Professional Documents

Culture Documents

Tax Slabs FY 2020-21 - by AssetYogi

Uploaded by

Mohan ChoudharyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Slabs FY 2020-21 - by AssetYogi

Uploaded by

Mohan ChoudharyCopyright:

Available Formats

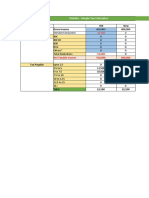

OLD VS NEW INCOME TAX SLABS FY 2020-21

Income (₹) Old Rate Tax Amount New Rate Tax Amount

Upto ₹ 2.5 Lakhs 0 0 0 0

₹ 2.5 Lakhs - ₹ 5 Lakhs 0 0 0 0

₹ 2.5 Lakhs - ₹ 5 Lakhs 5% 12,500 5% 12,500

₹ 5 Lakhs - ₹ 7.5 Lakhs 20% 50,000 10% 25,000

₹ 7.5 Lakhs - ₹ 10 Lakhs 20% 50,000 15% 37,500

₹ 10 Lakhs - ₹ 12.5 Lakhs 30% 75,000 20% 50,000

₹ 12.5 Lakhs - ₹ 15 Lakhs 30% 75,000 25% 62,500

> ₹ 15 Lakhs 30% 30%

Exemptions & Deductions YES NO

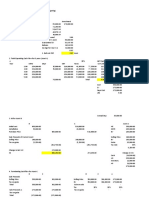

Gross Income (₹) 1,500,000

Low Medium High Very High

Deductions Deductions Deductions Deductions

A B C D

Gross Income 1,500,000 1,500,000 1,500,000 1,500,000

HRA Exemption 360,000

Standard Deduction 50,000 50,000 50,000 50,000

Loss from House Property 200,000

Gross Total Income 1,450,000 1,450,000 1,250,000 1,090,000

Deductions under Sec. 80C 150,000 150,000 150,000

Deductions under Sec. 80D 50,000

Net Taxable Income 1,450,000 1,300,000 1,100,000 890,000

Tax @ Old Slabs 257,400 210,600 148,200.00 114,920

Tax @ New Slabs 195,000 195,000 195,000 195,000

Gain/ Loss under New Slabs 62,400 15,600 -46,800 -80,080

BY - ASSETYOGI

Remarks

If Net Taxable Income is < ₹ 5 Lakhs

If Net Taxable Income is > ₹ 5 Lakhs

Break-Even

E

1,500,000

50,000

1,450,000

150,000

50,000

1,250,000

195,000

195,000

0

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Compare Old and New Income Tax Slabs for FY 2020-21 in IndiaDocument2 pagesCompare Old and New Income Tax Slabs for FY 2020-21 in IndiaSarang AgrawalNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiSACHIN REVEKARNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiMohan ChoudharyNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiAnubhav KumarNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiVishalNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiNirav TailorNo ratings yet

- Latest Income Tax Slabs - Fundfolio by Sharique SamsudheenDocument1 pageLatest Income Tax Slabs - Fundfolio by Sharique SamsudheensalmanNo ratings yet

- Figures and Illustrations - Financial RatiosDocument19 pagesFigures and Illustrations - Financial RatioscamillaNo ratings yet

- Investment B Is Better Than Investment ADocument5 pagesInvestment B Is Better Than Investment AAsh JaneNo ratings yet

- WorkingDocument4 pagesWorkingHaresh RajputNo ratings yet

- AF Ch. 4 - Analysis FS - ExcelDocument9 pagesAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinNo ratings yet

- Tax DefinitionsDocument4 pagesTax DefinitionsrajaNo ratings yet

- Task-1 Master Budget With Profit ProjectionsDocument5 pagesTask-1 Master Budget With Profit ProjectionsbabluanandNo ratings yet

- Provided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDocument5 pagesProvided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDebolina DasNo ratings yet

- Founding Stage Capitalization Table SummaryDocument6 pagesFounding Stage Capitalization Table SummarysonkarmanishNo ratings yet

- Quikchex 2020 Tax Comparison CalculatorDocument1 pageQuikchex 2020 Tax Comparison CalculatorSankar rajNo ratings yet

