Professional Documents

Culture Documents

Ultimate Mini Guide Property Development Investing V1

Uploaded by

zviviCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ultimate Mini Guide Property Development Investing V1

Uploaded by

zviviCopyright:

Available Formats

The Ultimate

Mini guide

to property development investing

MATTHEW CALLAHAN

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 1

Published by The Open Corporation 2013

www.opencorporation.com.au

www.openwealthcreation.com.au

© 2013 Matthew Callahan

This publication is copyright. All rights are reserved.

Except as permitted under the Copyright Act 1968 (Cth),

no part of this publication may be reproduced, stored or

transmitted by any means, electronic or otherwise, without

the specific written permission of the copyright owner.

Disclaimer

While reasonable care has been taken producing this book, no guarantees are

given in regards to the accuracy of its content or the material provided in the

web links. Property investing/development is a complex field and it is ever

changing. Every person’s circumstance is different, and therefore no reader

should rely solely or partially on the information in the book or the material in

web links provided by the author. Any person or organisation reading this book

or obtaining the material provided in the web link is responsible for their own

investment decisions. Open Corporation, its directors and employees are neither

liable, nor responsible for the result of any actions or losses incurred, whether

whole or partial, from the use of the content, information or tools provided.

The author is simply sharing information that he personally uses himself when

investing.

2 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

About the Author

As an investor in many different asset classes over the years and a

former banker, Matthew Callahan outlines his personal investment

journey and how the lessons learnt have come to form his views on

property development investing and why he believes it is a good

vehicle for building wealth.

Matthew lives in Melbourne with his wife Kate and their young

family. When Matthew isn’t exuding the merits of property

developments and raising capital for Open Corporation he is a full

time Dad to Alice & Ethan and a part time triathlete.

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 3

Table of contents

Introduction 5

What is property development? 7

My journey 9

Let the investing begin! 10

A bigger piece of the investment pie 11

Foreign exchange trading anyone? 14

A real-life foreign exchange experience 15

Vital flow information – the real truth 16

The quest continues 17

Fatherhood & a priority change 17

Enter property 19

Leave it to the professionals 21

So what?! What’s the difference? 24

Risk 27

How much property development can Australia handle? 28

Dispelling more misconceptions 29

A note on self-managed super funds (SMSFs) 30

How syndications work 31

A quick guide to building a risk profile 32

Product Disclosure Statements and

Information Memorandums 32

PDS/IM Checklist 33

4 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

introduction

‘The best investment on earth is earth.’

Louis J. Glickman, Real estate investor & philanthropist.

Have you ever said to yourself, ‘I wish I knew then what I know

now’? Most of us eventually reach this conclusion about some part

of our lives.

For me this revelation occurred a few years ago. I’d been an investor,

mainly in stocks, but with some residential property dabbling.

It wasn’t until I concluded my own property development that I

thought ‘Why haven’t I been doing this for years?!’

My learning curve was steep, but the expertise I gained from doing

my own property development was priceless. It helped me realise

that over the long term, the magic of compounding returns from

one project into another was an exciting prospect for future wealth.

I’m now fortunate to work with a team of experienced property

developers. Each day I speak with clients eager to grow their wealth,

I’m excited to introduce them to the property development world

my colleagues and I enjoy.

I’m an advocate of direct property investment in multiple forms.

It’s a vital part of my investment portfolio (including residential

property and it is one of the most popular means of investing).

The strategy of residential property investment is sound. In fact,

I’d encourage you to read my colleague Cam McLellan’s book My

four year old The Property Investor. Not only is it easy to read, it’s a

useful guide to investing in residential property through Cam’s real-

life experiences. You can find a copy at www.openwealthcreation.

com.au. However, few investors realise that the strategy of building

a residential property portfolio, though sound, isn’t the only game

in town.

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 5

My goal in writing this guide is to:

• reveal the merits of property development and

• dispel the myths many people I talk to have about investing

in property developments.

By reading this guide, you’ve already shown a desire to seek other

investment vehicles for your hard-earned cash. I hope you find

this guide enjoyable and informative and I warmly welcome your

questions and comments.

6 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

What is property development?

In a nutshell, property development is the process of buying land

and improving it such that the value rises more than the cost of

changes.

Property developments come in several different forms, but for the

purpose of this guide we’ll discuss two: ‘land only’ and ‘built form’

subdivisions.

Land only subdivision entails the acquisition of land which is then

subdivided and sold. The process generally includes earthworks,

roads, footpaths, green areas and services (e.g. drainage).

Built form subdivision involves the acquisition of land which is

then subdivided with houses, town homes or units constructed on

each lot.

In general, the processes involved in developing a parcel of land

are:

Due diligence

A process involving extensive investigation by the property

developer regarding the potential land acquisition. This may

involve environmental reports, architectural drawings and even

the likelihood that the local council will approve the plans. This

process may take several months and cost thousands of dollars, but

it’s designed to provide a high level of certainty that the developer

will be able to convert their vision into reality.

Land Acquisition

Once due diligence is completed to the property developer’s

satisfaction, terms and conditions are negotiated. Generally

speaking, the developer will negotiate the best possible conditions

under which they need to operate. This may include development

approval, timeframes or financing.

