Professional Documents

Culture Documents

Economic Indicators: Union Budget 2021

Uploaded by

Ishan Shukla0 ratings0% found this document useful (0 votes)

3 views3 pagesOriginal Title

in-tax-deloitte-union-budget-2021-top-10-economic-tax-and-policy-highlights-noexp

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views3 pagesEconomic Indicators: Union Budget 2021

Uploaded by

Ishan ShuklaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

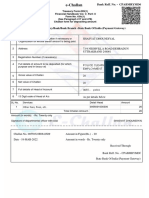

Union Budget 2021

Economic indicators

GDP to contract by Current account

7.7 percent in FY20-21 recorded a

surplus of

GDP growth for

FY22 is projected at

3.1 percent

of GDP in H1 FY21

11 percent* due to modest

imports

The RBI cut repo rate by May record a

surplus of

115 basis points to

4 percent after March 2020 2 percent

for FY21 altogether

Continues with

an accommodative

monetary policy stance

Net FDI inflow jumps to

US$27.5 billion for April-October 2020

14.8 percent higher than April-October 2019

Fiscal deficit in FY21 is projected CPI averaged at

to increase to 9.5 percent 6.6 percent

of GDP from April to December

To target 6.8 percent

2020, driven primarily

by food

in FY22 and below

inflation and

4.5 percent supply

by 2025-2026 disruptions

INR averaged at 74.63

Exports

contracted by

from April to December

2020 as against 15.7 percent

70.38 to US$ 200.8 billion

from April to from April to December 2020

December in 2019

*Growth is measured on a year-over-year basis on real values.

© 2021 Deloitte Touche Tohmatsu India LLP

Union Budget 2021

Top 10 policy

announcements

Government-owned Public sector

development banks proposed

finance institution to be

for infrastructure recapitalised up

debt financing to to INR 20,000

be set up crores (~US$2.67

billion)

A new asset reconstruction

company and an asset

management company

will take over existing

stressed debt

A new entity to be introduced to purchase debt

securities; infrastructure debt funds to be

allowed to raise capital through zero coupon

bonds; infrastructure trusts to be enabled to

borrow from foreign portfolio investors (FPIs)

A single securities markets Privatisation of two public

code to be introduced by sector banks and a general

consolidating four existing insurance company

acts covering capital announced; ongoing

market, depositories, disinvestments of

securities four public

contracts, and sector

government enterprises

securities to be

regulations completed

in FY22

Pipeline for monetisation of public assets

such as roads, railways, oil and gas

infrastructure, power transmission

infrastructure, warehouses, sports

stadiums, etc., to be put in place

Foreign direct investment limit Higher Education

in the insurance sector Commission to be

proposed to be hiked established through a

from 49 percent to legislation for

74 percent standard-setting,

accreditation,

regulation,

Regulated gold

and

exchanges to be set

funding

up countrywide

© 2021 Deloitte Touche Tohmatsu India LLP

Union Budget 2021

Top 10 tax highlights

No changes to corporate or Equalisation

personal income-tax rates levy expanded

by clarifying a)

scope of online

International Financial Services sale of goods/

Centre (IFSC): Eligibility conditions provision of

for India based fund manager services and b)

regime relaxed; income-tax consideration

exemption expanded for offshore on which the

banking units; royalty levy

income from aircraft applies

leasing to IFSC units

exempted

Tax holiday extended to startups incorporated

up to 31 March 2022; capital gains exemption

on investment in startups extended to

31 March 2022

Tax holiday on affordable New tax deduction at

housing projects extended source (TDS) at 0.1%

to those approved by 31 introduced for

March 2022; scope of the tax payments by specified

holiday expanded persons for purchase

to cover affordable of goods from

rental housing a resident

projects seller

Income-tax assessment timelines and the re-

assessment window to be reduced to nine

months and halved to three years, respectively

Faceless Income-tax A new Agriculture Infrastructure

Appellate Tribunal and Development Cess (AIDC) on

(ITAT) appeals import of 25 notified products

scheme with from 2 February 2021 and as

dynamic jurisdiction excise duty on petrol and diesel

to be introduced; once notified; consequential

Authority for reduction in basic

Advance Rulings customs duty also

replaced by Board announced

for Advance Rulings;

Settlement

Commission

discontinued – Customs duty structure to be

pending rationalised by eliminating

applications to be outdated exemptions and phasing

heard by interim out of all conditional exemptions

boards by 31 March immediately

after two years of

introduction

© 2021 Deloitte Touche Tohmatsu India LLP

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Investment Ideas 2022: Key ThemesDocument24 pagesInvestment Ideas 2022: Key ThemesIshan ShuklaNo ratings yet

- ICON Finals Casebook 2021-22Document149 pagesICON Finals Casebook 2021-22Ishan ShuklaNo ratings yet

- Rahul Babulal Pahade Primary Account Holder Name: Your A/C StatusDocument8 pagesRahul Babulal Pahade Primary Account Holder Name: Your A/C StatusrahulpahadeNo ratings yet

- RB Statement 2022 12 12 448307994Document15 pagesRB Statement 2022 12 12 448307994akhbar akhbar0% (1)

