Professional Documents

Culture Documents

Abbott India Cash Flows From Financing Activities Dividend Paid

Uploaded by

Taniya SinhaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abbott India Cash Flows From Financing Activities Dividend Paid

Uploaded by

Taniya SinhaCopyright:

Available Formats

Abbott India

Cash Flows from financing activities

Dividend Paid

Because dividend payments are made from retained earnings, which are part of shareholders'

equity, board of directors must authorize them. Dividends are not costs because they are cash

distributions from after-tax net income to shareholders. Dividend payments to shareholders of

record as of record dates are usually announced in news releases by publicly traded firms.

Typically, private companies do not make dividend payments public.

Dividends are a crucial strategic choice because investors expect a company's quarterly

dividend to continue after it is declared. Dividend reductions or suspensions are often viewed

by investors as a sign of financial fragility. Management might announce one-time special

dividends to distribute cash to shareholders without generating an expectation of quarterly

dividend payments, giving it more choice over how to invest any surplus funds.

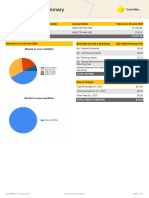

Cash Flow from Financing Activities For the year ended For the year ended

March 31, 2021 March 31, 2020

Dividend Paid (531.23) (138.12)

Analysis

The cash outflow has increased in 2021 as compared to 2020, this indicates that the company

has paid a higher dividend to its shareholders, the reasons for the same could be increase in

the retained earnings or higher returns as compared to the previous year. An increase of

393.11 Crores.

Dividend Distribution Tax Paid

Dividend distribution tax is a tax levied by the Indian government on Indian corporations

based on the amount of dividends paid to shareholders. According to the Union Budget of

India, the government is proposing to eliminate the dividend distribution tax in the financial

annual statement 2020.

Cash Flow from Financing Activities For the year ended For the year ended

March 31, 2021 March 31, 2020

Dividend Distribution Tax Paid - (28.39)

Payment of Lease Liabilities

A lease payment is the monthly equivalent of rent that is explicitly stipulated under a contract

between two parties, providing one party the legal right to use the other's real estate holdings,

manufacturing equipment, computers, software, or other fixed assets for a certain period.

Cash Flow from Financing Activities For the year ended For the year ended

March 31, 2021 March 31, 2020

Payment of Lease Liabilities (50.05) (50.05)

Analysis

In the case of Abbott India, the payment of lease liabilities remains the same for both years.

Interest Paid, other than on lease liabilities

Cash Flow from Financing Activities For the year ended For the year ended

March 31, 2021 March 31, 2020

Payment of Lease Liabilities (0.51) (0.23)

In financing activities all cash activities are recorded which relate to non-current liabilities

and owner’s equity. Hence the Interest paid is recorded here which shows that there has been

an increase in the payment by 0.28 Crores.

Cash Flow from Financing Activities For the year ended For the year ended

March 31, 2021 March 31, 2020

Net cash flows used in financing activities (581.79) (216.79)

The negative cash flow from financing activity indicates that the company is paying down

debt, paying dividends, and repurchasing stock.

Net increase/(decrease) in cash and cash 73.13 8.13

equivalents (A+B+C)

Cash and cash equivalents at the beginning of the 145.14 137.01

year

Cash and cash equivalents at the end of the year 218.27 145.14

Net Increase in cash and cash equivalents

Cash equivalents are assets that can be converted to cash in a matter of hours or days. Higher

liquidity is equal to an increase in cash equivalents. A company with a greater liquidity ratio

is thought to be healthier and less risky. This company will also benefit from a decreased

interest rate, resulting in increased profitability.

Cash and Cash equivalents at the beginning and at the end of the year

Abbott started 2020 with 137.01 and 2021 with 145.14 but at the end the cash equivalents

were 145.14 in 2020 and 218.27 in 2021 determining that the company has a significant

increase in their liquid assets and similar increase in their profitability.

