Professional Documents

Culture Documents

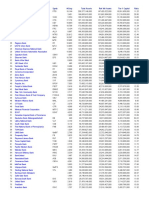

P-E Ratio1

Uploaded by

LCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P-E Ratio1

Uploaded by

LCopyright:

Available Formats

P/E ratio - Wikipedia, the free encyclopedia http://en.wikipedia.

org/wiki/P/E_ratio

11 References

12 External links

There are various P/E ratios, all defined as:

The price per share in the numerator is the market price of a single share of the stock. The earnings per share

in the denominator depends on the type of P/E:

"Trailing P/E" or "P/E ttm": Earnings per share is the net income of the company for the most recent

12 month period, divided by number of shares outstanding. This is the most common meaning of "P/E"

if no other qualifier is specified. Monthly earning data for individual companies are not available, so

the previous four quarterly earnings reports are used and earnings per share is updated quarterly. Note,

companies individually choose their financial year so the schedule of updates will vary.

"Trailing P/E from continued operations": Instead of net income, uses operating earnings which

exclude earnings from discontinued operations, extraordinary items (e.g. one-off windfalls and

writedowns), or accounting changes. Note, longer-term P/E data such as Schiller's uses net earnings.

"Forward P/E", "P/Ef", or "estimated P/E": Instead of net income, uses estimated net earnings over

next 12 months. Estimates are typically derived as the mean of a select group of analysts (note,

selection criteria is rarely cited). In times of rapid economic dislocation, such estimates become less

relevant as "the situation changes" (e.g. new economic data is published and/or the basis of their

forecasts become obsolete) more quickly than analysts adjust their forecasts.

The P/E ratio can alternatively be calculated by dividing the company's market capitalization by its total

annual earnings.

For example, if stock A is trading at $24 and the earnings per share for the most recent 12 month period is

$3, then stock A has a P/E ratio of 24/3 or 8. Put another way, the purchaser of the stock is paying $8 for

every dollar of earnings. Companies with losses (negative earnings) or no profit have an undefined P/E ratio

(usually shown as Not applicable or "N/A"); sometimes, however, a negative P/E ratio may be shown.

By comparing price and earnings per share for a company, one can analyze the market's stock valuation of a

company and its shares relative to the income the company is actually generating. Stocks with higher (and/or

more certain) forecast earnings growth will usually have a higher P/E, and those expected to have lower

(and/or riskier) earnings growth will in most cases have a lower P/E. Investors can use the P/E ratio to

compare the value of stocks: if one stock has a P/E twice that of another stock, all things being equal

(especially the earnings growth rate), it is a less attractive investment. Companies are rarely equal, however,

and comparisons between industries, companies, and time periods may be misleading.

Since 1900, the average P/E ratio for the S&P 500 index has ranged from 4.78 in Dec 1920 to 44.20 in Dec

1999[4], with an average around 15[5]. The average P/E of the market varies in relation with, among other

factors, expected growth of earnings, expected stability of earnings, expected inflation, and yields of

competing investments. For example, when US treasuries yield high returns, investors pay less for a given

earnings per share and P/E's fall.

2 of 10 10/11/04 5:33 PM

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Tier 1 Capital - All Banks1Document1 pageTier 1 Capital - All Banks1LNo ratings yet

- Tier 1 Capital - All BanksDocument1 pageTier 1 Capital - All BanksLNo ratings yet

- From Wikipedia, The Free Encyclopedia: Irrational Exuberance, 2d EdDocument1 pageFrom Wikipedia, The Free Encyclopedia: Irrational Exuberance, 2d EdLNo ratings yet

- Tier 1 Capital - All BanksDocument3 pagesTier 1 Capital - All BanksL100% (1)

- 101 Things Everyone Should Know About Economics 1Document1 page101 Things Everyone Should Know About Economics 1LNo ratings yet

- Hat-Trick-3 Easy-Entry-Exit Strategies9Document1 pageHat-Trick-3 Easy-Entry-Exit Strategies9LNo ratings yet

- Mark Minervini Stage 2 Uptrend and Trend TemplateDocument1 pageMark Minervini Stage 2 Uptrend and Trend TemplateL100% (1)

- Hat-Trick-3 Easy-Entry-Exit Strategies6Document1 pageHat-Trick-3 Easy-Entry-Exit Strategies6LNo ratings yet

- Hat-Trick-3 Easy-Entry-Exit Strategies8Document1 pageHat-Trick-3 Easy-Entry-Exit Strategies8LNo ratings yet

