Professional Documents

Culture Documents

18RMO15 - 18-24 - Annex B (PEG)

18RMO15 - 18-24 - Annex B (PEG)

Uploaded by

Axel Mendoza0 ratings0% found this document useful (0 votes)

10 views7 pagesOriginal Title

18RMO15_18-24_Annex B (PEG)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views7 pages18RMO15 - 18-24 - Annex B (PEG)

18RMO15 - 18-24 - Annex B (PEG)

Uploaded by

Axel MendozaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 7

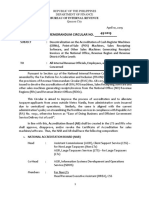

‘Annex "5?"

BUREAU OF INTERNAL REVENUE

RevenueRegion No.__~

Revenue District OFficeNo.

POST-EVALUATION GUIDE FORM

IMPORTANT!

lease flout al the applicable Information; otherwise, Indicate “NOT APPLICABLE” or “N/A.

|.__ GENERAL INFORMATION SHEET

Date of Post Evaluation: Mission Order No ‘Assigned tor

"TYPE OF TAXPAYER

Titarge Taxpayer 0 VAT-Registered

Ul Nom-Large Taxpayer G Non-VAT Registered

Taxpayer Registered Name: ‘Taxpayer Trade Name:

TIN and Branch Code: WeadlBranch Office:

LD Head office

1D Branch Office

‘address:

Line of Business/Business Style:

‘Total No. of Machines andjor Terminals Used in Business:

‘BUSINESS REGISTRATION VERIFICATION CHECKLIST (Note: Use addtional sheet if needed)

1. 5 there a Certificate of Registration (COR) | [ YES REMARKS, iFany

conspicuously posted within the business | NO

establishment?

is there an “ASK FOR RECEIPTS | 0 VES REMARKS, Fany

conspicuously posted within the business |: NO

establishment?

3+ Is there a BIR Form No. 0605 or Payment Form | [YES | REMARKS, if any

fon the Annual Registration Fee (ARF) |” NO

Page 1 of 7

Post. Evlaton Guide Form

Taxpayer/Authorized Rapresentative

Signature over Printad Name

‘Taxpayer's Registered Name

‘TWNand Branch Code

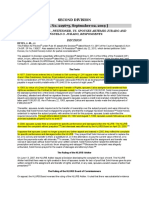

‘Annex "5?"

conspicuously posted within the business

establishment?

Ul__MANUAL RECEIPTS/INVOICES USED

"TYPE OF SALES DOCUMENT(S) USED:

1 Sales invoice

5 Offical Receipt

1 Other Supplementary Receipts/invoices,

‘©. Bill, Order Slip, Delivery Receipt, etc.

(please specify on the “Remarks” column)

REMARKS, Fany

‘SERIES RANGE(s) OF MANUAL RECEIPT/INVOICE REGISTERED

From

To

[MANUAL RECEIPTS/INVOICES VERIFICATION CHECKLIST.

Are the manual receiptlinvoices being used

by the taxpayer registered with the Bureau?

(if yes, please secure copy of Authority to Print

(ATP) and specify the ATP No(s) under the

Remarks” column.)

YES REMARKS, ifany

No

Does the taxpayer fue manual

raceipte/invoices in cate of system downtime?

(if No, recommend imposition of penalty and

advise taxpayer to issue manual

receiptlinvoice.)

TES REMARKS, any

ENO

3 Does the taxpayer sue separate

involce/receipt for each line of business or

industry type?

Does the taxpayer record or incorporate sales

from manual receiptslinvoices to the sales

machines? (If not, how does the taxpayer

record sales from manual recelptsfinvoices?

Please specify under the “Remarks” column)

YES REMARKS, ifany

ENO

ves REMARKS, ifany

TNO

each machine)

|, PERMIT'TO USE (PTU) SALES MACHINES (will use additional sheet for information of

"TYPE OF SALES MACHINES

1 Cash Register Machine (CRM)

1 Point-of Sales (POS) Machine

1 Spectal Purpose Machine (SPM)

L Server

Texpayer/Authorized Repreventative

Signature over Printad Name

© Branded [ Acknowledgement/Collection Receipt

© Cloned [Sales invoice/Receipt

E €ash Depository Machine

consolidator

EC Handheld Machine

Roving Machine

Others (Please specify)

(POSSETUP ‘MACHINE

Page 2 of 7

Post. Evlaton Guide Form

‘Annex "5?"

