,229 no data 0.23% Upper middle

income

65 Pensions- no data no data no data Lower middle

tested income

65 (men) 64 Means-tested 2,117,530 no data 2.24% High income:

(women) OECD

65 (men) and Means-tested no data no data no data High income:

60 (women) OECD

67(men) 62 Pensions- no data no data no data Lower middle

(women) tested income

65 Pensions- 2,275 no data 0.08% High income:

tested nonOECD

65 (men) and Means-tested 2,475,000 no data 0.09% Low income

62 (women)

65 and 6 Pensions- 8,791 no data 0.67% High income:

months tested nonOECD

60 (men) 55 Pensions- no data no data no data Upper middle

(women) tested income

65 Means-tested no data no data no data High income:

OECD

67 (men) 65 Means-tested 4,297 no data 0.18% Lower middle

(women) income

65 Pensions- no data no data no data High income:

tested nonOECD

60 Universal 896,470 no data 1.06% Lower middle

income

65 Universal 91,446 no data 0.33% Upper middle

income

60 (men) 55 Tested on 5,851,554 no data 1.50% Upper middle

(women) eligibility to income

pension and

individual

65 Means tested 1,700,000 no data 0.30% Upper middle

income

60 Universal 21,888 no data 0.40% High Income:

nonOECD

70 Means-tested no data no data no data Upper middle

income

65 Universal (with 4,764,820 no data 1.58% High income:

recovery from OECD

high-income

earners)

60 Means-tested 23,000 no data 0.40% Lower middle

income

65 Means-tested 840,032 no data 0.90% Upper middle

income

57 (men) and Means-tested 214,480 no data 0.02% Upper middle

52 (women) income

60 Universal no data no data no data no data

65 Means-tested 83,438 no data 0.18% Upper middle

income

65 Pensions- 14,934 no data 0.33% High income:

tested nonOECD

65 Means-tested no data no data no data High income:

OECD

60 Means-tested no data no data no data Upper middle

income

65 Means-tested 537,074 no data 0.31% Lower middle

income

70 Means-tested 13,600 no data 0.04% Lower middle

(currently only income

the poorest 32

63 municipalities)

Pensions- no data no data no data High income:

tested nonOECD

65 Pensions- no data no data no data High income:

tested OECD

65 Means-tested 586,000 no data 0.25% High income:

OECD

65 (men) and Means-tested 654,931 no data 3.70% Lower middle

60 (women) income

60 Means-tested 67,000 no data 0.14% High income:

OECD

65 Universal 43,398 no data 0.58% Lower middle

income

65 (normal Means-tested no data no data no data High income:

OAA), 70 nonOECD

(Higher OAA)

62 Means-tested no data no data no data High income:

OECD

67 Means-tested no data no data no data High income:

OECD

60 Means-tested 13700000 no data 0.04% Lower middle

(estimate) income

70 (60 if Means-tested 10000 no data 0.00% Lower middle

chronically ill) (approximate) income

66 Means-tested no data no data no data High income:

OECD

65-67 (men) Means-tested no data no data no data High income:

and 60-64 nonOECD

(women)

65 Means-tested no data no data no data High income:

OECD

60 Means-tested 51,846 no data 0.04% Upper middle

income

63 (men) 58 Pensions- no data no data no data Upper middle

(women) tested income

65 Means-tested 33,000 no data 0.02% Low income

55 Universal no data no data no data Low income

60 Universal 1,974 no data 0.65% Lower middle

income

65 Means-tested 3,609,794 no data 0.32% High income:

OECD

65 Universal 109,858 no data 3.39% Lower middle

income

63 (men) 58 Pensions- no data no data no data Low income

(women) tested

67 Pensions- no data no data no data Upper middle

tested income

70 (men) and Pensions- 80,000 no data 1.77% Lower middle

65 (women) tested income

62.5 (men) 60 Pensions- no data no data no data Upper middle

(women) tested income

65 Pensions- no data no data no data Lower middle

tested income

60 Means-tested no data no data no data High income:

nonOECD

60 Universal 160,947 no data 1.70% Upper middle

income

68 Universal 2,000,000 no data 0.04% Upper middle

(Mexico city) income

70 Universal (for 1,886,447 no data 0.11% Upper middle

residents of income

towns with

less than

64 Universal 238,000 no data no data no data

(Chiapas

State)

62(men) Pensions- 3,232 no data 0.21% Lower middle

57(women) tested income

60 (men) 55 Means-tested 2,596 no data no data Lower middle

(women) income

60 Universal 131,921 no data 1.36% Upper middle

income

70 (60 in Pensions- 792,515 no data 0.35% Low income

some areas) tested

65 Universal no data no data no data High income:

OECD

65 Universal no data no data no data High income:

OECD

65 (residents Pensions- 20,000 no data no data Lower middle

of Ekiti State tested income

only)

