Professional Documents

Culture Documents

Old Mutual Top 40 Index Fund: Fund Information Fund Performance As at 31/12/2021

Uploaded by

Ardine FickOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Old Mutual Top 40 Index Fund: Fund Information Fund Performance As at 31/12/2021

Uploaded by

Ardine FickCopyright:

Available Formats

MSCI AAA

OLD MUTUAL TOP 40 INDEX FUND E SG RATI NGS

CCC B BB BBB A AA AAA

DECEMBER 2021

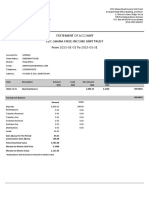

FUND INFORMATION FUND PERFORMANCE AS AT 31/12/2021

RISK PROFILE % PERFORMANCE (ANNUALISED)

Low to Moderate to Since

Low Moderate High 1-Yr 3-Yr 5-Yr 7-Yr 10-Yr Inception1

Moderate High

Fund (Class A) 27.5% 15.8% 11.5% 8.7% 11.4% 12.4%

RECOMMENDED MINIMUM INVESTMENT TERM Fund (Class B1) 2

27.9% 16.1% 11.8% 9.0% 11.7% 12.7%

1 year+ 3 years+ 5 years+ Fund (Gross)3 28.5% 16.6% 12.3% 9.4% 12.2% 13.3%

Benchmark 28.4% 16.7% 12.4% 9.6% 12.3% 13.6%

1

Performance since inception of the fund.

ESG FUND RATING 2

Class B1 fund is available through investment platforms such as Old Mutual Wealth.

3

Gross returns are shown to illustrate the fund’s index tracking ability before fees.

The environmental, social and governance (ESG) fund ratings are based Performance measurements over periods shorter than the recommended investment

on the exposure of the underlying assets held to industry-specific ESG term may not be appropriate. Past performance is no indication of future performance.

Fund returns are net of fees and measured against the benchmark.

risks and the ability to manage those risks relative to peers.

FUND OBJECTIVE

Rolling 12-Month Return Highest Average Lowest

The fund aims to provide long-term capital growth by tracking the

Fund (Since Inception) 66.7% 14.0% -39.2%

performance of the top 40 companies listed on the JSE Securities

Exchange (JSE).

Performance Since Inception

WHO IS THIS FUND FOR? 1 600

Fund

Indexed to 100 on 31 Jan 2001

This fund is suitable for investors who want to grow capital over the 1 400 Benchmark

SA Inflation

long term by tracking the FTSE/JSE Top 40 Index. The investor can 1 200

tolerate stock market volatility. 1 000

800

INVESTMENT MANDATE

600

The fund tracks the FTSE/JSE Top 40 Index as closely as possible and

400

invests in shares included in the index. The portfolio is tailored to match

200

the performance of the FTSE/JSE Top 40 Index, but other securities will

0

be held to offset high inflows and index fluctuations. Derivatives may Jan 01 Mar 05 May 09 Jul 13 Sep 17 Nov 21

be used for efficient portfolio management purposes. Past performance is no indication of future performance.

REGULATION 28 COMPLIANCE

Risk Statistics (Since Inception)

The fund aims to achieve long-term inflation-beating growth, and

Maximum Drawdown -43.5%

therefore may hold a higher allocation to equities than what is allowed

in terms of Regulation 28 of the Pension Funds Act. This fund is therefore Months to Recover 23

not Regulation 28 compliant. % Positive Months 58.6%

Annual Standard Deviation 16.9%

BENCHMARK: FTSE/JSE Top 40 Index Risk statistics are calculated based on monthly performance data from inception of the fund.

