Professional Documents

Culture Documents

IM No.: IM-BTLED3-1STSEM-2020-2021: What Is A Budget?

IM No.: IM-BTLED3-1STSEM-2020-2021: What Is A Budget?

Uploaded by

Guene BinwagOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IM No.: IM-BTLED3-1STSEM-2020-2021: What Is A Budget?

IM No.: IM-BTLED3-1STSEM-2020-2021: What Is A Budget?

Uploaded by

Guene BinwagCopyright:

Available Formats

Republic of the Philippines

NUEVA VIZCAYA STATE UNIVERSITY

Bayombong, Nueva Vizcaya

INSTRUCTIONAL MODULE

IM No.: IM-BTLED3-1STSEM-2020-2021

College: Teacher Education

Campus : Bayombong Campus

DEGREE BTLE COURSE NO. HE 4

PROGRAM

SPECIALIZATION HE COURSE TITLE Consumer Education

YEAR LEVEL 3 TIME FRAME 9hrs WKNO. 6-8 IM NO. 3

I. UNIT TITLE/CHAPTER TITLE: Money Management

II. LESSON TITLE : Management of Personal Resources

III. LESSON OVERVIEW

Making a budget is the most important thing you can do to manage your

money, but many people are reluctant to take this beneficial step. You may

associate budgeting with restrictions and a lot of hassle and headaches. Or you

may feel like you are too poor to budget. However, budgeting is essential

because it can help you save money instead of overspending and enables you to

make the most of every peso.

IV. DESIRED LEARNING OUTCOMES

At the end of the lesson, the students should be able to:

a. Discuss how budgeting, saving, and spending money are related

b. explain the importance of saving money

c. give and discuss the importance of budget and records in spending and saving

money

V. LESSON CONTENT

Everyone says you should have a budget, and that’s certainly good advice. But if

you’ve never had a budget, you may not be entirely sure what it is and what it’s

designed to accomplish.

What is a Budget?

Part of the problem with budgeting is that the word “budget” itself has a very

clinical meaning. The accounting definition of a budget is both dry and impersonal.

“A budget is an estimation of revenue and expense over a specified future

period of time and is usually compiled and re-evaluated on a periodic basis. Budgets

can be made for a person, a family, a group of people, a business, a government, a

country, a multinational organization or just about anything else that makes and spends

money. At companies and organizations, a budget is an internal tool used by

management and is often not required for reporting by external parties.”

NVSU-FR-ICD-05-00 (081220) Page 1 of 1

Republic of the Philippines

NUEVA VIZCAYA STATE UNIVERSITY

Bayombong, Nueva Vizcaya

INSTRUCTIONAL MODULE

IM No.: IM-BTLED3-1STSEM-2020-2021

How it can apply to you personally?

Take Control of Your Finances. At its core, budgeting is about taking control of

your money. Having a budget is a critical part of avoiding living in that financial

state. A budget is simply a strategy you put in place to make sure you spend less

than you earn.

Purpose of a Budget

The main purpose of a budget is to gain the upper hand on your financial

situation. There are all kinds of causes for stress, but one of the biggest is financial. The

problem is that it’s relentless. It’s not just that you fall behind in one month, but rather

that it’s a constant struggle every month. That can wear anyone down.

Start the Budgeting Process

In a real way, a budget is like taking a financial timeout. You’ll start the process

by doing an in-depth analysis of your current financial behavior. Mostly, that’s about

figuring out exactly how you spend the money you do have. And once you do, you’ll be

in a better position to evaluate how you can be more efficient with your finances.

Budgeting is “creating margin in your finances.” Like the extra space that

surrounds the text on the page of a book, margin is the extra money in your budget. If

you don’t have a budget, you probably don’t have any financial margin. The purpose of

a budget is to provide exactly that. Until you implement a budget of your own, it’s highly

unlikely you’ll ever make any progress on the financial side of your life.

Most people focus on the negative side of budgeting, but that’s approaching it

entirely from the wrong angle.

The Negatives of Budgeting

Changing your finances, which is always uncomfortable. And naturally, changes

in your finances will inevitably lead to changes in your lifestyle.

Learning to live on less than you earn. That’s a difficult concept if you’ve never

done it before.

Adopting the discipline to say “no” to yourself and your family when you’re

working to justify spending money on a “want” that you’re trying to convert into a

“need.”

