Professional Documents

Culture Documents

HHHHH

Uploaded by

Wan Amirah Fadhlina AriffOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HHHHH

Uploaded by

Wan Amirah Fadhlina AriffCopyright:

Available Formats

2 The audit of Bradley Co’s financial statements for the year ended 31 August 20X5 is nearly complete, and

nd the

auditor’s report is due to be issued next week. Bradley Co operates steel processing plants at 20 locations and sells

its output to manufacturers and engineering companies. You are performing an engagement quality control review on

the audit of Bradley Co, as it is a significant new client of your firm. The financial statements recognise revenue of

$2·5 million, and total assets of $35 million.

(a) One of the audit assistants who has been working on the audit of Bradley Co made the following comments when

discussing the completion of the audit with you:

‘I was assigned to the audit of provisions. One of the provisions, amounting to $10,000, relates to a legal claim

made against the company after an employee was injured in an accident at one of the steel processing plants. I

read all of the correspondence relating to this, and tried to speak to Bradley Co’s legal advisers, but was told by

the finance director that I must not approach them and should only speak to him about the matter. He said that

he is confident that only $10,000 needs to be recognised and that the legal advisers had confirmed this amount

to him in a discussion of the matter. I noted in the audit working papers that I could not perform all of the planned

audit procedures because I could not speak to the legal advisers. The audit manager told me to conclude that

provisions are correctly recognised in the financial statements based on the evidence obtained, and to move on

to my next piece of work. He said it didn’t matter that I hadn’t spoken to the legal advisers because the matter

is immaterial to the financial statements.

‘We received the final version of the financial statements and the chairman’s statement to be published with the

financial statements yesterday. I have quickly looked at the financial statements but the audit manager said we

need not perform a final detailed analytical review on the financial statements as the audit was relatively low risk.

The manager also said that he had discussed the chairman’s statement with the finance director, so no further

work on it is needed. The audit has been quite time-pressured and I know that the client wants the auditor’s

report to be issued as soon as possible.’

Required:

Explain the quality control and other professional issues raised by the audit assistant’s comments, discussing

any implications for the completion of the audit. (10 marks)

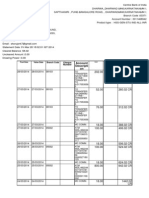

(b) The schedule of uncorrected misstatements included in Bradley Co’s audit working papers is shown below,

including notes to explain each matter included in the schedule. The audit engagement partner is holding a

meeting with management tomorrow, at which the uncorrected misstatements will be discussed.

Statement of profit or loss Statement of financial position

Debit Credit Debit Credit

$ $ $ $

1. Share-based payment scheme 300,000 300,000

2. Restructuring provision 50,000 50,000

3. Estimate of additional allowance

required for slow-moving inventory 10,000 10,000

–––––––– ––––––– ––––––– ––––––––

Totals 310,000 50,000 50,000 310,000

–––––––– ––––––– ––––––– ––––––––

Notes:

1. A share-based payment scheme was established in January 20X5. Management has not recognised any

amount in the financial statements in relation to the scheme, arguing that due to the decline in Bradley Co’s

share price, the share options granted are unlikely to be exercised. The audit conclusion is that an expense

and related equity figure should be included in the financial statements.

2. A provision has been recognised in respect of a restructuring involving the closure of one of the steel

processing plants. Management approved the closure at a board meeting in August 20X5, but only

announced the closure to employees in September 20X5. The audit conclusion is that the provision should

not be recognised.

3. The allowance relates to slow-moving inventory in respect of a particular type of steel alloy for which demand

has fallen. Management has already recognised an allowance of $35,000, which is considered insufficient

by the audit team.

You might also like

- Interpretation and Application of International Standards on AuditingFrom EverandInterpretation and Application of International Standards on AuditingNo ratings yet

- 304.AUDP - .L III Question CMA June 2021 Exam.Document3 pages304.AUDP - .L III Question CMA June 2021 Exam.Md Joinal AbedinNo ratings yet

- CFAP 6 AARS Winter 2020Document4 pagesCFAP 6 AARS Winter 2020ANo ratings yet

- The Professionals’ Academy of Commerce Pakistan's Leading Accountancy Institute Certificate in Accounting and Finance Stage Examinations June 17, 2020Document36 pagesThe Professionals’ Academy of Commerce Pakistan's Leading Accountancy Institute Certificate in Accounting and Finance Stage Examinations June 17, 2020ShehrozSTNo ratings yet

