Professional Documents

Culture Documents

(Ans.: (A) (B) (C) (D) (E) Basis Risk) : Direct Systematic Stock Price Volatility

Uploaded by

Lakhan Kodiyatar0 ratings0% found this document useful (0 votes)

7 views5 pagesThis document provides a summary of key concepts from 9 chapters on risk management:

1. It defines different types of risk like market risk, equity risk, interest rate risk, and basis risk. It also identifies the relationship between risk and return, and the role of the Chief Risk Officer.

2. It discusses risk management techniques like diversification, sensitivity analysis, decision tree analysis, and derivatives.

3. It defines risk measurement metrics like beta, R-squared, standard deviation, and duration. It also discusses risk management strategies like risk immunization.

4. It compares financial instruments like forwards, futures, options, swaps, and swaptions.

5. It outlines enterprise risk

Original Description:

Risk management mcq 2

Original Title

RM

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides a summary of key concepts from 9 chapters on risk management:

1. It defines different types of risk like market risk, equity risk, interest rate risk, and basis risk. It also identifies the relationship between risk and return, and the role of the Chief Risk Officer.

2. It discusses risk management techniques like diversification, sensitivity analysis, decision tree analysis, and derivatives.

3. It defines risk measurement metrics like beta, R-squared, standard deviation, and duration. It also discusses risk management strategies like risk immunization.

4. It compares financial instruments like forwards, futures, options, swaps, and swaptions.

5. It outlines enterprise risk

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views5 pages(Ans.: (A) (B) (C) (D) (E) Basis Risk) : Direct Systematic Stock Price Volatility

Uploaded by

Lakhan KodiyatarThis document provides a summary of key concepts from 9 chapters on risk management:

1. It defines different types of risk like market risk, equity risk, interest rate risk, and basis risk. It also identifies the relationship between risk and return, and the role of the Chief Risk Officer.

2. It discusses risk management techniques like diversification, sensitivity analysis, decision tree analysis, and derivatives.

3. It defines risk measurement metrics like beta, R-squared, standard deviation, and duration. It also discusses risk management strategies like risk immunization.

4. It compares financial instruments like forwards, futures, options, swaps, and swaptions.

5. It outlines enterprise risk

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

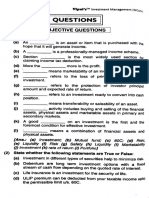

Chapter 1

(1) Fill in the blanks:

(a) Risk and Return have _______relationship with each other.

(b) Market risk is more commonly known as ________risk.

(c) Equity risk is the risk that arises from ________ volatility.

(d) Interest rate risk is the risk that arises from ________of interest rates in economy.

(e) _________is risk due to possible changes in spreads.

[Ans.: (a) Direct; (b) systematic; (c) stock price; (d) Volatility;

(e) Basis risk]

(2) State True or False:

(a) Risk and uncertainty are one and same.

(b) In Risk Management the most critical role is of Chief Risk Officer (CRO).

(c) Market Risk is diversifiable.

(d) Impact cost is used to measure credit risk.

(e) Operating Exposure is kind of foreign exchange risk.

[Ans.: (a) False; (b) True; (c) False; (d) False; (e) True]

Chapter 2

(3) Match the columns:

Column A Column B

(a) Risk management (i) opposite exposure

(b) Exposure netting (ii) reduce financial threat

(c) Managing Liquidity Risk (iii) various assets

(d) Diversification (iv) Storing Liquidity

(e) Fixed income securities (v) Quantitative Risk

Measurement

(f) Sensitivity analysis (vi) Safe Investments

(g) Tornado diagrams (vii) flow diagram

(h) Decision tree analysis (viii) special type of Bar chart

(i) Derivatives (ix) hedge operating exposure

(j) Marketing Strategies (x) Futures and option

[Ans.: (a – ii); (b – i); (c – iv); (d – iii); (e – vi); (f – v);

(g – viii); (h – vii); (i – x); (j – ix)]

Chapter 3

(1) Fill in the blanks:

(a) __________ measures return on a portfolio over and above that predicted by CAPM.

(b) __________ is widely used measure to calculate market risk of a portfolio or security.

(c) __________ is a statistical measure that represents the percentage of a fund or security's

movements that can be explained by movements in a benchmark index.

(d) __________ is square root of variance of rate of return.

(e) __________ is a strategy that matches the durations of assets and liabilities.

(f) The __________ on Banking Supervision provides a forum for regular cooperation on banking

supervisory matters.

