Professional Documents

Culture Documents

Lecture 7

Uploaded by

AbiotOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture 7

Uploaded by

AbiotCopyright:

Available Formats

NPTEL- History of Modern Economic Thought

Module 2

Lecture 7

Topics

2.4 David Ricardo I

2.4.1 Ricardo's distribution theory: land rent

2.4.2 Is rent price determining or price determined?

2.4 David Ricardo I

David Ricardo (1772-1823), a stockbroker turned economist made significant

contributions in the fields of value theory, methodology of economics, distribution

theory and international trade. He began his study of economics sometimes

around 1810 and published his first pamphlet in 1810. His major work, Principles

of Political Economy and Taxation, was published in 1817.

Writing after Smith, Ricardo departed significantly from Smith's methodology.

Smith's writing was based on deductive theory presenting his argument in the

context of historical and contemporary institutions.

Ricardo departed from the contextual framework and adopted a more abstract

framework representing reality with algebraic models.

He however was concerned with the existing problems such as Corn Law and

import tariff policy. But he always maintained that for devising correct policies we

need to understand reality through the lenses of models.

In the following lectures we will discuss Ricardo's contribution in the three most

important areas: labor theory of value, distribution theory and macroeconomic

policies.

Dept. of Humanities and Social Sciences, Indian Institute Of Technology, Kanpur

NPTEL- History of Modern Economic Thought

Ricardo's interest in the theory of distribution started because of the Corn Law

controversy. The Corn Laws are the regulations which were meant to restrict the

import of American corn to Britain. One group of supporters of the Corn Laws

argued that Corn Law would increase the return from agriculture which in turn

would increase the investment in agriculture. Another group of Supporters of

Corn law such as Malthus based their arguments not on the potential investment

but on the ground that abolition of the Law would cause redistribution of income

from of income from landowners to capitalists and this would reduce aggregate

demand as rent was consumed while profit is redistributed. Ricardo did not agree

with either of these arguments and went on to show why trade restriction is

detrimental for the economy.

There are three classes of people in Ricardian model: capitalists, laborers and

landlords. The capitalists hold a key role in the economy. First, they are the key

players in the efficient allocation of resources as they move their capital to the

area with the highest return. Second, the capitalists are instrumental in the path

of growth by saving and investment. In the Ricardian model the landlords are

mere parasites. In his view the supply curve of land is perfectly inelastic and

landlords get return for holding land without serving any socially useful function.

Classical economists in general were very critical of the landlords as they would

engage in conspicuous consumption instead of saving and accumulating capital.

The major assumptions include labor cost theory, neutral money, fixed coefficient

of production, constant return in manufacturing and diminishing returns in

agriculture, full employment, perfect competition, economic actors and wage fund

doctrine.

By labor cost theory we mean that relative prices over time are explained by

changes in labor cost measured in hours.

Neutral money implies that changes in money supply would not change in the

relative prices.

Fixed coefficient of production between labor and capital means that only one

combination of labor and capital can be used to produce a given output. This

means that if additional labor is employed they must be supplied with additional

capital in a certain proportion to increase output.

Dept. of Humanities and Social Sciences, Indian Institute Of Technology, Kanpur

NPTEL- History of Modern Economic Thought

Constant return in manufacturing means that the industrial supply curve is

horizontal while diminishing return in agriculture means that the supply curve is

upward sloping in agriculture.

Full employment means that no resource is involuntarily unemployed in the long

run.

Perfect competition implies that there are many buyers and sellers and no one

has any market power.

Economic actor assumption implies that individuals are rational, self-seeking

individuals.

Wages fund doctrine implies that capitalist sets a fund aside for wage payment

and wage rate = wage fund/labor force.

2.4.1 Ricardo's distribution theory: land rent

Ricardo was interested to analyze how total payment is distributed between

landlords and capitalists. Hence, it was important to distinguish between rent and

profit.

He realized that rent can be analyzed from both product side and cost side. He

said the rent exists because of (1) the scarcity of fertile land and (2) the law of

diminishing returns.

Rent from product side: Rent is the payment that equalizes the rate of profit.

For understanding Ricardo's theory of rent it is critical to understand intensive

and extensive margin.

