Professional Documents

Culture Documents

93-Article Text-283-1-10-20200314

Uploaded by

A1 techniquesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

93-Article Text-283-1-10-20200314

Uploaded by

A1 techniquesCopyright:

Available Formats

Leadership Styles of Bank Managers in Nationalized

Commercial Banks of India

Ajay Jain

HOD-Department of Integrated MBA, SRM University, Modinagar, U.P.

Shikha Chaudhary

Research Scholar, SRM University, Modinagar, U.P.

Abstract

Commercial banks are banks engaged in classic business of accepting deposits and giving

loans as against merchant banking, where the primary responsibility is to help business by

raising loans. NPA's in banks have reduced their profitability and goodwill in the eyes of

customers. Leadership styles of Managers' in banks at various levels provide a sound

background to the banking industry. Trait, behavioural and situational leadership studies,

ability, dynamism, perceptions, attitudes of bank managers are helpful to manage problems

in the banks and hence improvement in their performance. The study suggests that to adopt

participative leadership style to emphasize state development by infusing at each level of

management with a serve of belonging and involvement. Senior level managers should

develop work place relationship, which is one of the critical skills, every leader in today's

work environment and need to possess.

Introduction

The essence of leadership involves changes that result in accomplishing specific goals.

Planning is not representative of leadership, because planning involves providing order for

present circumstances. Strategic planning is representative of leadership, because strategic

plans prompt future action. Effective leaders are critical to the success of an organization,

and leadership development is important in developing good leaders. The development

process is not the primary focus of leadership because leadership is a model that includes

individual relationships. Successful leaders must be proficient in adjusting the attitudes and

actions of followers.

According to the study made by Panchanatham et al. (1993), which is an attempt to know the

relationship between leadership styles and problem solving techniques of executives of

Public Sector Enterprises, concluded that most of the executives used styles of leadership

like democratic, authoritative and free rein etc. The study also suggested designing separate

training progammes for problem solving and leadership styles and executives of various

branches should be considered equal for development programmes. It is also clear that,

Vol. VII, No. 1, March - August 2014

Leadership Styles of Bank Managers in Nationalized Commercial Banks of India 99

there is no relationship between leadership and problem solving styles. Syed Vazith

Hussain (2002) also analyzed various leadership styles in small scale units at micro level.

He defined the leadership styles as benevolent, autocrat, consultative, democratic etc. He

made a survey of 98 firms; having managers as owners of small scale units and found that

owner managers are also using different styles in their business, according to the need of

hour, although, they are free to use any style i.e. situational leadership style. The results of

the study concluded and favoured, situation of leadership style, which is most effective for

best results in the organization. Although, leadership is a new concept and having a

confusion, with the term management. There is a big difference between leadership and

management, leadership is an attitude and way of working, while management is a process

of planning, organizing, directing, motivating and control of individuals, to get designed

results. Leadership is the main source of motivation and creates work environment in the

large and small organizations as well.

Banking in India

In the new era of globalization; the banking sector has witnessed drastic changes at

structural and organizational levels. In the financial sector, banks act as an intermediary to

transfer the resources from those, who spend more than their earnings to those who spends

less. Banking plays a key role in deciding the best business practices in developing new

markets and clients, and creates new products for e-commerce and net-based technologies.

The history of banking in India is as old as trade. In ancient Indian literature such as the

Vedas and Manususmriti, there are quite a number of references to the indigenous banking

system which financed Indian trade and commerce. It was an age when the west had not even

evolved the monetary system. Banking however, was a special feature of the economic life

of towns in ancient times.

Types of Banks in India

There are various types of banks, which operate in India to meet the financial needs of

different categories of people engaged in agriculture, business profession; etc. The main

types may be given as follows:

Central Bank Commercial Development Cooperative Specialised

(RBI in India) Banks Banks Banks Banks

1. Public Sector Bank 1. District Primary Credit Societies 1. Exim Bank

2. Private Sector Bank 2. District Central Cooperative Banks 2. SIDBI

3. Foreign Bank 3. State Cooperative Banks 3. NABARD

4. Regional Rural Bank

Vol. VII, No. 1, March - August 2014

100

Structure of Commercial Banking

The commercial banking structure in India consists of:

1. Scheduled Banks

2. Unscheduled Banks

The scheduled banks constitute those banks, which have been included in the second

schedule of the Bank of India (RBI) Act, 1934. RBI in turn, includes only those banks in this

schedule, which satisfy the criteria laid down vide section 42(6)(a) of the Act. The scheduled

commercial banks comprise the State Bank of India (SBI) and its Associates, the

nationalized banks, private sector banks, foreign banks, cooperative banks and regional

rural banks. The unscheduled banks are those banking companies as defined in clause(c) of

Section 5, of the Banking Regulation Act, 1949, which are not included in the schedule.

