Professional Documents

Culture Documents

Collateral Packet

Uploaded by

Devaraj SubramanyamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Collateral Packet

Uploaded by

Devaraj SubramanyamCopyright:

Available Formats

Collateral Instructions

Avalon Risk Management Insurance Agency LLC as General Agent for the sureties it represents can accept collateral in the

form of a letter of credit, certified check, bank check, cashier’s check, or cash wire transfer. The surety reserves the right to

request a letter of credit only. Collateral in the form of credit card payment can also be accepted for ISF bonds completed via

Web Merlin.

Please note that the original bond cannot be released until we have received the collateral and the completed and signed

Collateral Policy Agreement. Our office will contact you upon receipt of these documents and tell you when the bond can be

released.

In addition, please note there is a (6) six year statute of limitation for which CBP can assess a claim. Therefore collateral can

be held for (6) six years from the date of violation. Please follow every step of the instructions for the collateral type of your

choice.

Instructions for cash (ACH and Cash Wire Transfer)

1. Please advise the underwriting department that a wire transfer is to be expected and advise principal name, the name

and address of the bank that will be sending the wire. Please check with your bank for any fees that it may deduct

from the amount being transferred.

2. Wire transfer can be sent to:

Bank Name: JPMorgan Chase Bank NA.

Bank address: 100 E. Higgins Rd, Elk Grove Village, IL, 60007

Bank Routing Number: 071000013, SWIFT CODE: CHASUS33

Company Account Number: 840535694

Account Name: Avalon Risk Management Insurance Agency LLC

nd

Account Address: 150 NW Point Blvd., 2 Floor, Elk Grove Village, IL 60007

3. The attached Collateral Policy Agreement must be completed and sent to: ARM-Bond_Underwriting@avalonrisk.com

or faxed to (847) 700-8117.

Instructions for checks

1. The certified check, bank check or cashier’s check should be made payable to “Avalon Risk Management”.

PLEASE REFERENCE IMPORTER’S NAME ON THE CHECK.

2. The original check must be sent to Avalon Risk Management, Attn: Bond Underwriting, Address: 150 NW Point Blvd.,

nd

2 Floor, Elk Grove Village, IL 60007.

3. The attached Collateral Policy Agreement must be completed and sent to: ARM-Bond_Underwriting@avalonrisk.com

or faxed to (847) 700-8117.

Instructions for Letters of Credit

1. The bank issuing the letter of credit must be approved by the surety prior to issuance of the letter of credit. Please

provide full name and address of the bank to Avalon Risk Management for prior approval.

2. The bank must follow the letter of credit wording exactly as it appears on the attached form.

3. The original letter of credit should be sent to Avalon Risk Management, Attn: Bond Underwriting, 150 Northwest Point

nd

Boulevard, 2 Floor, Elk Grove Village, IL 60007.

4. The attached Collateral Policy Agreement must be completed and sent to: ARM-Bond_Underwriting@avalonrisk.com

or faxed to (847) 700-8117

Should you have any questions please contact our underwriting office at

ARM-Bond_Underwriting@avalonrisk.com or 847-700-8473.

LETTER OF CREDIT WORDING

*ISSUING BANK MUST BE FDIC APPROVED AND HAVE A HIGHLINE FINANCIAL

RATING OF AT LEAST 40 OR HIGHER.

<Financial Institution Letterhead Required>

<Financial Institution ABA number required>

<Date>

IRREVOCABLE STANDBY LETTER OF CREDIT NO. #<bank will provide>

APPLICANT: <MUST MATCH BOND EXACTLY> AMOUNT: <$00,000.00>

<Full Address>

BENEFICIARY: AVALON RISK MANAGEMENT INSURANCE AGENCY, LLC

FOR THE BENEFIT OF THE

SURETIES IT REPRESENTS

nd

150 NORTHWEST POINT BLVD, 2 Floor

ELK GROVE VILLAGE, ILLINOIS 60007

To Whom It May Concern:

We hereby establish this Irrevocable Letter of Credit (L.O.C.) in favor of Avalon Risk Management Insurance

Agency, LLC for the benefit of the Sureties it represents for the drawing up to United States <$Amount> effective

immediately. This Letter of Credit is issued, presentable and payable by your draft(s) at <name & address of

financial institution>, drawn against this letter of credit on our bank, on the following terms and conditions:

Partial drawings are permitted; however, the combined drawings cannot exceed the aggregate amount

stated in this letter

All drafts must be marked “Drawn Under Letter of Credit No.#<bank needs to provide>”

This credit expires on <expiration date> - 12:01 a.m.

