Professional Documents

Culture Documents

Cash book types

Uploaded by

RINTU SAHAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash book types

Uploaded by

RINTU SAHACopyright:

Available Formats

3.

cash book

Before talking about the cash book, let us know what is cash. Cash is a current asset which

consists of items used in day to day financial transactions as medium of exchange. cash

includes, currency notes made of paper, coins, demand deposits, money orders, checks and

bank overdrafts etc.

Cash book

The cash book is used to record receipts and payments of cash. It works as a book of original

entry as well as a ledger account. The entries related to receipt and payment of cash are first

recorded in the cash book and then posted to the relevant ledger accounts. Moreover, a cash

book is a substitute for cash account in the ledger. A company that properly maintains a cash

book does not need to open a cash account in its ledger.

1.cash book is a journal as well as a ledger

2.cash account shows only debit balance

3.only cash transactions are recorded in cash book

Types of cash book

There are four major types of cash book that companies usually maintain to account for their

cash flows. These are given below:

1. A single column cash book to record only cash transactions.

2. A double/two column cash book to record cash as well as bank transactions.

3. A triple/three column cash book to record cash, bank and purchase discount and sales

discount.

4. A petty cash book to record small day to day cash expenditures.( simple and

analytical)

Formats

A single column cash book to record only cash transactions.

A double/two column cash book to record cash as well as discount transactions.

A triple/three column cash book to record cash, bank and purchase discount and sales

discount.

Definition of Contra Entry

Contra entry refers to transactions involving cash and bank account. In other words, any entry

which affects both cash and bank accounts is called a contra entry.

If a transaction requires entries on both the debit and the credit sides simultaneously, it is called

'Contra entry'.

a. When an account is opened with a bank and deposited cash in to bank account.

b. The firm's cash is deposited in the bank.

c. The cash is withdrawn from bank for office use.

d. The cheques received from debtors, are not deposited in the bank on the same day.

(The cheques received from debtors and deposited in the bank on the same day no contra entry

and a crossed cheque received and deposited)

A petty cash book/ ANALYTICAL PETTY CASH BOOK

Problems on cash book

2nd goods sold to bharath 40000

2nd reced 3500 in full settlement of 4000 from bharath

3rd purchased from ganesh 3000

4th sold goods for 35000 and received 25000 immediately

6th purchased machinery for 50000

8th withdrawn cash for office use 20000 and personal use 10000

9th paid life insurance premium 3000

30/12/ withdrawn for personal use 300.

30/12. Recd a cheque from raj 30000

31/12 Raj cheque deposited.

31st received a crossed cheque from poorvik 8000

1 BOD- 5000

6. And deposited on 7th

You might also like

- Cash BookDocument4 pagesCash Booksrisaidegree collegeNo ratings yet

- What is a cash bookDocument4 pagesWhat is a cash bookPayal MaskaraNo ratings yet

- The Cash BookDocument22 pagesThe Cash Bookrdeepak99No ratings yet

- Cash Book PDFDocument24 pagesCash Book PDFsavinay agrawalNo ratings yet

- Ch-5 Cash BookDocument19 pagesCh-5 Cash Bookvel gadgetsNo ratings yet

- Accounting For Current Assets - Cash and ReceivablesDocument17 pagesAccounting For Current Assets - Cash and ReceivablesvladsteinarminNo ratings yet

- What Is A Cash Book?: Double/two Column Cash Book Triple/three Column Cash BookDocument7 pagesWhat Is A Cash Book?: Double/two Column Cash Book Triple/three Column Cash BookAiman KhanNo ratings yet

- Tally-1Document61 pagesTally-1vidya gubbala100% (1)

- Lecture-2 (Cash Book)Document31 pagesLecture-2 (Cash Book)Ali AhmedNo ratings yet

- Chapter 3 Accounting Books and RecordsDocument77 pagesChapter 3 Accounting Books and RecordsRashid Hussain80% (5)

- Convention of Conservatism: Debiting and CreditingDocument57 pagesConvention of Conservatism: Debiting and CreditingvasusantNo ratings yet

- Cash BookDocument6 pagesCash BookTefo Lelentle Itachi MatlhoNo ratings yet

- Cash BookDocument15 pagesCash Bookswatee89No ratings yet

- Journe LDocument8 pagesJourne LBhasker KharelNo ratings yet

- © Ncert Not To Be Republished: Recording of Transactions-IIDocument59 pages© Ncert Not To Be Republished: Recording of Transactions-IIIas Aspirant AbhiNo ratings yet

- Grade 11 - Cbse-Chapter 4 Recording of Transaction IIDocument42 pagesGrade 11 - Cbse-Chapter 4 Recording of Transaction IIhum_tara1235563No ratings yet

- Acounting System SectionDocument98 pagesAcounting System SectionKaashifNo ratings yet

- Ncert Fm-Ac-xi Chapter 4Document59 pagesNcert Fm-Ac-xi Chapter 4shaannivasNo ratings yet