These banks can function in all banking sectors. The function of commercial banks may be

given as below:

(i) Primary functions, (ii) Secondary functions, (iii) General Utility functions.

Motivation and Problem Statement

The subject of leadership has for a long time occupied a central role in the study of

organization and administration. It all started innocently enough with psychological and

sociological scheme of the nature of leadership in very general terms. In accordance with

the trait, behavioural and situational leadership theories discussed in literature. There are

three major trends in leadership studies, in the first phase, leadership is analysed in terms of

the personally his behavior, ability, dynamism, perceptions and attitudes. Later, social

scientists looked at the pattern of a leader's interaction with others. A major omission from

the research literature on leadership is the detailed consideration of situational, structural,

and environmental circumstances, which explain variations in leadership style.

Banking Industry in India

The Indian banking industry is one of the largest in the world. The banking sector is the

second largest spender on IT, which is also in line with the international scenario. The Indian

Public Sector banks started with ALPMS. Slowly, they shifted to branch automation. But

they have to move a step further bank automation, where the customer belongs to a bank and

not a specific branch, as in some of the foreign and private banks.

Information technology has basically been used under two different avenues in banking- one

is communication and connectivity and other is business process reengineering. It enables

sophisticated product development, better market infrastructure and implementation of

reliable techniques for control of risks and helps the financial intermediary's reach

Vol. VII, No. 1, March - August 2014

Leadership Styles of Bank Managers in Nationalized Commercial Banks of India 101

geographically distant and diversified markets. In view of this, technology has changed the

control of the three major functions performed by the banks, access to liquidity,

transformation of assets and monitoring of risks. Further, I.T. and communication

networking systems have a crucial bearing on the efficiency of money, capital and foreign

exchange markets.

Non-Performing Assets

NPA means an asset or account of borrower, which has been classified by a bank or financial

institution as substandard, doubtful or loss asset, in accordance with the directions or

guidelines relating to asset classification issued by RBI. Various studies have been

conducted to analyse the reasons for NPA. What so ever may be, complete elimination of

NPA is impossible for the following two reasons:

1. Overhang component

2. Incremental Component

The overhand component is due to environmental reasons, business cycle, etc. The

incremental component may be due to internal bank management, credit policy. Terms

credit etc. Increase in provision for bad loans save the country's largest leader State Bank of

India lost 35% slumpt in net profit Rs. 2375 crores in the second quarter ended Sept. 2013

NPA (%), was 2.44% in the year 2012, raised to 2.91% in the year 2013. The bank set aside

Rs. 2645 crores during the quarter as a cover against potential bad loans for the same period.

Objectives of the Study

After studying problems faced by Banking Industry and Leadership styles, Researcher felt

the need of study leadership, to guide banking staff for improvement of the performance of

banks. The study may achieve the following objectives:

(i) To study relationship between managerial positions in the hierarchy and their leadership

styles,

(ii) To test, whether leadership styles depends on size of the organization,

(iii) To test leadership styles and joining of bank manager's are correlated.

(iv) To study that personality traits of bank managers affect the leadership styles followed.

Vol. VII, No. 1, March - August 2014

102

Research Methodology

The study is based on primary data collection through questionnaire and personal interviews

of the bank managers under study. The study is concerned of leadership styles and role of

bank managers at higher levels and satisfaction of customers and bank staff, and their role in

improving performance of banks and reducing NPA's. The study has taken, following

assumptions, which have been tested at 5% level of significance, using various tests in the

study.

Hypothesis

The study is based on the following assumptions as follows:

H01: There is no relationship among leadership styles and controlling strategies, need-

satisfaction and commitment with the organization,

H02: There is no correlation between manager's position in the hierarchy and their

leadership styles.

H03: Leadership styles and size of the organization are correlated,

H04: Indian Bank managers do not possess the personality traits of leaders.

Selection of Sample

The study is based on 200 middle and senior level managers of commercial banks, ten in

number in Delhi-NCR Region. It includes- S.B.I., Bank of India, Bank of Barod, P.N.B.,

Canara Bank, Central Bank of India, Indian Bank, Indian Overseas Bank etc. The study is

based on Independent variables like- situational variable, personally centred variable etc.

