Professional Documents

Culture Documents

Introduction To Financial Statement Analysis

Uploaded by

TričiaStypayhørliksønOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To Financial Statement Analysis

Uploaded by

TričiaStypayhørliksønCopyright:

Available Formats

Friday, 21 August 2020 8:14 pm

REVIEW OF BASIC ACCOUNTING

Accounting is the process of recording, classifying, summarizing and interpreting. ACRONYMS TO REMEMBER

It is the process of identifying, measuring and communicating economic

information to permit informed judgement and decision by users of the AICPA - American Institute of Certified

Public Accountants

information. Accounting provides quantitative information that is useful for AAA - American Accounting

economic decisions. Association

ASC - Accounting Standards

Codification

4 ASPECTS OR PROCESSES OF ACCOUNTING PICPA - Philippine Institute of Certified

Public Accountants

1. Recording - writing down of business transactions

2. Classifying - sorting similar ad related transactions into A, L, and OE.

3. Summarizing - preparing financial statements.

4. Interpreting - representing the qualitative and quantitative financial

information.

USERS OF ACCOUNTING INFROMATION INTERNAL USERS

- Management

- Owners/Stockholders - Employees

- Investors - Owners

- Government

- Financial Institutions/Creditors EXTERNAL USERS

- Management - Creditors - Investors

- Employees - Tax Authorities - Regulatory Authorities

- Banks (SEC, DOLE)

3 TYPES OF BUSINESS ORGANIZATIONS - Suppliers

1. Sole Proprietorship - owned and managed by one

person. (DTI) 3 TYPES OF PARTNERSHIP

2. Partnership - two or more people, at least one

general partners and some (or many) limited General Partnership - all partners are held

partners. (SEC) liable and responsible for debts.

3. Corporation - owners are those that hold shares Limited Partnership - one partner may or

of stock. Managed by BOD's. (SEC) can invest capital/funds.

Limited Liability Partnership - protects

each partners' personal asset and each

2 TYPES OF CORPORATION partner from debts or liability incurred by

other partners.

C Corporation - separate tax-paying entities

S Corporation - pass-through entities

New Section 1 Page 1

3 TYPES OF BUSINESS OPERATIONS

Service - rendering of services.

Trading or Merchandising - buying and selling of goods.

Manufacturing - production of items to be sold.

Accounting System - methods used by the business to keep records of its financial activities.

Transaction - completed action which can be expressed in monetary terms.

GAAP (Generally Accepted Accounting Principles)

- Accounting principles and processes, standards and underlying assumptions that

are used in preparing financial statements

BASIC ACCOUNTING CONCEPTS & PRINCIPLES

Fundamental Concepts

1. Entity Concept - a business enterprise is separate and distinct from its owner or investor.

2. Periodicity (Time Period) Principle - financial statements are to be divided into specific time

intervals. (specified time periods)

3. Dual Effect - total amount on the left side should always be equal to the right side of the

equation, any change must be matched with a corresponding change in another account.

4. Matching Principle - cost should be matched with the revenue generated.

5. Going Concern - business is expected to continue indefinitely.

6. Accrual Basis - income should be recognized at the time it is earned such as when goods

are delivered or when services have been rendered (also applies to expenses).

7. Stable Monetary Unit - recorded business transaction can be expressed in terms of

currency and the value of currency is assumed to be stable over time.

Other Basic Principles

8. Objectivity Principle - financial statements must be presented with supporting evidence.

9. Historical Cost - all properties and services acquired by the business must be recorded at its

original acquisition cost.

10. Materiality - financial reporting is only concerned with information significant enough to

affect decisions.

11. Adequate Disclosure - all relevant and material information should be reported.

12. Consistency - the approaches used in the reporting must be uniformly employed from

period to period to allow comparison of results between time periods.

