Professional Documents

Culture Documents

Investment Plan

Uploaded by

Nitin AgarwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Plan

Uploaded by

Nitin AgarwalCopyright:

Available Formats

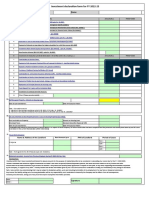

QSS TECHNOSOFT PRIVATE LIMITED

Investment Declaration Form For Tax Saving For Financial Year 2020-2021

Company Qss Technosoft Pvt. Ltd. Emp No 2338 Employee nu

Employee

Name Riya Agrawal PAN Number CGGPA5993L Non submiss

Address Qss Technosoft Pvt. Ltd., Ground Floor, Logix Infotech Park, Sector 59, Noida Date of Joining 25/06/2019

The following Investments will be made by me during the Period April 2020 to March 2021

(PLEASE REFER NOTE BEFORE FILLING UP THE AMOUNTS)

PARTICULARS Max. Amount Your Declaration

a Deduction U/s 10 for( Employees who joined after 1st April 2020, exemption will be considered from DOJ) Monthly Rent No. of Month Annual Amount

House Rent- If the date of joining is after 1st April 2020, please mention No. of month from date of joining till 31st March

2020. Rent below Rs.100000 PA need to be supported only(subject to fulfillment of rent payment) with rent receipt and Rent

of Rs.100000 above per Annum need to be supported with rent receipts , PAN Number of Land Lard and rent agreement

while submitting the proofs during Jan 2021. 8300.00 12 99600.00

b Deduction under Section 24 Property Type Eligibility Your Declaration

Interest on Housing Loan : The home loan must be for purchase and construction of a property, The acquisition or

construction is completed within 5 years(3 Years till Financial Year 2015-16) from the end of the financial year in which the

loan was taken Self Occupied 200000.00

(The Limit is 2,00,000/- for Self Occupied Property and no limit for Let out Property)12 C with calculation for Let out property when applicable is mandatory. Housing Loan - if you have taken the

housing loan and loan is taken prior to 1.4.99 then deduction is allowed up to 30,000/- only. (House property should not be let out for availing this benefit)

c Deduction under Chapter VIA

Sec 80D - Medical Insurance Premium:Rs. 25,000/- exemption is available towards the premium paid for self, spouse & children.Additional

deduction of Rs. 30,000 for insurance on the health of parents have been provided, if the parents are senior citizen(60 years above) then

1 exemption will be up to Rs. 50,000/- 25000.00/ 50000.00

Sec 80DD - Medical treatment/insurance of handicapped dependant (Rs.75000/- exemption for Normal disability, Rs.125000/- for severe 75000.00/

2 disability (ie-80% and above) 125000.00

Sec 80DDB - Medical treatment (specified diseases only) Refer specified deseases tab to know the list of diseases qualify for tax exemption- 40000.00/

3 (In case of senior citizen, the maximum exemption limit is Rs.60000/-) 60000.00

Sec 80E - Interest on higher education loan (For self & dependents)- Exemption is available towards the interest payment on loan subject to

4 availing before 7 years from the date of commencement of loan repayment No Limit

Sec 80G - Donations (On actual Basis, Should submit the original proof of payment to avail the tax benefit) Refer the donation tab to know

5 the institutioins listed under IT and can avail tax exemption through salary On Actual Basis

Sec 80U - Handicapped (Self)-In case of normal disability exemption allowed is Rs.75000/- & in case of severe disability exemption allowed 75000.00/

6 is Rs.1,25,000/- 125000.00

Deduction under sec.80C The maximum amount of investments qualifying for exemption u/s 80C including Employee contribution towards

d PF is Rs 1,50,000/-.

1 Pension Plan ( Dependents as per IT act)

2 Life Insurance Premium ( Dependents as per IT act)

3 Public Provident Fund ( Dependents as per IT act)

4 Deposit in NSC

5 Interest on NSC reinvested (unto 5th completed year only)

6 ULIP of UTI/LIC ( Dependents as per IT act)

7 Principal Loan (Housing Loan) Repayment (Repayment of Principal Amount of Housing Loan and payment of Stamp duty & Registration fee)

8 NPS

8 Mutual Funds

9 Children tuition Fees (Only school / Tuition Fees)

10 Investment in Specified Equity Shares

11 Term deposit (5 Years and Above)

12 Post office time deposit for 5 year & above

13 Others (Please Specify)

Section 80CCD,80CCD(1B),80CCD(2)Employee can contribute to Government notified Pension Schemes (like National Pension Scheme –

e NPS). The contributions can be upto 10% of the salary (or) Gross Income and Rs 50,000 additional tax benefit u/s 80CCD (1b) In FY 2014-

