Professional Documents

Culture Documents

Document 11221

Document 11221

Uploaded by

Kathie Alegarme0 ratings0% found this document useful (0 votes)

10 views16 pagesOriginal Title

Document-11221

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views16 pagesDocument 11221

Document 11221

Uploaded by

Kathie AlegarmeCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 16

Saint Columban College

College of Business Education

Pagadian City

Auditing Problems

Midterms.

Instructions: Answer the problems with your mind and when you have no answer let your heart guide you and most of

the time it will be correct.

Problem 1

‘A Company is an importer and wholesaler. Its merchandise is purchased from a number of suppliers and is warehouse

until sold to consumers

In conducting his audit for the year ended December 31,2018, the Company's CFA determined that the system of

internal control was good. Accordingly, he observed the physical inventory at an interim date, November 30, 2018,

instead of year end

The following information was obtained from the general ledger:

Inventory, January 1, 2018 90,000

Inventory, November 30, 2018 225,000

Sales for 11 months ended November 30, 2018 800,000

Sales for the year ended December 31,2018 950,000

Purchases for 11 months ended Nov 30, 2018

(before audit adjustments) 720,000

Purchases for year ended December 31, 2018

(before audit adjustments) 810,000

Additional Information is as follows:

a. Goods received on November 28 but recorded as purchases in December 10,000

b. Deposits made in October 2018 for purchases to be made in 2019 but

charged to Purchases 14,000

¢. Defective Merchandise returned to suppliers:

Total at November 30, 2018 5,000

Total at December 31, 2018 12,000

‘The returns have not been recorded pending receipt of credit memos from the suppliers.

‘The defective goods were not included in the inventory.

4d. Goods shipped in November under FOB destination and received in December

were recorded as purchases in November 18,500

e. Through the carelessness of the client’s warehouseman, certain goods were

damaged in December and sold in the same month at its cost 20,000

F. Audit of the clients November inventory summary revealed the following:

Items duplicated 3,000

Purchased in transit:

under FOB Shipping point 12,000

under FOB destination 18,500

items counted but not included in

the inventory summary 7,000

Errors in extension the overvalued the items 4,000

1. The correct amount of net purchases up to November 30, 2018 is.

A. 716,000

8. 682,500

C. 682,500

. 706,500

2. The correct amount of net purchases up to December 31, 2018 is

A. 765,500

8. 803,000

€. 784,000

D. 789,000

3. The correct inventory on November 30, 2018 is

‘A. 206,500

B. 214,500

c. 237,000

D.218,500

‘4. What is the gross income for eleven months ended November 30, 2018?

A. 234,000

8. 217,000

€. 224,000

D. 237,500

5. What is the estimated inventory on December 31, 2018

‘A. 183,100

8, 175,900

c. 184,400

1. 190,000

Problem 2

Engaged as external auditor of B company on February 28, 2013, you were unable to observe the taking of inventory on

December 31, 2012, which was reported to amount to 360,000. The following data, however, were gathered by you:

Inventory December 31,2011 320,000

Purchases during 2012 43,410,000

Cash sales during 2012 350,000

Shipment received on Dec. 26, 2012, included in

Physical inventory but not recorded as purchases

10,000

Deposits made with suppliers, entered as purchases

goods were no received in 2012 20,000

Collections on Accounts Receivable 1,800,000

Accounts Receivable, Jan 12012 250,000

Accounts Receivable, Dec. 31, 2012 300,000

Gross profit percentage on sales 40%

6. How much is the Total Goods available for Sale?

A. 1,740,000

8. 1,400,000

€. 1,720,000

D. 1,420,000

7. How much is the Cost of Sales?

A. 1,320,000

B. 2,200,000

. 1,310,000

D. 1,300,000

8. How much is the credit sales?

1,850,000

. 1,750,000

- 1,800,000

1,900,000

COeP

9. How much is the inventory per audit?

‘A. 350,000

B. 360,000

C. 380,000

D. 400,000

10. The estimated inventory shortage at December 31, 2012?

‘A. 40,000

8. 50,000

C. 60,000

Do

Problem 3

‘On May 31, 2019, a fire completely destroyed the Work in Process inventory of 8 Company. Physical inventory figures

were published as follows:

As of January 1, 2019 ‘As of May 31, 2019

Raw materials 15,000 30,000

Work-in-Process 50,000 -

Finished Goods 70,000 60,000

Sales for the five months of 2012 were 150,000. Raw materials purchased were 50,000. Freight no purchases was 5,000.

