Professional Documents

Culture Documents

Chapter 3: Meetings of Board and Its Powers: 1) Amendment in Section 173 - Rule 4

Uploaded by

anil agarwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 3: Meetings of Board and Its Powers: 1) Amendment in Section 173 - Rule 4

Uploaded by

anil agarwalCopyright:

Available Formats

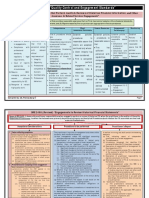

Chapter 3: Meetings of Board and its Powers

1) Amendment in Section 173 – Rule 4

As per Rule 4,

(1) the following matters shall not be dealt with in any meeting held through video conferencing

or other audio visual means-

i) the approval of the annual financial statements;

ii) the approval of the Board’s report;

iii) the approval of the prospectus;

iv) the Audit Committee Meetings for consideration of financial statement including consolidated

financial statement if any, to be approved by the board under sub- section (1) of section 134

of the Act, and

v) the approval of the matter relating to amalgamation, merger, demerger, acquisition and

takeover.

Provided that where there is quorum presence in a meeting through physical presence

of directors, any other director may participate conferencing through video or other

audio visual rneans.

2) For the period beginning from the commencement of the Companies (Meetings of Board

and its Powers) Amendment Rules, 2020 and ending on the [30th June 2021], the

meetings on matters referred to in sub-rule (1) may be held through video conferencing

or other audio visual means in accordance with rule 3

Chapter 1: The Securities Contract (Regulation) Act, 1956

3) Section 29B Inserted by the International Financial Services Centres Authority Act,

2019, w.e.f. 01-10-2020.

Powers of Board not to apply to International Financial Services Centre (Section 29B)

Notwithstanding anything contained in any other law for the time being in force, the

powers exercisable by the Board under this Act,—

a) shall not extend to an International Financial Services Centre set up under subsection

(1) of section 18 of the Special Economic Zones Act, 2005;

b) shall be exercisable by the International Financial Services Centres Authority

established under sub-section (1) of section 4 of the International Financial Services

Centres Authority Act, 2019, in so far as regulation of financial products, financial

services and financial institutions that are permitted in the International Financial

Services Centres are concerned.

CA Swapnil Patni for more details visit www.swapnilpatni.com

The Securities Exchange Board of India Act, 1992

4) Inserted by the International Financial Services Centres Authority Act, 2019, w.e.f. 01-

10-2020.

Section 28C Powers of Board not to apply to International Financial Services Centre:

Notwithstanding anything contained in any other law for the time being in force, the

powers exercisable by the Board under this Act,—

a) shall not extend to an International Financial Services Centre set up under sub- section

(1) of section 18 of the Special Economic Zones Act, 2005;

b) shall be exercisable by the International Financial Services Centres Authority established

under sub-section (1) of section 4 of the International Financial Services Centres

Authority Act, 2019, in so far as regulation of financial products, financial services and

financial institutions that are permitted in the International Financial Services Centres

are concerned.

The Foreign Contribution (Regulation) Act, 2010

5) Amendment in section 3

Prohibition to accept foreign contribution (Section 3)

As per the section following persons are prohibited to accept foreign contribution:

a) candidate for election;

b) correspondent, columnist, cartoonist, editor, owner, printer or publisher of a registered

news- paper;

c) Public Servant, Judge, Government servant or employee of any corporation or any1.

other body controlled or owned by the Government;

d) member of any Legislature;

e) political party or office-bearer thereof;

f) organisation of a political nature as may be specified under section 5(1) by the Central

Government;

g) association or company engaged in the production or broadcast of audio news or audio

visual news or current affairs programmes through any electronic mode, or any other

electronic form as defined in the Information Technology Act, 2000 or any other mode

of mass communication;

h) correspondent or columnist, cartoonist, editor, owner of the association or company

referred to in clause (g).

Explanation.1 –

For the purpose of clause (c), "public servant" means a public servant as defined in

section 21 of the Indian Penal Code (45 of 1860).