ASISA CATEGORY: South African – Equity – Large Cap 5-Year Annualised Rolling Returns (Fund vs Benchmark)

FUND Frank Sibiya & Bernisha Lala 25%

Fund

MANAGER(S): (Old Mutual Customised Solutions (Pty) Ltd)

20% Benchmark

Indexed to 100 on 31 Dec 2001

LAUNCH DATE: 31/01/2001

15%

SIZE OF FUND: R1.1bn

10%

DISTRIBUTIONS: (Quarterly)*

5%

Date Dividend Interest Total Total %

0%

31/12/2021 1.52c 0.24c 1.76c 0.14%

30/09/2021 26.95c 0.11c 27.06c 2.42% -5%

Dec 11 Dec 13 Dec 15 Dec 17 Dec 19 Dec 21

30/06/2021 2.18c 0.25c 2.43c 0.21%

31/03/2021 10.85c 0.07c 10.92c 0.94% PRINCIPAL HOLDINGS

* Class A fund distributions HOLDING % OF FUND

Compagnie Financière Richemont 15.9%

FUND COMPOSITION

BHP Group Plc 13.0%

ASSET & PERCENTAGE ALLOCATION

Anglo American Plc 10.3%

Industrials 44.5%

Naspers Ltd 6.8%

Resources 36.9% Prosus NV 4.4%

MTN Group Ltd 4.0%

Financials 16.0%

FirstRand Ltd 3.9%

1.5% Mondi Plc 2.5%

Liquid Assets

Impala Platinum Holdings Ltd 2.4%

SA Property 1.3%

Standard Bank Group Ltd 2.3%

THIS IS THE MINIMUM DISCLOSURE DOCUMENT AS REQUIRED BY BOARD NOTICE 92

Funds are also available via Old Mutual Wealth and MAX Investments.

Helpline 0860 234 234 Fax +27 21 509 7100 Internet www.oldmutualinvest.com Email unittrusts@oldmutual.com

OLD MUTUAL TOP 40 INDEX FUND

DECEMBER 2021

FUND MANAGER INFORMATION FUND COMMENTARY

The Old Mutual Top 40 Fund tracks the FTSE/ The FTSE/JSE Top 40 Index returned 16.25% for

FRANK SIBIYA |

JSE Top 40 Index and its shareholdings replicate the quarter and 28.40% for the one-year period

PORTFOLIO MANAGER

the constituents that make up this benchmark. ended December 2021. The Mid- and Small Cap

• BSc Mathematical

At month-end the benchmark sector allocation Indices returned 3.83% and 8.75% respectively

Sciences

was as follows: for the quarter and 4.29%% and 7.33% for the

• 12 years of industry

• Resources 39.90% month of December 2021 respectively. The best

experience

• Financials 16.00% and worst performing sectors for the quarter

BERNISHA LALA |

PORTFOLIO MANAGER • Real Estate 0.68% ended December 2021 were consumer services

• CFA • Industrials 43.43% and healthcare with returns of 40.69% and -7.53%

• MSc Advanced Analytics & respectively.

Cash exposure is kept as low as possible to give

Decision Sciences Among the top performing shares for the quarter

investors the full benefit of being invested in

• BSc Financial Engineering were Compagnie Financière Richemont, Gold Fields

(Hons) equities. Investment flows are matched with the

Ltd and Amplats, with returns of 55.2%, 41.3% and

• BSc Financial corresponding market transactions on a daily

39.3% respectively. The worst performing shares

Mathematics basis to ensure that the performance of the fund

were Old Mutual Ltd, Aspen Pharmaceuticals

• 16 years of industry is in line with its benchmark. Futures contracts

and Spar Ltd with returns of -20.9%, -17.2% and

experience are used, when appropriate, to minimise trading

-14.9% respectively.

costs and gain exposure to equities.

The fund rebalances once every quarter in line with

Long-term investors choose this fund because

the index. There were no constituent additions

they are looking for a pure equity fund and are

cost-conscious. Investors seeking consistency to and deletions from the FTSE/JSE Top 40

can use this fund as their core portfolio strategy Index, which rebalanced as at close on Friday

and assign smaller portions to other investment 17 December 2021.

vehicles that aim to outperform the market. Source: Old Mutual Investment Group as at 31/12/2021

OTHER INVESTMENT CONSIDERATIONS ONGOING

INVESTMENT CONTRACT MINIMUMS*: Class A Class B1*

• Monthly: R500 Annual service fees (excl. VAT) 0.60% 0.35%

• Lump sum: R10 000 * Please note: The Class B1 fund is only available through investment platforms such as Old Mutual

• Ad hoc: R500 Wealth.

