Professional Documents

Culture Documents

IRS Form W-2 Tax Document

Uploaded by

MickeyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IRS Form W-2 Tax Document

Uploaded by

MickeyCopyright:

Available Formats

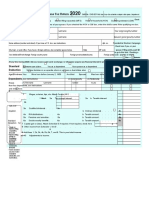

a Employee’s social security number Safe, accurate, Visit the IRS website at

590-87-8644 OMB No. 1545-0008 FAST! Use www.irs.gov/efile

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

23-2424444 $1,000.00 $0.00

c Employer’s name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

Zero Squad Limited $1,000.00 $0.00

5 Medicare wages and tips 6 Medicare tax withheld

3900 S Las Vegas Blvd Las Vegas

Las Vegas, Nevada 89119 $1,000.00 $0.00

7 Social security tips 8 Allocated tips

d Control number 9 10 Dependent care benefits

e Employee’s first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12

C

Zero Squad Limited o

d

e

13 Statutory Retirement Third-party 12b

3900 S Las Vegas Blvd Las Vegas employee plan sick pay C

o

Las Vegas, Nevada 89119 d

e

14 Other 12c

C

o

d

e

12d

C

o

d

e

f Employee’s address and ZIP code

15 State Employer’s state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

NV $1,000.00 $0.00

Form W-2 Wage and Tax Statement

Copy B—To Be Filed With Employee’s FEDERAL Tax Return.

2021 Department of the Treasury—Internal Revenue Service

This information is being furnished to the Internal Revenue Service.

You might also like

- IRS W-2 Form TitleDocument1 pageIRS W-2 Form TitleKeller Brown JnrNo ratings yet

- 2021 W2 Angela LiDocument1 page2021 W2 Angela LiDAISY CRAINNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerHot HeartsNo ratings yet

- Wage and Tax StatementDocument6 pagesWage and Tax StatementNick RubleNo ratings yet

- IRS Form W2Document1 pageIRS Form W2nurulamin00023No ratings yet

- w2 Efile 2023Document10 pagesw2 Efile 2023latrellNo ratings yet

- 623 Cce 3 BD 2 FB 0Document1 page623 Cce 3 BD 2 FB 0mondol miaNo ratings yet

- Wage and Tax Statement: Copy C-For EMPLOYEE'S RECORDS (See Notice To On The Back of Copy B.)Document1 pageWage and Tax Statement: Copy C-For EMPLOYEE'S RECORDS (See Notice To On The Back of Copy B.)Steven LinNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document1 pageProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09rohit dasNo ratings yet

- Sarah Paredes 21w2Document2 pagesSarah Paredes 21w2Sarah ParedesNo ratings yet

- W2 Preview titleDocument1 pageW2 Preview titlemrs merle westonNo ratings yet

- Green Knight Economic Development Corporation IRS Form 990 For FY2015, Showing $20K in Community Grants On $1.8m of RevenueDocument27 pagesGreen Knight Economic Development Corporation IRS Form 990 For FY2015, Showing $20K in Community Grants On $1.8m of RevenueDickNo ratings yet

- Matthew Wozniak W2 2021 W2 202233131923Document3 pagesMatthew Wozniak W2 2021 W2 202233131923MwNo ratings yet

- Ka/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Document4 pagesKa/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Jonathan Seagull LivingstonNo ratings yet

- Tax - 2020-2021 PDFDocument2 pagesTax - 2020-2021 PDFShanto ChowdhuryNo ratings yet

- 2019 Chandler D Form 1040 Individual Tax Return - Records-ALDocument7 pages2019 Chandler D Form 1040 Individual Tax Return - Records-ALwhat is thisNo ratings yet

- Payroll Register PD01-31-13 PDFDocument26 pagesPayroll Register PD01-31-13 PDFJoseph ManriquezNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09John Bean100% (1)

- File Your NJ Tax Return Online or by E-FileDocument68 pagesFile Your NJ Tax Return Online or by E-FileStephen HallickNo ratings yet

