Professional Documents

Culture Documents

3-43. The Following Computations Are For The Decision Tree That Follows

Uploaded by

Something Chic0 ratings0% found this document useful (0 votes)

9 views3 pagesOriginal Title

3-43 to 3-45 Solution

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views3 pages3-43. The Following Computations Are For The Decision Tree That Follows

Uploaded by

Something ChicCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

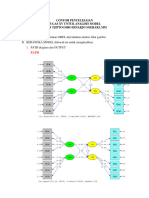

3-43. The following computations are for the decision tree that follows.

EU(node 3) = 0.95(0.78) + 0.5(0.22) = 0.85

EU(node 4) = 0.95(0.27) + 0.5(0.73) = 0.62

EU(node 5) = 0.9(0.89) + 0(0.11) = 0.80

EU(node 6) = 0.9(0.18) + 0(0.82) = 0.16

EU(node 7) = 1(0.5) + 0.55(0.5) = 0.78

EU(conduct survey) = 0.85(0.45) + 0.8(0.55) = 0.823

EU(conduct pilot study) = 0.80(0.45) + 0.7(0.55) = 0.745

EU(neither test) = 0.81

Therefore, the best decision is to conduct the survey. Jim is a risk avoider.

3-44. a. P(good economy | prediction of

good economy) = = 0.923

0.8 0.6 0.1 0.4

P(poor economy | prediction of

good economy) = = 0.077

0.8 0.6 0.1 0.4

P(good economy | prediction of

poor economy) = = 0.25

0.2 0.6 0.9 0.4

P(poor economy | prediction of

poor economy) = = 0.75

0.2 0.6 0.9 0.4

b. P(good economy | prediction of

good economy) = = 0.949

0.8 0.7 0.1 0.3

P(poor economy | prediction of

good economy) = = 0.051

0.8 0.7 0.1 0.3

P(good economy | prediction of

poor economy) = =

0.341

0.2 0.7 0.9 0.3

P(poor economy | prediction of

poor economy) = =

0.659

0.2 0.7 0.9 0.3

3-45. The expected value of the payout by the insurance company is

EV = 0(0.999) + 100,000(0.001) = 100

The expected payout by the insurance company is $100, but the policy costs $200, so the net

gain for the individual buying this policy is negative (–$100). Thus, buying the policy does

not maximize EMV since not buying this policy would have an EMV of 0, which is better

than a negative $100. However, a person who buys this policy would be maximizing the

expected utility. The peace of mind that goes along with the insurance policy has a relatively

high utility. A person who buys insurance would be a risk avoider.

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Decision TheoryDocument32 pagesDecision TheoryAmul Shrestha100% (1)

- Case Problem R.C. ColemanDocument5 pagesCase Problem R.C. ColemanSomething ChicNo ratings yet

- Memo Chapter 3 11th Solution Manual Quantitative Analysis For ManagementDocument46 pagesMemo Chapter 3 11th Solution Manual Quantitative Analysis For ManagementKEANU JOOSTE73% (15)

- LeDucThinh-BABAIU14255-Decision TreeDocument7 pagesLeDucThinh-BABAIU14255-Decision TreeVô Thường50% (2)

- Decision Making (Copy From OR Book)Document103 pagesDecision Making (Copy From OR Book)Rebecca CaquilalaNo ratings yet

- Case Problem 2 Office Equipment, Inc.Document2 pagesCase Problem 2 Office Equipment, Inc.Something ChicNo ratings yet

- Case Problem 1 Regional AirlinesDocument5 pagesCase Problem 1 Regional AirlinesSomething ChicNo ratings yet

- Case Problem 1 Property Purchase StrategyDocument2 pagesCase Problem 1 Property Purchase StrategySomething Chic100% (1)

- Case Problem 3 Truck Leasing StrategyDocument4 pagesCase Problem 3 Truck Leasing StrategySomething ChicNo ratings yet

