Professional Documents

Culture Documents

Auditors' Report: - Auditor's Report - Form 35A - Company Rules, 1985 - By: Rehan Farhat

Auditors' Report: - Auditor's Report - Form 35A - Company Rules, 1985 - By: Rehan Farhat

Uploaded by

AsadZahidOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auditors' Report: - Auditor's Report - Form 35A - Company Rules, 1985 - By: Rehan Farhat

Auditors' Report: - Auditor's Report - Form 35A - Company Rules, 1985 - By: Rehan Farhat

Uploaded by

AsadZahidCopyright:

Available Formats

| Auditor’s Report | Form 35A | Company Rules, 1985 |_______________________By: Rehan Farhat

Auditors’ Report

A. Introductory Paragraph.

B. Responsibility of management and of auditors.

C. Scope, reasonable assurance about no misstatement, assessing policies etc.

D. Opinion

E. True and fair view.

F. Zakat opinion.

1. The auditor has obtained all the information and explanation which they consider

necessary for the purpose of audit.

2. Proper books of accounts have been kept [Sec-230]

3. Accounts have been drawn up in conformity with the Companies` Ordinance, 1984.

[Sec-234(2)]

4. Accounting policies are in accordance with approved IASs. [Sec-234(3)]

5. Accounts are in agreement with books of accounts. (T/B = G/L)

6. Expenditure was incurred for the purpose of the business.

7. Business conducted, investments made and expenditures incurred were with in the objects

of the company.

8. Whether or not Financial Statements give a true and fair view.

9. Whether or not zakat was deducted and deposited in the Central Zakat Fund and other

funds.

If any negative event is reported, report will be qualified. In this case give reasons for such

qualification.

_________________________________________________________________________________________

Visit: http://www.icap.org.pk for latest news

For Queries and Suggestions: rehanfarhataca@msn.com or rehanfarhataca@gmail.com

You might also like

- Question Bank Auditing B.com 6th SemDocument35 pagesQuestion Bank Auditing B.com 6th SemViraja Guru73% (15)

- Introduction To SociologyDocument28 pagesIntroduction To Sociologysohail merchant100% (1)

- Notes-Qualified and Unqualified Audit ReportDocument5 pagesNotes-Qualified and Unqualified Audit ReportIMRAN GNo ratings yet

- Audit GroupDocument17 pagesAudit GroupYoseph MekonnenNo ratings yet

- Auditors Report On Financial StatementDocument13 pagesAuditors Report On Financial Statementaffanq86No ratings yet

- Audt Notes & Qstns KceDocument224 pagesAudt Notes & Qstns KcenderitulinetNo ratings yet

- Principles of Audit and AssuranceDocument20 pagesPrinciples of Audit and AssuranceUnique OfficialsNo ratings yet

- 01 Acctg Ed 13 - The Accountancy Profession PDFDocument3 pages01 Acctg Ed 13 - The Accountancy Profession PDFTammy ZoreNo ratings yet

- Unit 3 (I)Document4 pagesUnit 3 (I)Saniya HashmiNo ratings yet

- Audit Question BankDocument431 pagesAudit Question Bank3259 ManishaNo ratings yet

- Acc101 - Lecture Note 1 - 115306Document13 pagesAcc101 - Lecture Note 1 - 115306Bianca Rose AnneNo ratings yet

- QuestionsDocument8 pagesQuestionsSK SchreaveNo ratings yet

- Statement of Submissin of Audit Report in Form-704Document704 pagesStatement of Submissin of Audit Report in Form-704Suruchi Kejriwal GoyalNo ratings yet

- AFIN102 Notes Pack 1Document40 pagesAFIN102 Notes Pack 1boy.poo90No ratings yet

- 13 Reports - Other Assurance and Related ServicesDocument9 pages13 Reports - Other Assurance and Related ServicesDia Mae GenerosoNo ratings yet

- AA CH 7Document71 pagesAA CH 7Eyayaw AshagrieNo ratings yet

- Auditors' Report To The MembersDocument2 pagesAuditors' Report To The MembersSunny MaghnaniNo ratings yet

- FORM 704 Deepak Samant (10 11) RemDocument21 pagesFORM 704 Deepak Samant (10 11) RemJyoti_s190No ratings yet

- Aud Rept 2011Document2 pagesAud Rept 2011drshaahNo ratings yet

- 02 FabmDocument28 pages02 FabmMavs MadriagaNo ratings yet

- Standards On AuditingDocument59 pagesStandards On AuditingCa Siddhi GuptaNo ratings yet

- AUDITDocument32 pagesAUDITVijayraj ShettyNo ratings yet

- Form 704Document704 pagesForm 704Dhananjay KulkarniNo ratings yet

- ACC301 Auditing NotesDocument19 pagesACC301 Auditing NotesShakeel AhmedNo ratings yet

- Auditing BookDocument63 pagesAuditing BooksasmallulusitakantNo ratings yet

- Inter-Paper-6-RTPs, MTPs and Past PapersDocument149 pagesInter-Paper-6-RTPs, MTPs and Past Paperssixipa1033No ratings yet

- Analysis of Audit ReportsDocument5 pagesAnalysis of Audit ReportsPhilip WellsNo ratings yet

- Deffgh Fill inDocument5 pagesDeffgh Fill inaleah de jesusNo ratings yet

- Auditor' Report.Document8 pagesAuditor' Report.Johan GutierrezNo ratings yet

- Audit GKJDocument24 pagesAudit GKJtutuaman603No ratings yet

- Accountants' Reports On Profit Forecasts: Regulation and PracticeDocument23 pagesAccountants' Reports On Profit Forecasts: Regulation and PracticeProf Niamh M. BrennanNo ratings yet

