Professional Documents

Culture Documents

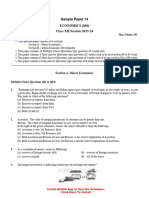

GDP Growth Rates Business Cycles

Uploaded by

Jie Xian LimOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GDP Growth Rates Business Cycles

Uploaded by

Jie Xian LimCopyright:

Available Formats

Page 1 of 5

SECTION A: ANWER ALL QUESTIONS ( 40 MARKS )

1. a) Based on Table 1.1, write the formula and calculate the growth in GDP for

2013:

Table 1.1

2012 2013

GDP $110 million $115 million

( 4 marks )

b) Explain the four phases of a business cycle.

( 4 marks )

2. Refer to Table 2.1 to answer the following questions:

Table 2.1

Marginal Propensity to Consumer 0.9 0.8

Initial Change in Spending $50 million $50 million

a. Write the formula and calculate the expenditure multiplier when MPC is

0.9 and 0.8 respectively.

( 3 marks )

b. Write the formula and calculate the change in real GDP when MPC is 0.9

and 0.8 respectively.

( 3 marks )

c. Explain the relationship between MPC and the expenditure multiplier.

( 2 marks )

( 2 mar

3. a. Explain the concept of full employment.

( 2 marks )

b. Discuss three types of unemployment present in an economy during a

recession.

( 6 marks )

DBAS Macroeconomics Set 1 QP E0614

Page 2 of 5

4. Assume that the economy is initially at full employment. With the aid of an

aggregate demand-aggregate supply diagram, illustrate and explain how a

contractionary fiscal policy affects the price level and real GDP.

( 8 marks )

5. a. List three functions of money.

( 3 marks )

b. Write the formula and calculate the money multiplier when the required

reserve ratio is:

i) 20%

ii) 25%

( 5 marks )

DBAS Macroeconomics Set 1 QP E0614

Page 3 of 5

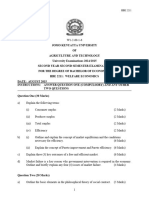

SECTION B: ANSWER 3 OUT OF 5 QUESTIONS ( 20 MARKS EACH )

6. Refer to Table 6.1 and answer the following questions:

Table 6.1

Year 2012 2013

($’billion) ($’billion)

Investment 40 35

Government Expenditure 30 25

Consumption 60 65

Net Export Expenditure 50 40

Net Income from abroad 15 10

Net Taxes 5 8

Profits 25 30

* All values shown are at current prices

a. Write the formula and calculate the nominal GDP for 2012 and 2013.

( 5 marks )

b. The price index for 2012 is 100 and the price index for 2013 is 110. Write

the formula and calculate the real GDP for 2012 and 2013.

( 5 marks )

c. Write the formula and calculate the real GDP growth rate for 2013 and

comment on the phase of the business cycle that this economy is in.

( 5 marks )

d. State five possible limitations of using real GDP as a measure of economic

well-being.

( 5 marks )

DBAS Macroeconomics Set 1 QP E0614

Page 4 of 5

7. a. The number of unemployed persons is 5,000 and the number of employed

persons is 100,000.

i) Write the formula and calculate the numbers in the labour force.

( 3 marks )

ii) Write the formula and calculate the unemployment rate

( 3 marks )

b. An economy is experience inflation due to a rise in wages. With the aid of

an aggregate demand-aggregate supply diagram, illustrate and explain the

type of inflation this economy is facing.

( 7 marks )

c. An economy is experiencing inflation due to an improvement in consumer

and business confidence. With the aid of an aggregate demand-aggregate

supply diagram, illustrate and explain the type of inflation this economy is

facing.

( 7 marks )

8. a. Discuss three factors that will increase the long-run aggregate supply.

( 6 marks )

b. Assuming that an economy is initially at full employment. With the aid of

an aggregate demand-aggregate supply diagram, illustrate and explain the

impact of each of the following events on the price level and real GDP

(Note: Treat each event separately):

i) There is an increase in the prices of raw materials.