- Answers To Practice Questions: Risk and ReturnDocument11 pagesAnswers To Practice Questions: Risk and ReturnmasterchocoNo ratings yet

- Case Problem 1 Wagner Fabricating CompanyDocument3 pagesCase Problem 1 Wagner Fabricating CompanySomething ChicNo ratings yet

- 4831 S2016 PS2 AnswerKeyDocument9 pages4831 S2016 PS2 AnswerKeyAmy20160302No ratings yet

- Solutions Manual to accompany Introduction to Linear Regression AnalysisFrom EverandSolutions Manual to accompany Introduction to Linear Regression AnalysisRating: 1 out of 5 stars1/5 (1)

- Case Problem 3 Textile Mill SchedulingDocument4 pagesCase Problem 3 Textile Mill SchedulingSomething ChicNo ratings yet

- Unit II Supplemental Practice ProblemsDocument5 pagesUnit II Supplemental Practice Problemsgunna4liphNo ratings yet

- Quiz 7Document3 pagesQuiz 7朱潇妤No ratings yet

- Decision Science AssignmentDocument9 pagesDecision Science AssignmentBhagyashree NagarkarNo ratings yet

- SFE1.4.2 - UDJ - (SOL) Exam of Mar 2013, For Practice - SOLUTIONSDocument2 pagesSFE1.4.2 - UDJ - (SOL) Exam of Mar 2013, For Practice - SOLUTIONSGonçalo RibeiroNo ratings yet

- Week 2 Exercise Due Date: Submission MethodDocument3 pagesWeek 2 Exercise Due Date: Submission MethodAlya Khaira NazhifaNo ratings yet

- Risk Ppt. Chapter 5Document54 pagesRisk Ppt. Chapter 5Jmae GaufoNo ratings yet

- Midterm Exam Investments May 2010 InstructionsDocument5 pagesMidterm Exam Investments May 2010 Instructions张逸No ratings yet

- Memo Chapter 3 11th Solution Manual Quantitative Analysis For ManagementDocument46 pagesMemo Chapter 3 11th Solution Manual Quantitative Analysis For ManagementSunkanmi FadojuNo ratings yet

- Decision ScienceDocument8 pagesDecision ScienceHimanshi YadavNo ratings yet

- FM09-CH 05Document4 pagesFM09-CH 05Mukul KadyanNo ratings yet

- Chapter Eight End of Chapter Useful Questions and SolutionsDocument18 pagesChapter Eight End of Chapter Useful Questions and SolutionsAbhinav AgarwalNo ratings yet

- Capital StructureDocument11 pagesCapital StructureMira miguelitoNo ratings yet

- Name:Emmanuel Morgan Tembo NUMBER:201702046 Program:Accounting and Finance Course:Financial Management and Risk AppraisalDocument11 pagesName:Emmanuel Morgan Tembo NUMBER:201702046 Program:Accounting and Finance Course:Financial Management and Risk AppraisalEmmanuel Ēzscod TemboNo ratings yet

- 28619156Document6 pages28619156Farjana MouNo ratings yet

- DR Tjip Contoh Penyelesaian Analisis Model Soal IvDocument10 pagesDR Tjip Contoh Penyelesaian Analisis Model Soal IvTiara KemalaNo ratings yet

- Chapter 6 - Problem Solving (Risk)Document5 pagesChapter 6 - Problem Solving (Risk)Shresth KotishNo ratings yet

- Data Analysis For Managers Week 1Document6 pagesData Analysis For Managers Week 1Siva PraveenNo ratings yet

- Exercise 2.1: Historical Simulation MethodDocument8 pagesExercise 2.1: Historical Simulation MethodHang PhamNo ratings yet

