Professional Documents

Culture Documents

Ifac Public Sector Committee: Employee Benefits

Uploaded by

Blessmore Andrew ChikwavaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ifac Public Sector Committee: Employee Benefits

Uploaded by

Blessmore Andrew ChikwavaCopyright:

Available Formats

Draft for PSC Review November 2002 Item 9.

3

Page 9.6

IFAC Issued Month 2003

Exposure Draft XX

Public Response Due Date XX Month 2003

Sector

Committee

DRAFT ONLY

FOR PSC REVIEW

NOVEMBER 2002

Employee Benefits

Proposed International Public Sector

Accounting Standard

Issued for

comment by

the International

Federation of

Accountants

ED XX Employee Benefits Other than Post-employment Benefits

Draft for PSC Review November 2002 Page 9.7

This Exposure Draft was approved by the Public Sector Committee of the

International Federation of Accountants.

Acknowledgment

This Exposure Draft of an International Public Sector Accounting Standard is

drawn primarily from International Accounting Standard IAS 19 (2002),

Employee Benefits published by the International Accounting Standards

Committee (IASC). The International Accounting Standards Board (IASB) and

the International Accounting Standards Committee Foundation (IASCF) were

established in 2001 to replace the IASC. The International Accounting Standards

(IASs) issued by the IASC remain in force until they are amended or withdrawn

by the IASB. Extracts from IAS 19 are reproduced in this publication of the

Public Sector Committee of the International Federation of Accountants with the

permission of the IASB.

The approved text of the IASs is that published by the IASB in the English

language, and copies may be obtained directly from IASB Publications

Department, 7th Floor, 166 Fleet Street, London EC4A 2DY, United Kingdom.

E-mail: publications@iasb.org.uk

Internet: http://www.iasb.org.uk

IASs, Exposure Drafts and other publications of the IASC and IASB are

copyright of the IASCF.

“IAS”, “IASB”, “IASC”, “IASCF” and “International Accounting Standards”

are Trade Marks of the IASCF and should not be used without the approval of the

IASCF.

Information about the International Federation of Accountants and copies of this Exposure

Draft can be found at its internet site, http://www.ifac.org.

The approved text of this Exposure Draft is that published in the English language.

Copyright © 2003 by the International Federation of Accountants. All rights reserved.

Copies of this Exposure Draft may be made for the purpose of preparing comments to be

submitted to IFAC, provided such copies are for personal or intra-organization use only and

are not sold or disseminated, and provided each copy acknowledges IFAC’s copyright and

sets out IFAC’s address in full. Otherwise, no part of this publication may be reproduced,

stored in a retrieval system, or transmitted, in any form or by any means, electronic,

mechanical, photocopying, recording, or otherwise, without the prior written permission of

the International Federation of Accountants.

International Federation of Accountants

535 Fifth Avenue, 26th Floor

New York, New York 10017

United States of America

Web site: http://www.ifac.org

DRAFT ONLY FOR PSC REVIEW PSC November 2002

Draft for PSC Review November 2002 Page 9.8

Commenting on this Exposure Draft

This Exposure Draft of the International Federation of Accountants was

prepared by the Public Sector Committee. The proposals in this

Exposure Draft may be modified in the final Standard in the light of

comments received before being issued in the form of an International

Public Sector Accounting Standard.

Comments should be submitted in writing so as to be received by XX

Month 2003. E-mail responses are preferred. Unless respondents to

Exposure Drafts specifically request confidentiality, their comments are a

matter of public record once a Standard has been issued. Comments

should be addressed to:

The Technical Director

International Federation of Accountants

535 Fifth Avenue, 26th Floor

New York, New York 10017

United States of America

Fax: +1 (212) 286-9570

E-mail Address: EDComments@ifac.org

DRAFT ONLY FOR PSC REVIEW PSC November 2002

8

Draft for PSC Review November 2002 Page 9.9

INTRODUCTION

Accounting Standards for the Public Sector

The International Federation of Accountants — Public Sector Committee

(the Committee) is developing a core set of recommended accounting

standards for public sector entities referred to as International Public

Sector Accounting Standards (IPSASs). The Committee recognizes the

significant benefits of achieving consistent and comparable financial

information across jurisdictions and it believes that the IPSASs play a

key role in enabling these benefits to be realized.

The IPSASs are based on the International Financial Reporting Standards

(IFRSs), formerly known as International Accounting Standards (IASs),

issued by the International Accounting Standards Board (IASB), where

the requirements of those Standards are applicable to the public sector.

The Committee is also developing IPSASs that deal with accounting

issues in the public sector that are not addressed in the IFRSs or IASs.

The adoption of IPSASs by governments will improve both the quality Item 18 has

and comparability of financial information reported by public sector proposed

entities around the world. The Committee strongly encourages amendments

to the

governments and national standard setters to engage in the development “Introduction”

of its Standards by commenting on the proposals set out in these to IPSASs to

Exposure Drafts. The Committee recognizes the right of governments be considered

and national standard setters to establish guidelines and accounting by the PSC.

standards for financial reporting by the public sector in their This

“introduction”

jurisdictions. The Committee encourages the adoption of IPSASs and is marked up

the harmonization of national requirements with IPSASs. Financial for one of

statements should be described as complying with IPSASs only if they those

comply with all the requirements of each applicable IPSAS. proposed

amendments.

DRAFT ONLY FOR PSC REVIEW PSC November 2002

9

Draft for PSC Review November 2002 Page 9.10

Due Process and Timetable

An important part of the process of developing IPSASs is for the

Committee to receive comments on the proposals set out in these

Exposure Drafts from governments, public sector entities, auditors,

standard setters and other parties with an interest in public sector

financial reporting. Accordingly, each proposed IPSAS is first released

as an Exposure Draft, inviting interested parties to provide their

comments. Exposure Drafts will usually have a comment period of four

months, although longer periods may be used for certain Exposure

Drafts. Upon the closure of the comment period, the Committee will

consider the comments received on the Exposure Draft and may modify

each proposed IPSASs in the light of the comments received before

proceeding to issue a final Standard.

It is anticipated that the complete set of initial Standards will be Staff

amendments

substantially completed by the end of 2001. based on

amendments

Purpose of the Exposure Draft made to the

“Introduction”

when

This Exposure Draft proposes to establish requirements for the considering

accounting treatment and disclosure of employee benefits other than IPSAS 19 and

IPSAS 20.

post-employment benefits, other long-term employee benefits and equity

compensation benefits. The PSC continues to monitor the current IASB

work on post-employment benefits and share-based payments with a

view to issue a separate Exposure Draft on post-employment benefits ,

other long-term employee benefi ts and equity compensation benefits in

the future.

Request for Comments

Comments are invited on any proposals in this Exposure Draft by xx

Month 2003. The Committee would prefer that respondents express a

clear overall opinion on whether the Exposure Draft in general is

supported and that this opinion be supplemented by detailed comments,

whether supportive or critical, on the issues in the Exposure Draft.