- Sprintclass Mock - Q2Document2 pagesSprintclass Mock - Q2Nur AmirahNo ratings yet

- Advanced Audit & Assurance: RequiredDocument4 pagesAdvanced Audit & Assurance: RequiredLaskar REAZNo ratings yet

- Assessment Test 1Document3 pagesAssessment Test 1Arslan AhmadNo ratings yet

- Advance Stage May June 2012 - AllDocument27 pagesAdvance Stage May June 2012 - AllSHEIKH MOHAMMAD KAUSARUL ALAMNo ratings yet

- AUDIT & ASSURANCE - ND-2022 - QuestionDocument7 pagesAUDIT & ASSURANCE - ND-2022 - QuestionTamzid Ahmed AnikNo ratings yet

- AUDIT & ASSURANCE - ND-2023 - QuestionDocument6 pagesAUDIT & ASSURANCE - ND-2023 - QuestionusmanbfaizNo ratings yet

- Certificate in Accounting and Finance Stage Exam Audit and Assurance QuestionsDocument3 pagesCertificate in Accounting and Finance Stage Exam Audit and Assurance QuestionsAdil AfridiNo ratings yet

- 1773006669aaa - LPS 4 - Q PDFDocument2 pages1773006669aaa - LPS 4 - Q PDFAhmad Ali AyubNo ratings yet

- F20-AAUD Questions Dec08Document3 pagesF20-AAUD Questions Dec08irfanki0% (1)

- Aud and atDocument21 pagesAud and atVtgNo ratings yet

- MTQs F2Document8 pagesMTQs F2Menaal UmarNo ratings yet

- Case Set 7 - Subsequent Events and Going ConcernDocument5 pagesCase Set 7 - Subsequent Events and Going ConcernTimothy WongNo ratings yet

- 3 Implications For Report - Bradley - ClarkDocument9 pages3 Implications For Report - Bradley - Clarksbracca1No ratings yet

- AA RTP M24Document32 pagesAA RTP M24luvkumar3532No ratings yet

- TH STDocument34 pagesTH STShivani KumariNo ratings yet

- Pe2 Auditing Nov05Document14 pagesPe2 Auditing Nov05api-3825774No ratings yet

- Audit, Assurance and Related Services: Certified Finance and Accounting Professional Stage ExaminationDocument3 pagesAudit, Assurance and Related Services: Certified Finance and Accounting Professional Stage Examinationmunira 22No ratings yet

- CFAP 6 AARS Winter 2017Document3 pagesCFAP 6 AARS Winter 2017shakilNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument13 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestGJ ELASHREEVALLINo ratings yet

- Audit MTP Nov'22Document22 pagesAudit MTP Nov'22Kushagra SoniNo ratings yet

- Accounts RTP May 23Document34 pagesAccounts RTP May 23ShailjaNo ratings yet

- CASE STUDY BASED (WITHOUT ANSWERS)Document14 pagesCASE STUDY BASED (WITHOUT ANSWERS)mshivam617No ratings yet

- Advanced Auditing: T I C A PDocument4 pagesAdvanced Auditing: T I C A PDanish KhanNo ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- RTP - May 2022 - Paper 3Document26 pagesRTP - May 2022 - Paper 3SSRA ARTICALSNo ratings yet

- RTP May2022 - Paper 5 Advanced AccountingDocument46 pagesRTP May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- I. Multiple ChoicesDocument7 pagesI. Multiple ChoicesAlain Fung Land MakNo ratings yet

- Solutions To Auditing & Assurance Standards Nov 2009 - PCC/IPCCDocument9 pagesSolutions To Auditing & Assurance Standards Nov 2009 - PCC/IPCCtanguduhareeshNo ratings yet

- ADVANCED AUDITING AND PROFESSIONAL ETHICS-3 QDocument16 pagesADVANCED AUDITING AND PROFESSIONAL ETHICS-3 QCAtestseriesNo ratings yet

- Attention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Document9 pagesAttention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Dharnis123No ratings yet

- CB1 - April23 - EXAM - Clean ProofDocument7 pagesCB1 - April23 - EXAM - Clean ProofAdvay GuglianiNo ratings yet

- C2 Grande Finale Solving Nov 2023 - Set 2 (Questions)Document6 pagesC2 Grande Finale Solving Nov 2023 - Set 2 (Questions)Jones lubaNo ratings yet

- CA-Inter-Accounts-RTP-Nov23-castudynotes-comDocument33 pagesCA-Inter-Accounts-RTP-Nov23-castudynotes-comAbhishant KapahiNo ratings yet

