Professional Documents

Culture Documents

Tata Motors'domestic Biz Reports Best Net Sales: On A High

Uploaded by

Lalith KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tata Motors'domestic Biz Reports Best Net Sales: On A High

Uploaded by

Lalith KumarCopyright:

Available Formats

Tata Motors’domestic

biz reports best net sales

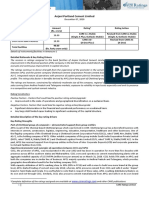

Domestic automotive business accounts for 31% of consolidated net sales in Q3

KRISHNA KANT

Mumbai, 7 February

T

ata Motors’ domestic business has

continued to outgrow its global

business as it reported its highest

quarterly net sales of around ~22,300

crore in the December quarter of

financial year 2021-22 (Q3FY22), a 45 per

cent jump year-on-year (YoY) from

~15,390 crore a year.

In comparison, the company’s con-

solidated net sales declined 3.2 per cent

YoY to around ~72,500 crore, from around

~74,900 crore a year ago.

This was also the first quarter when

the company reported profits at its pas- ON A HIGH

senger vehicle (PV) division since

Q1FY18, when separate numbers were

made available. Before that, the entire The historical trend in Tata Motors domestic automotive business

domestic business was a single reporting

segment for the company.

The domestic PV business reported

profits before interest and taxes (PBIT)

of ~835 crore in Q3FY22, against a loss of

~381 crore a year ago. The commercial

vehicle (CV) segment, however, reported

a loss of ~77 crore in Q3FY22, against PBIT

of ~350 crore a year ago.

The domestic automotive division,

which includes the CV and Tata-branded

PV divisions, accounted for 31 per cent

of consolidated net sales in Q3FY22, just

Source: Capitaline, Compiled by BS Research Bureau

a notch below the decade-high figure of

31.6 per cent in Q2, and up from 20 per

cent in Q3FY21. (See the adjoining chart)

However, on a trailing 12-months

of ~12,316 crore in Q3FY22, up 29.2 per

cent YoY from ~9,530 crore a year ago.

Tata Capital and

basis, the domestic automotive business The current financial year has so far subsidiary to raise

accounted for 26 per cent of the compa-

ny’s consolidated net sales, the highest

been one of the best for Tata Motors’

domestic automotive business, especially ~1,500-crore debt

since Q3FY13. Tata Motors’ consolidated its PV segment, since the acquisition of DEV CHATTERJEE

business includes its British subsidiary JLR in 2007. For nearly a decade after Mumbai, 7 February

Jaguar Land Rover (JLR), the domestic that acquisition, the company’s finances

vehicle financing division, besides the at the consolidated level were dominated Tata Capital and its subsidiary, Tata Capital

domestic CV and PV divisions. by the performance of its British subsid- Financial Services, are planning to raise fresh

In contrast, the JLR division, which iary, while the domestic business only debt of ~1,500 crore through bonds. The

still accounts for two-thirds of Tata played a marginal role. boards of both companies cleared the

Motors’ consolidated net sales, is facing For example, between 2013 and 2020, fundraising by issuing non-convertible

a slowdown due to semiconductor chip the domestic business contributed just debentures (NCDs) in the last week of

shortage. JLR’s net sales dropped 18.3 per 17 per cent to Tata Motors’ consolidated January.

cent YoY in Q3FY22 to ~47,900 crore, from revenue on average and very little to Tata Sons has infused ~3,500 crore in

~58,600 crore a year ago. profits as the company consistently lost Tata Capital in the last five years. Of this,

The growth at the company’s domes- money in its domestic PV business. ~1,000 crore was infused in financial year

tic business is being driven by its PV divi- Most analysts expect Tata Motors’ 2019-20 (FY20) and ~2,500 crore in FY19. Tata

sion, which reported its highest-ever domestic business to continue its good Sons has not invested in TCL’s equity thus far

quarterly revenues of ~8,600 crore in Q3, show, driven by a robust demand for its in the current fiscal. In the fresh fundraise, a

a 72 per cent jump YoY. In comparison, new range of sports utility vehicles and banker said Tata Capital will raise ~1,000

the CV division — that includes buses, first-mover advantage in the electric crore while another ~500 crore will be raised

trucks and light CVs — reported revenues vehicle segment. by Tata Capital Financial Services.