‘Taxpayer's Registered Name

‘TWNand Branch Code

Tistand-Alone T Server

Stand-Alone with Server Consolidator Dumb Terminal

Global [ Recelpting/invoicing Machine

"Decentralize

others

‘TYPE OF PERMIT TO USE (PTU) ISSUED:

1 Final Pru

1 Provisional PTU

5 PTUSpecial Purpose Machine

PTUNO: | MIN, if Machine Serial | DATEISSUED: | VALID UNTIL:

applicable: Number:

PERMIT TO USE VERIFICATION CHECKLIST

1s there a PTU attached/posted or the PTU detalls | YES REMARKS, ifany

shown* on each duly registered sales machine? | 1 NO

“NOTE: For handheld machines/devices: the details

of PTU must be shown on the start-up screen due to

the size of the handheld device or a copy either

attached or integrated as part of the handheld

machineldevice.

2 Is therea decal attached to the machine? 1 YES REMARKS, fany

No

3 For SPM: Does the machine generate principal |" VES REMARKS, fany

receipts/invoices, Le. Official Receipt or Sales | |: NO

Invoice?

(if yes, please seal the machine and recommend

Imposition of penalties, then advise taxpayer to

register machine as CRM, POS machine, etc.)

Are there machine(s) subject for repair? YES REMARKS, ifany

ENO

5 W answer to Section I, em No.4 1s VES: DId the | DYES REMARKS, IFany

taxpayer submit a written notification prior to the | NO

repair of sales machines addressed to the Revenue

District Office (RDO) having jurisdiction over the

place o location where the machine is being used?

(ifyes secure copy ofthe writen notification)

For Roving Machine(s): 1s the machine registered | VES REMARKS, ifany

with the RDO having jurisdiction over the | 1 No

taxpayer's Head office? (if not, please specify the

RDO where the roving machine is registered under

the “Remarks” column.)

7 For Roving Machine(s): Did the taxpayer submit | [YES REMARKS, any

letter request from the RDO where the roving | [NO

rmachine(s) are registered andlor from the RDO | Q

having jurisdiction over the place or location where

the machine(s) willbe used?

Page 3 of 7

Post. Evluton Guide Form

Taxpayer/Authorized Rapresentative

Signature over Printad Name

‘Annex "5?"

‘Taxpayer's Registered Name

TWNand Branch Code

Gf yes, secure a copy of the letter request to use

roving machine(s) and the period when the machines

will be used at Its current location.)

& For Machine(s) with Provisional PTU: Did the |) YES REMARKS, any

rmachine(s) undergo the process of Accreditation | (: NO

by the supplierdeveloper/software provider prior

to the prescribed period of three (3) months? (If

yes, require the taxpayer to request forthe Final PTU

from its supplierideveloperisoftware providers and

recommend the imposition of corresponding

penalties.)

Is the Machine User, a Pseudo-supplier? 1 YES REMARKS, any

No.

10. If yes: Is there compliance with the required | 0 YES REMARKS, any

‘quarterly submission of Summary List of Machines | |. NO

sold?

IV.___INVOICING/RECEIPTING REQUIREMENTS,

‘TYPE OF PAPER USED TO GENERATE RECEIPTS/INVOICES:

1 Non-Thermal Papet

5 Thermal Paper

INVOICINGIRECEIPTING REQUIREMENTS VERIFICATION CHECKLIST

1% Does the invoicelreceipt generated from the | YES REMARKS, fany

sales machines have all the required | 11 No

Information pursuant to existing revenue

‘issuances?