- 941 1st QTR 2010Document2 pages941 1st QTR 2010Larry BartonNo ratings yet

- Profit or Loss From Business: Edwin Der 353-46-3457 PhotographerDocument2 pagesProfit or Loss From Business: Edwin Der 353-46-3457 PhotographerJames100% (1)

- 2021 W-2 and Earnings SummaryDocument2 pages2021 W-2 and Earnings SummaryKawljeet Singh KohliNo ratings yet

- Hynum Greg Angela - 20i - CCDocument76 pagesHynum Greg Angela - 20i - CCAdmin OfficeNo ratings yet

- W 2Document3 pagesW 2Bar ChenNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument3 pagesU.S. Individual Income Tax Return: Filing StatuspyatetskyNo ratings yet

- Nolasco W2Document2 pagesNolasco W2MARCOS NOLASCONo ratings yet

- 2022 46-1240832 XXX-XX-8976 1410.00: CORRECTED (If Checked)Document2 pages2022 46-1240832 XXX-XX-8976 1410.00: CORRECTED (If Checked)Minerva BetancourtNo ratings yet

- Direct Loans MPN SummaryDocument15 pagesDirect Loans MPN Summarydog dogNo ratings yet

- TB US TaxRefund 2009 ENG PackDocument8 pagesTB US TaxRefund 2009 ENG Packabsolute_absurdNo ratings yet

- Profit or Loss From Business: Linda Gercken 156-56-8670Document2 pagesProfit or Loss From Business: Linda Gercken 156-56-8670ROB100% (1)

- Notice To Employee: WWW - Irs.gov/efileDocument2 pagesNotice To Employee: WWW - Irs.gov/efileRODRIGO GRIJALBA CABREJOSNo ratings yet

- Direct Deposit Enrollment Form: Account Information AmountDocument1 pageDirect Deposit Enrollment Form: Account Information AmountClifton WilsonNo ratings yet

- Pay Stub DetailsDocument1 pagePay Stub DetailsCresteynTeyngNo ratings yet

- Amanda K Scott 3535 W Cambridge AVE Fresno, CA 93722-6561Document6 pagesAmanda K Scott 3535 W Cambridge AVE Fresno, CA 93722-6561Amanda Scott100% (1)

- Dezhao Li: Earnings StatementDocument1 pageDezhao Li: Earnings StatementAnna LiNo ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementRich1781No ratings yet

- W-2 Form DetailsDocument1 pageW-2 Form DetailsSadiki LuhandeNo ratings yet

- Certain Government Payments: Copy B For RecipientDocument2 pagesCertain Government Payments: Copy B For RecipientDylan Bizier-Conley100% (1)

- Semir Demiri 50 14Th ST North Edgartown Ma 02539Document2 pagesSemir Demiri 50 14Th ST North Edgartown Ma 02539SemirNo ratings yet

- Vba 21 4192 AreDocument2 pagesVba 21 4192 AreGene GloverNo ratings yet

- Debit Account Transactions Date Description Type Amount Available Anson BasackerDocument3 pagesDebit Account Transactions Date Description Type Amount Available Anson BasackerClifton WilsonNo ratings yet

- MyfileDocument1 pageMyfileanon-302065No ratings yet

- Maria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 07712Document2 pagesMaria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 0771216baezmcNo ratings yet

- P010 636211442428322820 T14385011dupD1 PDFDocument1 pageP010 636211442428322820 T14385011dupD1 PDFAnonymous pY5EUXUpaNo ratings yet

- December StatementDocument3 pagesDecember StatementNoriely Altagracia Paulino RivasNo ratings yet

- Square 2022 W-2Document2 pagesSquare 2022 W-2Zane CardinalNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Thomas LawrenceNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax Return. Copy 2-To Be Filed With Employee's State, City, or Local Income Tax Return7cf42b5d98No ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document4 pagesWage and Tax Statement: OMB No. 1545-0008jgoldson235No ratings yet