You might also like

- Provincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionFrom EverandProvincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionNo ratings yet

- Consolidated Financial Results For The Year Ended March 31, 2008Document44 pagesConsolidated Financial Results For The Year Ended March 31, 2008Anurag AgarwalNo ratings yet

- News ArticlesDocument20 pagesNews ArticlesPriya GoyalNo ratings yet

- Milestone Gears Private Limited-03-09-2020Document4 pagesMilestone Gears Private Limited-03-09-2020Puneet367No ratings yet

- Tata Motors Limited: ModeratorDocument23 pagesTata Motors Limited: ModeratorAditi Gulati GroverNo ratings yet

- Cfas Narrative 1Document2 pagesCfas Narrative 1Maryden BurgosNo ratings yet

- Directors Report Year EndDocument18 pagesDirectors Report Year EndGanesh SharmaNo ratings yet

- Nse Bse LetterDocument29 pagesNse Bse Lettergmatmat200No ratings yet

- Tata Motors IntroDocument11 pagesTata Motors Introprathamesh tawareNo ratings yet

- Weekly News: By: Kapil Singh PathaniaDocument14 pagesWeekly News: By: Kapil Singh PathaniaCapil Path A NiaNo ratings yet

- Tata Motors: Q1FY11 Results Review - Press Meet 19 August 2010Document18 pagesTata Motors: Q1FY11 Results Review - Press Meet 19 August 2010karthikeyan un reclusNo ratings yet

- Group 10 - Tata MotorsDocument30 pagesGroup 10 - Tata MotorsSayan MondalNo ratings yet

- Bajaj Auto Q3FY22 Consolidated ProfitDocument3 pagesBajaj Auto Q3FY22 Consolidated ProfitShayan RCNo ratings yet

- Astra 2010-10-28 - 9M10 Results ReleaseDocument4 pagesAstra 2010-10-28 - 9M10 Results ReleaseJim Andy HermawanNo ratings yet

- Press 12may23Document5 pagesPress 12may23Arun SinghNo ratings yet

- Internship at Rosy Blue SecuritiesDocument12 pagesInternship at Rosy Blue SecuritiesKrish JoganiNo ratings yet

- Tata Motors Company 1QFY23 Under Review 28 July 2022Document9 pagesTata Motors Company 1QFY23 Under Review 28 July 2022Rojalin SwainNo ratings yet

- Q1 FY21 Adversely Impacted by COVID 1 9Document4 pagesQ1 FY21 Adversely Impacted by COVID 1 9Esha ChaudharyNo ratings yet

- Airtel q409 ReportDocument5 pagesAirtel q409 ReportharisheNo ratings yet

- Q1 2020 EarningsDocument7 pagesQ1 2020 Earningsshivshankar HondeNo ratings yet

- PT Astra International TBK 2016 Full Year Financial StatementsDocument7 pagesPT Astra International TBK 2016 Full Year Financial StatementsAchmad Rifaie de JongNo ratings yet

- LGB Q4FY12Update 05may2012Document4 pagesLGB Q4FY12Update 05may2012equityanalystinvestorNo ratings yet

- A Report On Turnaround Strategy of Tata MotorsDocument16 pagesA Report On Turnaround Strategy of Tata MotorsMohammed Khurshid Gauri100% (5)

- Press 25jan23Document5 pagesPress 25jan23Tanmay JagtapNo ratings yet

- STDA Group Assignment FinalDocument6 pagesSTDA Group Assignment FinalSamrin KhanNo ratings yet

- Press Release Q3fy19Document6 pagesPress Release Q3fy19movies hubNo ratings yet

- Ril Half Year Ended 2019Document16 pagesRil Half Year Ended 2019Pragya Singh BaghelNo ratings yet

- Tata Motors Consolidated Q2 FY21 Results: EBIT Breakeven and Positive Free Cash Flows Delivered in The QuarterDocument4 pagesTata Motors Consolidated Q2 FY21 Results: EBIT Breakeven and Positive Free Cash Flows Delivered in The QuarterEsha ChaudharyNo ratings yet

- Years: Indus Motor Company LimitedDocument14 pagesYears: Indus Motor Company LimitedAdnan JaitapkerNo ratings yet

- Bajaj Auto FSADocument20 pagesBajaj Auto FSAVandit BhuratNo ratings yet

- Stimulus 12 IssueDocument8 pagesStimulus 12 Issuecapdash2002No ratings yet

- TATA Impact On India's GDP and Economic Growth @ayush - MittalDocument2 pagesTATA Impact On India's GDP and Economic Growth @ayush - MittalAyush MittalNo ratings yet

- Tata Motors Group Q2 FY24 Financial Results Press ReleaseDocument5 pagesTata Motors Group Q2 FY24 Financial Results Press ReleaseSaadNo ratings yet

- Financial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Result)Document15 pagesFinancial Results With Results Press Release & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Press Release NewDocument3 pagesPress Release NewVarun KumarNo ratings yet

- Industry AnalysisDocument7 pagesIndustry Analysisavinash singhNo ratings yet

- CONTENTSDocument22 pagesCONTENTSYash Saxena KhiladiNo ratings yet

- Union Budget 2019: Aditya Channam & Rahul NagpalDocument21 pagesUnion Budget 2019: Aditya Channam & Rahul Nagpalravi tejaNo ratings yet