2016, the maximum tax exemption allowed under Section 80CCD is Rs 1.5 Lakh only. In Financial Year 2016-2017 or Assessment Year

(2017-2017), this will be Rs 1.5 Lakh (u/s 80 CCD 1 ) and additional exemption of Rs 50,000 u/s 80CCD (1b) will be allowed 1,50,000 & 50,000

Previous Employment Salary (Applicable only for the employees who joined after 01/04/2020). Form 12B along with attested copy of statement of Income from

f previous employer is mandatory

1 PE income after Section 10 Exemption

2 PE Profession tax paid

3 PE Provident Fund Paid

4 List Others deductions allowed by Previous employer

Declaration: I RIYA AGRAWAL hereby declare that I will make investments against my declarations for the purpose of rebate/deduction to be considered in calculating my income tax for the F Y 2020-

2021 and will submit the supporting documents during the yearend proof submission or at the time of resignation . I further undertake that wherever eligible investments are in the name of

spouse/children/dependent parents, the same will be made out of my income and claim thereof shall not be made elsewhere to get Income Tax benefit.

Riya

Date: 11/1/2021 Employee Signature

You might also like

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Atria Institute of TechnologyDocument3 pagesAtria Institute of TechnologykiranNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationDocument1 pageThe ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationLantNo ratings yet

- Investment Declaration Form - FY 2022-23Document7 pagesInvestment Declaration Form - FY 2022-23varaprasadNo ratings yet

- Tax filing title generatorDocument1 pageTax filing title generatorAkshay AcchuNo ratings yet

- Investment Declaration Form - 2022-2023Document3 pagesInvestment Declaration Form - 2022-2023Bharathi KNo ratings yet

- Employee Tax Declaration - FY 22-23-DBMPDocument3 pagesEmployee Tax Declaration - FY 22-23-DBMPthetrilight2023No ratings yet

- Investment Declaration FY 2024-25Document6 pagesInvestment Declaration FY 2024-25Kumar BhaskarNo ratings yet

- Declaration Form 12BB 2022 23Document4 pagesDeclaration Form 12BB 2022 23S S PradheepanNo ratings yet

- IT Declaration Form FY 2018-19Document3 pagesIT Declaration Form FY 2018-19sgshekar3050% (2)

- Tax Decalaration 2023-24Document3 pagesTax Decalaration 2023-24thetrilight2023No ratings yet

- 02 Future Proof Declaration FormatDocument3 pages02 Future Proof Declaration FormatLucy SapamNo ratings yet

- Employee Tax Declaration - AY 2019-20Document4 pagesEmployee Tax Declaration - AY 2019-20mathuNo ratings yet

- Employee Tax Declaration - AY 2019-20Document1 pageEmployee Tax Declaration - AY 2019-20mathuNo ratings yet

- Investment Declaration Form11-12Document2 pagesInvestment Declaration Form11-12girijasankar11No ratings yet

- Employees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022Document3 pagesEmployees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022neeta rautelaNo ratings yet

- Investment Declaration Form For FY - 2017-18Document2 pagesInvestment Declaration Form For FY - 2017-18arunNo ratings yet

- Tax Declaration Form 2021 22Document4 pagesTax Declaration Form 2021 22Kasiviswanathan ChinnathambiNo ratings yet

- Investment Declaration Form F.Y 2023-24Document4 pagesInvestment Declaration Form F.Y 2023-24Aditi Suryavanshi100% (1)

- Investment Proof Submission Form23 24Document6 pagesInvestment Proof Submission Form23 24Bindu madhaviNo ratings yet

- Investment Declaration Form - 2021-22Document3 pagesInvestment Declaration Form - 2021-22rajamani balajiNo ratings yet

- Income Tax Declaration Form FY 22 23 AY 23 24Document2 pagesIncome Tax Declaration Form FY 22 23 AY 23 24kishoreNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionVinayak DhotreNo ratings yet

- Individual-Txation-FY-2018-19-with - JJDocument64 pagesIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYNo ratings yet

- Old Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Document4 pagesOld Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Suhas BNo ratings yet

- Tax Rebate Claim Form-2019Document2 pagesTax Rebate Claim Form-2019Muhammad Hanif SuchwaniNo ratings yet

- Guidelines For Tax Declaration For The Financial Year 2014-15Document10 pagesGuidelines For Tax Declaration For The Financial Year 2014-15Sri vathsan (sri510)No ratings yet

- IT Declaration Form 2019-20Document1 pageIT Declaration Form 2019-20KarunaNo ratings yet

- IDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1Document3 pagesIDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1ragupathi.arumugaNo ratings yet

