Professional Documents

Culture Documents

Diagnostic Exams - Taxation

Diagnostic Exams - Taxation

Uploaded by

Kristine Lirose Bordeos0 ratings0% found this document useful (0 votes)

25 views6 pagesOriginal Title

Diagnostic Exams_Taxation

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views6 pagesDiagnostic Exams - Taxation

Diagnostic Exams - Taxation

Uploaded by

Kristine Lirose BordeosCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

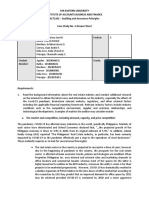

47. Xtaupayer made waisbe the folowing Financia information

Gross sales - Php 10,000,000

‘ost of sates Pr 6,000,000

eens:

Salaries and wages ~ Po 3,000,000

“anspotation ond tae! —Php 20,000,

Rental -Php 240,000

Representation expense ~ Php 200,000

Depreciation expense Php 200,000

Office supplies ~ Php 20,000,

Miscellaneous expenses — Pho 10,000,

How much isthe taxable income ifthe taxpayers a domestic corporation and opted for O80?

Note: Indicate onl the amount (no peso sign, no decimal round aff to the nearest peso, no comma).

For example, your answer ten thousand, neat 10000, If your answers tro oe transactions

exempt, indicate 0.

48, A taxpayer made avaiable the fllowing financial information

Gross sales Php 10,000,000

Cost of sales ~ Php 6,000,000,

Expenses:

Salaries and wages ~ Php 1,000,000

“Transportation and travel ~ Php 20,000,

Rental - Php 240,000

Representation expense ~ Php 200,000

Depreciation expense Php 200,000

Office suples~ Php 20,000,

‘Miscellaneous expenses — Php 10,000,

ther information

Assets

Labiity 3m

sHe-2M

How much isthe income tax due ifthe taxpayer isan ordinary partnership and opted fr 050?

Note: Indicate only the amount (no peso sig, no decimal, round off tothe nearest peso, no comvmah

For example, your answer is ten thousand, indicate 10000 If your answers tera oe transactions

remot, Inaeate 0.

49, The following information appearedin the 2020 BIR Form 2316 (Certifies of Compensation

Payment/Tax Withheld) of Ncanor, purely compensation income eamer:

‘Gross compensation income Php 400,000

13” month pay and other benefits 40,000.00,

sss 10,000.00

Phithealth contributions 10,000.00

Pagibig contributions 110,000.00

Union dues 110,000.00,

Commission 50,000.00

‘Amount of taxes withheld (by the employer) 30,000.00

Question: The total non-taxable portion to be deducted from gross compensation income of Nicanor is

‘Note: Indicate only the amount (no peso sign, no decimal, round off to the nearest peso, no comma).

For example, if your answer is ten thousand, indicate 10000. If your answer is zero or transaction is.

exempt, indicate 0.

50, The following information appeared in the 2020 BIR Form 2316 (Certificate of Compensation

Payment/Tax Withheld) of Nicanor, 2 purely compensation income earner:

Gross compensation income Php 400,000.00

13% month pay and other benefits 40,000.00,

sss 10,000.00

Philhealth contributions 10,000.00

Pagibig contributions 110,000.00

Union dues 110,000.00

Commission 50,000.00

‘Amount of taxes withheld (by the employer) 30,000.00

Question: The net taxable compensation income to be used in computing the taxis:

Note: Indicate only the amount (no peso sign, no decimal, round off to the nearest peso, no comma).

For example, if your answer is ten thousand, indicate 10000. If your answer is zero or transaction Is.

exempt, indicate 0.

51, Nicanor sold a residential house and lot located in Cebu in the amount of Php 10 Milion, Zonal

value of lands at Php 5 Million while Assessor's Fair Market Value is Php 4 Million for the lot and.

Php 4 Million for the house. Independent appraiser valued the property at Php 20Million

How much is the Capital Gains Tax?

"Note: indicate only the amount (no peso sign, no decimal, round off to the nearest peso, no comma).

For example, if your answer is ten thousand, indicate 10000. If your answer is zero or transaction is.

exempt, indicate 0.

52. Nicanor, an employee of ABC Corp., suffered an accident at work and died. The following are

Information were made available by the employer:

Basic salary Php 600,000.00

13" month pay and other benefits 100,000.00

Commission 100,000.00

Separation Pay $500,000.00

Gross compensation income Php —1,300,000.00

‘Question: How much is the total exclusions from gross income?

Note: Indicate only the amount (no peso sign, no decimal, round off to the nearest peso, no comma).