( 7 marks )

ii) There is a fall in income taxes.

( 7 marks )

DBAS Macroeconomics Set 1 QP E0614

Page 5 of 5

9. The Central Bank decides to purchase government bonds.

a. Is this an expansionary or contractionary monetary policy? Explain two

other monetary tools the government can use to achieve the same objective.

( 6 marks )

b. With the aid of a money market diagram, illustrate and explain the impact

of this policy on interest rate.

( 6 marks )

c. Assume that the economy is initially at full employment. With the aid of an

aggregate demand-aggregate supply diagram, illustrate and explain the

impact of this policy on the economy’s price level and real GDP.

( 8 marks )

10. a. With the aid of exchange rate diagram, illustrate and explain the impact that

each of the following events will have on Singapore’s exchange rate (Note:

Treat each case separately):

i) There is an increase in imports.

( 5 marks )

ii) There is an increase in exports.

( 5 marks )

b. With the aid of diagrams, illustrate and explain how government could use

import tariff and import quota to restrict trade.

( 10 marks )

END OF PAPER

DBAS Macroeconomics Set 1 QP E0614

You might also like

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- DBAS Macroeconomics Past Year Paper 3 QPDocument5 pagesDBAS Macroeconomics Past Year Paper 3 QPJie Xian LimNo ratings yet

- DBA Macroeconomics Tutorial Questions 2017Document10 pagesDBA Macroeconomics Tutorial Questions 2017Limatono Nixon 7033RVXLNo ratings yet

- DBA7103 - Economics Ananlysis For BusinessDocument20 pagesDBA7103 - Economics Ananlysis For BusinessThanigaivel KNo ratings yet

- General InstructionsDocument4 pagesGeneral InstructionsAditya ShrivastavaNo ratings yet

- CAT 2-Fundamentals of EconomicsDocument7 pagesCAT 2-Fundamentals of Economicstrevor.gatuthaNo ratings yet

- BECO260 Final Examination Revision SheetDocument36 pagesBECO260 Final Examination Revision Sheetbill haddNo ratings yet

- Sample Examination PaperDocument4 pagesSample Examination PapernuzhatNo ratings yet

- 2021 Fort Street HSC Economics TrialDocument12 pages2021 Fort Street HSC Economics Triallg019 workNo ratings yet

- UACE ECONOMICS PAPER 1: Oligopoly, Inflation, UnemploymentDocument2 pagesUACE ECONOMICS PAPER 1: Oligopoly, Inflation, UnemploymentJohn DoeNo ratings yet

- UACE Economics 2017 Paper 1Document3 pagesUACE Economics 2017 Paper 1fahrah daudaNo ratings yet

- 2023-09-03 Macroquestionpaper2016Document4 pages2023-09-03 Macroquestionpaper2016ManyaNo ratings yet

- DBA7103Document22 pagesDBA7103Ankit AgarwalNo ratings yet

- P220/1 Economics Paper 1 July /august 2017 3 HoursDocument3 pagesP220/1 Economics Paper 1 July /august 2017 3 HoursSaudah MusaNo ratings yet

- University of Mauritius: Instructions To CandidatesDocument8 pagesUniversity of Mauritius: Instructions To Candidates80tekNo ratings yet

- ECON 203 Midterm 2013W FaisalRabbyDocument7 pagesECON 203 Midterm 2013W FaisalRabbyexamkillerNo ratings yet

- Economics Set BDocument10 pagesEconomics Set BdeepansinghranaNo ratings yet

- Dey's Sample Papers Economics-XII - Exam Handbook 2023Document37 pagesDey's Sample Papers Economics-XII - Exam Handbook 2023Heer Sirwani0% (1)

- Ujian Akhir Semester Pascasarjana Usu (Ekonomi Pembangunan)Document4 pagesUjian Akhir Semester Pascasarjana Usu (Ekonomi Pembangunan)RamaNo ratings yet