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 7

Planning

This involves developing a design for the land and negotiating to

obtain all necessary permits. Simply put, this part of the process

is about ‘what’ the developer wants to build and asking the local

council for approval.

This process can take 6 to 18 months, depending on the property

developer’s intentions for the land. The developer may engage

town planners and needs to work closely with the local council.

The developer may not always obtain approval for every aspect of

the development and therefore needs experience and creativity to

ensure the best possible outcome for the project.

Construction

Once the property developer has obtained approval for ‘what’

they’re going to build, they must submit to the council plans for

‘how’ they’re going to build the property development.

If it’s a land only subdivision, engineering plans will have to be

submitted regarding the contouring of land, drainage and other

environmental factors.

If the property development is built form (e.g. town homes, units)

architectural and building plans must also be submitted. This

involves a builder, engineers and other consultants to ensure a

successful project.

Marketing and sales

The branding and promoting the end product (whether it’s land

only or built form) often requires the help of marketing specialists.

Getting the right branding and marketing are crucial. You must

understand the right target market to sell to, given the style,

location and pricing of the property development.

As financing may depend on obtaining a number of pre-sales or

off-the-plan sales, it’s important to start this process early.

8 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

Sales are often conducted through local real estate agents

or wholesale groups (provided the Developer has the right

relationships). Their job can be made easier if the right branding and

marketing have been achieved. Highlighting the significant stamp

duty savings a potential buyer can achieve is an important factor

when marketing and selling during the early stages of construction.

My journey

My desire to grow my wealth didn’t start with property development.

Rather, my investment journey was scattered with a few potholes

and the odd dead end.

I didn’t come from money and, as the youngest child of eight, I

knew that if I were going to grow my wealth, it had to come from

within me.

Investors have various reasons for wanting to grow their wealth.

For me, it started with quality education and a desire to never

stop learning. Education is expensive, so I had to postpone wealth

building and be the starving student (complete with two-minute

noodles!) first.

Once I’d paid my dues, I began my formal career. I also began my

more passionate career to growing my wealth. My initial goals were

of the material accumulation kind: a sports car, a big house on the

beach, trips to exotic locales and some nice suits to impress the

boss.

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 9

Let the investing begin!

I knew that to grow my wealth, I had to be involved in the money

game somehow. Banking seemed a logical place to start. (After all,

they had plenty of money and I’d always wanted to own one as a

kid!)

Fortunately, my work involved me in the management of company

pension plans, which were predominately invested in the stock

market. Not unexpectedly, I gravitated towards stock market

investing too.

I looked at the historical price charts, read the popular financial

press and spent not nearly enough time studying annual reports.

Looking back today, I realise I took the easy way by adopting the

market’s ‘herd mentality’. If a stock got a good write-up and the so-

called ‘experts’ recommended it, I figured it must be good.

Herd mentality. It’s not easy to go against the pack. You need to take

a great deal of time to research the market. And you must have the

discipline to get out if a stock is going against you. Warren Buffet, one

of the most successful investors in modern times, doesn’t give specific

stock recommendations to the public. I drew a big lesson from this.

I wish I could say I was a successful investor back then, but I wasn’t.

Yes, I had some good months – but was I achieving my goals? No.

Over the years, my gains were minimal.

You’d think that with the kind of knowledge I was accumulating,

I’d have been more successful. It was only once I started investing

in property developments that I realised my equity trading history

was, at best, a gamble with long odds. My suits were still well and

truly ‘off the rack’.

10 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

Before you tell yourself you’ve been doing it wrong for years, let

me clarify. My investment activities were short-term, with no long-

term time horizon.

Equities, bonds and other investments still form a small part of my

investment portfolio but my investment time horizon is now more

than two years.

Tip

Investing in anything takes time, dedication and, above all,

expertise acquired over a long period. Before you decide to

go it alone, ask yourself if you really have the time needed

to dedicate yourself.

A bigger piece of the investment pie

Why does property form a relatively big part of my investment

portfolio? It’s all about control and execution.

Let me explain.

If you buy into a managed fund that holds BHP Billiton shares (and

many do) what control does the fund manager have over BHP and

its decisions that will ultimately grow your wealth?

The answer is little to none. What’s more, the stock has two

outcomes: it goes up (you make money) or it goes down (you lose

money). Excluding any dividend you may receive, that’s it!

One of the reasons I have such affection for property development

is that as the development manager, you can manage and control

your investment if the environment changes.

For example, at Open Corporation, our primary goal is to develop a

site, sell it, make profit and move to the next development.

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 11

In our developments, this has always been the outcome. But let’s

say property prices come under pressure and go down. Due to the

nature of developments, this is by no means a disaster. Property

developers have direct control over what happens if a project

encounters changed conditions. The managers can choose to:

1. sell a completed product (e.g. houses, units) at prevailing market

rates or

2. rent the product until the market recovers and then sell (as my

colleague Cam says, ‘property is like a bad haircut, time will

eventually fix it’).

Most property developments have a profit margin of around 20%.

So, unless the market dips by more than 20%, the chance of losing

part or all of your capital is small relative to other investment types.