The fee is accrued daily and paid to the management company on a monthly basis. Other charges

* These investment minimums are not limited to this fund. They can be apportioned

incurred by the fund, and deducted from its portfolio, are included in the TER. A portion of

across the funds you have selected in your investment contract. Old Mutual Unit Trusts’ annual service fees may be paid to administration platforms.

INITIAL CHARGES (Incl. VAT): TAX REFERENCE NUMBER: 9511/398/14/2

Initial adviser fee will be between 0% and 3.45%.

ISIN CODES: Class A ZAE000028122

Class B1 ZAE000028130

36 Months 12 Months

Total Expenses (Incl. Annual Service Fee) (30/09/2021) Class A Class B1* Class A Class B1*

Total Expense Ratio (TER) Incl. VAT 0.72% 0.43% 0.71% 0.43%

Transaction Cost (TC) 0.09% 0.09% 0.06% 0.06%

Total Investment Charge 0.81% 0.52% 0.77% 0.49%

* Please note: The Class B1 fund is available through investment platforms such as Old Mutual Wealth.

TER is a historic measure of the impact the deduction of management and operating costs has on a fund’s value. A higher TER does not necessarily imply a poor return, nor does a low

TER imply a good return. The current TER, which includes the annual service fee, may not necessarily be an accurate indication of future TERs. Transaction Cost (TC) is a necessary cost in

administering the fund and impacts fund returns. It should not be considered in isolation as returns may be impacted by many other factors over time including market returns, the type of

fund, the investment decisions of the investment manager and the TER.

Funds are also available via Old Mutual Wealth and MAX Investments.

Helpline 0860 234 234 Fax +27 21 509 7100 Internet www.oldmutualinvest.com Email unittrusts@oldmutual.com

We aim to treat our clients fairly by giving you the information you need in as simple a way as possible, to enable you to make informed decisions about your investments.

• We believe in the value of sound advice and so recommend that you consult a financial planner before buying or selling unit trusts. You may, however, buy and sell without the help of a

financial planner. If you do use a planner, we remind you that they are entitled to certain negotiable planner fees or commissions.

• You should ideally see unit trusts as a medium- to long-term investment. The fluctuations of particular investment strategies affect how a fund performs. Your fund value may go up or down.

Therefore, we cannot guarantee the investment capital or return of your investment. How a fund has performed in the past does not necessarily indicate how it will perform in the future.

• The fund fees and costs that we charge for managing your investment are disclosed in this Minimum Disclosure Document (MDD) and in the table of fees and charges, both of which are

available on our public website or from our contact centre.

• Additional information of the proposed investment, including brochures, application forms and annual or quarterly reports, can be obtained, free of charge, from Old Mutual Unit Trust

Managers (RF) (Pty) Ltd, from our public website at www.oldmutualinvest.com or our contact centre on 0860 234 234.

• Our cut-off time for client instructions (e.g. buying and selling) is at 15:00 each working day for all our funds, except for our money market funds, where the cut-off is at 12:30.

• The valuation time is set at 15:00 each working day for all our funds, excluding our money market funds which is at 13:00, to determine the daily ruling price (other than at month-end when

we value the Old Mutual Index Funds and Old Mutual Multi-Managers Fund of Funds range at 17:00 close). Daily prices are available on the public website and in the media.

• Unit trusts are traded at ruling prices, may borrow to fund client disinvestments and may engage in scrip lending. The daily ruling price is based on the current market value of the fund’s

assets plus income minus expenses (NAV of the portfolio) divided by the number of units on issue.

• The Net Asset Value to Net Asset Value figures are used for the performance calculations. The performance quoted is for a lump sum investment. The performance calculation includes

income distributions prior to the deduction of taxes and distributions are reinvested on the ex-dividend date. Performances may differ as a result of actual initial fees, the actual investment

date, the date of reinvestment and dividend withholding tax. Annualised returns are the weighted average compound growth rates over the performance period measured. Performances

are in ZAR and as at 31 December 2021. Sources: Morningstar and Old Mutual Investment Group (FSP no. 604).