The initial sense of a loss of freedom when first implementing your budget.

Learning to live without those little goodies and indulgences you’ve been treating

yourself to over the years.

If you focus on the negatives, you may never start budgeting. But that’s why it’s

mission-critical to focus instead on the positives.

The Advantages of Budgeting

Once you implement a budget, you’ll begin to develop a sense of control over

your finances that you’ve never known. It can be incredibly empowering.

You’ll begin building savings, which will represent tangible evidence of the

greater control you’re gaining over your finances.

If you were in debt when you began budgeting, you’ll begin to see your balances

decline – along with your monthly payments on credit cards. You’ll start to realize

you can get out of debt.

NVSU-FR-ICD-05-00 (081220) Page 2 of 1

Republic of the Philippines

NUEVA VIZCAYA STATE UNIVERSITY

Bayombong, Nueva Vizcaya

INSTRUCTIONAL MODULE

IM No.: IM-BTLED3-1STSEM-2020-2021

When your savings reach a comfortable level, and your debts are well on their

way to being paid off, you may begin investing. That’s when you’ll begin creating

wealth for the future.

You’ll come to realize that your budget, as painful as it might be, is creating more

options in your life.

Your stress level will decline, enabling you to sleep better at night and to feel

better about yourself.

As your financial situation begins to improve, you’ll once again be able to indulge

yourself in some extras, only this time you’ll do it without guilt.

If you’ve been struggling with starting a budget because of how bad it will feel,

change your focus, and think more about how good it will feel when you have it

up and running. In other words, focus on the benefits at the end, not the

struggles at the beginning.

Short of having a winning lottery ticket or a large inheritance, no one achieves

financial independence without an investment of time and effort. And trust me, financial

freedom is a worthy goal. But that will never happen until you get control over your

budget.

The Three Types of Budgets

There are more than three types of budgets, so many in fact that it’s probably

impossible to put a number on it. Virtually anyone who knows anything about finance

has published a book or an online course to give you their version of the ultimate

budget.

But in my experience, three types of budgets are the most effective and will work best

for most people.

50-20-30 Budget

The numbers, 50-20-30, represent percentages of your net income allocated to

general spending categories.

Those categories are as follows:

50% of your after-tax income goes to necessary expenses, like housing, utilities,

food, minimum debt payments, insurance premiums, and the like.

20% is allocated to savings and/or debt repayment. For debt payment, it

represents payments over and above the minimum required monthly payments.

The idea is to increase your payments to pay down your debts faster.

30% goes to “wants.” These are the extras in life that you don’t need, but you buy

them because they make life more pleasant. This category includes vacations,

entertainment, concert tickets, sporting events, and going to the movies.

NVSU-FR-ICD-05-00 (081220) Page 3 of 1

Republic of the Philippines

NUEVA VIZCAYA STATE UNIVERSITY

Bayombong, Nueva Vizcaya

INSTRUCTIONAL MODULE

IM No.: IM-BTLED3-1STSEM-2020-2021

The 50-

20-30 budget is its emphasis on the big picture. Most budgeting methods focus on the

details of budgeting, like the individual expense line items. With this method, personal

expenses aren’t as necessary. For example, the 30% allocation to wants you can spend

any way you choose. You can decide which pleasures you wish to pay for in life, without

having to go on the financial equivalent of a diet. There’s also a lot of flexibility in this

budget method. If you can’t fit your necessities neatly in 50% of your after-tax income,

you can move some of your allocations from your wants category.

Most like about the method is the emphasis on saving money. Most people try

to get by saving just 10% or so of their paychecks. That’s certainly a step in the right

direction, but in my own experience, you’ll need to save a lot more to build wealth. 20%

is the minimum in that direction.

The Envelope Method

Long ago and far away – when people typically paid their bills in cash – many

used this method as a standard budgeting procedure. It involved putting actual currency

into individual envelopes earmarked for each household expense. It’s conceivable you

could’ve had 15 to 20 cash bearing envelopes to match all of your expenses.

A few people still handle their finances that way, but the envelope method has

evolved in recent decades. Though far fewer people put cash in envelopes, the basic

methodology remains the same. You set up a budget in which each expense has an

“envelope” that you need to fill with sufficient funds to pay the expense it represents.