However, this is provided the property development doesn’t rely on

excessive debt (another thing an experienced property developer

will effectively control), which can tip the scales if prices do fall or

costs increase substantially.

12 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

According to RP Data, during the global financial crisis (GFC) the

median residential house price in capital cities dropped by only

10%. Compare this to what happened with shares: the ASX200

dropped by over 50%!

I agree that lower property prices mean returns aren’t as good. But,

due to the profit margin, you could still expect some returns over

a longer timeframe.

Compare this ability to manage a development given a negative

economic impact with your fund manager’s ability to control the

stock you own. I take property development every time. How I

wish I knew then what I know now!

Tip

Thanks to a built-in margin, property developers have more

flexibility to manage a positive outcome if conditions move

against them. If you don’t have the time, expertise, or capital,

to pull off a property development on your own you should

consider investing with a property development manager

who can take care of everything, including site acquisition,

to give you peace of mind.

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 13

‘I have never met a man who could forecast the market.’

Warren Buffett, Chairman and CEO of Berkshire Hathaway.

Foreign exchange trading anyone?

By participating regularly in investor expos across Australia, I’ve

been fortunate to meet many attendees. I get frustrated, however,

when I meet investors who fancy themselves as foreign exchange

or ‘forex’ traders. They’ve attended all the seminars with the

soothsayers extolling their charting wisdom that, so long as you

interpreted the historical forex price charts correctly, you can

make a fortune.

14 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

Like forex, technical analysis (or basing your investments on charts) is

poignantly described by Eugene Fama, the father of modern finance, as

‘astrology’.

With today’s technology, the thought of trading on a real-time

forex platform with tradable quotes ticking across multiple screens

would make people feel like they were Captain Kirk on the bridge

of their own spaceship hurtling at warp speed to planet Financial

Independence!

The notion of trading on such a platform, in the comfort of your own

home, would make anyone feel like a big-time trader. How could

you lose? The soothsayers teach you all about risk management

systems, including when to buy and sell, and you aren’t risking all

your capital at once. Besides, the forex charts never lie … right?

A real-life foreign exchange experience

As my formal banking career continued, I was exposed to the forex

market – in part as a trader for the bank, but primarily as a forex

salesman to regional banks and large corporations.

This experience dramatically impacted my view of forex as a means

to grow wealth (and it’s why I feel frustrated when I meet would-

be investors). My chief concern is the lack of information traders

have, which dramatically increases risk.

Let me give you a real-life example.

While working at the bank, I was seconded to a regional treasury

department in Manchester UK – where some of our best clients

were English premier football clubs. These clubs used the bank for

their forex requirements whenever they were acquiring new players

from Europe. They sold us Pounds Sterling and we sold them Euros

so they could make the purchase.

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 15

As these transactions often exceeded ten million Pounds Sterling,

they affected the forex market.

My concern was (and remains) this: what hope does the average

forex trader have of knowing about these and other global

transactions?

Answer: None!

Just as a fund manager can’t control BHP, forex traders have no

control over their market. Worse, they’re likely to be ‘underwater’

as they have no built-in margin. By this I mean there’s no value-

add when you buy currency or shares. Your break-even price is the

price at which you bought (including all closing costs).

With property development, however, the end product’s break-

even price may be 20% lower than the prevailing market price.

Vital flow information – the real truth

The truth is that amateur forex ‘traders’ not only have a 50/50

chance (at best!) to make money, they’re also oblivious to global

market events that could impact their position at any moment.

Still not convinced? Consider this.

According to the Bank of International Settlements, the forex

market trades around US$4 trillion every business day. Large

banks and global institutions account for the vast majority of this

volume. So, unless you work in a large dealing room and have a

bird’s-eye view of the financial flows being transacted minute to

minute, you’re simply flying blind.

Amateur forex traders never have this vital flow information that

can affect their trades.

I’d prefer a far better market gauge before jumping in as an amateur

trader.

16 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

Tip

Never trade forex as a means of wealth creation: you simply

don’t have all the vital information!

The quest continues

I grew up in Canada and was fortunate to travel abroad as my

banking career progressed. I was even more fortunate to meet my

future wife, Kate, while working in Dubai.

Kate was born in Melbourne. After several years in the UK and

Dubai, we decided to settle in Melbourne (not the ideal time zone

for my illustrious investing career!)

Given my history, you’d think I’d put my hard-earned cash under

the mattress and never look at another investment opportunity.

I was also rapidly concluding that equities and especially forex

simply weren’t worth the risk, given the return.

Then something profound happened ...

I became a dad!

Fatherhood & a priority change

Becoming a dad was one of the best things that had ever happened

to me. Yet it was scary to think how I was going to provide for this

new bundle of responsibility.

Remember how I told you about my need for education and my

desire to live in a bigger house and have an expensive car? Well,

I continue to carry that education philosophy with me to this day

and want to instil it in my daughter Alice.

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 17

But my priorities changed from material accumulation to an

overwhelming desire to give Alice the best education I could afford.

Not just an academic education, although this is a key ingredient,

but to be able to afford her life experiences that will help formulate

part of that education; and the odd trip to Disneyland!