62 (Flexible) Means-tested no data no data no data High income:

OECD

70 Pensions- no data no data no data Upper middle

tested income

65 Means-tested 25,000 no data 0.12% Lower middle

income

65 Means-tested 40,676 no data no data Upper middle

income

77 (in process Means-tested 145,166 no data 0.01% Lower middle

of extension) income

65 Means-tested no data no data no data High income:

OECD

67 (in 2009 - Pensions- no data no data no data Upper middle

the time of tested income

implementatio

n) 65 Universal 8,700 no data 1.30% Lower middle

income

63 Universal no data no data no data Upper middle

income

68 Means-tested 16,010 no data 0.10% High income:

nonOECD

60 Means-tested 2,647,000 no data 1.14% Upper middle

income

65 Means-tested 253,207 no data 0.11% High income:

OECD

60 Universal 44,739 no data 1.90% Upper middle

income

60 Pensions- 55,000 no data 0.60% Lower middle

tested income

65 Pensions- 818 915 no data 0.52% High income:

tested OECD

65 (men) 60 Pensions- no data no data no data High income:

(women) tested OECD

65 (men) 60 Pensions- no data no data no data Low income

(women) tested

60 Pensions- 5,636,497 no data 0.13% Lower middle

tested income

60 Universal 63,614 no data 0.62% Lower middle

income

65 Means-tested no data no data no data High income:

nonOECD

65 Means-tested no data no data no data Upper middle

income

62 (men) 57 Pensions- no data no data no data Lower middle

(women) tested income

65 (60 in Universal no data no data no data Low income

Karamoja

Region)

63 (men) 58 Means-tested no data no data no data Lower middle

(women) income

65 Means-tested 2,474,410 no data 0.47% High income:

OECD

65 Means-tested no data no data no data High income:

OECD

70 Means-tested 64,000 no data 0.62% Upper middle

(approximately income

)

60 (men) 55 Pensions- no data no data no data Low income

(women) tested

60 (men) and Means-tested 675,000 no data no data Upper middle

55 (women) (expected total income

for 2012)

80 Pensions- 431,871 no data 0.01% Lower middle

tested income

60 Means-tested 96,700 no data 0.04% Lower middle

income

60 Universal 4,500 no data no data Low income

You might also like

- Social Protection Program Spending and Household Welfare in GhanaFrom EverandSocial Protection Program Spending and Household Welfare in GhanaNo ratings yet

- A Review of The State Pension Scheme in Ghana PDFDocument59 pagesA Review of The State Pension Scheme in Ghana PDFTAKUNDANo ratings yet

- Tabla Excel Taller NovenoDocument5 pagesTabla Excel Taller NovenoD i d i e r Al e x a n d e r M e n d i v e l s oNo ratings yet

- FPL Chart For All Programs 04.01.2023Document1 pageFPL Chart For All Programs 04.01.2023ERIC HubbardNo ratings yet

- Carteira Nacional de Vacinacao DigitalDocument1 pageCarteira Nacional de Vacinacao Digitaletchartsamuel3No ratings yet

- RH 6 Month Key Perforemance Feed Back 2016Document7 pagesRH 6 Month Key Perforemance Feed Back 2016seid MohammedNo ratings yet

- Japan Metabo LawDocument16 pagesJapan Metabo LawReginNo ratings yet

- Budgeting Workbook - GADDocument24 pagesBudgeting Workbook - GADlgu-mina mpdcNo ratings yet

- UK Disability Statistics - Prevalence and Life ExperiencesDocument45 pagesUK Disability Statistics - Prevalence and Life ExperiencesKuro ShiroNo ratings yet

- Region of The Americas Update: BrazilDocument7 pagesRegion of The Americas Update: BrazilRichard Jared Gallardo AcevedoNo ratings yet

- Irish Pensions Crisis OECD June 2009Document3 pagesIrish Pensions Crisis OECD June 2009James DwyerNo ratings yet

- Central America: Measures of MortalityDocument10 pagesCentral America: Measures of MortalityAlexander DacumosNo ratings yet

- Epidemiology of Periodontal Diseases in Adults From Latin AmericaDocument21 pagesEpidemiology of Periodontal Diseases in Adults From Latin AmericaFernando Freitas PortellaNo ratings yet

