Professional Documents

Culture Documents

Aafr Ifrs 16 Icap Past Papers With Solution

Aafr Ifrs 16 Icap Past Papers With Solution

Uploaded by

Aqib SheikhCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aafr Ifrs 16 Icap Past Papers With Solution

Aafr Ifrs 16 Icap Past Papers With Solution

Uploaded by

Aqib SheikhCopyright:

Available Formats

IFRS-16 : LEASES PAST PAPERS

Question 1 (D-20)

Health Pharma Limited (HPL) entered into the following arrangements during 2019:

On 1 January 2019, HPL acquired a capsule manufacturing machine from Hi-Tech Industries Limited for a lease

term of 5 years with instalments payable annually in advance. The useful life of the machine was estimated at 6

years.

1. HPL paid the 1st instalment of Rs. 50 million on 1 January 2019. However, subsequent lease payments are

subject to increase/decrease in line with consumer price index (CPI). At lease inception, HPL estimated that

CPI will increase by 10% annually. However, CPI increased by 14% in 2019 and consequently Rs. 57 million was

paid on 1 January 2020 as 2nd instalment. At 31 December 2019, HPL estimated that the annual increase in

CPI will continue to be 14% in future years.

HPL is also required to pay a usage fee of Rs. 0.3 per capsule produced in excess of 30 million capsules per

annum from the machine. At lease inception, HPL planned to produce 40 million capsules each year during

the lease term. During 2019, HPL produced 40 million capsules and accordingly an amount of Rs. 3 million was

also paid along with 2nd instalment.

2. On 1 April 2019, HPL entered into a contract with Auto Limited (AL) for the use of 8 Refrigerated Trucks for a

period of 3 years at semi-annual payment of Rs. 10 million payable in arrears. AL is also required to provide

two drivers along with each truck. The amount of Rs. 10 million can be allocated to the trucks’ rental and

drivers’ cost in the ratio of 70:30 respectively.

All costs pertaining to running and maintenance of trucks, would be paid by AL. However, HPL is required to

reimburse 30% of the fuel cost to AL. Fuel cost for 2019 was Rs. 4 million. HPL paid its share of fuel cost in

2020.

HPL uses these trucks for transportation of inventory all over the country. In order to save fuel and time, AL

often replaces a similar truck at the required location from one of AL’s nearby office. AL is also required to

provide a substitute truck in case of accident and maintenance work.

3. On 1 July 2019, HPL sold its warehouse building to Macro Finance Limited (MFL) for cash of Rs. 1,400 million.

Immediately before the transaction, the building was carried at Rs. 900 million and had remaining useful life

of 18 years. At the same time, HPL entered into a contract with MFL for the right to use the warehouse

building for 10 years, with annual payment of Rs. 180 million payable in arrears. Fair value of the building at

the date of sale was Rs. 1,500 million. The rate of interest implicit in the lease is 11% per annum.

The terms and conditions of the transaction are such that the transfer of the building by HPL satisfies the

requirements for determining when a performance obligation is

satisfied in IFRS 15.

HPL's incremental borrowing rate is 12% per annum.

Required:

Prepare the extracts relevant to the above transactions from HPL's statement of financial position and statement

of profit or loss for the year ended 31 December 2019 in accordance with the IFRS. (Comparative figures and

notes to the financial statements are not required) (20)

PREPARED BY FAHAD IRFAN 1

IFRS-16 : LEASES PAST PAPERS

Question 2 (J-19)

On 1 January 2018, FL acquired a building on lease for a non-cancellable period of 6 years. Lease contains rent

free period of 2 years and 4 annual rentals of Rs. 60 million each are payable starting from the end of 3rd year.

Applicable discount rate is 12%. Nothing has been recorded in the FL’s books in this respect.

Required:

Discuss how the above transactions/events should be dealt with in FL’s books for the year ended 31 December

2018. (Show all calculations wherever possible. Also mention any additional information needed to account for

the above transactions/events) (03)

Question 3 (D-18)

On 1 January 2015, Datsun Motors Limited (DML) acquired a machine on lease through Bolan Leasing Company

(BLC) to manufacture components of a new model of vehicle, on the following terms:

(i) Non-cancellable lease period is 7 years.

(ii) The agreement contains an option for DML to extend the lease for further 3 years in which case the legal

title of the machine will be transferred to DML at the end of 10 years.

(iii) Lease installments are payable annually in advance as under:

first seven installments at Rs. 80 million each.

three installments at Rs. 70 million each for the optional period.