- ATR Trailing Stop2Document1 pageATR Trailing Stop2LNo ratings yet

- What Is An ATR Trailing Stop?: New Trader UDocument1 pageWhat Is An ATR Trailing Stop?: New Trader ULNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 5 Building Pro Forma Financial Statements Part 2Document8 pages5 Building Pro Forma Financial Statements Part 2sanu sayedNo ratings yet

- Enchantment Cosmetics Inc Offers A Line of Cosmetic and PerfumeDocument1 pageEnchantment Cosmetics Inc Offers A Line of Cosmetic and Perfumetrilocksp SinghNo ratings yet

- Case - The Indian Sugar Industry - Q1Document4 pagesCase - The Indian Sugar Industry - Q1Qazi100% (1)

- Unit 24: Measuring The Cost of Living (Ans)Document5 pagesUnit 24: Measuring The Cost of Living (Ans)Minh Châu Tạ ThịNo ratings yet

- Swami ChartsDocument5 pagesSwami Chartscyrus68No ratings yet

- Annual Equivalence Analysis: Annual Equivalent Criterion Applying Annual Worth Analysis Mutually Exclusive ProjectsDocument43 pagesAnnual Equivalence Analysis: Annual Equivalent Criterion Applying Annual Worth Analysis Mutually Exclusive ProjectsGayuh WNo ratings yet

- Old Mutual Balanced FundDocument2 pagesOld Mutual Balanced FundSam AbdurahimNo ratings yet

- Strategy ImplementedDocument6 pagesStrategy Implementedshreyas raoNo ratings yet

- Absorption and Marginal CostingDocument4 pagesAbsorption and Marginal CostingTrya SalsabillaNo ratings yet

- Week 10 Economics Seminar ExercisesDocument2 pagesWeek 10 Economics Seminar ExercisesElia LozovanuNo ratings yet

- Sri Lanka - EconomicCrisisDocument3 pagesSri Lanka - EconomicCrisisJames EscalonaNo ratings yet

- Security Analysis & Portfolio Management: TOPIC-Empirical Tests of EMH & Negative Evidence of EMHDocument12 pagesSecurity Analysis & Portfolio Management: TOPIC-Empirical Tests of EMH & Negative Evidence of EMHPurvi ShahNo ratings yet

- ICE Three Month SONIA Index Futures: Contract SpecificationDocument2 pagesICE Three Month SONIA Index Futures: Contract SpecificationSatvinder Deep SinghNo ratings yet

- Final ExamDocument340 pagesFinal ExamTopik PutraNo ratings yet

- Management and Cost Accounting: Colin DruryDocument18 pagesManagement and Cost Accounting: Colin DruryYasmine MagdiNo ratings yet

- Cost of Capital: Test Code: R36 COCA Q-BankDocument15 pagesCost of Capital: Test Code: R36 COCA Q-BankMarwa Abd-ElmeguidNo ratings yet

- Currency TraderDocument29 pagesCurrency TraderOuwehand OrgNo ratings yet

- Behavioral Finance QUIZDocument2 pagesBehavioral Finance QUIZChelsea MedranoNo ratings yet

- IAPM AnswersDocument3 pagesIAPM AnswersSukhchain patel PatelNo ratings yet

- Methods of Valuation of FirmsDocument90 pagesMethods of Valuation of Firmsmuskaan bhadadaNo ratings yet

- Fin544-Stock and Debt ApproachDocument21 pagesFin544-Stock and Debt ApproachRakesh MoparthiNo ratings yet

- OpenStax Economics TestBank Ch05 ElasticityDocument18 pagesOpenStax Economics TestBank Ch05 Elasticitymariam.tarekakrNo ratings yet

- Palepu 3e - TB - Ch02 Class Exercise Chapter 2Document6 pagesPalepu 3e - TB - Ch02 Class Exercise Chapter 2nur zakirahNo ratings yet

- MT Final ReportDocument28 pagesMT Final ReportNehal SharmaNo ratings yet

- AutoProctor - Socratease QuizDocument12 pagesAutoProctor - Socratease QuizSUKUL 2No ratings yet

- Adri 1 SgsDocument6 pagesAdri 1 Sgsابوالحروف العربي ابوالحروفNo ratings yet

- RQDocument3 pagesRQKathlyn Joyce SumangNo ratings yet

- Forex Bank Trading Strategy Revealed Learn To Track The Smart MoneyDocument7 pagesForex Bank Trading Strategy Revealed Learn To Track The Smart MoneyMichael Mario100% (1)

- PArt 1level of Sugar Usage and The Increase On The Product Prices of Selected Refreshment Stall I1Document7 pagesPArt 1level of Sugar Usage and The Increase On The Product Prices of Selected Refreshment Stall I1garry-kunNo ratings yet

- An Introduction To EzSMCDocument14 pagesAn Introduction To EzSMCMusa AliNo ratings yet