- Caf Audit RTP May-24Document27 pagesCaf Audit RTP May-24sunil bohraNo ratings yet

- Intermediate May 2019 B3Document22 pagesIntermediate May 2019 B3PASTORYNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument12 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestshankitNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument12 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The Restritz meshNo ratings yet

- Caf 8 Aud Autumn 2021Document5 pagesCaf 8 Aud Autumn 2021Huma BashirNo ratings yet

- 304.AUDP - .L III December 2020Document3 pages304.AUDP - .L III December 2020Md Joinal AbedinNo ratings yet

- MTP 3 14 Questions 1680520270Document7 pagesMTP 3 14 Questions 1680520270Umar MalikNo ratings yet

- Unsolved Paper Part IDocument107 pagesUnsolved Paper Part IAdnan KazmiNo ratings yet

- Activity 4 Ch293031 Drill With Answer KeyDocument2 pagesActivity 4 Ch293031 Drill With Answer KeyMABI ESPENIDONo ratings yet

- D11 AudDocument2 pagesD11 AudadnanNo ratings yet

- Paper12 Solution RevisedDocument17 pagesPaper12 Solution Revised15Nabil ImtiazNo ratings yet

- Audit and Assurance: Certificate in Accounting and Finance Stage ExaminationDocument4 pagesAudit and Assurance: Certificate in Accounting and Finance Stage ExaminationUsama RajaNo ratings yet

- Extracted Chapter 1Document103 pagesExtracted Chapter 1PalisthaNo ratings yet

- Assignment 2021Document1 pageAssignment 2021Alamin Rahman JuwelNo ratings yet

- D11 AudDocument2 pagesD11 AudadnanNo ratings yet

- Final Examination Advice ACC3200 T2 2020 Date of Exam: 11 November 2020 Time: 4 PM - 7 PM (3 Hours) - Part A: Multiple Choice Questions (50 Marks)Document10 pagesFinal Examination Advice ACC3200 T2 2020 Date of Exam: 11 November 2020 Time: 4 PM - 7 PM (3 Hours) - Part A: Multiple Choice Questions (50 Marks)Hariprasad KSNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument10 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The Restritz meshNo ratings yet

- CAF 8 AUD Spring 2023Document3 pagesCAF 8 AUD Spring 2023saad.office101No ratings yet

- Term Test 1Document3 pagesTerm Test 1Hassan TanveerNo ratings yet

- Graded Quesions Complete Book0 PDFDocument344 pagesGraded Quesions Complete Book0 PDFFarrukh AliNo ratings yet

- GUIDELINE ANSWERS FOR COMPANY ACCOUNTS AND AUDITING PRACTICESDocument80 pagesGUIDELINE ANSWERS FOR COMPANY ACCOUNTS AND AUDITING PRACTICESmkeyNo ratings yet

- May 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeDocument19 pagesMay 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeVonnieNo ratings yet

- 18552pcc Sugg Paper Nov09 2 PDFDocument14 pages18552pcc Sugg Paper Nov09 2 PDFGaurang AgarwalNo ratings yet

- Q3 (B) InformationDocument1 pageQ3 (B) InformationWan Amirah Fadhlina AriffNo ratings yet

- MJ19 Sample AFM QPDocument12 pagesMJ19 Sample AFM QPNoor SohailNo ratings yet

- Q3 (B) InformationDocument1 pageQ3 (B) InformationWan Amirah Fadhlina AriffNo ratings yet

- Q2 (B) RequirementDocument1 pageQ2 (B) RequirementWan Amirah Fadhlina AriffNo ratings yet

- Bradley Co Audit IssuesDocument1 pageBradley Co Audit IssuesWan Amirah Fadhlina AriffNo ratings yet

- Unggul Indah Cahaya - Bilingual - 31 - Des - 2017 - Released - RevisiDocument125 pagesUnggul Indah Cahaya - Bilingual - 31 - Des - 2017 - Released - Revisiwr KheruNo ratings yet

- NBP Funds: NBP Aitemaad Mahana Amdani Fund (NAMAF)Document1 pageNBP Funds: NBP Aitemaad Mahana Amdani Fund (NAMAF)Sajid rasoolNo ratings yet

- Problems 7 10Document19 pagesProblems 7 10Margiery GannabanNo ratings yet

- Credit Creation: Primary Deposits: Primary Deposits Arise or Formed When Cash or Cheque Is Deposited byDocument7 pagesCredit Creation: Primary Deposits: Primary Deposits Arise or Formed When Cash or Cheque Is Deposited byMaisha AnzumNo ratings yet