New Section 1 Page 2

You might also like

- Accounting 101Document4 pagesAccounting 101Cheche AmpoanNo ratings yet

- Accounting Midterms ReviwerDocument5 pagesAccounting Midterms ReviwermariaNo ratings yet

- Accounting 1Document3 pagesAccounting 1Carmina Dongcayan100% (1)

- Primitive Accounting Middle Ages Industrial Revolution & Corporate Organization Information AgeDocument28 pagesPrimitive Accounting Middle Ages Industrial Revolution & Corporate Organization Information AgePhil Cahilig-GariginovichNo ratings yet

- Integrated AccountingDocument4 pagesIntegrated AccountingJennilou AñascoNo ratings yet

- Chapter-One 1. Introduction To Accounting and Business: Objectives After Studying This Chapter, You Should Be Able ToDocument16 pagesChapter-One 1. Introduction To Accounting and Business: Objectives After Studying This Chapter, You Should Be Able ToAbrha636100% (1)

- LS 1 - ACCOUNTING AND ITS ENVIRONMENT Part 2Document53 pagesLS 1 - ACCOUNTING AND ITS ENVIRONMENT Part 2Danielle Angel Malana100% (1)

- Chapter 1 Int. To Acc. and BusinessDocument13 pagesChapter 1 Int. To Acc. and BusinessSellihom TadesseNo ratings yet

- Financial Accounting Discussion 1Document11 pagesFinancial Accounting Discussion 1Tasha HilarieNo ratings yet

- Accounting Is The Art of RecordingDocument10 pagesAccounting Is The Art of RecordingChristine ChuaNo ratings yet

- Abm1 PPTDocument161 pagesAbm1 PPTPavi Antoni Villaceran100% (1)

- ACCOUNTING-WPS OfficeDocument6 pagesACCOUNTING-WPS OfficeNorjehanie AliNo ratings yet

- BAM 1 - Fundamentals of AccountingDocument33 pagesBAM 1 - Fundamentals of AccountingimheziiyyNo ratings yet

- Accounting and Its EnvironmentDocument27 pagesAccounting and Its EnvironmentMarta MeaNo ratings yet

- Far 1 Accounting For Partnership Corporation Midterms Review CompressDocument12 pagesFar 1 Accounting For Partnership Corporation Midterms Review CompressBuhia, Alexandra DeniceNo ratings yet

- Principle ch-1 EditedDocument14 pagesPrinciple ch-1 Editedfitsum tesfayeNo ratings yet

- External Users: Not Directly Involved. These Are Secondary Users of Financial Information Who Are PartiesDocument8 pagesExternal Users: Not Directly Involved. These Are Secondary Users of Financial Information Who Are PartiesAizel AlindoyNo ratings yet

- Chapter 1-Introduction To Financial Accounting (Acc106)Document17 pagesChapter 1-Introduction To Financial Accounting (Acc106)Syahirah AzlyzanNo ratings yet

- Principles of Accounting (Notes)Document6 pagesPrinciples of Accounting (Notes)hjpa2023-7388-23616No ratings yet

- CHAPTER 1 and 2 Overview and Concepts in AccountingDocument15 pagesCHAPTER 1 and 2 Overview and Concepts in AccountingVin FajardoNo ratings yet

- Acct-1 Chap-1-1Document11 pagesAcct-1 Chap-1-1Natnael GetahunNo ratings yet

- Accounting ReviewerDocument6 pagesAccounting ReviewerFictional PlayerNo ratings yet

- Accounting Concepts An PrinciplesDocument3 pagesAccounting Concepts An PrinciplesDanica QuinacmanNo ratings yet

- Far NotesDocument4 pagesFar NotesMikasa AckermanNo ratings yet

- Accounting 101Document6 pagesAccounting 101Gianna ReyesNo ratings yet

- ACT103 - Module 1Document13 pagesACT103 - Module 1Le MinouNo ratings yet

- Lesson 1Document33 pagesLesson 1Cher NaNo ratings yet

- Chapter 1 8Document19 pagesChapter 1 8Ren AikawaNo ratings yet

- Accounting PrinciplesDocument22 pagesAccounting PrinciplesMicah Danielle S. TORMONNo ratings yet

- Fabm MidtermDocument7 pagesFabm MidtermSamantha LiberatoNo ratings yet

- Chapter 1 PPT - UpdatedDocument64 pagesChapter 1 PPT - Updatedjoudaa alkordyNo ratings yet

- Chapter 1 Notes: Created Tags UpdatedDocument6 pagesChapter 1 Notes: Created Tags UpdatedTristan RamosNo ratings yet

- Mfe Finals ReviewerDocument3 pagesMfe Finals ReviewerMerry Joy SolizaNo ratings yet