One of the advantages is that if you

go over budget in one expense

category, you can usually find

additional funds from another

expense that’s lower than

expected. And for what it’s worth,

you don’t need to set up a system

of physical envelopes anymore.

There are envelope budgeting

apps you can use to do it digitally.

The most prominent is an app

known as Mvelopes. It works by

“giving a purpose to each peso in

NVSU-FR-ICD-05-00 (081220) Page 4 of 1

Republic of the Philippines

NUEVA VIZCAYA STATE UNIVERSITY

Bayombong, Nueva Vizcaya

INSTRUCTIONAL MODULE

IM No.: IM-BTLED3-1STSEM-2020-2021

your budget,” which is precisely what the paper envelope method does. It will enable

you to take an old school budgeting system and do it digitally.

Zero-Based Budget

Using the zero-based budget, if you manage your money correctly, your budget

will zero out every month. That’s because the method forces you to account for every

dollar in your budget. Every dollar must go toward a specific expense, or moved into

savings or put toward debt reduction.

The zero-based budget works on the assumption that any money in your budget

that doesn’t have a specific purpose is likely to disappear into excess spending. For this

reason, it tends to be more restrictive than other budget types. It may best be used if

you’ve had difficulty managing your finances in the past, and lack the discipline to

handle unallocated funds.

The Importance of Budgeting

Implementing a budget doesn’t have to be – and shouldn’t be – complicated and

painful. Sure, it will involve an element of sacrifice at the very beginning. But as each

month passes, it should get more comfortable. And as it does, you’ll begin to sense

greater control over your finances. That’s an important point by itself. The whole

purpose of implementing a budget is to make you the master of your money, rather than

letting your money control you. That’s a worthwhile goal even if you never plan to get

rich. But it will be even more critical if you do.

Financial independence is a goal well worth pursuing. It’s not merely about the

constant accumulation of more money, but rather one of having progressively greater

control over your life. Having a budget in place will help you move closer toward living

the life you’ve always dreamed of living.

The Importance of Saving Money

We save, basically, because we can't predict the future. Saving money can help

you become financially secure and provide a safety net in case of an emergency.

Here are a few reasons why we save:

Emergency cushion - This could be any number of things: a new roof for your

house, out-of-pocket medical expenses, or sudden loss of income. You will need

money set aside for these emergencies to avoid going into debt to pay for your

necessities.

Retirement – If you intend to retire someday, you will probably need savings

and/or investments to take the place of the income you'll no longer get from your

job.

Average Life Expectancy – With more advances in medicine and public health,

people are now living longer and needing more money to get by.

Volatility of Social Security – Social Security was never intended to be the

primary source of income and should be treated as a supplement to income.

Education - The costs for private and public education are rising every year and

it's getting tougher to meet these demands.

Without money put away in savings and/or investments, you open yourself up to

other risks as well. For example, not having enough money to pay for emergency dental

care may force you into taking a loan that your savings might otherwise have covered.

NVSU-FR-ICD-05-00 (081220) Page 5 of 1

Republic of the Philippines

NUEVA VIZCAYA STATE UNIVERSITY

Bayombong, Nueva Vizcaya

INSTRUCTIONAL MODULE

IM No.: IM-BTLED3-1STSEM-2020-2021

Tips for saving money:

Save windfall income – Any unexpected money such as income tax return

money.

Collect loose change and deposit it in the bank – Use a piggy bank and

deposit its contents when its full.

Try frugality – Purchase cheaper off brand items and save money.

Break a habit – Try doing one less thing you expensive venture a week and

apply that money to your savings.

Save lunch money –Bring your lunch to work and invest in yourself.

Have a “buy nothing week”.

Compare costs of major items before purchasing anything – Do your due

diligence, shop around before making major purchases.

Use coupons – Coupons are a great way to reduce living expenses.

VI. LEARNING ACTIVITIES

Rein In Your Wants!

Your task: As a student, there’s a good chance you’re not responsible for paying for all

of your own living expenses -- housing, groceries, etc. -- which means much of your

spending could be on “wants.” In this activity, you’ll assess your current spending, try

one recommended strategy for cutting your spending, and then develop your own plan

to see if it works any better.

Part I: Initial Trial - Track your Spending

1. If you were to categorize each of your purchases (Ex: Food, entertainment,

transportation, etc), what are the main areas you spent money in?