- DownloadDocument6 pagesDownloadpankhewalegNo ratings yet

- Income Tax Declaration Form FY 22023 24 AY2024 25Document1 pageIncome Tax Declaration Form FY 22023 24 AY2024 25mrleftyftwNo ratings yet

- Income Tax Ready Reckoner 2011-12Document28 pagesIncome Tax Ready Reckoner 2011-12kpksscribdNo ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- Employee Declaration Form 15Document4 pagesEmployee Declaration Form 15Bliss BilluNo ratings yet

- The Financial Kaleidoscope - Feb 2021 (Eng)Document9 pagesThe Financial Kaleidoscope - Feb 2021 (Eng)MdNo ratings yet

- Income Tax Declarations Form (SMCI) FY 2022 2023Document1 pageIncome Tax Declarations Form (SMCI) FY 2022 2023Nitesh KumarNo ratings yet

- Investment Declaration Form 2012-13 PDFDocument1 pageInvestment Declaration Form 2012-13 PDFnovalhemantNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- On Employee Tax SavingDocument21 pagesOn Employee Tax SavingChaitanya MadisettyNo ratings yet

- Form No 12BB FY 2020-21 (AY 2021-22)Document6 pagesForm No 12BB FY 2020-21 (AY 2021-22)Avinash ChandraNo ratings yet

- Investment Declaration Form For The Financial Year 2014 - 15Document7 pagesInvestment Declaration Form For The Financial Year 2014 - 15devanyaNo ratings yet

- Income Tax Actual Proof Submission Form Fy 2021 - 2022Document3 pagesIncome Tax Actual Proof Submission Form Fy 2021 - 2022muralianand92No ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionnikunjrnanavatiNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof Submissiongopikiran6No ratings yet

- Investments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenDocument8 pagesInvestments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenGourav BathejaNo ratings yet

- Tax Proof Forms PDFDocument1 pageTax Proof Forms PDFAnushyantan NicholasNo ratings yet

- Final-Investment Declaration Form FY 19 - 20Document12 pagesFinal-Investment Declaration Form FY 19 - 20Bhupender RawatNo ratings yet

- Tax Declaration FormatDocument1 pageTax Declaration FormatrameshbabumeelaNo ratings yet

- Handbook - Tax Planning Level 1Document22 pagesHandbook - Tax Planning Level 1Prem SagarNo ratings yet

- Employees Declaration For IncomeDocument1 pageEmployees Declaration For Incomehareesh13hNo ratings yet

- Theorem Tax Plan 2012-13Document1 pageTheorem Tax Plan 2012-13Ashwini PadhyNo ratings yet

- Investment GuidelineDocument3 pagesInvestment GuidelineBuchi YarraNo ratings yet

- Aditya Life InsuranceDocument2 pagesAditya Life InsuranceMirzaNo ratings yet

- Employee Proof Submission Form - 2011-12Document5 pagesEmployee Proof Submission Form - 2011-12aby_000No ratings yet

- Income Tax Guide: Key Tax Concepts for Salaried IndividualsDocument19 pagesIncome Tax Guide: Key Tax Concepts for Salaried Individualsharry.anjh3613No ratings yet

- Employees Proof Submission Form (EPSF) - 2010-11Document1 pageEmployees Proof Submission Form (EPSF) - 2010-11amararenaNo ratings yet

- Tax Certificate - 008857356 - 161253Document1 pageTax Certificate - 008857356 - 161253gaurav sharmaNo ratings yet

- IT Declaration Form Revised SalaryDocument1 pageIT Declaration Form Revised SalaryMANUBHOPALNo ratings yet

- IT Declaration FormatDocument2 pagesIT Declaration FormatKamal VermaNo ratings yet

- Class 9Document86 pagesClass 9bmbsnpNo ratings yet

- Instant Systems IncDocument6 pagesInstant Systems IncNitin AgarwalNo ratings yet

- First Download This Sheet Then Edit: HRA Exemption Will Be Minimum of Following 3Document3 pagesFirst Download This Sheet Then Edit: HRA Exemption Will Be Minimum of Following 3deva.the.contender8108No ratings yet

- Freshers Jobs 8 Feb 2022Document13 pagesFreshers Jobs 8 Feb 2022Nitin AgarwalNo ratings yet

- Freshers Jobs 7 Feb 2022Document20 pagesFreshers Jobs 7 Feb 2022Nitin AgarwalNo ratings yet

- Assessable and Taxable IncomeDocument8 pagesAssessable and Taxable Incomedpak bhusalNo ratings yet

- Far Aicpa Questions 2020Document54 pagesFar Aicpa Questions 2020Jon100% (1)