- Basic Accounting Crash CourseDocument5 pagesBasic Accounting Crash CourseCyra JimenezNo ratings yet

- ACT103 - Topic 1Document3 pagesACT103 - Topic 1Juan FrivaldoNo ratings yet

- BAC 813 - Financial Accounting Premium Notes - Elab Notes LibraryDocument111 pagesBAC 813 - Financial Accounting Premium Notes - Elab Notes LibraryWachirajaneNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Basic ConceptsDocument5 pagesBasic ConceptsAgatha ApolinarioNo ratings yet

- Fabmlt 1Document3 pagesFabmlt 1lemonNo ratings yet

- Basic Accounting-Made EasyDocument20 pagesBasic Accounting-Made EasyRoy Kenneth Lingat100% (1)

- Modules 1Document4 pagesModules 1JT GalNo ratings yet

- I Introduction To AccountingDocument9 pagesI Introduction To AccountingDirck VerraNo ratings yet

- Acctg BasicsDocument5 pagesAcctg BasicsLmark VerdadNo ratings yet

- Development and Basic Concepts of Accounting 1Document10 pagesDevelopment and Basic Concepts of Accounting 1saphirejunelNo ratings yet

- Basic AccountingDocument7 pagesBasic AccountingBaby PinkNo ratings yet

- Acca101 SGDocument4 pagesAcca101 SGBeatrice Dominique C. PepinoNo ratings yet

- Summary 2Document4 pagesSummary 2Anne Thea AtienzaNo ratings yet

- Chapter 1 Class NotesDocument8 pagesChapter 1 Class Notesraviloves07No ratings yet

- Principles of Accounting (Notes)Document5 pagesPrinciples of Accounting (Notes)hjpa2023-7388-23616No ratings yet

- Buss1030 Notes: 1.1 Factors Affecting The Complexity of A Changing Business EnvironmentDocument56 pagesBuss1030 Notes: 1.1 Factors Affecting The Complexity of A Changing Business EnvironmentTINo ratings yet

- Accounting For EMBA Prepared by Ahmed SabbirDocument95 pagesAccounting For EMBA Prepared by Ahmed Sabbirsabbir ahmed100% (1)

- CAT 1 Module (NIAT Encoded)Document245 pagesCAT 1 Module (NIAT Encoded)UFO CatcherNo ratings yet

- Unit 1 - Introduction To Principles of AccountingDocument100 pagesUnit 1 - Introduction To Principles of AccountingNgonga FumbeloNo ratings yet

- Fin Acc TextbookDocument520 pagesFin Acc TextbookjrjhvbydfnNo ratings yet

- Accounting - DoneDocument6 pagesAccounting - Doneayaa caranzaNo ratings yet

- Revised Conceptual Framework 1st LessonDocument18 pagesRevised Conceptual Framework 1st LessonheeeyjanengNo ratings yet

- Far AssignmentDocument5 pagesFar AssignmentMy everyday LifeeeNo ratings yet

- Conceptual Foundation of Company AccountingDocument6 pagesConceptual Foundation of Company AccountingBibhush MaharjanNo ratings yet

- Business EtiquetteDocument1 pageBusiness EtiquetteTričiaStypayhørliksønNo ratings yet

- Behind Closed Doors - CritiqueDocument2 pagesBehind Closed Doors - CritiqueTričiaStypayhørliksønNo ratings yet

- GR NO 208113 - Dolores Diaz Vs PeopleDocument3 pagesGR NO 208113 - Dolores Diaz Vs PeopleTričiaStypayhørliksønNo ratings yet

- G.R. No. 153511 - Case DigestDocument3 pagesG.R. No. 153511 - Case DigestTričiaStypayhørliksønNo ratings yet

- GR NO 208113 - Dolores Diaz Vs PeopleDocument3 pagesGR NO 208113 - Dolores Diaz Vs PeopleTričiaStypayhørliksønNo ratings yet

- Ebook Ebook PDF Short Term Financial Management Fifth Edition PDFDocument41 pagesEbook Ebook PDF Short Term Financial Management Fifth Edition PDFlaura.gray126100% (40)

- Demo Rapidminer New Data April 5Document6 pagesDemo Rapidminer New Data April 5Mohit SainiNo ratings yet