Dependent variables have been selected as- leadership styles.

Analysis of Data

Situational Variables

The study has taken H01, which predict a relation between a manager's position in the

hierarchy and his leadership style, with senior managers adopting more participative

leadership style as compared to junior managers. Table 1 gives means and standard

deviation of the leadership style score of managers drawn from five levels of the hierarchy in

commercial banks.

Vol. VII, No. 1, March - August 2014

Leadership Styles of Bank Managers in Nationalized Commercial Banks of India 103

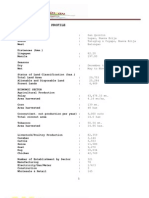

Table 1: Leadership Style (Likert) Score of Manager's positioned at different levels of

the hierarchy

Scale No. of Managers Mean Standard Deviation SΣx

M.M.G. II 33 2.79 0.38 .07

M.M.G. III 38 2.96 0.39 .06

M.M.G. IV 47 3.27 0.55 .08

S.M.G. V 56 4.15 0.56 .09

S.M.G. VI 26 4.88 0.12 .02

Source: Questionnaire and Interview of Bank Managers

Likert's Score analysis should be interpreted as-

System-1 (Exploitive Authoritarian) covers the range from 1 to 1.99,

System-2 (Benevolent Authoritarian) covers the range from 2 to 2.99,

System-3 (Consultative) covers the range from 3 to 3.99, and

System-4 (Participated) covers the range from 4 to 4.99.

It is evident from the study that none of managers had an authoritarian exploitive style of

leadership. A relationship between scale and style is apparent, with middle management

Scale II and III, mangers having a benevolent authoritarian style, the senior management

Scale IV managers having a consultative style, and the managers belonging to the senior

management scale V and VI, having a participative leadership style with the later scoring

higher than the former within the participative range of 4.00 to 4.99.

To statistically test the hypothesis, an analysis of variance has been done (refer Table 2)

using the sum of squares method.

Table value of F for (4,173) d.f. is 3.32, and calculated value is 105.46 (at 5% level of

significance) which is much higher than table value. So, the research hypothesis stating that

the leadership style of managers varies as they move up in the hierarchy is accepted.

Table 2: ANOVA Table

Sources of Sum of Squares Degree of Means F

Variability Freedom

Square

Between scale 91.12 4 22.78 F = 22.78/.0216

means

Within scales 37.39 173 0.216 = 105.41

Vol. VII, No. 1, March - August 2014

104

Researcher also analysed the significance of the difference between the means by applying

't' test. The result of the test are presented in Table 3.

Table 3: Difference between in means of leadership style scores of Bank Managers at

different levels of the hierarchy

Scales Means Difference between means ‘t' Statistic

d.f. tcx t .05

Between II and III 2.79-2.96 0.17 69 1.848 >1.28

Between III and IV 2.96-3.27 0.31 83 3.100 >1.28

Between IV and V 3.27-4.15 0.88 81 7.333 >1.28

Between V and VI 4.15-4.88 0.73 58 7.934 >1.28

Source: Questionnaire and Interviews.

The results of the 't' test indicate clearly that the differences in the means of the leadership

style scores of managers belonging to different levels of the hierarchy are statistically

significant, confirming the finding that managers lower in the hierarchy have a benevolent

authoritarian style of leadership, while those, who are senior, have a consultative style and

senior most managers have a participative leadership style.

Conclusion

Commercial banks are in the business of providing banking services to individuals, small

businesses and large organizations. Today's commercial banks are more diverse than ever.

But, there are several problems in the banks which have been discussed earlier and major

problems are increase in NPA's control and guidance through RBI. The researcher has taken

a problem relating to leadership styles in the commercial banks and their relationship

between personality traits, behavior and attributes of bank managers. The study is based

upon hypothesis, which have been tested at 5% level of significance, using 't' test and 'F' test.

The study has come out with the conclusion that middle level mangers have a benevolent

authoritarian style, the senior management Scale IV managers have a consultative style, and

the managers belonging to the senior management scale V and VI, have a participative

leadership style which is clearly indicative that style of leadership varies with the hierarchy

of managers.

Major Contributions

The study may make following suggestion to the policy makers, to improve working of the

Vol. VII, No. 1, March - August 2014

Leadership Styles of Bank Managers in Nationalized Commercial Banks of India 105

banks:

(i) Directive style should be implemented in highly structured group, because this

approach is more effective,

(ii) Senior level managers should develop work place relationship, which is one of the

critical skills, every leader in today's work environment need to persons.

