Professional Documents

Culture Documents

Un Audited Financial Statements Half Yearly 2021

Uploaded by

Ibrahim SheikhOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Un Audited Financial Statements Half Yearly 2021

Uploaded by

Ibrahim SheikhCopyright:

Available Formats

MUTUAL TRUST BANK LIMITED AND ITS SUBSIDIARIES

1H CONDENSED INTERIM FINANCIAL STATEMENTS (UNAUDITED)

AS AT AND FOR THE FIRST HALF ENDED 30 JUNE, 2021

In compliance with the Bangladesh Securities and Exchange Commission (BSEC) letter No. SEC/CFD/Misc/233/2004/615, dated 2 February, 2010 and the Dhaka and Chittagong Stock Exchange (Listing) Regulations, 2015, we are pleased to present the un-audited Consolidated Financial Statements

of Mutual Trust Bank Limited as at and for the first half ended 30 June, 2021. These Consolidated Financial Statements are comprised of the financials of Mutual Trust Bank Limited including Off-shore Banking Unit, Islamic Banking and its subsidiaries i.e. MTB Securities Limited, MTB Capital Limited

and MTB Exchange (UK) Limited, which are prepared as per International Accounting Standard (IAS) 34 “Interim Financial Reporting”.

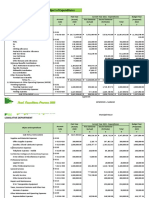

Condensed Consolidated Balance Sheet (Unaudited) Condensed Consolidated Profit and Loss Account (Unaudited) Condensed Consolidated Statement of Cash Flow (Unaudited)

As at 30 June 2021 For the period ended 30 June 2021 For the period ended 30 June 2021

01 January to 01 January to 01 April to 01 April to 01 January to 01 January to

June'2021 2020

30 June 2021 30 June 2020 30 June 2021 30 June 2020 30 June' 2021 30 June' 2020

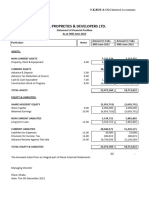

Property and Assets BDT BDT

Particulars BDT BDT BDT BDT BDT BDT

Cash 11,691,463,335 11,781,494,720 A) Cash Flows From Operating Activities:

In Hand (Including Foreign Currency) 3,027,709,136 2,839,955,309 Interest Income 7,205,934,141 8,451,078,247 3,487,839,638 3,773,035,228

Interest Received 11,256,019,980 9,486,719,202

With Bangladesh Bank and its agent Bank(s) (including foreign currency) 8,663,754,199 8,941,539,411 Interest Expenses 4,487,064,075 6,405,759,405 2,168,408,107 3,090,713,174

Net Interest Income 2,718,870,066 2,045,318,842 1,319,431,531 682,322,054 Interest Paid on Deposits, Borrowings, etc. (6,720,967,080) (6,788,542,214)

Balance with other Banks & Financial Institutions 2,991,989,434 5,030,965,937 Dividend Income 22,409,291 5,983,480

Income from Investments 1,464,748,341 1,891,821,309 749,595,814 1,081,363,929

In Bangladesh 419,703,070 3,322,877,323 Fees & Commission Income 985,672,944 780,890,768

Commission, Exchange and Brokerage 985,672,944 780,890,768 548,977,219 335,046,384

Outside Bangladesh 2,572,286,364 1,708,088,615 Other Operating Income 457,006,596 294,522,725 286,350,660 163,619,333 Recoveries of Loans & Other advances previously written off - 197,080

Money at Call & Short Notice - 1,114,100,000 Total Other Income 2,907,427,881 2,967,234,803 1,584,923,693 1,580,029,646 Cash Paid to Employees as Salaries and Allowances (1,797,391,028) (1,772,651,437)

Total Operating Income 5,626,297,946 5,012,553,644 2,904,355,225 2,262,351,700 Cash Paid to Suppliers (47,279,859) (24,752,256)

Investments 40,824,835,402 36,656,698,182 Less: Operating Expenses: Advance Income Tax Paid (334,338,235) (773,877,168)

Government 34,545,700,270 32,826,020,472 Salary & Allowances 1,781,610,785 1,761,017,537 920,235,524 909,386,909 Cash Received from Other Operational Income 590,445,416 953,010,388

Others 6,279,135,132 3,830,677,710 Rent Taxes Insurance Electricity etc. 351,406,454 304,193,900 173,533,118 142,466,086 Cash Paid for Other Operational Expenses (985,465,600) (887,417,931)

Legal Expenses 2,387,108 699,211 1,091,797 96,157 Cash Flow from Operating Activities before Changes in Net Current Assets: 2,969,105,829 979,559,912

Loans and Advances 218,142,705,270 203,887,322,069

Postage Stamps and Telecommunication etc. 8,434,496 7,520,365 4,674,309 3,120,437

Loans, Cash Credits, Overdrafts, etc. 215,375,250,988 202,140,630,692 Stationery Printing and Advertisements etc. 47,279,859 24,752,256 21,773,122 9,489,387

Bills Purchased and Discounted 2,767,454,282 1,746,691,377 Managing Director's Remuneration 15,780,243 11,633,900 9,957,762 6,527,075 Loans & Advances (16,981,824,532) (11,147,058,033)

Director's Expenses 1,108,800 803,549 497,800 184,949 Other Assets (1,981,909,114) (444,414,852)