• MSCI ESG Research LLC’s (“MSCI ESG”) Fund Metrics and Ratings (“the information”) provide environmental, social and governance data with respect to underlying securities within more

than 31 000 multi-asset class mutual funds and ETFs globally. MSCI ESG is a registered investment adviser under the Investment Advisers Act of 1940. MSCI ESG materials have not been

submitted to, nor received approval from the US SEC or any other regulatory body. None of the information constitutes an offer to buy or sell, or a promotion or recommendation of any

security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. None of the

information can be used to determine which securities to buy or sell or when to buy or sell them. The information is provided “as is” and the user of the information assumes the entire risk

of any use it may make or permit to be made of the information.

Old Mutual Customised Solutions (Pty) Ltd is a Licensed Financial Services Provider.

Old Mutual Unit Trust Managers (RF) (Pty) Ltd, registration number 1965 008 47107, is a registered manager in terms of the Collective Investment Schemes Control Act 45 of 2002. Old Mutual

is a member of the Association for Savings and Investment South Africa (ASISA). Old Mutual Unit Trust Managers has the right to close the portfolio to new investors in order to manage it more

efficiently in accordance with its mandate.

Trustee: Standard Bank, PO Box 54, Cape Town 8000. Tel: +27 21 401 2002, Fax: +27 21 401 3887. Issued: January 2022

You might also like

- OMAlbaraka Equity FundDocument2 pagesOMAlbaraka Equity FundArdine FickNo ratings yet

- Old Mutual Core Conservative FundDocument2 pagesOld Mutual Core Conservative FundSam AbdurahimNo ratings yet

- Old Mutual Albaraka Equity Fund: Fund Information Fund Performance As at 31/08/2021Document2 pagesOld Mutual Albaraka Equity Fund: Fund Information Fund Performance As at 31/08/2021Sam AbdurahimNo ratings yet

- Old Mutual Core Balanced FundDocument2 pagesOld Mutual Core Balanced FundSam AbdurahimNo ratings yet

- Old Mutual SAQuoted Property FundDocument2 pagesOld Mutual SAQuoted Property FundMarlvinNo ratings yet

- OMAlbaraka Balanced FundDocument2 pagesOMAlbaraka Balanced FundArdine FickNo ratings yet

- Old Mutual Albaraka Balanced Fund: Fund Information Fund Performance As at 31/08/2021Document2 pagesOld Mutual Albaraka Balanced Fund: Fund Information Fund Performance As at 31/08/2021Sam AbdurahimNo ratings yet

- Old Mutual Balanced FundDocument2 pagesOld Mutual Balanced FundSam AbdurahimNo ratings yet

- Singapore Dynamic Bond Fund: Investment ObjectiveDocument2 pagesSingapore Dynamic Bond Fund: Investment ObjectiveXavier Alexen AseronNo ratings yet

- JPM ASEAN Equity Fund Factsheet - C Acc USD - 1120 - SEASGIIDocument4 pagesJPM ASEAN Equity Fund Factsheet - C Acc USD - 1120 - SEASGIIsidharth guptaNo ratings yet

- 2q19 Eaof LetterDocument13 pages2q19 Eaof LetterDavid BriggsNo ratings yet

- USAA Cornerstone Moderately Aggressive Fund 2022 - 1QDocument2 pagesUSAA Cornerstone Moderately Aggressive Fund 2022 - 1Qag rNo ratings yet

- Prulink-Dynamic-Income-Fund BrochureDocument2 pagesPrulink-Dynamic-Income-Fund BrochureboscoNo ratings yet

- Global Income Fund Global Income Fund: Jpmorgan Investment Funds Jpmorgan Investment FundsDocument3 pagesGlobal Income Fund Global Income Fund: Jpmorgan Investment Funds Jpmorgan Investment FundsAnurak SuwanichkulNo ratings yet