Direct Labor for the five months was 40,000. To determine the value of lost inventory, the insurance adjusters have

agreed to use an average gross profit rate of 32.5%. Assume that manufacturing overhead was 45% of the direct labor

cost.

11. The value of the goods manufactured and completed as of May 31,2012 was

A. 60,000

8, 90,000

c. 95,000

D.91,250

12. Raw Materials used during the first five months of 2012 were

‘A, 25,000

B, 35,000

¢. 40,000

. 45,000

13, The total value of goods put into process during the five-month period amounted to

A. 143,000

8, 150,000

C. 168,000

, 148,000

1A, The valve of the destroyed work-in-process inventory as determined by the insurance adjusters would be

A. 56,750

8, 65,750

C. 86,750

0. 57,650

Problem 4

‘A portion of the S Company's balance sheet appears as follows:

December 31,2012 December 31, 2011

Assets:

Cash 353,300 100,000

Notes Receivable 0 25,000

Inventory ? 199,875

Liabilities

Accounts Payable 75,000

S company pays for all operating expenses with cash and purchases all inventory on credit. During 2012, cash totaling

471,700 was paid on accounts payable. Operating expenses for 2012 totaled 220,000. All sales are cash sales. The

inventory was restocked by purchasing 1,500 units per month and valued by using periodic FIFO. The unit cost of

inventory was 32.6 during January 2012 and increased .1 per month during the year. S sells only one product. All sales

‘are made for 50 per unit. The ending inventory for 2011 was valued at 32.5 per unit.

15, Total units sold during 2012

‘A. 18,300

8, 18,400

¢.18,500

D. 18,600

16, Total purchases for 2012

‘A. $80,000

B. 585,670

C. 596,700

1D. 592,300

17. Accounts payable on December 31, 2012 is

‘A. 203,530

8. 201,350

. 200,000

D. 201,000

18. How much units is the beginning inventory?

A.6,130

8. 6,000

C.6,200

0. 6,150

A. 192,500

B. 192,950

€. 192,000

D. 193,000

20. Net income for the year ended 2012

‘A. 89,530

8. 95,625

C.96,375,

0.97,235,

Problem 5

The following data were taken from the financial statements of Agnes Inc. a calendar-year merchandi

1. Balance Sheet Data

Dec. 31, 2011 Dec. 31, 2012

Accounts Receivable, Net 84,000 78,000

Inventory 150,000 140,000

Accounts Payable 95,000 98,000

2. Total sales were 1,200,000 for 2012 and 1,100,000 for 2011. Cash sales were 20% of total sales each year.

3. Cost of Goods sold was 840,000 for 2012

4, Variable general and adm

istrative expenses for 2012 were 120,000. They have varied in proportion to sales. 50%

hhave been paid in the year incurred and 50% in the following year. Unpaid general and administrative expenses are not

included in the accounts payable above.

5. Fixed general and administrative expenses, including 35,000 depreciation and 5,000 bad debt expenses, totaled

100,000 each year. 80% of fixed general and administrative expenses involving cash were paid in the year incurred and

20% the following year. Each year there was a 5,000 bad debt estimate and a 5,000 write-off. Unpaid general and

administrative expenses are not included in accounts payable above,

21. Cash collected during 2012 resulting from total sales in 2011 and 2012

‘A. 1,200,000

B. 1,191,000

c. 1,198,000

D. 1,201,000

22.Cash disbursed during 2012 for purchase of merchandise

‘A. 825,000

8. 827,000

c. 828,000

D. 830,000

23, Cash disbursed for 2012 for variable and fixed general and administrative expenses

‘A. 165,000

8. 175,000

c. 188,000

. 195,000

Problem 6

‘You have been asked to review the records and prepare corrected financial statements for Twin Corporation. The books

of account are in agreement with the following balance Sheet

Twin Corporation

BALANCE SHEET

December 31, 2012

Assets lial

Cash 5,000 ‘Accounts Payable 2,000

Accounts Receivable 10,000 Notes Payable 4,000

Notes Receivable 3,000 Share Capital 10,000

Inventory 25,000 Retained Earnings 27,000

Total 43,000 Total 43,000

‘A review of Twin's books indicates that the following errors and omissions had not been corrected during the applicable

years:

Dec. 31 Inventory Inventory Prepaid Unearned Accrued ‘Accrued

Overvalued Undervalued Expense Revenue Expense Revenue

2009 : 6,000 900 - 200 :

2010 7,000 - 700 400 1s 125

2011 8,000 - 00 : 100 -

2012 : 9,000 600 300 50 150

‘According to the books, profits are 5,500 in 2010, 6,500 in 2011, and 7,500 in 2012. No dividends were declared there

years and no adjustments were made to retained earnings. Assume the company started operations in 2009.