Fixed Asset including Premises, Furniture & Fixtures 4,718,874,225 4,896,306,425

Auditor's Fees - 217,729 - 104,896 Bank Deposits 3,001,041,667 (5,499,850,000)

Other Assets 8,260,532,513 5,902,372,242 Depreciation & Repair & Maintenance of Assets 368,565,066 367,940,076 187,031,528 185,564,609 Customers' Deposits 5,078,574,118 5,229,767,291

Non-Banking Assets - - Other Expenses 571,876,227 531,968,318 310,415,481 222,968,618 Borrowing from Other Banks, Financial Institutions & Agents 4,580,402,658 3,978,534,409

Total Operating Expenses 3,148,449,038 3,010,746,840 1,629,210,441 1,479,909,122

Total Property and Assets 286,630,400,179 269,269,259,576 Other Liabilities 2,843,510,861 1,901,996,544

Profit Before Provision 2,477,848,908 2,001,806,804 1,275,144,784 782,442,578

(3,460,204,343) (5,981,024,641)

Liabilities and Capital Less: Provision for Loans,Investment & Other

Net Cash Flows from Operating Activities (491,098,514) (5,001,464,729)

Borrowing from other Banks, Financial Institutions & Agents 35,427,711,097 30,847,308,439 Provision for Unclassified Loan and Advance 175,163,287 69,639,585 603,788,880 39,206,703

B) Cash Flow from Investing Activities:

Provision for Classified Loan and Advance 376,015,873 366,640,765 (43,431,743) 145,418,366

Deposits and Other Accounts 195,982,721,108 190,120,484,514 Provision for Off-Balance Sheet items (Expenses) 160,002,233 35,093,621 65,988,175 (19,118,767) Investments in T. Bills, T. Bonds and other (1,661,388,437) (30,318,562)

Current Deposit & Other Accounts 20,819,296,985 19,206,638,034 Provision for Investment in Share of Quoted Co. 136,000,000 34,000,000 83,000,000 1,000,000 Investments in Shares & Bonds (2,448,457,421) (21,813,135)

Bills Payable 2,505,484,397 1,988,092,081 Provision for Other Assets 9,500,000 - 9,500,000 Purchase of Fixed Assets (Net) (140,880,351) (1,028,739,271)

Savings Deposit 39,121,487,612 36,214,629,286 Total Provision 856,681,393 505,373,971 718,845,312 166,506,302 Net Cash Flow from Investing Activities (4,250,726,210) (1,080,870,968)

Fixed Deposits 89,256,035,388 94,752,893,487 Profit Before Tax 1,621,167,516 1,496,432,833 556,299,472 615,936,276 C) Cash Flow from Financing Activities:

Special Noticed Deposits 21,605,253,194 15,370,530,851 Less: Income Tax Expenses 747,238,176 408,026,123 284,145,302 62,032,990 Subordinated debts 1,500,000,000 3,400,000,000

Deposit Products 22,675,163,533 22,587,700,775 Current Tax Expenses 719,521,358 540,805,429 243,943,050 114,494,793 Net Cash Flow from Financing Activities 1,500,000,000 3,400,000,000

Deferred Tax Expenses/(Income) 27,716,818 (132,779,306) 40,202,253 (52,461,803)

Other Liabilities 24,879,249,202 20,440,174,149 D) Net Increase in Cash and Cash Equivalents (3,241,824,724) (2,682,335,697)

Net Profit After Tax 873,929,339 1,088,406,710 272,154,169 553,903,286

E) Effect of Changes of Exchange Rates on Cash and Cash Equivalents (1,014,564) 1,114,440

Bond 12,350,000,000 10,850,000,000 Shareholders' of the Bank 873,927,712 1,088,406,516 272,153,716 553,903,317 F) Opening Cash and Cash Equivalents 17,928,429,557 18,150,276,998

Perpetual Bond 3,150,000,000 650,000,000 Minority Interest 1,627 195 454 (31)

Closing Cash and Cash Equivalents (D+E+F) 14,685,590,269 15,469,055,741

Subordinated Debts 9,200,000,000 10,200,000,000 873,929,339 1,088,406,710 272,154,169 553,903,286

Retained Surplus Brought Forward 2,166,251,505 2,253,888,061 2,166,251,505 2,253,888,061 The above closing Cash and Cash Equivalents include:

Total Liabilities 268,639,681,407 252,257,967,102 3,040,179,217 3,342,294,577 2,438,405,221 2,807,791,378 Cash in Hand 3,027,709,136 2,849,331,742

Appropriations: Balance with Bangladesh Bank and its Agent Bank 8,663,754,199 8,839,303,008

Capital/Shareholders' Equity

Bonus Shares Issued during the year 738,632,410 - 738,632,410 - Balance with Other Banks & Financial Institutions 2,991,989,434 3,589,044,291

Paid up Capital 8,124,956,590 7,386,324,180

Transferred to Statutory Reserve 298,559,179 296,662,614 99,622,894 125,557,437

Statutory Reserve 5,336,082,545 5,037,523,366 Money at Call and Short Notice - 189,100,000

Transferred to Start-Up Fund 8,168,437 2,532,761 -

Share Premium 1,095,304,778 1,095,304,778 1,045,360,026 296,662,614 840,788,065 125,557,437

