Professional Documents

Culture Documents

The Daily Pip Cycle: Step by Step Guide

The Daily Pip Cycle: Step by Step Guide

Uploaded by

Eric Woon Kim Thak0 ratings0% found this document useful (0 votes)

58 views11 pagesOriginal Title

Daily Pip Cycle

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

58 views11 pagesThe Daily Pip Cycle: Step by Step Guide

The Daily Pip Cycle: Step by Step Guide

Uploaded by

Eric Woon Kim ThakCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

THE DAILY PIP CYCLE

Step by step guide

Introduction

First thing, be sure to have learnt the order block

strategy before jumping to this strategy. Without

the foundation you will struggle.

Take your time understanding the concept and

acknowledge that this is an edge and every edge

will have failed set ups. However, understanding

that an edge is for long term profitability.

So why use this strategy?

This is ideal for those who are looking to trade

intraday set ups during London session.

The entry criteria no different to our order block

strategy, you simply need to understand the why.

The cycle

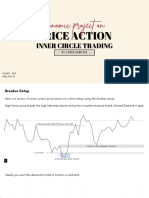

Below is the set up in a very basic visual

representation

So lets try and understand the theory and the

reasons why this happens

The Theory

The theory is based on the liqudity. Simple as that.

We all know by now that liquidity is what fuels the

market and this strategy is based on grabbing

liquidity and running.

So, whats the backstory?

During the Asian it is believed to be a 'ranging' or

'consolidating market'

Now what do we know about consolidating

markets and how the markets function?

Ranging markets = Equilibrium between buyers and

sellers. Everyones happy.

Will this last?

Of course not mate!

So, the idea is to grab liquidity from either the

sellers of buyers and the reversing. Our entry is

that reversal.

Make sense so far?

The Theory

So what is ideal for this strategy to work?

You need a ranging market during the Asian

session.

By now you all should able to distinguish between a

ranging market and a trending market.

why do you want a ranging market?

Because of the equilibrium in the market, we need

that liqudity hunt. If market is trending, this not

only make liquidity grabs unclear but it lowers the

probability as there is no question of institutions

looking for higher or lower prices as the trending

markets will already show its hand and intentions.

You may use this on trending markets but bare in

the mind the win rate and probability.

The Edge: Step 1

Now, once London opens, this is when you have to

be ready. Why during London?

The first 2-3 hours is the most liquid time in the

markets and if this set up was to play out it will do

so during this session.

So how do you set it up?

On any time frame you are comfortable with, mark

our the asian range high and low and set an alert.

The Edge: Step 2

Great, you have set your alerts. Now we wait for a

break of either the high or the low.

Once you alert goes off, it is time for getting an

entry now.

So in terms of entry, how do we do it?

It is the same entry patterns either pattern one or 2

and you can enter at entry type 1 or 2, the choice is

yours and to find what you prefer.

The Edge: Step 3

Wait for our two rule entry to show. Then you

know what to do next. Trade without fear and with

full confidence in the edge.

In terms of timeframes, this is a personal

preference as to which time frame you wish to get

an entry from. Never forget the fractal nature of

the market. It will all replicate.

The Edge: Step 3 Continued

Targets where do you put it?

Simple, for the asian range high or low depending

on if you are buying or selling.

Alternatively you can manage the trade as you see

fit. If this is pro trend, my be wise to take partials

and leave a little volume to run. Or if its counter set

a hard TP. But the choice is yours how you manage

the trade not mine.

The key facts

Remember this is an edge, it will have losing runs.

You need to trust the edge for longevity.

Remember the theory and logic behind everything

you do. Never forget that. No logic no trade.

Market runs on liquidity and that is exactly what this

edge is built on. We are essentially entering on an LG.

When we break the asian range, do we need to react

off an OB? - No you do not. Doesn't always do this. If

you see our entry pattern take it with confidence. If it

reacts to an OB this is simply a confluence for you at

this point.

What pairs?

This is up to you. Generally GBP, EUR and USD pairs

work well. Stick to majors purely for the liquidity

Trust the process and back test over and over till you

are confident. I cannot give you confidence, this what

you have to practice and develop.