- Scanning The Marketing EnvironmentDocument15 pagesScanning The Marketing EnvironmentjaipuriajaipurNo ratings yet

- Sohail2014 Article CharacteristicsOfWeldPoolBehavDocument9 pagesSohail2014 Article CharacteristicsOfWeldPoolBehavIshan ShuklaNo ratings yet

- Development of Stainless Steel Welding Wire For Galvanized Steel SheetsDocument7 pagesDevelopment of Stainless Steel Welding Wire For Galvanized Steel SheetsIshan ShuklaNo ratings yet

- New Findings On The Efficiency of Gas Shielded Arc WeldingDocument7 pagesNew Findings On The Efficiency of Gas Shielded Arc WeldingIshan ShuklaNo ratings yet

- Textile IndustryDocument47 pagesTextile Industryyousuf AhmedNo ratings yet

- Balance of Payments: Chapter ThreeDocument36 pagesBalance of Payments: Chapter ThreeHu Jia QuenNo ratings yet

- Case (Renminbi) - Discussion QuestionsDocument2 pagesCase (Renminbi) - Discussion QuestionsAnimesh ChoubeyNo ratings yet

- Fundamental of Marketing: COMSATS University Islamabad (Lahore Campus)Document5 pagesFundamental of Marketing: COMSATS University Islamabad (Lahore Campus)Shahzad HassanNo ratings yet

- Exchange Control Regulations in The CMA: Is Lesotho Lagging Behind?Document19 pagesExchange Control Regulations in The CMA: Is Lesotho Lagging Behind?Tseneza RaselimoNo ratings yet

- Export Promotion MeasuresDocument3 pagesExport Promotion MeasuresRammi BeygNo ratings yet

- Name of The Treasury/Sub-Treasury/Bank/Bank Branch - State Bank of India (Payment Gateway)Document1 pageName of The Treasury/Sub-Treasury/Bank/Bank Branch - State Bank of India (Payment Gateway)Shasvat DhoundiyalNo ratings yet

- Baseball Stadium Financing SummaryDocument1 pageBaseball Stadium Financing SummarypotomacstreetNo ratings yet

- IMF-Mexico Credit Line 2Document9 pagesIMF-Mexico Credit Line 2Mian Muhammad YounusNo ratings yet

- Profitability of Hotel IndustryDocument2 pagesProfitability of Hotel IndustryMaybelyn Umali CatindigNo ratings yet

- Tax Havens & How They Work: Group 7Document10 pagesTax Havens & How They Work: Group 7Magical MakeoversNo ratings yet

- February 2017 AppointmentsDocument11 pagesFebruary 2017 AppointmentsAntoinette SmithNo ratings yet

- India Exports and ImportsDocument16 pagesIndia Exports and ImportsAR Ananth Rohith BhatNo ratings yet

- Saarc Preferential Trading Arrangement (Sapta) : Naina Lalwani - 19531034Document12 pagesSaarc Preferential Trading Arrangement (Sapta) : Naina Lalwani - 19531034Naina lalwaniNo ratings yet

- Where Have All The Jobs Gone?: by Rahul Chauhan, Rohit Lamba, and Raghuram RajanDocument3 pagesWhere Have All The Jobs Gone?: by Rahul Chauhan, Rohit Lamba, and Raghuram RajanMohd. RahilNo ratings yet

- Chapter 1 Eco561Document32 pagesChapter 1 Eco561norshaheeraNo ratings yet

- Gratuity Withdrawal FormDocument2 pagesGratuity Withdrawal FormKrishna ChandarNo ratings yet

- Degree of Financial Leverage Formula Excel TemplateDocument4 pagesDegree of Financial Leverage Formula Excel TemplateSyed Mursaleen ShahNo ratings yet

- CommSec State of The States January 2010Document6 pagesCommSec State of The States January 2010peter_martin9335No ratings yet

- Operations of MozalDocument12 pagesOperations of MozalRahul GuptaNo ratings yet

- Invoice GPR PajakDocument51 pagesInvoice GPR Pajakhandika CHNo ratings yet

- Special Economic Zone (SEZ) Under GST - Taxguru - inDocument3 pagesSpecial Economic Zone (SEZ) Under GST - Taxguru - inAKSHITA SRIVASTAVANo ratings yet

- World Bank or IBRDDocument1 pageWorld Bank or IBRDmahesani_128_suhaiNo ratings yet

- International Business-2nd Major AssignmentDocument5 pagesInternational Business-2nd Major AssignmentvikramNo ratings yet

- Circle Electric 40, Yousuf Mansion, New Elephant Road, Dhaka Pay SlipDocument12 pagesCircle Electric 40, Yousuf Mansion, New Elephant Road, Dhaka Pay SlipDJ ATANUNo ratings yet

- Frozen Food: Next Big ExportDocument5 pagesFrozen Food: Next Big Exporthabibun naharNo ratings yet

- Q1 2022 Multifamily Market ReportDocument6 pagesQ1 2022 Multifamily Market ReportDaniel López MuñozNo ratings yet