(iii) Bank managers should adopt participative leadership style to emphasize staff

development by infusing each level of management with a sense of belonging and

involvement. This would require on their parts, consultation with their subordinates

and the latter's participation in decision making.

References

Panchanatham, N., Rajendran, K. & Karuppiah K. K. (1993). A Study of Executive Leadership Styles

and Problem Solving Behaviour. Indian Journal of Industrial Relations, 29(1), 101-108.

Syed Vazith Hussain (2002). Leadership Styles in Small Scale Industries. The Indian Journal of

Commerce, 55(3), 45-54.

Vol. VII, No. 1, March - August 2014

You might also like

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- 1 Paper Scopus PurusharthaDocument9 pages1 Paper Scopus PurusharthaRohit ParabNo ratings yet

- Research MethodologyDocument12 pagesResearch MethodologySulo's SoulNo ratings yet

- Performace Evaluation of Selected Banking Companies in India: A StudyDocument25 pagesPerformace Evaluation of Selected Banking Companies in India: A StudyVinayak BhalbarNo ratings yet

- Pooja MishraDocument7 pagesPooja MishrasmsmbaNo ratings yet

- Impact of HRD Practices on Managerial Effectiveness in Indian BanksDocument11 pagesImpact of HRD Practices on Managerial Effectiveness in Indian BanksDrSanjay RastogiNo ratings yet

- Co OperativeDocument9 pagesCo OperativeDelete SinghNo ratings yet

- Research Paper On Indian Banking SystemDocument4 pagesResearch Paper On Indian Banking Systemhtlchbaod100% (1)

- Project Report ON: Master of Business AdministrationDocument55 pagesProject Report ON: Master of Business AdministrationNikhil SharmaNo ratings yet

- Credit Appraisal Process at Bank of IndiaDocument32 pagesCredit Appraisal Process at Bank of IndiaRajat MahajanNo ratings yet

- Shahajan Begam (Repaired) BRDocument84 pagesShahajan Begam (Repaired) BRsanjaydutta8No ratings yet

- A Study On Cooperative Banks in India With Special Reference To Lending PracticesDocument6 pagesA Study On Cooperative Banks in India With Special Reference To Lending PracticesSrikara Acharya100% (1)

- Dena BNK Project FinalDocument82 pagesDena BNK Project FinalNirmal MudaliyarNo ratings yet

- Financial RiskDocument68 pagesFinancial RiskGouravNo ratings yet

- 07 - Chapter 1Document43 pages07 - Chapter 1sushilaNo ratings yet

- Commercial BAnk in IndiaDocument8 pagesCommercial BAnk in IndiasouvikNo ratings yet

- A Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaDocument9 pagesA Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaIAEME PublicationNo ratings yet

- Ific FinalDocument49 pagesIfic FinalAmir AbdullahNo ratings yet

- Jagadguru Dattatray College of TechnologyDocument8 pagesJagadguru Dattatray College of TechnologyRitesh MishraNo ratings yet

- JEL Classification: C83, C88, E43, G2, H8Document9 pagesJEL Classification: C83, C88, E43, G2, H8Pramod DNo ratings yet

- Minor Research Project Entitled "A Study On Co-Operative Banks in India and Its Professionalism"Document7 pagesMinor Research Project Entitled "A Study On Co-Operative Banks in India and Its Professionalism"Jay PawarNo ratings yet

- Research Methodology: Introduction To Credit AppraisalDocument123 pagesResearch Methodology: Introduction To Credit AppraisalAstute ReportNo ratings yet

- IJRHS 2013 Vol01 Issue 07 06Document5 pagesIJRHS 2013 Vol01 Issue 07 06Kalyani ThakurNo ratings yet

- A Study On Cooperative Banks in India With Special Reference ToDocument9 pagesA Study On Cooperative Banks in India With Special Reference ToAllen AlfredNo ratings yet

- Sathya's Iob ProjectDocument35 pagesSathya's Iob ProjectVenkatesh ChowdaryNo ratings yet

- Synopsis On Comparative Study On ICICI and SBIDocument9 pagesSynopsis On Comparative Study On ICICI and SBIitsruchika18100% (7)

- Management of Financial InstitutionsDocument260 pagesManagement of Financial Institutionsshivam67% (3)

- Credit Appraisal Research Methodology at SBIDocument121 pagesCredit Appraisal Research Methodology at SBIprathamesh kerkarNo ratings yet