High probability = When asian range is ranging.

When asian range is trending - probability is low but

it's up to you to test to see what you prefer.

US session - this is either a reversal or continuation of

London. We will never know. Its up to you if you want

to hold for TP or close at US session.

Enjoy the

process and

love the

art of

trading

TRADE SAFE

You might also like

- WWADocument8 pagesWWARachid Ahmed100% (4)

- Institutional Trading CourseDocument2 pagesInstitutional Trading CourseArtha fx100% (3)

- NJAT Private Telegram - Structure & Timeframes: Key Points To RememberDocument12 pagesNJAT Private Telegram - Structure & Timeframes: Key Points To RememberSharma comp100% (4)

- Liquidity and ManipulationDocument20 pagesLiquidity and ManipulationAtharva Sawant82% (22)

- Institutional Candle 1Document4 pagesInstitutional Candle 1Thabang100% (3)

- Vertex InvestingDocument18 pagesVertex Investingquentin oliverNo ratings yet

- Choch Trading PlanDocument22 pagesChoch Trading PlanDario Anchava91% (11)

- External & Internal Range Liquidity - WatermarkDocument6 pagesExternal & Internal Range Liquidity - WatermarkMohammad Syaiful Amri100% (1)

- WWA Market StructureDocument1 pageWWA Market StructureMus'ab Abdullahi BulaleNo ratings yet

- Step by Step GuideDocument17 pagesStep by Step GuideAdonis Poseidon86% (7)

- Flipping Markets: Trading PlanDocument28 pagesFlipping Markets: Trading PlanDario Anchava88% (8)

- Market Structure and Powerful Setups by Wade FX SetupsDocument77 pagesMarket Structure and Powerful Setups by Wade FX SetupsCling5923100% (2)

- Liquidity TTrades EduDocument8 pagesLiquidity TTrades EduDevie ChristianNo ratings yet

- Liquidity Price VoidDocument12 pagesLiquidity Price VoidSIDOW ADENNo ratings yet

- ICT Mentorship EP1 SummaryDocument7 pagesICT Mentorship EP1 Summarytoto0% (1)

- CryptoDocument57 pagesCryptoafs100% (1)

- Key Info (ICT)Document1 pageKey Info (ICT)Planet TravisNo ratings yet

- Multi Time Frame Structure Breakdown: Ivan KumburovicDocument6 pagesMulti Time Frame Structure Breakdown: Ivan KumburovicFX IINo ratings yet

- 261 A Syllabus Spring 2012 Full VersionDocument17 pages261 A Syllabus Spring 2012 Full VersionMikhail StrukovNo ratings yet

- Snowflake2 @FOREXSyllabusDocument27 pagesSnowflake2 @FOREXSyllabusHamzah Ahmed100% (3)

- Forex Market - StructureDocument8 pagesForex Market - Structuredafx67% (3)

- Tradable Order BlocksDocument24 pagesTradable Order BlocksFelipe Silva93% (15)

- Forex Trading Bootcamp Day 5 - Imbalance, Liquidity and Indicator Based StrategiesDocument46 pagesForex Trading Bootcamp Day 5 - Imbalance, Liquidity and Indicator Based StrategiesArrow Builders100% (5)

- Inducement ICT Capital Compressed 1Document100 pagesInducement ICT Capital Compressed 1Lewis MendezNo ratings yet

- Ict Smart Money ReversalDocument6 pagesIct Smart Money ReversalKaezel Joyce BadillaNo ratings yet

- Lower - Timeframe - Bullish - Order - FlowDocument30 pagesLower - Timeframe - Bullish - Order - FlowAleepha Lelana100% (5)

- Flipping Markets: PDF Cheat SheetDocument59 pagesFlipping Markets: PDF Cheat SheetAsh Sam100% (8)

- Supply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.From EverandSupply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.No ratings yet

- Photon Trading - Market Structure BasicsDocument11 pagesPhoton Trading - Market Structure Basicstula amar100% (2)