- MP - 3 - Peso Growth FundDocument2 pagesMP - 3 - Peso Growth FundFrank TaquioNo ratings yet

- Jupiter Global Emerging Markets Corporate Bond Factsheet-GB-Retail-LU1551064923-En-GB PDFDocument4 pagesJupiter Global Emerging Markets Corporate Bond Factsheet-GB-Retail-LU1551064923-En-GB PDFeldime06No ratings yet

- USAA Cornerstone Conservative Fund 2022 - 1QDocument2 pagesUSAA Cornerstone Conservative Fund 2022 - 1Qag rNo ratings yet

- Fact SheetDocument1 pageFact SheetSumit GiriNo ratings yet

- Sedania Innovator (Sedania-Ku) : Average ScoreDocument11 pagesSedania Innovator (Sedania-Ku) : Average ScoreEyet OsmiNo ratings yet

- Pfes Ar EngDocument25 pagesPfes Ar EngKuanChau YapNo ratings yet

- USAA Cornerstone Moderate Fund 2022 - 1QDocument2 pagesUSAA Cornerstone Moderate Fund 2022 - 1Qag rNo ratings yet

- 6 - Kiid - Uitf - Eq - Bpi Eq - Jun2015Document3 pages6 - Kiid - Uitf - Eq - Bpi Eq - Jun2015Nonami AbicoNo ratings yet

- Nikko AM Shenton Singapore Dividend Equity Fund SGD - Fund Fact SheetDocument3 pagesNikko AM Shenton Singapore Dividend Equity Fund SGD - Fund Fact SheetSaran SNo ratings yet

- Capturing Factor Premia: September 2015Document10 pagesCapturing Factor Premia: September 2015Utkarsh ChoudharyNo ratings yet

- PIALEFDocument1 pagePIALEFEileen LauNo ratings yet

- Fs SP Uk Investment Grade Corporate Bond IndexDocument4 pagesFs SP Uk Investment Grade Corporate Bond IndexAlokNo ratings yet

- Nedgroup Investments Global Flexible Fund ADocument2 pagesNedgroup Investments Global Flexible Fund Amakhathe mabitleNo ratings yet

- Paytm Masterclass DSP AMCDocument17 pagesPaytm Masterclass DSP AMCDaniel JamesNo ratings yet

- Mrs - Fidelity Global Inflation-Linked Bond Fund Usd - Class 5Document2 pagesMrs - Fidelity Global Inflation-Linked Bond Fund Usd - Class 5emirav2No ratings yet

- Conservative at Least Five (5) Years: Account of The ClientDocument2 pagesConservative at Least Five (5) Years: Account of The ClientkimencinaNo ratings yet

- Barings Global Senior Secured Bond FundDocument4 pagesBarings Global Senior Secured Bond FundFrancis MejiaNo ratings yet

- ALFM Peso Bond FundDocument2 pagesALFM Peso Bond FundkimencinaNo ratings yet

- Mfu Indiaeq Acc enDocument4 pagesMfu Indiaeq Acc enAlly Bin AssadNo ratings yet

- Eq Uitf Bpi Gefof Nov 2017Document4 pagesEq Uitf Bpi Gefof Nov 2017Jelor GallegoNo ratings yet

- Fund Allocation Investment Objective: Pami Equity Index Fund, IncDocument1 pageFund Allocation Investment Objective: Pami Equity Index Fund, IncRamil MontealtoNo ratings yet

- Southchester Fund Fact SheetDocument3 pagesSouthchester Fund Fact Sheetmarko joosteNo ratings yet

- Risk and Return: L RamprasathDocument6 pagesRisk and Return: L RamprasathMayank RanjanNo ratings yet

- UTI Large Cap Fund (Formerly UTI Mastershare Unit Scheme)Document28 pagesUTI Large Cap Fund (Formerly UTI Mastershare Unit Scheme)rinkuparekh13No ratings yet

- USAA Cornerstone Moderately Conservative Fund 2022 - 1QDocument2 pagesUSAA Cornerstone Moderately Conservative Fund 2022 - 1Qag rNo ratings yet