- Standerd ChartedDocument58 pagesStanderd ChartedashishgargNo ratings yet

- v5 n3 Article5Document12 pagesv5 n3 Article5mobinsaiNo ratings yet

- S.No - Topic Page No 1 6: PurposeDocument48 pagesS.No - Topic Page No 1 6: PurposeprernaNo ratings yet

- INSPIRA JOURNAL OF COMMERCEECONOMICS COMPUTER SCIENCEJCECS Vol 05 No 01 January March 2019 Pages 133 To 137Document5 pagesINSPIRA JOURNAL OF COMMERCEECONOMICS COMPUTER SCIENCEJCECS Vol 05 No 01 January March 2019 Pages 133 To 137sharonNo ratings yet

- Comparative Analysis of Private Sector BankDocument66 pagesComparative Analysis of Private Sector BankRashmita Bhatt50% (4)

- Sindhudurg District Central Co-operative Bank Introduction (38 charactersDocument29 pagesSindhudurg District Central Co-operative Bank Introduction (38 charactersSupriya MestryNo ratings yet

- Study Retail Banking Operations Customer OpinionsDocument47 pagesStudy Retail Banking Operations Customer Opinionszaru1121No ratings yet

- Sbi SMeDocument123 pagesSbi SMeSarfaraz I. DarveshNo ratings yet

- Credit Appraisal in SBIDocument123 pagesCredit Appraisal in SBIvivekdudejaNo ratings yet

- PESTLE Anal of BIDocument20 pagesPESTLE Anal of BIGaurav SainiNo ratings yet

- NischayDocument51 pagesNischaybiltu majiNo ratings yet

- A Study On Credit Appraisal System On SME of Union Bank of IndiaDocument56 pagesA Study On Credit Appraisal System On SME of Union Bank of IndiaSarva ShivaNo ratings yet

- A Study of Performance Appraisal in BanksDocument10 pagesA Study of Performance Appraisal in BanksNeelampariNo ratings yet

- 1532 PDFDocument9 pages1532 PDFChandrashekhar GurnuleNo ratings yet

- Credit Appraisal Procees in SME Sector of State Bank of India..Document124 pagesCredit Appraisal Procees in SME Sector of State Bank of India..randhawa_bindu786100% (1)

- SBI Credit Appraisal ProcessDocument123 pagesSBI Credit Appraisal ProcessVinod DhoneNo ratings yet

- CO OPERATIVE BANKS Rural Marketing SynopsisDocument3 pagesCO OPERATIVE BANKS Rural Marketing SynopsisNageshwar SinghNo ratings yet

- Performance Comparison of Private Sector Banks With The Public Sector Banks in IndiaDocument8 pagesPerformance Comparison of Private Sector Banks With The Public Sector Banks in IndiaRaviNo ratings yet

- PRIYANKA H.R-avi4Document80 pagesPRIYANKA H.R-avi4karmacooldudeNo ratings yet

- Synopsis GlobalisationDocument11 pagesSynopsis GlobalisationSumit Aggarwal100% (1)

- Credit Appraisal ReportDocument125 pagesCredit Appraisal ReportSadaf IqbalNo ratings yet

- Issues and Challenges in Indian Banking SectorDocument7 pagesIssues and Challenges in Indian Banking Sectorbhattcomputer3015No ratings yet

- Final Research PaperDocument16 pagesFinal Research Paperaman DwivediNo ratings yet

- Study of Performance of Public and Private Sector BankDocument12 pagesStudy of Performance of Public and Private Sector BankVarun SharmaNo ratings yet

- Kalyan City - Blogspot.com 2010 09 Functions of Reserve Bank of IndiaDocument6 pagesKalyan City - Blogspot.com 2010 09 Functions of Reserve Bank of IndiaAlokdev MishraNo ratings yet

- Black BookDocument88 pagesBlack BookRaghav LakhotiaNo ratings yet

- Submitted in Partial Fulfillment For The Degree Of: Project Study Report OnDocument37 pagesSubmitted in Partial Fulfillment For The Degree Of: Project Study Report OnUsha GiriNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Marketing of Consumer Financial Products: Insights From Service MarketingFrom EverandMarketing of Consumer Financial Products: Insights From Service MarketingNo ratings yet

- Small and Medium Enterprises’ Trend and Its Impact Towards Hrd: A Critical EvaluationFrom EverandSmall and Medium Enterprises’ Trend and Its Impact Towards Hrd: A Critical EvaluationNo ratings yet

