Professional Documents

Culture Documents

Vher$er (CIN) LE5190MH20046011 48838

Uploaded by

Venkatesh W0 ratings0% found this document useful (0 votes)

57 views1 page1) This provisional certificate provides details of interest and principal amounts for MR. KUNDAN KUMAR's housing loan from IDBI Bank for claiming tax deductions in the 2017-2018 financial year.

2) The total interest amount for the period is Rs. 236,190 and the principal amount is Rs. 158,328.

3) Principal repayments through EMIs and prepayments up to March 31, 2018 qualify for a tax deduction under Section 80C if the amounts are paid from taxable income.

Original Description:

Original Title

1641373032-2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) This provisional certificate provides details of interest and principal amounts for MR. KUNDAN KUMAR's housing loan from IDBI Bank for claiming tax deductions in the 2017-2018 financial year.

2) The total interest amount for the period is Rs. 236,190 and the principal amount is Rs. 158,328.

3) Principal repayments through EMIs and prepayments up to March 31, 2018 qualify for a tax deduction under Section 80C if the amounts are paid from taxable income.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

57 views1 pageVher$er (CIN) LE5190MH20046011 48838

Uploaded by

Venkatesh W1) This provisional certificate provides details of interest and principal amounts for MR. KUNDAN KUMAR's housing loan from IDBI Bank for claiming tax deductions in the 2017-2018 financial year.

2) The total interest amount for the period is Rs. 236,190 and the principal amount is Rs. 158,328.

3) Principal repayments through EMIs and prepayments up to March 31, 2018 qualify for a tax deduction under Section 80C if the amounts are paid from taxable income.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

(DEE

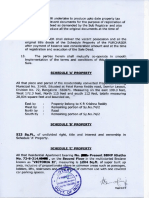

MR, KUNDAN KUMAR 19-12-2017

2ND FLA NO 46 PRAKRUTHI LYT HENNUR CROSS:

NEAR CRYSTAL MANSION APT

BANGALORE

KARNATAKA

Pin Code:- 560043

Phone No:- 919844044170

Ret: Alc no:- 363 / 0363675100002233

‘AC No:- 0363675 100002233

(Customer 1D:- 79420049

TO WHOMSOEVER IT MAY CONCERN

PROVISIONAL CERTIFICATE FOR THE FINANCIAL YEAR 2017-2018

This (so certty that MR. KUNDAN KUMAR/MAS SIKHA_ was sanctioned housing loan trom IDBI Bank Ld. in respect of

the following property

8-501 STH FLR 8 BLK, RAAGA KANNUR VLG, BIDARAHALL! HOBL/

BANGALORE, KARNATAKA

560049

‘The provisional details of Interest and Principal for claiming deduction under Section 24(b) & 80 C of Income Tax Act, 1961

{or the period- 01-04-2017 to 31-03-2018 are as under:

1) Interest from 01-04-2017to 09-03-2018 As, 222535

2)Accrued Interest from 10-03-2018 to 31-03-2018 Rs, 13655

9) Total interest Rs, 236190

4) Principat As, 158328

Notes:

1Linterest is calculated on dally balances at monthly rests. Repayments due Above are exclusive of arrears if any.

interest and Principal lgures are subject to change in case of prepayment/ And/or change in repayment schedule.

‘3.Principal repayments through EMI's and/or Prepayments quailty for deduction Under Section 80 C ifthe amounts are

actually paid by 31-03-2018

4.Deduction under Section 80 C can be claimed only it

1. The repaymentof the loan ls made out of income chargeable to tax and

2. The property for which the loan Is taken Is not transferred before expiry of § years from the end of the financial

‘year In which the possession of such property is obtained

‘THESE CONDITIONS HAVE NOT BEEN VERIFIED BY IDBI BANK LTD.

S.interest payable on the loan (including Pre EMI Interest, if any) is allowed as a deduction under Section 24 (b)

The onus of establishing eligiblity vests with the subject cllent.