- POA 1 (Prepared)Document22 pagesPOA 1 (Prepared)Mohit ShahNo ratings yet

- Form-704 NewDocument251 pagesForm-704 NewHusaina NasikwalaNo ratings yet

- Module 2Document11 pagesModule 2Ruthika Sv789No ratings yet

- As 01Document9 pagesAs 01Dipak UgaleNo ratings yet

- Ledger Name Tally Head: Role of Accountant: An Accountant Performs Financial Functions Related To The CollectionDocument5 pagesLedger Name Tally Head: Role of Accountant: An Accountant Performs Financial Functions Related To The CollectionAejaz MohamedNo ratings yet

- Unit 6Document14 pagesUnit 6YonasNo ratings yet

- Screenshot 2023-09-12 at 7.48.02 PMDocument149 pagesScreenshot 2023-09-12 at 7.48.02 PMDisha JainNo ratings yet

- Guidance Note On Engagements To Review FDocument14 pagesGuidance Note On Engagements To Review Fapi-3828505No ratings yet

- Principles of AuditingDocument82 pagesPrinciples of AuditingABID ANAYATNo ratings yet

- CPAR AT - Other Assurance EngagementsDocument9 pagesCPAR AT - Other Assurance EngagementsJohn Carlo CruzNo ratings yet

- Unit-4 FMEA - AccountingDocument33 pagesUnit-4 FMEA - AccountingLoveena RamchandaniNo ratings yet

- Auditors ReportDocument6 pagesAuditors ReportMayette VegaNo ratings yet

- BCom 6th Sem - AuditingDocument46 pagesBCom 6th Sem - AuditingJibinNo ratings yet

- Assginment On Audit Report: Advance AuditingDocument9 pagesAssginment On Audit Report: Advance AuditingFaizan ChNo ratings yet

- Rodell Accounts Year Ending 31/03/07Document13 pagesRodell Accounts Year Ending 31/03/07unlockdemocracyNo ratings yet

- Kes Shroff College of Arts and CommerceDocument24 pagesKes Shroff College of Arts and CommerceSagar ChitrodaNo ratings yet

- Icpak Audit ManualDocument17 pagesIcpak Audit ManualHilda MuchunkuNo ratings yet

- Audit and AuditorDocument14 pagesAudit and AuditorAamir NabiNo ratings yet

- CA Inter Paper 6 Compiler 8-8-22Document316 pagesCA Inter Paper 6 Compiler 8-8-22KaviyaNo ratings yet

- Rohit Yadav 55Document7 pagesRohit Yadav 55Sameer ChoudharyNo ratings yet

- Audit Program For EquityDocument12 pagesAudit Program For EquityIra Jean DaganzoNo ratings yet

- Chapter - 1 Introduction of 1) Meaning of AuditingDocument31 pagesChapter - 1 Introduction of 1) Meaning of AuditingRajesh GuptaNo ratings yet

- Auditing Sols To Homework Tute Qs - S2 2016 (WK 4 CH 8)Document6 pagesAuditing Sols To Homework Tute Qs - S2 2016 (WK 4 CH 8)sonima aroraNo ratings yet

- 6.8 Accounting and AuditingDocument9 pages6.8 Accounting and AuditingGuru Prasad ChaudharyNo ratings yet

- Introduction To AccountingDocument40 pagesIntroduction To AccountingMuskan BohraNo ratings yet

- Accounting StandardsDocument10 pagesAccounting StandardsSakshi JaiswalNo ratings yet

- Audit Chapter 3Document18 pagesAudit Chapter 3Nur ShahiraNo ratings yet

- Solution Assurance and Audit Practice Nov 2007Document10 pagesSolution Assurance and Audit Practice Nov 2007Samuel DwumfourNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Assignment - 2Document2 pagesAssignment - 2sohail merchantNo ratings yet

- Assignment 1Document6 pagesAssignment 1sohail merchantNo ratings yet

- How To Create An Interview Winning CDocument5 pagesHow To Create An Interview Winning Csohail merchantNo ratings yet

- Professor's Grade Book: Chart TitleDocument3 pagesProfessor's Grade Book: Chart Titlesohail merchantNo ratings yet

- Computer TipsDocument7 pagesComputer Tipssohail merchantNo ratings yet

- Piece Rate System and Time Rate SystemDocument6 pagesPiece Rate System and Time Rate Systemsohail merchantNo ratings yet

- News PDF-Notification 20152k15 ADocument3 pagesNews PDF-Notification 20152k15 Asohail merchantNo ratings yet

- Pivot Easy WorkDocument10 pagesPivot Easy Worksohail merchantNo ratings yet

- Branch Banking CompleteDocument195 pagesBranch Banking Completesohail merchantNo ratings yet

- QuestionsDocument28 pagesQuestionssohail merchant100% (1)

- HRM BookDocument278 pagesHRM Booksohail merchantNo ratings yet

- I e Presentation SeminarDocument46 pagesI e Presentation Seminarsohail merchantNo ratings yet

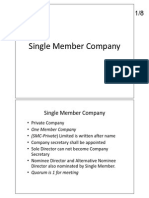

- Print SMCDocument8 pagesPrint SMCsohail merchantNo ratings yet

- Ch20 InvestmentAppraisalDocument32 pagesCh20 InvestmentAppraisalsohail merchantNo ratings yet