Conclusion

The cash flow statement includes the changes in cash and cash equivalents in operating

activities, investment activities, and financing activities, as well as the net change in cash and

cash equivalents in special treatments. It also includes the cash balance at the end of the

quarter. When the opening cash and cash equivalents are added to the net change, the result is

the cash and cash equivalent closing balance. The cash flow statement provides a clear

picture of how working capital is being used. In the above cash flow statement it is clear that

the company has raised profits and paid off debts efficiently hence the investment

opportunities are also very high for Abbott India.

You might also like

- ProblemsDocument2 pagesProblemsNah HamzaNo ratings yet

- How To Start A Business - Short GuideDocument30 pagesHow To Start A Business - Short GuideLich_king2100% (1)

- Accounting Test TravelokaDocument8 pagesAccounting Test TravelokaGabriella CikaNo ratings yet

- CFA Institute: Actual Exam QuestionsDocument8 pagesCFA Institute: Actual Exam QuestionsFarin KaziNo ratings yet

- Butler Lumber CompanyDocument8 pagesButler Lumber CompanyAnmol ChopraNo ratings yet

- Quiz - Home Branch AccountingDocument18 pagesQuiz - Home Branch AccountingJessie MacoNo ratings yet

- Corporate Finance Quiz Questions and AnswersDocument2 pagesCorporate Finance Quiz Questions and Answersharisankar sureshNo ratings yet

- Single Entry (DONE!)Document8 pagesSingle Entry (DONE!)magoimoi0% (1)

- FSA of Nalin LeaseDocument8 pagesFSA of Nalin LeaseM43CherryAroraNo ratings yet

- Tata Consumer - CFS Analysis COMPLETEDocument10 pagesTata Consumer - CFS Analysis COMPLETEPratham MalhotraNo ratings yet

- FSA of Chandni TextileDocument9 pagesFSA of Chandni TextileM43CherryAroraNo ratings yet

- Ratio and Interpretaion With GraphsDocument12 pagesRatio and Interpretaion With GraphsShilpiNo ratings yet

- Joaxjill NotesDocument6 pagesJoaxjill NotesAlliah Czyrielle Amorado PersinculaNo ratings yet

- Acc224 Ca3Document9 pagesAcc224 Ca3MohitNo ratings yet

- 202004241009363724jksharma Integrative Problems in Financial DecisionsDocument5 pages202004241009363724jksharma Integrative Problems in Financial Decisionssonamsri76No ratings yet

- 2020 21 RGICL Annual ReportDocument113 pages2020 21 RGICL Annual ReportShubrojyoti ChowdhuryNo ratings yet

- CASHFLOWDocument16 pagesCASHFLOWAnkit AgarwalNo ratings yet

- 2022EOFYSummaryDocument3 pages2022EOFYSummaryHanny KeeNo ratings yet

- Ilovepdf MergedDocument41 pagesIlovepdf MergedShreyanshi AgarwalNo ratings yet

- CEAT Limited Neeraj Cia 3Document9 pagesCEAT Limited Neeraj Cia 3Neeraj BalamNo ratings yet

- Financial Statement Construction ExerciseDocument3 pagesFinancial Statement Construction Exercisesuresh sivadasanNo ratings yet

- Examen Ingles HitesDocument2 pagesExamen Ingles HitesKawaii SoledadNo ratings yet

- Tata Motors AnalysisDocument9 pagesTata Motors AnalysisrastehertaNo ratings yet

- Course Name Course Code Student Name Student ID DateDocument7 pagesCourse Name Course Code Student Name Student ID Datemona asgharNo ratings yet

- Acc Sample Paper 3 Typed by DhairyaDocument5 pagesAcc Sample Paper 3 Typed by DhairyaMaulik ThakkarNo ratings yet

- 28 07 2023 - 344571Document4 pages28 07 2023 - 344571Boda TanviNo ratings yet

- Balance Sheet InterpretationDocument3 pagesBalance Sheet InterpretationAkanksha KadamNo ratings yet

- Procter & Gamble Hygiene and Health Care Limited: Annual Report 2020-21Document14 pagesProcter & Gamble Hygiene and Health Care Limited: Annual Report 2020-21parika khannaNo ratings yet