- 2020 Indian income tax slab ratesDocument2 pages2020 Indian income tax slab ratessarwar raziNo ratings yet

- Income Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionDocument4 pagesIncome Tax Calculator FY 2018-19 (AY 2019-20) : Head DescriptionEr Amit JambhulkarNo ratings yet

- CAPITAL STRUCTURE Sums OnlinePGDMDocument6 pagesCAPITAL STRUCTURE Sums OnlinePGDMSoumendra RoyNo ratings yet

- Cash Flow ForecastDocument6 pagesCash Flow ForecastKlinik Keluarga Dr-NoermanNo ratings yet

- Quikchex 2019 Tax Comparison PDFDocument5 pagesQuikchex 2019 Tax Comparison PDFGMFL MumbaiNo ratings yet

- Problem #23 Page110Document2 pagesProblem #23 Page110jelai anselmoNo ratings yet

- Solution Manual For Managerial Economics Applications Strategies and Tactics 13th Edition DownloadDocument7 pagesSolution Manual For Managerial Economics Applications Strategies and Tactics 13th Edition DownloadStephenWolfpdiz100% (45)

- Tax CalculatorDocument3 pagesTax CalculatorAbhi RamachandranNo ratings yet

- Calculate New Salary Tax by Ather SaleemDocument2 pagesCalculate New Salary Tax by Ather Saleemabdul_348No ratings yet

- Year Cash Benefit Depreciation Income BT Tax at 50% Income AT Cashflow After Tax DF at 10%Document6 pagesYear Cash Benefit Depreciation Income BT Tax at 50% Income AT Cashflow After Tax DF at 10%Farhan Khan MarwatNo ratings yet

- Capital BudgetingDocument6 pagesCapital BudgetingFarhan Khan MarwatNo ratings yet

- Silvia Caffe - SolutionDocument1 pageSilvia Caffe - SolutionMurtaza BadriNo ratings yet

- Calculate New Salary Tax by Ather SaleemDocument2 pagesCalculate New Salary Tax by Ather SaleemMalikKamranAsifNo ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingAngelo VilladoresNo ratings yet

- Old vs New Tax Regimes Comparison for FY 2023-24Document7 pagesOld vs New Tax Regimes Comparison for FY 2023-24Gajendra HoleNo ratings yet

- Practical Practice QuestionsDocument17 pagesPractical Practice QuestionsGungun SharmaNo ratings yet

- Estate TaxDocument7 pagesEstate TaxSirci RamNo ratings yet

- Only Fill Yellow Cells: WorkingsDocument2 pagesOnly Fill Yellow Cells: WorkingsvikrammoolchandaniNo ratings yet

- Calculate New Salary Tax by ShajarDocument2 pagesCalculate New Salary Tax by Shajarshajar-abbasNo ratings yet

- Capital Budgeting: YR Cash BenefitDocument12 pagesCapital Budgeting: YR Cash BenefitFarrukh AbbasNo ratings yet

- Income Tax Amendment FA 2017 - Key Highlights of Individual TaxationDocument14 pagesIncome Tax Amendment FA 2017 - Key Highlights of Individual TaxationrakeshNo ratings yet

- Calculate TaxDocument8 pagesCalculate TaxPhilipp WiegandNo ratings yet

- Main Tables (Lower Version)Document2 pagesMain Tables (Lower Version)vishalbharatshah2776No ratings yet

- Calculating Tax for AOPsDocument26 pagesCalculating Tax for AOPsAbdullah HameedNo ratings yet

- LP 2 Checking For UnderstandingDocument4 pagesLP 2 Checking For UnderstandingRIZLE SOGRADIELNo ratings yet

- Amc Calculator - To Share - Updated v3Document8 pagesAmc Calculator - To Share - Updated v3diegocardenas0091No ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisDwain pinakapogiNo ratings yet

- Main TablesDocument1 pageMain Tablesvishalbharatshah2776No ratings yet

- Financial Model 1Document1 pageFinancial Model 1ahmedmostafaibrahim22No ratings yet

- Aa, Capital First Cash Available To Priority 1-CC Total Cash Payment To PartnerDocument6 pagesAa, Capital First Cash Available To Priority 1-CC Total Cash Payment To PartnerGarp BarrocaNo ratings yet

