Professional Documents

Culture Documents

Exchange Traded Funds Our Solutions

Uploaded by

JCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exchange Traded Funds Our Solutions

Uploaded by

JCopyright:

Available Formats

Exchange Traded Funds (ETFs)

Our Solutions

For Professional Clients only

The value of an investment in the portfolios and any income from them can go down as well as up and as with any

investment you may not receive back the amount originally invested.

Our overall AUM (end of June 2018)

USD6.7bn

Our ETFs

Our range of 27 ETFs enables our clients to access developed and emerging

equity markets at global, regional and country levels. We are recognised as

experts in emerging markets, underpinned by our footprint, our local market

knowledge and access through out global network. This has allowed us to Cost

develop a successful broad emerging market ETF range to sit along side our Transparent

efficient

developed market products. This combined offering allows investors to access

global equity markets and manage global investment portfolios.

HSBC active systematic ETFs

In October 2017, we launched our first active systematic strategies. These ETFs will take

advantage of our long track record in smart beta and fundamentally weighted strategies, a Tracking

well resourced research team of 20 investment professionals, supported by technology

infrastructure and experienced ETF portfolio managers. Both ETFs offer diversification from

passive and active strategies, and cost efficient access to ‘smart beta’ solutions.

HSBC Multi Factor Worldwide Equity UCITS ETF: The strategy uses a proprietary multi

factor investment model which aims to provide consistent outperformance against a market

capitalisation weighted index over the medium to long term through exposures to a suite of

diversified factor-based risk premia.

HSBC Economic Scale Worldwide Equity UCITS ETF: The strategy uses a systematic

investment approach and invests in companies according to their ‘economic scale’. The

chosen measure for economic scale is a company’s contribution to Gross National Product,

often referred to as ‘value added’.

Cost efficiency in practice

At the heart of our investment process is delivering close tracking error and managing tracking error budgets, while minimising the funds

execution costs. We have a proven track record in providing competitively priced market access solutions; supported by our dedicated

portfolio management teams, our investment in the latest trading technology and a dedicated global equity dealing team.

TER / OCF (%) Market average1

Euro Stoxx 50

HSBC Euro Stoxx 50 UCITS ETF 0.05 0.11

MSCI Japan

HSBC MSCI Japan UCITS ETF 0.19 0.33

S&P 500

HSBC S&P 500 UCITS ETF 0.09 0.12

MSCI World

HSBC MSCI World UCITS ETF 0.15 0.28

MSCI Emerging Markets

HSBC MSCI Emerging Markets UCITS ETF 0.40 0.39

Source: Bloomberg, HSBC Global Asset Management as at end of June 2018.

1. Market average has been computed by looking at the TER of the main Europe-domiciled ETFs tracking the same benchmark.

Exchange Traded Funds: Our Solutions 2

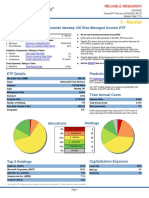

ETF/ETP assets by region listed

3,423

2,130 2,405

802

562

USDbn

506

276

158 170

136 126

117 117

86

65

50

2015 2016 2017

Canada USA Europe Japan Asia ex Japan

Benefits of HSBC ETFs

Diversification Transparency

Benefits of broad exposure The basket of underlying

within an asset class or

category.

securities (“PCF”) is

published every day.

USD650bn

YTD December 2017-

net inflows globally

Cost effective Liquidity

Relatively low costs and ETF liquidity comes from the

transparent annual

management fees.

underlying securities and is

enhanced by secondary ETF AUM growth 2017

markets.

36.3%

Accurate No minimum

Precision tracking Controlled risk investment

Target exposure to asset Robust quantitative portfolio Physical replication ETFs can be bought and

classes, investment style or management, trading and minimizes risk. sold in 1 share.

sector. risk monitoring ensure

efficiency.

Source: ETFGI as at end of December 2017.

Exchange Traded Funds: Our Solutions 3

Partnership in index and systematic equity

We have successfully managed index funds for external clients since

30+ years

1988, with dedicated portfolio management teams across global

markets, leveraging our infrastructure and expertise. We currently

manage USD43 billion1 in passive and systematic strategies. Our

ETF solutions are built on our strong index tracking heritage,

integrated platform and disciplined process.