- US Internal Revenue Service: f1040nr - 2004Document5 pagesUS Internal Revenue Service: f1040nr - 2004IRSNo ratings yet

- W-2 Tax FormDocument7 pagesW-2 Tax FormMaria HowellNo ratings yet

- Understanding Your PaystubDocument2 pagesUnderstanding Your PaystubmashaNo ratings yet

- Va Invoice To Be Paid TomorrowDocument2 pagesVa Invoice To Be Paid TomorrowmikeNo ratings yet

- 0ZB43 0ZB44 1837 20200101 W2Report W2Report 001Document2 pages0ZB43 0ZB44 1837 20200101 W2Report W2Report 001Ian CabanillasNo ratings yet

- Monthly Bank Statement SummaryDocument4 pagesMonthly Bank Statement SummaryClifton WilsonNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document3 pagesWage and Tax Statement: OMB No. 1545-0008h6bnyrr9mrNo ratings yet

- Schedule of Liabilities (SBA Form 2202)Document1 pageSchedule of Liabilities (SBA Form 2202)Vaé Ribera100% (1)

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Employee's W-2 FormDocument1 pageEmployee's W-2 FormDAISY CRAINNo ratings yet

- form-w2-Ramona-Crawford 2Document9 pagesform-w2-Ramona-Crawford 2Nicole CarutherNo ratings yet

- Notice Hons Admission 2020 2021 031021Document1 pageNotice Hons Admission 2020 2021 031021MickeyNo ratings yet

- 666 Computer Technology 1st SemDocument24 pages666 Computer Technology 1st SemMickeyNo ratings yet

- Assignment HSC2022 WK9Document43 pagesAssignment HSC2022 WK9MickeyNo ratings yet

- Death Certificate: Shadeed Monsur Ali Medical College HospitalDocument3 pagesDeath Certificate: Shadeed Monsur Ali Medical College HospitalMickeyNo ratings yet

- Assignment HSC2022 WK9Document43 pagesAssignment HSC2022 WK9MickeyNo ratings yet

- Encep Suryana Indonesia: Perum Griya Permata 2 Kopkarin Blok A8 Gunungmanik, TanjungsariDocument1 pageEncep Suryana Indonesia: Perum Griya Permata 2 Kopkarin Blok A8 Gunungmanik, TanjungsariEncep SuryanaNo ratings yet

- Your CV - : Upvesh KumarDocument1 pageYour CV - : Upvesh KumarMickeyNo ratings yet

- Assignment HSC2022 WK9Document43 pagesAssignment HSC2022 WK9MickeyNo ratings yet

- CH-2 (LR) FinalDocument41 pagesCH-2 (LR) FinalJason RaiNo ratings yet

- Mahindra Price ListDocument1 pageMahindra Price Listkishan KumarNo ratings yet

- 060 SkillFront The Lean Six Sigma FrameworkDocument241 pages060 SkillFront The Lean Six Sigma FrameworkSnics Desarrollo HumanoNo ratings yet

- Perdana Annual Report 2010Document276 pagesPerdana Annual Report 2010Yusop MDNo ratings yet

- LEGAL DOSSIER AND LEGAL DOCUMENT IN ENGLISHDocument58 pagesLEGAL DOSSIER AND LEGAL DOCUMENT IN ENGLISHCristian Silva TapiaNo ratings yet

- Confidential Marketplace AgreementDocument7 pagesConfidential Marketplace AgreementLee LimNo ratings yet

- PUMBA - DSE A - 506 - LDIM - 1.1 Nature and Scope of International Trade Law - PPTDocument34 pagesPUMBA - DSE A - 506 - LDIM - 1.1 Nature and Scope of International Trade Law - PPTTô Mì HakkaNo ratings yet