‘This Certificate Being Provisional in nature requires

no authorization from IDBI BANK LTD.

IDBI Bank Led. PAN No: AABCIE426

‘Vher$er (CIN) LE5190MH20046011

48838

You might also like

- Housing Loan (0363675100002233) Provisional Certificate-2017-18 PDFDocument1 pageHousing Loan (0363675100002233) Provisional Certificate-2017-18 PDFsikha singh67% (9)

- HOME LOAN INTEREST CERTIFICATE For FY 2021-22Document1 pageHOME LOAN INTEREST CERTIFICATE For FY 2021-22Harish Ghorpade100% (4)

- Unlocking-Wealth-through-Indices-RB Thulane PDFDocument94 pagesUnlocking-Wealth-through-Indices-RB Thulane PDFMathias100% (1)

- To Whomsoever It May Concern Provisional Interest CertificateDocument1 pageTo Whomsoever It May Concern Provisional Interest CertificateSHOBHRAJ MEENA0% (1)

- Unofficial Solutions Manual To R.A Gibbon's A Primer in Game TheoryDocument36 pagesUnofficial Solutions Manual To R.A Gibbon's A Primer in Game TheorySumit Sharma83% (23)

- Lac It Cert 832987 PDFDocument1 pageLac It Cert 832987 PDFManoj Kumar0% (1)

- Bhaveshpriyam@ PDFDocument1 pageBhaveshpriyam@ PDFDonally PatelNo ratings yet

- IT Certificate 622197149Document1 pageIT Certificate 622197149karimshiekNo ratings yet

- Premium Paid Certificate Sandip PatilDocument2 pagesPremium Paid Certificate Sandip Patilbebo03450% (2)

- Housing Laon (0726675100007849) Provisional Certificate PDFDocument1 pageHousing Laon (0726675100007849) Provisional Certificate PDFanon_1747268810% (1)

- Car Loan Nagendra StatementDocument1 pageCar Loan Nagendra Statementnavengg521No ratings yet

- Web It CertDocument1 pageWeb It CertGuna SeelanNo ratings yet

- HHLHYE00424239 Provisional (2019-2020)Document1 pageHHLHYE00424239 Provisional (2019-2020)sanjeevNo ratings yet

- MR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021Document1 pageMR Parmar Krishnarajsinh 554/1, Satyam Society, Sector-22, Gandhinagar, GANDHINAGAR-382021parmarkrishnarajsinh100% (1)

- Botswana Power SectorDocument19 pagesBotswana Power SectorJeremiah MatongotiNo ratings yet

- Housing Loan 0363675100002233 Provisional Certificate 2017 18 PDFDocument1 pageHousing Loan 0363675100002233 Provisional Certificate 2017 18 PDFNeha JainNo ratings yet

- Housing Loan (0363675100002233) Final Certificate - 2016-17 PDFDocument1 pageHousing Loan (0363675100002233) Final Certificate - 2016-17 PDFsikha singh50% (2)

- MR Mangali Srinivas Plot No 96 Sy No 38, Sangareddy, Odf Colony, Sangareddy, MEDAK-502001Document1 pageMR Mangali Srinivas Plot No 96 Sy No 38, Sangareddy, Odf Colony, Sangareddy, MEDAK-5020019440777274mcnuNo ratings yet

- View CertificateDocument1 pageView CertificateSatyanarayana NandulaNo ratings yet

- Provisional Certificate For The Financial Year 2020-2021: To Whomsoever It May ConcernDocument1 pageProvisional Certificate For The Financial Year 2020-2021: To Whomsoever It May ConcernVenkateshNo ratings yet

- View CertificateDocument1 pageView CertificateGopal PenjarlaNo ratings yet

- House ReceiptDocument1 pageHouse ReceiptArunNo ratings yet

- Housing Loan (0363675100002233) Final Certificate - 2015-16 PDFDocument1 pageHousing Loan (0363675100002233) Final Certificate - 2015-16 PDFsikha singh0% (1)

