Professional Documents

Culture Documents

in This Code, Unless The Context Otherwise Requires, - : Definitions

in This Code, Unless The Context Otherwise Requires, - : Definitions

Uploaded by

Deepak0 ratings0% found this document useful (0 votes)

4 views1 pageThis document defines key terms used in the Code, including:

1) "Accounting year" which means the year commencing on April 1st.

2) "Appropriate Government" which refers to the Central Government for establishments under its authority, and State Government for all other establishments.

3) "Company", "Cooperative Society", and "Corporation" which refer to business entities defined under other Acts.

4) "Contractor" and "Contract Labour" which refer to workers hired through contractors for establishments.

It provides concise definitions for various terms to clarify their meaning within the context of the Code.

Original Description:

Code on Wages 2019, Page -2

Original Title

THE CODE ON WAGES, 2019 No. 29 of 2019 - Pg 2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document defines key terms used in the Code, including:

1) "Accounting year" which means the year commencing on April 1st.

2) "Appropriate Government" which refers to the Central Government for establishments under its authority, and State Government for all other establishments.

3) "Company", "Cooperative Society", and "Corporation" which refer to business entities defined under other Acts.

4) "Contractor" and "Contract Labour" which refer to workers hired through contractors for establishments.

It provides concise definitions for various terms to clarify their meaning within the context of the Code.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pagein This Code, Unless The Context Otherwise Requires, - : Definitions

in This Code, Unless The Context Otherwise Requires, - : Definitions

Uploaded by

DeepakThis document defines key terms used in the Code, including:

1) "Accounting year" which means the year commencing on April 1st.

2) "Appropriate Government" which refers to the Central Government for establishments under its authority, and State Government for all other establishments.

3) "Company", "Cooperative Society", and "Corporation" which refer to business entities defined under other Acts.

4) "Contractor" and "Contract Labour" which refer to workers hired through contractors for establishments.

It provides concise definitions for various terms to clarify their meaning within the context of the Code.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

2 THE GAZETTE OF INDIA EXTRAORDINARY [PART II—

Definitions. 2. In this Code, unless the context otherwise requires,––

(a) "accounting year" means the year commencing on the 1st day of April ;

(b) "Advisory Board" means the Central Advisory Board or, as the case may be,

the State Advisory Board, constituted under section 42;

(c) "agricultural income tax law" means any law for the time being in force relating

to the levy of tax on agricultural income;

(d) "appropriate Government" means,––

(i) in relation to, an establishment carried on by or under the authority of

the Central Government or the establishment of railways, mines, oil field, major

ports, air transport service, telecommunication, banking and insurance company

or a corporation or other authority established by a Central Act or a central

public sector undertaking or subsidiary companies set up by central public

sector undertakings or autonomous bodies owned or controlled by the Central

Government, including establishment of contractors for the purposes of such

establishment, corporation or other authority, central public sector undertakings,

subsidiary companies or autonomous bodies, as the case may be, the Central

Government;

(ii) in relation to any other establishment, the State Government;

(e) "company" means a company as defined in clause (20) of section 2 of the

Companies Act, 2013; 18 of 2013.

(f) "contractor", in relation to an establishment, means a person, who —

(i) undertakes to produce a given result for the establishment, other than

a mere supply of goods or articles of manufacture to such establishment, through

contract labour; or

(ii) supplies contract labour for any work of the establishment as mere

human resource and includes a sub-contractor;

(g) "contract labour" means a worker who shall be deemed to be employed in or

in connection with the work of an establishment when he is hired in or in connection

with such work by or through a contractor, with or without the knowledge of the

principal employer and includes inter-State migrant worker but does not include a

worker (other than part-time employee) who ––

(i) is regularly employed by the contractor for any activity of his

establishment and his employment is governed by mutually accepted standards

of the conditions of employment (including engagement on permanent basis),

and

(ii) gets periodical increment in the pay, social security coverage and

other welfare benefits in accordance with the law for the time being in force in

such employment;

(h) "co-operative society" means a society registered or deemed to be registered

under the Co-operative Societies Act, 1912, or any other law for the time being in force 2 of 1912.

relating to co-operative societies in any State;

(i) "corporation" means any body corporate established by or under any Central

Act, or State Act, but does not include a company or a co-operative society;

(j) "direct tax" means––

(i) any tax chargeable under the––

(A) Income-tax Act, 1961; 43 of 1961.