- FSA - E - 21BSPHH01C0677-Milan MeherDocument16 pagesFSA - E - 21BSPHH01C0677-Milan MeherMilan MeherNo ratings yet

- MSA 1 Winter2021Document16 pagesMSA 1 Winter2021RSM PakistanNo ratings yet

- Papper 4Document7 pagesPapper 4Endalkachew GutetaNo ratings yet

- Financial Report - EditedDocument7 pagesFinancial Report - EditedMaina PeterNo ratings yet

- Profitability RatiosDocument4 pagesProfitability RatiosDorcas YanoNo ratings yet

- PL Appropriation AcDocument6 pagesPL Appropriation AcShivangi Aggarwal100% (1)

- Eicher Motors CFProject Group11Document10 pagesEicher Motors CFProject Group11Greeshma SharathNo ratings yet

- Absl Amc IpoDocument4 pagesAbsl Amc IpoRounak KhubchandaniNo ratings yet

- Paper 12 - Company Accounts and Audit Syl2012Document116 pagesPaper 12 - Company Accounts and Audit Syl2012sumit4up6rNo ratings yet

- Tute Group I 42 Assignment 2 Dev Krishna Goyal 22bc473Document7 pagesTute Group I 42 Assignment 2 Dev Krishna Goyal 22bc473Vigo GroupNo ratings yet

- Vadilal Industries LimitedDocument29 pagesVadilal Industries LimitedSubhash YadavNo ratings yet

- Financial Management Assignement: Company Name: Marico LTDDocument14 pagesFinancial Management Assignement: Company Name: Marico LTDAvijit DindaNo ratings yet

- Accounts Finance - AssignmentDocument16 pagesAccounts Finance - AssignmentvellithodiresmiNo ratings yet

- 105 DepaDocument12 pages105 DepaLA M AENo ratings yet

- Ratio AnalysisDocument16 pagesRatio AnalysisAbdul RehmanNo ratings yet

- IDFC-AMC 2021 Annual-ReportDocument63 pagesIDFC-AMC 2021 Annual-ReportvinitNo ratings yet

- Questions Answers: Operating Activities, Investment, Financing Activities Zero Debit Telephone and Credit CashDocument3 pagesQuestions Answers: Operating Activities, Investment, Financing Activities Zero Debit Telephone and Credit CashPranav SharmaNo ratings yet

- EMB 815 Assignment 2 by Professor J O OtusanyaDocument10 pagesEMB 815 Assignment 2 by Professor J O OtusanyaAliyu GafaarNo ratings yet

- Good Hope PLC: Annual ReportDocument11 pagesGood Hope PLC: Annual ReporthvalolaNo ratings yet

- 71484bos57500 p5Document30 pages71484bos57500 p5KingNo ratings yet

- ITC Infotech USA Inc. Annual Report 2021 1Document6 pagesITC Infotech USA Inc. Annual Report 2021 1Chandrasekhar ReddypemmakaNo ratings yet

- Ratio AnalysisDocument4 pagesRatio AnalysisNave2n adventurism & art works.No ratings yet

- Annual Report 2021-22 PDFDocument179 pagesAnnual Report 2021-22 PDFMohnish KhianiNo ratings yet

- Ratio Analysis: Part I of The Accounting ProjectDocument38 pagesRatio Analysis: Part I of The Accounting ProjectShruss VlogssNo ratings yet

- Wilton Re US Holdings 2021 Consolidated Financial Statement 1Document57 pagesWilton Re US Holdings 2021 Consolidated Financial Statement 1MrDorakonNo ratings yet

- SailashreeChakraborty 13600921093 FM401Document12 pagesSailashreeChakraborty 13600921093 FM401Sailashree ChakrabortyNo ratings yet

- Airbus Finance BV Financial Statements HY2021Document17 pagesAirbus Finance BV Financial Statements HY2021Tú NguyễnNo ratings yet

- Scope 3Document4 pagesScope 3vithyaNo ratings yet

- EV Annual Report 2021 22Document69 pagesEV Annual Report 2021 22deepakturi2002No ratings yet