I was already worrying how I could fund this bright future. So

imagine my reaction when Kate told me we had a second child on

the way 2½ years after Alice!

My eyes widened as I contemplated the returns I was going to have

to make, now that I’d just doubled my education costs. Time was

not on my side and I was starting to think that inheritance was my

only way out!

Yes, my priorities had changed and my determination to build my

wealth was even stronger.

In short, I no longer cared about tailored suits!

18 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

Enter property

After seven years of working in the Australian financial industry,

I became disillusioned with my superannuation. Financial advisors

claiming to be ‘unique’ or have an ‘edge’ were simply ‘singing

from the same song book’ (i.e. peddling the same managed equity

and balanced funds) as everyone else. In short, they were merely

brokers for big managed funds.

I became even more disillusioned when my super grew one year,

made far less the next, then lost the gains from several previous

years. To compound my frustration, the fund manager was making

money despite my (lack of ) returns! Why was he driving a Mercedes

while I took the train?!

My wealth-growing investment options were starting to narrow.

At this time, I noticed that my neighbourhood was undergoing

renewal. Small property developments were replacing old and

derelict houses. Whether it was my ego, or my wish to give my kids

an education, I believed that with prudent investigation I too could

have a property development.

But when I enquired about a property for sale in my area, I asked the

real estate agent what ‘STCA’ meant. Once I learnt that something

so basic within the real estate industry stood for ‘subject to council

approval’ I knew I was way out of my depth. (and I could tell, so did

the real estate agent, by his tone of voice!)

I had no idea how to get council approval. I didn’t even know what

I needed approval for (though the property’s sign suggested four

units).

After researching the market and learning much more about the

council development approval process, I realised this was a major

risk for any project.

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 19

I identified several property developments in my price range. I

believed that if the end product was correctly priced for the current

market, I’d succeed.

In conducting my own due diligence, I

investigated all costs I’d conceivably face

if I chose to invest in and manage my own

property development.

Most importantly, I ‘sussed out’ various

builders to ensure I didn’t get a shark.

My final step into the first property development was to review all

the investment experience I’d acquired while building my wealth.

I then distilled five characteristics I felt I needed on my investment

checklist. Below is what I actually wrote in 2011. This high-level

visual of various investments was very telling!

20 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

My due diligence paid off with respect to finding a builder. I found

not just a good one, but a great one. He was instrumental in helping

me build my financial model and helping me to avoid many of the

pitfalls that afflict the ‘recreational developer’. He gave me the

confidence to move forward with the development. Without my

builder, I’m not sure I’d have proceeded.

From this sound financial modelling base, I then managed the

project and it allowed me create a product that was in demand by

being at the right price point.

I’d achieved a high return with relatively low risk. Not surprisingly,

this early success increased my desire to invest in more property

developments.

However, as I look back at this first project, I realise my success

came down to due diligence and finding a good builder. I wonder if

my lack of experience would’ve hindered my ability to complete the

project if something had gone wrong. Would the end result have

been the same?

Leave it to the professionals

My great builder’s name was Steve. During our interactions, I told

him how much I enjoyed property and wanted to do more. We

chatted about my career experiences and Steve suggested I meet

his son Matt.

Matt, already a top developer, was growing a company with his

brother Allister and their business partner, Cam. They were

ambitious, successful and very knowledgeable about the property

development industry. After friendly discussions with these

partners about their vision for the future, I realised I wanted to join

them.

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 21

While I didn’t need to be hired to invest in their projects, I saw

a symbiotic relationship: I could help them drive this exciting

business forward by using my financial expertise in capital raising

while continuing to grow my wealth by investing in the projects

being developed.

Fortunately, they liked my Canadian accent and thought I could

take a joke or two. And so I was hired!

I’ve since learnt a great deal about property development with

Open Corporation. This experience has convinced me that:

A. property development is a great way to build wealth and

B. investing via a ‘syndication’ structure (described soon) further

reduces risk.

Let me explain ...

One of the biggest risks I took with my property development

was using all my cash. I also used my house as collateral for a

construction loan from the bank. If things really went pear shaped,

my family would lose their home.

As you can imagine, convincing my wife this BIG risk was a good

idea was one of the toughest hurdles I faced. (It made dealing with

local councils look easy!).

As you’ve seen, my builder and I managed to pull it off. But

hindsight and new expertise made me realise how dangerous this

approach was. Part of my saving grace was that I could draw on my

strong financial modelling, my existing relationship with the bank

and my understanding of what banks look for when determining

whether or not to lend money.

Additionally, as an investor in our syndicated property

developments, there’s no recourse against bank loans. In other

words, no bank can hold you, as an investor, personally liable if a

loan isn’t repaid.

22 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

I enjoyed project managing my own development and the profit

it produced. But to make any project successful, you must actively

manage the process.

As the project manager of my own development, I’d have to

negotiate the construction loan with the bank, manage the builder,

develop a marketing plan and work regularly with the sales agent.

During many sleepless nights, when things weren’t going to plan,

I’d think, ‘If I fail, how will I educate my kids?’

Then the light bulb went on. I realised I could achieve similar returns

(with less hassle) through syndications as I could by managing my

own project!