CA Swapnil Patni for more details visit www.swapnilpatni.com

Explanation.2 -

In clause (c) and section 6, the expression “corporation” means a corporation owned or

controlled by the Government and includes a Government company as defined in

section 617 of the Companies Act, 1956 (Now section 2(45) of the Companies Act,

2013)

6) For section 7 of the principal Act, the following section shall be substituted, namely:—

Prohibition to transfer foreign contribution to other person (Section 7)

According to the section, person who –

a) is registered & granted a certificate, or has obtained prior permission under this Act; &

b) receives any foreign contribution,

shall not transfer such foreign contribution to any other person unless such other person

is also registered and had been granted the certificate or obtained the prior permission

under this Act:

No person who –

a) is registered & granted a certificate or has obtained prior permission under this Act; and

b) receives any foreign contribution,

shall transfer such foreign contribution to any other person."

7) Amendment in section 8

Restriction to utilize foreign contribution for administrative purpose (Section 8)

1. Every person, who is registered and granted a certificate or given prior permission

under this

Act and receives any foreign contribution, shall—

2.

a) utilise such contribution for the purposes for which the contribution has been received:

Provided that any foreign contribution or any income arising out of it shall not be used

for speculative business;

Provided further that the Central Government shall, by rules, specify the activities or

business which shall be construed as speculative business for the purpose of this section;

Speculative activities have been defined in Rule 4 of FCR, 2011 as under:-

i) any activity or investment that has an element of risk of appreciation or depreciation of

the original investment, linked to marked forces, including investment in mutual funds

or in shares;

ii) participation in any scheme that promises high returns like investment in chits or land or

similar assets not directly linked to the declared aims and objectives of the organization

or association.

b) not defray as far as possible such sum, not exceeding fifty per cent twenty per cent of

such contribution, received in a financial year, to meet administrative expenses :

CA Swapnil Patni for more details visit www.swapnilpatni.com

Provided that administrative expenses exceeding fifty per cent twenty per cent of such

contribution may be defrayed with prior approval of the Central Government.

2. The Central Government may prescribe the elements which shall be included in the

administra tive expenses and the manner in which the administrative expenses referred

to in sub- section (1) shall be calculated.

Amounts that constitute Administrative Expenses

i) salaries, wages, travel expenses or any remuneration realised by the Members of the

Executive Committee or Governing Council of the person;

ii) all expenses towards hiring of personnel for management of the activities of the person

and salaries, wages or any kind of remuneration paid, including cost of travel, to such

personnel;

iii) all expenses related to consumables like electricity and water charges, telephone

charges, postal charges, repairs to premise(s) from where the organisation or

Association is functioning, stationery and printing charges transport and travel charges

by the Members of the Executive Committee or Governing Council and expenditure on

office equipment;

iv) cost of accounting for and administering funds;

v) expenses towards running and maintenance of vehicles;

vi) cost of writing and filing reports;

vii) legal and professional charges; and

viii) rent of premises, repairs to premises and expenses on other utilities:

Amounts not to be counted as administrative expenses:

i) Expenditure incurred on salaries or remuneration of personnel engaged in training or

for collection or analysis of field data of an association primarily engaged in research

or training ;

ii) Expenses incurred directly in furtherance of the stated objectives of the welfare oriented

organisation such as salaries to doctors of hospital, salaries to teachers of school etc.;

8) Amendment in section 11

Registration of certain persons with Central Government (Section 11)

1) Person having a definite cultural, economic, educational, religious or social programme

II) shall not accept foreign contribution unless such person obtains a certificate of

registration from the Central Government.

III) However, that-

a) any association registered with the Central Government under section 6, or

b) granted prior permission under that section of the Foreign Contribution (Regulation) Act,

1976, as it stood immediately before the commencement of this Act,

IV) shall be deemed to have been registered or granted prior permission, as the case may

be, under this Act and such registration shall be valid for a period of five years from the

CA Swapnil Patni for more details visit www.swapnilpatni.com

date on which this section comes into force.