- Sources of Finance ExplainedDocument114 pagesSources of Finance Explained7229 VivekNo ratings yet

- Design of Anchor Bolts Embedded in MasonryDocument6 pagesDesign of Anchor Bolts Embedded in MasonryAnonymous DJrec2No ratings yet

- Example - Complete Model of Eng Management ReportDocument38 pagesExample - Complete Model of Eng Management ReportSyah RullacmarNo ratings yet

- Template For Preparing TANSCST ProposalDocument6 pagesTemplate For Preparing TANSCST ProposalAntony88% (8)

- Philips LCD Monitor 220EW9FB Service ManualDocument10 pagesPhilips LCD Monitor 220EW9FB Service Manualpagy snvNo ratings yet

- TD2Document4 pagesTD2Terry ChoiNo ratings yet

- Answer Key Determinants & Matrices: B C C B B C D A B CDocument2 pagesAnswer Key Determinants & Matrices: B C C B B C D A B CElbert EinsteinNo ratings yet

- Unit 8 Grammar Short Test 1 A+B Impulse 2Document1 pageUnit 8 Grammar Short Test 1 A+B Impulse 2karpiarzagnieszka1No ratings yet

- Nursing Grand Rounds Reviewer PDFDocument17 pagesNursing Grand Rounds Reviewer PDFAlyssa Jade GolezNo ratings yet

- Year Overview 2012 FinalDocument65 pagesYear Overview 2012 FinalArjenvanLinNo ratings yet

- SSRN Id983401Document43 pagesSSRN Id983401LeilaNo ratings yet

- 04 Greeting Card Activity RubricDocument1 page04 Greeting Card Activity RubricJon Jon Marcos100% (2)

- 11 Core CompetenciesDocument11 pages11 Core CompetenciesrlinaoNo ratings yet

- MSCL PipeDocument9 pagesMSCL PipeAhmad Zakwan Asmad100% (1)

- Central Council For Research in Ayurvedic Sciences: CCRAS Post Doctoral Fellowship Scheme (CCRAS PDF Scheme)Document2 pagesCentral Council For Research in Ayurvedic Sciences: CCRAS Post Doctoral Fellowship Scheme (CCRAS PDF Scheme)TUSHAR DASHNo ratings yet

- International Financial Law Reforms After Global CrisisDocument5 pagesInternational Financial Law Reforms After Global CrisisВладиславNo ratings yet

- NY Long Island Group - Jun 2008Document8 pagesNY Long Island Group - Jun 2008CAP History LibraryNo ratings yet

- Crim Cases MidtermsDocument76 pagesCrim Cases MidtermsCoreine Valledor-SarragaNo ratings yet

- Etextbook 978 0078025884 Accounting Information Systems 4th EditionDocument61 pagesEtextbook 978 0078025884 Accounting Information Systems 4th Editionmark.dame383100% (48)

- Case Study of Vietinbank Dao Hoang NamDocument14 pagesCase Study of Vietinbank Dao Hoang NamNam ĐàoNo ratings yet

- Municipal Profile of Umingan, PangasinanDocument51 pagesMunicipal Profile of Umingan, PangasinanGina Lee Mingrajal Santos100% (1)

- Research On HIBADocument9 pagesResearch On HIBAPixel GeekNo ratings yet

- Senate Bill 365Document5 pagesSenate Bill 365samtlevinNo ratings yet

- JKM320PP-72 305-320 Watt Poly Crystalline Solar Module Technical SpecificationsDocument2 pagesJKM320PP-72 305-320 Watt Poly Crystalline Solar Module Technical SpecificationsRonal100% (1)

- Ok 1889 - PDF PDFDocument40 pagesOk 1889 - PDF PDFIngeniería Industrias Alimentarias ItsmNo ratings yet

- Ansys Workbench Tutorial: Structural & Thermal Analysis Using The ANSYS Workbench Release 11.0 EnvironmentDocument5 pagesAnsys Workbench Tutorial: Structural & Thermal Analysis Using The ANSYS Workbench Release 11.0 EnvironmentMuhammad HaroonNo ratings yet

- DC Booms Service Training OverviewDocument129 pagesDC Booms Service Training OverviewTamás Leményi100% (1)

- CW3 - 4Document2 pagesCW3 - 4Rigel Zabate100% (1)

- 11 - Surrogate Constraints 1968Document9 pages11 - Surrogate Constraints 1968asistensi pakNo ratings yet

- AarDocument2 pagesAarkomar agusNo ratings yet