Respondents are also invited to provide detailed comments indicating the

specific paragraph number or groups of paragraphs to which they relate,

clearly explaining the issue and suggesting alternative wording, with

supporting reasoning, where this is appropriate.

DRAFT ONLY FOR PSC REVIEW

10

Draft for PSC Review November 2002 Page 9.11

Specific Matters for Comment

In applying IASs to public sector entities, the Committee is aware of the

importance of adapting those Standards so that they contribute to

improved financial reporting in the public sector. To ensure that

outcome is achieved, the Committee would particularly value comment

on the proposals to:

(a) exclude post-employment benefits, other long-term employee

benefits and equity compensation benefits from the scope of the

IPSAS . The PSC continues to monitor the current IASB work

on post-employment benefits and share based payments with a

view to issue a separate expos ure draft on these subjects in the

future.

(b) include guidance on the recognition and measurement of

employee benefits provided in a non-monetary form such as

housing, motor cars, medical care and free or subsidized goods

and services (paragraphs 14 to 16 ). The guidance deals with

cases where the employees’ right to non-monetary benefits:

(i) do not accrue in proportion to their period of service

and do not accumulate; or

(ii) may accrue in proportion to periods of service and/or

accumulate over a number of reporting periods;

(c) include guidance on constructive obligations resulting in the

recognition of a liability for termination benefits which is

consistent and replicates the provisions of IPSAS 19 in relation

to restructuring (paragraphs 37 to 42) or include in the IPSAS a

cross reference to IPSAS 19; and

(d) whether the discount rate described in paragraph 45 of the

exposure draft is the appropriate rate for discounting termination

benefits obligations of the public sector.

DRAFT ONLY FOR PSC REVIEW

11

Draft for PSC Review November 2002 Page 9.12

Contents

International Public Sector Accounting Standard

IPSAS XX

Employee Benefits

OBJECTIVE

SCOPE Paragraphs 1–8

DEFINITIONS 9

SHORT TERM EMPLOYEE BENEFITS 10– 28

Recognition and Measurement 12 – 28

All Short-term Employee Benefits 12 – 16

Short-term Compensated Absences 17 – 22

Bonus Plans 23 – 28

Disclosure 29

TERMINATION BENEFITS 30 – 50

Recognition and Measurement 31 – 47

Recognition 31 – 42

Measurement 43 – 47

Disclosure 48 – 50

TRANSITIONAL PROVISIONS 51

EFFECTIVE DATE 52 – 53

COMPARISON WITH IAS 19

DRAFT ONLY FOR PSC REVIEW

12

Draft for PSC Review November 2002 Page 9.13

INTERNATIONAL PUBLIC SECTOR

ACCOUNTING STANDARD IPSAS XX

Employee Benefits

The standards, which have been set in bold italic type, should be read in

the context of the commentary paragraphs in this Standard, which are in

plain type, and in the context of the “Preface to International Public

Sector Accounting Standards”. International Public Sector Accounting

Standards are not intended to apply to immaterial items.

Objective

The objective of this Standard is to prescribe the accounting and

disclosure for employee benefits other than post-employment benefits,

other long-term benefits and equity compensation benefits. The Standard

requires an entity to recognize:

(a) a liability when an employee has provided service in exchange

for employee benefits to be paid in the future; and

(b) an expense when the entity consumes the economic benefit

arising from service provided by an employee in exchange for

employee benefits.

Scope

1. This Standard should be applied by an employer in accounting

for employee benefits.

2 This Standard does not deal with reporting by employee benefit

plans(see IAS 26, accounting and Reporting by retirement

benefit Plans).

Paras 1

1. An entity which prepares and presents financial statements to 3

added by

under the accrual basis of accounting should apply this staff.

Standard in accounting for employee benefits other than:

(a) post-employment benefits;

(b) other long-term employee benefits

(c) equity compensation benefits; and

DRAFT ONLY FOR PSC REVIEW

13

Draft for PSC Review November 2002 Page 9.14

(d) employee benefits dealt with in other International

Public Sector Accounting Standards

2. This Standard applies to all public sector entities other than

Government Business Enterprises.

3. Government Business Enterprises (GBEs) are required to

comply with International Accounting Standards (IASs) issued

by the International Accounting Standards Committee. The

Public Sector Committee’s Guideline No. 1 Financial Reporting

by Government Business Enterprises notes that IASs are

relevant to all business enterprises, regardless of whether they

are in the private or public sector. Accordingly, Guidelin e No. 1

recommends that GBEs should present financial statements that

conform, in all material respects, to IASs.

43. This Standard applies to all employee benefits, including those

provided:

(a) under formal plans or other formal agreements between

an entity and individual employees, groups of

employees or their representatives;

(b) under legislative requirements, or through industry

arrangements, whereby enterprises are required to

contribute to national, state, industry or other multi-

employer plans; or

(c) by those informal practices that give rise to a

constructive obligation. Informal practices give rise to

a constructive obligation where the enterprise has no

realistic alternative but to pay employee benefits. An

example of a constructive obligation is where a change

in the enterprise's informal practices would cause

unacceptable damage to its relationship with

employees.

45. Employee benefits to which this standard applies include:

(a) short-term employee benefits, such as wages, salaries

and social security contributions, paid annual leave and

paid sick leave, profit sharing and bonuses (if payable

within twelve months of the end of the period) and non-

monetary benefits (such as medical care, housing, cars

and free or subsidised goods or services but not equity

compensation benefits) for current employees; and

DRAFT ONLY FOR PSC REVIEW

14

Draft for PSC Review November 2002 Page 9.15

(b) post-employment benefits such as pensions, other

retirement benefits, post-employment life insurance and

post-employment medical care;

(c) other long-term employee benefits, including long-

service leave or sabbatical leave, jubilee or other long-

service benefits, long-term disability benefits and, if

they are not payable wholly within twelve months after

the end of the period, profit sharing, bonuses and

deferred compensation;

(db) termination benefits; and.

(e) equity compensation benefits.

Because each category identified in (a) to and (eb) above has

different characteristics, this Standard establishes separate

requirements for each category.

56. Employee benefits include benefits provided to either employees

or their dependants and may be settled by payments (or the

provision of goods or services) made either directly to the

employees, to their spouses, children or other dependants or to

others, such as insurance companies.

67. An employee may provide services to an entity on a full time,

part time, permanent, casual or temporary basis. For the

purpose of this Standard, employees include directors or

members of the governing body and other management

personnel.