2) Acceptance of foreign contribution after obtaining prior permission of the Central

Government:

V) Every person may, if it is not registered with the Central Government, accept any foreign

contribution only after obtaining the prior permission of the Central Government and

such prior permission shall be valid for the specific purpose for which it is obtained and

from the specific source

VI) Provided that the Central Government, on the basis of any information or report, and

after holding a summary inquiry, has reason to believe that a person who has been

granted prior permission has contravened any of the provisions of this Act, it may, 3.

pending any further inquiry, direct that such person shall not utilise the unutilised

foreign contribution or receive the remaining portion of foreign contribution which has

not been received or, as the case may be, any additional foreign contribution, without

prior approval of the Central Government:

VII) Provided further that if the person referred to in sub-section (1) or in this sub-section

has been found guilty Further, if the person has been found guilty of violation of any of

the provisions of this Act or the Foreign Contribution (Regulation) Act, 1976, the

unutilised or unreceived amount of foreign contribution shall not be utilised or received,

as the case may be, without the prior approval of the Central Government.

3) The Central Government may, by notification in the Official Gazette, specify -

a) the person or class of persons who shall obtain its prior permission before accepting

the foreign contribution; or

b) the area or areas in which the foreign contribution shall be accepted and utilised with

the prior permission of the Central Government; or

c) the purpose or purposes for which the foreign contribution shall be utilised with the prior

per- mission of the Central Government; or

d) the source or sources from which the foreign contribution shall be accepted with the prior

permission of the Central Government.

9) Amendment in section 12

In section 12 of the principal Act, after sub-section (1), the following sub-section shall

be inserted, namely:-

‘(1A) Every person who makes an application under sub-section (1) shall be required to

open ‘‘FCRA Account’’ in the manner specified in section 17 and mention details of

such account in his application.’.

10) Addition of section 12A

After section 12 of the principal Act, the following section shall be inserted namely:-

"12A. Notwithstanding anything contained in this Act, the Central Government may

CA Swapnil Patni for more details visit www.swapnilpatni.com

require that any person who seeks prior permission or prior approval under section 11,

or makes an application for grant of certificate under section 12, or, as the case may

be, for renewal of certificate under section 16, shall provide as identification document,

the Aadhaar number of all its office bearers or Directors or other key functionaries, by

whatever name called, issued under the Aadhaar (Targeted Delivery of Financial and

Other Subsidies, Benefits and Services) Act, 2016, or a copy of the Passport or Overseas

Citizen of India Card, in case of a foreigner.".

11) Amendment in section 13

4.

1) Where the Central Government is satisfied that pending consideration of the question

of cancelling the certificate on any of the grounds mentioned in sub- section 14(1), it

is necessary so to do, it may, by order in writing, suspend the certificate for such period

not exceeding one hundred and eighty days as may be specified for a period of one

hundred and eighty days, or such further period, not exceeding one hundred and eighty

days, as may be specified in the order.

2) Effect of suspension: Every person whose certificate has been suspended shall -

a) not receive any foreign contribution during the period of suspension of certificate.

VIII) However, the Central Government, on an application made by such person, if it

considers appropriate, allow receipt of any foreign contribution by such person on such

terms and conditions as it may specify;

b) utilise, in the prescribed manner, the foreign contribution in his custody with the prior

approval of the Central Government.

IX) Rule 14 of FCR, 2011 defines the extent of amount that can be utilised in case of

suspension of the certificate of registration. The unspent amount that can be utilised in

case of suspension of a certificate of registration may be as under:—

i) In case the certificate of registration is suspended under sub-section (1) of section 13 of

the Act, up to twenty-five per cent of the unutilised amount may be spent, with the prior

approval of the Central Government, for the declared aims and objects for which the

foreign contribution was received.

ii) The remaining seventy-five per cent of the unutilised foreign contribution shall be

utilised only after revocation of suspension of the certificate of registration.

12) Addition of section 14A

"14A. On a request being made in this behalf, the Central Government may permit any

person to surrender the certificate granted under this Act, if, after making such inquiry

as it deems fit, it is satisfied that such person has not contravened any of the provisions

of this Act, and the management of foreign contribution and asset, if any, created out

of such contribution has been vested in the authority as provided in sub- section (1) of

CA Swapnil Patni for more details visit www.swapnilpatni.com

section 15.".