- Chapter 5 HW SolnDocument10 pagesChapter 5 HW SolnthemangoburnerNo ratings yet

- Supply & Demand 2Document27 pagesSupply & Demand 2mgpchangNo ratings yet

- Risk Profile: UTILIDAD ESPERADA (2.5) 2900 27.3312Document3 pagesRisk Profile: UTILIDAD ESPERADA (2.5) 2900 27.3312César VallejoNo ratings yet

- MGS3100 Sample Exam Questions #3Document6 pagesMGS3100 Sample Exam Questions #3api-25888404No ratings yet

- Risk 2Document33 pagesRisk 2Alba María Carreño GarcíaNo ratings yet

- Portfolio QuestionsDocument3 pagesPortfolio QuestionsMeshack MateNo ratings yet

- Self-Test 5 FN 211 Matrices and RegressionsDocument5 pagesSelf-Test 5 FN 211 Matrices and RegressionsRaiNz SeasonNo ratings yet

- Summarizing Data - Statistical HydrologyDocument6 pagesSummarizing Data - Statistical HydrologyJavier Avila100% (1)

- Business Statistics Final Exam ExampleDocument19 pagesBusiness Statistics Final Exam ExampleEtulan AduNo ratings yet

- Ans To The Q. No. 1: Interpretation of The Direct Requirement MatrixDocument4 pagesAns To The Q. No. 1: Interpretation of The Direct Requirement MatrixSarwar AlamNo ratings yet

- Chapter 4: Time Value of Money: FIN 301 Homework Solution Ch4Document8 pagesChapter 4: Time Value of Money: FIN 301 Homework Solution Ch4spicegyalNo ratings yet

- Pure Mathematics IA: Ms. TimsonDocument12 pagesPure Mathematics IA: Ms. TimsonGhh FyjNo ratings yet

- Tutorial Chapter 11 - SolutionDocument4 pagesTutorial Chapter 11 - SolutionMahina NozirovaNo ratings yet

- Practice Question - Chaptr 4Document8 pagesPractice Question - Chaptr 4Pro TenNo ratings yet

- ANNUITIESDocument16 pagesANNUITIESDina Jean SombrioNo ratings yet

- Buhlmann Credibility Homework SolutionsDocument11 pagesBuhlmann Credibility Homework Solutionschitechi sarah zakiaNo ratings yet

- Solutions Ch05Document6 pagesSolutions Ch05jessicalaurent1999No ratings yet

- Solution To Chapter 11 Assigned ProblemsDocument4 pagesSolution To Chapter 11 Assigned ProblemsBombitaNo ratings yet

- ConfidenceIntervals MSS Supp VideoDocument23 pagesConfidenceIntervals MSS Supp VideoannaNo ratings yet

- FALLSEM2023-24 CSE3013 ETH VL2023240103712 2023-08-01 Reference-Material-IDocument34 pagesFALLSEM2023-24 CSE3013 ETH VL2023240103712 2023-08-01 Reference-Material-Isiddharth guptaNo ratings yet

- Week 07-Decision Analysis Ch19Document31 pagesWeek 07-Decision Analysis Ch19Nyssa AdiNo ratings yet

- CI For Sign TestDocument4 pagesCI For Sign TestHadia Azhar2558No ratings yet

- MODULE 1 - Investment and Portfolio Mgt.Document23 pagesMODULE 1 - Investment and Portfolio Mgt.Prime Johnson FelicianoNo ratings yet

- Statistics and Probability (Week 3)Document7 pagesStatistics and Probability (Week 3)China PandinoNo ratings yet

- CVG2181 Assignment 1 George&AbdullaDocument5 pagesCVG2181 Assignment 1 George&Abdullatajiw17001No ratings yet

- Answers To Section Two Exercises A Review of Chapters 5 - 7Document7 pagesAnswers To Section Two Exercises A Review of Chapters 5 - 7Jennifer WijayaNo ratings yet

- Solution 1Document8 pagesSolution 1frq qqrNo ratings yet

- Decision Science 1 Ans: A) Probability Tree DiagramDocument10 pagesDecision Science 1 Ans: A) Probability Tree DiagramjakadNo ratings yet