- Vicom 2Document7 pagesVicom 2johnsolarpanelsNo ratings yet

- CFAP 1 AFR Winter 2022Document5 pagesCFAP 1 AFR Winter 2022Ali HaiderNo ratings yet

- D - 05 Berger PaintsDocument7 pagesD - 05 Berger PaintstanyaNo ratings yet

- Task 2 Strategic Financial Management (20800) Financial AnalysisDocument7 pagesTask 2 Strategic Financial Management (20800) Financial AnalysisperelapelNo ratings yet

- Maria FinalDocument8 pagesMaria FinalrideralfiNo ratings yet

- Devyani International LTD - IPO Note-1Document4 pagesDevyani International LTD - IPO Note-1chinna rao100% (1)

- Project 2 Acct400aDocument10 pagesProject 2 Acct400aapi-736250712No ratings yet

- Ratio Analysis: The Balance Sheet For FinancialDocument10 pagesRatio Analysis: The Balance Sheet For FinancialWahidul Islam 222-14-522No ratings yet

- Annual Report March 31 2022Document118 pagesAnnual Report March 31 2022phanindhar002No ratings yet

- Company 2 - HDFCDocument7 pagesCompany 2 - HDFCGourishNo ratings yet

- ISSM 541 Winter 2015 Assignment 5Document5 pagesISSM 541 Winter 2015 Assignment 5Parul KhannaNo ratings yet

- Accounting EntriesDocument22 pagesAccounting EntriesSendil KumarNo ratings yet

- Case Study 2Document3 pagesCase Study 2Siti Nabilah50% (2)

- Accounting EquationsDocument27 pagesAccounting EquationsSrijita ChatterjeeNo ratings yet

- DBB2104 Unit-08Document24 pagesDBB2104 Unit-08anamikarajendran441998No ratings yet

- The History of Banking and Other Financial Institutions in EthiopiaDocument14 pagesThe History of Banking and Other Financial Institutions in Ethiopiamichaelgezae97% (77)

- Assignment 2Document3 pagesAssignment 2AlbertoNo ratings yet

- Most Important Terms and Conditions: Student Loan SchemeDocument2 pagesMost Important Terms and Conditions: Student Loan SchemeAtharv singh BishtNo ratings yet

- Brigham Risk Return PP TDocument7 pagesBrigham Risk Return PP Tshahmed999No ratings yet

- Financial Literacy Literature ReviewDocument7 pagesFinancial Literacy Literature Reviewf1gisofykyt3100% (1)

- Bank Course OutlineDocument17 pagesBank Course Outlinemarivic hammidanyNo ratings yet

- Tax 1 Midterms Reviewer-AuslDocument18 pagesTax 1 Midterms Reviewer-AuslAlyanna Gayle FajardoNo ratings yet

- Oil & Gas: Equity ResearchDocument19 pagesOil & Gas: Equity ResearchForexliveNo ratings yet

- Bills DiscountingDocument9 pagesBills DiscountingChintan JoshiNo ratings yet

- Chap 21-2Document8 pagesChap 21-2JackNo ratings yet

- 2.5 Monetary Policy (SL&HL)Document30 pages2.5 Monetary Policy (SL&HL)Shuchun YangNo ratings yet

- PPT Week 1 OkDocument27 pagesPPT Week 1 OkDelwiena AgnelNo ratings yet

- Pharmacy2U Pharmacy2U Limited Consolidated Financial StatementsDocument17 pagesPharmacy2U Pharmacy2U Limited Consolidated Financial StatementsYASH AGRAWALNo ratings yet

- Revision Worksheet 7 Simple InterestDocument2 pagesRevision Worksheet 7 Simple InterestMith SarkerNo ratings yet

- 4.2 Home Assignment Questions - Income From SalaryDocument3 pages4.2 Home Assignment Questions - Income From SalaryAashi Gupta100% (1)

- Fields MappingDocument15 pagesFields MappingChristian RamosNo ratings yet

- Capital Budgeting TechniquesDocument2 pagesCapital Budgeting TechniquesmananipratikNo ratings yet