24, Adjusted profit (loss) for 2009

a. 7,500

b.14,200

8,500

4. 20,000

25. Adjusted profit (loss) for 2010

a. 7,850

b. (7,850)

©. 7,900

d. (7,900)

26. Adjusted profit (loss) for 2011

5,550

b. 5,650

5,450

.5,750

27. Adjusted profit (loss) for 2012

a. 21,000

b, 22,500

¢. 24,500

4, 25,000

28, Adjusted Retained Earnings in December 31, 2012

a. 27,000

b. 36,500

€. 36,200

36,400

Problem 7

‘The owner of a trading company engaged your services as auditor. There is a discrepancy between the company’s

-ome and the sales volume. The owner suspects that the staff is committing theft. You are to determine whether or

not this is true. Your investigations revealed the following:

1. Physical inventory, taken December 31, 2012 under your observation, showed that cost was 26,500 and market value

25,000. The inventory of January 1, 2012 showed cost of 39,000 and market value of 37,500, Itis the firms practice to

value inventory at “lower of cost or market”. Any loss between cost and market value is included in “Other expenses”

2. The average gross profit rate was 40% of net sales

3. The accounts receivables as of January 1, 2012 were 13,500. During 2012, accounts receivables written off during the

year amounted to 1,000. Accounts receivable as of December 31, 2012 were 37,500

4. Outstanding purchase invoice amounted to 50,000 at the end of 2012. At the beginning of 2012 they were 37,500

5. Receipts from customers during 2012 amounted to 300,000

6. Disbursements to merchandise creditors amounted to 200,000

29, The total sales for 2012

‘A.277,000

8. 300,000

. 324,000

D. 325,000

30. The total purchase for 2012 is

‘A.187,500

8. 200,000

€. 212,500

1D. 325,000

31. Adjusted Inventory as of December 31, 2012

A. 50,000

8. 55,000

C. 60,000

1D. 65,000

32. The amount of inventory shortage is

‘A. 30,000

B. 30,600

C. 45,000

. 95,000

Problem 8

The Isabela Company is a wholesale distributor of automatic replacements parts. Initial amounts taken from Isabela’s

accounting record are as follows:

Inventory at December 31,2012 (based on physical count) is 1,250,000.

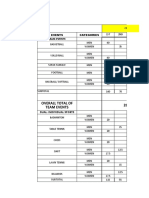

Accounts Payable Schedule at December 31,2012

yeni Terms

/endor

Amount

2/10, net 30

Bee 265,000

net 30

coo. sa0iK00

co. net 30

300,000

feo. net 30

225,000

Feo net 30 :

ecm. net 30 -

Total

41,000,000

Sales in 2012 9,000,000

Additional Information is as follows:

1. Parts held on consignment from C company to Isabela, the consignee, amounting to 155,000, were included in the

physical count of goods in Isabela’s warehouse on December 31,2012 and in accounts payable in December 31, 2012.

2. P 22,000 of parts which were purchased from F Company and paid for in December 2012 were sold in the last week of

2012 and appropriately recorded as sales of 28,000. The parts were included in the physical count of goods in Isabela’s

‘ware house on December 31, 2012 because the parts were in the loading dock waiting to be picked up by the customers.

3, Parts in transit on December 31, 2012, to customers, shipped FOB shipping point on December 28, 2012, amounted to

34,000. The customers receive the parts on Jan 6, 2013. Sales of 40,000 to the customers for the parts were recorded by

Isabela on January 2, 2013.

4. Retailers were holding 210,000 at cost (250,000 at retail) of goods consignment from Isabela, the consigner, at their

stores on 12/31/12.

5. Goods were in transit from G Company to Isabela on December 31, 2012. The cost of good was 25,000 and they were

shipped F.0.8. shipping point on December 29, 2012.

6. A quarterly freight bill in the amount of 2,000 specifically relating to merchandise purchases in December 2012, all of

which was still in the inventory at December 31, 2012, was received on January 3, 2013. The freight bill was not included

in either the inventory or in accounts payable at December 31, 2012.

7. All of the purchases from B Company occurred during the last seven days of the year. These items have been recorded

in accounts payable and accounted for in the physical inventory at cost before discount. Isabela’s policy is to pay

invoiced in time to take advantage of all cash discounts, adjust inventory accordingly and record accounts payable, net

of cash discounts.

