Professional Documents

Culture Documents

Creating SAP Reconciliation Account: Vendors

Uploaded by

Jagan MohanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Creating SAP Reconciliation Account: Vendors

Uploaded by

Jagan MohanCopyright:

Available Formats

SAP financial accounting has several sub ledgers, including accounts receivable,

accounts payable and asset accounting. An account is maintained for each customer,

vendor or asset in the sub ledger. When preparing financial statements the details of

these individual accounts are not necessary. Instead, every asset, customer or vendor

account is linked to a certain SAP reconciliation account, also known as a control

account. Each SAP reconciliation account is used to reconcile the sub ledgers with the

general ledger. SAP reconciliation accounts are reported on the financial statements,

while the individual sub ledger accounts are not.

The SAP general ledger is linked to the sub ledgers. For every transaction posted in the

sub ledger, the same value will be updated to the corresponding reconciliation account.

For example, reconciliation account 160000 is used for trade vendors. Let’s assume we

have vendor A with account 36. If we post an invoice of $2000 to vendor A, account

36 will be debited for $2000 and the reconciliation account 160000 will also be debited

automatically for $2000.

Creating SAP Reconciliation Account

SAP reconciliation accounts are created very similar to all other general ledger

accounts. There are just a few attributes that need to be set correctly. Transaction

code FS00 is used to create reconciliation accounts centrally.

In this tutorial, we will not walk through the entire account creation process, as a

reconciliation account is created in much the same way as any other general ledger

account. Instead, let’s examine account 160000 for AP (Accounts Payable)

reconciliation. We will walk through the three main areas where a reconciliation account

differs from other accounts.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Grocery Store Start Up and Operations Guide PDFDocument45 pagesGrocery Store Start Up and Operations Guide PDFJoan Barrientos GarciaNo ratings yet

- Purchase OrderDocument1 pagePurchase OrderJagan MohanNo ratings yet

- Monstertrak - Ca Career Guide: Successful InterviewingDocument11 pagesMonstertrak - Ca Career Guide: Successful InterviewingJagan MohanNo ratings yet

- Microsoft Word PuzzelsDocument45 pagesMicrosoft Word Puzzels2vijNo ratings yet

- Basic SD TopicsDocument47 pagesBasic SD TopicsJagan MohanNo ratings yet

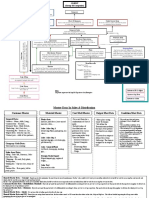

- Business Consolidation Area: Org Units Represents The Legal & Org Views of An EnterpriseDocument9 pagesBusiness Consolidation Area: Org Units Represents The Legal & Org Views of An EnterpriseJagan MohanNo ratings yet

- Pricing ProceedureDocument21 pagesPricing ProceedureJagan MohanNo ratings yet

- Func Spec For New Output Creation For Nigeria Invoice PrintingDocument11 pagesFunc Spec For New Output Creation For Nigeria Invoice PrintingJagan MohanNo ratings yet

- SAP SD Training by PraveenDocument15 pagesSAP SD Training by PraveenJaved Ahamed43% (7)

- Benefit MatrixDocument25 pagesBenefit MatrixgarozoNo ratings yet

- Marketing Channel Strategy in Rural Emerging Markets Ben NeuwirthDocument40 pagesMarketing Channel Strategy in Rural Emerging Markets Ben NeuwirthPrakhar DadhichNo ratings yet

- Pnadp 098Document124 pagesPnadp 098Jagan MohanNo ratings yet

- Good Neighbours CommunityDocument8 pagesGood Neighbours CommunityJagan MohanNo ratings yet

- Business Plan Pack Dec 12Document28 pagesBusiness Plan Pack Dec 12massimo78No ratings yet

- LSMWDocument4 pagesLSMWJagan MohanNo ratings yet

- SD Question AnswersDocument37 pagesSD Question Answersanon-850305100% (1)