Prize Bond 2,137,500 2,276,700

Revaluation Reserve on Investment in Securities 649,721,658 535,041,698 Retained Surplus, Carried Forward 1,994,819,191 3,045,631,963 1,597,617,156 2,682,233,941 14,685,590,269 15,469,055,741

Foreign Currency Translational Gain/ Loss 2,923,306 3,937,871

General Reserve 786,777,324 786,777,324 Earnings Per Share (EPS) (2020 Restated) 1.08 1.34 0.26 0.79 Net Operating Cash Flows Per Share (2020 Restated) (0.60) (6.16)

Retained earnings 1,994,819,191 2,166,251,505

Total Shareholders' Equity 17,990,585,393 17,011,160,723

Minority Interest 133,379 131,752

Chairman Director Managing Director & CEO Chairman Director Managing Director & CEO

Total Liabilities and Shareholders' Equity 286,630,400,179 269,269,259,576

Net Asset Value (NAV) per share (2020 Restated) 22.14 20.94

Off-Balance Sheet Items Group Chief Financial Officer Group Company Secretary Group Chief Financial Officer Group Company Secretary

Contra & Contingent Assets & Liabilies:

Acceptances and endorsements

Letter of guarantee

34,039,658,109

39,860,068,274

25,672,241,302

34,887,687,852 Condensed Consolidated Statement of Changes in Equity (Unaudited)

Irrevocable letters of credit

Bills for collection

29,828,893,644

8,280,414,715

25,753,147,769

7,282,893,368

As at 30 June 2021

Total Off-Balance Sheet Items including Contingent Liabilities 112,009,034,741 93,595,970,291

Amount in BDT

Revaluation Foreign

Paid-up Statutory Share Reserve on Currency General Retained Minority

Particulars Total Total

Capital Reserve Premium Investment Translation Reserve Earnings Interest

Chairman Director Managing Director & CEO in Securities Gain/(Loss)

Balance as at January 01, 2021 7,386,324,180 5,037,523,366 1,095,304,778 535,041,698 3,937,871 786,777,324 2,166,251,505 17,011,160,723 131,752 17,011,292,474

Bonus Share Issued during the period 738,632,410 (738,632,410) - -

Group Chief Financial Officer Group Company Secretary

Currency Translation differences (1,014,564) (1,014,564) (1,014,564)

Transferred to Start-Up Fund (8,168,437) (8,168,437)

DISCLOSURE ON 1st HALF UN-AUDITED Revaluation Reserve transferred during the period 114,679,960 114,679,960 114,679,960

CONSOLIDATED FINANCIAL STATEMENTS 2021 Net Profit for the period after Tax 873,927,712 873,927,712 1,627 873,929,339

Appropriation made during the period 298,559,179 (298,559,179) - -

Amount in BDT Balance as at 30 June, 2021 8,124,956,590 5,336,082,545 1,095,304,778 649,721,658 2,923,306 786,777,324 1,994,819,191 17,990,585,393 133,379 17,998,887,209

Consolidated

Particulars

June 30, 2021 June 30, 2020 Balance as at 30 June, 2020 7,034,594,460 4,988,616,393 1,095,304,778 273,906,395 6,506,679 786,777,324 3,045,631,962 17,231,337,991 130,040 17,231,468,031

Net Asset Value (NAV) 17,990,585,393 17,231,337,991

Net Asset Value (NAV) Per Share (Restated) 22.14 21.21

Earnings Per Share (EPS) (Restated) 1.08 1.34

Net Operating Cash Flow (NOCF) Per Share (Restated) (0.60) (6.16) Chairman Director Managing Director & CEO Group Chief Financial Officer Group Company Secretary

Mutual Trust Bank Limited and Its Subsidiaries 1.5.2 MTB Exchange (UK) Limited (MTB UK) 2.5 According to IAS-12 “Income Taxes”, Current Tax comprises of 2.10 Net Operating Cash Flows Per Share (NOCFS)

NOCFS for the period has stood at BDT (0.60) compare to the same period of

Selective Notes to the Condensed Interim Financial Statements Bangladesh Bank vide their letter No: BRPD(M)204/25/2010-289 dated Operating Profit before Provision after adjustment of permanent

As at and for the period ended 30 June 2021 19/08/2010 has accorded approval to the bank for opening a fully owned disallowances. last year of BDT (6.16) [Restated, Original NOCFS: BDT (7.11)] mainly due to

subsidiary company in the name of MTB Exchange (UK) Limited. The Required provision for current tax has been calculated on operating profit reduction of gap between collection of deposits / fund and deployment of fund

Company was incorporated on September 14, 2010 under the Companies Act before provision as per the Income Tax Ordinance 1984 as well as according through advances over the same period of previous year. Calculation of

1.0 Legal status and nature of the Bank NOCFS as of 1H 2021 is as under:

Mutual Trust Bank Limited (MTB) was incorporated in Bangladesh in the year 2006 of UK with the registration number 7282261 as a private company limited to IAS 12, so the tax rates stood at 29.04% and 27.02% for the 1H of 2021 and

1999 as a Banking Company under the Companies Act, 1994 as a Public by shares. The registered office is located at 25 White Chapel Road, London, 1H for 2020 respectively which is shown below:

United Kingdom. Calculation of NOCFPS: Net operating cash flow/No. of

Limited Company. All types of commercial banking services are provided by shares outstanding

the Bank within the stipulations laid down by the Bank Companies Act, 1991 Particulars 01 January to 30 June 2021 01 January to 30 June 2020