13) Amendment in section 16

Renewal of certificate (Section 16)

1) Every person who has been granted a certificate, shall have such certificate renewed

within six months before the expiry of the period of the certificate.

Provided that the Central Government may, before renewing the certificate, make such

inquiry, as it deems fit, to satisfy itself that such person has fulfilled all conditions

specified in sub-section (4) of section 12.".

2) The application for renewal of the certificate shall be made to the Central Government

in such form and manner with such fee as may be prescribed. 5.

3) The Central Government shall renew the certificate, ordinarily within ninety days from

the date of receipt of application for renewal of certificate subject to such terms and

conditions as it may deem fit and grant a certificate of renewal for a period of five

years.

X) However, in case the Central Government does not renew the certificate within the said

period of ninety days, it shall communicate the reasons therefor to the applicant.

XI) Further that the Central Government may refuse to renew the certificate in case where

a person has violated any of the provisions of this Act or rules made thereunder.

14) Amendment in section 17

Foreign contribution through scheduled bank (Section 17)

XII) Every person who has been granted a certificate or given prior permission shall receive

foreign contribution in a single account only through such one of the branches of a

bank as he may specify in his application for grant of certificate. However, person may

open one or more ac- counts in one or more banks for utilising the foreign contribution

received by him . No funds other than foreign contribution shall be received or

deposited in such account or accounts.

XIII) Every bank or authorised person in foreign exchange shall report to such authority

as may be specified —

a) prescribed amount of foreign remittance;

b) the source and manner in which the foreign remittance was received; and

c) other particulars, in such form and manner as may be prescribed.

1. Every person who has been granted certificate or prior permission under section 12 shall

receive foreign contribution only in an account designated as "FCRA Account" by the

bank, which shall be opened by him for the purpose of remittances of foreign

contribution in such branch of the State Bank of India at New Delhi, as the Central

Government may, by notification, specify in this behalf: Provided that such person may

also open another ‘‘FCRA Account’’ in any of the scheduled bank of his choice for the

CA Swapnil Patni for more details visit www.swapnilpatni.com

purpose of keeping or utilising the foreign contribution which has been received from

his ‘‘FCRA Account’’ in the specified branch of State Bank of India at New Delhi: Provided

further that such person may also open one or more accounts in one or more scheduled

banks of his choice to which he may transfer for utilising any foreign contribution

received by him in his ‘‘FCRA Account’’ in the specified branch of the State Bank of India

at New Delhi or kept by him in another ‘‘FCRA Account’’ in a scheduled bank of his

choice: Provided also that no funds other than foreign contribution shall be received or

deposited in any such account.

2. The specified branch of the State Bank of India at New Delhi or the branch of the

scheduled bank where the person referred to in sub-section (1) has opened his foreign

contribution account or the authorised person in foreign exchange, shall report to such 6.

authority as may be specified, —

a) the prescribed amount of foreign remittance;

b) the source and manner in which the foreign remittance was received; and

c) other particulars,

d) in such form and manner as may be prescribed.'

CA Swapnil Patni for more details visit www.swapnilpatni.com

You might also like

- Legal OpinionDocument8 pagesLegal OpinionEvin Megallon VillarubenNo ratings yet

- STP Formatting Guide 010707Document2 pagesSTP Formatting Guide 010707yeuhqhNo ratings yet

- Impact of Unethical Practices On Business Environment: A Case Study On ToyotaDocument7 pagesImpact of Unethical Practices On Business Environment: A Case Study On ToyotaWasifNo ratings yet

- Carriage of Goods LiabilityDocument1 pageCarriage of Goods LiabilityAlexPamintuanAbitanNo ratings yet

- FAA Order 8900.1 CHG 218Document5 pagesFAA Order 8900.1 CHG 218Muhammad Ashraful KabirNo ratings yet

- As 2049-2002 Roof TilesDocument7 pagesAs 2049-2002 Roof TilesSAI Global - APAC0% (1)