33. Total Net adjustments to Inventory

A. 52,700

8. 54,700

60,000

0. 58,000

34, Total Net adjustments to Accounts Payable

A, (133,300)

8, (135,300)

. (135,000)

. (133,000)

35, Adjust Inventory as of December 31, 2012

‘A. 1,302,700

8. 1,304,700

. 1,310,000

D. 1,308,000

36. Adjust Accounts Payable as of December 31, 2012

‘A, 866,700

8. 864,700

C. 865,000

1. 867,000

37 Adjust Sales for 2012

‘A. 9,000,000

8, 9,030,000

.9.040,000

1D. 9,050,000

Problem 9

In connection with your examination of the financial statements of Ruth Tambok, Inc. for the year ended

December 31, 2013, you were able to obtain certain information during your audit of the accounts receivable

and related accounts.

© The December 31, 2013 balance in the Accounts receivable control accounts is P837, 900.

© Anaging schedule of the accounts receivable as of December 31, 2013 is presented bleow:

‘Age Net debit balance Percentage to be applied after

corrections have been made

60 days and under 387, 800 ‘PERCENT

61 to 90 days 307, 100 2 PERCENT

91 to 120 days 89, 800 5 PERCENT |

‘Over 120 days 53, 200 Definitely uncollectible,

9,000; the remainder is

estimated to be 25%

uncollectible

Total P837, 900

‘Two entries made in the Doubtful Accounts Expense account were:

1. A debit on December 31 for the amount of the credit to the allowance for doubtful accounts.

2. Acredit for P6, 100 on November 30, 2013, and a debit to Allowance for Doubtful Accounts

because of a bankruptcy. The related sales took place on October 1, 2013.

‘* The allowance for Doubtful Accounts schedule is presented below:

Debit Credit | Balance

January 1, 2013 P19, 700

November 30, 2013 P6, 100 13, 600

December 31, 2013 P41, 895 P55, 945

(P837, 900 X 5%)

‘© There is a credit balance in one account receivable (61 to 90 days) of P11,000; it represents an advance

on sales contract.

Required:

Based on the above and the result of your audit, answer the following:

38. How much is the adjusted balance of accounts receivable as of December 31, 2013?

A. 522,500 |

8. 535,200 :

. 533, 800 {

D. 533,500 f

39. How much is the adjusted balance of the allowance for doubtful accounts as of December 31, 2013?

A. 25,475

823,523

. 25,432

D. 24,522 |

40. How much is the doubtful accounts expense for the year 20132 |

A. 19,252

B. 20, 875

€.18,523

0. 21,524

41. How much is the net adjustment to the doubtful accounts expense account?

A. Decrease by 14,920

8. Increase by 15,120

€. Decrease by 15,120

D. Increase by P14, 920

PROBLEM 10

In connection with the audit of the financial statements of Charm Corporation, your audit senior instructed

you to examine the company’s accounts receivable.

Prior to any adjustments you were able to extract the following balances from Charm’s trial balance as of

December 31, 2013:

Accounts receivable P 1,327, 500

Allowance for doubtful accounts 45, 000

From the schedule of accounts receivable as of December 31, 2013, you determined that this account

includes the following:

Accounts with debit balances:

60 days old and below P715, 500

61 to 90 days, 351, 600

Over 90 days 256,200 P1, 324, 200

Advances to officers 49, 200

Accounts with credit balances (45, 000)

Accounts receivable per GL 1, 327, 500

The credit balance in customer's account represents collection from a customer whose account had been

written of as uncollectible in 2012.

Accounts receivable for more than a year totaling P63, 000 should be written off.

Confirmation replies received directly from customers disclosed the following exceptions:

‘Customer. Customer's comment Audit findings

‘Swernette ‘The good sold on December 1 | The client failed to record

were returned on December _| credit memo no. 23 for P36,

16, 2013 000. The merchandise was

included in the ending

i — _ inventory at cost.

Ramil We do not owe this amount _| Investigation revealed that

*%H@ (bad word).we did not _| goods sold for P48, 000 were

receive any merchandise from | shipped to Ramil on

your company December 29, 2013, terms

FOB shipping point. The goods

were lost in transit and the

shipping company has

acknowledged its

responsibility for the lost

| merchandise.

Jojo Tam entitled to a 10% ‘Anne is an employee of

employee discount. Your bill | Charm.starting November

should be reduced by P3, 600 | 2013, all company employees

were entitled toa special

_ discount.

Efem We have not yet sold the Merchandise billed for P54,

goods. We will remit the 000 were consigned to Efem

proceeds as soon as the goods | on December 30, 2013. The

are sold. goods cost P39, 000.