2. How do you feel about the amount you spent? If you have a budget for yourself,

does this spending fit within that budget?

Part II: Suggested Intervention

NVSU-FR-ICD-05-00 (081220) Page 6 of 1

Republic of the Philippines

NUEVA VIZCAYA STATE UNIVERSITY

Bayombong, Nueva Vizcaya

INSTRUCTIONAL MODULE

IM No.: IM-BTLED3-1STSEM-2020-2021

3. Did reflecting on how happy the purchase would make you change your spending

habits at all? Why or why not?

4. Are there items you purchased that you assumed would make you happy, but in

retrospect did not?

VII. ASSIGNMENT

1. Many Filipinos struggle to live within their budget, why do you think budgeting is so

difficult for so many?

VIII. EVALUATION

IX. REFERENCES

InCharge Debt Solutions and the Federal Trade Commission. League of United

Latin American Citizen 1133 19th St, NW, Suite 1000, Washington, DC -833-6130

, G. 2020. Millennial Money, Llc. All Rights Reserved Millennial Money

Retrieved from https://millennialmoney.com/what-is-a-budget/

Retrieved from https://www.thebalance.com/reasons-to-budget-money-2385699

Retrieved from https://www.ngpf.org/curriculum/budgeting/activities/

NVSU-FR-ICD-05-00 (081220) Page 7 of 1

You might also like

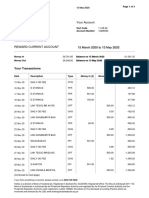

- Halifax StatementDocument4 pagesHalifax StatementЮлия П100% (1)

- Budgeting 101: From Getting Out of Debt and Tracking Expenses to Setting Financial Goals and Building Your Savings, Your Essential Guide to BudgetingFrom EverandBudgeting 101: From Getting Out of Debt and Tracking Expenses to Setting Financial Goals and Building Your Savings, Your Essential Guide to BudgetingRating: 4 out of 5 stars4/5 (11)

- DS-1 Volume 3 Addendum 1 - 16-AUG-2021Document5 pagesDS-1 Volume 3 Addendum 1 - 16-AUG-2021jaymuscat100% (3)

- Lesson-Plan Financial LiteracyDocument6 pagesLesson-Plan Financial Literacymarjory balog100% (2)

- A Doctor's Prescription To Comprehensive Financial WellnessDocument15 pagesA Doctor's Prescription To Comprehensive Financial WellnessHank WeinstockNo ratings yet

- Cost ProjectDocument48 pagesCost ProjectBhavyaNo ratings yet

- Chapter3 NugentDocument24 pagesChapter3 Nugentapi-304916120No ratings yet

- Supply What Is Being Asked Below.: BudgetDocument5 pagesSupply What Is Being Asked Below.: BudgetPrincess Eunnah O. DaydayNo ratings yet

- UNDERSTANDING YOUR FINANCES THROUGH LIFE'S CHANGES: CLOSING THE RELATIONSHIP GAP IN FINANCIAL LITERACYFrom EverandUNDERSTANDING YOUR FINANCES THROUGH LIFE'S CHANGES: CLOSING THE RELATIONSHIP GAP IN FINANCIAL LITERACYNo ratings yet

- HOW TO LIVE ON MINIMUM WAGE: Practical Tips and Strategies for Surviving on a Tight Budget (2023 Guide for Beginners)From EverandHOW TO LIVE ON MINIMUM WAGE: Practical Tips and Strategies for Surviving on a Tight Budget (2023 Guide for Beginners)No ratings yet

- Budget DiscussionDocument2 pagesBudget Discussionnoor fatimaNo ratings yet

- Gestión del Dinero Paso a Paso Para PrincipiantesFrom EverandGestión del Dinero Paso a Paso Para PrincipiantesRating: 5 out of 5 stars5/5 (1)

- Shahrukh Momin Roll No 25 Class: 12ADocument11 pagesShahrukh Momin Roll No 25 Class: 12APrerana PorechaNo ratings yet

- Financial LiteracyDocument2 pagesFinancial LiteracyHazer StrikesNo ratings yet

- Habits That Drive Financial Growth: Take Care Of Your Finances To Increase Your Savings, Secure Your Future And Be Prepared For EmergenciesFrom EverandHabits That Drive Financial Growth: Take Care Of Your Finances To Increase Your Savings, Secure Your Future And Be Prepared For EmergenciesNo ratings yet