1.5.3 MTB Capital Limited (MTBCL) Operating profit before Provision 2,477,848,908 2,001,806,804

BDT

(as amended up to date) and directive as received from the Bangladesh Bank Total net operating cash flows (a) (491,098,514)

from time to time. Registered office of the Bank is at MTB Centre, 26 Gulshan The Bank obtained permission to embark upon Merchant Banking from the Provision for Current Tax 719,521,358 540,805,429

Securities and Exchange Commission (SEC) vides its certificate Number of shares outstanding as of 30 June 2021 (b) 812,495,659

Avenue, Gulshan 1, Dhaka 1212. The Bank started its commercial business Tax rate 29.04% 27.02% Net operating cash flow per share (a/b) (0.60)

from October 24, 1999. The Bank is listed with the Dhaka and Chittagong No.MB-55/2010 dated December 06, 2010 under the Securities and Exchange

Stock Exchanges Limited. Authorized Capital of the Bank is BDT 10 billion. Commission Act, 1993. The operation has started as on April 17, 2011. 2.6 Calculation of Deferred Tax: 2.11 Reconciliation of statement of cash flows from operating activities

The Bank has 119 (One Hundred and Nineteen) branches including 14 BDT

(Fourteen) SME/Agri Branches and 32 (Thirty Two) sub branches all over the 2.0 Significant Accounting Policies Taxable temporary difference arising from the carrying Particulars 01 January to 01 January to

Bangladesh, 164 (One Hundred and Sixty Four) Agent Banking Centre, value of fixed assets (483,947,660) June 30, 2021 June 30, 2020

04(Four) air lounge and 02 (Two) Booth located at Hazrat Shahjalal 2.1 Basis of Accounting Deductibles temporary difference arising from the

International Airport, Dhaka. The financial statements of the Bank as at and for the period ended 30 June provision of classified loan 2,698,441,106 Profit before provision 2,477,848,908 2,001,806,804

2021 have been prepared under the historical cost convention, on a going Net deductible temporary difference (a) 2,214,493,446 Adjustment for non-cash items

1.1 Principal Activities concern basis and in accordance with the “first schedule (Sec- 38)” of the Bank Depreciation on fixed assets 290,694,399 295,521,676

Companies Act, 1991 (as amended up to date) and as per the BRPD circular Tax rate (b) 37.50%

The principal activities of the bank are to provide all kinds of commercial Closing deferred tax assets (a X b) 830,435,042 Amortization on software 24,878,481 28,858,205

banking services to its customers through its branches and offices in no. 14 dated 25 June 2003, other Bangladesh Bank Circulars, International Interest on lease liability 41,855,040 -

Financial Reporting Standards (IFRS) adopted by the Financial Reporting Opening deferred tax assets 858,157,826

Bangladesh such as accepting deposits, corporate, SME and retail banking, 357,427,920 324,379,881

personal financial services, project finance, etc. Council of Bangladesh (FRC), The Companies Act 1994, The Securities and Deferred tax income of the Bank (27,722,784)

Adjustment with non-operating activities

Exchange Rules 1987, Dhaka & Chittagong Stock Exchanges Listing Deferred tax income of subsidiaries 5,966

Recovery of written of loan - 197,080

1.2 Off-Shore Banking Unit (OBU) Regulations 2015, The Income Tax Ordinance 1984 and other laws and rules Consolidated deferred tax income 27,716,818 Accounts Receivable 2,684,528,410 (238,632,270)

The Bank obtained Off-shore Banking Unit Permission vide Letter No. BRPD applicable in Bangladesh. All inter-branch account balances and transactions

among the Corporate Head Office and the branches have been taken into Accounts Payable on deposits (2,275,758,045) (382,782,809)

(P-3)744(105)/2009-4470 dated December 3, 2009 and commenced its 2.7 Composition of Shareholders’ Equity: Loss on sale of assets 2,739,671 1,545,336

operation on December 07, 2009. The Off-shore Banking Unit is governed account. BDT Loss on revaluation of Government Securities 56,657,199 46,923,058

under the rules and guidelines of Bangladesh Bank. The principal activities of Paid up Capital (812,495,659 Ordinary shares @ 10.00 each) 8,124,956,590 468,167,235 (572,749,604)

the Unit are to provide all kinds of commercial banking services to its 2.2 Basis of Consolidation

The consolidated financial statements include the financial statements of Statutory Reserve 5,336,082,545 Changes in operating assets and liabilities

customers in foreign currencies approved by the Bangladesh Bank. Share Premium 1,095,304,778 Changes in loans & advances (16,981,824,532) (11,147,058,033)

Mutual Trust Bank Limited, Off-shore Banking Units, Islamic Banking and its

subsidiaries i.e. MTB Securities Limited, MTB Capital Limited and MTB Revaluation Reserve on Investment in Securities 649,721,658 Changes in deposits & other accounts 8,079,615,785 (270,082,709)

1.3 Islamic Banking: Changes in borrowings 4,580,402,658 3,978,534,409

Exchange (UK) Limited. The consolidated financial statements are prepared to Foreign Currency Translation gain 2,923,306

The Bank obtained permission for Islamic Banking from Bangladesh Bank vide Changes in other assets (1,981,909,114) (444,414,852)