- Assignment 1, Macroeconomics 2016-2017Document3 pagesAssignment 1, Macroeconomics 2016-2017Laurenţiu-Cristian CiobotaruNo ratings yet

- 63 Question PaperDocument2 pages63 Question PaperPacific TigerNo ratings yet

- EconomicsDocument9 pagesEconomicsSimha SimhaNo ratings yet

- MODEL EXAMINATION (2020 - 21) ECONOMICS (030) Class - Xii TIME: 3 Hours Max. Marks: 80 General InstructionsDocument7 pagesMODEL EXAMINATION (2020 - 21) ECONOMICS (030) Class - Xii TIME: 3 Hours Max. Marks: 80 General InstructionsAkshaya AkNo ratings yet

- Final Exam - 2019 SpecialDocument12 pagesFinal Exam - 2019 SpecialLiz zzzNo ratings yet

- N5 Economics QP 2017Document5 pagesN5 Economics QP 2017Edwin AmanzeNo ratings yet

- Ba0508 18-19 2Document7 pagesBa0508 18-19 2ccNo ratings yet

- Tutorial Test Question PoolDocument6 pagesTutorial Test Question PoolAAA820No ratings yet

- KASNEB - Aug 2009 To Nov 2010Document13 pagesKASNEB - Aug 2009 To Nov 2010Josephe Mwinizi50% (2)

- Macroeconomics Assignment 2Document4 pagesMacroeconomics Assignment 2reddygaru1No ratings yet

- ECO MOCK TEST 02 SPCCDocument3 pagesECO MOCK TEST 02 SPCCsattwikd77No ratings yet

- Test 10 Macro Full CourseDocument4 pagesTest 10 Macro Full CourseanxyisminecraftNo ratings yet

- P220/1 ECONOMICS Mock Exam QuestionsDocument3 pagesP220/1 ECONOMICS Mock Exam Questionsssempijja jamesNo ratings yet

- Cbse Class 12 Economics Sample Paper Set 1 QuestionsDocument6 pagesCbse Class 12 Economics Sample Paper Set 1 QuestionsSaturo GojoNo ratings yet

- Macroecononics Unit1 Basic Economic ConceptDocument75 pagesMacroecononics Unit1 Basic Economic ConceptChanel CocoNo ratings yet

- 2019 Fall FinalsDocument12 pages2019 Fall FinalsmeganyaptanNo ratings yet

- Question Bdek2203 Introductory MacroeconomicsDocument9 pagesQuestion Bdek2203 Introductory Macroeconomicsdicky chongNo ratings yet

- EconomicsDocument157 pagesEconomicsportableawesomeNo ratings yet

- MAC 2E SSG Ch9Document17 pagesMAC 2E SSG Ch9inmaaNo ratings yet

- Part A / Bahagian A Short Questions / Soalan Pendek Instructions / ArahanDocument8 pagesPart A / Bahagian A Short Questions / Soalan Pendek Instructions / ArahanAdam KhaleelNo ratings yet

- AP Macro Problem Set 3 StudentDocument2 pagesAP Macro Problem Set 3 Studentspfitz11No ratings yet

- Microeconomics End Term Exam ReviewDocument7 pagesMicroeconomics End Term Exam ReviewKartik GurmuleNo ratings yet

- 2017-JAIBB PBE NovDocument2 pages2017-JAIBB PBE Novfarhadcse30No ratings yet

- Practice Paper Class XII Eco PaperDocument12 pagesPractice Paper Class XII Eco PaperAarush100% (1)

- 14. December 2021 Economics -Pilot PaperDocument2 pages14. December 2021 Economics -Pilot Paperapplicationacc05No ratings yet

- CAIF Stage Exam QuestionsDocument4 pagesCAIF Stage Exam QuestionssaimNo ratings yet

- 2314 - DIPL - ECO0006 - Main EQP v2 FinalDocument10 pages2314 - DIPL - ECO0006 - Main EQP v2 FinalPN VNo ratings yet