We take a pragmatic approach to managing ETFs with two equally

experience managing

important objectives: close tracking and minimising costs.

passive and systematic

We offer equity market exposure to a range of global markets. We

carefully select indices where we can manage trading costs and

liquidity.

equity portfolios

Our tracking method and value-added approach to managing passive

funds have enabled us to consistently produce returns that closely

mirror the index within target tracking tolerances. The strength of HSBC’s capabilities

Through considered implementation, we aim to find the optimal

trade-off between temporary tracking error and transaction costs,

when trading at large rebalance points, such as an index

reconstitution or a portfolio model review. The optimal balance and

duration of implementation is important in achieving this objective

and ultimately improves portfolio performance over time. Our

research has shown this approach adds, net of transaction costs, to

the performance of passive portfolios and is driven as a function of

the size of the opportunity set available, i.e. frequency of rebalances

and number of index changes. The diversification of implementation ESG and

is based on the detailed analysis of trade characteristics such as munitions

liquidity, demand and supply profiles, volume multiple indicators,

price movements over short periods, expected market impact, and

stock

portfolio risk. screening

Strong

HSBC added value relationship

with the

administrator

01

07

Execution Pre-trade

analysis Competitive

execution

Evolve

strategy

02 costs

06 Added Trading

strategy Dedicated

Value global equity

dealing team

Continuous

review 03

Investment

05 team

Execution review

04

1. As at end of June 2018.

Source: HSBC Global Asset Management. For illustrative purposes only.

Exchange Traded Funds: Our Solutions 4

Strong index tracking heritage

INDEX & ACTIVE

30

Strategy, portfolio construction and

Launch of proprietary

SYSTEMATIC quantitative tools.

Strategies

Core research team

2011

Establishment of

2000

Years experience in index and quantitative equity management

research

Systematic Research

Launched our first UK index team within HSBC Global

1988 – 1998

fund – American Index Fund. Asset Management.

1989 – FTSE All Share Index Developing our active

Fund, HSBC European Index systematic model

Fund, and, HSBC Japan Index portfolios and building

Fund research and insights

leveraged by our equity

1994 – HSBC FTSE 100 Index portfolio managers

Fund

1997/1998 – HSBC FTSE 250

Index Fund, and HSBC Pacific

Index Fund

Portfolio modeling /

Development of our

industry leading Visuliser

construction

2012

platform, a proprietary

portfolio modelling,

2004

construction and risk

1st Multi Factor Institutional

analytics system –

mandate

integrated across our

global network

Developing proprietary technology

Launch of HSBC’s

Portfolio / stock

Global Equities (MSCI ACWI

2006

proprietary portfolio and

management

2015

based) strategy launched stock investment decision

tool – TRAC – supporting

UK Mutual funds launched – US,

our passive investment

UK and Japan country funds

process to deliver

improved and scalable

execution

2009 – 2011

Physical 2009 - Listed our first ETFs on

Replication the LSE.

Launched 24 ETFs across

Cash management

developed and emerging Roll out and further

2016

markets. integration of PECMan,

Dedicated 2010 – cross listed our ETFs

across France, Germany and

the proprietary Cash

Management Investment

passive portfolio Switzerland Decision Tool -

supporting our passive

management team investment process

across all types of

2012

Launch of our Fundamentally

index solutions Weighted Strategies: Economic

Scale Equity

Risk modelling

Updates to our risk

2015

modelling – creation of

proprietary tools and

High tracking Launch of UCITS Common

resources

2015

Contractual Funds, based on

accuracy our Economic Scale Equity

Strategies – offering tax

Large efficient, transparent cross

Enhancements to our process

border pooling

investments Use of trade optimisation

in the latest techniques that improve

implementation

2015+

Launch Multi Factor strategies- risk / adjusted returns

Trading /

trading Income, HGIF Global Lower focusing on the equity

2017

Carbon Equity market trading micro

technology Launched two new Active ETFs

structure, with access to

data and technology to

– following our proprietary enhance the process and

Active Systematic strategies fund risk adjusted returns

2018

Index projections

Launch of our new ICAV

2016+

platform in Ireland to promote

our passive funds cross border. Proprietary projection of

index changes by the

HSBC Index Funds Team

Exchange Traded Funds: Our Solutions 5

Our ETF investment process

Index activity / Rebalances

Rebalance / review

Timing and announcement

Frequency and overlap

Client requirements

Objectives

Constraints

Universe

Strategy

Market

segment Analysis

Impact

Estimated cost / risk

Portfolio construction approach

Size of assets

Breadth of benchmark

Liquidity profile of stocks

Custody and admin costs

Trade execution

Index rebalance frequency Benchmark / Market

Market access route

events monitoring

Method of execution

Corporate actions

– electronic

Strategy weights

Reporting

Free float and share

Risk trading

in issue changes

Dividend

management

Share offerings

Rights issues

Risk management

Source: HSBC Global Asset Management. For illustrative purposes only.