(g) __________ is a computerized mathematical technique that allows people to account for risk in

quantitative analysis and decision making.

(h) __________ is defined as first order derivative of price with respect to interest rate.

(i) The __________ is the weighted average term to maturity of the cash flows from a bond.

(j) __________ is a formula that expresses the measurable change in the value of a security in

response to a change in interest rates.

[Ans.: (a) Jensen measure; (b) ; (c) R-squared;

(d) Standard deviation; (e) Risk Immunization; (f) Basel Committee; (g) Simulation; (h) Duration; (i)

Macaulay duration; (j) Modified duration]

Chapter 4

(2) Fill in the blanks:

(a) __________ is an agreement between two people or entities where settlement takes place on

future date at a price which is pre decided.

(b) __________ is an agreement between two people or entities where settlement takes place on

future date at price which is pre decided.

(c) Options are of two type call and __________.

(d) __________ is defined as an agreement where two parties agree to exchange cash flow on a

future date according to a predetermined arrangement.

(e) A call __________ gives its holder right to enter into a swap as a fixed rate payer.

[Ans.: (a) Forward; (b) Futures; (c) put; (d) Swap; (e) Swaption]

(3) True or False:

(a) A put swaption gives its holder right to enter into a swap as a floating rate payer.

(b) Lack of counterparty is not a limitations of swaps.

(c) In risk arbitrage the arbitrageur will buy all of the stocks of the underlying index and sell the futures

for the index.

(d) When foreign-based companies issue stock in their country, these are referred to as ordinary

shares (ORDs).

(e) The risk-return trade-off is the principle that potential return rises with an increase in risk.

[Ans.: (a) True; (b) False; (c) False; (d) True; (e) True]

Chapter 5

(4) Fill in the blanks:

(a) __________ improves an organization’s strategic decision making by addressing threats and

opportunities.

(b) __________ considers only hazard and operational risks that can affect an organization.

(c) COSO stands for __________.

(d) The matrix includes four categories of objectives across the top – strategic, operations,

__________.

(e) __________ analysis is a process that identifies the strengths, weaknesses, opportunities and

threats of an organization

(f) The risk register starts with a __________.

[Ans.: (a) ERM; (b) traditional risk management; (c) Committee of Sponsoring Organizations; (d)

reporting and compliance;

(e) SWOT; (f) risk management plan]

(5) True or false:

(a) ERM looks at additional risks such as environmental, compliance, financial and strategic.

(b) The COSO ERM Framework has four Components and four objectives categories.

(c) ERM concepts in the process include the risk philosophy or risk strategy, risk culture and risk

appetite.

(d) The matrix includes four categories of objectives across the top – strategic, operations, reporting

and compliance.

[Ans.: (a) True; (b) False; (c) True; (d) True]

Chapter 6

(6) True or False:

(a) Risk Governance deals with increasingly complex business operations and activities.

(b) Better capital allocation involves identification of areas of redundancy.

(c) A risk management policy is approved by regional head.

(d) A planning process involving the preparation of business plans and rolling monthly

forecasts.

[Ans.: (a) True; (b) True; (c) False; (d) True]

(7) Match the column:

Column A Column B

(a) risk governance (i) Higher quality information

(b) GRC (ii) systemic approach

(c) Internal audit (iii) listing agreement

(d) Clause 49 (iv) corporate governance

(e) Process optimizations (v) own and manage risk

(f) first line of defence (vi) Non-value-added activities are

eliminated

[Ans.: (a – ii); (b – i); (c – iv); (d – iii); (e – vi); (f – v)]

Chapter 7

(8) Fill in the blanks:

(a) __________ service is an independent professional service with the goal of

improving information.

(b) Assurance services provide independent and professional opinions that reduce __________.

(c) There are basically __________ assurance reports widely known in Assurance Services.

(d) The overall responsibility for the selection of team members rests with the __________.

(e) __________ is fundamental for objective, unbiased and reliable audits.

(f) Many a times lack of __________ may act as a barrier in assurance services.

(g) The lower the level of knowledge and experience, the __________ the probability that an expert

may be required in the team.

(h) In __________, Practitioner shall always express inference in form of written reports.

[Ans.: (a) Risk Assurance; (b) information risk; (c) two; (d) team leader; (e) Auditor independence; (f)

benchmark criteria;

(g) Higher; (h) Risk Assurance]

(9) True or False:

(a) The level of assurance engagement risk is lower in a limited assurance engagement than in a

reasonable assurance engagement.

(b) Auditor independence is fundamental for objective, unbiased and reliable audits.