8. This Standard does not apply to:

(a) post -employment benefits such as pensions, other

retirement benefits, post-employment life insurance and Drafted

by staff.

post-employment medical care;

(b) other long-term employee benefits, including long-

service leave or sabbatical leave, jubilee or other long-

service benefits, long-term disability benefits and, if

they are payable twelve months or more after the end of

the period, profit sharing, bonuses and deferred

compensation;

(c) equity compensation benefits; and

DRAFT ONLY FOR PSC REVIEW

15

Draft for PSC Review November 2002 Page 9.16

(d) employee benefits dealt with in other International

Public Sector Accounting Standards.

Definitions

79. The following terms are used in this Standard with the

meanings specified:

Employee benefits are all forms of consideration given by an

entity in exchange for service rendered by employees.

Short-term employee benefits are employee benefits (other

than termination benefits and equity compensation benefits)

which fall due wholly within twelve months after the end of the

period in which the employees render the related service.

Post-employment benefits are employee benefits (other than

termination benefits and equity compensation benefits) which

are payable after the completion of employment.

Staff note

Other long-term employee benefits are employee benefits that some

(other than post-employment benefits, termination benefits definitions

and equity compensation benefits ) which do not fall due relating to

pension

wholly within twelve months after the end of the period in provisions

which the employees render the related service. of IAS 19

were

Termination benefits are employee benefits payable as a result omitted

(rather than

of either: struck

through) as

(a) an entity's decision to terminate an employee's they were

employment before the normal retirement date; or not relevant

to this ED.

(b) an employee's decision to accept voluntary Definitions

added from

redundancy in exchange for those benefits. other

IPSASs are

Equity compensation benefits are employee benefits under marked up.

which either:

(a) employees are entitled to receive equity financial

instruments issued by the enterprise (or its parent); or

(b) the amount of the enterprise's obligation to employees

depends on the future price of equity financial

instruments issued by the entity.

DRAFT ONLY FOR PSC REVIEW

16

Draft for PSC Review November 2002 Page 9.17

Equity compensation plans are formal or informal

arrangements under which an enterprise provides equity

compensation benefits for one or more employees.

Vested employee benefits are employee benefits that are not

conditional on future employment.

A constructive obligation is an obligation that derives from an

entity’s actions where:

(a) by an established pattern of past practice, published

policies or a sufficiently specific current statement,

the entity has indicated to other parties that it will

accept certain responsibilities; and

(b) as a result, the entity has created a valid expectation

on the part of those other parties that it will discharge

those responsibilities.

A legal obligation is an obligation that derives from:

(a) a contract (through its explicit or implicit terms);

(b) legislation; or

(c) other operation of law.

Liabilities are present obligations of the entity arising from

past events, the settlement of which is expected to result in an

outflow from the entity of resources embodying economic

benefits or service potential.

Short-term Employee Benefits

810. Short-term employee benefits include items such as:

(a) wages, salaries and social security contributions;

(b) short-term compensated absences (such as paid annual

leave and paid sick leave) where the absences are

expected to occur within twelve months after the end of

the period in which the employees render the related

employee service;

DRAFT ONLY FOR PSC REVIEW

17

Draft for PSC Review November 2002 Page 9.18

(c) profit sharing and bonuses payable within twelve

months after the end of the period in which the

employees render the related service; and

(d) non-monetary benefits (such as medical care, housing,

cars and free or subsidised goods or services) for

current employees.

911. Accounting for short-term employee benefits is generally

straightforward because no actuarial assumptions are required to

measure the obligation or the cost and there is no possibility of

any actuarial gain or loss. Moreover, short-term employee

benefit obligationsthey are measured on an undiscounted basis.

Recognition and Measurement

All Short-term Employee Benefits

1012. When an employee has rendered service to an entity during an

accounting period, the entity should recognise the

undiscounted amount of short-term employee benefits

expected to be paid in exchange for that service:

(a) as a liability (accrued expense), after deducting any

amount already paid. If the amount already paid

exceeds the undiscounted amount of the benefits, an

entity should recognise that excess as an asset

(prepaid expense) to the extent that the prepayment

will lead to, for example, a reduction in future

payments or a cash refund; and

(b) as an expense, unless another International

Accounting Standard requires or permits the

inclusion of the benefits in the cost of an asset (see,

for example, IAS 2,IPSAS 12 Inventories, and IAS

16,IPSAS 17 Property, Plant and Equipment).

Paragraphs 1117, 14 20 and 17 24 explain how an entity

should apply this requirement to short-term employee benefits

in the form of compensated absences and profit sharing and

bonus plans.

13 In some circumstances, employee benefits that are paid or

become payable during the period may result in future economic

benefits or service potential. Such amounts are recognized as Drafted by

Staff.

based on

para 12(b)

DRAFT ONLY FOR PSC REVIEW

18

Draft for PSC Review November 2002 Page 9.19

assets rather than expenses. An example would be wages and

salaries incurred in producing inventories or constructing other

assets. In these cases the wages and salaries will be included in

the cost of those assets under IPSAS 12 Inventories or IPSAS 17

Property, Plant and Equipment .

14 Short-term e mployee benefits may be provided in a n on-

monetary form such as housing, motor cars , medical care , and

free or subsidized goods or services (including interest free or Paragraphs 14

to 16 are

subsidised loans). In some circumstances , the employees’ right based on

to such non-monetary benefits do not acc rue in proportion to similar

their period of service and do not accumulate; rather the right to commentary

in the

receive such benefits in each period exists irrespective of the Australian

duration of service provided by employees. For example , Standard on

payment of health insurance premium by the empl oyer or employee

benefits,

arrangements for the delivery of free or subsidised goods or AASB 1028.

services to employees are not usually dependent on the duration

of service and the employee becomes entitled to such benefits, if

any, on employment. In such circumstances, the cost asso ciated

with providing the benefits is recognized as an expense in the

period in which the benefits are taken by employees . The

amount recognised as expense is determined on the basis of net

marginal cost (if any) to the entity of the benefits provided. No

liability is recognized for non-accumulating benefits that the

employees do not take during the reporting period.

15 In other circumstances, employee’s entitlement to non-monetary

benefits may accrue in proportion to periods of service and /or

accumulate over a number of reporting periods. For example ,

the length of time for which employees are entitled to use the

entity’s housing facilities may be proportional to their periods of

service. To the extent that the entitlements are accumulating

and have not been settled, those benefits satisfy the definition of

liabilities. In such cases , the amount recognized as liability is

determined on the basis of the net marginal cost (if any) to the

employer of the benefits expected to be provided. This requires

employers to recognize as expenses (unless included in the

carrying amount of an asset in accordance with another IPSAS)

accumulating non-monetary benefits in the reporting periods

during which employees accumulate those benefits and not in

the reporting per iods during which the benefits are taken.