- Who Covid-19 Situation Report For Aug. 11, 2020Document17 pagesWho Covid-19 Situation Report For Aug. 11, 2020CityNewsTorontoNo ratings yet

- Survey Analysis - Internship Programme (Semester Vi) : Marital StatusDocument15 pagesSurvey Analysis - Internship Programme (Semester Vi) : Marital StatusPriyankaSahasrabudheNo ratings yet

- Ministry of Social Development: B. ST C Tu - C - NDocument16 pagesMinistry of Social Development: B. ST C Tu - C - NStuff NewsroomNo ratings yet

- Statistics of The Cases Novel Coronavirus Infection enDocument8 pagesStatistics of The Cases Novel Coronavirus Infection enVale IgnaciaNo ratings yet

- PCC Bop Report To NwminpacDocument7 pagesPCC Bop Report To NwminpacMoodz TutanesNo ratings yet

- Oral ProyectDocument6 pagesOral ProyectKarent Lorena Yara GonzalezNo ratings yet

- Hawassa University College of Medicine & Health Sciences Department of Ophthalmology & OptometryDocument298 pagesHawassa University College of Medicine & Health Sciences Department of Ophthalmology & Optometryhenok birukNo ratings yet

- Taiwan Health Profile: Basic Statistics (2016) International ComparisonsDocument2 pagesTaiwan Health Profile: Basic Statistics (2016) International ComparisonsAmalia MollyNo ratings yet

- City of Greater Bendigo Health and Wellbeing Profile April 2017Document5 pagesCity of Greater Bendigo Health and Wellbeing Profile April 2017EmmaNo ratings yet

- Group 1 Barangay Budgeting FinalDocument4 pagesGroup 1 Barangay Budgeting Finalpat lanceNo ratings yet

- Annual Gender and Development PlanDocument3 pagesAnnual Gender and Development PlanJoanna Marie TelanNo ratings yet

- Basis Data Terpadu Sebagai Penentu Sasaran Program Bantuan SosialDocument2 pagesBasis Data Terpadu Sebagai Penentu Sasaran Program Bantuan SosialFerdiand RahmadyaNo ratings yet

- WI Demographic 071510 RRDocument2 pagesWI Demographic 071510 RRnchc-scribdNo ratings yet

- The Tragedy of COVID 19 in Brazil: 124 Maternal Deaths and CountingDocument3 pagesThe Tragedy of COVID 19 in Brazil: 124 Maternal Deaths and CountingPrix_aeNo ratings yet

- Charity Excellence Funder Research List - Older People PDFDocument30 pagesCharity Excellence Funder Research List - Older People PDFIan McLintock100% (1)

- Pension Reversals in Central and Eastern Europe: October 30, 2019Document37 pagesPension Reversals in Central and Eastern Europe: October 30, 2019JorkosNo ratings yet

- Comparative Matrix HIES - FNLDocument2 pagesComparative Matrix HIES - FNLKhan Mohammad Mahmud HasanNo ratings yet

- COVID-19 Sitrep 04112021Document6 pagesCOVID-19 Sitrep 04112021Deibis RiveroNo ratings yet

- Family Benefits A-ZDocument2 pagesFamily Benefits A-Zbogdan serbanoiuNo ratings yet

- Attachment Ayrin P. Santos 5-31-2023 9-45-25 AMDocument2 pagesAttachment Ayrin P. Santos 5-31-2023 9-45-25 AMsantosashley.teamjarellNo ratings yet

- Alpena: Key Trends Over Time BASE YEAR (2010) Most Recent YearDocument2 pagesAlpena: Key Trends Over Time BASE YEAR (2010) Most Recent YearJulie RiddleNo ratings yet

- Alpena: Key Trends Over Time BASE YEAR (2010) Most Recent YearDocument8 pagesAlpena: Key Trends Over Time BASE YEAR (2010) Most Recent YearJulie RiddleNo ratings yet

- VA Demographics 071910 RRDocument2 pagesVA Demographics 071910 RRnchc-scribdNo ratings yet

- Demand and Supply AnalysisDocument12 pagesDemand and Supply AnalysisMary Chriszle DomisiwNo ratings yet

- COVID-19 Vaccine Daily Bulletin No. 253Document21 pagesCOVID-19 Vaccine Daily Bulletin No. 253Charlie ManilaNo ratings yet

- Covid 19 Cumulative Cases 04.19.20Document1 pageCovid 19 Cumulative Cases 04.19.20René CotoNo ratings yet

- Social Security Programs - English - 2022 23Document7 pagesSocial Security Programs - English - 2022 23Khan RafiNo ratings yet

- Dementia Economic Impact Report 2020Document133 pagesDementia Economic Impact Report 2020lospumas48329No ratings yet