You might also like

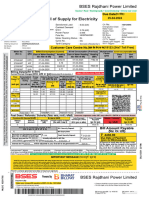

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)DRAGO GAMINGNo ratings yet

- Study Notes On PESTLE Analysis PESTLE Is A Mnemonic Which in Its Expanded Form Denotes P For Political, E For Economic, S ForDocument3 pagesStudy Notes On PESTLE Analysis PESTLE Is A Mnemonic Which in Its Expanded Form Denotes P For Political, E For Economic, S ForAnupamaa SinghNo ratings yet

- The Employees' Provident Funds and Miscellaneous Provisions Act, 1952Document21 pagesThe Employees' Provident Funds and Miscellaneous Provisions Act, 1952Nabendu Karmakar100% (2)

- Highlights On Labour CodesDocument68 pagesHighlights On Labour CodesGhanashyam Dey100% (1)

- Joel Greenblatt The Little Book That Beats The Market Talks at Google Chinese TranslationDocument28 pagesJoel Greenblatt The Little Book That Beats The Market Talks at Google Chinese TranslationSun ZhishengNo ratings yet

- Emirates Airline Strategic Management Project ReportDocument19 pagesEmirates Airline Strategic Management Project Reportmoniyca berlian hadiNo ratings yet

- VAT and SD Act 2012 EnglishDocument91 pagesVAT and SD Act 2012 EnglishMonjurul HassanNo ratings yet

- Marks and SpencerDocument16 pagesMarks and SpencerAdil Mahmud100% (2)

- Convention on International Interests in Mobile Equipment - Cape Town TreatyFrom EverandConvention on International Interests in Mobile Equipment - Cape Town TreatyNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVaibhav MaheshwariNo ratings yet

- The Code On Wages, 2019 No. 29 of 2019Document29 pagesThe Code On Wages, 2019 No. 29 of 2019Awinash Kumar GuptaNo ratings yet

- The Code On Wages 2019-1Document42 pagesThe Code On Wages 2019-1Monami MajhiNo ratings yet

- Code On WagesDocument4 pagesCode On WagesUditanshu MisraNo ratings yet

- Labour Code On Wages Bill, 2015Document46 pagesLabour Code On Wages Bill, 2015Avinash SharmaNo ratings yet

- Uttarakhand SGST - EnglishDocument208 pagesUttarakhand SGST - EnglishNitin BhatnagarNo ratings yet

- The Excise Duty Act, 2002Document169 pagesThe Excise Duty Act, 2002siwakotibishal1No ratings yet

- Gujarat GST Bill, 2017Document199 pagesGujarat GST Bill, 2017JagdishLimbachiyaNo ratings yet

- Insurance Act, 2010Document80 pagesInsurance Act, 2010Joy MajumderUSNo ratings yet

- CGST Act 2017 PDFDocument103 pagesCGST Act 2017 PDFRam IyerNo ratings yet

- DEFINITIONS. - (1) in This Act, Unless The Context Otherwise Requires, - (A)Document3 pagesDEFINITIONS. - (1) in This Act, Unless The Context Otherwise Requires, - (A)pandit_sandeep84No ratings yet

- NOTIFICATION NO 13 2017 CENTRAL TAX RATE SECTION 9 OF THE CGST ACT 2017 LEVY Amp CODocument12 pagesNOTIFICATION NO 13 2017 CENTRAL TAX RATE SECTION 9 OF THE CGST ACT 2017 LEVY Amp CObhaviknagoriNo ratings yet

- TELANGANA SHOPS AND ESTABLISHMENTS ACT 1988 Telan36639COM744582Document24 pagesTELANGANA SHOPS AND ESTABLISHMENTS ACT 1988 Telan36639COM744582MALKANI DISHA DEEPAKNo ratings yet

- The Companies Act 1956Document336 pagesThe Companies Act 1956alkca_lawyerNo ratings yet

- KPK Wages - Act 2013Document13 pagesKPK Wages - Act 2013HumayunNo ratings yet

- Annexure I - DefinitionsDocument4 pagesAnnexure I - DefinitionsAVNISH PRAKASHNo ratings yet

- The Value Added Tax and Supplementary Duty Act, 2012Document76 pagesThe Value Added Tax and Supplementary Duty Act, 2012Mohammad SaifNo ratings yet