- Insurance Contract Dispute Over Non-DisclosureDocument57 pagesInsurance Contract Dispute Over Non-DisclosureMy Trần HàNo ratings yet

- Commercial Law Review Insurance Law OutlineDocument8 pagesCommercial Law Review Insurance Law OutlineMegan AglauaNo ratings yet

- Can Taxes Be Incentives CEE Lesson PlanDocument9 pagesCan Taxes Be Incentives CEE Lesson PlanYasmin AliNo ratings yet

- Checklist for visa application | Tourism, visiting family and friendsDocument5 pagesChecklist for visa application | Tourism, visiting family and friendsАлла ГідораNo ratings yet

- BINS Bupa Global Claim Form en 2005 21089Document8 pagesBINS Bupa Global Claim Form en 2005 21089R.Pearlsis SophiNo ratings yet

- Acorn Welcome Letter PC v3.7Document2 pagesAcorn Welcome Letter PC v3.7shafiqullahhashumiNo ratings yet

- Professional Practice 1 ReviewerDocument11 pagesProfessional Practice 1 ReviewerAira DavidNo ratings yet

- CEM - Development Finance Project Funding - Mac2021 - Lecture 6Document29 pagesCEM - Development Finance Project Funding - Mac2021 - Lecture 6Tham CherryNo ratings yet

- SHPS Health Care Reimbursement Claim FormDocument3 pagesSHPS Health Care Reimbursement Claim FormmlbissNo ratings yet

- Republic Act No. 9442: AciastDocument4 pagesRepublic Act No. 9442: AciastMarilyn MalaluanNo ratings yet

- Plagiarism Checker Report - A Free Online PlagiarDocument1 pagePlagiarism Checker Report - A Free Online PlagiarAlisaNo ratings yet

- Maid Insurance Policy BenefitsDocument24 pagesMaid Insurance Policy BenefitsgNo ratings yet

- Mugisha Pascal-Assessment of The Factors Affecting The Uptake of The Life Insurance Policy in Uganda A Case Study of SANLAM Insurance LTD, UgandaDocument68 pagesMugisha Pascal-Assessment of The Factors Affecting The Uptake of The Life Insurance Policy in Uganda A Case Study of SANLAM Insurance LTD, Ugandamaq aqNo ratings yet

- Service Agreement HBADocument15 pagesService Agreement HBAMa. Liza PajarojaNo ratings yet

- Investor Preferences Towards Mutual FundsDocument80 pagesInvestor Preferences Towards Mutual FundsVijay MNo ratings yet

- Cm1 Interquestions 100 Day ChallengeDocument58 pagesCm1 Interquestions 100 Day ChallengeMahek ShahNo ratings yet

- Hanad General Trading Financial Statements 2023Document8 pagesHanad General Trading Financial Statements 2023Nyakwar Leoh NyabayaNo ratings yet

- Chapter 3 Fringe & de Minimis BenefitsDocument6 pagesChapter 3 Fringe & de Minimis BenefitsNovelyn Hiso-anNo ratings yet

- Module 1Document52 pagesModule 1Sarim AliNo ratings yet

- Assignment 2Document19 pagesAssignment 2KSNo ratings yet

- Certificate of Insurance: Inbound TravelDocument1 pageCertificate of Insurance: Inbound Travelprisca ncuncuNo ratings yet

- Application Form For Declaration As A Healthcare Service ProviderDocument3 pagesApplication Form For Declaration As A Healthcare Service ProviderAccess Umoja100% (1)

- 2014 IRS Form 990 Sumter Electric Cooperative Return of Tax Exempt OrganizationDocument26 pages2014 IRS Form 990 Sumter Electric Cooperative Return of Tax Exempt OrganizationNeil GillespieNo ratings yet

- Rights and Responsibilities of WorkersDocument10 pagesRights and Responsibilities of Workersharujeons —No ratings yet

- Which of The Following Is The Most Likely Item To Result in A Deferred Tax AssetDocument2 pagesWhich of The Following Is The Most Likely Item To Result in A Deferred Tax AssetAllen KateNo ratings yet

- Impact of Pradhan Mantri Jan-Dhan Yojana: An OvereviewDocument8 pagesImpact of Pradhan Mantri Jan-Dhan Yojana: An OvereviewPawaniGuptaNo ratings yet

- Top Indian Bureaucracy News Whispers in The CorridorsDocument1 pageTop Indian Bureaucracy News Whispers in The CorridorsCBS CHANDIGARHNo ratings yet

- 2022 Sheep Productions JV SouthDocument14 pages2022 Sheep Productions JV SouthCatatan Faizin 2No ratings yet