- Various Time Value Situations Answer Each of These Unrelated QueDocument1 pageVarious Time Value Situations Answer Each of These Unrelated QueM Bilal SaleemNo ratings yet

- Jnri Credit 127 Corporation: Promissory NoteDocument3 pagesJnri Credit 127 Corporation: Promissory NoteEra gasperNo ratings yet

- Financial Risk Management Fs Analysis Students CopyDocument7 pagesFinancial Risk Management Fs Analysis Students Copyshai santiagoNo ratings yet

- MBA Finance Thesis Topics: Stock Analysis, Mutual Funds, Banks, InsuranceDocument2 pagesMBA Finance Thesis Topics: Stock Analysis, Mutual Funds, Banks, InsuranceSalman Rahi100% (2)

- ISA 580 MindMapDocument1 pageISA 580 MindMapAli HaiderNo ratings yet

- Final Judgment For Defendants v. Wells Fargo Bank, N.A., in A Residential Mortgage Foreclosure Case After Trial Held in Hernando County, Florida, Before Judge Angel On Feb. 14, 2013.Document11 pagesFinal Judgment For Defendants v. Wells Fargo Bank, N.A., in A Residential Mortgage Foreclosure Case After Trial Held in Hernando County, Florida, Before Judge Angel On Feb. 14, 2013.Chuck Kalogianis100% (1)

- Acc2202 w21 Excel Assignment 1 Student File FinalDocument10 pagesAcc2202 w21 Excel Assignment 1 Student File FinalHao FanNo ratings yet

- Banking Porters Five ForcesDocument3 pagesBanking Porters Five ForcesShivani RedkarNo ratings yet

- FINAL Internship Report of Askari BankDocument126 pagesFINAL Internship Report of Askari Bankatif aslam29% (7)

- Chapter 1 MFDocument11 pagesChapter 1 MFmanisha manuNo ratings yet

- Week 4 General Annuity Take AwayDocument9 pagesWeek 4 General Annuity Take AwayJohn Daniel AntolinNo ratings yet

- e-StatementBRImo 453901021380539 May2023 20230619 112554Document7 pagese-StatementBRImo 453901021380539 May2023 20230619 112554Dwi AlmadaniNo ratings yet

- Mutual Fund Investment From An Individual's PerspectiveDocument89 pagesMutual Fund Investment From An Individual's PerspectiveSAJIDA SHAIKHNo ratings yet

- Investment in Subsidiary Problem A - Equity Model and Cost ModelDocument7 pagesInvestment in Subsidiary Problem A - Equity Model and Cost ModelJessica IslaNo ratings yet

- Bond Portfolio Management 25728 Autumn 2012 Assignment 1Document5 pagesBond Portfolio Management 25728 Autumn 2012 Assignment 1Dai DexterNo ratings yet

- Print Financials 1Document1 pagePrint Financials 1ER ABHISHEK MISHRANo ratings yet

- CH 7 SolutionsDocument12 pagesCH 7 SolutionsGabriel PanoNo ratings yet

- Canara BankDocument6 pagesCanara Bankannu priyaNo ratings yet

- Chapter 13 - Basic - ET3Document3 pagesChapter 13 - Basic - ET3anthony.schzNo ratings yet

- Account Descripti On: Cheque NumberDocument12 pagesAccount Descripti On: Cheque NumberSrujan KulkarniNo ratings yet

- 4A8 OperationDocument8 pages4A8 OperationCarl Dhaniel Garcia SalenNo ratings yet

- Lec8 - Class Exercise 4aDocument2 pagesLec8 - Class Exercise 4aMUHAMMAD HAMIZAN BIN ROSMAN MoeNo ratings yet

- Abstruct: Keywords: Hedge Accounting, Risk Management, International Accounting Standards, FairDocument11 pagesAbstruct: Keywords: Hedge Accounting, Risk Management, International Accounting Standards, Fairlakhdimi abdelhamidNo ratings yet

- Leumi Wire Form PDFDocument3 pagesLeumi Wire Form PDFGregory GilbertNo ratings yet

- Federalregister - Gov/d/2020-20527, and On Govinfo - GovDocument24 pagesFederalregister - Gov/d/2020-20527, and On Govinfo - GovForkLogNo ratings yet

- Asset Turnover Ratio Definition (Rev. 2020) - InvestopediaDocument6 pagesAsset Turnover Ratio Definition (Rev. 2020) - InvestopediaBob KaneNo ratings yet