Professional Documents

Culture Documents

Quiz 1

Quiz 1

Uploaded by

Bilal AfzalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz 1

Quiz 1

Uploaded by

Bilal AfzalCopyright:

Available Formats

Fin_ance Fundamentals - MBA (B) Name: _ _!

_ _~_i____

K....::..

.

Quiz# I_-Fall 2021 (Nov 4, 2021) ID#: _ _ _ _ __

T otal Points: IO

Select the sino/e

b

hest answer and md,cate

• . • with

your choice · a fl.!£..!I.·

· l

I.

An agency problem can be alleviated:

a. when a firm is a sole proprietorship. . .

b. by compensating managers in such a way that acting in the best interest of shareholders is also m the be st

interest of managers. ·U __,, £

C. by asking managers to take on more risk than they are comfortable taking. 2,..... _B

d. all of the above 3 . . -- Pt

© both a and b above ..:.,..;..---

2.

Y_,, 6

Which one of the following is a capital budgeting decision? 5: __. tr

J\ determining how much debt should be borrowed from a particular lender B

l..'.7' a retailer decidi_ng whether to open a new store or not <& :::--

c. deciding when to repay a long-term debt 1 ----C

u

d.

e.

determining how much inventory to keep on hand

determining how much money should be kept in the bank checking account 9

15

;:g

3. ~ich of the following statements is true? I 1> _,,. B

(1/ Sole proprietorships and partnerships generally have a tax advantage over many corporations, especially

large ones. /

b. Passive investment approach attempts to outperform the market (index) through timing or selecting

undervalued securities. Y---

C. "crowding out" refers to the phenomenon of government spending more than its revenues. \J.

d. More than one of the statements are true

4. Which of the following statements is false?

a. The Principal-Agent Problem arises because managers generally have little incentive to work in the

interest of shareholders when this means working against their own self-interest.

et:) Dealer bid prices exceed ask prices. X

c. If you buy shares of Coca-Cola on the primary market, Coca-Cola receives the money because the

company has issued new shares.

d. More than one of the statements are false

5. Which of the following statements is false?

0 It is generally easier to transfer one's ownership interest in a partnership than in a corporation. X

b. Money markets are markets for debt securities with original maturity of one year or less. y /

C. Rights offerings are often used when an already Hstedcompanyraises new equity ~

d. More than one of the statements are false

6. Which of the following statements is true?

a. Warren Buffett believes that markets are ge~~rally efficient (i.e., market price= Intrinsic value) and

search for undervalued securities is futile. l-

@ The pr?cess of planning an~ managing a firm's long-term investments is called capital budgeting.\/'

c. The pnmruy goal of financial management is to maintain steady growth in both sales and net earnings of

thefrrm. X

d. More than one of the statements are true

7. Which of the following statements is false? . th Pakistan Stock Exchange

a. A public limited company's share trade on organized exchanges_such as e

(PSX); whereas private companies shares do not trade on fina~cial mahrk~t\ t" the transaction is called

b. When stock in a closely held corporation is offered to the pu?hc for t e irs~e,

"going public," and the market for such stock is called the pnmary mar~et. fl t when the cash

Accounting profits and cash flows are generally the same since accounting profits re ec

flow is received. 'I--

d. More than one of the statements are false

Which of the following statements is false? . H h · "r1•sk 1so

· l at1on

· " 1· e

8. a. One of the advantages of a holding company structure such as Berksh 1_re at a war is ' · .,

obligations of one operating company do not spill over to other operating compame_s.

One of the principles of Warren Buffett is to diversity reasonably but don't overdo it.

b Dual class shares refer to the practice where a company stock is listed and traded on two stock exchanges

(V - domestic exchange and international exchange.

d. More than one of the statements are false

Which of the following statements is false?

9. ).\-\ V

The mixture of debt and equity used by a firm to finance its operations is called its capital structure.

(__'.';) Primary difference between a broker and a dealer is that a broker makes money out of bid and ask spread,

whereas a dealer works on commission. 'j- - -- - - - -

c. · A company's sale increased from 100 million to 200 million in 5 years which is equivalent to compound

annualized growth rate (CAGR) of 14.87%

d. More than one of the statements are false

10. Which of the following statements is false?

a. Intrinsic value of ~ k primarily depends on the cash flows, timing of the cash flows, and riskiness of

,,-:-) the cash flows.