- Practical Examples With STATADocument36 pagesPractical Examples With STATAwudnehkassahun97No ratings yet

- Why The Rule of 10Document9 pagesWhy The Rule of 10Nguyễn TrangNo ratings yet

- Bsc. Sem-Corporate Finance Retake Exam - Solution Guide: August 5, 2016 2 HoursDocument6 pagesBsc. Sem-Corporate Finance Retake Exam - Solution Guide: August 5, 2016 2 HoursDerek LowNo ratings yet

- Principles of Corporate Finance 10th Edition Brealey Solutions ManualDocument14 pagesPrinciples of Corporate Finance 10th Edition Brealey Solutions Manualbrainykabassoullw100% (24)

- Ch. 6: Beta Estimation and The Cost of EquityDocument2 pagesCh. 6: Beta Estimation and The Cost of EquitymallikaNo ratings yet

- FM09-CH 06Document2 pagesFM09-CH 06Mukul KadyanNo ratings yet

- Case Problem 2 Harbor Dunes Golf CourseDocument2 pagesCase Problem 2 Harbor Dunes Golf CourseSomething ChicNo ratings yet

- Case Problem 2 Forecasting Lost SalesDocument2 pagesCase Problem 2 Forecasting Lost SalesSomething ChicNo ratings yet

- Case Problem 2 Distribution Systems DesignDocument6 pagesCase Problem 2 Distribution Systems DesignSomething ChicNo ratings yet

- Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable Costing QuestionsDocument4 pagesPredetermined Overhead Rates, Flexible Budgets, and Absorption/Variable Costing QuestionsSomething ChicNo ratings yet

- Chapter 2 Sol 31-39Document8 pagesChapter 2 Sol 31-39Something ChicNo ratings yet

- What Is PhysicsDocument2 pagesWhat Is PhysicsSomething ChicNo ratings yet

- Case Problem 1 Workload BalancingDocument3 pagesCase Problem 1 Workload BalancingSomething ChicNo ratings yet

- Activity-Based Management and Activity-Based CostingDocument2 pagesActivity-Based Management and Activity-Based CostingSomething ChicNo ratings yet

- Types of LibrariesDocument3 pagesTypes of LibrariesSomething ChicNo ratings yet

- 15-61. The Following Are Independent Audit Situations For Which You Are To Recommend AnDocument4 pages15-61. The Following Are Independent Audit Situations For Which You Are To Recommend AnSomething ChicNo ratings yet

- Chapter 2 Sol 40-43Document6 pagesChapter 2 Sol 40-43Something ChicNo ratings yet

- Chapter 3 Sol 11-20Document4 pagesChapter 3 Sol 11-20Something ChicNo ratings yet

- 3-31 To 3-41 SolutionDocument5 pages3-31 To 3-41 SolutionSomething ChicNo ratings yet

- Case Problem 2 Phoenix ComputerDocument3 pagesCase Problem 2 Phoenix ComputerSomething ChicNo ratings yet

- Case Problem 2 Production StrategyDocument2 pagesCase Problem 2 Production StrategySomething ChicNo ratings yet

- Case Problem 1 Forecasting SalesDocument3 pagesCase Problem 1 Forecasting SalesSomething ChicNo ratings yet

- Case Problem Dealer's Absorbing State Probabilities in Black JackDocument5 pagesCase Problem Dealer's Absorbing State Probabilities in Black JackSomething ChicNo ratings yet

- Case Problem 2 Investment StrategyDocument5 pagesCase Problem 2 Investment StrategySomething ChicNo ratings yet

- Case Problem 1 Textbook PublishingDocument2 pagesCase Problem 1 Textbook PublishingSomething ChicNo ratings yet

- Case Problem 1 Planning An Advertising CampaignDocument4 pagesCase Problem 1 Planning An Advertising CampaignSomething ChicNo ratings yet