- Market StructureDocument12 pagesMarket StructureHODAALE MEDIANo ratings yet

- Vertex: InvestingDocument12 pagesVertex: InvestingGolconda Mitra100% (2)

- Liquidity: Quantum Stone CapitalDocument6 pagesLiquidity: Quantum Stone CapitalCapRa Xubo100% (5)

- Precision Based Trading King. D Boateng IG@kingboatengofficialDocument24 pagesPrecision Based Trading King. D Boateng IG@kingboatengofficialnicholasNo ratings yet

- Choch Trading PlanDocument22 pagesChoch Trading PlanHarmanpreet Dhiman100% (4)

- 1st Week Trading JournalDocument14 pages1st Week Trading JournalWanpaNo ratings yet

- Rto Setup: This Could Be Daily, Weekly or Yearly CandleDocument3 pagesRto Setup: This Could Be Daily, Weekly or Yearly CandleSIDOW ADENNo ratings yet

- Free ZCFX PDFDocument50 pagesFree ZCFX PDFAnderson Bragagnolo100% (2)

- ICT Free Strategy FST PDFDocument22 pagesICT Free Strategy FST PDFAlassane Traore100% (3)

- Smart ExecutionDocument47 pagesSmart ExecutionYAYA100% (4)

- Tradable Order BlocksDocument28 pagesTradable Order BlocksKaran Singh RanaNo ratings yet

- Balhana Journal PDFDocument67 pagesBalhana Journal PDFAgus Setiawan100% (3)

- Trade PlanDocument8 pagesTrade PlanSIDOW ADEN100% (1)

- Order Block or POIDocument7 pagesOrder Block or POIvikramNo ratings yet

- Our Free PDF!: Welcome ToDocument42 pagesOur Free PDF!: Welcome ToPragya Richhariya100% (4)

- Liquidity GuideDocument20 pagesLiquidity Guide7q8jspp2sv100% (1)

- MMXM .ModelDocument8 pagesMMXM .Modeltiajung humtsoeNo ratings yet

- Not Just A Trade: First ObservationDocument2 pagesNot Just A Trade: First Observationhifi_universe9700No ratings yet

- Safe - Target - and - LTF - Price - ActionDocument9 pagesSafe - Target - and - LTF - Price - ActionRui Almeida100% (1)

- Free Ebook IncognitoDocument53 pagesFree Ebook IncognitoAnderson Bragagnolo100% (4)

- Prediction - Understanding HTF DirectionDocument10 pagesPrediction - Understanding HTF DirectionRui AlmeidaNo ratings yet

- Obstacles, Predictions and Market DirectionDocument22 pagesObstacles, Predictions and Market DirectionRui AlmeidaNo ratings yet

- Order BlocksDocument8 pagesOrder Blocksdaniel75% (4)

- Protected Structure Vs Targeted StructureDocument4 pagesProtected Structure Vs Targeted StructureFrom Shark To WhaleNo ratings yet

- Entry Criteria, Targets and Market DirectionDocument16 pagesEntry Criteria, Targets and Market DirectionRui Almeida100% (2)

- 2023 Mentorship GEMS PDF?Document31 pages2023 Mentorship GEMS PDF?Sukh100% (1)

- Pip Factory Entry PDF.: Table of ContentsDocument35 pagesPip Factory Entry PDF.: Table of ContentsVillaca KeneteNo ratings yet

- The Empowered Forex Trader: Strategies to Transform Pains into GainsFrom EverandThe Empowered Forex Trader: Strategies to Transform Pains into GainsNo ratings yet

- Fast-Up Trading: FUT Mentorship ProgramDocument7 pagesFast-Up Trading: FUT Mentorship ProgramSIDOW ADENNo ratings yet

- Rule Based TradingDocument3 pagesRule Based TradingSIDOW ADEN100% (1)

- Rto Setup: This Could Be Daily, Weekly or Yearly CandleDocument3 pagesRto Setup: This Could Be Daily, Weekly or Yearly CandleSIDOW ADENNo ratings yet

- CandlesDocument6 pagesCandlesSIDOW ADENNo ratings yet

- Trade PlanDocument8 pagesTrade PlanSIDOW ADEN100% (1)