Treasury stock refers to company shares that have been acquired by the government. X'.

c. In acco~~ing, emphasis is ~laced on net income as a measure-of performance. In Finance, the primary

emphasis 1s on cash flows since that is what investors use to value a firm.

d. More than one of the statements are false

tin~nce Fundamentals_ MBA (B)***

Name: _ _ K_8f~---

ID #: _ _ _ _ __

T u12# I_-Fal12021 (Nov4,2021)

otal Points: IO

Select the single best answer and indicate your choice with a circle.

I. Which of the following statement is false?

a. Two major styles of invesl!}lent are value and growth. Investors following value style typically look for

/4"; undervalued securities. /

Money markets are markets for common stocks and long-term debt. Y . .

c. Intrinsic value of a stock primarily depends on the cash flows, timing of the cash flows, and nskmess of

l

the cash flows.

d. More than one of the statements are false

2. Which of the following statements is false?

© Treasury stock refers to company shares that have been acquired by the government. x'

b. One key value of limited liability is that it lowers owners' risks and thereby enhances a firm's value. v

c. Dealer ask prices exceed bid prices. - -------- 1--- 8 I

d. More than one of the statements are false - A

3. Which of the following statements is false?

a.

3---

Sole proprietorships and partnerships generally have a tax advantage over many corporations, especiall>,1

_§__

e.

large ones. -

@ Warren Buffett believes that markets are generally efficient (i.e., market price= Intrinsic value) and 5 B I \

search for undervalued securities is futile. X -1)

c. Compensating managers in the form of stock option plan generally tend to align the interests of owner{;,-:;:;--

and managers. v 7 _, A

d. More than one of the statements are false g' _,,, A'

4. Which of the following statements is false?

a. Active investment approach attempts to outperform the market (index) through timing or selecting --

C

(f) undervalued securities. / l o _,,(...,

Primary difference between a broker and .a ~ealer is that a broker makes money out of bid and ask spread,

whereas a dealer works on commission. X

c. The primary function of the secondary market is to provide liquidity V

d. More than one of the statements are false

5. Which of the following statements is false?

~ l. The mixture of debt and equity used by a firm to finance its operations is called its capital structure. V

Dual class common shares refer to the practice where a company stock is listed and traded on two stock

exchanges - domestic exchange and international exchange. )(

c. An agency problem can be alleviated when a firm is a sole proprietorship. v

d. More than one of thesfiitements are false

6. Which of the following statements is false?

a. Accounting profits and cash flows are generally the same since accounting profits reflect when the cash

flow is received. X

b. A private limited company's share trade on organized exchanges such as the Pakistan Stock Exchange

(PSX); whereas public compani~s shares are owned by governments. \

c. A broker ~cts as an agent when 1t executes orders on behalf of its clients ( or principal) whereas a dealer

trades for its own account. ------- '

0 More than one of the statements are false

\

· . her u coming trip to Miami for

You overhear

. y your kn manager saying that she plans

. to book an Ocean-view

. d room

th t onr manager

p •is trave 1·ng

I at the

7. a meet mg. ou ow that the interior rooms are much less expensive an a you

Company's expense. This use of additional funds comes about as a result of:

(f) agency problem.

b. an adverse selection problem.

c. a moral hazard.

d. accounting focus instead of economic reality focus

)Y?ich of

CY Athe following

stock statements

is said to is false?

be unde.-valued •

and presents a buy opportunity when its market price is greater th.an its

8.

b.

intrinsic value. X

The statement, "Be greedy when the market is fearful al!,P be fearful when the market is greedy"

represents the views of a contrarian value investor. . . .

c. Rights offerings allow the existing shareholders to maintain their proportionate ownership in a company·

d. More than one of the statements are false

9. Which of

a. theof

One following statements

the advantages of a is false? company structure such as Berkshire Hathaway is "risk isolation", i.e.,

holding

obligations of one operating company do not spill over to other operating

One of the disadvantages of a sole proprietorship is that the proprietor is exposed to unlimited liability. v

Private debt refers to short term debt securities issued by companies )<

More than one of the statements are false -

I 0. Which of the following statements is true?

a. "crowding out" refers to the phenomenon of government spending more than its revenues. X .

1-., Most of the acquisitions of Warren Buffett for Berkshire Hathaway are a result of hostile takeover).

