Professional Documents

Culture Documents

July 3

Uploaded by

Vikash SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

July 3

Uploaded by

Vikash SinghCopyright:

Available Formats

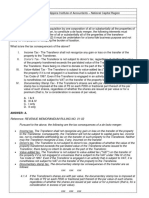

Premium Receipt

Receipt No.: 526334479JUL2102 | Receipt Date: 31-JUL-2021

Personal Details

Policy Number: 526334479 Email ID: singhvikash657@gmail.com

Policyholder Name: Mr. Vikash Kumar Singh PAN Number: FRAPS3968B

Address: PLOT-26, FLAT NO-301 SRIRAM PUNARVASU Customer GSTIN: Not Available

GAUTAMI ENCLAVE, KONDAPUR Current Residential State: Telangana

Hyderabad- 500084

Telangana

Mobile Number: 8904688219

Policy Details

Plan Name: Max Life Online Term Plan Plus Policy Commencement Date: 31-JUL-2018

Life Insured: Mr. Vikash Kumar Singh Policy Term: 39 Years Premium Payment Term: Regular

Premium Payment Frequency: Quarterly Date of Maturity: 31-JUL-2057 Modal Premium (incl. GST): ` 2,114.00

Late Payment Fee (incl GST): ` 0.00 Premium Received (incl. GST): ` 2,114.00

GST Details Connect for more details

Coverage Taxable SGST/UTGST CGST IGST Name

Type Value (`) Rate Amount (`) Rate Amount (`) Rate Amount (`) Customer Services Customer Advisory Team

Base 1,748.72 NA 0.00 NA 0.00 18% 314.77

Rider 42.83 NA 0.00 NA 0.00 18% 7.71

Contact Number

Late Payment 0.00 NA 0.00 NA 0.00 18% 0.00

18601205577

Total GST Value: ` 322.48

GSTIN: 06AACCM3201E1Z7 GST Regd. State: Haryana SAC CODE: 997132

Total Sum Assured of base

plan and term rider (if any)

31-JUL-2021 to

` 1,00,00,000.00 ` 2,114.00 30-OCT-2021 31-OCT-2021

*Important Note:

1.For payment mode other than in cash, this receipt is conditional upon the credit in our account. Payment of premium amount does not constitute commencement of risk. The risk commencement starts

after acceptance of risk by us.

2.Amount received would be adjusted against the due premium as per terms and conditions of the policy.

3.Premiums may be eligible for tax benefits under section 80C/80CCC/80D/37(1) of the income Tax Act 1961. Kindly consult your tax advisor for more information. Tax benefits are liable to change due

to changes in legislation or government notification.

4.GST shall comprise CGST, SGST / UTGST or IGST (whichever is applicable) including cesses and levies, if any. All applicable taxes, cesses and levies, as per prevailing laws, shall be borne by you. For GST

purposes, this premium receipt is Tax invoice. Assessable Value in GST for Endowment First Year is 25%, Renewal Year is 12.5%, Single Premium Annuity is 10%, Term and Health is 100%.

Authorised Signatory

PRM21V5.9 10072021 PRODUCT UIN: 104N092V03

E.&O.E 2021-07-31.03.35.14.280981

You might also like

- Lipc C250872923Document1 pageLipc C250872923Vineet HegdeNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsNeeraj TyagiNo ratings yet

- Transaction ReceiptDocument1 pageTransaction ReceiptMuhammed ZekariyaNo ratings yet

- Policy CertificateDocument5 pagesPolicy CertificateRahulpatel25No ratings yet

- Abi Premium 1Document1 pageAbi Premium 1manikandan BalasubramaniyanNo ratings yet

- Renewal - 71131775 - 2022-10-28 11 29 51 525Document1 pageRenewal - 71131775 - 2022-10-28 11 29 51 525VASANT PatelNo ratings yet

- Icici PolicyDocument2 pagesIcici Policydeepak7837No ratings yet

- Screenshot 2023-12-14 at 1.02.56 PMDocument1 pageScreenshot 2023-12-14 at 1.02.56 PMshashikumarsk0711No ratings yet

- Welcome To Transport Department Government of Telangana - IndiaDocument1 pageWelcome To Transport Department Government of Telangana - Indiashiva kumarNo ratings yet

- Renewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaDocument1 pageRenewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaYT ENTERTAINMENTNo ratings yet

- FeeReceipt Sep2019Document1 pageFeeReceipt Sep2019KavitaNo ratings yet

- Zprmrnot 21163309 8704721Document1 pageZprmrnot 21163309 8704721Arnav MishraNo ratings yet

- Transaction ReceiptDocument1 pageTransaction ReceiptbabucpyNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- Siti Broadband (Sep-Oct) BillDocument1 pageSiti Broadband (Sep-Oct) BillBARUN BIKASH DENo ratings yet

- For HDFC ERGO General Insurance Company Limited: Dear Priteshkumar Kanubhai VyasDocument3 pagesFor HDFC ERGO General Insurance Company Limited: Dear Priteshkumar Kanubhai VyasKrutarth VyasNo ratings yet

- Insurance Parents Top UpDocument45 pagesInsurance Parents Top UpAbhinav SinhaNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificateVishal DNo ratings yet