16 Where goods or services have been purchased from other

entities, t he net marginal cost will be the cost of the acquired

DRAFT ONLY FOR PSC REVIEW

19

Draft for PSC Review November 2002 Page 9.20

goods or services less any amount expected to be paid or

payable by employees. When non-mo netary benefits provided

by the entity are in the form of interest-free or subsidised loans,

the amount recognized as liabilities is based on the expected

marginal cost to the employer of borrowing those funds, less the

expected interest charged to employe es. Where the goods or

services that the employer produces or manufactures (for

example motor vehicles) are to be sold to employees a ta

discount, the amount recognized as liabilities is based on

marginal production costs less amounts expected to be paid or

payable by employees.

Short-term Compensated Absences

1117. An entity should recognise the expected cost of short-term

employee benefits in the form of compensated absences under

paragraph 10 12 as follows:

(a) in the case of accumulating compensated absences,

when the employees render service that increases

their entitlement to future compensated absences; and

(b) in the case of non-accumulating compensated

absences, when the absences occur.

1218. An entity may compensate employees for absence for various

reasons including vacation, sickness and short-term disability,

maternity or paternity, jury service and military service.

Entitlement to compensated absences falls into two categories:

(a) accumulating; and

(b) non-accumulating.

1319. Accumulating compensated absences are those that are carried

forward and can be used in future periods if the current period's

entitlement is not used in full. Accumulating compensated

absences may be either vesting (in other words, employees are

entitled to a cash payment for unused entitlement on leaving the

entity) or non-vesting (when employees are not entitled to a cash

payment for unused entitlement on leaving). An obligation

arises as employees render service that increases their

entitlement to future compensated absences. The obligation

exists, and is recognised, even if the compensated absences are

non-vesting, although the possibility that employees may leave

before they use an accumulated non-vesting entitlement affects

the measurement of that obligation.

DRAFT ONLY FOR PSC REVIEW

20

Draft for PSC Review November 2002 Page 9.21

1420. An entity should measure the expected cost of accumulating

compensated absences as the additional amount that the entity

expects to pay as a result of the unused entitlement that has

accumulated at the balance sheet date.

1521. The method specified in the previous paragraph 20

measuresrequires the obligation to be measured at the amount of

the additional payments that are expected to arise solely from

the fact that the benefit accumulates. In many cases, an entity

may not need to make detailed computations to estimate that

there is no material obligation for unused compensated

absences. For example, a sick leave obligation is likely to be

material only if there is a formal or informal understanding that

unused paid sick leave may be taken as paid vacation.

Example Illustrating Paragraphs 14 20 and 1521

An A government entity has 100 employees, who are each entitled to

five working days of paid sick leave for each year. Unused sick leave

may be carried forward for one calendar year. Sick leave is taken first

out of the current year's entitlement and then out of any balance

brought forward from the previous year (a LIFO basis). At 31

December 20X1, the average unused entitlement is two days per

employee. The entity expects, based on past experience which is

expected to continue, that 92 employees will take no more than five

days of paid sick leave in 20X2 and that the remaining 8 employees

will take an average of six and a half days each.

The entity expects that it will pay an additional 12 days of sick pay as

a result of the unused entitlement that has accumulated at 31

December 20X1 (one and a half days each, for 8 employees).

Therefore, the entity recognises a liability equal to 12 days of sick

pay.

1622. Non-accumulating compensated absences do not carry forward:

they lapse if the current period's entitlement is not used in full

and do not entitle employees to a cash payment for unused

entitlement on leaving the entity. This is commonly the case for

sick pay (to the extent that unused past entitlement does not

increase future entitlement), maternity or paternity leave and

compensated absences for jury service or military service. An

entity recognises no liability or expense until the time of the

absence, because employee service does not increase the amount

of the benefit.

DRAFT ONLY FOR PSC REVIEW

21

Draft for PSC Review November 2002 Page 9.22

Profit Sharing and Bonus Plans

23 In some jurisdictions, government departments or agencies or

other public sector entities may initiate bonus plans to provide Drafted

incentives to , for example, encourage the efficient performance by staff.

of work by employees. In such cases, the entity may have a

present obligation to make payments under the bonus plan.

1724. An entity should recognise the expected cost of profit sharing

and bonus payments under paragraph 10 12 when, and only

when:

(a) the entity has a present legal or constructive

obligation to make such payments as a result of past

events; and

(b) a reliable estimate of the obligation can be made.

A present obligation exists when, and only when, the entity has

no realistic alternative but to make the payments.

Deleted

18. Under some profit sharing plans, employees receive a share of

as relates

the profit only if they remain with the entity for a specified

to profit

period. Such plans create a constructive obligation as employees

sharing

render service that increases the amount to be paid if they

not

remain in service until the end of the specified period. The

relevant

measurement of such constructive obligations reflects the

to public

possibility that some employees may leave without receiving

sector.

profit sharing payments.

Example Illustrating Paragraph 18

sharing plan requires an entity to pay a specified proportion of

its net profit for the year to employees who serve throughout

the year. If no employees leave during the year, the total profit

sharing payments for the year will be 3% of net profit. The

entity estimates that staff turnover will reduce the payments to

2.5% of net profit.

The entity recognises a liability and an expense of 2.5% of net

profit.

1925. An entity may have no legal obligation to pay a bonus.

Nevertheless, in some cases, an entity has a practice of paying

bonuses. In such cases, the entity has a constructive obligation

because the entity has no realistic alternative but to pay the

DRAFT ONLY FOR PSC REVIEW

22

Draft for PSC Review November 2002 Page 9.23

bonus. The measurement of the constructive obligation reflects

the possibility that some employees may leave without receiving

a bonus.

2026. An entity can make a reliable estimate of its legal or constructive

obligation under a profit sharing or bonus plan when, and only

when:

(a) the formal terms of the plan contain a formula for

determining the amount of the benefit;

(b) the entity determines the amounts to be paid before the

financial statements are authorised for issue; or

(c) past practice gives clear evidence of the amount of the

entity's constructive obligation.

2127. An obligation under profit sharing and bonus plans results from

employee service and not from a transaction with the entity's

owners. Therefore, an entity recognises recognizes the cost of

profit sharing and bonus plans not as a distribution of net profit

but as an expense.

2228. If profit sharing and bonus payments are not due wholly within

twelve months after the end of the period in which the

employees render the related service, those payments are not

short term employee benefits and do not fall within the scope of

this Standard.other long-term employee benefits (see paragraphs

XXX126-131). Also, Iif profit sharing and bonus payments

meet the definition of equity compensation benefits, an entity

treats them under paragraphs 144-152. they do not fall within the

scope of this Standard

Disclosure of Short-term Employee Benefits

23. 29 Although this Standard does not require specific disclosures

about short-term employee benefits, other International Public

Sector Accounting Standards may require disclosures. For

example, where required by IAS 24 IPSAS 20 , Related Party

Disclosures, an entity discloses information about employee

benefits for key management personnel. IAS 1 IPSAS 1 ,

Presentation of Financial Statements, requires that an entity that

classifies its expenses by function should disclose additional

information on the nature of staff costsemployee benefit costs in

the notes and show the provision for employee benefit costs

DRAFT ONLY FOR PSC REVIEW

23

Based on

paras 111

and 96 (e)

Draft for PSC Review November 2002 Page 9.24 of IPSAS 1.

separately on the face of the statement of financial position or in

the notes.