- Food - Good Bad and The UglyDocument19 pagesFood - Good Bad and The UglyAbdul JohnyyNo ratings yet

- Gad 2024 123Document5 pagesGad 2024 123acvcollectionservicesNo ratings yet

- BA 2009 (March)Document2 pagesBA 2009 (March)New York SenateNo ratings yet

- Leger Report - National Healthcare SurveyDocument36 pagesLeger Report - National Healthcare SurveyCityNewsTorontoNo ratings yet

- Pollara EconoOutlook2023Document18 pagesPollara EconoOutlook2023Toronto StarNo ratings yet

- Coronavirus Disease (COVID-19) : Situation Report - 114Document16 pagesCoronavirus Disease (COVID-19) : Situation Report - 114CityNewsTorontoNo ratings yet

- EntitlementDocument2 pagesEntitlementawwathe77No ratings yet

- Consolidated SC AWP 2021-2022 FinalDocument49 pagesConsolidated SC AWP 2021-2022 FinalSymon KimeliNo ratings yet

- 11 627 m2020036 Eng PDFDocument1 page11 627 m2020036 Eng PDFMNo ratings yet

- Activities and Concerns of Canadian Youth During The COVID-19 PandemicDocument1 pageActivities and Concerns of Canadian Youth During The COVID-19 PandemicMNo ratings yet

- Imf DM Export 20230925Document32 pagesImf DM Export 20230925z_k_j_vNo ratings yet

- Weekly COVID-19 Summary - PAHO - 03222022Document10 pagesWeekly COVID-19 Summary - PAHO - 03222022VICTOR HUGONo ratings yet

- Budgetary Requirements 2022Document2 pagesBudgetary Requirements 2022Archelaus PacenaNo ratings yet

- Annual Gender and Development (Gad) Plan and Budget Fy 2021Document1 pageAnnual Gender and Development (Gad) Plan and Budget Fy 2021Ink Nijuan100% (1)

- Coronavirus Disease (COVID-19) : Situation Report - 179Document18 pagesCoronavirus Disease (COVID-19) : Situation Report - 179CityNewsTorontoNo ratings yet

- Old Age Security Canada Pension PlanDocument2 pagesOld Age Security Canada Pension PlanAndrewNo ratings yet

- El Canton GLDocument3 pagesEl Canton GLjane_lee_15No ratings yet

- Poverty in Australia 2020: Acoss and Unsw SydneyDocument32 pagesPoverty in Australia 2020: Acoss and Unsw SydneyJoe KenyonNo ratings yet

- 2011 FF Alz - MSDocument1 page2011 FF Alz - MSsippydogNo ratings yet

- 2132 WeDocument1 page2132 Wesuper_spiritNo ratings yet

- 32 ErwDocument1 page32 Erwsuper_spiritNo ratings yet

- 321 WeDocument1 page321 Wesuper_spiritNo ratings yet

- 32 ErwDocument1 page32 Erwsuper_spiritNo ratings yet

- Reseller Dell MedanDocument1 pageReseller Dell Medansuper_spiritNo ratings yet

- RewqDocument1 pageRewqsuper_spiritNo ratings yet

- 12 SerDocument1 page12 Sersuper_spiritNo ratings yet

- 213 deDocument1 page213 desuper_spiritNo ratings yet

- 12 WerDocument1 page12 Wersuper_spiritNo ratings yet

- 23 WeqDocument1 page23 Weqsuper_spiritNo ratings yet

- ConverterDocument117 pagesConvertersuper_spiritNo ratings yet

- 345 SewDocument1 page345 Sewsuper_spiritNo ratings yet

- SwerDocument1 pageSwersuper_spiritNo ratings yet

- 3456Document1 page3456super_spiritNo ratings yet

- WeqDocument1 pageWeqsuper_spiritNo ratings yet

- WeqDocument1 pageWeqsuper_spiritNo ratings yet

- QweDocument1 pageQwesuper_spiritNo ratings yet

- ErtDocument1 pageErtsuper_spiritNo ratings yet

- ErtDocument1 pageErtsuper_spiritNo ratings yet

- File ListDocument10 pagesFile ListDerek BatchelorNo ratings yet

- ConverterDocument117 pagesConvertersuper_spiritNo ratings yet

- WerDocument1 pageWersuper_spiritNo ratings yet

- RteDocument1 pageRtesuper_spiritNo ratings yet

- ConverterDocument117 pagesConvertersuper_spiritNo ratings yet

- ConverterDocument1 pageConvertersuper_spiritNo ratings yet

- ConverterDocument1 pageConvertersuper_spiritNo ratings yet

- HGF Life 1Document1 pageHGF Life 1super_spiritNo ratings yet

- ConverterDocument1 pageConvertersuper_spiritNo ratings yet

- Foreign Exchange Rate - U.KDocument3 pagesForeign Exchange Rate - U.Kpramodkb_cusatNo ratings yet