DML also incurred initial direct cost of Rs. 15 million for the lease. DML's incremental borrowing rate on 1 January

2015 was 8% per annum. Useful life of the machine is 12 years.

On commencement of the lease, DML was reasonably certain that the option to extend the term will be exercised.

However, after first year of production of the new model, DML assessed that the model is not popular in the

market. Therefore, in 2016, DML concluded that it is not reasonably certain that DML would exercise the option

to extend the lease for three years. DML's incremental borrowing rate on 1 January 2016 was 9% per annum.

Advanced Accounting and Financial Reporting Page 5 of 6

After another disappointing year of the new model, DML negotiated with BLC and the lease contract was

amended on 1 January 2017 by reducing the original lease term from 7 years to 5 years with the same annual

payments. DML's incremental borrowing rate on 1 January 2017 was 10% per annum.

Required:

Determine the amounts of ‘Right of use asset’ and ‘Lease liability’ as at 31 December 2015, 2016 and 2017 and

reconcile the opening and closing balances of each year. (17)

Question 4 (D-17)

a) Following are the details of lease related transactions of Patel Limited (PL):

On 1 July 2015 PL acquired a plant for lease term of 5 years at Rs. 18 million per annum, payable in arrears. Fair value

and useful life of this plant as on 1 July 2015 were Rs. 60 million and 6 years respectively. Bargain purchase option at

PREPARED BY FAHAD IRFAN 2

IFRS-16 : LEASES PAST PAPERS

the end of lease term would be exercisable at Rs. 1 million. On July 2015 PL’s incremental borrowing rate was 9% per

annum.

After one year, PL sub-let this plant for Rs. 21 million per annum, payable in arrears for lease term of 5 years.

Implicit rate of this transaction was 11% per annum. (06)

b) On 1 July 2014, PL acquired a building for its head office for lease term of 8 years at Rs. 50 million per annum,

payable in arrears.

However, after the board’s decision of constructing own head office building, PL negotiated with the lessor and

the lease contract was amended on July 2016 by reducing the original lease term from 8 to 6 years with same

annual payments.

Incremental borrowing rates on 1 July 2014 and 1 July 2016 were 12% and 10% per annum

respectively. (07)

Required:

Prepare the extracts relevant to the above transactions from PL’s statements of financial position and profit or

loss for the year ended 30 June 2017, in accordance with the International Financial Reporting Standards.

(Comparatives figures and notes to the financial statements are not required)

Question 5 (J-16)

United Front (Private) Limited (UFPL) is a company engaged in manufacturing and marketing of automotive

components for auto assemblers in Pakistan. On 1 January 2015 the company entered into two sale and leaseback

agreements with Sun Leasing Limited.

The details of machines sold and leased back under the two agreements are as under:

Machine-A Machine-B

Date of purchase 1-Jan-10 1-Jan-13

Cost (Rs. in million) 150 48

Useful life (in years) 10 10

Sale price to the lessor (Rs. in million) 78 41

Fair market value (Rs. in million) 80 44

The terms of lease agreements are as follows:

Machine-A Machine-B

Lease term 5 years 3 years

Annual rentals (Rs. in million) 18.283 4

Installment due in arrears in advance

Down payment 10% Nil

The market interest rate is 9.5% per annum while the market rates of rentals for machines similar to Machine-A

and Machine-B are Rs. 19 million and Rs. 7 million per annum respectively.

Required:

Prepare the relevant extracts from the statements of financial position and comprehensive income for the year

ended 31 December 2015, in accordance with the International Financial Reporting Standards. (18)

PREPARED BY FAHAD IRFAN 3

IFRS-16 : LEASES PAST PAPERS

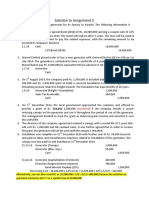

Solution 1

PREPARED BY FAHAD IRFAN 4

IFRS-16 : LEASES PAST PAPERS

Solution 2

Even though the agreement contains a rent-free period of two years, right of use asset and

corresponding lease liability should be recognized in the books on 1 January 2018 at the present value

of lease payment

i.e. Rs. 145 million [60×1.12–2×{(1–1.12–4)÷0.12}]

Depreciation of Rs. 24.2 million (145÷6) should be recognized.

Interest of Rs. 17.4 million (145×12%) would be recognized making the lease liability to Rs. 162.4

million.

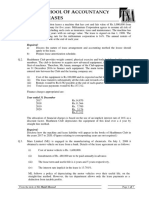

Solution 3

PREPARED BY FAHAD IRFAN 5

IFRS-16 : LEASES PAST PAPERS

Solution 4

PREPARED BY FAHAD IRFAN 6

IFRS-16 : LEASES PAST PAPERS

Solution 5

PREPARED BY FAHAD IRFAN 7

IFRS-16 : LEASES PAST PAPERS

PREPARED BY FAHAD IRFAN 8

You might also like

- Updated - FAR 1 Sir ARM Final BookDocument527 pagesUpdated - FAR 1 Sir ARM Final BookZain Jamil100% (1)

- IFRS 16 LeasesDocument7 pagesIFRS 16 LeasesMazni HanisahNo ratings yet

- Financial Reporting (FR) Question Pack: Sr. No. ACCA Exam Paper Syllabus Area CoveredDocument52 pagesFinancial Reporting (FR) Question Pack: Sr. No. ACCA Exam Paper Syllabus Area CoveredVasileios Lymperopoulos100% (1)

- Management Accounting Exam Practice KitDocument405 pagesManagement Accounting Exam Practice Kittshepiso msimanga100% (4)

- Far2 Icap Chapter Wise Past Papers With Solution Prepared by Fahad IrfanDocument172 pagesFar2 Icap Chapter Wise Past Papers With Solution Prepared by Fahad IrfanmiketrumpNo ratings yet

- F9 - Mock C - QuestionsDocument7 pagesF9 - Mock C - QuestionspavishneNo ratings yet

- FR Study Guide Questions and Answers 4th EditionDocument176 pagesFR Study Guide Questions and Answers 4th EditionAartika Nath100% (3)

- Ias 20 QuestionsDocument6 pagesIas 20 QuestionsGonest Gone'stoëriaNo ratings yet

- Assignment 2 SolutionDocument4 pagesAssignment 2 SolutionSobhia Kamal100% (1)

- CPA Ireland Financial Accounting 2015-18Document161 pagesCPA Ireland Financial Accounting 2015-18Ahmed Raza Tanveer100% (1)

- F7 LectureDocument259 pagesF7 LectureĐạt LêNo ratings yet

- Fixed LeaseDocument9 pagesFixed LeaseMikeNo ratings yet

- Aafr Ias 12 Icap Past Paper With SolutionDocument17 pagesAafr Ias 12 Icap Past Paper With SolutionAqib Sheikh100% (1)

- Aafr Ias 12 Icap Past Paper With SolutionDocument17 pagesAafr Ias 12 Icap Past Paper With SolutionAqib Sheikh100% (1)

- Chapter 3-Consolidated Statement of Profit and LossDocument11 pagesChapter 3-Consolidated Statement of Profit and LossSheikh Mass JahNo ratings yet

- Sample Past Exam Questions RevisedDocument23 pagesSample Past Exam Questions RevisedAngie100% (2)

- IFRS 15 Revenue From Customer Contract NewDocument21 pagesIFRS 15 Revenue From Customer Contract NewHuỳnh Minh Gia HàoNo ratings yet

- This Study Resource Was: Airlines International Balance SheetDocument6 pagesThis Study Resource Was: Airlines International Balance SheetAlina ZubairNo ratings yet

- Financial Management Question Bank 2019 PDFDocument384 pagesFinancial Management Question Bank 2019 PDFtsere butsereNo ratings yet

- A2 Recognition, Measurement, Valuation, and Disclosure PDFDocument7 pagesA2 Recognition, Measurement, Valuation, and Disclosure PDFbernard cruzNo ratings yet

- Exercise - IAS 23 Borrowing CostsDocument6 pagesExercise - IAS 23 Borrowing CostsMazni Hanisah100% (1)

- PSA - Financial Accounting (Question Bank) PDFDocument276 pagesPSA - Financial Accounting (Question Bank) PDFbanglauser50% (2)

- Group Accounts - Subsidiaries (CSOFP) : Chapter Learning ObjectivesDocument58 pagesGroup Accounts - Subsidiaries (CSOFP) : Chapter Learning ObjectivesKeotshepile Esrom MputleNo ratings yet

- CFAP 1 AAFR Summer 2017Document10 pagesCFAP 1 AAFR Summer 2017Aqib SheikhNo ratings yet

- 09 - Cash and Bank BalancesDocument4 pages09 - Cash and Bank BalancesAqib SheikhNo ratings yet

- Aafr Ifrs 15 Icap Past Papers With SolutionDocument10 pagesAafr Ifrs 15 Icap Past Papers With SolutionAqib Sheikh0% (1)

- Ifrs 2 Share Based Payment (2021)Document7 pagesIfrs 2 Share Based Payment (2021)Tawanda Tatenda HerbertNo ratings yet

- CPA Ireland Corporate Reporting 2015-18Document174 pagesCPA Ireland Corporate Reporting 2015-18Ahmed Raza Tanveer100% (1)

- FAR-I Borrowing Cost IAS-23 Sir MMDocument7 pagesFAR-I Borrowing Cost IAS-23 Sir MMarhamNo ratings yet

- Purchase ConsiderationDocument5 pagesPurchase ConsiderationAR Ananth Rohith BhatNo ratings yet

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda0% (1)

- Cost of Capital-ProblemsDocument6 pagesCost of Capital-ProblemsUday GowdaNo ratings yet

- Corporate Reporting Past Question Papers (ICAB)Document55 pagesCorporate Reporting Past Question Papers (ICAB)Md. Zahidul Amin100% (1)

- ADocument7 pagesAAyad Abdelkarim NasirNo ratings yet

- IND AS 32, 107, 109 (With Questions & Answers)Document69 pagesIND AS 32, 107, 109 (With Questions & Answers)Suraj Dwivedi100% (1)

- IAS 40 ICAB QuestionsDocument5 pagesIAS 40 ICAB QuestionsMonirul Islam Moniirr100% (1)

- Financial Instruments (2021)Document17 pagesFinancial Instruments (2021)Tawanda Tatenda Herbert100% (1)

- NFRS 15 - Revenue From Contracts With CustomerDocument18 pagesNFRS 15 - Revenue From Contracts With CustomerApilNo ratings yet

- Past Paper FAR1Document105 pagesPast Paper FAR1Hamza VirkNo ratings yet

- Capital BudgetingDocument8 pagesCapital BudgetingArun AntonyNo ratings yet

- List of Topics For Cost Accounting Assignments - Sem V - AY 2021-22-1Document2 pagesList of Topics For Cost Accounting Assignments - Sem V - AY 2021-22-1Manan Shah0% (1)

- EPS MCQs PDFDocument8 pagesEPS MCQs PDFMaria Jawed100% (1)

- Ias 33 Eps F7Document27 pagesIas 33 Eps F7Sai Manikanta Pedamallu100% (1)

- ICAEW Accounting IAS 07 MCQ With ANSDocument3 pagesICAEW Accounting IAS 07 MCQ With ANShopeacca50% (2)

- Fa Mcqs (Icap)Document133 pagesFa Mcqs (Icap)MUHAMMAD ASLAMNo ratings yet

- Financial Reporting Revision Kit (0) - 1Document371 pagesFinancial Reporting Revision Kit (0) - 1Peter Osundwa Kiteki50% (2)

- Learning Curves: Areas of ConsequenceDocument10 pagesLearning Curves: Areas of ConsequenceAhmed RazaNo ratings yet

- Question Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based) PDFDocument50 pagesQuestion Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based) PDFTwsif Tanvir Tanoy92% (13)

- Integrated and Non Integrated System of AccountingDocument46 pagesIntegrated and Non Integrated System of AccountingGanesh Nikam67% (3)

- IAS - 16 Property, Plant and EquipmentDocument11 pagesIAS - 16 Property, Plant and EquipmentArm ButtNo ratings yet

- IntermediateDocument139 pagesIntermediateabdulramani mbwanaNo ratings yet

- 20-21 Module 6 RevenueDocument15 pages20-21 Module 6 RevenueSiddesh100% (1)

- Chuẩn mực KTQTDocument24 pagesChuẩn mực KTQTChi PhươngNo ratings yet

- Lease Question and SolutionDocument7 pagesLease Question and Solutionsajedul100% (1)

- Gzu Taxation Practice Questions: Mining: Page 1 of 2Document2 pagesGzu Taxation Practice Questions: Mining: Page 1 of 2Tawanda Tatenda Herbert100% (3)

- Sa Sept10 Ias16Document7 pagesSa Sept10 Ias16Muiz QureshiNo ratings yet

- Icag FM Past QuestionsDocument398 pagesIcag FM Past QuestionsMelvin AmohNo ratings yet