- Auditing Test Bank Ch1Document34 pagesAuditing Test Bank Ch1Rosvel Esquillo95% (21)

- Ebcl Dec 2021 25102021Document96 pagesEbcl Dec 2021 25102021khushi jaiswalNo ratings yet

- Foreign Contribution Regulation Rules 2011Document6 pagesForeign Contribution Regulation Rules 2011Latest Laws TeamNo ratings yet

- FAQs on Foreign Contributions RegulationsDocument10 pagesFAQs on Foreign Contributions RegulationsrkhariNo ratings yet

- TDS Not DeductDocument6 pagesTDS Not DeductAnil WayanadNo ratings yet

- The Companies Act, 1956: 211. Form and Contents of Balance-Sheet and Profit and Loss Account.Document10 pagesThe Companies Act, 1956: 211. Form and Contents of Balance-Sheet and Profit and Loss Account.Paul ArijitNo ratings yet

- It ProvisionDocument10 pagesIt Provisionvkailash12No ratings yet

- Tax Law Guide to Indian Income TaxDocument133 pagesTax Law Guide to Indian Income TaxTahaNo ratings yet

- Section 16Document17 pagesSection 16d-fbuser-65596417No ratings yet

- B.-Deductions in Respect of Certain Payments: Section 10Document4 pagesB.-Deductions in Respect of Certain Payments: Section 10Babu GupthaNo ratings yet

- Ministry of Corporate Affairs Publishes New LLP RulesDocument169 pagesMinistry of Corporate Affairs Publishes New LLP RulesshankarvittaNo ratings yet

- Income Tax Department 80cDocument6 pagesIncome Tax Department 80cSrikanth SuryaNo ratings yet

- UntitledDocument92 pagesUntitledPawandeep SinghNo ratings yet

- Advance Ruling: 14.1 Definitions (Section 28E)Document5 pagesAdvance Ruling: 14.1 Definitions (Section 28E)timirkantaNo ratings yet

- FC Faq 07062019 PDFDocument20 pagesFC Faq 07062019 PDFsandeep kulhariaNo ratings yet

- CA Inter Law Amendments May 2021Document3 pagesCA Inter Law Amendments May 2021Soul of honeyNo ratings yet

- FCRA RegulationsDocument3 pagesFCRA RegulationsAhona MukherjeeNo ratings yet

- Senate Bill No. - : Senate of The PhilippinesDocument13 pagesSenate Bill No. - : Senate of The PhilippinesAizaLizaNo ratings yet

- Foreign Contribution (Regulation) Act, 2010Document66 pagesForeign Contribution (Regulation) Act, 2010Karthik RamasamyNo ratings yet

- Explanation.-For The Purposes of This SectionDocument2 pagesExplanation.-For The Purposes of This SectionJeremy RemlalfakaNo ratings yet

- 25RMA Act 2010Document130 pages25RMA Act 2010Nyingtob Pema NorbuNo ratings yet

- Sec 194aDocument3 pagesSec 194asayanghosh55No ratings yet

- CTPMDocument28 pagesCTPMIndu Shekhar PoddarNo ratings yet

- Tax Updates For December 2011 31 10 2011Document35 pagesTax Updates For December 2011 31 10 2011gangadhardaNo ratings yet

- Tax Updates For December 2011 31 10 2011Document35 pagesTax Updates For December 2011 31 10 2011Rakhi ChaubeyNo ratings yet

- Fra Act 2015 EnglishDocument24 pagesFra Act 2015 EnglishMohammad FaridNo ratings yet

- Union Budget 2013-14 - Highlights of Direct Tax ProposalsDocument5 pagesUnion Budget 2013-14 - Highlights of Direct Tax Proposalsankit403No ratings yet

- Form For Application For Grant of Licence To Be A Certifying AuthorityDocument19 pagesForm For Application For Grant of Licence To Be A Certifying AuthorityAppy Gowda GNo ratings yet

- Value Added Tax Act AmendmentsDocument42 pagesValue Added Tax Act AmendmentsJamie ReyesNo ratings yet