- Budgeting: How to Make a Budget and Manage Your Money and Personal Finances Like a ProFrom EverandBudgeting: How to Make a Budget and Manage Your Money and Personal Finances Like a ProNo ratings yet

- 1) Budgeting Basics - IntroductionDocument20 pages1) Budgeting Basics - IntroductionAngelo HuligangaNo ratings yet

- Budget DiscussionDocument4 pagesBudget DiscussionLester AgoncilloNo ratings yet

- Budgeting BasicsDocument21 pagesBudgeting BasicsMish AlontoNo ratings yet

- A Study On Family BudgetingDocument110 pagesA Study On Family BudgetingJEREMY MAKALINTALNo ratings yet

- Cassandra Vazquez - Francolino - Financial Literacy Portfolio 2021Document10 pagesCassandra Vazquez - Francolino - Financial Literacy Portfolio 2021Luna SantiagoNo ratings yet

- Money Management for Beginners & DummiesFrom EverandMoney Management for Beginners & DummiesRating: 4.5 out of 5 stars4.5/5 (3)

- Lesson 4.1budgetingDocument8 pagesLesson 4.1budgetinghansel krakersNo ratings yet

- Un curso de finanzas personales: Descubre Como ser más Frutal y a Ahorrar y a Invertir tu Dinero, Incluso si estás Empezando desde Cero. Incluye 2 Libros- Cómo Lograr el Control Absoluto sobre tus Gastos y Dinero, La Guía para Invertir que Cualquiera pueda UsarFrom EverandUn curso de finanzas personales: Descubre Como ser más Frutal y a Ahorrar y a Invertir tu Dinero, Incluso si estás Empezando desde Cero. Incluye 2 Libros- Cómo Lograr el Control Absoluto sobre tus Gastos y Dinero, La Guía para Invertir que Cualquiera pueda UsarRating: 4.5 out of 5 stars4.5/5 (2)

- Family BudgetDocument6 pagesFamily BudgetYatharth Kohli100% (1)

- Real Life Money Plan WorkbookDocument26 pagesReal Life Money Plan WorkbookPatricia Antão Moutinho83% (6)

- Braving BudgetsDocument23 pagesBraving Budgetsjoemar estreraNo ratings yet

- How to Control Your Finances: Save Money, Increase Income, Invest, & Grow your NetworthFrom EverandHow to Control Your Finances: Save Money, Increase Income, Invest, & Grow your NetworthNo ratings yet

- Budgeting: Unlocking the Keys to Financial Freedom. How to Start Budgeting and Save More, Retire Early, Get Out of Debt and Live a more Fulfilling and Stress-free Life.: Personal Finance RevolutionFrom EverandBudgeting: Unlocking the Keys to Financial Freedom. How to Start Budgeting and Save More, Retire Early, Get Out of Debt and Live a more Fulfilling and Stress-free Life.: Personal Finance RevolutionNo ratings yet

- SURVIVING ON A DIET HOME BUDGET: Practical Tips and Delicious Recipes for Eating Healthy on a Tight Budget (2023 Guide for Beginners)From EverandSURVIVING ON A DIET HOME BUDGET: Practical Tips and Delicious Recipes for Eating Healthy on a Tight Budget (2023 Guide for Beginners)No ratings yet

- Minimalist Budget: Everything You Need To Know About Saving Money, Spending Less And Decluttering Your Finances With Smart Money Management StrategiesFrom EverandMinimalist Budget: Everything You Need To Know About Saving Money, Spending Less And Decluttering Your Finances With Smart Money Management StrategiesRating: 5 out of 5 stars5/5 (1)

- Financial PlanningDocument3 pagesFinancial PlanningAll AccessNo ratings yet

- Budgeting 101: Expert Strategies to Manage Your Personal FinancesFrom EverandBudgeting 101: Expert Strategies to Manage Your Personal FinancesNo ratings yet

- Budgeting Guides For People With Fluctuating IncomesDocument2 pagesBudgeting Guides For People With Fluctuating IncomesKingsley NwalozieNo ratings yet

- How To Budget Your Money - The 50-20-30 GuidelineDocument7 pagesHow To Budget Your Money - The 50-20-30 GuidelineAndrew Peter100% (1)