(V An individual's net worth= total assets - total liabilities

o. More than one of the statements are true

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- MR Edward Mandizvidza 28640 Umqousi Fairdale Cape Town 7100: Transactions in RAND (ZAR) Accrued Bank ChargesDocument4 pagesMR Edward Mandizvidza 28640 Umqousi Fairdale Cape Town 7100: Transactions in RAND (ZAR) Accrued Bank Chargesamazing mandizvidzaNo ratings yet

- Short Term Financial Management 3rd Edition Maness Test BankDocument5 pagesShort Term Financial Management 3rd Edition Maness Test Bankjuanlucerofdqegwntai100% (16)

- ADM 2350 Final Exam SolnsDocument11 pagesADM 2350 Final Exam SolnsIshan Vashisht100% (1)

- Comparative Income Statements and Balance Sheets For Merck ($ Millions) FollowDocument6 pagesComparative Income Statements and Balance Sheets For Merck ($ Millions) FollowIman naufalNo ratings yet

- Settlement LetterDocument3 pagesSettlement LetterKritikaNo ratings yet

- Key STQ-6 Valuation Fall 2021Document2 pagesKey STQ-6 Valuation Fall 2021Bilal AfzalNo ratings yet

- Chapter 1 - MCQsDocument4 pagesChapter 1 - MCQsThuyển ThuyểnNo ratings yet

- Kami Export - Andi Hajdarmataj - COMPARE - Understanding The Types of Student Loans (#9)Document4 pagesKami Export - Andi Hajdarmataj - COMPARE - Understanding The Types of Student Loans (#9)Andi HajdarmatajNo ratings yet

- MCQ Fin 502Document50 pagesMCQ Fin 502Tareque Rubel90% (10)

- Financial Market & Institution WorksheetDocument5 pagesFinancial Market & Institution Worksheetbikilahussen100% (1)

- Q12 KeyDocument3 pagesQ12 KeyMuhammad AbdullahNo ratings yet

- UntitledDocument6 pagesUntitledMuhammad AbdullahNo ratings yet

- Business Finance 1st WeekDocument11 pagesBusiness Finance 1st WeekErleNo ratings yet

- Chapter 1 Introduction To Corporate FinanceDocument8 pagesChapter 1 Introduction To Corporate FinanceNicole BelisarioNo ratings yet

- MGT of FM & Institution WorksheetDocument5 pagesMGT of FM & Institution WorksheetfitsumNo ratings yet

- Tutorial 4Document11 pagesTutorial 4vananhvapham123No ratings yet

- QUIZDocument3 pagesQUIZsabiliNo ratings yet

- Invetment MGT Test-B PDFDocument2 pagesInvetment MGT Test-B PDFtemedebereNo ratings yet

- Chapter 2: Introduction To Securities MarketDocument7 pagesChapter 2: Introduction To Securities Marketravi100% (2)

- Chapter 12 ModDocument15 pagesChapter 12 Modvivek guptaNo ratings yet

- Chapter 1 - MCQsDocument4 pagesChapter 1 - MCQsHải LinhNo ratings yet

- SAS#8-FIN081 Long Quiz 1Document5 pagesSAS#8-FIN081 Long Quiz 1Eunice Lyafe PanilagNo ratings yet

- Finman Final Exam ProblemDocument10 pagesFinman Final Exam ProblemJayaAntolinAyusteNo ratings yet

- Investing Basics Bonds Student V52Document5 pagesInvesting Basics Bonds Student V52nikola.zyszkiewiczNo ratings yet

- Achievement Test Business Finance 1Document8 pagesAchievement Test Business Finance 1Lorna B. MoncadaNo ratings yet

- Practice Questions - Fill in The Blanks: ScienceDocument2 pagesPractice Questions - Fill in The Blanks: ScienceJudy PhanomphoneNo ratings yet

- Management of Financial ServicesDocument8 pagesManagement of Financial ServicesShikha100% (1)

- Test - Managerial İKT236 Managerial EconomicsDocument4 pagesTest - Managerial İKT236 Managerial EconomicsMohamed MamdouhNo ratings yet

- Fin 072 P1 Exam With AkDocument9 pagesFin 072 P1 Exam With AkCyrille MirandaNo ratings yet

- Quiz Questions: Student Centre Chapter 2: Review of AccountingDocument4 pagesQuiz Questions: Student Centre Chapter 2: Review of AccountingSandyNo ratings yet

- MCQs On Capital StructureDocument7 pagesMCQs On Capital Structuremercy100% (1)

- Tutorial 1 Choose ONE Correct Answer ONLYDocument4 pagesTutorial 1 Choose ONE Correct Answer ONLYnhoctracyNo ratings yet

- UntitledDocument3 pagesUntitledMuhammad AbdullahNo ratings yet

- Sebenta Inglês AplicadoDocument30 pagesSebenta Inglês AplicadoJoana PimentelNo ratings yet