Letter No. BRPD(P-3)745(51)/ 2019-9642 dated November 25, 2019. Through a common financial period ending 30 June 2021. General Reserve 786,777,324

Retained Earnings 1,994,819,191 Changes in other liabilities 2,843,510,861 1,901,996,544

the Islamic Banking the Bank extends all types of Islamic Shariah compliant

2.3 Cash Flow Statement Total Shareholders’ Equity 17,990,585,393 (3,460,204,343) (5,981,024,641)

finance like Lease, Hire Purchase Shirkatul Melk (HPSM), Bai Muazzal,

Cash flow statement has been prepared in accordance with the International Income tax paid (334,338,235) (773,877,168)

Household Scheme etc. and different types of deposits like Mudaraba savings

deposits, Mudaraba term deposits, Al-Wadeeah current deposits, Accounting Standard-7 “Cash Flow Statement” under direct method as 2.8 Net Asset Value Per Share (NAVPS): (491,098,514) (5,001,464,729)

monthly/quarterly profit paying scheme etc. recommended in the BRPD Circular no.14, dated June 25, 2003 issued by the Net assets value (NAV) per share as of 1H 2021: BDT 22.14 which was BDT 2.12 Reporting Period

Banking Regulation & Policy Department of Bangladesh Bank. 20.94 (Restated) in December 2020. Calculation of the NAVPS furnished These financial statements cover the period from 01 January to 30 June 2021.

1.4 Agent Banking: below:

The Bank obtained permission from Bangladesh Bank on 07/01/2016 vide 2.4 Provisions 2.13 General

Calculation of NAVPS: Net asset value/ No. a) These financial statements are presented in BDT, which is the bank’s functional

reference no BRPD (P-3) 745 (51)/2016-142 to start the operation of Agent of shares outstanding

Banking and subsequently started its commercial operation on 06/06/2016. 2.4.1 Loans and Advance currency. Figure appearing in these financial statements have been rounded off to

Provision for Loans and Advance has been made as per directives/letter BDT the nearest BDT.

The services that are currently being offered includes- Account Opening Total net assets value (a) 17,990,585,393

(Savings), Cash deposit & withdrawal (Agent Banking A/C),Cash Deposit in issued by Bangladesh Bank from time to time. As well as Bangladesh Bank b) Figures of the previous year have been rearranged to conform to the current

letter Reference No. DBI-1/119/2020-1616 dated June 24, 2020, Number of shares outstanding as of 30 June 2021 (b) 812,495,659 year’s presentation.

Branch A/C, Inward foreign remittance disbursement, Collections of bills/utility Net asset value per share (a/b) 22.14

bills, Payment of social benefits, Transfer of funds, Payment of salaries, DBI-1/119/2021-1023 dated April 13, 2021 and DOS (RMMCMS)

Generation and issuance of bank statements, SME Loan repayment 1154/161/2021-1841 dated 26 April, 2021 regarding approval to defer the 2.14 Review of the Financial Statements

2.9 Earnings Per Share (EPS) These Un-Audited Financial Statements were reviewed by the MTB Board Audit

collection, Balance inquiry, Internet Banking & SMS banking, Corporate required provision amount over the next three years from 2021 to 2023. The Bank calculates EPS in accordance with International Accounting

Bill/Distributor fee collection, Insurance Premium Collection etc. Committee in its 4th meeting for 2021 held on 26 July 2021 and was subsequently

Standard (IAS) 33 “Earning per Share” which has been shown in the profit and approved by the MTB Board in its 264th meeting held on 28 July 2021.

2.4.2 Investment loss account. EPS as of 1H 2021: BDT 1.08 as against BDT 1.34 (Restated,

1.5 Subsidiary Companies Provisions for diminution in value of investment is made for loss arising from Original EPS: BDT 1.55) of 1H 2020. EPS has decreased compared to the

decrease of the value of investment in quoted shares as per directives of the same period of last year due to higher requirement of loan loss provision. 2.15 Credit Rating

1.5.1 MTB Securities Limited (MTBSL) competent authorities. Calculation of EPS as of 1H 2021 is as under: Credit Rating Information and Services Limited (CRISL) has rated the Bank based

MTB Securities Limited was incorporated in Bangladesh as a private limited on December 31, 2020 with “AA” (pronounced as Double A) in the Long Term and

company on March 01, 2010 vide its registration No. 82868/10 and converted 2.4.3 Off - Balance Sheet Exposures Calculation of Basic EPS: Net profit after tax/ No. of ST-2 for the Short Term. The date of rating was May 23, 2021.

into public Ltd. company in the year 2015 under The Companies Act 1994. The Off-balance sheet items have been disclosed under contingent liabilities and shares outstanding

other commitments according to Bangladesh Bank guidelines. As per BRPD BDT Periods Rating Validity Long Term Rating Short Term Rating

company has started its commercial operation on September 23, 2010 after January to December 2020 22 May, 2022 AA ST-2

getting approval from the Bangladesh Securities and Exchange Commission Circular no.14 of September 23, 2012, Circular letter no.1 of January 03, 2018, Net profit after tax (a) 873,927,712

Circular No. 7 of 21 June 2018 and Circular No.13 of 18 October 2018 the Number of shares outstanding (b) 812,495,659 January to December 2019 14 July, 2021 AA ST-2