- Bahagian A Mengandungi 5 Soalan. Jawab SEMUA.: BDEK2203/SEPT 08/F-RRDocument9 pagesBahagian A Mengandungi 5 Soalan. Jawab SEMUA.: BDEK2203/SEPT 08/F-RRFarah DibaNo ratings yet

- 03 Macro PS Inflation and DeflationDocument4 pages03 Macro PS Inflation and DeflationCat maryNo ratings yet

- 2019-JAIBB PBE JulyDocument1 page2019-JAIBB PBE Julyfarhadcse30No ratings yet

- EC Sample Paper 14 UnsolvedDocument7 pagesEC Sample Paper 14 Unsolvedmanjotsingh.000941No ratings yet

- HBE 2211 WELFARE ECONOMICSDocument3 pagesHBE 2211 WELFARE ECONOMICSakitabriannaNo ratings yet

- MBA (BE) II Semester Examination 2021 Paper Title AnalysisDocument17 pagesMBA (BE) II Semester Examination 2021 Paper Title Analysissahil sharmaNo ratings yet

- 2022-23 UT2 Econ S5 Sect B QsDocument8 pages2022-23 UT2 Econ S5 Sect B Qs6s89ng2yymNo ratings yet

- Tutorial 1Document3 pagesTutorial 1Chun Yeen NgaiNo ratings yet

- Macro Term Test 1415 Oct (Final)Document7 pagesMacro Term Test 1415 Oct (Final)Nicholas Giovanna ChongNo ratings yet

- Online Special Examination September 2021: Economics Exam Ii 12 (Cambridge) .........Document6 pagesOnline Special Examination September 2021: Economics Exam Ii 12 (Cambridge) .........Chirath FernandoNo ratings yet

- Economics Class - XII Time - 3 Hours. Maximum Marks - 100 Notes: 1. 2. 3. 4. 5. 6. 7Document12 pagesEconomics Class - XII Time - 3 Hours. Maximum Marks - 100 Notes: 1. 2. 3. 4. 5. 6. 7sahilNo ratings yet

- XII ECONOMICS SAMPLE PAPER 2020-21Document10 pagesXII ECONOMICS SAMPLE PAPER 2020-21akankasha thakurNo ratings yet

- Economics For Managers Dr. SandeepDocument3 pagesEconomics For Managers Dr. SandeepRamteja SpuranNo ratings yet

- 12th QPDocument4 pages12th QPSam StrierNo ratings yet

- Philippine Tourism Overview Political Structures and SubdivisionsDocument2 pagesPhilippine Tourism Overview Political Structures and Subdivisionspatricia navasNo ratings yet

- Management Theory FrameworkDocument3 pagesManagement Theory FrameworkNaveed KhanNo ratings yet

- Unomboti Jesu NdianiDocument17 pagesUnomboti Jesu NdianiMufundisi_RuvimboNo ratings yet

- Banking: 1. Commercial BankDocument6 pagesBanking: 1. Commercial BankAryan RawatNo ratings yet

- CH 04Document14 pagesCH 04leisurelarry999No ratings yet

- MeTC DirectoryDocument3 pagesMeTC Directoryprinsesa0810No ratings yet

- 10th US History - Globalization - WorksheetDocument2 pages10th US History - Globalization - Worksheetangelicamiaot2No ratings yet

- Loan From 3 Year Onwards: Are NTH Avi NG Rou ND Two Yea RsDocument1 pageLoan From 3 Year Onwards: Are NTH Avi NG Rou ND Two Yea RstsrajanNo ratings yet

- CDPDocument115 pagesCDPAr Kunal PatilNo ratings yet

- AmsaiDocument1 pageAmsaiDidi MiiraNo ratings yet

- Presentation To IEEDocument17 pagesPresentation To IEEAbubakar MehmoodNo ratings yet

- Microeconomics Diagrams ExplainedDocument9 pagesMicroeconomics Diagrams ExplainedMayfair NgNo ratings yet

- NNN Bank Report Q1 2019Document3 pagesNNN Bank Report Q1 2019netleaseNo ratings yet