- The Foreign Contribution (Regulation) Act, 2010: by The End of This Chapter, You Will Be Able ToDocument44 pagesThe Foreign Contribution (Regulation) Act, 2010: by The End of This Chapter, You Will Be Able ToDimple KhandheriaNo ratings yet

- Basic Concepts of Income Tax ExplainedDocument47 pagesBasic Concepts of Income Tax Explainedleela naga janaki rajitha attiliNo ratings yet

- Amendments Applicable For Nov 2018 Exam: Income TaxDocument4 pagesAmendments Applicable For Nov 2018 Exam: Income TaxKrishna DasNo ratings yet

- 93FCR0107FLDocument12 pages93FCR0107FLPrasad NayakNo ratings yet

- Chapter VIII Rebates and ReliefsDocument14 pagesChapter VIII Rebates and ReliefsShweta VermaNo ratings yet

- Provident Fund, Subscription To Certain Equity Shares or Debentures, Etc. 80CDocument6 pagesProvident Fund, Subscription To Certain Equity Shares or Debentures, Etc. 80CSteven SpencerNo ratings yet

- AssetsDocument7 pagesAssetsNidhi YadavNo ratings yet

- Section 194Document10 pagesSection 194Hitesh NarwaniNo ratings yet

- Income Tax ActDocument50 pagesIncome Tax ActMahesh NaikNo ratings yet

- Companies (Acceptance of Deposits) Rules 2014Document14 pagesCompanies (Acceptance of Deposits) Rules 2014PratyakshaNo ratings yet

- Sales Tax Act, 1990 (Amended-Upto-01!07!2021)Document271 pagesSales Tax Act, 1990 (Amended-Upto-01!07!2021)Taimur RahmanNo ratings yet

- Explanation.-The Provisions of This Paragraph Shall Not Apply in The Case of A Non-GovernmentDocument9 pagesExplanation.-The Provisions of This Paragraph Shall Not Apply in The Case of A Non-GovernmentAl Amin SarkarNo ratings yet

- Regulating and Promoting the Insurance IndustryDocument5 pagesRegulating and Promoting the Insurance IndustrytahirhotagiNo ratings yet

- Service Tax Rules, 1994Document75 pagesService Tax Rules, 1994Gens GeorgeNo ratings yet

- Companies Act dividend declaration rulesDocument10 pagesCompanies Act dividend declaration rulesSidharthNo ratings yet

- The Payment of Bonus Act 1965Document8 pagesThe Payment of Bonus Act 1965Abhishek ShahNo ratings yet

- ITR's and AssessmentDocument11 pagesITR's and Assessmentashutosh4iipmNo ratings yet

- ICDR Guidelines - IGP - April 05 2019Document6 pagesICDR Guidelines - IGP - April 05 2019Srishti 2k22No ratings yet

- 209A. (1) (I) (Ii)Document29 pages209A. (1) (I) (Ii)Manoj NamdevNo ratings yet

- Inherent Limitations On The Power of TaxationDocument6 pagesInherent Limitations On The Power of TaxationEdwin Villegas de NicolasNo ratings yet

- THE INDUSTRIAL DEVELOPMENT AND REGULATION ACT 1951Document6 pagesTHE INDUSTRIAL DEVELOPMENT AND REGULATION ACT 1951Dakshata GadiyaNo ratings yet

- (C) "Government Company" Means A Company in Which Not Less Than Fifty-One Per CentDocument34 pages(C) "Government Company" Means A Company in Which Not Less Than Fifty-One Per CentArvind SarafNo ratings yet

- GST RefundsDocument26 pagesGST RefundsMuskan SharmaNo ratings yet

- Income Tax Act, 1961Document13 pagesIncome Tax Act, 1961Sanketh_Surey_6489No ratings yet

- GST Update130 PDFDocument3 pagesGST Update130 PDFTharun RajNo ratings yet

- Income Deemed To Accrue or Arise in IndiaDocument12 pagesIncome Deemed To Accrue or Arise in IndiaSuryaNo ratings yet