- BZAN 505 Quiz 2 - SolutionDocument6 pagesBZAN 505 Quiz 2 - SolutionJahedulHoqNo ratings yet

- Acct Statement XX6542 20112021Document37 pagesAcct Statement XX6542 20112021Niranjan soniNo ratings yet

- Ceres Emails (Redacted)Document11 pagesCeres Emails (Redacted)Nick PopeNo ratings yet

- Renault Duster Case Study - v5Document18 pagesRenault Duster Case Study - v5Supriya BhartiNo ratings yet

- Unit 2Document14 pagesUnit 2Rahul kumarNo ratings yet

- Carbon Inventory Methods PDFDocument315 pagesCarbon Inventory Methods PDFMohamedNo ratings yet

- GoogleDocument4 pagesGoogleAlifa MugiaNo ratings yet

- Writing 2Document2 pagesWriting 2Lot DelaNo ratings yet

- Wa0012Document2 pagesWa0012Plr. BaswapurNo ratings yet

- Perception of Consumer Towards Use of Plastic Money-1Document108 pagesPerception of Consumer Towards Use of Plastic Money-1Kewal Tare0% (1)

- Instruction Doc Bug 22345859Document14 pagesInstruction Doc Bug 22345859Dinesh Babu TatappagariNo ratings yet

- Department of Education: Republic of The PhilippinesDocument4 pagesDepartment of Education: Republic of The PhilippinesRochelle May CanlasNo ratings yet

- International Marketing 15th Edition Cateora Test BankDocument25 pagesInternational Marketing 15th Edition Cateora Test BankMatthewRosarioksdf100% (53)

- CV & Cover2021Document3 pagesCV & Cover2021HamidiNo ratings yet

- BNM RateDocument3 pagesBNM RateKj LeeNo ratings yet

- PGP26320 Ashwin Zade v6Document2 pagesPGP26320 Ashwin Zade v6Ashwin ZadeNo ratings yet

- Town and Country in Europe (Book)Document355 pagesTown and Country in Europe (Book)miaoz12No ratings yet

- Essentials of Economics 4th Edition Hubbard Test Bank Full Chapter PDFDocument67 pagesEssentials of Economics 4th Edition Hubbard Test Bank Full Chapter PDFalbertkaylinocwn100% (11)

- ATI Aerospace New Products and CapabilitiesDocument4 pagesATI Aerospace New Products and CapabilitiesShreya SharadNo ratings yet

- III Sem BCOM Corporate Accounting SSM 1-5 ModulesDocument148 pagesIII Sem BCOM Corporate Accounting SSM 1-5 ModulesSinghan SNo ratings yet

- Maam Nario Eco 1 Module 4Document6 pagesMaam Nario Eco 1 Module 4Kier Arven SallyNo ratings yet

- Chapt. 10 Developing Compensation PlanDocument19 pagesChapt. 10 Developing Compensation PlanDominique Hazel LeeNo ratings yet

- MC 2015-09Document6 pagesMC 2015-09Purisima D. BagsawanNo ratings yet

- Customer Satisfaction and Business PerformanceDocument7 pagesCustomer Satisfaction and Business PerformanceLongyapon Sheena StephanieNo ratings yet

- Execution of The Message:how Was The Message Conveyed? What: Joy Vaseline Men DoublemintDocument2 pagesExecution of The Message:how Was The Message Conveyed? What: Joy Vaseline Men DoublemintRjay IbinaNo ratings yet

- Session 21 - 09102021Document60 pagesSession 21 - 09102021skkaviya sethilrajakirthikaNo ratings yet

- Module 17. Takt TimeDocument15 pagesModule 17. Takt Timetaghavi1347No ratings yet

- Responding Serious Customer Complaints (Customer Service)Document2 pagesResponding Serious Customer Complaints (Customer Service)Alan CarranzaNo ratings yet

- No. 10 Financial Market Covering Letters PDFDocument3 pagesNo. 10 Financial Market Covering Letters PDFalzndlNo ratings yet