- 7993761947155757203Document1 page7993761947155757203Sourav MohapatraNo ratings yet

- Provisional Certificate For The Financial Year 2021-2022: To Whomsoever It May ConcernDocument2 pagesProvisional Certificate For The Financial Year 2021-2022: To Whomsoever It May ConcernKumar AbhisshekNo ratings yet

- Provisional CertificateDocument1 pageProvisional CertificateNiklesh ChandakNo ratings yet

- Provisional Fy 20-21Document1 pageProvisional Fy 20-21Kedar YadavNo ratings yet

- Web It CertDocument1 pageWeb It Certprashasya duttNo ratings yet

- Loan StatementDocument1 pageLoan Statementsockalingam.mNo ratings yet

- Home Loan AllDocument3 pagesHome Loan Allsumanpal78No ratings yet

- Web It CertDocument1 pageWeb It CertSuppy PNo ratings yet

- Saidarao HomeLoan IT Certificate 624837418Document1 pageSaidarao HomeLoan IT Certificate 624837418Charan KumarNo ratings yet

- Zxyzvyyyyy 1223Document1 pageZxyzvyyyyy 1223VIGNESHNo ratings yet

- HDFCDocument1 pageHDFCKulish JoshiNo ratings yet

- HDFC 1Document1 pageHDFC 1Vivekananda PenumarthiNo ratings yet

- 2137163339215539595Document1 page2137163339215539595raval.sunil955No ratings yet

- HomeloanDocument1 pageHomeloanSamrat MazumderNo ratings yet

- Interest On Housing Loan Provisional Certificate 2020 21Document1 pageInterest On Housing Loan Provisional Certificate 2020 21tabrez khanNo ratings yet

- Provisional Certificate 2018-2019Document1 pageProvisional Certificate 2018-2019RohanNo ratings yet

- Provisional Certificate For The Financial Year 2016-2017: To Whomsoever It May ConcernDocument1 pageProvisional Certificate For The Financial Year 2016-2017: To Whomsoever It May Concernvarsha sekharNo ratings yet

- MR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074Document1 pageMR Javed Mohammad Monis B295, Chattarpur Enclave, PHASE 2, NEW DELHI-110074javedmonis07No ratings yet

- IT Certificate 668951954Document1 pageIT Certificate 668951954Sidharth SNo ratings yet

- HDFC 876Document1 pageHDFC 876Xen Operation DPHNo ratings yet

- HL IT - Certificate - 621058739 FY 23-24 SampleDocument1 pageHL IT - Certificate - 621058739 FY 23-24 SampleGouravpurvi100% (1)

- IDFCFIRSTBankstatement 10086745019Document1 pageIDFCFIRSTBankstatement 10086745019rohit kumarNo ratings yet

- SUSNEHADocument2 pagesSUSNEHAsusnehanalam47No ratings yet

- 4330467076170342677Document1 page4330467076170342677vamsi patnalaNo ratings yet

- DocumentDocument1 pageDocumentkalyan0% (1)

- (Cin) L65190mh2004goi148838Document2 pages(Cin) L65190mh2004goi148838Kantesh KudapaliNo ratings yet

- MR Shaik Mansoor Hussain H NO 87 1101 P 363 A, Ganesh Nagar, 4Th Class Colony, KURNOOL, KURNOOL-518002Document1 pageMR Shaik Mansoor Hussain H NO 87 1101 P 363 A, Ganesh Nagar, 4Th Class Colony, KURNOOL, KURNOOL-518002Shaik MansoorhussainNo ratings yet

- View CertificateDocument1 pageView CertificateadiNo ratings yet

- Web It CertDocument1 pageWeb It CertRana BiswasNo ratings yet

- Interest Certificate HDFCDocument1 pageInterest Certificate HDFCdavidgordan0207No ratings yet

- For Indiabulls Housing Finance LimitedDocument1 pageFor Indiabulls Housing Finance LimitedWild RaacNo ratings yet