- SBI Xpress Credit Scheme AnnexuresDocument5 pagesSBI Xpress Credit Scheme Annexureskaran100% (3)

- Forms ManagementDocument20 pagesForms ManagementJean Carlo NaderaNo ratings yet

- Bank Recon and PCFDocument2 pagesBank Recon and PCFAiza Ordoño0% (1)

- Payroll SKDocument2 pagesPayroll SKNicolai Andrei RodriguezNo ratings yet

- Global Business Environment - The External Macro EnvironmentDocument10 pagesGlobal Business Environment - The External Macro Environmentoureducation.in100% (1)

- 1final. Nature and Importance of Agriculture2013Document410 pages1final. Nature and Importance of Agriculture2013Mara Jean Marielle CalapardoNo ratings yet

- Sunrise Sector of Indian Economy: Information TechonologyDocument5 pagesSunrise Sector of Indian Economy: Information Techonology110- Karishma verhaniNo ratings yet

- Using Direct Costing for Decision MakingDocument16 pagesUsing Direct Costing for Decision MakingGabriel BelmonteNo ratings yet

- Trade Finance PresentationDocument32 pagesTrade Finance Presentations10032No ratings yet

- Subhash Dey's IED Textbook 2024-25 Sample PDFDocument46 pagesSubhash Dey's IED Textbook 2024-25 Sample PDFravinderd2003No ratings yet

- Deciding The Course of Action: Situation Analysis (Where Are We?)Document32 pagesDeciding The Course of Action: Situation Analysis (Where Are We?)PuttyErwinaNo ratings yet

- History of Economic thought module IDocument56 pagesHistory of Economic thought module IKahsayhagosNo ratings yet

- Final - LST - Candidates PDFDocument137 pagesFinal - LST - Candidates PDFSHREYASI PATILNo ratings yet

- 770976ce9 - DLeon Part IDocument5 pages770976ce9 - DLeon Part IMuhammad sohailNo ratings yet

- Practice ECF1100 Final Exam Sem 2 2019 SolutionsDocument7 pagesPractice ECF1100 Final Exam Sem 2 2019 SolutionsFarah PatelNo ratings yet

- William HalalDocument11 pagesWilliam HalalFarrukh JamilNo ratings yet

- SatDocument5 pagesSatbluishred22No ratings yet

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationFrom EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationRating: 4 out of 5 stars4/5 (11)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsFrom EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsRating: 4.5 out of 5 stars4.5/5 (94)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaFrom EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaNo ratings yet

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetFrom EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetNo ratings yet

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationFrom EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationRating: 4.5 out of 5 stars4.5/5 (46)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- The Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldFrom EverandThe Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldRating: 4 out of 5 stars4/5 (17)

- Doughnut Economics: Seven Ways to Think Like a 21st-Century EconomistFrom EverandDoughnut Economics: Seven Ways to Think Like a 21st-Century EconomistRating: 4.5 out of 5 stars4.5/5 (37)

- Economics 101: How the World WorksFrom EverandEconomics 101: How the World WorksRating: 4.5 out of 5 stars4.5/5 (34)

- The Sovereign Individual: Mastering the Transition to the Information AgeFrom EverandThe Sovereign Individual: Mastering the Transition to the Information AgeRating: 4.5 out of 5 stars4.5/5 (89)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyFrom EverandChip War: The Quest to Dominate the World's Most Critical TechnologyRating: 4.5 out of 5 stars4.5/5 (227)

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailFrom EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailRating: 4.5 out of 5 stars4.5/5 (237)

- The New Elite: Inside the Minds of the Truly WealthyFrom EverandThe New Elite: Inside the Minds of the Truly WealthyRating: 4 out of 5 stars4/5 (10)

- Look Again: The Power of Noticing What Was Always ThereFrom EverandLook Again: The Power of Noticing What Was Always ThereRating: 5 out of 5 stars5/5 (3)

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentFrom EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentRating: 4.5 out of 5 stars4.5/5 (92)