Exchange Traded Funds: Our Solutions 6

Investing in proprietary technology

At HSBC Global Asset Management we have heavily invested in

leading investment technology to support our investment process

and seize opportunities for our clients as they emerge. Our leading

proprietary technology ensures the efficiency and accuracy of

information- supporting consistent tracking and fund performance. At Trade

modelling

HSBC our technological developments are integrated into our Exposure

Management

investment platform, providing: module

In-house proprietary algorithms and optimisation techniques, Algorithmic Fund /

trades Benchmark

Direct feeds of large pools of data, Passive module

investment

Risk management coded and embedded across the platform at Risk process

Management

both pre- and post-trade. and reporting

This is ever evident in the regards to managing our ETF range;

Access, roles

where the technology compliments the ability of our investment team and privileges

Order

to bring cost savings and better performance outcomes for funds and Management

clients. integration

Physical replication and optimisation

Our ETFs benefit from our physical replication approach- where our portfolios are

invested in the constituents of the underlying index, and do not use synthetic

instruments, such as swaps sand other derivatives, to mirror index performance.

Some studies have shown that synthetic funds can offer a lower tracking error over

time than physically replicated funds. However, the risks associated with synthetic

index-based funds, most importantly counterparty risk, are often regarded as a less

attractive investment option.

In cases where buying all the underlying securities is not cost-effective, physical

funds can use an optimised method of portfolio construction and trade generation.

The optimisation method, purchases a representative proportion of securities in the

underlying index, which is highly correlated to owning the entire index. Optimisation

offers lower costs especially in regards to broad indices composing a very large

number of stocks such as the MSCI Emerging Markets.

Controversial weapons screening: benefit

Closely Tracked, of doing the right thing

In 2010 HSBC Global Asset Management implemented a screening

Minimised Execution of controversial weapons such as anti-personnel mines, cluster

munitions, biological and chemical weapons, and depleted uranium

Costs across the active business to exclude investments in issuers that are

involved in these weapons.

We subsequently expanded this screening to optimised index funds,

and then later to our entire passive ranges including our suite of

ETFs.

The Convention on Cluster Munitions (CCM) took effect in August

2010. Several countries adopted legislation on cluster munition, but

the laws around passive funds investing are not clear cut.

We believe there are several reasons why the decision to expand the

screening across all our equity investments is the right one:

We aim to comply with the spirit and the letter of the law

The screening currently has a minor performance/tracking

impact. We believe that as the focus on this subject increases,

companies still involved might choose to cease their

involvement, reducing the need for screening

Exchange Traded Funds: Our Solutions 7

How to invest in HSBC ETFs Authorised participants1

HSBC ETFs can be bought through a regulated stock exchange. HSBC ETFs are supported by a large network of authorised

They are easy to use, a low cost investment option and are widely participants. The following list of institutions are authorised to create

available on most online brokerage accounts and through financial and redeem shares in the ETF range:

advisers.

Goldenberg HSBC Global

Stockbroker Hehmeyer Markets

You can buy HSBC ETFs during daily trading hours using a

stockbroker. If you do not have a stockbroker already then the IMC Trading Optiver

exchange can help you locate a stockbroker. Please note that other

fees may apply.

Susquehanna BAML

HSBC ETFs are listed throughout Europe:

London Stock Exchange Flow Traders Virtu

Deutsche Boerse

Morgan

Euronext Paris Jane Street

Stanley

Six Switzerland

Societe

Commerzbank

Borsa Italiana Generale

RBC

Execution platforms Official Market Makers

HSBC ETFs can be purchased via a wide range of execution Authorised Participants

platforms some of which are listed below:

Aegon Elevate Raymond James

AJ Bell Fidelity Funds Network Standard Life

Alliance Trust Savings James Hay Transact

Ascentric Novia Zurich

Aviva Wrap Nucleus

Why HSBC as an ideal ETF partner?

Focused product Robust investment Track record and Competitive Transparent Liquidity and

offering process performance pricing accessibility

Core index 1. In depth analysis A strong history of The ability to offer 1. Fully transparent 1. Quoted

capabilities covering of portfolio low tracking error competitive with physical continuously

a large variety of universe drawn from our TER/OCF across replication, no throughout the

markets 2. Robust deep experience in our ETFs securities day on European

technology and index based lending exchanges

support investing 2. All constituents 2. Market making

infrastructure online commitments for

3. Rigorous risk all products

monitoring

1. The contact details of our authorised participants are available on our dedicated ETF website- http://www.etf.hsbc.com/etf/uk/professional/trading.html

Source: HSBC Global Asset Management. For illustrative purposes only.