Open Corporation taught me that by investing in a number of

developments through syndication offerings, I was spreading my

projects across different states, thus further reducing my risk with

geographic diversification.

Now I could sleep soundly, knowing the project was being

managed by an experienced expert whose job was to look after the

development’s day-to-day running.

I could be a passive investor, diversify my risk and make good

returns.

My experience has provided me with a better understanding of

what constitutes a good investment, given the risk profile. Today

I’m an investor in most of Open Corporation’s developments. Those

that I haven’t invested in has been because of the high demand

from investors like you. Considering that most of our projects are

returning upwards of 20% per annum this high demand really isn’t

surprising.

As you might imagine, I’m also very proud to be an equity investor

in the company itself. My wealth creation goals are once more on

the up and up – and I can almost see my children’s degrees hanging

on the wall!

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 23

So what?! What’s the difference?

You wouldn’t be amiss to ask: ‘OK, but just like equities and forex,

isn’t property development about predicting the market?’

The difference between these investment types and property

development can be explained with three concepts:

1. Value add.

2. Execution.

3. Underlying (hard) asset.

Value Add

Property development is about taking a (relatively) raw piece of

land and creating value by building an end product that someone’s

willing to buy.

The idea is that the sum of the end products is significantly higher

in value than the raw land.

It’s really no different to buying chips (fries) at McDonalds. They

buy raw potatoes from farmers, add value to them (transport,

wash, cut, fry) then sell them to you with your burger.

As you can well imagine, the price per kilogram McDonalds pays

for potatoes is dramatically less than the price per kilogram you

pay for chips.

There’s nothing wrong with this; it’s a matter of adding value and

creating a product that’s in demand. Property development works

on the same concept, as you can see below.

24 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

Execution

The process of taking raw land and developing it into homes buyers

wish to purchase is no easy feat. But an experienced property

developer can avoid the pitfalls of land purchase negotiation,

engineering and environmental reports, building costs, financial

modelling, marketing, branding, sales and so on.

In short, you’re investing in people – the expertise of the

development manager.

A good development manager positions the end product in the

market at a price competitive with prevailing like-for-like products.

I agree this involves an element of market analysis. But on this

basis, a good property developer isn’t trying to predict the market

and isn’t relying on growth. They’re using actual sales figures to

determine today’s price to ensure they can achieve the desired

financial outcome.

Property development gives you extra margin through the value-

add process. Market predictions, like those required in equities or

forex investing, aren’t all you have to hang your hat on.

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 25

Yes, market prices may go down, but a good property development

has a margin built into its expected returns to compensate for a

downturn. Alternatively, if market prices go up, investors can

expect to see a better return.

Underlying (hard) asset

With land purchase, one thing’s certain: it never goes away. This

is an important attribute. Further, it cannot be destroyed and you

can’t make more of it. But with equities, the value can be completely

eliminated. Public companies can go bankrupt. Forex prices can

fluctuate to levels not seen again for years.

This is a big point of difference.

26 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

Risk

‘Risk comes from not knowing what you’re doing.’

Warren Buffett.

The topic of risk is so important, it has its own section in this guide.

Another concern I hear from potential property development

investors is that it’s too risky, given the returns.

This is a valid and important concern to address.

Had I not done my own property development first, I wouldn’t have

believed the projected returns of the syndications I now invest in,

given the risk.

Each time you hand your money to an institution to invest, there’s

some element of risk. The negative impact can vary from not

reaching a forecasted return to losing everything.

The ‘risk return trade-off ’ (also known as the ‘efficient frontier’) is

demonstrated in the graph below. The return for each asset class

comes with a corresponding increase or decrease in volatility

(i.e. risk). For example, property offers a ‘moderate’ return with a

comparable risk.

Yet this graph considers asset classes in general. I’d therefore argue

that picking a well-managed property development, with good

margins, in a desired or growing suburb, will move your returns

to a higher point on the return scale, but not with a corresponding

increase on the volatility (risk) axis.

What’s more, diversifying across multiple property developments

in different geographic locations can further reduce risk.

This makes good property development a superior investment

option, in my opinion.

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 27

How much property development can Australia

handle?

The press report daily on Australia’s economy. Some pundits try

to extrapolate the latest data. But every factoid can be interpreted

many different ways!

For me, the economics are simple. Australia is a developed country,

with a growing population, well-defined legal and social structures

and a wealth of natural resources. Like all counties, it’s still

vulnerable to economic cycles. But Australia remains a desirable

immigration destination and its land is a fixed quantity.

In other words, I take a long-term approach. This is consistent with

the National Housing Supply Council’s 2011 State of Supply Report.

Among its findings was an estimate of 12.0 million households by

2030, an increase of 3.3 million households between 2010 and 2030.

28 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

In its report, the Council believes there’s a cumulative shortfall of

186,800 dwellings (June 2010) that’s likely to increase in coming

years. Good news for property developers!

Dispelling more misconceptions

Throughout this guide I’ve argued that property development

investing is a solid way to grow your wealth, given the risk.

The investing mechanism I now use is generally through

syndications. Unfortunately, I get the impression many everyday

investors think syndications are mysterious, complicated and not

worth their attention.