We hereby agree with the drawers, endorsers, and bona fide holders of the drafts under and in compliance with

the terms of this credit that such drafts will be duly honored upon presentations to the drawee.

It is the condition of this Letter of credit that it is deemed to be automatically extended without amendment for one

year from the expiry date hereof, or any future expiration date, unless 60 days prior to any expiration date we

notify you by certified registered mail that we elect not to consider this Letter of Credit renewed for any such

additional period.

This credit is subject to the Uniform Customs and Practice for Documentary Credits (2007 Revision) International

Chamber of Commerce Brochure No. 600.

Sincerely,

<Authorized Financial Institution Signature>

<Title>

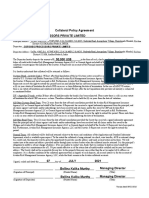

Collateral Policy Agreement

COFOODS PROCESSORS PRIVATE LIMITED

Principal: ___________________________________________________________________________________________

Sy.No. 456/2,456/3,456/4,458/1,458/2,458/3,458/5,461/3, Aarugolanu Road,Aarugolanu Village, Bapulapadu Mandal,

Principal Address: ____________________________________________________________________________________

Krishna District-521106,Andhra Pradesh, INDIA.

COFOODS PROCESSORS PRIVATE LIMITED

Depositor: __________________________________________________________________________________________

Sy.No.456/2,456/3,456/4,458/1,458/2,458/3,458/5,461/3, Aarugoanu Road,Aarugolanu Village, Babpulapadu Mandal,

Depositor Address: ____________________________________________________________________________________

Krishna District-521106, Andhra Pradesh, India

50,000 US$

The Depositor hereby deposits the amount of $__________________ in the form of cash, checks, credit card payment and/or

letters of credit with Avalon Risk Management Insurance Agency LLC as General Agent on behalf of the Sureties It

Represents as collateral security against the liability of the Sureties It Represents on account of the Principal named above,

subject to the following conditions:

It is hereby understood that collateral will be returned as follows:

Customs Bond – Activity Code 1: 90 days after final liquidation of the last Customs entry secured by said bond and all claims

and/or fees owed to U.S. Customs and Border Protection (CBP) and Avalon Risk Management Insurance Agency LLC as

General Agent on behalf of the Sureties It Represents have been paid in full. Furthermore, Avalon Risk Management

Insurance Agency, LLC and the Sureties It Represents reserve the right to extend this period based on any liability that has

not been exhausted under said bonds. Please note there is a (6) six year statute of limitation for which CBP can assess a

claim following the date of termination. In the case of AD/CVD entries, there is no statute of limitation and collateral will only

be returned 90 days after the last liquidation date provided all liability is exhausted as mentioned before.

ISF – Appendix D bonds: within 30 days after all liability under the bond(s) has been exhausted. Please note there is a (6) six

year statute of limitation for which CBP can assess a claim. Therefore collateral can be held for (6) six years from the date of

violation.

All Other Customs Bond Types: Two (2) years from the date of bond cancellation provided the Avalon Risk Management

Insurance Agency LLC as General Agent on behalf of the Sureties It Represents has received a signed indemnity agreement

from the principal, and all claims against said bonds and/or undertakings have been resolved and all claims and/or fees owed

to CBP and Avalon Risk Management Insurance Agency LLC as General Agent on behalf of the Sureties It Represents have

been paid in full. Furthermore, Avalon Risk Management Insurance Agency, LLC and the Sureties It Represents reserve the

right to extend this period. Please note there is a (6) six year statute of limitation for which CBP can assess a claim following

the date of termination.

All Other Bond Types: Two (2) years from the date of bond cancellation provided the Surety has received a signed indemnity

agreement from the principal and all claims against said bonds and/or undertakings have been resolved and all claims and/or

fees owed to the Obligee and Avalon Risk Management Insurance Agency LLC as General Agent on behalf of the Sureties It

Represents have been paid in full. Furthermore, Avalon Risk Management Insurance Agency, LLC and the Sureties It

Represents reserve the right to extend this period.