- Sa20190515 PDFDocument4 pagesSa20190515 PDFMitess Boñon BrusolaNo ratings yet

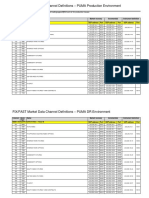

- FIX/FAST Market Data Channel Definitions - PUMA Production EnvironmentDocument3 pagesFIX/FAST Market Data Channel Definitions - PUMA Production EnvironmentVaibhav PoddarNo ratings yet

- HSBCDocument9 pagesHSBCMohammad Mehdi JourabchiNo ratings yet

- 5 Strategic Capacity Planning For Products and ServicesDocument39 pages5 Strategic Capacity Planning For Products and ServicesRubaet HossainNo ratings yet

- Conde Build Enterprises: Official ReceiptDocument1 pageConde Build Enterprises: Official ReceiptCondebuild StaffNo ratings yet

- Pag-Ibig PAMP - NegoSale - Batch - 3 - 102819Document15 pagesPag-Ibig PAMP - NegoSale - Batch - 3 - 102819Patricia Marie ManaliliNo ratings yet

- Original Listing ApplicationDocument4 pagesOriginal Listing ApplicationMihaela GaneaNo ratings yet

- Brokerage Business PlanDocument19 pagesBrokerage Business PlanMuhammad Ahmed50% (4)

- Times-Trib 43 MGDocument28 pagesTimes-Trib 43 MGnewspubincNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument4 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internaszairah jean baquilarNo ratings yet

- Ross12e - CHAPTER 4 - NMIMS - Practice Problems and Solutions For ClassDocument8 pagesRoss12e - CHAPTER 4 - NMIMS - Practice Problems and Solutions For Classwander boyNo ratings yet

- HK Weekly Summary 20230718Document2 pagesHK Weekly Summary 20230718Nabil JazliNo ratings yet

- Sps. Carpo v. ChuamDocument13 pagesSps. Carpo v. ChuamEmma Ruby Aguilar-ApradoNo ratings yet

- Camposol Holding 3q 2020 Presentation PDFDocument23 pagesCamposol Holding 3q 2020 Presentation PDFJorge Zegarra ValverdeNo ratings yet

- Concertina Barb Wire (1) .Xlsxengineering EstimateDocument4 pagesConcertina Barb Wire (1) .Xlsxengineering Estimatepja shanthaNo ratings yet

- 02-06-09 Lynn Federal Court OrderDocument6 pages02-06-09 Lynn Federal Court OrdermderigoNo ratings yet

- FS of Infinity Adventure Farm and ResortDocument35 pagesFS of Infinity Adventure Farm and ResortbeldiansitsolutionsNo ratings yet

- Far660 Jan 2018 SolutionDocument7 pagesFar660 Jan 2018 SolutionHanis ZahiraNo ratings yet

- USBNDocument9 pagesUSBNAhmad Azka PrasetyoNo ratings yet

- Asset Liability ManagementDocument8 pagesAsset Liability ManagementAvinash Veerendra TakNo ratings yet

- Loan Wo Title Islamic Madam Ainul Lecture Notes PDFDocument3 pagesLoan Wo Title Islamic Madam Ainul Lecture Notes PDFFreya MehmeenNo ratings yet

- 41b EnglishDocument28 pages41b Englishபூவை ஜெ ரூபன்சார்லஸ்No ratings yet

- Project Cost ManagementDocument34 pagesProject Cost ManagementJanele PoxNo ratings yet

- Account Management & Client Services: Ashita Gupta 13PGDM136Document71 pagesAccount Management & Client Services: Ashita Gupta 13PGDM136Karan GuptaNo ratings yet

- HRM - AskaribankDocument21 pagesHRM - Askaribankhamidmalik-10% (1)

- Test EksDocument7 pagesTest EksAleksandra AbramovaNo ratings yet

- IDN Times - Taskforce - Media & HomelessDocument1 pageIDN Times - Taskforce - Media & HomelessHanan Rananta ArbiNo ratings yet

- Corporate Disclosure Practices in Indian Software IndustryDocument35 pagesCorporate Disclosure Practices in Indian Software IndustrysiyatuliNo ratings yet