7 Hanswer to Section IV, Item No.1 of this form | YES REMARKS, any

Is NO: Are the following information reflected | 1: NO

fon the receiptsjinvoices generated from the

sales machines, to wit:

‘a. Taxpayeruser's Name, Address,

Business Style (#f any), TIN, Branch Code

land MIN;

’b. Date of transaction and Serial Number of | 0 YES REMARKS, any

the receipt/invoice (with minimum of six | ENO

digits running series);

‘© Aspace provided for the Name, Address, | 0 YES REMARNS, Hany

TIN and Business Style (if any) of the | No

bbuyer/lient;

‘@_ Description of the items/goods or nature | 0 YES REMARKS, Hany

of service, including its quantity, unit and | [2 NO

total cost with VAT Amount;

‘& For mixed transactions: the amounts | 0 YES REMARKS, fany

Involved must provide breakdown of the | [: NO

following: VATable Sales, VAT Amount,

VAT Zero Rated Sales and VAT Exempt

Sales;

Page 4 of 7

Post. Evluton Guide Form

Taxpayer/Authorized Rapresentative

Signature over Printad Name

‘Annex "5?"

‘Taxpayer's Registered Name

TWNand Branch Code

Name, Address and TIN ofthe Accredited |" YES REMARKS, fany

Supplier of CRM/POS [Other Sales | |: NO

Recelpting System/ Software;

& Accreditation Number and the Date of | VES REMARKS, any

‘Accreditation of the Accredited Supplier | (. NO

specifying the Date of Issuance and

Validity Date;

‘h.BIRFinal PTU Number; and YES REMARKS, fany

No

The phrase: “THIS INVOICE SHALL BE | YES REMARKS, fany

VALID FOR FIVE (5) YEARS FROM THE | 1: NO

DATE OF PERMIT TO USE”;

The phrase: “THIS DOCUMENT IS NOT | U YES REMARKS, ifany

VALID FOR CLAIM OF INPUT TAX” (for | C NO

non-VAT —invoicelreceipts. and

supplementary receiptsjinvoices);

Senior Citizen andlor PWD details, f | 1 YES REMARKS, ifany

necessary, such as: co No

i. SCPWD TIN;

ii, SCPWD 1D;

'SCIPWD Discount;

Iy._ Signature of SCIPWD.

V.__ SALES BOOK/REPORT AND/OR BACK-END REPORTS

‘TYPE OF SALES BOOK/REPORTS: ‘NAME OF SALES REPORTS GENERATED

1 Manual Bound or Looseleaf SalesBook _| (Please specify):

{Sales Book for Senior Citizen/PWD

5 Computerized/Back-end Sales Report(s)

DETAILS OF SALES BOOK/REPORT

"TYPE OF SALES DOCUMENT(S) GENERATED: REMARKS, Ifany

1 Sales Invoice

15 Offical Receipt

5 Other Supplementary Recelptsiinvoices,

‘¢. Bill, Void Slip, Return Slip, etc.

(please specify on the “Remarks” column)

‘SERIES RANGE(s) OF INVOICE/RECEIPT USED BASED ON Z-READING

From To

PERIOD COVERAGE BASED ON 7 READING.

From To

"TOTAL SALES REPORTED FOR THE CURRENT TOTAL SALES REPORTED FOR THE PREVIOUS PERIOD

PERIOD COVERAGE: COVERAGE:

Page 5 of 7

Post. Evlaton Guide Form

Taxpayer/Authorized Rapresentative

Signature over Printad Name

Taxpayer's Registered Name

TWNand Branch Code

‘Annex "5?"

‘SALES REPORT VERIFICATION CHECKLIST

System or Computerized Books of Accounts?

% Does the Sales BooklReport reflect the | YES ‘REMARKS, ifany

transactions sequentially based on the series | 7 NO

range used within the period coverage?

2 Does the Sales Book Report reflect various | © YES "REMARKS, ifony

discounts, uch as but not limited tor Regular | 1 NO

Discount, Employee Discount, Promotional

Discount, whichever Is applicable? (Please

specly the type of discounts offered by the

taxpayer, ifany.)

3 For VAT Registered Taxpayer with mixedsales | 0 YES REMARKS, iFany

transactions: Are the type of sales disclosed | 1 NO

separately, ie, VATable Sales, VAT-Exempt

Sales, Zero-Rated Sales, ete

% Are there separate reports Tor Cancelled, | YES REMARKS, FFany

Void, Return, Refund and other adjustments, | ‘NO

whichever is applicable to the taxpayer's type

of industry?