Before the GFC, self-managed super funds (SMSFs) weren’t a

widely used superannuation investment vehicle. Now people are

starting SMSFs in record numbers.

Syndications are becoming more widely used as their merits are

fully understood. Syndications pool small amounts of money to

make big profits relative to the original investment. Each investor

receives ownership in the syndicate (which owns the development)

proportional to their original investment.

Countless times I’ve chatted with potential investors who’ve said

they can’t invest in property developments because they don’t have

enough money or don’t want to tie up their money for ten years.

Yet some of our investors invest as little as $15,000 and the average

property takes merely two years to complete!

Syndications don’t require you to invest additional cash (unless you

invest in stages, e.g. 50% now and 50% in three months). Once you

make your initial investment, that’s all you have to contribute.

Syndications are a passive investment. You leave the project

management to the experts while you sit back and watch your

property develop through regular newsletter updates.

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 29

Syndications invest in the development of the project, not the

purchase of the end product.

Generally speaking, syndication investing means there’s no recourse

to the investors should the bank loan not be repaid. However, a

good property developer will ensure this is never a concern. Refer

to Low gearing (debt or leverage) in the PDS/IM Checklist.

Tip

When investing in managed property developments, instead

of going through an industry fund, go directly to a property

developer who manages the project.

A note on self-managed super funds (SMSFs)

While it’s not in this guide’s scope to discuss SMSFs, I can say that at

least 75% of our investors use their SMSF to invest in our property

developments. I therefore encourage you to talk to your financial

advisor or accountant. (I know my super fund is getting a boost!)

30 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

How syndications work (step-by-step)

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 31

A quick guide to building a risk profile

Analysing risks vs returns on any investment is critical. Over the

last few years, I’ve been fortunate to be intimately involved in the

acquisition, approval, development, capital raising and marketing

of a number of property developments.

Because I’ve been involved in all aspects of the property development

process, I’ve gained a unique perspective on growing wealth.

Over the years I’ve learnt it’s important to understand all aspects of

a potential investment before you invest.

Below is a guide to help identify what to look for.

Product Disclosure Statements and Information

Memorandums

Of the many potential risks a property development faces, some

are riskier than others.

Important information is contained in the product disclosure

statement (PDS) or information memorandum (IM). Along with

this guide, the PDS or IM is another important resource to help

educate you on the merits of investing in a property development.

32 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

Property developments have more ‘moving parts’ than many

investment vehicles. So it’s important to ensure you understand all

aspects of your potential investment before you commit.

Interestingly, most first-time developers don’t fully understand

how to ‘control the levers’ that make or break a development.

Each property development has unique characteristics, so expand

your education by asking lots of questions. If you don’t like what

you hear it’s time to ask yourself, ‘Is this the right development for

me to invest in?’

It’s crucial you don’t get emotional about a potential investment. A

logical approach helps you stay focused and identify which project

aspects may warrant further understanding or disclosure.

There are plenty of development opportunities out there, so move

on to another if the one you’re analysing doesn’t stack up for any

reason.

Below is a checklist of what to look for when reading a PDS or IM.

PDS/IM Checklist

Development approval

All property developments require local council approval to

undertake the project. While gaining this approval before raising

funds for a project may seem logical, it’s often not the case. Property

developers in the process of obtaining council approval may look

to raise funds to continue the application.

The danger, of course, is that the development doesn’t proceed.

Even if it does, it may not be as profitable as advertised by the

developer if the council reduces the number of units or town

homes for which the developer originally applied.

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 33

Tip

If the council development approval isn’t in the PDS or IM, ask

to see a copy.

Fixed build price

Apart from the land purchase, the development cost (which can

include civil and road works and/or building constructions) is a

major expense.

To eliminate the risk of cost escalation, the property development

manager should fix these costs with the relevant third party provider

before raising capital (or at least be very certain the quoted costs

will be the agreed price when construction starts).

Any change to this cost can have a major impact on investment

return.

Tip

If the quoted build price isn’t in the PDS or IM, ask to see

a copy.

Initial investment only

Invest in property developments that require an initial investment

only. You don’t want to learn, after making your initial investment,

that unless you invest more money in a property development

project, it may not be completed.

Tip

Your initial investment may comprise two or more payments,

separated by anywhere from two weeks to several months.

34 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

Contingency

As discussed, the PDS or IM should reveal all costs, and major

expenses should be fixed through negotiations with third party

providers (e.g. builders, contracts).

Nevertheless, property developments are a major undertaking and

it’s important to include a contingency or ‘buffer’ to expected costs.

Unforseen costs invariably creep into projects. So it’s prudent to

add a contingency of 5% to 10% of construction costs to a project,

depending on complexity and size. Advertised returns should

include this contingency. That way, you can draw comfort knowing

that if the project does have cost overruns to the extent of the

contingency, you still achieve the return.

Tip

A contingency should be explicitly quoted in the financials of

the property development’s PDS or IM.

Low gearing (debt or leverage)

An important component of financing a property development

is debt. As with personal finances, however, too much debt can

increase risk, restrict cash flow and lead to financial distress.