- Iefinmt Reviewer For Quiz (#2) : I. IdentificationDocument9 pagesIefinmt Reviewer For Quiz (#2) : I. IdentificationpppppNo ratings yet

- Test 4for Students - Topic 4Document5 pagesTest 4for Students - Topic 4Yến NguyễnNo ratings yet

- Trial Med Anagement-1Document2 pagesTrial Med Anagement-1Youssef NabilNo ratings yet

- PDF 01 Introduction To Financial Management Keypdf DDDocument4 pagesPDF 01 Introduction To Financial Management Keypdf DDPrincesNo ratings yet

- CFA Level 1 - Test 2 - PMDocument26 pagesCFA Level 1 - Test 2 - PMHongMinhNguyenNo ratings yet

- MAS Handout - Overview of Financial ManagementDocument2 pagesMAS Handout - Overview of Financial ManagementDivine VictoriaNo ratings yet

- Chapter 1: An Overview of Financial ManagementDocument5 pagesChapter 1: An Overview of Financial Managementctyre34No ratings yet

- Practice - Ch. 1Document6 pagesPractice - Ch. 1林祐群No ratings yet

- Colegio de San Juan de Letran: NAME - SECTIONDocument9 pagesColegio de San Juan de Letran: NAME - SECTIONmaria evangelistaNo ratings yet

- Homework Topic 1 - To SendDocument7 pagesHomework Topic 1 - To SendThùy NguyễnNo ratings yet

- 8230 Sample Final 1Document8 pages8230 Sample Final 1lilbouyinNo ratings yet

- Philippine School of Business Administration: Cpa ReviewDocument9 pagesPhilippine School of Business Administration: Cpa ReviewLeisleiRagoNo ratings yet

- Financial Analysis Placement TestDocument15 pagesFinancial Analysis Placement TestAbigail SubaNo ratings yet

- FinMan 1 - Prelim Reviewer 2017Document17 pagesFinMan 1 - Prelim Reviewer 2017Rachel Dela CruzNo ratings yet

- Wk1 Worksheet BFDocument5 pagesWk1 Worksheet BFMitchelle DumlaoNo ratings yet

- Homework Topic 1 - To SendDocument5 pagesHomework Topic 1 - To SendMun KangNo ratings yet

- REVIEWER in Basic AccountingDocument5 pagesREVIEWER in Basic AccountingLala BoraNo ratings yet

- QuizDocument26 pagesQuizDung Le100% (1)

- 6cost of Capital or Financing DecisionsDocument6 pages6cost of Capital or Financing DecisionsNovs MacapulayNo ratings yet

- New Doc 2018-10-17 23.27.47 - 1Document7 pagesNew Doc 2018-10-17 23.27.47 - 1Prashant TodkarNo ratings yet

- Chapter 2Document4 pagesChapter 2HuyNguyễnQuangHuỳnhNo ratings yet

- ECO 550 Test BankDocument192 pagesECO 550 Test BankGroovyGuy9933% (3)

- Chapter 1 Homework Assignment Fall 2018Document8 pagesChapter 1 Homework Assignment Fall 2018Marouf AlhndiNo ratings yet

- Problemset2 PDFDocument4 pagesProblemset2 PDFAbhishekKumarNo ratings yet

- Introduction To Corporate Finance (Test Question With Answers)Document9 pagesIntroduction To Corporate Finance (Test Question With Answers)Haley James ScottNo ratings yet

- Corporate Finance MCQs PDFDocument63 pagesCorporate Finance MCQs PDFNhat QuangNo ratings yet

- Macro-Chapter 13 - UnlockedDocument9 pagesMacro-Chapter 13 - UnlockedTrúc LinhNo ratings yet

- CH 1 Quiz Fin 11Document2 pagesCH 1 Quiz Fin 11Erma CaseñasNo ratings yet

- Tutorial-1 FMADocument6 pagesTutorial-1 FMANguyễn NhungNo ratings yet

- Textile Industry of PakistanDocument1 pageTextile Industry of PakistanBilal AfzalNo ratings yet

- Textile Industry of PakistanDocument1 pageTextile Industry of PakistanBilal AfzalNo ratings yet

- Sports Manufacturing Industry of PakistanDocument1 pageSports Manufacturing Industry of PakistanBilal AfzalNo ratings yet

- Healthcare Sector of PakistanDocument1 pageHealthcare Sector of PakistanBilal AfzalNo ratings yet