- Napkin Finance: Build Your Wealth in 30 Seconds or LessFrom EverandNapkin Finance: Build Your Wealth in 30 Seconds or LessRating: 3 out of 5 stars3/5 (3)

- Mastering the Art of Budgeting: A Comprehensive Guide for Financial SuccessFrom EverandMastering the Art of Budgeting: A Comprehensive Guide for Financial SuccessNo ratings yet

- Money Management Skills: A Beginners Guide On Personal Finance And Living Debt FreeFrom EverandMoney Management Skills: A Beginners Guide On Personal Finance And Living Debt FreeNo ratings yet

- BudgetDocument3 pagesBudgetChatter SinghNo ratings yet

- Building A Budget: Credit Card DebtDocument5 pagesBuilding A Budget: Credit Card DebtRohit BajpaiNo ratings yet

- 7 Managin G Personal FinanceDocument16 pages7 Managin G Personal FinanceRoann VelascoNo ratings yet

- Budgeting Tools and How My Budg - Francis JonahDocument15 pagesBudgeting Tools and How My Budg - Francis JonahJulien KhalilNo ratings yet

- FinanceDocument2 pagesFinanceMica YoungNo ratings yet

- Personal Finance for Teens and College Students: The Complete Guide to Financial Literacy for Teens and Young AdultsFrom EverandPersonal Finance for Teens and College Students: The Complete Guide to Financial Literacy for Teens and Young AdultsNo ratings yet

- The Average Joe’s Guide to Budgeting: The Only Guide You Will Need to Start Budgeting Properly, Get Rid of Debt, And Attain Your Financial Peace of MindFrom EverandThe Average Joe’s Guide to Budgeting: The Only Guide You Will Need to Start Budgeting Properly, Get Rid of Debt, And Attain Your Financial Peace of MindNo ratings yet

- Budgeting and Dpending StrategiesDocument9 pagesBudgeting and Dpending StrategiesMaimai DuranoNo ratings yet

- Assignment 2Document2 pagesAssignment 2allyNo ratings yet

- The Art of Extreme Budgeting: How to Live on Almost Nothing and ThriveFrom EverandThe Art of Extreme Budgeting: How to Live on Almost Nothing and ThriveNo ratings yet

- Budget Like a Boss: Take Control of Your Finances with Simple Budgeting and Saving StrategiesFrom EverandBudget Like a Boss: Take Control of Your Finances with Simple Budgeting and Saving StrategiesNo ratings yet

- Financial StabilityDocument5 pagesFinancial StabilityyukiNo ratings yet

- Portfolio WrittenDocument31 pagesPortfolio Writtenapi-488799211No ratings yet

- ReflectionDocument3 pagesReflectionGuene BinwagNo ratings yet

- R-Module 1Document3 pagesR-Module 1Guene BinwagNo ratings yet

- IntroDocument2 pagesIntroGuene BinwagNo ratings yet

- Research 1Document5 pagesResearch 1Guene BinwagNo ratings yet

- Chapter 1.L 2 Use of Farm Tools and EquipmentDocument4 pagesChapter 1.L 2 Use of Farm Tools and EquipmentGuene BinwagNo ratings yet

- Chapter 1. IntroDuctionDocument4 pagesChapter 1. IntroDuctionGuene BinwagNo ratings yet

- TOMATO (Lycopersicum Esculentum) Jam Fortified With MANGO, Pineapple, Papaya and Apple FruitDocument38 pagesTOMATO (Lycopersicum Esculentum) Jam Fortified With MANGO, Pineapple, Papaya and Apple FruitGuene BinwagNo ratings yet

- IM No.: IM-BTLED3-1STSEM-2020-2021: Republic of The Philippines Nueva Vizcaya State University Bayombong, Nueva VizcayaDocument9 pagesIM No.: IM-BTLED3-1STSEM-2020-2021: Republic of The Philippines Nueva Vizcaya State University Bayombong, Nueva VizcayaGuene BinwagNo ratings yet

- Leverage Ratio DefinitionDocument3 pagesLeverage Ratio DefinitionNiño Rey LopezNo ratings yet

- IDFCFIRSTBankstatement 10081906550 235126745Document18 pagesIDFCFIRSTBankstatement 10081906550 235126745Bajrang mirwadNo ratings yet