(c) In Risk Assurance, Practitioner may express inference in form of written or oral reports.

[Ans.: (a) False; (b) True; (c) False]

Chapter 8

(10) Fill in the blanks:

(a) The _________ in a typical corporation are its investors, employees and customers.

(b) ______ are a common type of internal stakeholder and are greatly affected by the outcome of a

business.

(c) ________ are a little difficult to identify, as they do not have a direct relationship with the company.

(d) Government is an example of ___________.

(e) ________ expect quality service and adequate customer care service.

[Ans.: (a) primary stakeholders; (b) Investors; (c) External stakeholders; (d) external stakeholders; (e)

Customers]

(11) True or false:

(a) Customers looks to maximize their wealth.

(b) Some commonly known techniques to meet stakeholder’s expectations and managing

stakeholder’s risk includes analysing stakeholders.

(c) An increase in the number of stakeholders adds stress to the project and influences the project’s

complexity level.

(d) Stakeholders can be internal only.

(e) The most common investors are equity shareholders and bond holders.

[Ans.: (a) False; (b) True; (c) True; (d) False; (e) True]

Chapter 9

(12) Match the column:

Column A Column B

(a) Many multinational insurers (i) supervise insurance business

(b) Insurance Act (ii) joint venture or acquisition

(c) IRDA Reforms (iii) issuance of certificate of

registration

(d) Duties of IRDA (iv) protect the interest of

policyholders

[Ans.: (a – ii); (b – i); (c – iv); (d – iii)]

(13) True or False:

(a) An actuary is a professional dealing with the assessment and management of risk for financial

investments.

(b) Many multinational insurers are entering into developing countries either through joint venture or

through acquisition.

(c) Asia-Pacific presents lesser opportunities for insurers seeking growth.

(d) IRDA is the regulator of the insurance industry in India.

(e) SEBI protects interest of policyholders in India.

(f) Appeals against the orders of IRDAI are to be preferred to SAT.

[Ans.: (a) True; (b) True; (c) False; (d) True; (e) True]

Chapter 10

(14) Fill in the blanks:

(a) __________ is a contract between two parties, the insured and the insurer.

(b) __________ provides life insurance coverage for a specified term.

(c) ULIP stands for __________.

(d) Non-life insurance policies are also known as ________.

(e) __________ also known as insurance for insurers or stop-loss insurance

(f) Under __________, the reinsurer receives a prorated share of the premiums of all policies sold

by the insurer.

(g) __________ is an arrangement between a bank and an insurance company.

(h) __________ is a type of non-proportional coverage in which the reinsurer covers the losses

exceeding the insurer's retained limit.

[Ans.: (a) Life Insurance; (b) Term assurance/insurance; (c) Unit Linked Insurance Plan; (d) General

insurance; (e) Reinsurance;

(f) proportional reinsurance; (g) Bancassurance; (h) Excess-of-loss reinsurance]

(15) State True or False:

(a) Alternative risk transfer enables companies to transfer risks to another party or to capital markets

investors.

(b) The pure premium, which is determined by actuarial studies, consists of that part of the premium

necessary to pay for claims and claims related expenses.

(c) An insurance claim is a formal request to an insurance company asking for a payment based on

the terms of the government policy.

[Ans.: (a) True; (b) True; (c) False]

Chapter 11

(16) Fill in the blanks:

(a) As per IRDA regulation surveyor to be appointed within __________ hours.

(b) If the insured person dies during the term of the policy, the __________ arises.

(c) Policy is suitable for the owner of a property, one who holds property in trust or in commission,

individuals/ financial institutions who have financial interest in the property.

(d) In many countries the third party liability cover is broken in two parts, viz.; third party bodily injury

and __________.

(e) __________ refers to amount that equals expected costs, including a fair return to capital.

[Ans.: (a) 72; (b) death claim; (c) Fire insurance; (d) third party property damage; (e) Fair Premium]

(17) True or False:

(a) Surveyor shall communicate his findings to the insurer within 20 days of his appointment.

(b) A life insurance company, upon receiving a claim, shall process the claim after 10 days.

(c) Marine Insurance is a system of financial protection against the happenings of accidental during

sea transportation.

(d) A marine insurance policy undertakes to insure (cover) the insured in the event of a loss caused

by an insured risk.

(e) The premium that just covers expected claim costs is called the pure premium.

