Professional Documents

Culture Documents

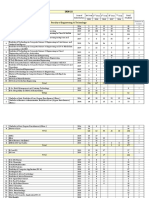

Deductions From Gross Total Income

Deductions From Gross Total Income

Uploaded by

Laxmi Wankhede0 ratings0% found this document useful (0 votes)

21 views90 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views90 pagesDeductions From Gross Total Income

Deductions From Gross Total Income

Uploaded by

Laxmi WankhedeCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 90

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BOSCH Authorization Letter - For HiremeeDocument1 pageBOSCH Authorization Letter - For HiremeeLaxmi WankhedeNo ratings yet

- 1.3.4 - Name of Research Projects - InternshipDocument2 pages1.3.4 - Name of Research Projects - InternshipLaxmi WankhedeNo ratings yet

- Summary - Student Data - 20-21Document2 pagesSummary - Student Data - 20-21Laxmi WankhedeNo ratings yet

- Life Insurance U2Document8 pagesLife Insurance U2Laxmi WankhedeNo ratings yet

- CONTROLLING OF RELAY USING RASPBERRY PiDocument11 pagesCONTROLLING OF RELAY USING RASPBERRY PiLaxmi WankhedeNo ratings yet

- Arrest PDF WarrantDocument27 pagesArrest PDF WarrantLaxmi WankhedeNo ratings yet

- The Foreign Trade (Development and Regulation) Act, 1992Document3 pagesThe Foreign Trade (Development and Regulation) Act, 1992Laxmi WankhedeNo ratings yet

- RemedialNewTimeTable31 10 18Document7 pagesRemedialNewTimeTable31 10 18Laxmi WankhedeNo ratings yet

- Securitas I OnDocument11 pagesSecuritas I OnLaxmi WankhedeNo ratings yet

- Rem Time Table (July-Dec. 2020)Document24 pagesRem Time Table (July-Dec. 2020)Laxmi WankhedeNo ratings yet

- EEEE Remidial Time Table Ugc 2020 To 2018Document19 pagesEEEE Remidial Time Table Ugc 2020 To 2018Laxmi WankhedeNo ratings yet