- Exchange Rate: DefinitionDocument10 pagesExchange Rate: Definitionknowledge worldNo ratings yet

- Exchange ArithmeticDocument12 pagesExchange ArithmeticRohit AggarwalNo ratings yet

- 1.CFA二级基础段经济 Vincent 标准版Document142 pages1.CFA二级基础段经济 Vincent 标准版tong gongNo ratings yet

- Exchange Rate 31 May 2023Document2 pagesExchange Rate 31 May 2023BRTA SCSNo ratings yet

- Module - 15 Exchange Rate Arithmetic: Forward RatesDocument12 pagesModule - 15 Exchange Rate Arithmetic: Forward RatesDebarshi GhoshNo ratings yet

- Basic Math VocabularyDocument6 pagesBasic Math VocabularyDanna valentina Arevalo hernandezNo ratings yet

- Foreign ExchangeDocument21 pagesForeign Exchangevinayak Ag100% (1)

- Mata Kuliah Pengantar Ilmu Ekonomi & Bisnis: Disusun OlehDocument3 pagesMata Kuliah Pengantar Ilmu Ekonomi & Bisnis: Disusun OlehAmelia PutriNo ratings yet

- International Finance - Interest Rate ParityDocument17 pagesInternational Finance - Interest Rate ParityMileth Xiomara Ramirez GomezNo ratings yet

- Chapter 18Document29 pagesChapter 18UsmanNo ratings yet

- S10 107 TWNDocument3 pagesS10 107 TWNJinko JankoNo ratings yet

- Performa Invoice PoDocument72 pagesPerforma Invoice PoBana TourNo ratings yet

- Fiat MoneyDocument1 pageFiat MoneysaadgeniousNo ratings yet

- Money in Hong Kong EnglishDocument7 pagesMoney in Hong Kong EnglishDevin Chun Yue KwanNo ratings yet

- Share Indian - Economy - 17 - Daily - Class - Notes - Sankalp - UPSC - 2024Document5 pagesShare Indian - Economy - 17 - Daily - Class - Notes - Sankalp - UPSC - 2024anchal srivastavaNo ratings yet

- Foreign Exchange MarketDocument12 pagesForeign Exchange MarketJoksmer MajorNo ratings yet

- Chapter 11 Tugas DosenDocument11 pagesChapter 11 Tugas DosenElsa Siregar100% (1)

- Conversor de Divisas Online Con FormulasDocument11 pagesConversor de Divisas Online Con FormulasnoeNo ratings yet

- Chapter 4 - PPPDocument44 pagesChapter 4 - PPP23a4010609No ratings yet

- 10025Document16 pages10025Anwesha MondalNo ratings yet

- Materi Remittance Presentasi BNTT - 14 Okt 23Document167 pagesMateri Remittance Presentasi BNTT - 14 Okt 23Selfiana GoethaNo ratings yet

- Format LPJ InternDocument6,470 pagesFormat LPJ InternElfan ApoyNo ratings yet

- HI (S Sy FC MR DFN Zob Ced CG WNTM Socdfbs BnspehyDocument132 pagesHI (S Sy FC MR DFN Zob Ced CG WNTM Socdfbs BnspehyLuisPaucarNo ratings yet

- Money Vocabulary CrosswordDocument2 pagesMoney Vocabulary Crosswordandrea delgadoNo ratings yet

- BNM RateDocument3 pagesBNM RateKj LeeNo ratings yet

- Create Customer Statements Execution ReportDocument11 pagesCreate Customer Statements Execution ReportShakhir MohunNo ratings yet

- Work Sheet 1 - Exchange RatesDocument4 pagesWork Sheet 1 - Exchange Ratesanon_438224697No ratings yet

- Tribhuvan University: QuestionsDocument2 pagesTribhuvan University: QuestionsSabin ShresthaNo ratings yet

- Economics - 3 - RBIDocument14 pagesEconomics - 3 - RBIArisha AzharNo ratings yet

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsRating: 3.5 out of 5 stars3.5/5 (9)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Stiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreFrom EverandStiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreRating: 4.5 out of 5 stars4.5/5 (13)

- U.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadFrom EverandU.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadNo ratings yet

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationFrom EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationNo ratings yet

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)