General Terms: All collateral will be held and returned subject to the terms and conditions of the Application and Standard

Indemnity Agreement, which is available upon request. To the extent the collateral is being returned via check, wire transfer,

ACH or returned charge to a credit card, the depositor will be given the opportunity to provide specific address and bank

account return instructions. We will contact you at the name and address provided and/or through your customs broker when

the collateral may be returned. It is the principal’s obligation to notify us of any change of address. If we are unable to contact

you, funds that we continue to hold on your behalf will become subject to a maintenance fee of 1.5% per month effective as of

the return date of undeliverable certified mail to your last known address. The Surety shall not be responsible for any loss to

the property from any cause other than the act or neglect of its officers or employees. It is a further condition of the collateral

agreement that, in regards to cash deposits, all accrued interest is for the account of Avalon Risk Management Insurance

Agency, LLC, while the funds remain in the Avalon collateral accounts.

06

Signed, sealed and dated this __________day JULY

of ______________________, 2021

_______________.

________________________________ Bollina Kalika Murthy

________________________________ Managing Director

________________________________

(Signature of Principal) (Printed Name) (Title)

________________________________ Bollina Kalika Murthy

________________________________ Managing Director

________________________________

(Signature of Depositor) (Printed Name) (Title)

Version dated 09/21/2016

You might also like

- Loc TemplateDocument1 pageLoc Templaterabbit pinkNo ratings yet

- Direct Deposit FormDocument1 pageDirect Deposit Formandrewdallas948No ratings yet

- Loan Agreement Paperwork of $5000.00Document8 pagesLoan Agreement Paperwork of $5000.00Alex SpecimenNo ratings yet

- eyJpdiI6ImlURytlY2w5N3h0VXB3RVowM0pTeWc9PSIsInZhbHVlIjoiVXVQTnErUlFKUjFKOEVZZEFRN21KQT09IiwibWFjIjoiYmE1MTdmZmYyNzQ4OTgwZWZlOWIwY2ExNTBhMmRiMDliMTA3YzIwOTZlZTZjMzNiMTQ3N2ViZmVhM2E3MGUzNSJ9Document2 pageseyJpdiI6ImlURytlY2w5N3h0VXB3RVowM0pTeWc9PSIsInZhbHVlIjoiVXVQTnErUlFKUjFKOEVZZEFRN21KQT09IiwibWFjIjoiYmE1MTdmZmYyNzQ4OTgwZWZlOWIwY2ExNTBhMmRiMDliMTA3YzIwOTZlZTZjMzNiMTQ3N2ViZmVhM2E3MGUzNSJ9GlendaNo ratings yet

- Settle Credit Card Dues for LessDocument3 pagesSettle Credit Card Dues for LessJenifer MaryNo ratings yet

- Specialized Loan Servicing Charges $250 For A Refi, and $125 For A Loan ModDocument4 pagesSpecialized Loan Servicing Charges $250 For A Refi, and $125 For A Loan ModTim BryantNo ratings yet

- B - Letter 1 - 1st Dispute Letter To Pretend LenderDocument5 pagesB - Letter 1 - 1st Dispute Letter To Pretend Lenderbigwheel897% (31)

- Wetsign DisclosuresDocument3 pagesWetsign DisclosuresChase CashionNo ratings yet

- SignedDocument14 pagesSignedtrumpu01No ratings yet

- Welcome Letter 162032006Document6 pagesWelcome Letter 162032006faizalkapadia737No ratings yet

- Standby Letter of Credit - Sample Format: CounterpartyDocument2 pagesStandby Letter of Credit - Sample Format: Counterpartyvovica6843No ratings yet

- Welcome Letter - 203319753 PDFDocument6 pagesWelcome Letter - 203319753 PDFRITIK DESHBHRATARNo ratings yet

- Kohls Cardmember AgreementDocument3 pagesKohls Cardmember AgreementADEDAMOPE ODUESONo ratings yet

- Application ID / New Customer: 031BS3Y3ST880 / 643963Document4 pagesApplication ID / New Customer: 031BS3Y3ST880 / 643963Mubashir AsifNo ratings yet