- Alpesh Accountancy ProjectDocument16 pagesAlpesh Accountancy Projectalpeshupadhyay2810No ratings yet

- Accounting For CashDocument9 pagesAccounting For CashNatty STAN100% (1)

- Financial Accounting E-Learning Notes on Bank AccountsDocument32 pagesFinancial Accounting E-Learning Notes on Bank AccountsFaith OzuahNo ratings yet

- Introduction To Accounting & Baiscs of JournalDocument227 pagesIntroduction To Accounting & Baiscs of Journaldateraj100% (1)

- IEAS W Grade 11 Accountancy Chapter 3Document32 pagesIEAS W Grade 11 Accountancy Chapter 3Zainab NaginaNo ratings yet

- Double Entry Book Keeping SystemDocument14 pagesDouble Entry Book Keeping SystemVisakh Vignesh100% (1)

- Accountancy: Basics of AccountingDocument9 pagesAccountancy: Basics of AccountingBallavi RaniNo ratings yet

- Financial Accounting Chapter 4Document59 pagesFinancial Accounting Chapter 4abhinav2018No ratings yet

- Accounting Prefinals ReviewerDocument9 pagesAccounting Prefinals ReviewerMaxine RodriguezNo ratings yet

- Subsidiary BooksDocument7 pagesSubsidiary BooksRashmi PatelNo ratings yet

- Accounting Books - Journal and LedgerDocument15 pagesAccounting Books - Journal and LedgerClair De luneNo ratings yet

- Source Document of AccountancyDocument7 pagesSource Document of AccountancyVinod GandhiNo ratings yet

- Chapter 5 Special Books Updated PDFDocument36 pagesChapter 5 Special Books Updated PDFmayank guptaNo ratings yet

- Accounting 111Document6 pagesAccounting 111SOMOSCONo ratings yet

- I. Personal Account. II. Impersonal AccountDocument11 pagesI. Personal Account. II. Impersonal AccountrsvmarketingNo ratings yet

- Tally IntroductionDocument5 pagesTally IntroductionamitgpatNo ratings yet

- Worbook Practice 1: 1. Circle The Correct Option in Each SentenceDocument3 pagesWorbook Practice 1: 1. Circle The Correct Option in Each SentenceBeth Flor G. CaNo ratings yet

- Banks Other Bank TransactionsDocument35 pagesBanks Other Bank TransactionsBrenda PanyoNo ratings yet

- Basic Bank Documents and TransactionDocument25 pagesBasic Bank Documents and TransactionJoselyn Amon100% (1)

- Account 1Document30 pagesAccount 1sant100% (1)

- Mba Faaunit - IIDocument15 pagesMba Faaunit - IINaresh GuduruNo ratings yet

- Some Cash and Bank TransactionsDocument11 pagesSome Cash and Bank TransactionsSameer ShindeNo ratings yet

- Journal & LedgerDocument14 pagesJournal & Ledgerzaya sarwar100% (1)

- Journal PostingDocument22 pagesJournal PostingPoonam JadhavNo ratings yet

- Accounting 041642 091436Document71 pagesAccounting 041642 091436Blessing ChandisaitaNo ratings yet

- POA Assessment 1Document4 pagesPOA Assessment 1Dave ChowtieNo ratings yet

- Accountancy Notes PDF Class 11 Chapter 3 and 4Document5 pagesAccountancy Notes PDF Class 11 Chapter 3 and 4Rishi ShibdatNo ratings yet

- Befa Unit IVDocument12 pagesBefa Unit IVNaresh Guduru93% (15)

- Cash and Petty CashbookDocument7 pagesCash and Petty CashbookLycan LycanNo ratings yet

- Do You Have A: SavingsDocument34 pagesDo You Have A: SavingsLee TeukNo ratings yet

- Unit 2Document69 pagesUnit 2Simardeep SalujaNo ratings yet

- Chapter 2 - Basic Documents and TransactionsDocument33 pagesChapter 2 - Basic Documents and Transactionsmarissa casareno almuete100% (1)

- Chapter 1Document5 pagesChapter 1palash khannaNo ratings yet

- Assignment 4Document4 pagesAssignment 4Yashveer SinghNo ratings yet

- Week 1: Basic Documents and Transactions Related To Bank DepositsDocument6 pagesWeek 1: Basic Documents and Transactions Related To Bank Depositsgregorio gualdadNo ratings yet

- Chapter 3 Accounting Books and RecordsDocument77 pagesChapter 3 Accounting Books and RecordsJafari Selemani100% (1)

- Subsidiary books record transactionsDocument7 pagesSubsidiary books record transactionsRajaRajeswari.LNo ratings yet

- Recording of Accounting Transaction (Theory and Practical Problem)Document13 pagesRecording of Accounting Transaction (Theory and Practical Problem)Mubin Shaikh NooruNo ratings yet