(BSEC). The Brokerage registration is REG 3.1/DSE-197/2010/427 and January to December 2018 15 July, 2020 AA ST-2

Dealer registration is REG 3.1/DSE-197/2010/428. Bank has maintained provision against off-balance sheet exposures. Earnings per share (a/b) 1.08

The un-audited First Half Financial Statements (1H, 2021) are available on www.mutualtrustbank.com

You might also like

- 1.office of The MayorDocument29 pages1.office of The MayorVIRGILIO OCOY IIINo ratings yet

- The Collection of Local Tax On Cable Television in Metro Manila Issue of Practices and Reform by Ricardo A. Lavendia Jr.Document89 pagesThe Collection of Local Tax On Cable Television in Metro Manila Issue of Practices and Reform by Ricardo A. Lavendia Jr.Anonymous auHXN5Fn100% (7)

- Budget Preparation 2022 TreasDocument11 pagesBudget Preparation 2022 TreasMary Jane Sande GelbolingoNo ratings yet

- Lecture 8 - 8 Point and EV To EBITDA by CA Rachana RanadeDocument8 pagesLecture 8 - 8 Point and EV To EBITDA by CA Rachana RanadeMufaddal DaginawalaNo ratings yet

- Tax Summative 2Document14 pagesTax Summative 2Von Andrei MedinaNo ratings yet

- Lesson 2 Statement of Comprehensive IncomeDocument24 pagesLesson 2 Statement of Comprehensive IncomeMylene Santiago100% (2)

- Financial Statements 2020: Half YearlyDocument2 pagesFinancial Statements 2020: Half Yearlyshahid2opuNo ratings yet

- EBL Q1 FS2023 UnauditedDocument2 pagesEBL Q1 FS2023 UnauditedAnwar Hossain ReponNo ratings yet

- Financial StatementDocument4 pagesFinancial StatementAphrodite ArgennisNo ratings yet

- Abridged Interim Unaudited Condensed Financial Statements For The Six Months Ended 30 June 2021Document7 pagesAbridged Interim Unaudited Condensed Financial Statements For The Six Months Ended 30 June 2021Dani ShaNo ratings yet

- RTCL Properties & Developers LIMITED-2022Document15 pagesRTCL Properties & Developers LIMITED-2022Asad RanaNo ratings yet

- Financial Statements - 40Document18 pagesFinancial Statements - 40Liliana MNo ratings yet

- Unaudited Financial Statements For The Period Ended 30 September, 2021Document2 pagesUnaudited Financial Statements For The Period Ended 30 September, 2021Fuaad DodooNo ratings yet

- Half Yearly Financial Statements As On 30 June 2021 (Unaudited)Document1 pageHalf Yearly Financial Statements As On 30 June 2021 (Unaudited)Sheikh NayeemNo ratings yet

- BRS Economic Update - SL Budget 2024Document22 pagesBRS Economic Update - SL Budget 2024Sudheera IndrajithNo ratings yet

- Societe Generale Ghana PLC 2021 Audited Financial StatementsDocument2 pagesSociete Generale Ghana PLC 2021 Audited Financial StatementsFuaad DodooNo ratings yet

- KIIL Reesults Q3Document5 pagesKIIL Reesults Q3Abdul SamadNo ratings yet

- Different Collection2022-23Document6 pagesDifferent Collection2022-23Friends Law ChamberNo ratings yet

- CR-July-Aug-2022Document6 pagesCR-July-Aug-2022banglauserNo ratings yet

- Proposed New Appropriations, by Object of Expenditures: Legislative DepartmentDocument9 pagesProposed New Appropriations, by Object of Expenditures: Legislative DepartmentVIRGILIO OCOY IIINo ratings yet

- Axis Bank - AR21 - Standalone Financial StatementsDocument80 pagesAxis Bank - AR21 - Standalone Financial StatementsArbaz TaiNo ratings yet

- CF-Export-05-03-2024 7Document11 pagesCF-Export-05-03-2024 7v4d4f8hkc2No ratings yet

- Axis Bank - AR21 - Consolidated Financial StatementsDocument48 pagesAxis Bank - AR21 - Consolidated Financial StatementsRakeshNo ratings yet

- Summary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Document1 pageSummary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Fuaad DodooNo ratings yet

- Choo Bee Metal Industries Berhad (10587-A)Document18 pagesChoo Bee Metal Industries Berhad (10587-A)Iqbal YusufNo ratings yet

- 2Q 2023 Bursa (PMMA)Document15 pages2Q 2023 Bursa (PMMA)kimNo ratings yet

- JIL Results 31122022Document12 pagesJIL Results 31122022shalini15_85No ratings yet

- Fusen Pharmaceutical Company Limited 福 森 藥 業 有 限 公 司Document22 pagesFusen Pharmaceutical Company Limited 福 森 藥 業 有 限 公 司in resNo ratings yet

- CF-Export-05-03-2024 10Document11 pagesCF-Export-05-03-2024 10v4d4f8hkc2No ratings yet

- Societe Generale Ghana PLC Unaudited Financial Statements For The Half Year Ended 30 June 2021Document2 pagesSociete Generale Ghana PLC Unaudited Financial Statements For The Half Year Ended 30 June 2021Fuaad DodooNo ratings yet

- Deposit Insurance System in BangladeshDocument2 pagesDeposit Insurance System in BangladeshSohel RanaNo ratings yet