[Ans.: (a) False; (b) False; (c) True; (d) True; (e) True]

You might also like

- Life Insurance Exam Questions and Answers PDFDocument13 pagesLife Insurance Exam Questions and Answers PDFDairo GaniyatNo ratings yet

- Risk and Refinements in Capital Budgeting: Multiple Choice QuestionsDocument8 pagesRisk and Refinements in Capital Budgeting: Multiple Choice QuestionsRodNo ratings yet

- Premium Calculator For LIC JEEVAN ANKUR Mr. Arul MuruganDocument15 pagesPremium Calculator For LIC JEEVAN ANKUR Mr. Arul MuruganNarendar KumarNo ratings yet

- (B) Expense RatioDocument11 pages(B) Expense RatioVirender RawatNo ratings yet

- Tybfm Sem Vi QBDocument27 pagesTybfm Sem Vi QBHitesh BaneNo ratings yet

- MCQ (Bold Correct Answer)Document13 pagesMCQ (Bold Correct Answer)Gauresh NaikNo ratings yet

- Cong Thuc Bai Tap TTCKDocument74 pagesCong Thuc Bai Tap TTCKMy TramNo ratings yet

- MB361F-Jan 06Document17 pagesMB361F-Jan 06lokeshgoyal2001100% (1)

- Tybaf Sem 6 Sapm Sample QuestionsDocument11 pagesTybaf Sem 6 Sapm Sample QuestionsKrishna ParabNo ratings yet

- TB 1Document16 pagesTB 1Zuhaib SultanNo ratings yet

- Paper 1-Fundamentals of Economics and Management: MTP - Foundation - Syllabus 2016 - December 2019 - Set 1Document7 pagesPaper 1-Fundamentals of Economics and Management: MTP - Foundation - Syllabus 2016 - December 2019 - Set 1Manirul NirobNo ratings yet

- Financial Management Mcqs With AnswersDocument53 pagesFinancial Management Mcqs With Answersviveksharma51No ratings yet

- Share DocumentDocument1,034 pagesShare DocumentDeepak ChamaNo ratings yet

- Bi - 17 Ubi 516 - Investment ManagementDocument21 pagesBi - 17 Ubi 516 - Investment ManagementNisha PatelNo ratings yet

- Investment Management ObjectivesDocument10 pagesInvestment Management ObjectivesAnjali AnanthakrishnanNo ratings yet

- Paper 1-Fundamentals of Economics and Management: MTP - Foundation - Syllabus 2016 - December 2019 - Set 2Document7 pagesPaper 1-Fundamentals of Economics and Management: MTP - Foundation - Syllabus 2016 - December 2019 - Set 2Manirul NirobNo ratings yet

- Gat Subject Management Sciences Finance Mcqs1 50Document5 pagesGat Subject Management Sciences Finance Mcqs1 50Muhammad NajeebNo ratings yet

- Gat Subject Management - Sciences Finance mcqs51 100 PDFDocument5 pagesGat Subject Management - Sciences Finance mcqs51 100 PDFSamia Khalid0% (1)

- MCQ2 0Document22 pagesMCQ2 0Numan AliNo ratings yet

- Chapter Two: A Market That Has No One Specific Location Is Termed A (N) - MarketDocument9 pagesChapter Two: A Market That Has No One Specific Location Is Termed A (N) - MarketAsif HossainNo ratings yet

- MCQs of Financial ManagementDocument21 pagesMCQs of Financial Managementettappan10No ratings yet

- Compilation of FMSM Telegram McqsDocument17 pagesCompilation of FMSM Telegram McqsAddvit ShrivastavaNo ratings yet

- MCQ - Bba - Investment ManagementDocument15 pagesMCQ - Bba - Investment ManagementRamees KpNo ratings yet

- PAPER-6A Financial Management MCQSDocument64 pagesPAPER-6A Financial Management MCQSgurukhanolkar2004No ratings yet

- FXTM - Model AnswersDocument17 pagesFXTM - Model AnswersRajiv WarrierNo ratings yet

- MCQ SapmDocument15 pagesMCQ SapmMahima SinghNo ratings yet

- ImcfDocument64 pagesImcfHʌɩɗɘʀ AɭɩNo ratings yet

- Caii BRM Model Questions RaviDocument69 pagesCaii BRM Model Questions RaviramunagatiNo ratings yet

- Financial Management - SmuDocument0 pagesFinancial Management - SmusirajrNo ratings yet

- Test Bank International Finance MCQ (Word) Chap 10Document38 pagesTest Bank International Finance MCQ (Word) Chap 10Mon LuffyNo ratings yet

- U5 Risk-Management-Case StudyDocument8 pagesU5 Risk-Management-Case StudyK.SHARVESH 22IH08No ratings yet