- 31 2020 1571 PDFDocument2 pages31 2020 1571 PDFNandakishor AjNo ratings yet

- Premium Paid AcknowledgementDocument1 pagePremium Paid AcknowledgementArpit SinghalNo ratings yet

- HDFC PolicyDocument30 pagesHDFC PolicyXen Operation DPHNo ratings yet

- CertificateDocument4 pagesCertificatemadhu gandheNo ratings yet

- FPPack PDFDocument34 pagesFPPack PDFmeet1996No ratings yet

- Policy No Name Address: Received Amount: 48924Document1 pagePolicy No Name Address: Received Amount: 48924Bhanu RawatNo ratings yet

- Invoice 408 4521932 Balaji Book House Madhu Kumar KetteDocument2 pagesInvoice 408 4521932 Balaji Book House Madhu Kumar Kettemr pirateNo ratings yet

- 1579589569513Document2 pages1579589569513Manish ChopraNo ratings yet

- Bording PassDocument3 pagesBording PassSunder NingombamNo ratings yet

- (Formerly Known As Max Bupa Health Insurance Co. LTD.) : Product Name: Reassure - Product Uin: Maxhlip21060V012021Document47 pages(Formerly Known As Max Bupa Health Insurance Co. LTD.) : Product Name: Reassure - Product Uin: Maxhlip21060V012021apprenant amitNo ratings yet

- Renewal Premium Receipt: Invoice Number: A150048237100041Document1 pageRenewal Premium Receipt: Invoice Number: A150048237100041Aasiya shadab KhanNo ratings yet

- Professional CourseDocument1 pageProfessional Coursesiva kumarNo ratings yet

- Premium Receipts PDFDocument1 pagePremium Receipts PDFAJAY JAISWALNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurupatel dharmeshNo ratings yet

- M3L2Document4 pagesM3L2ajayroy12No ratings yet

- Offer LetterDocument12 pagesOffer LetterFarhan KhanNo ratings yet

- Health Insurance - 202316222434Document54 pagesHealth Insurance - 202316222434AayushNo ratings yet

- Tax Certificate - 008927742 - 131310Document2 pagesTax Certificate - 008927742 - 131310Vignesh MahadevanNo ratings yet

- Sailaja Jaliparthi Icici PrudentialDocument1 pageSailaja Jaliparthi Icici PrudentialSobhan JaliparthiNo ratings yet

- Covaxin 1st Dose CertificateDocument1 pageCovaxin 1st Dose CertificateMohitTagotraNo ratings yet

- Insurance SelfDocument61 pagesInsurance SelfAbhinav SinhaNo ratings yet

- 1865362Document1 page1865362Bhavesh ParekhNo ratings yet

- Order ID 5297449678Document1 pageOrder ID 5297449678sagarsingla1234509876No ratings yet

- Mani HealthDocument7 pagesMani HealthManish Tewari50% (2)

- Ashwani KumarDocument1 pageAshwani KumarTarunNo ratings yet

- Consolidated Premium Paid STMT 2020-2021 PDFDocument1 pageConsolidated Premium Paid STMT 2020-2021 PDFSHITESH KUMARNo ratings yet

- 80D SelfDocument1 page80D Selfnikhil nadakuditiNo ratings yet

- Tax Invoice: 1046.17 Total Invoice Amount RsDocument2 pagesTax Invoice: 1046.17 Total Invoice Amount RsAayush AggarwalNo ratings yet

- 17-18 Lic Statement PDFDocument2 pages17-18 Lic Statement PDFAyush ThongeNo ratings yet

- Premium Paid Certificate: Date: 14-DEC-2017Document1 pagePremium Paid Certificate: Date: 14-DEC-2017zuhebNo ratings yet

- 80D Pdf-AnkitDocument1 page80D Pdf-AnkitSaurabh RaghuvanshiNo ratings yet

- Received With Thanks ' 2,308.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 2,308.00 Through Payment Gateway Over The Internet FromKumara RagavendraNo ratings yet

- Received With Thanks ' 17,774.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 17,774.00 Through Payment Gateway Over The Internet FromRavi Kiran HrNo ratings yet

- PDF 17256553 1586590267466Document7 pagesPDF 17256553 1586590267466Lucky TraderNo ratings yet

- HSAA188212000100Document3 pagesHSAA188212000100Taquee AhmadNo ratings yet

- PDF 16045523 1571921316928Document5 pagesPDF 16045523 1571921316928Rohit TamuliNo ratings yet

- Sacred Earth Renewal LicenseDocument6 pagesSacred Earth Renewal LicenseAnu RadhaNo ratings yet

- Renewal Premium Receipt: This Receipt Is Subject To Realisation of Cheque AmountDocument1 pageRenewal Premium Receipt: This Receipt Is Subject To Realisation of Cheque AmountjontyamitNo ratings yet

- PreviewPDF 1Document1 pagePreviewPDF 1shaikrehan612No ratings yet

- PolicyDocument55 pagesPolicyBaneNo ratings yet

- 297511794-OctDocument1 page297511794-OctVikash SinghNo ratings yet

- Consolidated Life Insurence Premium Receipt FY-2022-2023-SujanDocument1 pageConsolidated Life Insurence Premium Receipt FY-2022-2023-SujanSujanNo ratings yet