- 2021 2020 Bank Group Bank Group: in Thousands of Ghana Cedis in Thousands of Ghana CedisDocument2 pages2021 2020 Bank Group Bank Group: in Thousands of Ghana Cedis in Thousands of Ghana CedisFuaad DodooNo ratings yet

- Antler Fabric Printers (PVT) LTD 2016Document37 pagesAntler Fabric Printers (PVT) LTD 2016IsuruNo ratings yet

- Holdings Limited: McdowellDocument14 pagesHoldings Limited: McdowellSarvesh SatavalekarNo ratings yet

- Update Date: 15/03/2023 Unit: Million Dong: Balance Sheet - BKG 2018 2019 2020 2021Document9 pagesUpdate Date: 15/03/2023 Unit: Million Dong: Balance Sheet - BKG 2018 2019 2020 2021The Meme ReaperNo ratings yet

- National Bank of Pakistan: Standalone Financial Statements For The Half Year Ended June 30, 2010Document35 pagesNational Bank of Pakistan: Standalone Financial Statements For The Half Year Ended June 30, 2010kasimzzzNo ratings yet

- CF-Export-05-03-2024 18Document11 pagesCF-Export-05-03-2024 18v4d4f8hkc2No ratings yet

- Particulars Jan Feb Mar Apr May Jun Jul: (Version 2)Document2 pagesParticulars Jan Feb Mar Apr May Jun Jul: (Version 2)Rubelyn Quimat RepasaNo ratings yet

- 195879Document69 pages195879Irfan MasoodNo ratings yet

- Uba Annual Report Accounts 2022Document286 pagesUba Annual Report Accounts 2022G mbawalaNo ratings yet

- Q2FY22 ResultsDocument16 pagesQ2FY22 ResultsrohitnagrajNo ratings yet

- Reg30LODR QFR LRReport 31dec2020 WebsiteDocument15 pagesReg30LODR QFR LRReport 31dec2020 WebsiteAnveshNo ratings yet

- CIB Separate Financial Statements Mar 2022 EnglishDocument29 pagesCIB Separate Financial Statements Mar 2022 EnglishPT l Pardox TechNo ratings yet

- f-31573740-0 BMRI Penyampaian Bukti Iklan 31573740 Lamp3 PDFDocument1 pagef-31573740-0 BMRI Penyampaian Bukti Iklan 31573740 Lamp3 PDFAbieZen TorettoNo ratings yet

- Condensed Quarterly Accounts (Un-Audited)Document10 pagesCondensed Quarterly Accounts (Un-Audited)Perah ShaikhNo ratings yet

- SCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022Document13 pagesSCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022kimNo ratings yet

- Viraj Wijeratne 2223 Revised SET ComputationDocument1 pageViraj Wijeratne 2223 Revised SET Computationattackdfg2002No ratings yet

- Nesco 19.05.20Document19 pagesNesco 19.05.20Miku DhanukaNo ratings yet

- NIB Financial Statements 2017Document12 pagesNIB Financial Statements 2017rahim Abbas aliNo ratings yet

- Bajaj Auto International Holdings B.V.: Balance SheetDocument22 pagesBajaj Auto International Holdings B.V.: Balance SheetPhani TejaNo ratings yet

- Sbi 2022-23qs (Autosaved) Robin and HiteshDocument21 pagesSbi 2022-23qs (Autosaved) Robin and HiteshHitesh GuptaNo ratings yet

- Good Hope PLC: Annual ReportDocument11 pagesGood Hope PLC: Annual ReporthvalolaNo ratings yet

- Proposed New Appropriations, by Object of Expenditures Secretary To The SanggunianDocument9 pagesProposed New Appropriations, by Object of Expenditures Secretary To The SanggunianVIRGILIO OCOY IIINo ratings yet

- Weekly Meeting October 2022Document42 pagesWeekly Meeting October 2022Abang GaffiNo ratings yet

- Construction and CafeDocument25 pagesConstruction and Cafeassefamenelik1No ratings yet

- Bangladesh q2 Report 2020 Tcm244 553471 enDocument8 pagesBangladesh q2 Report 2020 Tcm244 553471 entdebnath_3No ratings yet

- 28th Annual Report-2022Document165 pages28th Annual Report-2022titu_1552No ratings yet

- Abott LabDocument6 pagesAbott LabRizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- Overseas BankingDocument16 pagesOverseas BankingafzalhashimNo ratings yet

- Quarter Report April 20 2022Document29 pagesQuarter Report April 20 2022Binu AryalNo ratings yet

- ALFA HAUL FY2021Document9 pagesALFA HAUL FY2021Nathan Fredrick OlingaNo ratings yet

- Analysis of The Finance Bill 2023 by SMAC Advisory-1Document81 pagesAnalysis of The Finance Bill 2023 by SMAC Advisory-1Abu TayeabNo ratings yet

- Experience IIFTDocument4 pagesExperience IIFTJayesh JaiswalNo ratings yet

- Business Fundamentals: Md. Shahidullah KayserDocument45 pagesBusiness Fundamentals: Md. Shahidullah KayserIbrahim SheikhNo ratings yet

- Annual Report 2020 FinalDocument216 pagesAnnual Report 2020 FinalIbrahim SheikhNo ratings yet

- List of Bank of BDDocument12 pagesList of Bank of BDIbrahim SheikhNo ratings yet