Termination Benefits

132. 30 This Standard deals with termination benefits separately from

the other employee benefits dealt with in this S tandard. because

the event which gives rise to an obligation is the termination

rather than employee service.

Recognition

133.31. An entity should recognise termination benefits as a liability

and an expense when, and only when, the entity is

demonstrably committed to either:

(a) terminate the employment of an employee or group of

employees before the normal retirement date; or

(b) provide termination benefits as a result of an offer

made in order to encourage a voluntary redundancy.

134.32. An entity is demonstrably committed to a termination when,

and only when, the entity has a detailed formal plan for the

termination and is without realistic possibility of withdrawal.

The detailed plan should include, as a minimum:

(a) the location, function, and approximate number of

employees whose services are to be terminated;

(b) the termination benefits for each job classification or

function; and

(c) the time at which the plan will be implemented.

Implementation should begin as soon as possible and

the period of time to complete implementation should

be such that material changes to the plan are not

likely.

135. 33. A government or Aan government entity may be committed, by

legislation, by contractual or other agreements with employees

or their representatives or by a constructive obligation based on

business practice, custom or a desire to act equitably, to make

payments (or provide other benefits) to employees when it

terminates their employment. Such payments are termination

benefits. Termination benefits are typically lump-sum

payments, but sometimes also include:

DRAFT ONLY FOR PSC REVIEW

24

Draft for PSC Review November 2002 Page 9.25

(a) enhancement of retirement benefits or of other post-

employment benefits, either indirectly through an

employee benefit plan or directly; and

(b) salary until the end of a specified notice period if the

employee renders no further service that provides

economic benefits to the entity.

1. 34. In some jurisdictions, S some employee benefits are payable

regardless of the reason for the employee's departure. The

payment of such benefits is certain (subject to any vesting or

minimum service requirements) but the timing of their payment

is uncertain. Although such benefits are described in some

countries as termination indemnities, or termination gratuities,

they are post-employment benefits, rather than termination

benefits and do not fall within the scope of this Standard. Some

entities provide a lower level of benefit for voluntary

termination at the request of the employee (in substance, a post-

employment benefit) than for involuntary termination at the

request of the entity. The additional benefit payable on

involuntary termination is a termination benefit. Para 36

(para 138

137. 35. Termination benefits do not provide an entity with future of IAS 19)

refers to

economic benefits and are recognised as an expense benefits

immediately. which

mostly are

13836 Where an enterprise recognises termination benefits, the related to

stage 2 of

enterprise may also have to account for a curtailment or the project.

retirement benefits or other employee benefits (see paragraph However it

109 Staff note: Para 109 of IAS 19 deals with the recognition of might be

gains or losses on the curtailment or settlement of a defined useful to

retain it in

benefit plan). this ED.

ALTERNATIVE 1

Cross Reference to IPSAS19 (see agenda item 9.1):

“A government or an individual entity may be committed to

provide benefits to employees when terminating their

employment. IPSAS 19 provides guidance on how the general

recognition criteria are applied to the recognition of a provision

for restructuring costs (including costs related to termination

benefits). That guidance may also be relevant to the

recognition of expenses and liabilities for employee

termination benefits arising from a constructive obligation

under this

DRAFT

Standard”.

ONLY FOR PSC REVIEW

25

Draft for PSC Review November 2002 Page 9.26

OR ALTERNATIVE 2

Replicating and adapting guidance

from IPSAS 19 (see agenda item 9.1):

Start of paragraphs that are based on IPSAS 19.

Note: These paragraphs are not included in IAS 19

37. A government or an individual entity may be committed by a

Paras 37 to

constructive obligation to provide termination benefits to 42 are

employees when terminating their employment. A constructive based on

obligation arises only when the entity has a detailed formal plan similar

paras in

setting out the minimum information requir ed in paragraph 3 2 IPSAS 19.

and has raised valid expectations in employees affected (or their see the

representative) that it will carry out the termination by starting memo

(agenda

to implement that plan or by announcing its main features to item 9.1)

those employees (or their representatives).

38. Evidence that a government or an individual government entity

has started to implement a termination plan would be provided,

for example, by the public announcement of the main features of

the plan. A public announcement of a detailed plan to terminate

the employment constitutes a constructive obligation to

terminate only if it is made in such a way and in sufficient detail

(that is, setting out the main features of the plan) that it gives

rise to valid expectations in employees (or their representatives),

that the government or the entity will carry out the terminations.

39. For a plan to be sufficient to give rise to a constructive

obligation when communicated to those employees affected by

it, its implementation needs to be planned to begin as soon as

possible and to be completed in a timeframe that makes

significant changes to the plan unlikely. If it is expected that

there will be a long delay before the terminations begins or that

the terminations will take an unreasonably long time, it is

unlik ely that the plan will raise a valid expectation on the part of

employees that the government or individual entity is at present

DRAFT ONLY FOR PSC REVIEW

26

Draft for PSC Review November 2002 Page 9.27

committed to terminations, because the timeframe allows

opportunities for the government or entity to change its plans.

40. A d ecision by management or the governing body to terminate

the employment of employees taken before the reporting date

does not give rise to a constructive obligation at the reporting

date unless the entity has, before the reporting date:

(a) started to implement the termination plan; or

(b) announced the main features of the termination plan to

those employees affected by it in a sufficiently specific

manner to raise a valid expectation in them that the

entity will carry out the terminations.

In some cases, an entity starts to implement a termination plan,

or announces its main features to those affected, only after the

reporting date. Disclosure may be required under International

Public Sector Accounting Standard IPSAS 14 Events After the

Reporting Date, i f the terminations are of such importance that

their non-disclosure would affect the ability of the users of the

financial statements to make proper evaluations and decisions.

41. Although a constructive obligation is not created solely by a

management or governing body decision , an obligation may

result from other earlier events together with such a decision.

For example, negotiations with employee representatives for

termination payments may have been concluded subject only to

governing body or board app roval. Once that approval has been

obtained and communicated to the employees affected (or their

representatives), the entity has a constructive obligation to carry

out the terminations, if the entity has a detailed formal plan

containing the minimum information set out in paragraph 3 2;

and has raised valid expectations in those employees affected

that it will carry out the terminations.

42. In some countries, the ultimate authority for making decisions

about a public sector entity is vested in a governing body or

board whose membership includes representatives of interests

other than those of management (for example, employees) or

notification to these representatives may be necessary before the

governing body or board decision is taken. Because a decision

by such a governing body or board involves communication to

these representatives, it may result in a constructive obligation

to carry out terminations.