For example, if your answer is ten thousand, indicate 10000. If your answer is zero or transaction is

‘exempt, indicate 0

53, ABC Corp. disclosed the following information in their payroll accounts:

‘+ Salaries and wages paid to minimum wage earners ~ Php 1,000,000

‘+ Salaries and wages paid to persons holding managerial position ~ Php 1,000,000

‘+ Salaries and wages paid to persons holding rank and file position ~ Php 1,000,000

‘+ Salaries and wages paid to family members (ghost employees) ~ Php 1,000,000

‘+ Salaries and wages paid to qualified senior citizens ~ Php 1,000,000

‘+ Salaries and wages paid to qualified persons with disability ~ Php 1,000,000

How much is the maximum salaries and wages allowable and deductible against gross income?

'58.A taxpayer which was registered in 2010 made available the following financial information for

y2021

Balance Sheet

Asset Php SOM

LUabilty Php 30M

Stockholders Equity Php 20M

Income Statement

Gross sales Php 10,000,000

Cost of sles ~ Php 6,000,000

operating Expenses - Php 2,000,000

How much s the income tax payable if the taxpayer isa domestic corporation?

Note: Indicate only the amount (no peso sign, no decimal, round of tothe nearest peso, no comma).

For example, If your answer isten thousand, indicate 10000. f your answer is zero or transaction is

exempt, indicate 0,

59. A taxpayer which was registered in 2010 made availabe the following financial information for

12021

Balance Sheet:

Asset -Php SOM

Liability - Php 30M

Stockholders’ Equity - Php 20M

Income Statement

‘Gross sales - Php 10,000,000

Cost of sales ~Pho 6,000,000

‘Operating Expenses - Php 5,900,000

How much i the income tax payable if the taxpayers a domestic corporation?

Note: Indicate only the amount (no peso sign, no decimal, round off to the nearest peso, no comma}.

For example, if our answer is ten thousand, indicate 10000. f your answer is zero or trancaction is

660. A taxpayer which was registered in 2010 made availabe the following financial information for

2021:

Balance Sheet:

Asset - Php SOM

ability - Php 30M

Stockholders’ Equity - Php 20M

Income Statement:

Gross sales - Php 100,000,000

Cost of sales ~ Php 60,000,000

Operating Expenses - Php 30,000,000

How much is the income tax payable ifthe taxpayer isa domestic corporation?

Note: Indicate only the amount (no peso sign, no decimal, round off tothe nearest peso, no comma)

For example if your answer is ten thousand, indicate 10000. if your answer is zero or transaction is

exempt, indicate 0

61. Ataxpayer which was registered in 2020 made availabe the following financial information for

Tv2021:

Balance Sheet:

Asset - Php SOM

Liability - Php 30M

Stockholders’ Eouitv - Pho 20M

Income Statement:

Gross sales - Php 10,000,000

Cost of sales — Php 4,000,000

Operating Expenses - Php 5,900,000

How much is the income tax payable if the taxpayer is a domestic corporation?

Note: Indicate only the amount (no peso sign, no decimal, round off to the nearest peso, no comma}.

For example, if your answer is ten thousand, indicate 10000. If your answer is zero or transaction is

exempt, indicate 0

62. A taxpayer which was registered in 2020 made available the following financial information for

Ty2021:

Balance Sheet:

‘Asset - Php SOM

LUability - Php 30M

‘Stockholders’ Equity - Php 20M

Income Statement:

Gross sales - Php 100,000,000

Cost of sales — Php 60,000,000

Operating Expenses - Php $0,000,000

How much is the income tax payable if the taxpayer is a domestic corporation?

Note: Indicate only the amount (no peso sign, no decimal, round off to the nearest peso, no comma}.

For example, if your answer is ten thousand, indicate 10000. If your answer is zero or transaction is

exempt, indicate 0

63. A taxpayer which was registered in 2010 made available the following financial information for

Ty2021:

Balance Sheet:

Asset - Php SOM

Liability -Php 30M

Stockholders’ Equity -Php 20M

Income Statement

Gross sales - Php 100,000,000

Cost of sales Php 60,000,000

Operating Expenses - Php $0,000,000

How much i the income tax payable if the taxpayer isa domestic corporation?

Note: Indicate only the amount (no peso sign, no decimal, round off to the nearest peso, no comma}.

For example, if your answer is ten thousand, indicate 10000. If your answer i zero or transaction is

exempt, indicate 0

64. Nicanor, a businessman engaged in selling goods and services, reported gross sales of Php 1

Million and gross receipts of Php 2 Million. The company spent Php 150,000 for representation

expenses. How much Is the non-deductible representation expense?

Note: Indicate only the amount (no peso sign, no decimal, ound off to the nearest peso, no comma).

For example, if your answer s ten thousand, indicate 10000. If your answer is zero or transaction is

exempt, indicate 0.

65. ABC Corp, a family corporation, with an asset of valuing Php 1,000,000 was able to earn a net

income of Php 4,000,000. With expansion insight, it borrowed money from the XYZ Bank in the

amount of Php 1 Million with an interest rate of 10%. Interest income from ABC Corp.'s bank

deposits in DEF Bank earned Php 20,000.00

How much is the allowable or deductible expense?