- Revenue Regulations No. 07-10 - Implementing The Tax Privileges Provisions of Republic Act No. 9994 (Expanded Senior Citizens Act of 2010)Document13 pagesRevenue Regulations No. 07-10 - Implementing The Tax Privileges Provisions of Republic Act No. 9994 (Expanded Senior Citizens Act of 2010)Cuayo JuicoNo ratings yet

- Section 139 - Return of incomeDocument7 pagesSection 139 - Return of incomeAnand LakraNo ratings yet

- The Following Clause 10 (D) of Section 10 by The Finance Act, 2003, W.E.F. 1-4-2004Document10 pagesThe Following Clause 10 (D) of Section 10 by The Finance Act, 2003, W.E.F. 1-4-2004120133No ratings yet

- EnglishDocument90 pagesEnglishsanjaifromusaNo ratings yet

- Export Guidelines in Nigeria PDFDocument6 pagesExport Guidelines in Nigeria PDFetohNo ratings yet

- Custom House AgentsDocument13 pagesCustom House AgentsMurali MohanNo ratings yet

- Et Iso 605 2001 PDFDocument10 pagesEt Iso 605 2001 PDFgabisoNo ratings yet

- DILG Region XII issues order on attendance to Seal of Good Local Governance trainingDocument3 pagesDILG Region XII issues order on attendance to Seal of Good Local Governance trainingJadelyn Bernadas CabAhugNo ratings yet

- 26 Filipinas CIA. de Seguros, Et Al. vs. MandanasDocument13 pages26 Filipinas CIA. de Seguros, Et Al. vs. MandanasGia DimayugaNo ratings yet

- Verified ComplaintDocument18 pagesVerified Complaintsmayer@howardrice.comNo ratings yet

- Department of Labor: fs17c AdministrativeDocument3 pagesDepartment of Labor: fs17c AdministrativeUSA_DepartmentOfLaborNo ratings yet

- Long Quiz ReviewDocument6 pagesLong Quiz ReviewCamille BagadiongNo ratings yet

- LABOR STANDARDS WAGESDocument1 pageLABOR STANDARDS WAGESInna De LeonNo ratings yet

- 1 Basic Electrical Safety SafetycorDocument2 pages1 Basic Electrical Safety SafetycorHendri Agustinus KollyNo ratings yet

- US Army Camouflage Improvement Effort SolicitationDocument67 pagesUS Army Camouflage Improvement Effort SolicitationsolsysNo ratings yet

- Success Stories by Girls Entrepreneurs NigeriaqravlDocument2 pagesSuccess Stories by Girls Entrepreneurs Nigeriaqravlspiderteller7No ratings yet

- Chapter 1 "Quality Control and Engagement Standards"Document8 pagesChapter 1 "Quality Control and Engagement Standards"Raul KarkyNo ratings yet

- ProspectusDocument8 pagesProspectusshanumanuranu100% (1)

- 19 - Pboap Vs DoleDocument17 pages19 - Pboap Vs DoleMia AdlawanNo ratings yet

- Victoriano V Elizalde Rope Workers UnionDocument9 pagesVictoriano V Elizalde Rope Workers UnionCyndi OrolfoNo ratings yet

- Directors Duties: Skip To Primary Content Skip To Secondary ContentDocument4 pagesDirectors Duties: Skip To Primary Content Skip To Secondary ContentHimal AcharyaNo ratings yet

- Chapter 3Document54 pagesChapter 3koushik kumarNo ratings yet

- US Department of Justice Official Release - 02062-06 Tax 802Document2 pagesUS Department of Justice Official Release - 02062-06 Tax 802legalmattersNo ratings yet

- LTR SupplyDocument2 pagesLTR Supplyanon_919994949No ratings yet

- Business Licence Bylaw No. 3328Document14 pagesBusiness Licence Bylaw No. 3328BillMetcalfeNo ratings yet

- MV Registration VehicleDocument3 pagesMV Registration VehicleKhak UsNo ratings yet

- BECG Reckoner - MBA GTUDocument115 pagesBECG Reckoner - MBA GTUsorathia jignesh100% (2)