- Aifa QBDocument44 pagesAifa QBkrishna chaitanyaNo ratings yet

- Objectives, Case Based Que of TS GrewalDocument42 pagesObjectives, Case Based Que of TS Grewalmamta.bdvrrmaNo ratings yet

- QR Code Collage of Objectives TypeDocument29 pagesQR Code Collage of Objectives Typejaychhugani594No ratings yet

- c2 Financial Markets and Institutions يطDocument6 pagesc2 Financial Markets and Institutions يطfeedbackalone feedbackNo ratings yet

- MCQ Financial Management B Com Sem 51Document17 pagesMCQ Financial Management B Com Sem 51laxmikushwah7272No ratings yet

- Company Analysis and Stock ValuationDocument0 pagesCompany Analysis and Stock ValuationxxxthejobNo ratings yet

- Question PaperDocument19 pagesQuestion PapernoisomeNo ratings yet

- Ipm Objective QuestionsDocument2 pagesIpm Objective QuestionsBabu PaidikalvaNo ratings yet

- ch4TB PDFDocument8 pagesch4TB PDFChan Man Hin0% (2)

- MCQ's For Midterm Test - 7th April 2012Document6 pagesMCQ's For Midterm Test - 7th April 2012Nalin Indika KumaraNo ratings yet

- Chapter 4 - Q&ADocument19 pagesChapter 4 - Q&APro TenNo ratings yet

- Chapter 1 - Intro To CFDocument2 pagesChapter 1 - Intro To CFParth GargNo ratings yet

- MCQ Financial Management B Com Sem 5 PDFDocument17 pagesMCQ Financial Management B Com Sem 5 PDFRadhika Bhargava100% (2)

- MEFA BitsDocument5 pagesMEFA BitsShaik Mohammad MujeebNo ratings yet

- Exam1 BFDocument9 pagesExam1 BFTumaini JM100% (2)

- Practice Quiz 30016 FQDocument17 pagesPractice Quiz 30016 FQJason DanielNo ratings yet

- Accounting Objective QuestionsDocument63 pagesAccounting Objective QuestionsManjunathreddy Seshadri90% (10)

- BFM BDocument12 pagesBFM BMuralidhar GoliNo ratings yet

- QUIZZDocument57 pagesQUIZZmanoj_acharya100% (1)

- B. Com Sem VI Multiple Choice Based Questions For Online University ExamDocument8 pagesB. Com Sem VI Multiple Choice Based Questions For Online University ExamsugamNo ratings yet

- Model Exam - SAPM QPDocument2 pagesModel Exam - SAPM QPAshish kumar MBANo ratings yet

- BFN Alpha 2014 2015Document58 pagesBFN Alpha 2014 2015CHIDINMA ONUORAHNo ratings yet

- MTP - Foundation - Syllabus 2016 - June 2018 - Set 1: Paper - 1 - Fundamentals of Economics and ManagementDocument8 pagesMTP - Foundation - Syllabus 2016 - June 2018 - Set 1: Paper - 1 - Fundamentals of Economics and ManagementLemhar DayaoenNo ratings yet

- Financial ManagementDocument13 pagesFinancial ManagementEliNo ratings yet

- Financial Management Quiz QuestionsDocument6 pagesFinancial Management Quiz QuestionsAlauddin mahammadNo ratings yet

- Cbleecpu 07Document8 pagesCbleecpu 07Sanjay PanickerNo ratings yet

- 14-STRATEGIC MANAGEMENT by MohsinDocument10 pages14-STRATEGIC MANAGEMENT by Mohsinmohsin razaNo ratings yet

- Chapter One: 1. The Primary Goal of Corporate Management Is To - Shareholder WealthDocument8 pagesChapter One: 1. The Primary Goal of Corporate Management Is To - Shareholder WealthAsif HossainNo ratings yet

- CFA 2012: Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyFrom EverandCFA 2012: Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyRating: 3 out of 5 stars3/5 (2)

- RM (CH - 10-11)Document19 pagesRM (CH - 10-11)Lakhan KodiyatarNo ratings yet

- RM (CH - 8-9)Document22 pagesRM (CH - 8-9)Lakhan KodiyatarNo ratings yet

- History of Sustainable DevelopmentDocument2 pagesHistory of Sustainable DevelopmentLakhan KodiyatarNo ratings yet