DRAFT ONLY FOR PSC REVIEW

27

Draft for PSC Review November 2002 Page 9.28

End of paragraphs that are based on IPSAS 19.

Measurement

139.43. Where termination benefits fall due more than 12 months after IAS 19

requires that

the balance sheetreporting date, they should be discounted where

using the discount rate specified in paragraph 7845. termination

benefits fall

due more than

140.44. In the case of an offer made to encourage voluntary 12 months

redundancy, the measurement of termination benefits should after the

be based on the number of employees expected to accept the reporting date,

offer. they should be

discounted

using the

78.45. The rate used to discount termination benefit post-employment discount rate

benefit obligations that fall due more than 12 months after the applied to

reporting date should be determined by reference to market discount post-

employment

yields at the reportinge balance sheet date on high quality benefit

corporate bonds. In countries where there is no deep market obligations.

in such bonds, the market yields (at the reporting balance

sheet date) on government bonds should be used. The

currency and term of the corporate bonds or government

bonds should be consistent with the currency and estimated

term of the termination benefitspost-employment benefit

obligations. Mark up in

para 46 is

8046. The discount rate reflects the time value of money but not the based on

entity-specific credit risk borne by the entity’s creditors. The para 79 of

IAS 19 to

discount rate reflects the estimated timing of benefit payments. the extent

In practice, an entity often achieves this by applying a single relevant to

weighted average discount rate that reflects the estimated timing termination

and amount of benefit payments and the currency in which the benefits.

benefits are to be paid.

81 47 In some cases, there may be no deep market in bonds with a

sufficiently long maturity to match the estimated maturity of all

the benefit payments. In such cases, an entity uses current

market rates of the appropriate term to discount shorter term

payments, and estimates the discount rate for longer maturities

by extrapolating current market rates along the yield curve.

Disclosure of Termination Benefits

14148. Where there is uncertainty about the number of employees who

will accept an offer of termination benefits, a contingent liability

DRAFT ONLY FOR PSC REVIEW

28

Draft for PSC Review November 2002 Page 9.29

exists. As required by IAS 37, IPSAS 19 Provisions,

Contingent Liabilities and Contingent Assets, an entity discloses

information about the contingent liability unless the possibility

of an outflow in settlement is remote.

14249. As required by IAS 8IPSAS 3, Net profit Surplus or Loss Deficit

for the Period, Fundamental Errors and Changes in Accounting

Policies, an entity discloses the nature and amount of an

expense if it is of such size, nature or incidence that its

disclosure is relevant to explain the performance of the entity for

the period. Termination benefits may result in an expense

needing disclosure in order to comply with this requirement.

14350. Where required by IAS 24, IPSAS 20 Related Party

Disclosures, an entity discloses information about termination

benefits for key management personnel.

Transitional Provisions

15351. This section specifies the transitional treatment for defined

benefit plans. Where an entity first adopts this Standard, for

other employee benefits, the entityit applies IAS 8 IPSAS 3, Net

Profit Surplus or Loss Deficit for the Period, Fundamental

Errors and Changes in Accounting Policies.

Effective Date

52. This International Public Sector Accounting Standard Paras 52

becomes effective for annual financial statements covering and 53

are

periods beginning on or after XX Month Year. Earlier drafted

application is encouraged. by staff.

53. When an entity adopts the accrual basis of accounting, as

defined by International Public Sector Accounting Standards,

for financial reporting purposes, subsequent to this effective

date, this Standard applies to the entity’s annual financial

statements covering periods beginning on or after the date of

adoption.

DRAFT ONLY FOR PSC REVIEW

29

Draft for PSC Review November 2002 Page 9.30

Comparison with IAS 19

International Public Sector Accounting Standard IPSAS XX Employee

Benefits is drawn primarily from International Accounting Standard

IAS 19 Employee Benefits . The main differences between IPSAS XX

and IAS 19 are as follows:

• IPSAS XX uses different terminology, in certain insta nces, from

IAS 19. The most significant examples are the use of the terms

“entity”, “revenue”, “statement of financial performance”, and

“statement of financial position” in IPSAS XX. The equivalent

terms in IAS 19 are “enterprise”, “income”, “income

statement”, and “balance sheet”.

• IPSAS XX does not deal with post-employment benefits, other

long-term employee benefits and equity compensation benefits.

• IPSAS XX contains additional commentary in relation to

recognition and measurement of short-term non-monetary

benefits.

• IPSAS XX contains additional commentary in relation to

liabilities for termination benefits arising from constructive

obligations.

DRAFT ONLY FOR PSC REVIEW

30

You might also like

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanFrom EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanNo ratings yet

- Ifactransitiontoaccrual PDFDocument250 pagesIfactransitiontoaccrual PDFFryd PurabNo ratings yet

- CN 2021-0010Document84 pagesCN 2021-0010KrissaNo ratings yet

- IPSASB ED 47financial StatementsDocument48 pagesIPSASB ED 47financial StatementsMarian GrajdanNo ratings yet

- Basis-To-ed CF May 2015Document134 pagesBasis-To-ed CF May 2015studentul1986No ratings yet

- Ifric Update November 2015Document9 pagesIfric Update November 2015Neji HergliNo ratings yet

- (Latest) TOPIC 6 SPECIAL ISSUES IN FINANCIAL REPORTINGDocument65 pages(Latest) TOPIC 6 SPECIAL ISSUES IN FINANCIAL REPORTINGMuadz KamaruddinNo ratings yet

- ICAP TRsDocument45 pagesICAP TRsSyed Azhar Abbas0% (1)

- 5.6.9. ISA 710 Comparative Information DefDocument26 pages5.6.9. ISA 710 Comparative Information DefYessenia Elena Gonzalez MagallanesNo ratings yet

- Conceptual Framework Accounting SystemDocument13 pagesConceptual Framework Accounting SystemYes ChannelNo ratings yet

- SECTIONAL INDEX OF TECHNICAL RELEASESDocument37 pagesSECTIONAL INDEX OF TECHNICAL RELEASESHamza ShahidNo ratings yet

- ED SME ConclusionDocument49 pagesED SME ConclusionRadikaAqlanNo ratings yet

- IFRS 9 Financial InstrumentsDocument38 pagesIFRS 9 Financial Instrumentssaoodali1988No ratings yet

- HedgeAcct ED Dec10Document65 pagesHedgeAcct ED Dec10vdhienNo ratings yet

- FrameworkDocument3 pagesFrameworkVola AriNo ratings yet

- IPSAS 32 Service ConcessionDocument63 pagesIPSAS 32 Service ConcessionEmmaNo ratings yet

- The Conceptual Framework For Financial: ReportingDocument32 pagesThe Conceptual Framework For Financial: Reportingmoynul islamNo ratings yet

- 10th Iacc Workshop The Public Sector Committees Standards ProjectlDocument26 pages10th Iacc Workshop The Public Sector Committees Standards ProjectladriolibahNo ratings yet