- Homework Chapter 18 and 19Document7 pagesHomework Chapter 18 and 19doejohn150No ratings yet

- (Lecture 5) - Other Investment Appraisal DecisionsDocument21 pages(Lecture 5) - Other Investment Appraisal DecisionsAjay Kumar Takiar100% (1)

- IFRS 16 13102022 100655am 1Document3 pagesIFRS 16 13102022 100655am 1Adnan MaqboolNo ratings yet

- Module-Leasing and Hire Purchase Calculation of Lease RentalsDocument5 pagesModule-Leasing and Hire Purchase Calculation of Lease RentalsSINDHU NNo ratings yet

- FAR-II Test IFRS-16 (AB)Document2 pagesFAR-II Test IFRS-16 (AB)Waseim khan Barik zaiNo ratings yet

- Chapter 11 FinAcc2Document13 pagesChapter 11 FinAcc2Kariz Codog0% (2)

- IFRS-16 LeasesDocument7 pagesIFRS-16 LeasesHuzaifa WaseemNo ratings yet

- Aafr Ifrs 16 Icap Past Papers With SolutionDocument8 pagesAafr Ifrs 16 Icap Past Papers With SolutionAqib SheikhNo ratings yet

- BFD Past Paper AnalysisDocument8 pagesBFD Past Paper AnalysisAqib SheikhNo ratings yet

- BFD Crash Course (ICAP) - Muhammad Samie - 12-11-2021Document11 pagesBFD Crash Course (ICAP) - Muhammad Samie - 12-11-2021Aqib SheikhNo ratings yet

- South Asia Pakistan Terminals Limited - Counter Tariff: Effective From 2nd July 2018Document2 pagesSouth Asia Pakistan Terminals Limited - Counter Tariff: Effective From 2nd July 2018Aqib SheikhNo ratings yet

- Institute of Chartered Accountants of PakistanDocument4 pagesInstitute of Chartered Accountants of PakistanAqib SheikhNo ratings yet

- Pakistan Stock Exchange Named Best Performing in AsiaDocument2 pagesPakistan Stock Exchange Named Best Performing in AsiaAqib SheikhNo ratings yet

- The Institute of Chartered Accountants of PakistanDocument2 pagesThe Institute of Chartered Accountants of PakistanAqib SheikhNo ratings yet

- The Institute of Chartered Accountants of PakistanDocument4 pagesThe Institute of Chartered Accountants of PakistanAqib SheikhNo ratings yet

- The Institute of Chartered Accountants of PakistanDocument6 pagesThe Institute of Chartered Accountants of PakistanAqib SheikhNo ratings yet

- Announcement Regarding Presentation Amp Communication Skills Course PCSC - 2Document1 pageAnnouncement Regarding Presentation Amp Communication Skills Course PCSC - 2Aqib SheikhNo ratings yet

- The Institute of Chartered Accountants of PakistanDocument3 pagesThe Institute of Chartered Accountants of PakistanAqib SheikhNo ratings yet

- KCO-Rate-Card 2021Document13 pagesKCO-Rate-Card 2021Aqib SheikhNo ratings yet

- Memorandums and Letters: Apply Correct Memo and Letter FormatsDocument17 pagesMemorandums and Letters: Apply Correct Memo and Letter FormatsAqib Sheikh100% (1)

- ILO, 2020a ILO, 2020aDocument3 pagesILO, 2020a ILO, 2020aAqib SheikhNo ratings yet

- COVID 19 Pandemic Amp Pakistan Limitations and GapsDocument15 pagesCOVID 19 Pandemic Amp Pakistan Limitations and GapsAqib SheikhNo ratings yet

- Audit Program: Provision Against Long Term Deposits Against UtilitiesDocument4 pagesAudit Program: Provision Against Long Term Deposits Against UtilitiesAqib SheikhNo ratings yet

- 06 - Stores and SparesDocument4 pages06 - Stores and SparesAqib SheikhNo ratings yet

- 06 - Stock in TradeDocument5 pages06 - Stock in TradeAqib SheikhNo ratings yet

- 08 - Advances, Deposits, Prepayments and Other ReceivablesDocument4 pages08 - Advances, Deposits, Prepayments and Other ReceivablesAqib SheikhNo ratings yet

- Audit Program: Property Plant and EquipmentDocument8 pagesAudit Program: Property Plant and EquipmentAqib Sheikh100% (3)