- Planilla de Sueldos Y Salarios: #Nombre Haber Básico Bono Antigüedad Total Ganado Fecha de Ingreso F-110 TotalDocument4 pagesPlanilla de Sueldos Y Salarios: #Nombre Haber Básico Bono Antigüedad Total Ganado Fecha de Ingreso F-110 TotalAnonymous cASDjraltHNo ratings yet

- Planilla de Sueldos Y Salarios: #Nombre Haber Básico Bono Antigüedad Total Ganado Fecha de Ingreso F-110 TotalDocument4 pagesPlanilla de Sueldos Y Salarios: #Nombre Haber Básico Bono Antigüedad Total Ganado Fecha de Ingreso F-110 TotalAnonymous cASDjraltHNo ratings yet

- Spartan - 031121Document1 pageSpartan - 031121Hải Anh ChanNo ratings yet

- Consolidate Peanut and Snoopy FinancialsDocument4 pagesConsolidate Peanut and Snoopy FinancialsYandra Febriyanti0% (1)

- Lecture 3Document22 pagesLecture 3ahmed qazzafiNo ratings yet

- AE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBDocument7 pagesAE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBArly Kurt TorresNo ratings yet

- Income Tax: Click HereDocument3 pagesIncome Tax: Click HereRrrNo ratings yet

- AE 120 Group Activity AnswersDocument5 pagesAE 120 Group Activity AnswersRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Measures of Leverage: Abhishek SinhaDocument30 pagesMeasures of Leverage: Abhishek Sinhadev guptaNo ratings yet

- Capital Budgeting MathDocument3 pagesCapital Budgeting MathMD.TARIQUL ISLAM CHOWDHURYNo ratings yet

- 2017 Profit and Loss Statement ReviewDocument32 pages2017 Profit and Loss Statement ReviewKhairul AnuarNo ratings yet

- Solution-Class Exercise 2-Capital BudgetingDocument56 pagesSolution-Class Exercise 2-Capital Budgetinggaurav shettyNo ratings yet

- Final Capital Budgeting Class DiscussionDocument88 pagesFinal Capital Budgeting Class Discussiongaurav shettyNo ratings yet

- Rent Receipt Template 1. Employee DetailsDocument1 pageRent Receipt Template 1. Employee DetailsMohan ChoudharyNo ratings yet

- MHT Cet Triumph Physics Mcqs Based On STD Xi Xii Syllabus MH Board SolDocument489 pagesMHT Cet Triumph Physics Mcqs Based On STD Xi Xii Syllabus MH Board SolKhanak Kashyap0% (1)

- Catalog of Indian Coins in The British Museum - Moghul Emperors of HindustanDocument636 pagesCatalog of Indian Coins in The British Museum - Moghul Emperors of HindustanAshwin SevariaNo ratings yet

- Syllabus PDFDocument8 pagesSyllabus PDFdahiphalehNo ratings yet

- Report With ConvectionDocument6 pagesReport With ConvectionMohan ChoudharyNo ratings yet

- MPSC Rajyaseva Pre Syllabus EnglishDocument1 pageMPSC Rajyaseva Pre Syllabus EnglishMohan ChoudharyNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiMohan ChoudharyNo ratings yet

- ReadmeDocument1 pageReadmeAsad IslamNo ratings yet

- Difference Between Raster Scan and Random ScanDocument7 pagesDifference Between Raster Scan and Random ScanMohan ChoudharyNo ratings yet

- A Project ReportDocument43 pagesA Project ReportMohan ChoudharyNo ratings yet

- Jive to Twist - A history of iconic social dancesDocument5 pagesJive to Twist - A history of iconic social dancesHanz Christian PadiosNo ratings yet

- Family Code CasesDocument87 pagesFamily Code CasesIlanieMalinisNo ratings yet

- Providing Safe Water Purification Units to Schools and Communities in Dar es SalaamDocument19 pagesProviding Safe Water Purification Units to Schools and Communities in Dar es SalaamJerryemCSM100% (1)

- Very Effective Visualization TechniquesDocument21 pagesVery Effective Visualization Techniquesbobbydeb100% (6)