- Competition LawDocument49 pagesCompetition LawBalaji KondaNo ratings yet

- Vat Word FileDocument80 pagesVat Word FileRiad FaisalNo ratings yet

- Nagaland GST Act PDFDocument164 pagesNagaland GST Act PDFNitin BhatnagarNo ratings yet

- Companiesact 2013 GazetteDocument294 pagesCompaniesact 2013 Gazetteckd84No ratings yet

- Companies Act, 2013Document294 pagesCompanies Act, 2013Cma Saurabh AroraNo ratings yet

- CA13Document294 pagesCA13Knowitall77No ratings yet

- Companies Act - Notified SectionsDocument294 pagesCompanies Act - Notified SectionsSuzanne NealNo ratings yet

- Income-Tax Ordinance, 1984Document238 pagesIncome-Tax Ordinance, 1984NeehsadNo ratings yet

- The Public and Private Partnership Act 2021Document29 pagesThe Public and Private Partnership Act 2021Abdelrahman MohamedNo ratings yet

- Finance Act 2013 Edition IIIDocument72 pagesFinance Act 2013 Edition IIIAbdul Basit KtkNo ratings yet

- The Orissa Labour Welfare Fund Act, 1996Document34 pagesThe Orissa Labour Welfare Fund Act, 1996Soumya Ranjan NayakNo ratings yet

- CGST Act 2017Document103 pagesCGST Act 2017Fab SNo ratings yet

- Insurance Law PDFDocument28 pagesInsurance Law PDFXtreme Sports EntertainmentNo ratings yet

- CGSTDocument103 pagesCGSTRajesh TandonNo ratings yet

- Saudi Arabia India DtaaDocument15 pagesSaudi Arabia India DtaaRajiv BishnoiNo ratings yet

- The Competition (Amendment) Act, 2007Document52 pagesThe Competition (Amendment) Act, 2007Santosh RaikarNo ratings yet

- CGST PDF NOTES PDFDocument104 pagesCGST PDF NOTES PDFRaunak JainNo ratings yet

- Final ITO 1984 FA 2018Document176 pagesFinal ITO 1984 FA 2018Sarowar AlamNo ratings yet

- Odisha SGST PDFDocument136 pagesOdisha SGST PDFNitin BhatnagarNo ratings yet

- BusinessDocument5 pagesBusinessLov AnanadNo ratings yet

- Meghalaya SGST PDFDocument169 pagesMeghalaya SGST PDFNitin BhatnagarNo ratings yet

- 59 Companies Act 1956Document700 pages59 Companies Act 1956Arun KrishnanNo ratings yet

- The Employees' Provident Funds and Miscellaneous Provisions Act, 1952Document34 pagesThe Employees' Provident Funds and Miscellaneous Provisions Act, 1952Raj KrNo ratings yet

- Employees Provident Funds ActDocument32 pagesEmployees Provident Funds Actzareen10No ratings yet

- 1914 Myanmar Companies ActDocument162 pages1914 Myanmar Companies ActTj StevensonNo ratings yet

- The Payment of Gratuity Act, 1972Document9 pagesThe Payment of Gratuity Act, 1972varma511No ratings yet

- Microsoft Word - Employees Provident Fund ActDocument248 pagesMicrosoft Word - Employees Provident Fund ActManan ParikhNo ratings yet

- The Sindh Terms of Employment (Standing Orders) Act, 2015Document17 pagesThe Sindh Terms of Employment (Standing Orders) Act, 2015Abdul Samad ShaikhNo ratings yet

- Esi Act 1948 (Full Book)Document67 pagesEsi Act 1948 (Full Book)Satish DharwadkarNo ratings yet

- The - Insurance - Act - 1938Document159 pagesThe - Insurance - Act - 1938arbabyounas27No ratings yet

- CCM 236 (2010-11) FCRA: Foreign Contribution (Regulation) Act, 2010Document28 pagesCCM 236 (2010-11) FCRA: Foreign Contribution (Regulation) Act, 2010snehal188No ratings yet

- Code of OSH GazetteDocument86 pagesCode of OSH GazetteBuddho BuddhaNo ratings yet

- Agreement Between Japan and The Republic of IndonesiaDocument36 pagesAgreement Between Japan and The Republic of IndonesiaerfikaNo ratings yet