- Q3 FY21 Financial Statements FinalDocument30 pagesQ3 FY21 Financial Statements FinalMichael ScottNo ratings yet

- 2018 05 28 Group Performance For The Year Ended March 31 2018Document8 pages2018 05 28 Group Performance For The Year Ended March 31 2018Priyanka KumariNo ratings yet

- Goldis AR 2010Document139 pagesGoldis AR 2010AshNo ratings yet

- Financial Results, Limited Review Report, Auditors Report & Results Press Release For June 30, 2015 (Company Update)Document12 pagesFinancial Results, Limited Review Report, Auditors Report & Results Press Release For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- ACTIVITY #1 (Raiza R. Ananca)Document5 pagesACTIVITY #1 (Raiza R. Ananca)Raiza AnancaNo ratings yet

- Bajaj Auto EICDocument4 pagesBajaj Auto EICankitaNo ratings yet

- Tencent IrDocument14 pagesTencent IrAbie KatzNo ratings yet

- Koito Annual Report - 2019.03.31Document56 pagesKoito Annual Report - 2019.03.31Jeffrey AuNo ratings yet

- Tata Motors in TroubleDocument21 pagesTata Motors in TroubleNikhil M PatilNo ratings yet

- Mahindra & Mahindra Limited: Financial HighlightsDocument2 pagesMahindra & Mahindra Limited: Financial HighlightsRanjan BeheraNo ratings yet

- Financial Management Report 2Document44 pagesFinancial Management Report 2Shamsuddin SoomroNo ratings yet

- Vegi Sree Vijetha (1226113156)Document6 pagesVegi Sree Vijetha (1226113156)Pradeep ChintadaNo ratings yet

- Mastek Q3fy2010 Results ReleaseDocument4 pagesMastek Q3fy2010 Results ReleasegautamdalalNo ratings yet

- TATA MotorsDocument14 pagesTATA MotorsParesh ShrivastavaNo ratings yet

- LSCM AssignmentDocument24 pagesLSCM AssignmentChetan GandhiNo ratings yet

- Third Quarter Report MAR 31 2012Document20 pagesThird Quarter Report MAR 31 2012Asad Imran MunawwarNo ratings yet

- Bajaj Auto LTD - An AnalysisDocument25 pagesBajaj Auto LTD - An AnalysisDevi YesodharanNo ratings yet

- Press Release Anjani Portland Cement LimitedDocument5 pagesPress Release Anjani Portland Cement LimitedSandy SanNo ratings yet

- Tata Motors Group Q4fy23 Investor PresentationDocument58 pagesTata Motors Group Q4fy23 Investor PresentationSohail AlamNo ratings yet

- General Automotive Repair Revenues World Summary: Market Values & Financials by CountryFrom EverandGeneral Automotive Repair Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Starter Motors & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandStarter Motors & Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- 7.neural NetworksDocument19 pages7.neural NetworksLalith KumarNo ratings yet

- PMCI Analysis - 211279Document32 pagesPMCI Analysis - 211279Lalith KumarNo ratings yet

- Concatenate PracticeDocument4 pagesConcatenate PracticeLalith KumarNo ratings yet

- Industrial PolicyDocument16 pagesIndustrial PolicyLalith KumarNo ratings yet

- Ishita Ayan Dutt: Kolkata, 3 FebruaryDocument1 pageIshita Ayan Dutt: Kolkata, 3 FebruaryLalith KumarNo ratings yet

- Now, Portal To Help Houses Install Rooftop Solar Units: Shreya JaiDocument1 pageNow, Portal To Help Houses Install Rooftop Solar Units: Shreya JaiLalith KumarNo ratings yet

- The Target: Pre-Covid Levels: But Dials Back Expectations in Revenue in BEDocument1 pageThe Target: Pre-Covid Levels: But Dials Back Expectations in Revenue in BELalith KumarNo ratings yet

- 1) The Event Conducted by Me in My Graduation Level - 2) (A) Problems IdentifiedDocument3 pages1) The Event Conducted by Me in My Graduation Level - 2) (A) Problems IdentifiedLalith KumarNo ratings yet

- Board of Directors:: Product: Sunfeast Dark Fantasy Choco Fills Company: Itc LimitedDocument3 pagesBoard of Directors:: Product: Sunfeast Dark Fantasy Choco Fills Company: Itc LimitedLalith KumarNo ratings yet

- Ob Gen y Sec CDocument20 pagesOb Gen y Sec CLalith KumarNo ratings yet

- Information Technology CVS (211279,)Document14 pagesInformation Technology CVS (211279,)Lalith KumarNo ratings yet

