Professional Documents

Culture Documents

101 Things Everyone Should Know About Economics 8

Uploaded by

L0 ratings0% found this document useful (0 votes)

7 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 page101 Things Everyone Should Know About Economics 8

Uploaded by

LCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

The

first fifteen entries describe the economy, economic cycles, economic

results, and some of the measures economists use to measure economic activity.

1. INCOME

Income is the money we receive in order to buy what we need when we need it.

Economists look at income in several different ways—including where it comes

from, how much is earned, and how much of what is earned can really be spent.

Income includes the following money flows: wages to labor, profit to businesses

and enterprise, interest to capital, and rent to land.

What You Should Know

Income is what people earn through either direct labor or as owners of

investments. The amount of income we earn as individuals and families connects

to the economy’s prosperity and strength. It dictates how much we can

ultimately spend and the value we bring to the economy as a whole. The amount

of income earned collectively as a country determines the economic health of a

nation and of groups within it.

Economists look at national income (covered further under #4 GDP), per

capita income (income generated per person), and household income (how much

income is generated by the average household). In all but the worst times,

incomes should rise as people accomplish more by becoming more skilled and

productive at their jobs and in their businesses. Economists also speak of real

income increases—that is, increases adjusted for inflation, as opposed to

nominal increases, which represent the raw numbers but not necessarily true

income growth.

Economists also consider disposable income, or the amount of income

actually available for individuals and families to spend after taxes. Disposable

income is a truer indicator of how much purchasing power we really have, and

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

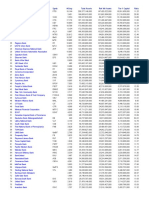

- Tier 1 Capital - All Banks1Document1 pageTier 1 Capital - All Banks1LNo ratings yet

- Tier 1 Capital - All BanksDocument1 pageTier 1 Capital - All BanksLNo ratings yet

- From Wikipedia, The Free Encyclopedia: Irrational Exuberance, 2d EdDocument1 pageFrom Wikipedia, The Free Encyclopedia: Irrational Exuberance, 2d EdLNo ratings yet

- Tier 1 Capital - All BanksDocument3 pagesTier 1 Capital - All BanksL100% (1)

- 101 Things Everyone Should Know About Economics 1Document1 page101 Things Everyone Should Know About Economics 1LNo ratings yet

- Hat-Trick-3 Easy-Entry-Exit Strategies9Document1 pageHat-Trick-3 Easy-Entry-Exit Strategies9LNo ratings yet

- Mark Minervini Stage 2 Uptrend and Trend TemplateDocument1 pageMark Minervini Stage 2 Uptrend and Trend TemplateL100% (1)

- Hat-Trick-3 Easy-Entry-Exit Strategies6Document1 pageHat-Trick-3 Easy-Entry-Exit Strategies6LNo ratings yet

- Hat-Trick-3 Easy-Entry-Exit Strategies8Document1 pageHat-Trick-3 Easy-Entry-Exit Strategies8LNo ratings yet

- ATR Trailing Stop2Document1 pageATR Trailing Stop2LNo ratings yet

- What Is An ATR Trailing Stop?: New Trader UDocument1 pageWhat Is An ATR Trailing Stop?: New Trader ULNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)