- 10000001667Document79 pages10000001667Chapter 11 DocketsNo ratings yet

- QWR Template - GenericDocument3 pagesQWR Template - GenericBob Ramers100% (2)

- IDFC Bank loan details and repayment optionsDocument6 pagesIDFC Bank loan details and repayment optionsTabe alamNo ratings yet

- Borrower Declaration - CA & LEI RegulationDocument2 pagesBorrower Declaration - CA & LEI RegulationSHASHI KANTNo ratings yet

- Welcome Letter - 160548927Document6 pagesWelcome Letter - 160548927MD AZHARNo ratings yet

- Clearing Mortgage DebtDocument2 pagesClearing Mortgage Debtteachezi100% (1)

- TC Sky1 062Document4 pagesTC Sky1 062jeffreygrimm8No ratings yet

- Express Authorization Template 1.16 4Document2 pagesExpress Authorization Template 1.16 4elhard shalloNo ratings yet

- Credit Repair SolutionsDocument6 pagesCredit Repair SolutionsCarolNo ratings yet

- No Objection Certificate (NOC) - 145947012Document1 pageNo Objection Certificate (NOC) - 145947012sirikrishnaNo ratings yet

- WLC LTRDocument6 pagesWLC LTRraghu INo ratings yet

- Approval ContractDocument3 pagesApproval Contractosas RichardNo ratings yet

- FT Autho LetterDocument1 pageFT Autho LetterDiana Rose AcupeadoNo ratings yet

- 2023-07-17T10 22 47 LoanAgreement 691671Document9 pages2023-07-17T10 22 47 LoanAgreement 691671juantirado0777No ratings yet

- 803 20200218 111928 PDFDocument7 pages803 20200218 111928 PDFlaxmangosavi100% (1)

- Welcome Letter 33875975Document3 pagesWelcome Letter 33875975Raj KumarNo ratings yet

- Settlement LetterDocument3 pagesSettlement LetterKritikaNo ratings yet

- Adverse Action NoticeDocument2 pagesAdverse Action NoticecoreyNo ratings yet

- Settlement LetterDocument3 pagesSettlement LetterKritikaNo ratings yet

- Loan Against Property AgreementDocument34 pagesLoan Against Property AgreementAli Khan AKNo ratings yet

- Doa TradeDocument17 pagesDoa TradeEduardo WitonoNo ratings yet

- Bank Guarantee SampleDocument2 pagesBank Guarantee SampleSergio BrokNo ratings yet

- 6033256806a953f6ff7b7459 - 2 Streams Brokerage - Carrier PacketDocument14 pages6033256806a953f6ff7b7459 - 2 Streams Brokerage - Carrier PacketMarissa WilliamsNo ratings yet

- Funds Availabilility Policy DisclosureDocument2 pagesFunds Availabilility Policy Disclosuresheriffusman1111No ratings yet

- Welcome Letter 131706428Document3 pagesWelcome Letter 131706428rupesh.gunjan90823No ratings yet

- Settlement LetterDocument3 pagesSettlement LetterKritikaNo ratings yet

- Credit - Report ZMDocument3 pagesCredit - Report ZMEric CartmanNo ratings yet

- Franchise Escrow AgreementDocument4 pagesFranchise Escrow AgreementKonan SnowdenNo ratings yet

- Paper From Advance America Cash AdvanceDocument6 pagesPaper From Advance America Cash AdvanceJoyNo ratings yet

- Idebt Assist 1 - 2010Document7 pagesIdebt Assist 1 - 2010paulNo ratings yet

- Consoloan Application Form 4Document3 pagesConsoloan Application Form 4bhon20No ratings yet

- Milestone® Gold Mastercard® The Bank of Missouri: Interest Rates and Interest ChargesDocument4 pagesMilestone® Gold Mastercard® The Bank of Missouri: Interest Rates and Interest ChargesDelois RoseboroNo ratings yet

- Joan Leach Approval LetterDocument4 pagesJoan Leach Approval LetterutilitiesNo ratings yet

- DOA Template LCDocument10 pagesDOA Template LCYash Mit100% (1)

- Letter of Credit Samples 2Document4 pagesLetter of Credit Samples 2Võ Nguyễn Hoàng LinhNo ratings yet