- Ind AS Alert: Marching Towards Better Reporting StructureDocument1 pageInd AS Alert: Marching Towards Better Reporting StructureKAJALINo ratings yet

- IFRS 17 Presentation " Accounting Treatment": July 2020Document66 pagesIFRS 17 Presentation " Accounting Treatment": July 2020benslama amelNo ratings yet

- IFRS 17 Assets For Acquisition Cash Flows: Explanatory ReportDocument34 pagesIFRS 17 Assets For Acquisition Cash Flows: Explanatory ReportWubneh AlemuNo ratings yet

- IFRS Overview ConferenceDocument12 pagesIFRS Overview ConferenceYagnesh DesaiNo ratings yet

- Ipsas 5-Borrowing Costs: AcknowledgmentDocument13 pagesIpsas 5-Borrowing Costs: Acknowledgmentriska putri utamiNo ratings yet

- E-Technical Update Nov2009Document14 pagesE-Technical Update Nov2009Atif RehmanNo ratings yet

- Insurance ContractsDocument88 pagesInsurance ContractsrmonangpsphmuntheNo ratings yet

- 2003 PR On ImprovementsDocument6 pages2003 PR On ImprovementsKreshen ShunmugamNo ratings yet

- IPSASB CP - Elements Recognition Phase - 2Document68 pagesIPSASB CP - Elements Recognition Phase - 2Vaike ChrisNo ratings yet

- 1204 - Invitation To Comment DRAFT For SMEIG Review - Sanath FernandoDocument74 pages1204 - Invitation To Comment DRAFT For SMEIG Review - Sanath FernandoSanath FernandoNo ratings yet

- Iaasb Isa 810 RevisedDocument31 pagesIaasb Isa 810 RevisedGlenn TaduranNo ratings yet

- Iaasb Ed Isae 3420 - Pro FormasDocument40 pagesIaasb Ed Isae 3420 - Pro FormasSergio Iván Giraldo GarcíaNo ratings yet

- E-Technical Update Jan2010Document11 pagesE-Technical Update Jan2010shakiraliqureshiNo ratings yet

- ED-CON 8-Conceptual Framework For Financial Reporting-Chap 4Document48 pagesED-CON 8-Conceptual Framework For Financial Reporting-Chap 4Jairo Mendez MoraNo ratings yet

- ISA 320 and 450Document25 pagesISA 320 and 450Lara MaderazoNo ratings yet

- E TechnicalDocument6 pagesE Technicalkhurram_66No ratings yet

- Ap12c Ias16 Property Plant EquipmentDocument22 pagesAp12c Ias16 Property Plant EquipmentyoussefNo ratings yet

- 2021 Public Input Complete Monograph Revised 12-14-2021 Reduced File SizeIIDocument1,270 pages2021 Public Input Complete Monograph Revised 12-14-2021 Reduced File SizeIIRodel AlmohallasNo ratings yet

- 550PBE-IAS-12-Jan16-IASB-191466.1Document27 pages550PBE-IAS-12-Jan16-IASB-191466.1Onwuchekwa Chidi CalebNo ratings yet

- IASB Update - February 2010Document6 pagesIASB Update - February 2010JCPAJONo ratings yet

- ISA (UK and Ireland) 706 Revised October 2012Document14 pagesISA (UK and Ireland) 706 Revised October 2012Josiah MwashitaNo ratings yet

- Ias 39Document43 pagesIas 39The ProtectorNo ratings yet

- IAS 16 Part BDocument12 pagesIAS 16 Part BRohail HanifNo ratings yet

- Ifrspracticestatement1 130Document12 pagesIfrspracticestatement1 130TiNo ratings yet

- Fallback To IFRS 9 Financial Instruments 2012Document2 pagesFallback To IFRS 9 Financial Instruments 2012German ChavezNo ratings yet

- 1992 FIDIC Joint Venture AgreementDocument27 pages1992 FIDIC Joint Venture AgreementBabu Balu Babu100% (3)

- NCSR 9-InF.14 - Considerations On The Implementation Arrangement For OnboarDocument5 pagesNCSR 9-InF.14 - Considerations On The Implementation Arrangement For OnboarManish RawatNo ratings yet

- 26 International Financial Reporting StandardsDocument3 pages26 International Financial Reporting StandardsClyleo Eddard YoupaNo ratings yet

- IFRS 9 Financial Instruments GuideDocument70 pagesIFRS 9 Financial Instruments GuideJ. JimenezNo ratings yet

- Financial Instruments: International Financial Reporting Standard 9Document68 pagesFinancial Instruments: International Financial Reporting Standard 9elle868No ratings yet

- IMF Committee Meeting Focuses on Debt Statistics MethodsDocument7 pagesIMF Committee Meeting Focuses on Debt Statistics MethodsHichemBdiriNo ratings yet

- SP 1 - 2009 Economic Development Advisory Committee Work PlanDocument6 pagesSP 1 - 2009 Economic Development Advisory Committee Work Planlangleyrecord8339No ratings yet

- IFRS On Point - January 2021Document8 pagesIFRS On Point - January 2021Khoa PhanNo ratings yet

- 004 - Chapter 02 - Financial Reporting FrameworksDocument10 pages004 - Chapter 02 - Financial Reporting FrameworksHaris ButtNo ratings yet

- 2021-IPSASB-Handbook Vol-1 ENG Web SecureDocument626 pages2021-IPSASB-Handbook Vol-1 ENG Web SecureTESDA PasMakNo ratings yet

- Chapter 1 - Introduction To IFRSDocument4 pagesChapter 1 - Introduction To IFRSBahader AliNo ratings yet

- IAASB Exposure Draft Proposed ISA 240 Revised FraudDocument162 pagesIAASB Exposure Draft Proposed ISA 240 Revised FraudUmmar FarooqNo ratings yet

- 4122 PDFDocument32 pages4122 PDFRussel Jun PachesNo ratings yet

- IFRS On Point - March 2020Document12 pagesIFRS On Point - March 2020The geek CuestaNo ratings yet

- Training On: International Financial Reporting Standards (IFRS)Document54 pagesTraining On: International Financial Reporting Standards (IFRS)Yaqeeroo TubeNo ratings yet

- Introductory Chapters To Derivatives 2021Document127 pagesIntroductory Chapters To Derivatives 2021Blessmore Andrew ChikwavaNo ratings yet

- Market Regulations, Benchmarks, Value Growth Investors Etc 2021Document59 pagesMarket Regulations, Benchmarks, Value Growth Investors Etc 2021Blessmore Andrew ChikwavaNo ratings yet

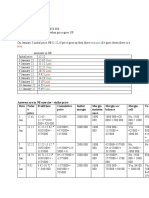

- Company Amount Invested (US$) Portfolio Allocation Returns (US$) Weighted ReturnsDocument5 pagesCompany Amount Invested (US$) Portfolio Allocation Returns (US$) Weighted ReturnsBlessmore Andrew ChikwavaNo ratings yet