Exchange Traded Funds: Our Solutions 9

HSBC ETF range

Base Dividend Replication

Fund name ISIN currency TER / OCF AUM (USD) frequency method

Developed markets – regional exposure

IE00B4X9L533

HSBC MSCI WORLD UCITS ETF USD 0.15% 566,734,644 Quarterly Optimisation

DE000A1C9KL8

IE00B5BD5K76 Physical

HSBC MSCI EUROPE UCITS ETF EUR 0.20% 185,260,924 Semi-annual

DE000A1C22L5 replication

IE00B4K6B022 Physical

HSBC EURO STOXX 50 UCITS ETF EUR 0.05% 147,449,230 Semi-annual

DE000A1C0BB7 replication

HSBC MSCI PACIFIC ex JAPAN IE00B5SG8Z57 Physical

USD 0.40% 36,157,024 Semi-annual

UCITS ETF DE000A1C22P6 replication

Developed markets – single country exposure

IE00B5KQNG97 Physical

HSBC S&P 500 UCITS ETF USD 0.09% 3,049,015,329 Semi-annual

DE000A1C22M3 replication

IE00B5WFQ436 Physical

HSBC MSCI USA UCITS ETF USD 0.30% 75,698,658 Semi-annual

DE000A1C22K7 replication

IE00B42TW061 Physical

HSBC FTSE 100 UCITS ETF GBP 0.07% 214,436,415 Semi-annual

DE000A1C0BC5 replication

Physical

HSBC FTSE 250 UCITS ETF IE00B64PTF05 GBP 0.35% 55,027,702 Quarterly

replication

IE00B5VX7566 Physical

HSBC MSCI JAPAN UCITS ETF USD 0.19% 234,854,804 Semi-annual

DE000A1C0BD3 replication

IE00B51B7Z02 Physical

HSBC MSCI CANADA UCITS ETF USD 0.35% 33,791,524 Semi-annual

DE000A1JF7N6 replication

Developed markets – property exposure

HSBC FTSE EPRA/NAREIT IE00B5L01S80 Physical

USD 0.40% 146,739,585 Quarterly

DEVELOPED UCITS ETF DE000A1JXC78 replication

Global markets – broad exposure

HSBC ECONOMIC SCALE IE00BKZG9Y92

USD 0.25% 420,249,255 Quarterly N/A (active)

WORLDWIDE EQUITY UCITS ETF DE000A2JG4F7

HSBC MULTI FACTOR IE00BKZGB098

USD 0.25% 249,201,811 Quarterly N/A (active)

WORLDWIDE EQUITY UCITS ETF DE000A2JG4G5

Source: HSBC Global Asset Management, as at end of June 2018.

Exchange Traded Funds: Our Solutions 10

HSBC ETF range

Base Dividend Replication

Fund name ISIN currency TER / OCF AUM (USD) frequency method

Emerging markets – regional exposure

HSBC MSCI AC FAR EAST EX IE00BBQ2W338

USD 0.60% 287,798,451 - Optimisation

JAPAN UCITS ETF DE000A1W2EK4

HSBC MSCI EM FAR EAST UCITS IE00B5LP3W10

USD 0.60% 37,086,531 Semi-annual Optimisation

ETF DE000A1C22Q4

HSBC MSCI EM LATIN AMERICA IE00B4TS3815 Physical

USD 0.60% 14,890,688 Quarterly

UCITS ETF DE000A1JF7T3 replication

HSBC MSCI EMERGING MARKETS IE00B5SSQT16

USD 0.40% 264,465,424 Quarterly Optimisation

UCITS ETF DE000A1JXC94

Emerging markets – single country exposure

IE00B5W34K94 Physical

HSBC MSCI BRAZIL UCITS ETF USD 0.60% 28,140,562 Semi-annual

DE000A1C22N1 replication

IE00B3S1J086 Physical

HSBC MSCI TAIWAN UCITS ETF USD 0.60% 11,143,087 Semi-annual

DE000A1JF7R7 replication

HSBC MSCI INDONESIA UCITS IE00B46G8275 Physical

USD 0.60% 45,228,777 Semi-annual

ETF DE000A1JF7Q9 replication

IE00B3Z0X395 Physical

HSBC MSCI KOREA UCITS ETF USD 0.60% 10,629,552 Semi-annual

DE000A1JXC60 replication

IE00B3X3R831 Physical

HSBC MSCI MALAYSIA UCITS ETF USD 0.60% 4,809,838 Semi-annual

DE000A1JF7S5 replication

IE00B44T3H88 Physical

HSBC MSCI CHINA UCITS ETF1 USD 0.60% 367,692,189 Semi-annual

DE000A1JF7L0 replication

HSBC MSCI CHINA A INCLUSION Physical

IE00BF4NQ904 USD 0.60% ~10,000,000 Quarterly

UCITS ETF2 replication

HSBC MSCI MEXICO CAPPED IE00B3QMYK80 Physical

USD 0.60% 10,796,171 Semi-annual

UCITS ETF DE000A1JF7P1 replication

HSBC MSCI SOUTH AFRICA IE00B57S5Q22 Physical

USD 0.60% 3,800,469 Semi-annual

CAPPED UCITS ETF2 DE000A1JF7M8 replication

IE00B5BRQB73 Physical

HSBC MSCI TURKEY UCITS ETF USD 0.60% 5,563,625 Semi-annual

DE000A1H49V6 replication

HSBC MSCI RUSSIA CAPPED IE00B5LJZQ16 Physical

USD 0.60% 179,010,993 Semi-annual

UCITS ETF DE000A1JXC86 replication

1. As at 27th July 2018 (launch date).

2. As at 24th April – previously HSBC MSCI South Africa UCITS ETF.

Source: HSBC Global Asset Management, as at end of June 2018.

Exchange Traded Funds: Our Solutions 11

Contact

For more information, please contact us:

Telephone: 0800 358 3011

Email: wholesale.clientservices@hsbc.com

Website: http://www.assetmanagement.hsbc.co.uk/en/intermediary

Key risks

The value of an investment in the portfolios and any income from them can go down as well as up and as with any investment you

may not receive back the amount originally invested.

Exchange Rate risk: Investing in assets denominated in a currency other than that of the investor’s own currency perspective exposes

the value of the investment to exchange rate fluctuations.

Derivative risk: The value of derivative contracts is dependent upon the performance of an underlying asset. A small movement in the

value of the underlying can cause a large movement in the value of the derivative. Unlike exchange traded derivatives, over-the-counter

(OTC) derivatives have credit risk associated with the counterparty or institution facilitating the trade.

Index Tracking risk: The performance of the Fund may not match the performance of the index it tracks because of fees and expenses,

market opening times and regulatory constraints.

Operational risk: The main risks are related to systems and process failures. Investment processes are overseen by independent risk

functions which are subject to independent audit and supervised by regulators.

Liquidity risk: Liquidity is a measure of how easily an investment can be converted to cash without a loss of capital and/or income in the

process. The value of assets may be significantly impacted by liquidity risk during adverse market conditions.

Emerging Market risk: Emerging economies typically exhibit higher levels of investment risk. Markets are not always well regulated or

efficient and investments can be affected by reduced liquidity.

Focused Strategy risk: Funds with a narrow or concentrated investment strategy may experience higher risk and return volatility and

lower liquidity than funds with amore diversified approach.

Important information

For Professional Clients only and should not be distributed to or relied upon by Retail Clients.

The material contained herein is for information only and does not constitute legal, tax or investment advice or a recommendation to any

reader of this material to buy or sell investments. You must not, therefore, rely on the content of this document when making any investment

decisions.

This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use

would be contrary to law or regulation. This document is not and should not be construed as an offer to sell or the solicitation of an offer to

purchase or subscribe to any investment.

Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target

where provided is indicative only and not guaranteed in any way. HSBC Global Asset Management (UK) Limited accepts no liability for any

failure to meet such forecast, projection or target.

HSBC ETFs are sub-funds of HSBC ETFs plc (“the Company”), an investment company with variable capital and segregated liability between

sub-funds, incorporated in Ireland as a public limited company, and is authorised by the Central Bank of Ireland. The company is constituted

as an umbrella fund, with segregated liability between sub-funds. Shares purchased on the secondary market cannot usually be sold directly

back to the Company. Investors must buy and sell shares on the secondary market with the assistance of an intermediary (e.g. a stockbroker)

and may incur fees for doing so. In addition, investors may pay more than the current Net Asset Value per share when buying shares and may

receive less than the current Net Asset Value per Share when selling them. UK based investors in HSBC ETFs plc are advised that they may

not be afforded some of the protections conveyed by the Financial Services and Markets Act (2000), (“the Act”). The Company is recognised

in the United Kingdom by the Financial Conduct Authority under section 264 of the Act. The shares in HSBC ETFs plc have not been and will

not be offered for sale or sold in the United States of America, its territories or possessions and all areas subject to its jurisdiction, or to United

States Persons. Affiliated companies of HSBC Global Asset Management (UK) Limited may make markets in HSBC ETFs plc. All applications

are made on the basis of the current HSBC ETFs plc Prospectus, relevant Key Investor Information Document (“KIID”), Supplementary

Information Document (SID) and Fund supplement, and most recent annual and semi-annual reports, which can be obtained upon request

free of charge from HSBC Global Asset Management (UK) Limited, 8 Canada Square, Canary Wharf, London, E14 5HQ. UK, or from a

stockbroker or financial adviser. Investors and potential investors should read and note the risk warnings in the prospectus, relevant KIID and

Fund supplement (where available) and additionally, in the case of retail clients, the information contained in the supporting SID.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally

invested. Where overseas investments are held the rate of currency exchange may also cause the value of such investments to fluctuate.

Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets.

Stock market investments should be viewed as a medium to long term investment and should be held for at least five years. Any performance

information shown refers to the past and should not be seen as an indication of future returns.

To help improve our service and in the interests of security we may record and/or monitor your communication with us. HSBC Global Asset

Management (UK) Limited provides information to Institutions, Professional Advisers and their clients on the investment products and services

of the HSBC Group. Approved for issue in the UK by HSBC Global Asset Management (UK) Limited, who are authorised and regulated by the

Financial Conduct Authority.

www.assetmanagement.hsbc.com/uk Copyright © HSBC Global Asset Management (UK) Limited 2018 All rights reserved.

18-XB-0619 EXP: 30/11/2018

Exchange Traded Funds: Our Solutions 12

You might also like

- Capital MarketsDocument542 pagesCapital MarketsMohaideen Subaire100% (4)

- Chapter Two: Asset Classes and Financial InstrumentsDocument27 pagesChapter Two: Asset Classes and Financial Instrumentsbilly93100% (1)

- Strategy Overview: Private Equity FundDocument2 pagesStrategy Overview: Private Equity FundleminhptnkNo ratings yet

- An easy approach to exchange traded funds: An introductory guide to ETFs and their investment and trading strategiesFrom EverandAn easy approach to exchange traded funds: An introductory guide to ETFs and their investment and trading strategiesRating: 3 out of 5 stars3/5 (2)

- Analysis of Financial Statements and Performance of Sports DirectDocument23 pagesAnalysis of Financial Statements and Performance of Sports DirectNaveed Saifi100% (5)

- Analysis of Indian Stock Market and Comparison of Corporate Stock Brokers FinalDocument62 pagesAnalysis of Indian Stock Market and Comparison of Corporate Stock Brokers Finaldollie0% (2)

- Trackinsight Global Etf Survey 2021Document113 pagesTrackinsight Global Etf Survey 2021mclaird01No ratings yet

- A Broad Range of Opportunities Our Exchange Traded Funds (Etfs)Document12 pagesA Broad Range of Opportunities Our Exchange Traded Funds (Etfs)JNo ratings yet

- Productlist Index Funds enDocument15 pagesProductlist Index Funds enpierreNo ratings yet

- Everything You Need to Know About ETFsDocument4 pagesEverything You Need to Know About ETFspratikNo ratings yet

- Exchange Traded FundsDocument13 pagesExchange Traded Fundsgreeninfo rainNo ratings yet

- Exchange Trade of FundDocument4 pagesExchange Trade of Fundnidhi thakurNo ratings yet

- PIMCO ETFs ISS - Smart PassiveDocument4 pagesPIMCO ETFs ISS - Smart Passivefreebanker777741No ratings yet

- Unlocking Portfolio Potential: UTI MF's Guide To Effective DiversificationDocument4 pagesUnlocking Portfolio Potential: UTI MF's Guide To Effective Diversificationrinkuparekh13No ratings yet

- Mi - ST - ATH: Invest in This Smallcase HereDocument1 pageMi - ST - ATH: Invest in This Smallcase HerehamsNo ratings yet

- Marketing Brochure TradePlus S&P New China Tracker - July 2019 (English)Document14 pagesMarketing Brochure TradePlus S&P New China Tracker - July 2019 (English)Alyssa AnnNo ratings yet

- Axis Nifty 100 Index Fund - NFODocument12 pagesAxis Nifty 100 Index Fund - NFOhammarworldNo ratings yet

- Vangaurd ETFDocument12 pagesVangaurd ETFdelossantos5542No ratings yet

- Vanguard Small Cap Value ETFDocument4 pagesVanguard Small Cap Value ETFKhalilBenlahccenNo ratings yet

- BlackRock IsharesDocument7 pagesBlackRock IsharesBenNo ratings yet

- E.a50 - KFS (Clean) - 20170918Document11 pagesE.a50 - KFS (Clean) - 20170918Eddie NgNo ratings yet

- A Study On Performance Evaluation of Equity Linked Saving Schemes (ELSS) of Mutual FundsDocument22 pagesA Study On Performance Evaluation of Equity Linked Saving Schemes (ELSS) of Mutual Fundsxc123544No ratings yet

- GF European Strategic Equity: The Fund Our Experienced Fund Management TeamDocument3 pagesGF European Strategic Equity: The Fund Our Experienced Fund Management Teamuniqueclub fabricsNo ratings yet

- Understanding of Mutual FundDocument20 pagesUnderstanding of Mutual FundshraddhashindeNo ratings yet

- Fidelity Funds - China Opportunities Fund: 31 July 2018 年年7⽉月31⽇日Document2 pagesFidelity Funds - China Opportunities Fund: 31 July 2018 年年7⽉月31⽇日silver lauNo ratings yet

- ETF Strategies and StructuresDocument40 pagesETF Strategies and StructuresJhuliza Carrasco IngaNo ratings yet

- DSP Multicap Fund - BrochureDocument4 pagesDSP Multicap Fund - BrochureSivaram NaturalFarmingNo ratings yet

- Invesco MSCI Sustainable Future ETF: Growth of $10,000Document3 pagesInvesco MSCI Sustainable Future ETF: Growth of $10,000sarah martinNo ratings yet

- Brochure - SA Rand ETF Managed Portfolios - Jul21Document7 pagesBrochure - SA Rand ETF Managed Portfolios - Jul21Ardine FickNo ratings yet

- Etf Retail FundsDocument7 pagesEtf Retail Fundsapi-313045815No ratings yet

- 2018 Stockspot ETF ReportDocument76 pages2018 Stockspot ETF ReportCamille Sara BartonNo ratings yet

- DB Guide To FX IndicesDocument84 pagesDB Guide To FX Indicesmzanella82No ratings yet

- HRAA Product SheetDocument7 pagesHRAA Product SheetANLE ANLENo ratings yet

- "Bees (Benchmark Exchange Traded Scheme) " About Exchange Traded FundsDocument8 pages"Bees (Benchmark Exchange Traded Scheme) " About Exchange Traded FundsratanNo ratings yet

- PPT-10 REITs - InvITs PresentaionDocument24 pagesPPT-10 REITs - InvITs PresentaionVikas MaheshwariNo ratings yet

- DSP Multicap-Singlepager A4Document4 pagesDSP Multicap-Singlepager A4Amal S DasNo ratings yet

- Nifty Bees (N) 1Document14 pagesNifty Bees (N) 1ankushishwarNo ratings yet

- See The Full Slides BelowDocument75 pagesSee The Full Slides BelowAnonymous Ht0MIJNo ratings yet

- Piof Ar EngDocument29 pagesPiof Ar EnghishamwahidinNo ratings yet

- Index Investment and Exchange Traded FundsDocument39 pagesIndex Investment and Exchange Traded FundsEint PhooNo ratings yet

- Exchange Traded Funds - : Structures and StrategiesDocument40 pagesExchange Traded Funds - : Structures and StrategiesYe koNo ratings yet

- Satrix Momentum Index Fund End 2018 PDFDocument14 pagesSatrix Momentum Index Fund End 2018 PDFVictor BothaNo ratings yet

- Factors Whitepaper EuDocument24 pagesFactors Whitepaper EuAnshuman SinghNo ratings yet

- The Asset Factsheet Apr 2023Document77 pagesThe Asset Factsheet Apr 2023Ally Bin AssadNo ratings yet

- 3 - Neutral: ETF Series Solutions: Nationwide Nasdaq-100 Risk-Managed Income ETFDocument3 pages3 - Neutral: ETF Series Solutions: Nationwide Nasdaq-100 Risk-Managed Income ETFphysicallen1791No ratings yet

- Pictet-Human-R EUR - FACTSHEET - LU2247920262 - EN - DEFAULT - 31jan2022Document4 pagesPictet-Human-R EUR - FACTSHEET - LU2247920262 - EN - DEFAULT - 31jan2022ATNo ratings yet

- Exchange Traded Funds: An Introductory GuideDocument12 pagesExchange Traded Funds: An Introductory Guideapi-313045815No ratings yet

- Fact Sheet - Legal and General Global Emerging Markets Index Fund 31-08-2020 UKDocument4 pagesFact Sheet - Legal and General Global Emerging Markets Index Fund 31-08-2020 UKLesley Fernandes MoreiraNo ratings yet

- HDFC MF Index Solutions Factsheet - March 2023Document75 pagesHDFC MF Index Solutions Factsheet - March 2023srivatsanpersonalNo ratings yet

- Rupeeting Core - Aggressive: Return: - 2.98 (3M ABS) RISK: HIGHDocument5 pagesRupeeting Core - Aggressive: Return: - 2.98 (3M ABS) RISK: HIGHJinesh ShahNo ratings yet

- India's Leading Index Fund ProviderDocument31 pagesIndia's Leading Index Fund ProviderDeepakDungariaNo ratings yet

- Your Essential Guide to Passive InvestingDocument15 pagesYour Essential Guide to Passive InvestinginvestorNo ratings yet

- JRFM 14 00283Document30 pagesJRFM 14 00283Conrado RosendoNo ratings yet

- Rc3a9sumc3a9 Produits Alternatifs DinvestissementDocument6 pagesRc3a9sumc3a9 Produits Alternatifs DinvestissementYawNo ratings yet

- Robeco Sept 2018Document4 pagesRobeco Sept 2018ouattara dabilaNo ratings yet

- Estmo 0001Document1 pageEstmo 0001ShahamijNo ratings yet

- Sequrity AnalysisDocument72 pagesSequrity AnalysisAbdul Kadir ArsiwalaNo ratings yet

- Indexing Made Easy - A Look at Popular Investing Strategies Using EtfsDocument9 pagesIndexing Made Easy - A Look at Popular Investing Strategies Using Etfsnishitpatel2783No ratings yet

