Professional Documents

Culture Documents

The Future of Peptide Development in The Pharmaceutical Industry

Uploaded by

Neer SorathiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Future of Peptide Development in The Pharmaceutical Industry

Uploaded by

Neer SorathiaCopyright:

Available Formats

The Future of Peptide Development in the Pharmaceutical Industry

Rodney Lax, Ph.D., Senior Director of Business Development North America, PolyPeptide Group

A couple of weeks ago I was asked how long I thought the current interest in peptides as drug candidates would last

before another class of molecule replaces them. My answer, based on the potential for new leads from genomics and the

length of clinical evaluation, was “about another 20 years”. I realized almost immediately that I have been saying that

for at least the last 10 years. Perhaps it is time to re‐think this one. Obviously, the interest in developing new peptide

therapeutics is going to be around a lot longer.

The growing significance of peptide therapeutics The potential of peptides should be no surprise.

So what has happened in the last decade that indicates Evolution has been honing the specificity of polypeptides

that peptides drugs have a long and secure future? for millions of years. Amino acid sequences –

whether they are in peptides or in proteins – control

Well, first there is increasing amount of statistical and direct all aspects of cellular function and coordinate

evidence to support this1. Forty years ago, back in the most intercellular communication. No other class of

seventies, the average frequency of peptides entering biological molecules offers the range of chemical

clinical trials was just over one per year. Ten and diversity that peptides and proteins possess. They are

twenty years on, it was 5 and 10 per year respectively, nature’s tool kit and the more we can use native

and as we approach the end of this decade, it looks peptides or closely related analogs, the safer and

like the annual number will be close to 20. There are more specific the drugs at the physician’s disposal.

now about 60 approved peptide drugs that will An advantage over small molecules is the fact that the

generate annual sales of approximately US$ 13 billion structural relationships between peptide drug

by the end of 2010. Although this only represents candidates and the physiologically active parent

about 1.5% of all drug product sales the numbers are molecules that they were derived from substantially

increasing dramatically with a current continuous reduces the risk of unforeseen side‐reactions. This is

annual growth rate (CAGR) between 7.5% and 10%. reflected in an over 20% probability of regulatory

There are about 140 peptide candidates in the clinic approval 2 , a rate which is double that of small

and (our best guess) about another 500 – 600 in molecules. In so far as they are composed of naturally

pre‐clinical development. occurring or metabolically tolerable amino acids, they

are generally non‐toxic and, as a result, toxicology

However it is more than just the numbers. Peptide studies often consume vastly more peptide drug

therapeutics are starting to show a maturity that substance than the subsequent clinical trials. Where

reflects their potential for addressing a growing range side‐effects occur, these are often related to dosage or

of medical challenges. While about half of the local reactions at the injection site. In general,

peptides in clinical trials target indications in peptides do not cause serious immune responses,

oncology, metabolic, cardiovascular and infectious although this must always be taken into consideration,

diseases, the total range of therapeutic areas particularly for longer sequences.

addressed encompasses a wide assortment of medical

disorders from endocrinological lesions through to The impact of new technologies

pain and hematology. A noticeable increase in the Peptides have not always been the most popular

number of peptides targeting metabolic disorders has candidates for drugs and it is worth asking why and

heralded a move towards longer and more complex what might have occurred to change the bias against

molecules. There is also a willingness of both the peptides as pharmaceutical agents. For many years,

pharmaceutical industry and its contract manufacturers peptide‐based therapies were regarded as being

to consider production scales of multi‐100 kg and limited to the treatment of hormonal lesions and later

even tons using both solid‐ and solution‐phase hormone‐dependent cancer. Other indications were

synthetic strategies. not obvious at the time. In addition, peptides – due

to their chemical structure – were expensive and

Not that shorter peptides (<10 residues) are going complicated pharmaceuticals to manufacture. They

away and the growing interest in peptide‐based also often had exceptionally short half‐lives making

therapeutic vaccines is currently opening up a whole chronic administration problematic and costly.

new market for such sequences. The manufacture of However, the main downside was the lack of oral

short sequences is significantly more economical than availability. With a few notable exceptions, peptides

for longer peptides (>30 residues). Such sequences, if are degraded to their component amino acids in the

required in large quantities, are also often amenable upper gut. Given the lack of patient compliance with

to solution‐phase approaches that offer scalability drugs that require chronic self‐injection – the

advantages over solid‐phase chemistry. exception being drugs for life‐threatening diseases

10 PharManufacturing: The International Peptide Review

such as Type I diabetes and insulin – wherever the manufacturing at up to a multi‐10 kg or 100‐kg scale

pharmaceutical industry saw an oral alternative they and are more suited to early stage clinical

opted against peptide (and protein‐based) drug development. In contrast to recombinant technology,

candidates. solid phase chemical approaches require significantly

less process development, use mainly generic

In the late 1980s, the introduction of long‐acting chemical and purification procedures, and are less

release (LAR) forms of peptides such as GnRH and personnel intensive in terms of production, quality

somatostatin analogs encapsulated in biodegradable a s s u r a n ce a n d r eg u la to r y a ffa ir s . C h e m i c a l

polymers that only required injection at extended approaches also allow significantly more flexibility in

intervals was a major step in increasing the design of analogs that require unnatural amino acids

acceptability of peptide drug substances. However, or non‐proteogenic components.

it was the advent of pharmaceuticals based on genetic

engineering and recombinant technology that 200‐litre Reactor for

gradually, but radically changed the mindset of the Solid Phase Peptide Synthesis

industry. Paradoxically, these new technologies that

many thought would make “peptide chemistry” ‐ as

a strategy for manufacturing peptides ‐ redundant,

actually succeeded in breaking down the main barrier

to peptide drugs (lack of oral bioavailability) and

caused a surge of interest in the chemical manufacture

of peptides. Genetically engineered proteins offered

a window to previously untreatable medical

conditions and – with it – the industry accepted the

need to develop drugs that could not be orally

administered. It also initiated a massive drive to find

alternative drug delivery platforms (to injection) that

would find patient acceptability and compliance.

Moreover, recombinant technology as a tool for

manufacturing peptides has not made the chemical

synthesis of peptides redundant – far from it. There

are a number of reasons for this. The first has to do

with the nature of recombinant technology itself.

Recombinant processes require substantial design

and development before clinical manufacturing lots

become available. The use and control of biological

organisms and the associated genetic engineering

require extensive quality management and regulatory

control. Downstream processing is usually complex

and customized to the specific product. In spite of the

almost negligible costs of starting materials, the price

of even the smallest scale GMP‐grade manufacturing

lot using fermentation of a recombinant organism is

likely to exceed US$ 1 million with a lead‐time of over

1 year. However, there is no doubt that recombinant

technology will play an increasingly important role

The second reason that chemical synthesis, in particular in peptide manufacturing in the future because

solid‐phase procedures based on Fmoc‐chemistry, is of quantity requirements. A number of peptides

still the manufacturing procedure of choice for such as salmon calcitonin, human glucagon, human

peptides has to do with changes in the peptide PTH (1‐34) and human brain natriuretic factor,

manufacturing industry. The last 15 years has seen a manufactured by recombinant technology, are

remarkable decrease in the cost of solid phase already commercially available. Procedures are

manufacturing – partly due to the cost of raw materials already being developed that allow the use of

and economy of scale, and partly due to the technical redundant codons to introduce unnatural amino

improvements in chromatographic equipment and acids into proteins and peptides, offering

media. There is no doubt that solid‐phase chemistry substantially more flexibility in the peptide sequences

approaches are faster and less expensive for available to this technology.

PharManufacturing: The International Peptide Review 11

Although many costs of chemical manufacture of The two extremes – dipeptides at one end and 50 to

peptides have decreased significantly in recent years, 100‐meric polypeptides at the other – represent

local labor and some solvent costs continue to rise, peptidic molecules of vastly different complexity with

and the unit cost of goods is still a major component significantly divergent physical and chemical

for drug manufacturers. One needs to be aware that properties, as well as different abilities to adopt

the manufacturing cost of some peptide drug secondary and tertiary structures. Small molecules

substances – particularly those above 30 amino acids and biologics are justifiably treated as different

in length – could represent significant challenges to classes of molecules by the regulatory authorities.

the final cost of goods of the drug product if they have Peptides, which span both categories, cannot be

to be given chronically at a high dose (>100 mg/day). assigned in toto to either. Given the mainly non‐toxic

If this is where you plan to go, you would be well nature of peptides, an impurity profile guideline that

advised to do some careful calculations before is based on “dose” and “indication”, or on the factual

committing to long‐term development. Economical data generated in the tox studies, might be more

commercial processes can be developed for most appropriate for those peptides that do not fulfill the

peptides, but significant, maybe multi‐million dollar requirements for small molecules. This is perhaps a

investments may be required along the way to too simplistic approach, and certainly any extrapolation

achieve that goal. Fortunately, many of the longer of data from tox studies can only be justified if the

sequence candidates under development are identical manufacturing process is used for both tox

exceptionally potent with daily doses in the and clinic. Nevertheless, the lack of harmonized

microgram range. guidelines needs addressing.

In passing, one should mention that there are still An unfortunate spin‐off of the lack of clear guidance

some peptides on the market that are isolated from for setting impurity profile specifications is that many

animal sources, but their numbers are dwindling. drug product manufacturers adopt the most

There is also some re‐emerging interest in using conservative and stringent limits for peptides

enzymatic procedures (reversed proteolysis) to (effectively using small molecule API guidelines for

synthesize specific sequences. The use of free amino complex peptides) in order to ensure that “no

acids as opposed to Fmoc‐derivatives as starting regulatory issues” arise. If one considers that most

materials has great economic appeal. peptide drugs have exceptionally low toxicity and are

administered at doses between 50 μg and 50 mg,

Current challenges requiring limits for individual, unidentified

One of the challenges facing the manufacturers of impurities of less than 0.1% constitutes an element of

both peptide drug substances and peptide drug “overkill”. While such caution may be warranted for

products today is the inability of regulatory authorities some products, for many it simply results in an

on different continents to come up with a harmonized unnecessary additional cost of goods.

set of guidelines that define what level of peptide

impurities can be present in peptide therapeutics. It While few companies can – at the start of product

is a challenge for two reasons. First, no‐one in the development – specify the final dose or will be

business is totally sure what is expected of them, and prepared to commit decisively to the commercial

– secondly – designing manufacturing processes to quantities that will eventually be required , a “best

produce a higher quality product than is required guess” of the commercial scale of manufacture, the

adds significantly to the cost of goods, possibly to the time‐line to achieve this and the anticipated cost of

point where an effective drug loses its economic goods helps CMOs design appropriate manufacturing

viability. processes. As a project moves from the multi‐100

gram to the multi‐10 kg scale and beyond, the process

The underlying issue is that the term “peptide” or will almost certainly have to evolve or change. The

even “complex peptide” is too vague to have failure to recognize this early in a project may result

meaningful regulatory usage. Peptides range from in progressing past a point of no return where

sequences containing only 2 amino acids, which are changes are not acceptable from a regulatory or

obviously “small molecules”, to sequences of up to economic standpoint. The choice of counterion is an

100 residues, where historically biochemists arbitrarily example. The solubility and stability of peptides can

decided that anything larger should be called a be influenced by their salt form and the initial choice

protein. That delineation is even fuzzier today where of counterion may be disadvantageous for large scale

– in deference to insulin as the long‐standing border manufacture. However, from a regulatory standpoint

line between recombinant and chemical synthesis – different salt forms of a peptide are considered to be

sequences longer than 50 amino acids are often different drug substances and changing from one to

referred to as “small proteins”. another may, therefore, be challenging.

12 PharManufacturing: The International Peptide Review

For biotech and emerging pharmaceutical companies For peptide API manufacturers one of the current

with their limited budgets, one of the most challenging challenges is matching equipment and other

issues today must be finding the correct balance between resources to meet customer requirements. Most clinical

expediency and due diligence. Many small biotech trials of peptide APIs involve annual quantities

companies do not have quality assurance or regulatory between 10 grams and 10 kilograms. While most of

affairs departments with adequate experience with the larger CMOs are equipped to handle several

peptides. Every CMO knows customers that expect parallel campaigns at this scale, they are not all so

their products to be delivered shortly after the purchase well equipped to make annual quantities of 100

order is issued, if not before. Right quality, right time and kilograms to a ton. There are very few projects that

right price (equating to high purity, expedited delivery routinely exceed 100 kg per year at a single site, the

and low unit cost respectively) are commonly cited goals most commonly cited being those of Fuzeon,

at the start of most projects. Unfortunately these three Eptifibitide and Bivalirudin. The acquisition and

demands are not mutually compatible and one usually maintenance of equipment for this scale of

has to be sacrificed to achieve the other two. In the hurry manufacture is difficult to justify if it is sitting idle for

to move forward, it is often easy to lose sight of the most of the year.

ultimate goals, which should be (a) an expedient approval,

(b) a robust, scalable and economic process, and (c) a The use of large equipment does not always

profitable drug product. Particularly for longer peptides, equate to economy of scale and certainly exposes

the urge to push forward quickly, without duly diligent both sponsor and contract manufacturing

characterization of the active pharmaceutical ingredient, organization (CMO) to enhanced risk if equipment

can result in disaster. Typical issues are the failure to fails. Working at larger scale is usually associated

d e t e ct i mp uri ties wh ic h c an n ot be rem o ved with longer hold times during or between process

chromatographically and then, as a consequence, may steps, conditions which can favor degradation or

require an alternative synthetic approach. Many aggregation. It is not difficult to make a case for the

analytical HPLC systems fail to resolve enantiomeric use of more modest equipment organized in tandem

forms or other isomers (e.g. β‐aspartyl transformations) or parallel configuration. Whatever the process that

of peptides, particularly if the sequences are long. If is eventually chosen to manufacture at a multi‐10 kg

such co‐eluting impurities arise due to degradation of or multi‐100 kg scale, it will probably have been

the peptide during storage, the peptide may continue through significant development and may not

to appear to meet the HPLC purity specifications, but resemble the process of the first GMP lots at all.

lose its pharmaceutical potency. Such impurities are It may not even be based on the same technology,

often missed unless the analytical method is e.g. if the switch to recombinant fermentation is

specifically designed to detect them. made.

Large‐capacity Liquid Phase Synthesis

PharManufacturing: The International Peptide Review 13

Perspective for the future

So what can we expect from peptide therapeutics in

the future?

We can expect the number of peptides entering

clinical trials to grow. We can expect the overall

complexity of peptide APIs, their potency (by design)

and their specificity (including the ability to target

specific organs and cells) to increase. The use of

peptides conjugated to PEGs, carbohydrates, antibod‐

ies and other proteins will become more frequent.

Peptides will not only be used as the active ingredient

of new drugs, but as “add‐ons” to other pharmaceu‐

tical agents to direct them to their targets, to ferry

them across cellular membranes, and to modify their

biological action.

We can expect the range of medical indications that

peptides address to grow. We can expect peptide‐

based antimicrobial peptides to find commercial use.

Almost certainly peptides will find increased usage

to treat obesity, metabolic syndromes and Type 2 diabetes.

The use of membrane‐penetrating peptides will increase

the number of intracellular targets. Peptides will be

used to address currently “undruggable” targets.

We can expect a massive upsurge of interest in peptide

therapeutics to occur once a delivery platform, that

can deliver short‐acting peptides efficiently into the

bloodstream, has been developed. This is not a question

of “if it happens”, but “when”. While an oral route

to obtain maximum compliance would be most desirable,

there are a number of non‐invasive (pulmonary, Although one can never rule out the introduction of

nasal) or minimally invasive (transdermal) devices in new chemistry, solid phase peptide synthesis based

development that might provide suitable and, in on Fmoc‐chemistry will probably continue to be the

terms of efficicacy, more attractive alternatives. “first choice” for the manufacture of most peptides

for some time to come. Changing established

We can expect the introduction of novel formulations approaches of manufacturing is significantly more

and excipients to stabilize peptides at room temperature. difficult in a GMP environment than in the research

We can expect the efficacy of long‐acting formulations laboratory. Manufacturers’ raw materials need to be

to improve and to enable smaller quantities of peptide economically affordable commodities available for all

drug products in the body to maintain activity over scales of production. It is also difficult to draft

longer periods of time. At the same time we should contingency (back‐up, secondary supplier) plans for

not forget that many peptides do not exert their proprietary manufacturing technologies. We will

pharmacological action only when maintained above continue to see a steady increase of new amino acid

a threshold concentration in the body. Indeed, most derivatives, of “exotic” amino acids and reagents.

peptides exert their biological function by acting as New strategies for coupling peptide fragments may

signals; “switching off” can be as important as contribute to peptide chemistry advancing regularly

“switching on”. This requires a combination of into the territory of pharmaceutical manufacture of

pulsatile administration and the ability of the body small proteins without the risk of uncontrollable

to degrade the peptide. One can anticipate that impurity profiles. Perhaps even more likely, we

computerized transdermal or implanted delivery will see the borders between peptide chemistry,

devices may eventually be able to fulfill this function. recombinant fermentation, enzymatic synthesis and

Coupled with physical or chemical targeting devices, bio‐organic chemistry overlap and merge, and

the concept of total temporal and chemical repair of become one set of tools for the design of large scale

hormonal and other “signal function” lesions may manufacturing processes rather than being different

become a reality. branches of contract manufacturing.

14 PharManufacturing: The International Peptide Review

1

One would hope that, as experience with peptides For anyone wanting to view statistics about peptide

grows, the regulatory directives will provide more therapeutics in more detail, the Peptide Therapeutics

guidance to industry as to how specifications for Foundation publishes a bi‐annual report “Development

impurity limits should be set. Without that guidance, Trends for Peptide Therapeutics” and you should

many potential peptide drugs may fall by the wayside visit their website at http://www.peptidetherapeutics.org

due to the technical or economical inability to meet /peptide‐therapeutics‐foundation.html

specifications that are excessively tight.

2

There is a 10 ‐ 12 year lag between a peptide drug

There are also many peptide‐associated issues where candidate entering clinical trials and its potential

new regulatory approaches are needed. Vaccine approval. The probability of regulatory approval can

“cocktails” is one. It is difficult to conceive how the be obtained by analyzing the individual approvals in

current regulatory expectations for peptide APIs for a fixed time period and comparing that with the

therapeutic usage (e.g. limits for impurities) can be number of peptide drug candidates entering clinical

applied to small gram quantities of the several trials 12 years earlier. By analysing consecutive time

peptide components of a vaccine product, which is periods an extrapolated probability can be calculated1.

not administered chronically, and still be economically

viable. Others include polydispersed peptides (e.g. Acknowledgement

poly‐lysine) or peptides attached to polymers which I would like to thank PharManufacturing for letting

currently pose significant challenges to analytical me offer some personal views on the future of peptide

characterization. However, one should not forget that therapeutics and peptide manufacturing. I would

Copaxone, which has the highest current sales for any also like to thank a number of my colleagues in the

peptide therapeutic, with worldwide sales of over PolyPeptide Group for their support reviewing this

US$ 3 billion, falls into the category of polydisperse document and providing suggestions.

hetero‐polypeptides, and is clear proof that a good

drug can “make it” whatever the analytical or About the Author

regulatory challenges. Rodney Lax is Senior Director of Business Development

at PolyPeptide Laboratories in Torrance (California).

As a final comment, we should mention that we He has a B.Sc. in Biochemistry from the University of

– as peptide contract manufacturers – often take Birmingham (UK) and obtained his Ph.D. at the

a retrospective look at those peptide therapeutic I n s titu te o f C a n cer Res ea r ch (Lo n do n , U K ) .

candidates that have made it and those that have Post‐graduate studies were in Germany at the

not. There is really no way of knowing at the start University of Ulm before moving to the University of

which ones will be successful. The only facts we Essen, where he became Associate Professor of

know for sure are that peptide therapeutics are Physiological Chemistry. He has been in the peptide

continuing to flourish and that their foreseeable manufacturing industry since 1986. He moved to his

future is secure. current position in the USA in 2003.

Thin Film Evaporator

PharManufacturing: The International Peptide Review 15

You might also like

- Peptide and Protein DeliveryFrom EverandPeptide and Protein DeliveryChris Van Der WalleRating: 2 out of 5 stars2/5 (1)

- Next Generation Kinase Inhibitors: Moving Beyond the ATP Binding/Catalytic SitesFrom EverandNext Generation Kinase Inhibitors: Moving Beyond the ATP Binding/Catalytic SitesNo ratings yet

- Peptide DrugDocument17 pagesPeptide DrugNADIA INDAH FITRIA NINGRUM -100% (1)

- 1 s2.0 S2590098621000130 MainDocument8 pages1 s2.0 S2590098621000130 MainEgo-free New-earthNo ratings yet

- Protein and Peptide Biopharmaceuticals: An OverviewDocument8 pagesProtein and Peptide Biopharmaceuticals: An OverviewSam SonNo ratings yet

- Zompra 2009Document17 pagesZompra 2009ngoc duy NguyenNo ratings yet

- Zhang 2007Document27 pagesZhang 2007taoufik akabliNo ratings yet

- Craik2012 Konformasi THDP AktivitasDocument12 pagesCraik2012 Konformasi THDP AktivitasHasna NoerNo ratings yet

- Controlled Delivery of Peptides and ProteinsDocument19 pagesControlled Delivery of Peptides and ProteinsVanessya Oscar PermatasariNo ratings yet

- Biopharmaceutical Factory of The Future: PharmaceuticalDocument12 pagesBiopharmaceutical Factory of The Future: PharmaceuticalEE KMNo ratings yet

- Drug Research. Myths, Hype and RealityDocument4 pagesDrug Research. Myths, Hype and RealitymagicianchemistNo ratings yet

- BiosimilarsDocument13 pagesBiosimilarsAhmed Abd El Aziz100% (1)

- Falconer 2011Document8 pagesFalconer 2011Miyyada AichaouiNo ratings yet

- 5 FAQs of Peptide R DDocument6 pages5 FAQs of Peptide R Dsabbira6688No ratings yet

- Peptide Based Drug Discovery Challenges and New Therapeutics Issn Book 59 1st Edition Ebook PDFDocument62 pagesPeptide Based Drug Discovery Challenges and New Therapeutics Issn Book 59 1st Edition Ebook PDFronald.robotham754100% (40)

- Report 2Document13 pagesReport 2api-3711225No ratings yet

- Chemistry in The Pharmaceutical IndustryDocument27 pagesChemistry in The Pharmaceutical IndustryUsi Nur PamilianiNo ratings yet

- Controlled Delivery SystemsDocument12 pagesControlled Delivery SystemsSusan NyaguthiìNo ratings yet

- Drug Delivery Thesis PDFDocument5 pagesDrug Delivery Thesis PDFdnppn50e100% (2)

- J Xphs 2015 12 001Document9 pagesJ Xphs 2015 12 001Suprio KamalNo ratings yet

- Protein PEGylation For The Design of Biobetters From Reaction To Purification ProcessesDocument17 pagesProtein PEGylation For The Design of Biobetters From Reaction To Purification ProcessesjokonudiNo ratings yet

- Global Peptide Therapeutics Market and Pipeline InsightDocument5 pagesGlobal Peptide Therapeutics Market and Pipeline InsightpnspharmaNo ratings yet

- J Ejpb 2004 03 003Document11 pagesJ Ejpb 2004 03 003thanaNo ratings yet

- Use Only: Biosimilars: Lights and Shadows in RheumatologyDocument5 pagesUse Only: Biosimilars: Lights and Shadows in Rheumatologyelenutza1No ratings yet

- Research Paper On Therapeutic ProteinsDocument6 pagesResearch Paper On Therapeutic Proteinsafmcitjzc100% (1)

- Antibodies 11 00001 v3Document21 pagesAntibodies 11 00001 v3fadhilNo ratings yet

- Drug Discovery Research PaperDocument7 pagesDrug Discovery Research Papercaq5kzrg100% (1)

- Future of Medicinal ChemDocument3 pagesFuture of Medicinal ChemJoy OdimegwuNo ratings yet

- Pharmaceuticals: Antimicrobial Peptides in 2014Document28 pagesPharmaceuticals: Antimicrobial Peptides in 2014Hermeson LimaNo ratings yet

- CosmeticsDocument21 pagesCosmeticsg20kpNo ratings yet

- For The Clinician: Biosimilars-Emerging Role in NephrologyDocument8 pagesFor The Clinician: Biosimilars-Emerging Role in NephrologyPeriUmardianaNo ratings yet

- Pharmacogenomics: Current Status and Future PerspectivesDocument13 pagesPharmacogenomics: Current Status and Future PerspectivesSergio VillicañaNo ratings yet

- PHD Thesis Drug Delivery SystemDocument4 pagesPHD Thesis Drug Delivery Systemgj9zvt51100% (2)

- Clinical Applications of PharmacogeneticsDocument304 pagesClinical Applications of PharmacogeneticsJosé Ramírez100% (1)

- Commercial Challenges and Emerging Trends in Oral Delivery of Peptide and Protein Drugs3Document15 pagesCommercial Challenges and Emerging Trends in Oral Delivery of Peptide and Protein Drugs3Arvind SharmaNo ratings yet

- Pharmaceutics 14 02043 v2Document73 pagesPharmaceutics 14 02043 v2Aman kumar singh 013No ratings yet

- Hoffmann 2010 Drug-Discovery-TodayDocument5 pagesHoffmann 2010 Drug-Discovery-Todayfiw ahimNo ratings yet

- Biosimilars Latin AmericaDocument17 pagesBiosimilars Latin AmericamaryNo ratings yet

- Natural Product Chemistry For Drug DiscoveryDocument458 pagesNatural Product Chemistry For Drug DiscoveryUğur ÇiğdemNo ratings yet

- Reverse Pharmacology and Systems Approaches For Drug Discovery and DevelopmentDocument12 pagesReverse Pharmacology and Systems Approaches For Drug Discovery and DevelopmentSreejith SreekumarNo ratings yet

- Hexa Research IncDocument5 pagesHexa Research Incapi-293819200No ratings yet

- Proton-Pump Inhibitors - Understanding The Complications and RisksDocument14 pagesProton-Pump Inhibitors - Understanding The Complications and RisksoscarcheongyjNo ratings yet

- Biotherapeutics As Drugs, Its Delivery Routes and Importance of Novel Carriers in BiotherapeuticsDocument13 pagesBiotherapeutics As Drugs, Its Delivery Routes and Importance of Novel Carriers in BiotherapeuticsVinayNo ratings yet

- Synthetic Peptides and Proteins To Elucidate Biological FunctionDocument11 pagesSynthetic Peptides and Proteins To Elucidate Biological FunctionqhqhqNo ratings yet

- 10 1016@j Jbiotec 2005 06 005 PDFDocument189 pages10 1016@j Jbiotec 2005 06 005 PDFNurismy RamadhaniNo ratings yet

- 1 s2.0 S2211383517306767 MainDocument12 pages1 s2.0 S2211383517306767 MainAlah Bacot.No ratings yet

- Thesis On Novel Drug Delivery SystemDocument5 pagesThesis On Novel Drug Delivery Systemshannonwilliamsdesmoines100% (2)

- Biosimilars ManuDocument6 pagesBiosimilars ManuIshan GhaiNo ratings yet

- Overcoming The Challenges in Administering Biopharmaceuticals - Formulation and Delivery Strategies PDFDocument18 pagesOvercoming The Challenges in Administering Biopharmaceuticals - Formulation and Delivery Strategies PDFvivitri.dewiNo ratings yet

- 7 Vol. 6 Issue 11 November 2015 IJPSR RE 1694Document11 pages7 Vol. 6 Issue 11 November 2015 IJPSR RE 1694Jayshree PatilNo ratings yet

- Drug Delivery System ThesisDocument7 pagesDrug Delivery System Thesistjgyhvjef100% (2)

- Drug ResearchDocument33 pagesDrug ResearchJakobus Benny SalimNo ratings yet

- Introduction To Biotechnology: Pharmaceutical To The Key Word We Can Suggest That The Subject Is About The Development ofDocument5 pagesIntroduction To Biotechnology: Pharmaceutical To The Key Word We Can Suggest That The Subject Is About The Development ofratheeshkumarNo ratings yet

- Biomedical Diagnostics Case Study Option 4Document6 pagesBiomedical Diagnostics Case Study Option 4Avril CoyleNo ratings yet

- Ebook Rang Dales Pharmacology E Book PDF Full Chapter PDFDocument67 pagesEbook Rang Dales Pharmacology E Book PDF Full Chapter PDFbrittany.banks170100% (28)

- Chemistry in The Pharmaceutical Industry Graham S. PoindexterDocument2 pagesChemistry in The Pharmaceutical Industry Graham S. PoindexterRajeswar RanjitkarNo ratings yet

- Comparability Pathway For The Approval of Similar Biologics With Respect To Reference Biologics in Europe and BrazilDocument13 pagesComparability Pathway For The Approval of Similar Biologics With Respect To Reference Biologics in Europe and Brazil10 Adarsh GuptaNo ratings yet

- ArticleDocument8 pagesArticleprachi singhNo ratings yet

- Rang Dales Pharmacology 9Th Edition Various Authors All ChapterDocument67 pagesRang Dales Pharmacology 9Th Edition Various Authors All Chaptercaroline.jones842100% (4)

- Ni 2018Document12 pagesNi 2018BHUMI BHATTNo ratings yet

- Lectures On EnzymesDocument123 pagesLectures On EnzymesProf Rakesh Sharma100% (2)

- Chem 153A UCLADocument83 pagesChem 153A UCLAChrisOrtNo ratings yet

- Nutrition 5 Basic Nutrients L1 ALL SDBakerDocument13 pagesNutrition 5 Basic Nutrients L1 ALL SDBakeralemayehuhatau21No ratings yet

- Exercise On Chemical Composition of The CellDocument7 pagesExercise On Chemical Composition of The CellNorliyana Ali100% (1)

- Concise Biochemistry MCQS: July 2017Document27 pagesConcise Biochemistry MCQS: July 2017nptel nptelNo ratings yet

- Test Bank For Textbook of Biochemistry With Clinical Correlations 7th Edition Thomas M DevlinDocument3 pagesTest Bank For Textbook of Biochemistry With Clinical Correlations 7th Edition Thomas M DevlinJames Carson100% (28)

- Activity 2.11 Trypsin Report of Core Practical Edexcel AsDocument5 pagesActivity 2.11 Trypsin Report of Core Practical Edexcel AsJesse EnglandNo ratings yet

- AQA Biology 2 Revision Notes PDFDocument31 pagesAQA Biology 2 Revision Notes PDFRajashree MuNo ratings yet

- Amino Acid: Met - Asp - Pro - Tyr - Val - THR - UAADocument5 pagesAmino Acid: Met - Asp - Pro - Tyr - Val - THR - UAAkimNo ratings yet

- A Practical Approach To Microarray Data Analysis-Daniel P. BerrarDocument385 pagesA Practical Approach To Microarray Data Analysis-Daniel P. BerrarBashistha KanthNo ratings yet

- Serum Free MediaDocument8 pagesSerum Free MediaVejerla PriyankaNo ratings yet

- CH 06Document6 pagesCH 06Enjie Elrassi100% (1)

- Focus Life Sciences Grade 10 Learner's Boo - UnknownDocument308 pagesFocus Life Sciences Grade 10 Learner's Boo - UnknownAaliyah Ballim79% (24)

- AP Biology Enzyme Kinetics Lab ReportDocument22 pagesAP Biology Enzyme Kinetics Lab ReportVictor Martin88% (8)

- Metabolism Nutrition Part 1 Crash Course AP 36Document8 pagesMetabolism Nutrition Part 1 Crash Course AP 36hwasawereNo ratings yet

- 2023genomic Sequencing in Colombian Coffee Fermentation Reveals New Records of Yeast SpeciesDocument10 pages2023genomic Sequencing in Colombian Coffee Fermentation Reveals New Records of Yeast SpeciesAngels ValenciaNo ratings yet

- 01 Discovery of DNA and RNA - 12-10-21Document6 pages01 Discovery of DNA and RNA - 12-10-21a192062No ratings yet

- L2 BioMolsDocument65 pagesL2 BioMolsSwayamNo ratings yet

- The BiOptimization BlueprintDocument49 pagesThe BiOptimization Blueprintrbj171271No ratings yet

- Activity No. 4 Amino Acids and ProteinsDocument6 pagesActivity No. 4 Amino Acids and ProteinsAngel EspanolNo ratings yet

- GFP TaggingDocument6 pagesGFP TaggingwaterdolNo ratings yet

- Aidd BiiDocument132 pagesAidd BiiMaxwell PryceNo ratings yet

- Introduction To Monomers and Polymers in ChemistryDocument10 pagesIntroduction To Monomers and Polymers in Chemistrygemrod floranoNo ratings yet

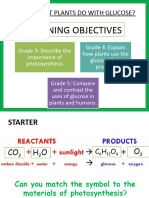

- Lesson 2 Uses of GlucoseDocument12 pagesLesson 2 Uses of Glucosekaniewska262No ratings yet

- Recent Applications of Kirkwood-Buff Theory To Biological SystemsDocument22 pagesRecent Applications of Kirkwood-Buff Theory To Biological SystemsanshuNo ratings yet

- Activity 6 Laboratory ProcedureDocument7 pagesActivity 6 Laboratory ProcedureAinie JuripaeNo ratings yet

- Protein Structure PDFDocument6 pagesProtein Structure PDFmradu1No ratings yet

- Actividad 1 Tema 1Document2 pagesActividad 1 Tema 1David BravoNo ratings yet

- Environmental Science 14th Edition Cunningham Test BankDocument22 pagesEnvironmental Science 14th Edition Cunningham Test Bankmarykirbyifsartwckp100% (12)

- Advances in Genetic Circuit Design Novel Biochemistries, Deep Part Mining, and Precision Gene ExpressionDocument15 pagesAdvances in Genetic Circuit Design Novel Biochemistries, Deep Part Mining, and Precision Gene ExpressionShampa SenNo ratings yet