- Personal BrandingDocument1 pagePersonal BrandingLalith KumarNo ratings yet

- Marketing Management Assignment (EMAMI NAVRATNA OIL)Document3 pagesMarketing Management Assignment (EMAMI NAVRATNA OIL)Lalith KumarNo ratings yet

- Land Reforms in PakistanDocument3 pagesLand Reforms in PakistanSikandar Hayat100% (1)

- Doctype HTML Qq8821Document202 pagesDoctype HTML Qq8821H.kelvin 4421No ratings yet

- 21 ST Century Lit Module 3Document6 pages21 ST Century Lit Module 3aljohncarl qui�onesNo ratings yet

- Human Resources Practices in WalmartDocument4 pagesHuman Resources Practices in WalmartANGELIKA PUGATNo ratings yet

- Justice Tim VicaryDocument5 pagesJustice Tim Vicaryاسماعيل الرجاميNo ratings yet

- The Mystery of Belicena Villca - Nimrod de Rosario - Part-1Document418 pagesThe Mystery of Belicena Villca - Nimrod de Rosario - Part-1Pablo Adolfo Santa Cruz de la Vega100% (1)

- Hard Rock CafeDocument6 pagesHard Rock CafeNove Jane Zurita100% (2)

- (Ang FORM Na Ito Ay LIBRE at Maaaring Kopyahin) : Republic of The Philippines 11 Judicial RegionDocument10 pages(Ang FORM Na Ito Ay LIBRE at Maaaring Kopyahin) : Republic of The Philippines 11 Judicial RegionKristoffer AsetreNo ratings yet

- Unit 06 ContractingDocument44 pagesUnit 06 Contractingparneet chowdharyNo ratings yet

- Economics 9708 A Level P3 NotesDocument12 pagesEconomics 9708 A Level P3 NotesFatima Rehan86% (7)

- GD190018051 Purvi Anil Ladge Anil/Vinanti Female 21/04/1997: Admit Card - 2019Document1 pageGD190018051 Purvi Anil Ladge Anil/Vinanti Female 21/04/1997: Admit Card - 2019Purvi LadgeNo ratings yet

- OzymandiasDocument13 pagesOzymandiasQuantaviousNo ratings yet

- DOC1387081 r7 AW47 SMDocument328 pagesDOC1387081 r7 AW47 SMRubén Cadima Barrientos100% (2)

- Q: BANK-0001: AnswersDocument48 pagesQ: BANK-0001: AnswersHazem El SayedNo ratings yet

- MR CliffordDocument9 pagesMR CliffordSalva MariaNo ratings yet

- Wassel Mohammad WahdatDocument110 pagesWassel Mohammad WahdatKarl Rigo Andrino100% (1)

- SimulcryptPrimer PDFDocument5 pagesSimulcryptPrimer PDFTechy GuyNo ratings yet

- 5 Species Interactions, Ecological Succession, Population ControlDocument8 pages5 Species Interactions, Ecological Succession, Population ControlAnn ShawNo ratings yet

- Dutch Lady NK Present Isnin 1 C PDFDocument43 pagesDutch Lady NK Present Isnin 1 C PDFAbdulaziz Farhan50% (2)

- Management Report On Unilever and ProcterDocument61 pagesManagement Report On Unilever and ProcterMuneeza Akhtar Muneeza Akhtar100% (2)

- Chapter 5 - Ia3Document3 pagesChapter 5 - Ia3Xynith Nicole RamosNo ratings yet

- Daniela Aya Course Title/Number: Education 42 - The Teaching Profession With FSDocument2 pagesDaniela Aya Course Title/Number: Education 42 - The Teaching Profession With FSJhunalyn AlvaradoNo ratings yet

- Ambush MarketingDocument18 pagesAmbush Marketinganish1012No ratings yet

- Christian 71 Example Road Center of The City Dublin IrelandDocument7 pagesChristian 71 Example Road Center of The City Dublin Irelandapi-25886097No ratings yet

- Annexure-I - ISO 9001 2015 CHECKLIST For OfficesDocument1 pageAnnexure-I - ISO 9001 2015 CHECKLIST For OfficesMahaveer SinghNo ratings yet

- How To Pray For The LostDocument2 pagesHow To Pray For The LostDanny HockingNo ratings yet

- Fundamentals of Accounting - Adjusting EntriesDocument4 pagesFundamentals of Accounting - Adjusting EntriesAuroraNo ratings yet

- Sop QC 04Document3 pagesSop QC 04MNuamanNo ratings yet

- HandoutDocument2 pagesHandoutDino ZepcanNo ratings yet

- EF3e Int Filetest 010a Answer SheetDocument1 pageEF3e Int Filetest 010a Answer SheetRomanNo ratings yet