- PortfolioConstruction RoleofEquities enDocument6 pagesPortfolioConstruction RoleofEquities enSamiiro AbdiNo ratings yet

- Ftse Index Solutions:: The Foundation of Successful EtfsDocument12 pagesFtse Index Solutions:: The Foundation of Successful EtfshelyeeNo ratings yet

- MCX reforms to boost commodity derivatives market in IndiaDocument8 pagesMCX reforms to boost commodity derivatives market in Indiavalueinvestor123No ratings yet

- IDFC Factsheet April 2021 - 3Document70 pagesIDFC Factsheet April 2021 - 3completebhejafryNo ratings yet

- Index Funds GuideDocument17 pagesIndex Funds GuidesambhavjoshiNo ratings yet

- ICICI Securities Ltd. - PCG HNI Note - SMIFS ResearchDocument11 pagesICICI Securities Ltd. - PCG HNI Note - SMIFS ResearchShweta ChaudharyNo ratings yet

- Syrian Capital Markets - The Report Syria 2010Document13 pagesSyrian Capital Markets - The Report Syria 2010k.ghazzi3580No ratings yet

- Momentum, Acceleration, and Reversal - 0Document12 pagesMomentum, Acceleration, and Reversal - 0Loulou DePanamNo ratings yet

- Financial Derivatives (Unit 1,2,3,4,5)Document63 pagesFinancial Derivatives (Unit 1,2,3,4,5)Nadeem KhanNo ratings yet

- Analysis of Investments & Management of Portfolios at Pakistan Stock ExchangeDocument41 pagesAnalysis of Investments & Management of Portfolios at Pakistan Stock ExchangeAdanNo ratings yet

- Mirae Asset Factsheet - March 2020 PDFDocument26 pagesMirae Asset Factsheet - March 2020 PDFManoj SharmaNo ratings yet

- Project On Hedge FundDocument10 pagesProject On Hedge FundNidhi GuptaNo ratings yet

- ReillyBrown IAPM 11e PPT Ch11Document58 pagesReillyBrown IAPM 11e PPT Ch11rocky wongNo ratings yet

- Stock Exchange IndicesDocument19 pagesStock Exchange IndicesBunu MarianaNo ratings yet

- Market Daily: Company UpdateDocument15 pagesMarket Daily: Company UpdatebodaiNo ratings yet

- WFE Exchange Factsheet Updated in Sept 2022Document184 pagesWFE Exchange Factsheet Updated in Sept 2022BigPalabraNo ratings yet

- Level III Guidelines Answers 2016Document50 pagesLevel III Guidelines Answers 2016kenNo ratings yet

- Market Indicator Series LectureDocument26 pagesMarket Indicator Series LectureCeila FerronNo ratings yet

- Financial Management OverviewDocument31 pagesFinancial Management OverviewSaif JillaniNo ratings yet

- Optimal Growth Vs Black Swan Part2 Web VersionDocument11 pagesOptimal Growth Vs Black Swan Part2 Web Versionsys1errNo ratings yet

- Liquidity Ratio of VodafoneDocument12 pagesLiquidity Ratio of VodafoneBenjamin Harris100% (1)

- Humanoid Robot Reinforcement Learning Algorithm For Biped WalkingDocument7 pagesHumanoid Robot Reinforcement Learning Algorithm For Biped WalkingJaveria ZiaNo ratings yet

- Visa Inc Fiscal 2022 Annual ReportDocument143 pagesVisa Inc Fiscal 2022 Annual ReportPankaj GoyalNo ratings yet

- Vanguard S&P 500 UCITS ETF: (USD) DistributingDocument4 pagesVanguard S&P 500 UCITS ETF: (USD) DistributingMateuszGóreckiNo ratings yet

- Riskometer - SEBI CircularDocument23 pagesRiskometer - SEBI CircularT SrinivasanNo ratings yet

- DLF AnnualDocument400 pagesDLF AnnualMayank NegiNo ratings yet

- Download ebook Essentials Of Investments 12E Ise Pdf full chapter pdfDocument67 pagesDownload ebook Essentials Of Investments 12E Ise Pdf full chapter pdfjanet.cochran431100% (21)

- Assignment INVESTMENTDocument3 pagesAssignment INVESTMENTfariaNo ratings yet

- Pershing Square Q1 12 Investor LetterDocument14 pagesPershing Square Q1 12 Investor LetterVALUEWALK LLCNo ratings yet

- NSE Welcome KitDocument26 pagesNSE Welcome KitjayabalrNo ratings yet

- Performance and Risk of Green FundsDocument13 pagesPerformance and Risk of Green FundsMatthieu LévêqueNo ratings yet

- 10B Olstein AnniversaryDocument21 pages10B Olstein AnniversaryMatt EbrahimiNo ratings yet