- Financial Accountancy Chapter 4 Notes PDFDocument55 pagesFinancial Accountancy Chapter 4 Notes PDFHarshavardhanNo ratings yet

- State Whether The Following Statements Are TRUE or FALSE 1. Total of Payments Side Can Be Greater Than Total of Receipts Side IDocument1 pageState Whether The Following Statements Are TRUE or FALSE 1. Total of Payments Side Can Be Greater Than Total of Receipts Side Iminharahmath55No ratings yet

- Estimasi Akuntansi - Kabelindo Multi TBK 2017Document151 pagesEstimasi Akuntansi - Kabelindo Multi TBK 2017Andry NugrahaNo ratings yet

- ATH Technologies (E) : New Management: 2016-2017Document2 pagesATH Technologies (E) : New Management: 2016-2017Siti Nurul Asyiqin Binti Mohd Nor H20A1810No ratings yet

- Chap 009Document50 pagesChap 009Sarojini Gopaloo100% (1)

- A Study of Consumers Behaviour Related To KTMDocument8 pagesA Study of Consumers Behaviour Related To KTMDiganta DaimaryNo ratings yet

- CBSE Class 12 Accountancy Syllabus 2023 24Document8 pagesCBSE Class 12 Accountancy Syllabus 2023 24kankariya1424No ratings yet

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 6Document44 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 6jasperkennedy094% (17)

- CH 11Document50 pagesCH 11Mareta Vina ChristineNo ratings yet

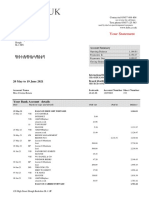

- Your Statement: 20 May To 19 June 2021Document3 pagesYour Statement: 20 May To 19 June 2021Cristina Rotaru100% (1)

- Core 4 Prepare Financial ReportsDocument27 pagesCore 4 Prepare Financial ReportsBongbong GalloNo ratings yet

- Non Deliverable ForwardDocument17 pagesNon Deliverable ForwardManish GuptaNo ratings yet

- Child Labour and Education UKDocument78 pagesChild Labour and Education UKDina DawoodNo ratings yet

- Annual Report TB 2018Document370 pagesAnnual Report TB 2018Laura Desi SitumorangNo ratings yet

- Auditing A Practical Approach 3rd Edition Moroney Solutions Manual PDFDocument30 pagesAuditing A Practical Approach 3rd Edition Moroney Solutions Manual PDFAyesha RGNo ratings yet

- Measuring Social ValueDocument7 pagesMeasuring Social ValueSocial innovation in Western AustraliaNo ratings yet

- Summary of RA 9153Document18 pagesSummary of RA 9153Michael Cai0% (1)

- Maximising Returns From A Retail Network Nov 2009Document5 pagesMaximising Returns From A Retail Network Nov 2009jaiganeshan89No ratings yet

- Chapter I IntroductionDocument34 pagesChapter I IntroductionSUBHI AWASTHINo ratings yet

- LazyPay-General Terms and ConditionsDocument15 pagesLazyPay-General Terms and Conditionsramakrishnan balanNo ratings yet

- Budgetary Control - L G ElectonicsDocument86 pagesBudgetary Control - L G ElectonicssaiyuvatechNo ratings yet

- IATF16949 Transition Audit Document Review Draft V5 Final Points EnglishDocument6 pagesIATF16949 Transition Audit Document Review Draft V5 Final Points EnglishSudhagarNo ratings yet

- Answer Paper 4Document18 pagesAnswer Paper 4SomeoneNo ratings yet

- Culture & Environment of Global MarketsDocument44 pagesCulture & Environment of Global MarketsMansi A KathuriaNo ratings yet

- IFFCO's Marketing Strategy and its Financial Impact on StakeholdersDocument59 pagesIFFCO's Marketing Strategy and its Financial Impact on StakeholdersMEGHANo ratings yet

- Payroll Basics for SMEsDocument56 pagesPayroll Basics for SMEseyraNo ratings yet

- Case Analysis On IOCLDocument12 pagesCase Analysis On IOCLRaoul Savio GomesNo ratings yet

- Philippine and International Accounting Standard-Setting OrganizationsDocument6 pagesPhilippine and International Accounting Standard-Setting OrganizationsChocobetternotNo ratings yet

- Management Assessment 1 - Short AnswersDocument16 pagesManagement Assessment 1 - Short AnswersArbabNo ratings yet

- Life Cycle Analysis TemplateDocument4 pagesLife Cycle Analysis Templateram010No ratings yet

- ACC 345 Module One Homework Template - StudentDocument37 pagesACC 345 Module One Homework Template - Studenttara50% (10)

- Understanding Risks and Risk Management Techniques from a Chapter on Personal and Commercial RisksDocument42 pagesUnderstanding Risks and Risk Management Techniques from a Chapter on Personal and Commercial Risks大大No ratings yet