- 524243536624287Document1 page524243536624287support marenNo ratings yet

- Loan Details SampleDocument1 pageLoan Details Samplekarthik dNo ratings yet

- 6134467757007882331Document1 page6134467757007882331Nitin GhotekarNo ratings yet

- Address: of The of The Employee 2021-2022Document3 pagesAddress: of The of The Employee 2021-2022Dipak PArmarNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80 (C) (2) (Xviii) OF THE INCOME TAX ACT, 1961Document2 pagesTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80 (C) (2) (Xviii) OF THE INCOME TAX ACT, 1961Vinod Kumar PandeyNo ratings yet

- HHLHYD00208643 ProvisionalDocument1 pageHHLHYD00208643 ProvisionalPranab PaulNo ratings yet

- MR Yogesh #4, Shiva Enclave, Zirakpur, Vill Bhabat, S.A.S NAGAR-140603Document1 pageMR Yogesh #4, Shiva Enclave, Zirakpur, Vill Bhabat, S.A.S NAGAR-140603yogeshNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Screenshot 2022-03-16 at 11.23.42 PMDocument1 pageScreenshot 2022-03-16 at 11.23.42 PMVenkatesh WNo ratings yet

- PredictDocument3 pagesPredictVenkatesh WNo ratings yet

- Most Important Terms and Conditions (Mitc) (For Individual Housing/ Non-Housing Loan)Document2 pagesMost Important Terms and Conditions (Mitc) (For Individual Housing/ Non-Housing Loan)Venkatesh W0% (1)

- Schedule A' Property: Lobbies, Lifts, Staircases Andoth9y Rpe of Common Use With One CoveredDocument1 pageSchedule A' Property: Lobbies, Lifts, Staircases Andoth9y Rpe of Common Use With One CoveredVenkatesh WNo ratings yet

- Aged About 91 Years, S/o. Late Vackayil KrishnaDocument5 pagesAged About 91 Years, S/o. Late Vackayil KrishnaVenkatesh WNo ratings yet

- Thumb PHPDocument1 pageThumb PHPVenkatesh WNo ratings yet

- Model GenDocument1 pageModel GenVenkatesh WNo ratings yet

- Main QimgDocument1 pageMain QimgVenkatesh WNo ratings yet

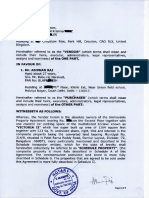

- Residing at S@MBB + Floor, Khirki Ext, Near Green Field SchoolDocument3 pagesResiding at S@MBB + Floor, Khirki Ext, Near Green Field SchoolVenkatesh WNo ratings yet

- Log Train None ResNet None CTCDocument21 pagesLog Train None ResNet None CTCVenkatesh WNo ratings yet

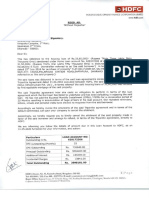

- Incidental Charges - Rs. 13841.00Document1 pageIncidental Charges - Rs. 13841.00Venkatesh WNo ratings yet

- Explain AbilityDocument1 pageExplain AbilityVenkatesh WNo ratings yet

- Log TrainDocument3 pagesLog TrainVenkatesh WNo ratings yet

- Train - Log - None ResNet None CTCDocument25 pagesTrain - Log - None ResNet None CTCVenkatesh WNo ratings yet

- Easy OcrDocument1 pageEasy OcrVenkatesh WNo ratings yet

- Read MeDocument1 pageRead MeVenkatesh WNo ratings yet

- DTRDocument1 pageDTRVenkatesh WNo ratings yet

- Lecture 4 - Insurance Company Operations (FULL)Document31 pagesLecture 4 - Insurance Company Operations (FULL)Ziyi YinNo ratings yet

- Practice Questions On Market IndexDocument3 pagesPractice Questions On Market Indexdpak bhusalNo ratings yet

- Ibm Case Study File-2Document15 pagesIbm Case Study File-2Vishwajeet DasNo ratings yet