- The Economy Condition of BangladeshDocument9 pagesThe Economy Condition of BangladeshIbrahim SheikhNo ratings yet

- Group 10Document23 pagesGroup 10Ibrahim SheikhNo ratings yet

- 0 Account Title and Explanation Ref Debit CreditDocument20 pages0 Account Title and Explanation Ref Debit Creditjenianus beanal100% (1)

- Practical Financial Management 6th Edition Lasher Solutions ManualDocument26 pagesPractical Financial Management 6th Edition Lasher Solutions Manualbarrydixonydazewpbxn100% (8)

- 55 - Chapter 6 Exercises With AnswersDocument4 pages55 - Chapter 6 Exercises With Answersgio gioNo ratings yet

- Annual Report 2011-2012Document44 pagesAnnual Report 2011-2012snm1976No ratings yet

- Intercompany-Profit Transaction: Plant AssetDocument29 pagesIntercompany-Profit Transaction: Plant AssetCici SintamayaNo ratings yet

- MTD YtdDocument350 pagesMTD YtdAmy Rose BotnandeNo ratings yet

- When Alex Rodriguez Moved To The Texas Rangers in 2001Document1 pageWhen Alex Rodriguez Moved To The Texas Rangers in 2001Amit PandeyNo ratings yet

- Ch4 SmithvilleDocument7 pagesCh4 SmithvilleLica Dapitilla Perin33% (3)

- Accounting Textbook Solutions - 27Document19 pagesAccounting Textbook Solutions - 27acc-expertNo ratings yet

- Al-Abbas Sugar Mills LTD: Balance SheetDocument3 pagesAl-Abbas Sugar Mills LTD: Balance SheetSamie ElahiNo ratings yet

- The Cost of Capital: Answers To End-Of-Chapter QuestionsDocument21 pagesThe Cost of Capital: Answers To End-Of-Chapter QuestionsMiftahul FirdausNo ratings yet

- Rjnth64oq - ACTIVITY - CHAPTER 16 - ACCOUNTING FOR DIVIDENDSDocument2 pagesRjnth64oq - ACTIVITY - CHAPTER 16 - ACCOUNTING FOR DIVIDENDSJustine Marie BalderasNo ratings yet

- Stephen F. English, OSB No. 730843 Julia E. Markley, OSB No. 000791 Edward Choi, OSB No. 135673 Perkins Coie LLPDocument80 pagesStephen F. English, OSB No. 730843 Julia E. Markley, OSB No. 000791 Edward Choi, OSB No. 135673 Perkins Coie LLPTTILaw100% (1)

- Taxation Treaties of India With Different Countries: Master of Business AdministrationDocument12 pagesTaxation Treaties of India With Different Countries: Master of Business AdministrationHarjot SandhayNo ratings yet

- Module 1 FArDocument6 pagesModule 1 FArfirestorm riveraNo ratings yet

- Intermediate Financial Management 11th Edition Brigham Test BankDocument20 pagesIntermediate Financial Management 11th Edition Brigham Test Banknicholasyoungxqwsbcdogz100% (34)

- Satish Pradhan Dnyanasadhana College: Department of BMS Sample MCQ Questions Subject: Strategic Financial ManagementDocument5 pagesSatish Pradhan Dnyanasadhana College: Department of BMS Sample MCQ Questions Subject: Strategic Financial Managementshyam1985No ratings yet

- ACFrOgCJ87XweE1ORK13I2yjbAMpCA3F8IcGcpwOM7Zst d62VpOa - XyXN MuGeegYkBFHwEvDzNOO7UyAo3ZaahtGIUUtsLu9puasYbmvQsTO8CMisioK4V7tRmWf MWfXFiQHjT0hWqlhMM4XDocument8 pagesACFrOgCJ87XweE1ORK13I2yjbAMpCA3F8IcGcpwOM7Zst d62VpOa - XyXN MuGeegYkBFHwEvDzNOO7UyAo3ZaahtGIUUtsLu9puasYbmvQsTO8CMisioK4V7tRmWf MWfXFiQHjT0hWqlhMM4XAngelica PagaduanNo ratings yet

- MFRS 116 PPE - Part 2 NotesDocument39 pagesMFRS 116 PPE - Part 2 NotesWAN AMIRUL MUHAIMIN WAN ZUKAMALNo ratings yet

- Jawaban UAS Akuntansi Lanjutan 2Document6 pagesJawaban UAS Akuntansi Lanjutan 2DANIEL TEJANo ratings yet

- BHEL Presentation Feb 2020Document26 pagesBHEL Presentation Feb 2020Nihal YnNo ratings yet

- 2019 FBS 200 Exam Solution FINALDocument11 pages2019 FBS 200 Exam Solution FINALger pingNo ratings yet

- Corporate Income Taxation 2024Document152 pagesCorporate Income Taxation 2024angelo eleazarNo ratings yet

- Celltrion PDFDocument48 pagesCelltrion PDFIosiasNo ratings yet

- Financial Management For Decision Makers Canadian 2nd Edition Atrill Solutions ManualDocument35 pagesFinancial Management For Decision Makers Canadian 2nd Edition Atrill Solutions Manualalmiraelysia3n4y8100% (26)

- Review of The Accounting ProcessDocument4 pagesReview of The Accounting ProcessAngel TumamaoNo ratings yet