- SVKM'S Mithibai College of Arts, Chauhan Institute of Science & Amrutben Jivanlal College of Commerce and Economics (Autonomous)Document12 pagesSVKM'S Mithibai College of Arts, Chauhan Institute of Science & Amrutben Jivanlal College of Commerce and Economics (Autonomous)Lakhan KodiyatarNo ratings yet

- Risk Management ProjectDocument12 pagesRisk Management ProjectLakhan KodiyatarNo ratings yet

- Introduction To Liquid FundsDocument7 pagesIntroduction To Liquid FundsLakhan KodiyatarNo ratings yet

- Debentures and BondsDocument13 pagesDebentures and BondsLakhan KodiyatarNo ratings yet

- Factors Responsible For Success and Failure of M&ADocument16 pagesFactors Responsible For Success and Failure of M&ALakhan KodiyatarNo ratings yet

- RM MCQDocument17 pagesRM MCQLakhan KodiyatarNo ratings yet

- RM (CH - 1-3)Document23 pagesRM (CH - 1-3)Lakhan KodiyatarNo ratings yet

- Financial Futures MarketDocument34 pagesFinancial Futures MarketchingNo ratings yet

- I1273818 - International Diploma in GRC - Unit 6Document35 pagesI1273818 - International Diploma in GRC - Unit 6Su H HarthyNo ratings yet

- Security Analysis - Investment ManagementDocument0 pagesSecurity Analysis - Investment ManagementAru BhartiNo ratings yet

- IC-01 Principles PDFDocument196 pagesIC-01 Principles PDFShiva Kumar100% (1)

- Finance AssignmentDocument34 pagesFinance AssignmentJeremy LewNo ratings yet

- Test 3 - PM - ADocument16 pagesTest 3 - PM - ADữ NguyễnNo ratings yet

- Chapter 2Document61 pagesChapter 2Meseret HailemichaelNo ratings yet

- Actuarial FunctionsDocument10 pagesActuarial FunctionsMvn VinayNo ratings yet

- 18 Ifrs 17Document14 pages18 Ifrs 17DM BuenconsejoNo ratings yet

- Synopsis of Banking ProjectDocument2 pagesSynopsis of Banking ProjectAmbalika Deb RoyNo ratings yet

- 18BC8171118 ArbazDocument51 pages18BC8171118 ArbazPiyush GuptaNo ratings yet

- Parodi, Peter - Pricing in General Insurance-CRC Press (2014) - 73-75Document3 pagesParodi, Peter - Pricing in General Insurance-CRC Press (2014) - 73-75Joseph OndariNo ratings yet

- Chapter 8 Key NotesDocument2 pagesChapter 8 Key NotesJapsNo ratings yet

- PrishaPolicy PitchDeckDocument14 pagesPrishaPolicy PitchDeckTanmay GuptaNo ratings yet

- Business Finance Module 4Document9 pagesBusiness Finance Module 4Lester MojadoNo ratings yet

- Principles of InsuranceDocument18 pagesPrinciples of Insurancerk0522No ratings yet

- IFRS 4 Insurance ContractDocument24 pagesIFRS 4 Insurance ContractSalmanNo ratings yet

- Test Bank Fin 220 Chap008 - CompressDocument43 pagesTest Bank Fin 220 Chap008 - CompressRey Josh RicamaraNo ratings yet

- Stages in Policy IssuanceDocument9 pagesStages in Policy IssuanceNeha AmitNo ratings yet

- 2022 INSURANCE LAW Course Outline by Atty. TugadiDocument8 pages2022 INSURANCE LAW Course Outline by Atty. TugadiBethNo ratings yet

- Web Aggregator SyllabusDocument5 pagesWeb Aggregator Syllabussam franklinNo ratings yet

- Objectives of The StudyDocument50 pagesObjectives of The StudyJasmandeep brarNo ratings yet

- Fundamental Legal PrinciplesDocument14 pagesFundamental Legal Principlespankajgupta100% (2)

- Norco Annual Report 2017Document107 pagesNorco Annual Report 2017Jigar Rameshbhai PatelNo ratings yet

- Insurance Past Bar QuestionsDocument3 pagesInsurance Past Bar QuestionsMichelle Mae Mabano100% (2)

- FIN542 Ind. AssignmentDocument10 pagesFIN542 Ind. AssignmentCici KakaNo ratings yet

- 3901 LN1Document3 pages3901 LN1Ayushmaan BhattacharjiNo ratings yet

- SBI Life Smart Money Back Gold Policy Document Form 426Document50 pagesSBI Life Smart Money Back Gold Policy Document Form 426Karthik MadyasthaNo ratings yet