Note: Indicate only the amount (no peso sign, no decimal, round off to the nearest peso, no comma}.

For example, if our answer is ten thousand, indicate 10000. If your answer is zero or transaction is

exempt, indicate .

66. In 2021, ABC Corp, established in 2015 reported the following information:

Balance Sheet

‘Asset -Php SOM

Liability - Php 30M

Stockholders’ Equity - Php 20M

Income statement:

Gross sales - Php $0,000,000

Cost of sales ~ Php 40,000,000

Operating Expenses - Php 20,000,000

How much i the income tax payable of ABC Corp.?

Note: indicate only the amount (no peso sign, no decimal, rund off to the nearest peso, no comma).

For example, if your answer is ten thousand, indicate 10000. If your answer is zero or transaction is.

exempt, indicate 0.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5811)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Working Capital Exercise PDFDocument5 pagesWorking Capital Exercise PDFKristine Lirose Bordeos100% (1)

- Case Study 2 - Planning An Audit of FSDocument7 pagesCase Study 2 - Planning An Audit of FSKristine Lirose Bordeos100% (3)

- Contingent Liab Bonds PayableDocument11 pagesContingent Liab Bonds PayableKristine Lirose Bordeos100% (1)

- Submitted By: Mr. Alfie G. Rellon (FB and Messenger) (AMA OED Student) (Agrsaudi: Username in The Site)Document7 pagesSubmitted By: Mr. Alfie G. Rellon (FB and Messenger) (AMA OED Student) (Agrsaudi: Username in The Site)Kristine Lirose BordeosNo ratings yet

- Raid Quiz Saidosd RecitDocument4 pagesRaid Quiz Saidosd RecitKristine Lirose BordeosNo ratings yet

- Income Tax For Corporation PDFDocument7 pagesIncome Tax For Corporation PDFKristine Lirose BordeosNo ratings yet

- Iat22 M2Document8 pagesIat22 M2Kristine Lirose BordeosNo ratings yet

- Tax - Income Tax Individuals (Easy)Document28 pagesTax - Income Tax Individuals (Easy)Kristine Lirose BordeosNo ratings yet

- Wally Bayola Bold PDFDocument104 pagesWally Bayola Bold PDFKristine Lirose BordeosNo ratings yet

- Top 5 TED TalksDocument11 pagesTop 5 TED TalksKristine Lirose BordeosNo ratings yet

- Resa AP q2 PDF FreeDocument14 pagesResa AP q2 PDF FreeKristine Lirose Bordeos100% (1)

- ACT1204 Auditing and Assurance Principles-Concepts and Applications Part 1Document1 pageACT1204 Auditing and Assurance Principles-Concepts and Applications Part 1Kristine Lirose BordeosNo ratings yet

- Lesson 5Document2 pagesLesson 5Kristine Lirose BordeosNo ratings yet

- VAT (Quiz)Document12 pagesVAT (Quiz)Kristine Lirose BordeosNo ratings yet

- Audit Case - Audit of Noncurrent LiabilitiesDocument6 pagesAudit Case - Audit of Noncurrent LiabilitiesKristine Lirose BordeosNo ratings yet

- English-Speech (Angel)Document1 pageEnglish-Speech (Angel)Kristine Lirose BordeosNo ratings yet

- Module 2 The Critical Basis of Studying RizalDocument33 pagesModule 2 The Critical Basis of Studying RizalKristine Lirose BordeosNo ratings yet

- Xtra CreditDocument4 pagesXtra CreditKristine Lirose BordeosNo ratings yet

- Cognitive Development Activity PDFDocument1 pageCognitive Development Activity PDFKristine Lirose BordeosNo ratings yet

- Marketing Aspect: Learning OutcomesDocument23 pagesMarketing Aspect: Learning OutcomesKristine Lirose BordeosNo ratings yet

- Presentation, Analysis, and Interpretation of DataDocument33 pagesPresentation, Analysis, and Interpretation of DataKristine Lirose BordeosNo ratings yet

- This Study Resource Was: Lecture NotesDocument9 pagesThis Study Resource Was: Lecture NotesKristine Lirose BordeosNo ratings yet

- Instruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASDocument2 pagesInstruction: Prepare The Answers in Written Form Using A Clean Paper (E.g. Yellow Pad, Bond Paper, Notebook Etc.) and Submit A Snapshot in CANVASKristine Lirose BordeosNo ratings yet

- Bed Dining Table Center TableDocument1 pageBed Dining Table Center TableKristine Lirose BordeosNo ratings yet

- Bed Dining Table Center TableDocument1 pageBed Dining Table Center TableKristine Lirose BordeosNo ratings yet

- Bed Dining Table Center TableDocument1 pageBed Dining Table Center TableKristine Lirose BordeosNo ratings yet