- Presentation On Sir Syed Ahmad Khan by YasirDocument14 pagesPresentation On Sir Syed Ahmad Khan by YasirAqib Sheikh85% (13)

- 05 - Long Term Loans and AdvancesDocument5 pages05 - Long Term Loans and AdvancesAqib SheikhNo ratings yet

- Implied TenancyDocument6 pagesImplied TenancyJhoanna Marie Manuel-AbelNo ratings yet

- AviTrader Monthly MRO E-Magazine 2018-08Document22 pagesAviTrader Monthly MRO E-Magazine 2018-08vishwanath hampannaNo ratings yet

- Sale and Purchase Agreement: The Vendor The PurchaserDocument5 pagesSale and Purchase Agreement: The Vendor The Purchaserdinda ajengNo ratings yet

- ESSAY QuestionsDocument7 pagesESSAY QuestionsAnonymous hB3sBE7z100% (1)

- Deed of Rental Agreement TemplateDocument3 pagesDeed of Rental Agreement TemplateMirza Sons SrinagarNo ratings yet

- Ducusin vs. Court of Appeals (G.R. No. L-58286 May 16, 1983.)Document4 pagesDucusin vs. Court of Appeals (G.R. No. L-58286 May 16, 1983.)Lourdes LorenNo ratings yet

- Company Creation: Documents RequiredDocument2 pagesCompany Creation: Documents RequiredNambinina RNo ratings yet

- Mines and Minerals ActDocument186 pagesMines and Minerals ActObey farai DubeNo ratings yet

- Restaurant Rules of ThumbDocument9 pagesRestaurant Rules of ThumbBrian MargulisNo ratings yet

- RICS APC Tips & TricksDocument69 pagesRICS APC Tips & TricksMuhammad Anamul Hoque100% (2)

- Civil Law Case Digests CompilationDocument20 pagesCivil Law Case Digests CompilationArmstrong BosantogNo ratings yet

- Real Estate Company ProfileDocument11 pagesReal Estate Company ProfileJoint Ventur100% (1)

- RHBDocument3 pagesRHBNeeraj Jain100% (1)

- Quick Notes Real Estate TaxationDocument3 pagesQuick Notes Real Estate TaxationJoshelle B. Bancilo100% (3)

- Cayetano and Tiongson v. CADocument9 pagesCayetano and Tiongson v. CAChen AbreaNo ratings yet

- Memorandum of AssociationDocument8 pagesMemorandum of AssociationSimraNo ratings yet

- Lease 1Document5 pagesLease 1richard kayNo ratings yet

- Alfanta Vs NoelDocument22 pagesAlfanta Vs NoelShiva0% (1)

- Requirements and Permits Needed in Registering Corporate Business in The Philippines Part 2Document2 pagesRequirements and Permits Needed in Registering Corporate Business in The Philippines Part 2deosa villamonteNo ratings yet

- Ijarah MechanismDocument5 pagesIjarah MechanismRezaul Alam100% (1)

- Lease ContractDocument2 pagesLease ContractOne TwoNo ratings yet

- Equity LLB. PART 2 (II) - Lecture Notes 1 Equity LLB. PART 2 (II) - Lecture Notes 1Document15 pagesEquity LLB. PART 2 (II) - Lecture Notes 1 Equity LLB. PART 2 (II) - Lecture Notes 1Chaman Lal Karotia100% (1)

- Water Supply Agreement - DraftDocument6 pagesWater Supply Agreement - DraftSreeNo ratings yet

- 20 Wilmon Auto Supply Corp Vs CADocument1 page20 Wilmon Auto Supply Corp Vs CAStephanie GriarNo ratings yet

- Land Transactions KalibalaDocument7 pagesLand Transactions Kalibalachris.oyuaNo ratings yet

- Guide To Starting Your Dental Practice (The ADA Practical Guide Series) - American Dental Association (January 12, 2011)Document128 pagesGuide To Starting Your Dental Practice (The ADA Practical Guide Series) - American Dental Association (January 12, 2011)Tea MetaNo ratings yet

- Additional Provision AddendumDocument3 pagesAdditional Provision AddendumlmariellayNo ratings yet

- Seatwork On Investment PropertyDocument2 pagesSeatwork On Investment PropertyMinetquemaNo ratings yet

- Workshop Living in The Czech Republic: WWW - Expatlegal.czDocument22 pagesWorkshop Living in The Czech Republic: WWW - Expatlegal.czImran ShaNo ratings yet