- A. Intax NotesDocument13 pagesA. Intax NotesIssy BNo ratings yet

- Tax Credits and Calculation of Tax: What Is Income Tax?Document31 pagesTax Credits and Calculation of Tax: What Is Income Tax?Thulani NdlovuNo ratings yet

- FORM No. 16: Pune Municipal CorporationDocument2 pagesFORM No. 16: Pune Municipal CorporationAtharv MarneNo ratings yet

- Neeraj Jawla & Associates: Chartered AccountantsDocument2 pagesNeeraj Jawla & Associates: Chartered AccountantsSandeep TyagiNo ratings yet

- Wey FinMan 4e TB AppI Payroll-AccountingDocument15 pagesWey FinMan 4e TB AppI Payroll-AccountingJim AxelNo ratings yet

- W2 PreviewDocument1 pageW2 Previewmrs merle westonNo ratings yet

- Chapter 17Document42 pagesChapter 17Dyllan HolmesNo ratings yet

- Hriq 42162014Document3 pagesHriq 42162014Aseem JainNo ratings yet

- Introduction To Tax Ideology and PolicyDocument64 pagesIntroduction To Tax Ideology and PolicyfazrinbusirinNo ratings yet

- Gamboa Incorporated Is A Relatively New U S Based Retailer of SpecialtyDocument1 pageGamboa Incorporated Is A Relatively New U S Based Retailer of Specialtytrilocksp SinghNo ratings yet

- Brochure 30 30 30 Eng2019Document5 pagesBrochure 30 30 30 Eng2019Fabian Sanchez HuertasNo ratings yet

- CIR v. Yumex PhilippinesDocument3 pagesCIR v. Yumex PhilippinesFrancis PunoNo ratings yet

- Jessica PayslipDocument2 pagesJessica Payslipdavd brebNo ratings yet

- CBIC Exempt Supply of Goods and Services From PSU To PSU From Applicability of Provisions Relating To TDS Vide Notification NoDocument1 pageCBIC Exempt Supply of Goods and Services From PSU To PSU From Applicability of Provisions Relating To TDS Vide Notification NoRaja Srinivasa ReddyNo ratings yet

- Wage Tax Refund Petition Tax Year: Salary/Hourly EmployeesDocument2 pagesWage Tax Refund Petition Tax Year: Salary/Hourly EmployeesStanley AndersonNo ratings yet

- GST For Ca Nov 21Document23 pagesGST For Ca Nov 21shruti guptaNo ratings yet

- Full Download Ebook PDF Public Finance Public Policy 6th Edition by Jonathan Gruber PDFDocument41 pagesFull Download Ebook PDF Public Finance Public Policy 6th Edition by Jonathan Gruber PDFjeanne.olivares36897% (37)

- DTAA Tax Project IndiaDocument31 pagesDTAA Tax Project IndiaRonak Shah100% (1)

- Charlwin Lee Cup NFJPIA NCR Taxation Questions Elimination RoundDocument26 pagesCharlwin Lee Cup NFJPIA NCR Taxation Questions Elimination RoundKenneth RobledoNo ratings yet

- Presentation On : Kiet Group of InstitutionsDocument27 pagesPresentation On : Kiet Group of InstitutionsVaishali SharmaNo ratings yet

- TRAIN Law BriefingDocument30 pagesTRAIN Law BriefingJoselito PabatangNo ratings yet

- USOnline PayslipDocument2 pagesUSOnline PayslipTami SariNo ratings yet

- Form IL-941: 2020 Illinois Withholding Income Tax ReturnDocument2 pagesForm IL-941: 2020 Illinois Withholding Income Tax ReturnArnawama LegawaNo ratings yet

- ACCT101 - MidtermsDocument15 pagesACCT101 - MidtermsNicole Anne Santiago SibuloNo ratings yet

- (Ecolebooks - Com) COMMERCE A LEVEL (FORM SIX) NOTES - TAXATIONDocument14 pages(Ecolebooks - Com) COMMERCE A LEVEL (FORM SIX) NOTES - TAXATIONMhiz MercyNo ratings yet

- POM-3.6 - Financial Management-Operational Objectives, Goals, Functional AreasDocument20 pagesPOM-3.6 - Financial Management-Operational Objectives, Goals, Functional AreasDhiraj SharmaNo ratings yet

- GST Tax Invoice Format For Goods - TeachooDocument2 pagesGST Tax Invoice Format For Goods - TeachooAshish Kamthania SaxenaNo ratings yet

- India AUG 2018Document1 pageIndia AUG 2018vsharsha100% (1)

- Frequently Asked Questions: US Rotary Clubs and The IRSDocument3 pagesFrequently Asked Questions: US Rotary Clubs and The IRSDavid Jhan CalderonNo ratings yet

- TAXATION 2 Chapter 7 Donors Tax PDFDocument6 pagesTAXATION 2 Chapter 7 Donors Tax PDFKim Cristian MaañoNo ratings yet