- Royce Special EquityDocument1 pageRoyce Special EquityscottNo ratings yet

- Zecon (Zecon-Ku) : Average ScoreDocument11 pagesZecon (Zecon-Ku) : Average ScoreEyet OsmiNo ratings yet

- Average Score: Kenanga Investment Bank (Kenanga-Ku)Document11 pagesAverage Score: Kenanga Investment Bank (Kenanga-Ku)Zhi_Ming_Cheah_8136No ratings yet

- factsheetMYHWSOF PDFDocument1 pagefactsheetMYHWSOF PDFPG ChongNo ratings yet

- Fund Fact Sheet - March 2019Document20 pagesFund Fact Sheet - March 2019Afthon Ilman Huda Isyfi100% (1)

- Franklin Resources, Inc.: Stock Report - March 12, 2022 - NYSE Symbol: BEN - BEN Is in The S&P 500Document9 pagesFranklin Resources, Inc.: Stock Report - March 12, 2022 - NYSE Symbol: BEN - BEN Is in The S&P 500apdusp2No ratings yet

- Odyssey RecordDocument1 pageOdyssey RecordAuromae IseloNo ratings yet

- NBP Funds: NBP Savings Fund (NBP-SF)Document1 pageNBP Funds: NBP Savings Fund (NBP-SF)Mian Abdullah YaseenNo ratings yet

- Building Global Portfolios PDFDocument57 pagesBuilding Global Portfolios PDFSean CurleyNo ratings yet

- FT India Life Stage 20s (G) : Snapshot of The SchemeDocument11 pagesFT India Life Stage 20s (G) : Snapshot of The SchemeSaloni MalhotraNo ratings yet

- Birla Sun Life MNC FundDocument1 pageBirla Sun Life MNC Fundellyacool2319No ratings yet

- IDR Equity Syariah Fund - AIA Fund Fact Sheet Jan 2020Document1 pageIDR Equity Syariah Fund - AIA Fund Fact Sheet Jan 2020Siti NurhayatiNo ratings yet

- NAFA Stock Fund May 2016Document1 pageNAFA Stock Fund May 2016jeb38293No ratings yet

- Data 2Document14 pagesData 2abhimanyu.chawla5503No ratings yet

- Fund Fact Sheet Jan 2021Document21 pagesFund Fact Sheet Jan 2021Yunus MohamadNo ratings yet

- Sharekhan's Top SIP Fund PicksDocument4 pagesSharekhan's Top SIP Fund PicksMarshal NagpalNo ratings yet

- Pru Life UK Fund Fact Sheet June 2018Document22 pagesPru Life UK Fund Fact Sheet June 20182by2 BlueNo ratings yet

- Risk Measures: Risk Analysis Distribution of ReturnsDocument7 pagesRisk Measures: Risk Analysis Distribution of ReturnsJBPS Capital ManagementNo ratings yet

- IE00B18GC888Document4 pagesIE00B18GC888a28hzNo ratings yet

- USAA Growth Fund - USAAX - 4Q 2022Document2 pagesUSAA Growth Fund - USAAX - 4Q 2022ag rNo ratings yet

- OMAlbaraka Balanced FundDocument2 pagesOMAlbaraka Balanced FundArdine FickNo ratings yet

- Syllabus: Cambridge O Level English Language 1123Document18 pagesSyllabus: Cambridge O Level English Language 1123Leow Zi LiangNo ratings yet

- Brochure - SA Rand ETF Managed Portfolios - Jul21Document7 pagesBrochure - SA Rand ETF Managed Portfolios - Jul21Ardine FickNo ratings yet

- CEFR Level Compared To IGCSEDocument1 pageCEFR Level Compared To IGCSEArdine FickNo ratings yet

- Scheme of Work: Cambridge O Level English Language 1123Document51 pagesScheme of Work: Cambridge O Level English Language 1123Hina imran100% (1)

- Non Bank Financial IntermediariesDocument53 pagesNon Bank Financial IntermediariesPuviin Varman100% (1)