- CVP Analysis Problem SolvingmbaDocument2 pagesCVP Analysis Problem SolvingmbaAnna Fermina Mendoza100% (1)

- Fitta: Foreign Investment and Transfer of Technology Act 2019Document23 pagesFitta: Foreign Investment and Transfer of Technology Act 2019Binayak GhimireNo ratings yet

- Ashish Krushi Kendra - Te 22-23 3-29-12-2022Document1 pageAshish Krushi Kendra - Te 22-23 3-29-12-2022Kajal PardhiNo ratings yet

- Nokia 6.1 Plus (Black, 64 GB) Refurbished - Good: Grand Total 6299.00Document2 pagesNokia 6.1 Plus (Black, 64 GB) Refurbished - Good: Grand Total 6299.00Swapnil Gade007No ratings yet

- 2021 02 09 SemiconductorsDocument15 pages2021 02 09 SemiconductorskakolakoNo ratings yet

- Philippine Valuation StandardsDocument45 pagesPhilippine Valuation StandardsAl MarzolNo ratings yet

- (Text Here) (Text Here) (Text Here) : Space-Themed Label TemplatesDocument8 pages(Text Here) (Text Here) (Text Here) : Space-Themed Label Templatesfarah6214No ratings yet

- A Comparative Analysis of Private and Public SectorDocument7 pagesA Comparative Analysis of Private and Public SectorShashwat VaidyaNo ratings yet

- Profile - of - MMM-converted - For MergeDocument7 pagesProfile - of - MMM-converted - For Mergemadhukar sahayNo ratings yet

- Home Guide To Install AcDocument2 pagesHome Guide To Install Ac5pdsg25nxqNo ratings yet

- Unit II National Income AccountingDocument61 pagesUnit II National Income Accountinggeeta neupaneNo ratings yet

- Indian Institute of Technology Indore - EngineeringDocument10 pagesIndian Institute of Technology Indore - EngineeringSagar raoNo ratings yet

- Midterm Macro 2Document22 pagesMidterm Macro 2chang vicNo ratings yet

- MGT201 Formulas From Chapter 1 To 22 (Document11 pagesMGT201 Formulas From Chapter 1 To 22 (Ali IbrahimNo ratings yet

- E TicketDocument3 pagesE Ticketakhyar.vindicatedNo ratings yet

- Economics Assignment.Document13 pagesEconomics Assignment.Zarish GulNo ratings yet

- Komatsu Hydraulic Excavator Pc290lc 10 Shop ManualDocument20 pagesKomatsu Hydraulic Excavator Pc290lc 10 Shop Manuallaura100% (29)

- Clamp Vertical: With Adjustable SpindleDocument2 pagesClamp Vertical: With Adjustable SpindleJavier LópezNo ratings yet

- Oct2014 EirDocument61 pagesOct2014 Eirnadhiya2007No ratings yet

- Topic 58 UKfrom1945Document10 pagesTopic 58 UKfrom1945Ana Giráldez RodríguezNo ratings yet

- 1 PartnershipDocument54 pages1 PartnershipShajidur RashidNo ratings yet

- Banking Sector in India: BY Divyabharathi (109) Vamsiprakash (110) DEEPAK (111) Goutham Reddy (112) HEMALATHADocument31 pagesBanking Sector in India: BY Divyabharathi (109) Vamsiprakash (110) DEEPAK (111) Goutham Reddy (112) HEMALATHAamulrocksNo ratings yet

- Junst2106036-Statement Huc0102 ContruccionDocument8 pagesJunst2106036-Statement Huc0102 Contruccioncarmen canturin cabreraNo ratings yet

- 4th QTR Week 6 (Risk Return Trade-Off)Document40 pages4th QTR Week 6 (Risk Return Trade-Off)Nichole Joy XielSera TanNo ratings yet

- (Eng) February Monthly Current Affairs Capsule by Vikas TayaDocument6 pages(Eng) February Monthly Current Affairs Capsule by Vikas TayariyasharmastudiesNo ratings yet

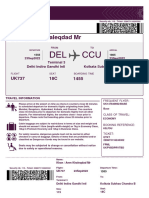

- Boarding Pass To KolkataDocument2 pagesBoarding Pass To KolkataA.N.M. Khaleqdad KhanNo ratings yet