Professional Documents

Culture Documents

Financial Modelling and Valuations: Key Highlights

Uploaded by

Avanish Kumar0 ratings0% found this document useful (0 votes)

8 views1 pageOriginal Title

Financial Modelling and Valuations

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageFinancial Modelling and Valuations: Key Highlights

Uploaded by

Avanish KumarCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Financial Modelling and Valuations

Key highlights

Focus on preparing candidates to be able to develop financial models from scratch on their

own

Real case studies and discussions with hands-on sessions

Coverage of basic as well as advanced financial concepts

Focus on developing thinking capability of candidates to perform financial analysis

Interview preparation focused towards roles like- Financial Analyst, Equity Research Analyst,

Credit Analyst and similar other roles

Optimal duration course to keep candidates stay focused

Course Curriculum Overview

1. Excel functions (Basic & Advanced)

2. Basic Finance Concepts- Financial Statements Analysis

3. Analysis of business models/revenue models

4. Discounted Cashflow Valuation

5. Comparable Company Analysis

6. Precedent Transactions Analysis

*Each topic will include solved and unsolved exercises for practice which the candidates are

supposed to complete during the course duration for better understanding.

You might also like

- Pub Admin & Good Gov PDFDocument1 pagePub Admin & Good Gov PDFAvanish KumarNo ratings yet

- UPSCPW Notes3Document3 pagesUPSCPW Notes3Avanish KumarNo ratings yet

- Onethods O: StarkDocument8 pagesOnethods O: StarkAvanish KumarNo ratings yet

- Java CoreDocument7 pagesJava CoreAvanish KumarNo ratings yet

- Java Super Keyword (With Examples)Document13 pagesJava Super Keyword (With Examples)Avanish KumarNo ratings yet

- Java Interface (With Examples)Document12 pagesJava Interface (With Examples)Avanish KumarNo ratings yet

- RequirementsDocument10 pagesRequirementsAvanish KumarNo ratings yet

- Java BasicsDocument78 pagesJava BasicsAvanish KumarNo ratings yet

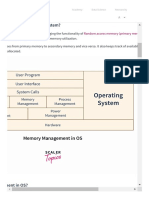

- Memory Management in Operating System - Scaler TopicsDocument1 pageMemory Management in Operating System - Scaler TopicsAvanish KumarNo ratings yet

- Introduction To Financial Risk Management (With R) Exercise 4 - Longer Horizon Returns of GoldDocument1 pageIntroduction To Financial Risk Management (With R) Exercise 4 - Longer Horizon Returns of GoldAvanish KumarNo ratings yet

- IIQF PythonDocument85 pagesIIQF PythonAvanish KumarNo ratings yet

- Atal Community Innovation CentreDocument22 pagesAtal Community Innovation CentreAvanish Kumar100% (1)

- Machine Learning For Everyone - in Simple Words. With Real-World Examples. Yes, Again PDFDocument62 pagesMachine Learning For Everyone - in Simple Words. With Real-World Examples. Yes, Again PDFAvanish KumarNo ratings yet

- Term 1 Term 2 Max Actual Score Weight Weighted Score Actual Score Subject 1 100 0 0 Subject 2 100 0 0 Subject 3 100 0 0 240 0.3 72 220 0 0 0Document2 pagesTerm 1 Term 2 Max Actual Score Weight Weighted Score Actual Score Subject 1 100 0 0 Subject 2 100 0 0 Subject 3 100 0 0 240 0.3 72 220 0 0 0Avanish KumarNo ratings yet

- SaralDocument1 pageSaralAvanish KumarNo ratings yet

- Overall Business Model and Strategy: M-CrilDocument6 pagesOverall Business Model and Strategy: M-CrilAvanish KumarNo ratings yet

- A Complete Guide To Credit Risk Modelling PDFDocument30 pagesA Complete Guide To Credit Risk Modelling PDFAvanish KumarNo ratings yet

- Maharashtra State Agricultural Marketing Board (MSAMB)Document32 pagesMaharashtra State Agricultural Marketing Board (MSAMB)Avanish KumarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)