- Variable Life Licensing Mock Exam (Set D) : Instructions: Please Encircle The Correct AnswerDocument14 pagesVariable Life Licensing Mock Exam (Set D) : Instructions: Please Encircle The Correct AnswerKenneth QuiranteNo ratings yet

- Fmutm Mock 05Document8 pagesFmutm Mock 05api-2686327667% (3)

- A4 Growealth Survey Oct 2020 PDFDocument1 pageA4 Growealth Survey Oct 2020 PDFAlois KudzaiNo ratings yet

- Chapter 03 Testbank: of Mcgraw-Hill EducationDocument59 pagesChapter 03 Testbank: of Mcgraw-Hill EducationshivnilNo ratings yet

- December 2013Document4 pagesDecember 2013Heather PageNo ratings yet

- Unit Trust Examination Mock QuestionsDocument67 pagesUnit Trust Examination Mock QuestionsDavie Cockett100% (2)

- Variable Mock Exam UpdatedDocument14 pagesVariable Mock Exam UpdatedOliver papaNo ratings yet

- New Sales Office - PenangDocument2 pagesNew Sales Office - PenangPhua Kien HanNo ratings yet

- Set 2 ENGLISH Questions Answers 010808Document12 pagesSet 2 ENGLISH Questions Answers 010808Azri LunduNo ratings yet

- Unit Trusts - African Alliance Kenya BrochureDocument16 pagesUnit Trusts - African Alliance Kenya BrochureManueli Kebbles MckubwaNo ratings yet

- IC Exam ReviewerDocument14 pagesIC Exam Reviewerfrancis75% (8)

- Variable ReviewerDocument14 pagesVariable ReviewerMaria Teresa ArceNo ratings yet

- Variable IC Mock Exam - 02062020 PDFDocument30 pagesVariable IC Mock Exam - 02062020 PDFMikaella Sarmiento100% (1)

- Chapter 03 - Test Bank: Multiple Choice QuestionsDocument24 pagesChapter 03 - Test Bank: Multiple Choice QuestionsKhang LeNo ratings yet

- CIMB Principal Asean Equity FundDocument73 pagesCIMB Principal Asean Equity Fundapi-26863276100% (2)

- Blackbook Project Indian Capital MarketDocument68 pagesBlackbook Project Indian Capital MarketRithik ThakurNo ratings yet

- Public Mutual PDFDocument256 pagesPublic Mutual PDFDavid BockNo ratings yet

- 3R Form 3 Chapter 3Document3 pages3R Form 3 Chapter 3Xue HuiNo ratings yet

- TA Global Technology Fund - July 2020Document3 pagesTA Global Technology Fund - July 2020mulder95No ratings yet

- T D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19Document2 pagesT D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19MinatiBindhaniNo ratings yet

- OMWealth OldMutualWealthLinkedRetirementIncomeDocument2 pagesOMWealth OldMutualWealthLinkedRetirementIncomeJohn SmithNo ratings yet

- STANLIB Ghana ProfileDocument16 pagesSTANLIB Ghana ProfileenatagoeNo ratings yet

- Express Trusts NotesDocument67 pagesExpress Trusts NotesJoshua Lin89% (9)

- Insurance Commision Variable Insurance ContractsDocument11 pagesInsurance Commision Variable Insurance ContractsPetRe Biong PamaNo ratings yet

- Absa Dividend Income FundDocument2 pagesAbsa Dividend Income FundGontse SitholeNo ratings yet

- Kenanga IutaDocument16 pagesKenanga IutaJohann AdamNo ratings yet

- Edc Ghana Fixed Income Unit Trust Statement of Account: Redemptions Shall Be Based On Marked-to-Market ValueDocument2 pagesEdc Ghana Fixed Income Unit Trust Statement of Account: Redemptions Shall Be Based On Marked-to-Market ValueAdepa IdasonNo ratings yet

- Economic Financial IssuingDocument11 pagesEconomic Financial Issuingdamahoj412No ratings yet