Let us explain this using an example. Suppose there are three grades of land

ranging from high to low fertility. The best fertile land produces 200 bushels of

wheat when first dose of labor and capital is given to it, produces 190 bushels

extra when the second dose is given and produces 180 bushels when the

third dose is given. The land does not produce anymore if more than three

units of land and capital is given to the land. Movement from 200 to 180

(which are nothing but the marginal productivities) is known as farming at the

intensive margin.

Dept. of Humanities and Social Sciences, Indian Institute Of Technology, Kanpur

NPTEL- History of Modern Economic Thought

On the other hand, the second grade of land produces 190 units when the

first dose of labor and capital and 180 bushels extra when the second dose is

given. This land does not produce anything extra when more than two units

are applied to the land.

Extensive margin

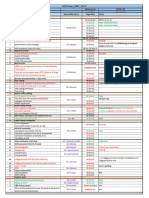

Intensive margin Units of L K Plot A Plot B Plot C

1 200 190 180

2 190 180

3 180

Table 1: Extensive margin and intensive margin

The third grade produces 180 units of wheat with one dose and labor and

capital and does not produce anything more with greater dose of labor and

capital.

Rent is the payment to the landlord that would equalize rate of profit on

different grades of land.

If three doses of labor and capital are applied to 3 plots of grade C land then

total product will be 540 bushels of wheat. On the other hand, three doses of

land is applied to grade A land total product would be 570. This implies that

that rent is zero for the marginal grade land i.e. grade C land. Also this shows

that rent for grade A land is 30 bushels.

Similarly if one applies two doses of labor and capital on a grade B land total

output is 370 while applying two units of land and capital would result in 360

bushels of wheat. This implies rent for grade B is 10 units.

Rent from cost side: A dose of capital and labor sell in the market for 100. The

marginal cost of producing 100th bushel of grain on grade A is

In grade B,

Dept. of Humanities and Social Sciences, Indian Institute Of Technology, Kanpur

NPTEL- History of Modern Economic Thought

In grade C,

From cost slide rent is measured in money term

(because it is competitive price)

Hence Total Revenue of grade

Rent from grade

Rent from grade

Rent from grade

2.4.2 Is rent price determining or is it price determined?

This is a very important question that acquired a central position in the economic

debates of the eighteenth and nineteenth century. This question was not merely

a question of economic techniques. This has quite important political economy

implication. If rent is price determining then the landlords are responsible for

price hike and subsequent low economic growth. If not, then the general price

movements would determine land owners income.

The answer however depends how one looks at the problem. Ricardo was one of

the first economists who could clearly analyze the answer.

For a society as a whole land rent is not a cost of production.

From society's point of view opportunity cost of land is zero. Any increase in

demand for land would induce higher price as total land supply for the society

cannot be increased.

Hence from society's point of view entire payment for land is rent and is fixed.

This is price determined and not price determining.

Ricardo looked at rent from societal perspective. Hence for him rent is not price-

determining.

Dept. of Humanities and Social Sciences, Indian Institute Of Technology, Kanpur

NPTEL- History of Modern Economic Thought

From individual's perspective

Opportunity Cost = Revenue from an alternative use.

Hence opportunity cost of land varies from one type of land use to another.

Hence from individual perspective rent is price determining.

Dept. of Humanities and Social Sciences, Indian Institute Of Technology, Kanpur

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Science G6: Quarter 2Document40 pagesScience G6: Quarter 2Frances Datuin100% (1)

- CBLM Bartending Ncii # 1 & 4aDocument265 pagesCBLM Bartending Ncii # 1 & 4aQueenly Mendoza Aguilar81% (21)

- Hach - MWP (Plan Vs Actual) Status - 22 Oct-1Document1 pageHach - MWP (Plan Vs Actual) Status - 22 Oct-1ankit singhNo ratings yet

- The Greenock HangingsDocument5 pagesThe Greenock HangingsInverclyde Community Development Trust100% (2)

- Ghost Hawk ExcerptDocument48 pagesGhost Hawk ExcerptSimon and SchusterNo ratings yet

- Business Plan On Best BakeryDocument16 pagesBusiness Plan On Best BakeryAbiot100% (1)

- Senior Essay by TekluDocument6 pagesSenior Essay by TekluAbiotNo ratings yet

- Factors Responsible For The Low Level of Investment ActivityDocument49 pagesFactors Responsible For The Low Level of Investment ActivityAbiotNo ratings yet

- Selale University College of Business and Economics Departement of EconomicsDocument28 pagesSelale University College of Business and Economics Departement of EconomicsAbiot100% (2)