- Assignment - DR 3Document6 pagesAssignment - DR 3Bilal AfzalNo ratings yet

- Glaxosmithkline Consumer Healthcare: Group MembersDocument19 pagesGlaxosmithkline Consumer Healthcare: Group MembersBilal AfzalNo ratings yet

- Brac Epl Stock Brokerage Limited Symphony (3Rd Floor), Piot: S.E (F) - 9, Road:142, Guishan Avenue, Dhaka-1212 To Whom It May ConcernDocument1 pageBrac Epl Stock Brokerage Limited Symphony (3Rd Floor), Piot: S.E (F) - 9, Road:142, Guishan Avenue, Dhaka-1212 To Whom It May ConcernzamanasifNo ratings yet

- Kohler Group 5Document6 pagesKohler Group 5Prateek PatraNo ratings yet

- Nature of Monetary EconomicsDocument17 pagesNature of Monetary EconomicsNorie ManiegoNo ratings yet

- Acct Statement - XX4059 - 05042024Document23 pagesAcct Statement - XX4059 - 05042024Benzene diazonium saltNo ratings yet

- Changxing Bufuna Textile Co., LTD.: We Hereby Confirm The Sales Information As BelowDocument1 pageChangxing Bufuna Textile Co., LTD.: We Hereby Confirm The Sales Information As BelowALRAYAN GOLDNo ratings yet

- Chapter 5 ExercisesDocument3 pagesChapter 5 ExercisesHình VậnNo ratings yet

- Capital MarketsDocument12 pagesCapital MarketsSanoj Kumar YadavNo ratings yet

- Salary Account Benefits Workings TNCDocument4 pagesSalary Account Benefits Workings TNCHarish S MNo ratings yet

- Tata Steel PPT On Investment DecisionDocument13 pagesTata Steel PPT On Investment DecisionhittimishraNo ratings yet

- iGB Personal Bank Account Fee Information Document 31mar2023Document2 pagesiGB Personal Bank Account Fee Information Document 31mar2023chen jam (1314)No ratings yet

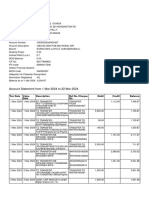

- Account Statement From 1 Mar 2024 To 22 Mar 2024: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument13 pagesAccount Statement From 1 Mar 2024 To 22 Mar 2024: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancerohit8324007No ratings yet

- Banking Awareness QuestionsDocument28 pagesBanking Awareness Questionsmunishd_7No ratings yet

- Economics Paper 3 HLDocument11 pagesEconomics Paper 3 HLkashnitiwary23No ratings yet

- 21.) UCPB V Samuel and BelusoDocument2 pages21.) UCPB V Samuel and BelusojoyceNo ratings yet

- Monica Jangid - D23 - Summer Internship Final ReportDocument77 pagesMonica Jangid - D23 - Summer Internship Final ReportcoolujjwaljainNo ratings yet

- CFM Mol 2023Document4 pagesCFM Mol 2023Noha TawfikNo ratings yet

- Uttara Bank Accounting PracticesDocument70 pagesUttara Bank Accounting Practicesশাইখ উদ্দীনNo ratings yet

- CMA DataDocument36 pagesCMA DataPramod GuptaNo ratings yet

- Rousseau v. Wells FargoDocument30 pagesRousseau v. Wells FargoMartin Andelman100% (1)

- FINANCIAL MANAGEMENT MODULE 1 6 Cost of CapitalDocument27 pagesFINANCIAL MANAGEMENT MODULE 1 6 Cost of CapitalMarriel Fate CullanoNo ratings yet

- The Unit-Of-Account Function of Money Is Crucial To The Operation of An Economy For Several ReasonsDocument13 pagesThe Unit-Of-Account Function of Money Is Crucial To The Operation of An Economy For Several Reasonstunvir abdullahNo ratings yet

- Chapter 3 - Investment IncomeDocument26 pagesChapter 3 - Investment IncomeRyan YangNo ratings yet

- Monetary Policy Statement October 2020Document2 pagesMonetary Policy Statement October 2020African Centre for Media ExcellenceNo ratings yet

- Cooperative Bank of OromiaDocument1 pageCooperative Bank of Oromiadursam328No ratings yet

- At 5Document9 pagesAt 5Joshua GibsonNo ratings yet

- ICICI Bank ATM Debit CardDocument720 pagesICICI Bank ATM Debit CardAbhishek SharmaNo ratings yet