- Model Shop BillDocument12 pagesModel Shop BillShree ShankaraNo ratings yet

- Bihar State Infrastructure Development Enabling ActDocument33 pagesBihar State Infrastructure Development Enabling Actman.singhNo ratings yet

- Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) Act, 1979Document128 pagesInter-State Migrant Workmen (Regulation of Employment and Conditions of Service) Act, 1979Ayesha AlwareNo ratings yet

- IGST Act With Amendments 1Document14 pagesIGST Act With Amendments 1sanjitaNo ratings yet

- Brief Notes On New Labour Codes 2020: by Advocate Anees S. Kazi, MumbaiDocument16 pagesBrief Notes On New Labour Codes 2020: by Advocate Anees S. Kazi, MumbaiVinay KumarNo ratings yet

- Chapter 16 The Monetary SystemDocument51 pagesChapter 16 The Monetary Systemyohana yNo ratings yet

- Family Business: What Makes It Unique?Document22 pagesFamily Business: What Makes It Unique?121923601018No ratings yet

- ARTICLEDocument2 pagesARTICLEMickaela CaldonaNo ratings yet

- Project 2Document35 pagesProject 2Vaishnavi DeokarNo ratings yet

- (Desk Research)Document13 pages(Desk Research)Manas Somwanshi100% (1)

- Leverages 1Document33 pagesLeverages 1mahato28No ratings yet

- District 205 Amended Facility Use AgreementDocument4 pagesDistrict 205 Amended Facility Use AgreementWGIL Radio100% (1)

- Not Everything That Is Faced Can Be ChangedDocument1 pageNot Everything That Is Faced Can Be ChangedJonas JonaitisNo ratings yet

- Stock Exchange and Its Losses BST Project Class 12Document13 pagesStock Exchange and Its Losses BST Project Class 12Varoon RajeshNo ratings yet

- Mini CaseDocument4 pagesMini CaseHesham MansourNo ratings yet

- Puzzle Ppt-PlayfulDocument14 pagesPuzzle Ppt-PlayfulArvind MishraNo ratings yet

- CSB Bank LTD - IPO Note - Nov'19Document10 pagesCSB Bank LTD - IPO Note - Nov'19puchooNo ratings yet

- Barclays SELLDocument16 pagesBarclays SELLbrucepackard3948No ratings yet

- Contracts For Differences Info CFDDocument2 pagesContracts For Differences Info CFDJoel FrankNo ratings yet

- Internal Audit Checksheet 2014 (API 9th Ed)Document22 pagesInternal Audit Checksheet 2014 (API 9th Ed)dekengNo ratings yet

- Marketing Plan For SOLIO BD2Document32 pagesMarketing Plan For SOLIO BD2Quazi Nazmus SakibNo ratings yet

- Market Analysis - CourseworkThe Competitive Advantage of FinlandDocument10 pagesMarket Analysis - CourseworkThe Competitive Advantage of FinlandscrimaniaNo ratings yet

- Pepsico Fast-Moving Consumer GoodsDocument3 pagesPepsico Fast-Moving Consumer GoodsRABIA MONGA-IBNo ratings yet

- SAP FICO Transaction CodesDocument18 pagesSAP FICO Transaction Codessomu_suresh5362No ratings yet

- Eajournalbg, Journal Manager, FRANCHISING AS A BUSINESS CONCEPT - CHANCE FOR MANY IN SERBIADocument20 pagesEajournalbg, Journal Manager, FRANCHISING AS A BUSINESS CONCEPT - CHANCE FOR MANY IN SERBIAtasyaserbiaNo ratings yet

- BGD Returnee Edited2Document28 pagesBGD Returnee Edited2Ataur Rahman MaruphNo ratings yet

- Bill of Supply For Electricity: Meter Reading StatusDocument2 pagesBill of Supply For Electricity: Meter Reading Statussharmashubham170295No ratings yet

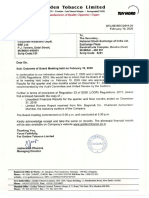

- Golden Tobacco Limited: Tuv NordDocument11 pagesGolden Tobacco Limited: Tuv NordRiddhi ChatterjeeNo ratings yet

- IFA-I Assignment PDFDocument3 pagesIFA-I Assignment PDFNatnael AsfawNo ratings yet