- History of Econ Thought-9 Pysiocracy-Jaquis TurgotDocument7 pagesHistory of Econ Thought-9 Pysiocracy-Jaquis TurgotAbiotNo ratings yet

- 3.2. (E) Mercantilism (1500-1750) : by Medieval ChurchmenDocument26 pages3.2. (E) Mercantilism (1500-1750) : by Medieval ChurchmenAbiotNo ratings yet

- THE ECONOMIC CONTRIBUTION AND CHALLENGES OF SAVING AND CREDIT INSTITUTIONS ch1,2,3 by TekluDocument18 pagesTHE ECONOMIC CONTRIBUTION AND CHALLENGES OF SAVING AND CREDIT INSTITUTIONS ch1,2,3 by TekluAbiotNo ratings yet

- WWDC 2020 Viewing GuideDocument13 pagesWWDC 2020 Viewing GuidejuniorNo ratings yet

- Ebf Rehearsal RubricDocument1 pageEbf Rehearsal Rubricapi-518770643No ratings yet

- East Coast Yacht's Expansion Plans-06!02!2008 v2Document3 pagesEast Coast Yacht's Expansion Plans-06!02!2008 v2percyNo ratings yet

- Music For BandDocument143 pagesMusic For BandTedTerroux604No ratings yet

- Please DocuSign Youssef ADMISSIONS FORM W ATDocument5 pagesPlease DocuSign Youssef ADMISSIONS FORM W ATyoussefkhalfaoui30No ratings yet

- Biology-Activity-3 - Growth and Development of PlantDocument3 pagesBiology-Activity-3 - Growth and Development of PlantnelleoNo ratings yet

- CV EnglishDocument1 pageCV EnglishVijay AgrahariNo ratings yet

- Your Best American GirlDocument9 pagesYour Best American GirlCrystaelechanNo ratings yet

- Summer ReadingDocument1 pageSummer ReadingDonna GurleyNo ratings yet

- 850 SQ MM AAC Conductor PDFDocument1 page850 SQ MM AAC Conductor PDFSamyak DeoraNo ratings yet

- Presentation On Modal Auxiliary VerbsDocument18 pagesPresentation On Modal Auxiliary VerbsAbdelhafid ZaimNo ratings yet

- Reading 2 - Julien Bourrelle - TranscriptDocument4 pagesReading 2 - Julien Bourrelle - TranscriptEmely BuenavistaNo ratings yet

- Applied Business Tools and Technologies: A. Activation of Prior KnowledgeDocument12 pagesApplied Business Tools and Technologies: A. Activation of Prior KnowledgeClaire CarpioNo ratings yet

- Cherrylene Cabitana: ObjectiveDocument2 pagesCherrylene Cabitana: ObjectiveMark Anthony Nieva RafalloNo ratings yet

- Lindsey Position PaperDocument14 pagesLindsey Position PaperRamil DumasNo ratings yet

- The Need For Culturally Relevant Dance EducationDocument7 pagesThe Need For Culturally Relevant Dance Educationajohnny1No ratings yet

- Evija - Lotus Cars Official WebsiteDocument5 pagesEvija - Lotus Cars Official WebsiteluyuanNo ratings yet

- Wall Panels Thesis PDFDocument161 pagesWall Panels Thesis PDFSanjay EvaneNo ratings yet

- Cape Police Report - Unattended BodyDocument2 pagesCape Police Report - Unattended BodyNews-PressNo ratings yet

- Approaches To Sampling MacrofungiDocument14 pagesApproaches To Sampling MacrofungiGerald GamboaNo ratings yet

- GoKReport1819Final 23091uDocument28 pagesGoKReport1819Final 23091uGurukrupa DasNo ratings yet

- Anatomy and Physiology Outline PDFDocument2 pagesAnatomy and Physiology Outline PDFHampson MalekanoNo ratings yet

- SC9 Vocab GHI - Buddhism - ClozeDocument2 pagesSC9 Vocab GHI - Buddhism - ClozeBeakerika shortsNo ratings yet

- Walt Disney BiographyDocument8 pagesWalt Disney BiographyIsaacRodríguezNo ratings yet

- Clam Antivirus 0.100.0 User ManualDocument34 pagesClam Antivirus 0.100.0 User ManualJacobus SulastriNo ratings yet