The benchmark is to ensure a project’s debt doesn’t exceed 60% of

its value. This loan-to-value ratio (LVR) is also called ‘gearing’. For

example, if a project is valued at $2.0 million, debt shouldn’t exceed

$1.2 million.

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 35

Tip

Property developments with some gearing enhance returns

because investors don’t need to put as much money into the

project, however, too much debt can put a project in jeopardy.

It’s a balancing act!

Presales

Achieving some presales (i.e. ‘off the plan’ sales of end products

before construction begins) helps ensure a profitable development.

Presales ensure that part of the debt is paid off at the earliest time,

thus reducing interest costs.

Presales may be a prerequisite for obtaining finance (but not if a

low level of gearing [debt] is required to fund the project).

Tip

If a project you’re determining to invest in doesn’t require

presales, ensure the debt level is lower than acceptable levels

(see section Low gearing above).

No sales price escalation

Financial modelling is a key part of project development. It provides

a detailed analysis of all costs, revenues and timings.

As not all elements of this analysis are known when writing a

PDS or IM, assumptions are often made. While this is normal and

acceptable, the reader (you!) must determine if these assumptions

are reasonable.

Some PDSs contain a ‘price escalation’ assumption. This assumes

the project will get a higher price for its end product than what’s

available in the market today.

36 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

This dangerous assumption makes a project’s advertised returns

look better.

If higher sales prices are achieved, this return to investors should

be considered value added – not assumed.

Tip

Look for projects that explicitly state that they assume no price

sales escalation. If they don’t, ask for the assumed price growth

escalation figures and determine if these are reasonable for the

area in which your project resides. You can get this information

by asking local estate agents and researching the area on

popular real estate websites

Stress testing

Sophisticated developers use this process to determine the impact

of various prices or costs on the development and determine

revised projected investor returns.

Examples of changes that may affect a project are sales prices or

construction cost. Time is another factor that can impact returns.

A PDS or IM should contain a matrix or table showing how your

return will be affected given a particular change.

Tip

If the PDS or IM doesn’t contain this information, consider

what the impacts might be.

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 37

Compliance

The investment community is heavily regulated by the government.

It’s important to ensure any investment you make is through a

manager or property developer that has an Australian Financial

Services Licence (AFSL). This way you ensure they comply with rules

and regulations designed to protect investors. Also, compliance

with the Australian Securities and Investment Commission (ASIC)

is equally important. This ensures a high level of disclosure.

Tip

Be wary of property developers that are unregistered or

unregulated – they may be ‘back yard’ or ‘first time’ operators

trying to raise money. You may not be getting the full story!

In summary

When reading the PDS or IM of any potential property development,

it’s vital to look for the above-mentioned risks and the developer’s

robust plan to manage or mitigate (i.e. reduce but not eliminate)

them.

If you can’t find these things, investing in that development may

be too risky.

38 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

About Open Corporation

At Open Corporation we’re passionate about property. So much

so that we want others to be energised and excited about property

too.

That’s why we have investors from across the spectrum: from mums

and dads to high-net-worth individuals to professional property

investing organisations.

We’re always keen to talk with potential investors to dispel myths

and educate them about this exciting class of property investing.

I hope this guide has gone a long way to doing that. Please drop

me a line and let me know if you enjoyed the guide or want to chat

about how you can become one of our investors.

I look forward to hearing from you!

Matthew Callahan

Head of Retail Funds

Open Corporation

mcallahan@opencorporation.com.au

T. 1300 649 564

THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING 39

NOTES

40 THE ULTIMATE MINI GUIDE TO PROPERTY DEVELOPMENT INVESTING

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- China Study DietDocument4 pagesChina Study DietSharma Malladi100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- BeachDocument3 pagesBeachElia MuñozNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- China Study DietDocument4 pagesChina Study DietSharma Malladi100% (1)

- A. Ralph Epperson - The New World OrderDocument361 pagesA. Ralph Epperson - The New World OrderBig Vee84% (43)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Silent Weapons For Quiet Wars - Operating Research Technical Manual TM-SW7905.1Document29 pagesSilent Weapons For Quiet Wars - Operating Research Technical Manual TM-SW7905.1Jean-Paul de Montréal97% (31)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Pre Start Flow Chart Start T Finish 120711Document1 pagePre Start Flow Chart Start T Finish 120711zviviNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Real Estate A Guide For Buyers and SellersDocument52 pagesReal Estate A Guide For Buyers and SellersNicolo MendozaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 20220223world Without Cancer The Story of Vitamin B17Document359 pages20220223world Without Cancer The Story of Vitamin B17zviviNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- 7 Step Proces To Succesfully Invest in Property FlowchartDocument1 page7 Step Proces To Succesfully Invest in Property FlowchartzviviNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

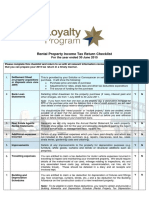

- Rental Property Checklist 2015 Tax YearDocument2 pagesRental Property Checklist 2015 Tax YearzviviNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Key Nursing SkillsDocument359 pagesKey Nursing Skillsmordanga100% (6)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Fluids and Electrolytes: Intensive Care Nursery House Staff ManualDocument6 pagesFluids and Electrolytes: Intensive Care Nursery House Staff ManualzviviNo ratings yet