- G20 & IndiaDocument2 pagesG20 & IndiaGRAMMAR SKILLNo ratings yet

- RoCond Theories and Procedures Webinar Region XDocument180 pagesRoCond Theories and Procedures Webinar Region Xnhiyzhar monimoNo ratings yet

- Project ProposalDocument7 pagesProject Proposalrehmaniaaa100% (3)

- Position Paper - Upland - CollanoDocument6 pagesPosition Paper - Upland - CollanoJepoyCollanoNo ratings yet

- 1000 Usd Trading PlanDocument1 page1000 Usd Trading PlanM Reza FauziNo ratings yet

- Account Usage and Recharge Statement From 23-Jan-2022 To 21-Feb-2022Document8 pagesAccount Usage and Recharge Statement From 23-Jan-2022 To 21-Feb-2022Lavatech TechnologyNo ratings yet

- Inventory ManagementDocument6 pagesInventory ManagementHimanshu SharmaNo ratings yet

- Thums-Up Party Pack 2.25L (Pack of 2) : Drashti 1001 Garden View BLDG Behind Shimpoli Road Borivali West Mum"-400092Document1 pageThums-Up Party Pack 2.25L (Pack of 2) : Drashti 1001 Garden View BLDG Behind Shimpoli Road Borivali West Mum"-400092Harshal MevadaNo ratings yet

- LESSON 1 The CW and GlobalizationDocument14 pagesLESSON 1 The CW and GlobalizationoykemsNo ratings yet

- Microeconomics An Intuitive Approach With Calculus 2nd Edition Thomas Nechyba Test BankDocument11 pagesMicroeconomics An Intuitive Approach With Calculus 2nd Edition Thomas Nechyba Test Bankjamesgregoryfzwjdynogt100% (26)

- Wages StructureDocument36 pagesWages StructureChaitanya MynampatiNo ratings yet

- Baptisms 27th Jul 1879 To 3rd Dec 1909 by DateDocument219 pagesBaptisms 27th Jul 1879 To 3rd Dec 1909 by Dateapi-20829797650% (4)

- Understanding Industrialisation Collectivisation in UssrDocument11 pagesUnderstanding Industrialisation Collectivisation in UssrMR. EXPLORERNo ratings yet

- Quarterly Brief: Valuation of Early-Stage CompaniesDocument17 pagesQuarterly Brief: Valuation of Early-Stage CompaniesViktorNo ratings yet

- Abe Ends Record Term at Japan Helm: The 300,000-Year Case For The 15-Hour WeekDocument44 pagesAbe Ends Record Term at Japan Helm: The 300,000-Year Case For The 15-Hour WeekHoangNo ratings yet

- UCB - PrithiwishDocument10 pagesUCB - PrithiwishPrithwish SinhaNo ratings yet

- Abstract ICEBAST - Sinta Wulandari and Rina RosalinaDocument5 pagesAbstract ICEBAST - Sinta Wulandari and Rina RosalinaTerieChoi LyceeNo ratings yet

- Mbaf0701 - Far - SyllabusDocument2 pagesMbaf0701 - Far - SyllabusRahulNo ratings yet

- Project ReportDocument15 pagesProject ReportAshish KhadakhadeNo ratings yet

- Naskah Soal PPU English QuizDocument6 pagesNaskah Soal PPU English Quizmiftahul faridNo ratings yet

- Renewable Energy Technologies (Elective) Sample Question Paper (Msbte Study Resources)Document4 pagesRenewable Energy Technologies (Elective) Sample Question Paper (Msbte Study Resources)Lakshman Naik100% (1)

- Office-2ndEd LSC SB 26597Document33 pagesOffice-2ndEd LSC SB 26597Desi LovegoodNo ratings yet

- Indian Villages – Our Strength or WeaknessDocument2 pagesIndian Villages – Our Strength or WeaknessJAY SolankiNo ratings yet

- Assignment # 1: Submitted FromDocument11 pagesAssignment # 1: Submitted FromAbdullah AliNo ratings yet