- Loan AgreementDocument5 pagesLoan AgreementAlice RomeroNo ratings yet

- Consent to Electronic CommunicationsDocument9 pagesConsent to Electronic CommunicationsLiliana MendozaNo ratings yet

- fileDocument24 pagesfilesmurphylee22No ratings yet

- LetterOfCredit Collateral Agreement M00AE M0071 A0003Document4 pagesLetterOfCredit Collateral Agreement M00AE M0071 A0003Ekologija FinansijeNo ratings yet

- Expert Credit Solutionscustomer AgreementDocument5 pagesExpert Credit Solutionscustomer AgreementrhondazNo ratings yet

- Banker Attested Letter - InstructionsDocument4 pagesBanker Attested Letter - InstructionsAshley CummingsNo ratings yet

- Solitude - Lockett - BOA 2-13 PDFDocument3 pagesSolitude - Lockett - BOA 2-13 PDFDarian MooreNo ratings yet

- Paper From Advance America Cash AdvanceDocument6 pagesPaper From Advance America Cash Advancekevin.johnsonloanNo ratings yet

- Repair Your Credit Score: The Ultimate Personal Finance Guide. Learn Effective Credit Repair Strategies, Fix Bad Debt and Improve Your Score.From EverandRepair Your Credit Score: The Ultimate Personal Finance Guide. Learn Effective Credit Repair Strategies, Fix Bad Debt and Improve Your Score.No ratings yet

- Suryamitra Raw Material RegisterDocument11 pagesSuryamitra Raw Material RegisterDevaraj SubramanyamNo ratings yet

- Responsible Use of Anti-Parasitics in Aquaculture: GuidelinesDocument30 pagesResponsible Use of Anti-Parasitics in Aquaculture: GuidelinesDevaraj SubramanyamNo ratings yet

- Responsible Use of Antimicrobials in Fish Production: GuidelinesDocument21 pagesResponsible Use of Antimicrobials in Fish Production: GuidelinesDevaraj SubramanyamNo ratings yet

- Invoice: Global Aquaculture Alliance D.B.A Best Aquaculture PracticesDocument2 pagesInvoice: Global Aquaculture Alliance D.B.A Best Aquaculture PracticesDevaraj SubramanyamNo ratings yet

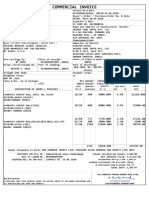

- Invoice 83Document1 pageInvoice 83Devaraj SubramanyamNo ratings yet

- Shrimp Exporter'S/Importer'S Declaration: (See Instructions On Reverse)Document4 pagesShrimp Exporter'S/Importer'S Declaration: (See Instructions On Reverse)Devaraj SubramanyamNo ratings yet

- Suryamitra Raw Material RegisterDocument11 pagesSuryamitra Raw Material RegisterDevaraj SubramanyamNo ratings yet

- Invoice 83Document1 pageInvoice 83Devaraj SubramanyamNo ratings yet

- Packing List: Invoice No & DateDocument1 pagePacking List: Invoice No & DateDevaraj SubramanyamNo ratings yet

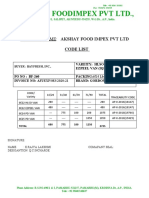

- Company Name: Akshay Food Impex PVT LTDDocument1 pageCompany Name: Akshay Food Impex PVT LTDDevaraj SubramanyamNo ratings yet

- Invoice: Global Aquaculture Alliance D.B.A Best Aquaculture PracticesDocument2 pagesInvoice: Global Aquaculture Alliance D.B.A Best Aquaculture PracticesDevaraj SubramanyamNo ratings yet

- Shrimp Exporter'S/Importer'S Declaration: (See Instructions On Reverse)Document4 pagesShrimp Exporter'S/Importer'S Declaration: (See Instructions On Reverse)Devaraj SubramanyamNo ratings yet

- Packing List: Invoice No & DateDocument1 pagePacking List: Invoice No & DateDevaraj SubramanyamNo ratings yet

- NOAA Mandatory Shrimp Entry DataDocument10 pagesNOAA Mandatory Shrimp Entry DataDevaraj SubramanyamNo ratings yet

- Collateral Packet-3 - For MergeDocument1 pageCollateral Packet-3 - For MergeDevaraj SubramanyamNo ratings yet