- Risc MatrixDocument9 pagesRisc MatrixAlexNo ratings yet

- Group Assignment Q3Document5 pagesGroup Assignment Q3Blessmore Andrew ChikwavaNo ratings yet

- Individula AssignmentDocument2 pagesIndividula AssignmentBlessmore Andrew ChikwavaNo ratings yet

- Lecture 1: Introduction To Financial System and Its OverviewDocument64 pagesLecture 1: Introduction To Financial System and Its OverviewBlessmore Andrew ChikwavaNo ratings yet

- Lecture 8: Market Efficiency: Prof E. ZirambaDocument52 pagesLecture 8: Market Efficiency: Prof E. ZirambaBlessmore Andrew ChikwavaNo ratings yet

- Horticulture Zimbabwe: Updated June 2012Document8 pagesHorticulture Zimbabwe: Updated June 2012Blessmore Andrew ChikwavaNo ratings yet

- Relationship of Ethical Leadership, Corporate Social Responsibility and Organizational PerformanceDocument16 pagesRelationship of Ethical Leadership, Corporate Social Responsibility and Organizational PerformanceSneha Abhash SinghNo ratings yet

- Job Satisfaction and Problems Among Academic Sta in Higher EducationDocument38 pagesJob Satisfaction and Problems Among Academic Sta in Higher EducationBlessmore Andrew ChikwavaNo ratings yet

- Hedge Funds in Global Markets: An Analysis of Regulation and Systemic RiskDocument104 pagesHedge Funds in Global Markets: An Analysis of Regulation and Systemic RiskBlessmore Andrew ChikwavaNo ratings yet

- Disadvantages of Using BinomialDocument1 pageDisadvantages of Using BinomialBlessmore Andrew ChikwavaNo ratings yet

- The Outsourcing Handbook A Guide To Outsourcing PDFDocument62 pagesThe Outsourcing Handbook A Guide To Outsourcing PDFMikiKikiNo ratings yet

- Thomas Conkling ThesisDocument52 pagesThomas Conkling ThesisBlessmore Andrew ChikwavaNo ratings yet

- Technical AnalysisDocument1 pageTechnical AnalysisBlessmore Andrew ChikwavaNo ratings yet

- Study of The Impact of Team Morale On Construction Project PerforDocument45 pagesStudy of The Impact of Team Morale On Construction Project PerforBlessmore Andrew ChikwavaNo ratings yet

- Number 3Document2 pagesNumber 3Blessmore Andrew ChikwavaNo ratings yet

- PysparkDocument407 pagesPysparkAlejandro De LeonNo ratings yet

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- VRIO AnalysisDocument2 pagesVRIO AnalysisrenjuannNo ratings yet

- Service Marketing of J&K BankDocument67 pagesService Marketing of J&K BankSubham ArenNo ratings yet

- Handwork Issue 4Document89 pagesHandwork Issue 4andrew_phelps100% (1)

- TABS Points System Implementing GuidelinesDocument8 pagesTABS Points System Implementing GuidelinesPortCallsNo ratings yet

- QUIZ 2-Mid.-Problems On Statement of Cash FlowsDocument2 pagesQUIZ 2-Mid.-Problems On Statement of Cash FlowsMonica GeronaNo ratings yet

- Intel To Enhance American Companies Competitiveness - Govt RoleDocument6 pagesIntel To Enhance American Companies Competitiveness - Govt RoleTrip KrantNo ratings yet

- Annual Report 2016 2017Document77 pagesAnnual Report 2016 2017Dream GoalNo ratings yet

- The Message Development Tool - A Case For Effective Operationalization of Messaging in Social Marketing PracticeDocument17 pagesThe Message Development Tool - A Case For Effective Operationalization of Messaging in Social Marketing PracticesanjayamalakasenevirathneNo ratings yet

- Stucor Chemba18 1Document8 pagesStucor Chemba18 1SELVAKUMAR SNo ratings yet

- Maintenance of Machinery & PlantsDocument22 pagesMaintenance of Machinery & PlantszeldotdotNo ratings yet

- Carlson School Corporate Investment Decisions Spring 2017Document12 pagesCarlson School Corporate Investment Decisions Spring 2017Novriani Tria PratiwiNo ratings yet

- Topic 6 - ADS 404 Chapter 6 2018Document25 pagesTopic 6 - ADS 404 Chapter 6 2018Nabil Azeem JehanNo ratings yet

- Doc Ssm.nurulhedayahDocument2 pagesDoc Ssm.nurulhedayahrezza590No ratings yet

- Salao SyllabusDocument22 pagesSalao SyllabusOtep de MesaNo ratings yet

- CEA Inspection Compliance Report SummaryDocument4 pagesCEA Inspection Compliance Report Summarykalyan ReddyNo ratings yet

- HR 2-Email DraftDocument4 pagesHR 2-Email DraftMallu SailajaNo ratings yet

- Schedule-H Contract Price WeightagesDocument20 pagesSchedule-H Contract Price Weightagesjalal100% (1)

- Certificate of Incorporation-20190704Document1 pageCertificate of Incorporation-20190704Pinky KumariNo ratings yet

- FAO Project ProfileDocument3 pagesFAO Project ProfileAbubakarr SesayNo ratings yet

- Corazza FB Series ENDocument4 pagesCorazza FB Series ENAbdullahNo ratings yet

- MBA Orientation Manual March 2021Document9 pagesMBA Orientation Manual March 2021SaranyaNo ratings yet

- BID FORM. Mun. of SaraDocument1 pageBID FORM. Mun. of Saravin arañoNo ratings yet

- Oracle® Iprocurement: Implementation and Administration Guide Release 12.2Document290 pagesOracle® Iprocurement: Implementation and Administration Guide Release 12.2Indumathi KumarNo ratings yet

- Industry Sources of Opportunities: Credit To:Mskrabbs19/Industrial-Sector-In-The-PhilippinesDocument34 pagesIndustry Sources of Opportunities: Credit To:Mskrabbs19/Industrial-Sector-In-The-PhilippinesdanieljudeeNo ratings yet

- CMT555 3 Pourbaix Diagrams Sem 4Document28 pagesCMT555 3 Pourbaix Diagrams Sem 4juaxxoNo ratings yet

- Para ImprimirDocument2 pagesPara ImprimirZymafayNo ratings yet

- Squatting LawsDocument3 pagesSquatting LawsRyan AcostaNo ratings yet

- Operators-Data-Sheet (Quezon City) PDFDocument3 pagesOperators-Data-Sheet (Quezon City) PDFGene JabonNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Freight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesFrom EverandFreight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesRating: 5 out of 5 stars5/5 (1)

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsFrom EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsRating: 4 out of 5 stars4/5 (1)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet