Professional Documents

Culture Documents

66

66

Uploaded by

Huzzain Pangcoga0 ratings0% found this document useful (0 votes)

7 views1 pageCopyright

© © All Rights Reserved

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 page66

66

Uploaded by

Huzzain PangcogaCopyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 1

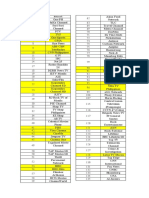

A drawee that accepts a bill of exchange

without acceptance assumes all the warran.

ties of an acceptor under Section 62 of the

NIL (FEBTC 0. Gold Palace Jewellery Compa-

ny, G.R. No. 168274, August 20, 2008).

(2)

If, on the other hand, there is no payment

nor acceptance of a check and there was

dishonor,

the

drawee bank cannot be

sued by the payee even if the dishonor

was wrongful because there is no privity

between the drawee and the payee; there is

no assignment of funds in favor of the payee

when a bill of exchange is issued (1978, 1986,

and 1999 Bar). However, the drawee bank

is liable to its client, the drawer, in case of

wrongful dishonor (1986 Bar).

Drawer - there is secondary liability (1986 Bar).

His warranties are: (1) admits the existence of

payee and his capacity to indorse; (2) engages

that the instrument will be accepted or paid

by the party primarily liable; and (3) engages

that if the instrument is dishonored and proper

proceedings are brought, he will pay to the party

entitled to be paid.

(1)

The drawer is liable to

a

subsequent

indorser who paid the holder on the basis

of the indorser's secondarily liability after

dishonor by non-acceptance (Sec. 151, NIL;

2011 Bar).

(2)

A drawer may sign through an agent and

the agent may sign per procuration which

means that there is a notice that the author-

ity of the agent is limited. In which case,

the holder examining the bill of exchange

must determine the extent of the authority

of the agent. This rule applies to acceptance

or indorsement through an

agent per

procuration (Sec. 21, NIL; 2011 Bar).

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Negotiable Instruments Law: Learning OutcomesDocument14 pagesNegotiable Instruments Law: Learning OutcomesHuzzain PangcogaNo ratings yet

- Barangay PiagmaDocument2 pagesBarangay PiagmaHuzzain PangcogaNo ratings yet

- Cignal Channel ListDocument2 pagesCignal Channel ListHuzzain PangcogaNo ratings yet

- Barangay Piagma: Wendel E. AvisadoDocument6 pagesBarangay Piagma: Wendel E. AvisadoHuzzain PangcogaNo ratings yet

- Negotiable Instruments Law: Learning OutcomesDocument12 pagesNegotiable Instruments Law: Learning OutcomesHuzzain PangcogaNo ratings yet

- Negotiable Instruments Law: Learning OutcomesDocument10 pagesNegotiable Instruments Law: Learning OutcomesHuzzain PangcogaNo ratings yet