- Capital Properties Preliminary Finance AssessmentDocument1 pageCapital Properties Preliminary Finance AssessmentzviviNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Key Nursing SkillsDocument359 pagesKey Nursing Skillsmordanga100% (6)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Nursing Abbreviations - Term ListDocument7 pagesNursing Abbreviations - Term Listɹǝʍdןnos100% (41)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Diabetes Mellitus IIDocument44 pagesDiabetes Mellitus IIGaladariNo ratings yet

- Ashworth College Semester ExamDocument11 pagesAshworth College Semester ExamG Jha100% (1)

- PRO FormaDocument2 pagesPRO FormaNovie Marie Balbin AnitNo ratings yet

- 1 9th Social Sura Guide 2019 2020 Sample Materials Tamil MediumDocument101 pages1 9th Social Sura Guide 2019 2020 Sample Materials Tamil Mediumn.ananthapadmanabhanNo ratings yet

- Introduction Personal Financial ManagementDocument3 pagesIntroduction Personal Financial ManagementLee K.No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Income Tax: General Principles: Module No. 4Document4 pagesIncome Tax: General Principles: Module No. 4Jay Lord Floresca100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Persiapan Pensiun Dan Kesiapan Pensiun Dalam Persepsi Pegawai Negeri Dan Pegawai SwastaDocument17 pagesPersiapan Pensiun Dan Kesiapan Pensiun Dalam Persepsi Pegawai Negeri Dan Pegawai SwastaAlla MandaNo ratings yet

- Parametric Portfolio Policy Using Currencies As An Asset ClassDocument107 pagesParametric Portfolio Policy Using Currencies As An Asset ClassArnar Ingi EinarssonNo ratings yet

- Topic: Shinhan: Financial GroupDocument13 pagesTopic: Shinhan: Financial GroupSabitkhattakNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Cap Table Modeling TemplateDocument11 pagesCap Table Modeling TemplateAde Hk100% (1)

- SAP FICO 3rd ArticleDocument2 pagesSAP FICO 3rd ArticleLakshmana SwamyNo ratings yet

- Record Keeping For Small BusinessDocument32 pagesRecord Keeping For Small BusinessApril Joy LascuñaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- SIP ReportDocument22 pagesSIP ReportAnup PatraNo ratings yet

- SZABIST Need-Based Scholarship Application Form: 1. Candidate'S InformationDocument14 pagesSZABIST Need-Based Scholarship Application Form: 1. Candidate'S InformationKaran KumarNo ratings yet

- Financial Ratio Analysis of Ciawi HospitalDocument11 pagesFinancial Ratio Analysis of Ciawi Hospitalkristina dewiNo ratings yet

- What Is An ATM: Automated Teller MachineDocument6 pagesWhat Is An ATM: Automated Teller MachineTilahun GirmaNo ratings yet

- Investment Centers and Transfer PricingDocument52 pagesInvestment Centers and Transfer Pricinganup akasheNo ratings yet

- European Distribution OverviewDocument3 pagesEuropean Distribution OverviewelainejournalistNo ratings yet

- Alfa Dyestuff Industries Ltd. 20-21Document14 pagesAlfa Dyestuff Industries Ltd. 20-21Naheyan Jahid PabonNo ratings yet

- Review Questions For Test #2 ACC210Document8 pagesReview Questions For Test #2 ACC210AaaNo ratings yet

- Islamic Banking in Bangladesh Progress and PotentialsDocument23 pagesIslamic Banking in Bangladesh Progress and Potentialssumaiya sumaNo ratings yet

- Exchange Rate Calculations: Exercise 1Document3 pagesExchange Rate Calculations: Exercise 1Rohit AggarwalNo ratings yet

- Substance Over FormDocument1 pageSubstance Over FormEdson Jorge MandlateNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Funded NextDocument1 pageFunded NextSathya PrakashNo ratings yet

- Beutel Goodman Canadian Equity Class F: Growth of 10,000 10-09-2009 - 10-09-2019 Morningstar Risk MeasuresDocument3 pagesBeutel Goodman Canadian Equity Class F: Growth of 10,000 10-09-2009 - 10-09-2019 Morningstar Risk MeasuresRoger SongNo ratings yet

- Partnership profit sharing ratiosDocument2 pagesPartnership profit sharing ratiosm v r rNo ratings yet

- Renewal Premium Reciept: 3095389 2021-01-30 19:10:45 LICI2021000166309684 1030191026835046Document1 pageRenewal Premium Reciept: 3095389 2021-01-30 19:10:45 LICI2021000166309684 1030191026835046SONU YADAVNo ratings yet

- Quarterly Report 20221231Document21 pagesQuarterly Report 20221231Ang SHNo ratings yet

- Chapter 4 - Completing The Accounting CycleDocument59 pagesChapter 4 - Completing The Accounting CycleTâm Lê Hồ HồngNo ratings yet

- PLM Business School Credit Management Module on Credit DecisionsDocument29 pagesPLM Business School Credit Management Module on Credit DecisionsHarlene BulaongNo ratings yet

- Applied factory overheadDocument4 pagesApplied factory overheadralfgerwin inesaNo ratings yet