- Excerpts From The Book 'The Lawless State (The Crimes of The U.S. Intelligence Agencies) ' by Morton H. Halperin, Jerry Berman, Robert Borosage, Christine Marwick (1976)Document50 pagesExcerpts From The Book 'The Lawless State (The Crimes of The U.S. Intelligence Agencies) ' by Morton H. Halperin, Jerry Berman, Robert Borosage, Christine Marwick (1976)Anonymous yu09qxYCM100% (1)

- The Merchant of Venice (Bullough)Document2 pagesThe Merchant of Venice (Bullough)Ana Stc100% (1)

- A Chart On The Covenant Between God and Adam KnownDocument1 pageA Chart On The Covenant Between God and Adam KnownMiguel DavillaNo ratings yet

- Evaluation and Comparison of Construction Safety Regulations in Kuwait Government SectorsDocument5 pagesEvaluation and Comparison of Construction Safety Regulations in Kuwait Government SectorsUntungSubarkahNo ratings yet

- The Great New Orleans Kidnapping Case-CompactadoDocument320 pagesThe Great New Orleans Kidnapping Case-Compactadofalanariga100% (1)

- Marketing Planning & Application: Submitted To Sir Bilal KothariDocument20 pagesMarketing Planning & Application: Submitted To Sir Bilal KothariSAIF ULLAHNo ratings yet

- Group 2 Selection ListDocument4 pagesGroup 2 Selection ListGottimukkala MuralikrishnaNo ratings yet

- Hitlist Rank - 2 (96909)Document13 pagesHitlist Rank - 2 (96909)AlokSinghNo ratings yet

- Ruta 57CDocument1 pageRuta 57CUzielColorsXDNo ratings yet

- Certbot Documentation GuideDocument124 pagesCertbot Documentation GuideMansour Ndiaye El CheikhNo ratings yet

- ETFO - Aboriginal History and Realities in Canada - Grades 1-8 Teachers' ResourceDocument4 pagesETFO - Aboriginal History and Realities in Canada - Grades 1-8 Teachers' ResourceRBeaudryCCLENo ratings yet

- BSP All AboutDocument9 pagesBSP All AboutRomnick VictoriaNo ratings yet

- Rehabili-Tation of THE Surround - Ings of Santa Maria de Alcobaça MonasteryDocument2 pagesRehabili-Tation of THE Surround - Ings of Santa Maria de Alcobaça MonasteryTashi NorbuNo ratings yet

- Sample Chart Human DesignDocument1 pageSample Chart Human DesignBimoNo ratings yet

- M2.1 J&J Singapore RHQ CaseDocument14 pagesM2.1 J&J Singapore RHQ CaseNishant DehuryNo ratings yet

- BibliographyDocument8 pagesBibliographyVysakh PaikkattuNo ratings yet

- BACC I FA Tutorial QuestionsDocument6 pagesBACC I FA Tutorial Questionssmlingwa0% (1)

- Factors that Increase Obedience and Causes of DisobedienceDocument4 pagesFactors that Increase Obedience and Causes of Disobedienceatif adnanNo ratings yet

- The 2015 IMD World Competitiveness ScoreboardDocument1 pageThe 2015 IMD World Competitiveness ScoreboardCarlos G.No ratings yet

- Banker Customer RelationshipDocument4 pagesBanker Customer RelationshipSaadat Ullah KhanNo ratings yet

- Chapter 1Document37 pagesChapter 1bhawesh agNo ratings yet

- Who Are The MillennialsDocument2 pagesWho Are The MillennialsSung HongNo ratings yet

- Environmental Activity PlanDocument2 pagesEnvironmental Activity PlanMelody OclarinoNo ratings yet

- Scoring Rubric For Automated FS Fabm2Document2 pagesScoring Rubric For Automated FS Fabm2Erica NapigkitNo ratings yet

- Collapse of The Soviet Union-TimelineDocument27 pagesCollapse of The Soviet Union-Timelineapi-278724058100% (1)

- Heavenly Nails Business Plan: Heaven SmithDocument13 pagesHeavenly Nails Business Plan: Heaven Smithapi-285956102No ratings yet