- Request For Duplicate BillDocument7 pagesRequest For Duplicate BillDevaraj SubramanyamNo ratings yet

- Sept Bank - NewDocument9 pagesSept Bank - NewLisa HesterNo ratings yet

- OD TERMS24838 SignedFinalDocument17 pagesOD TERMS24838 SignedFinalAnurag SoniNo ratings yet

- Final Chapter 6Document12 pagesFinal Chapter 6Nigussie BerhanuNo ratings yet

- Cash and Internal ControlDocument47 pagesCash and Internal ControlHEM CHEA100% (2)

- Financial and Managerial Accounting 14th Edition Warren Test BankDocument44 pagesFinancial and Managerial Accounting 14th Edition Warren Test Bankpamelajuarez05091999bsa100% (28)

- Statement Sep 23 XXXXXXXX0143Document2 pagesStatement Sep 23 XXXXXXXX0143mohdasimraza84No ratings yet

- Banking DomainDocument7 pagesBanking DomainManju DarsiNo ratings yet

- Lecture 3 - Banks and Other Financial InstitutionsDocument33 pagesLecture 3 - Banks and Other Financial Institutionsn nNo ratings yet

- Askari AR2010 (Final Version)Document212 pagesAskari AR2010 (Final Version)Muhammad Umair AshrafNo ratings yet

- Axis Bank EasyPay in Slip-DIT DehradunDocument1 pageAxis Bank EasyPay in Slip-DIT DehradunAkhtar Reza Khan0% (1)

- Xam Idea EconomicsDocument370 pagesXam Idea EconomicsCarl LukeNo ratings yet

- Salientes, Karl C. Reaction PaperDocument4 pagesSalientes, Karl C. Reaction PaperKarl Salientes50% (2)

- Cash and Cash EquivalentDocument5 pagesCash and Cash EquivalentMASIGLAT, CRIZEL JOY, Y.No ratings yet

- Auditing Cash and Bank BalancesDocument10 pagesAuditing Cash and Bank BalancesbikilahussenNo ratings yet

- Central Bank liable for encashing checks despite lack of authorityDocument1 pageCentral Bank liable for encashing checks despite lack of authorityxxxaaxxxNo ratings yet

- Bank Final AccountsDocument11 pagesBank Final AccountsSoumendra RoyNo ratings yet

- Ms. Nidhi Malhotra SoniaDocument87 pagesMs. Nidhi Malhotra SoniaShalini ThakurNo ratings yet

- BANKING NOTESDocument14 pagesBANKING NOTESjagankilari80% (5)

- Central Bank Controls Indian BankingDocument9 pagesCentral Bank Controls Indian BankingKIRIT PADALIA100% (1)

- General Banking System On First Security Islami Bank LTDDocument49 pagesGeneral Banking System On First Security Islami Bank LTDJohnathan RiceNo ratings yet

- Accounting Policies and StandardsDocument31 pagesAccounting Policies and StandardsAbhishek Kr Paul50% (2)

- MB0041 Accounts Assingment FinalDocument20 pagesMB0041 Accounts Assingment FinalRati BhanNo ratings yet

- Personal Ledger AccountDocument26 pagesPersonal Ledger Accountvinay_narula_425% (4)

- Al-Faysal Bank LTDDocument44 pagesAl-Faysal Bank LTDqalander abbasNo ratings yet

- Chapter Five: The Financial Statements of Banks and Their Principal CompetitorsDocument35 pagesChapter Five: The Financial Statements of Banks and Their Principal Competitorsعبدالله ماجد المطارنه100% (1)

- Abu Dhabi Islamic BankDocument9 pagesAbu Dhabi Islamic Bankapi-290353706No ratings yet

- Foreclosure Affidavit Cog1Document15 pagesForeclosure Affidavit Cog1Bhakta Prakash100% (7)

- Notes On Cash and Cash EquivalentsDocument5 pagesNotes On Cash and Cash EquivalentsLeonoramarie BernosNo ratings yet

- Conquest of Poverty (1933) Gerald Grattan McGeerDocument236 pagesConquest of Poverty (1933) Gerald Grattan McGeerDaniel ThompsonNo ratings yet

- Financial Statements - CIMB Group AR15 PDFDocument366 pagesFinancial Statements - CIMB Group AR15 PDFEsplanadeNo ratings yet