5 Are there separate reports for wansactions | YES REMARKS, iFany

involving Senior Citizen andjor Person with | NO

Disability (PWD)?

% Are the records reflected on the Sales | VES REMARKS, ifany

Book/Report updated? NO

7% For taxpayer maintaining Manual | YES REMARKS, ifany

BoundiLoose-Leaf Books of Accounts: Does | : NO

each sales machine being used has its own

Sales Book?

(if es please afi signature on the lat entries

made and secure a copy of the same.)

% Are the sales machines connected to or | 0 VES REMARKS, ifany

interfaced with a Computerized Accounting | (: NO

VI_ TECHNICAL REQUIREMENTS

‘TECHNICAL REQUIREMENTS VERIFICATION CHECKLIST

Is the machine nom-resettable?

YES

ENO

REMARKS, Hany

1s the machine resettable?

TES

ENO

REMARKS, any

3 Ifthe answer to Sec. Vi, Item No. 2 is YES: 15

the machine equipped with a reset counter

number that advances by 1 every time the

“pccumulated Grand Total” of machine

resets?

ES

ENO

REMARKS, any

‘%__Inrelation to Sec. Vi, item No. 31s the machine

equipped with a reset counter number that

ves

ENO

REMARKS, any

Texpayer/Authorized Repreventative

Signature over Printad Name

Page 6 of 7

Post. Evlaton Guide Form

‘Annex "5?"

‘Taxpayer's Registered Name

TWNand Branch Code

‘an be a prefix or suffix of the Involee/recelpt

number every time the invoicelreceipt serial

‘number Is already exhausted/used up?

5. Is the machine actually switched to “Training | () YES REMARKS, any

Mode” or “No Sale Transaction Mode”? No

6. iftheanswer to Sec. Vi,item5is YES: Does the | YES REMARKS, any

receiptlinvoice reflect the statement: “THIS IS | [ NO

NOT AN OFFICIAL RECEIPT/SALES INVOICE”

(RMO No. 102005)?

Vil___ OTHER OBSERVATIONS AND/OR FINDINGS.

Prepared by:

Revenue Officer

(Signature over Printed Name)

Revenue Officer

(Signature over Printed Name)

Conformed by:

Taxpayer/Taxpayer’s Representative

(Signature over Printed Name)

Date of Post Evaluation

Witness[es:

‘Gignature over Printed Name) (Gignature over Printed Name)

Page 7 of 7

Post. Evlaton Guide Form

Taxpayer/Authorized Rapresentative

Signature over Printad Name

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

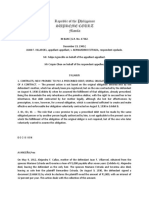

- RMC 49-2019 (Decentralization of POS Accre)Document6 pagesRMC 49-2019 (Decentralization of POS Accre)Axel MendozaNo ratings yet

- RR 17-2006 (Taxi Meter)Document28 pagesRR 17-2006 (Taxi Meter)Axel MendozaNo ratings yet

- Tan vs. Commission On ElectionsDocument31 pagesTan vs. Commission On ElectionsAxel MendozaNo ratings yet

- Balacuit vs. CFI of Agusan Del NorteDocument27 pagesBalacuit vs. CFI of Agusan Del NorteAxel MendozaNo ratings yet

- Solid Homes v. Spouses Jurado, G.R. No. 219673, September 2, 2019Document9 pagesSolid Homes v. Spouses Jurado, G.R. No. 219673, September 2, 2019Axel MendozaNo ratings yet

- Villaroel v. Estrada, G.R. No. 47362. Diciembre 19, 1940 (71 Phil 140)Document2 pagesVillaroel v. Estrada, G.R. No. 47362. Diciembre 19, 1940 (71 Phil 140)Axel MendozaNo ratings yet

- Cir Vs Fitness by Design, Nc. GR NO. 215957 NOVEMEBER 9, 2016Document2 pagesCir Vs Fitness by Design, Nc. GR NO. 215957 NOVEMEBER 9, 2016Axel MendozaNo ratings yet