- Plaint in The Court of Civil Judge Senior Division Nasik Summary Suit No. 1987Document3 pagesPlaint in The Court of Civil Judge Senior Division Nasik Summary Suit No. 1987AaradhyNo ratings yet

- Dragon Fruit Greek Yogurt Feasibility StudyDocument16 pagesDragon Fruit Greek Yogurt Feasibility StudyJamie HaravataNo ratings yet

- Neeraj CV-1Document2 pagesNeeraj CV-1AditiNo ratings yet

- KatturaiDocument2 pagesKatturaiMaria AlvaradoNo ratings yet

- Digital Marketing Campaign Plan For Lloyds BankDocument23 pagesDigital Marketing Campaign Plan For Lloyds BankOkikioluwa FajemirokunNo ratings yet

- Game TheoryDocument16 pagesGame TheoryVivek Kumar Gupta100% (1)

- Strategic Marketing Plan of NagadDocument26 pagesStrategic Marketing Plan of Nagadhojega100% (1)

- Case DigestsDocument48 pagesCase DigestsHazel Reyes-AlcantaraNo ratings yet

- Updated Blaw Past Papers by RNK-1Document90 pagesUpdated Blaw Past Papers by RNK-1muzamil azizNo ratings yet

- Module 6 Study Outline (July To December 2011) r1Document16 pagesModule 6 Study Outline (July To December 2011) r1ingmiri100% (1)

- Construction Project Administration ManuDocument764 pagesConstruction Project Administration ManujeddNo ratings yet

- Project: Restaurant at Thamel Designer: Needle Weave L Architects Job Address: Thamel, KathmanduDocument1 pageProject: Restaurant at Thamel Designer: Needle Weave L Architects Job Address: Thamel, KathmanduKiran BasuNo ratings yet

- Prelim Quiz 2Document11 pagesPrelim Quiz 2Sevastian jedd EdicNo ratings yet

- Electronic Ticket Receipt: 618 2433846967: Flight DetailsDocument5 pagesElectronic Ticket Receipt: 618 2433846967: Flight DetailsWai Min ThuNo ratings yet

- An Overview of Using Hydrogen as a Vehicle FuelDocument25 pagesAn Overview of Using Hydrogen as a Vehicle FuelAyush RajNo ratings yet

- Crisis Management Final Examination: "PT. Freeport Indonesia Big Gossan Collapsed"Document16 pagesCrisis Management Final Examination: "PT. Freeport Indonesia Big Gossan Collapsed"PavelBondarNo ratings yet

- TS Grewal Class 11 Accountancy Solutions Chapter 7Document10 pagesTS Grewal Class 11 Accountancy Solutions Chapter 7Vishek kashyap 10 A1 22No ratings yet

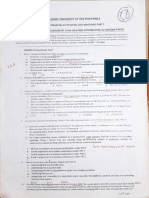

- Polytechnic University of the Philippines Advanced Financial Accounting and Reporting Part 2 Assessment ExamDocument9 pagesPolytechnic University of the Philippines Advanced Financial Accounting and Reporting Part 2 Assessment ExamBazinga HidalgoNo ratings yet

- Basics of Media Writing A Strategic Approach 2nd Edition Kuehn Test BankDocument10 pagesBasics of Media Writing A Strategic Approach 2nd Edition Kuehn Test BankDanDoylexdjcs100% (11)

- Capital BudgetingDocument2 pagesCapital BudgetingAlexis KingNo ratings yet

- GENERALLY ACCEPTED ACCOUNTING PRINCIPLES Chapter - 3Document3 pagesGENERALLY ACCEPTED ACCOUNTING PRINCIPLES Chapter - 3RitaNo ratings yet

- Megersa Business Plan. Mba 2024Document26 pagesMegersa Business Plan. Mba 2024Megersa100% (1)

- Insurance and Risk Management R6Y2dFBRs5Document290 pagesInsurance and Risk Management R6Y2dFBRs5jahnvi shahNo ratings yet