Dodong, ‘We do not owe you P60, 000. | The sale of merchandise on

We already paid our accounts | December 18, 2013 was paid

as evidenced by OR #1234 —_| by Dodong on January 6,

2014.

Francis Reduce your bill by P4, 500 __| This amount represents

freight paid by the customer

for the merchandise shipped

‘on December 17, 2013, terms,

FOB destination-collect.

Based on your discussion with Charm’s credit manager, you both agreed that an allowance for doubtful

accounts should be maintained using the following rates:

60 days old and below 1%

61 to 90 days 2%

Over 90 days 5

Required:

Based on the above end the result of your audit, answer the following:

42. The adjusted balance of accounts receivable in the 60 days and below category as of December 31,

2013.

A. 615,300

B. 616,000

C. 617, 400

D. None of the Above

43. The adjusted balance of accounts receivable as of December 31, 2013.

A. 1,162, 200

B. 1,250,000

€. 1,120,000

D. 1,350,000

44. The adjusted allowance for doubtful accounts as of December 31, 2013.

‘A. 22,500

B. 22, 866

C. 22,560

D. 23,502

45. The entry to adjust the allowance for doubtful accounts.

A. Allowance for doubtful accounts 4, 134

Doubtful accounts expense 4, 134

8. Doubtful accounts expense 4, 134

Allowance for doubtful accounts 4, 134

C. Allowance for doubtful accounts 4, 155

Doubtful accounts expense 4, 155

D. Doubtful accounts expense 4, 155

Allowance for doubtful accounts 4, 155

46. To gather audit evidence about the proper credit approval of sales, the auditor would selects a sample

cof documents from the population represented by the

a. Bill of lading

b. Customer order file

c. Sales invoice file

d. Subsidiary customers’ account ledger

PROBLEM 11

Efemela Company produces paints and related products for sale to the construction industry throughout

Davao City. While sale have remained relatively stable despite a decline in the amount of new construction,

there has been a noticeable change in the timeliness with which the company’s customers are paying their

bills.

The company sells its products on payment terms of 2/10,n/30. In the past, over 75 percent of the credit

customers have taken advantage of the discount by paying within 10 days of the invoice date. During the year

‘ended December 31, 2013, the number of customers taking the full 30 days to pay has increased. Current

indications are that less than 60% of the customers are now taking the discount. Uncollectible accounts as 2

percentage of total credit sales have risen from the 1.5% provided in the past years to 4% in the current year.

In response to your request for more information on the deterioration of accounts receivable collections the

company’s controller has prepared the following report:

Efemela Company

Accounts receivable Collections

December 31, 2013

The fact that some credit accounts will prove uncollectible is normal. And annual bad debt wite offs had been

1.5% of total credit sales for many years. However, during the year 2013, this percentage increased to 4%. The

accounts receivable balance is P1, 500, 000, and the condition of this balance in terms of age of collection is

shown below:

Proportion to total ‘Age of accounts Probability of collections

64% 1-10 days 99.0%

18% 11-30 days 97.5%

8% Past due 31- 60 days 95.0%

5% Past due 61-120 days 80.0%

3% Past due 121-180 days 65.0%

2% Past due over 180 days 20.0%

At the beginning of the year, the allowance for doubtful accounts had a credit balance of P27, 300. The

company has provided for a monthly bad debt expense accrual during the year based on the assumption that

4% of total credit sales will be uncollectible. Total credit sales for the year 2013 amounted to P8, 000, 000, and

write-offs of uncollectible accounts during the year totaled P22, 500.

Required:

47. How much is the adjusted balance of the allowance for doubtful accounts as of December 31, 2013?

A. P77, 100

8. 76,100

C. 78,500

D. 76,450

48. The necessary adjusting entry to adjust the allowance for doubtful accounts as of December 31, 20137

A. Allowance for doubtful accounts 22,300

Doubtful accounts expense 22,300

8. Doubtful accounts expense 22,300

Allowance for doubtful accounts 22,300

C. Allowance for doubtful accounts 21,200

Doubtful accounts expense 21,200

D. Doubtful accounts expense 21,200

Allowance for doubtful accounts 21,200

49. An aging analysis of accounts receivable would provide an indication as to the

a. Validity of the accounts

b. Integrity of the credit grantors

€. Collectability of the accounts

4. Solvency of the customers

50. Which account balance is most likely to be misstated if an aging of accounts receivable is not

performed?

a. Allowance for bad debts

b. Accounts receivable

€. Sales returns and allowances

d. Sales revenue

51. An auditor selects a sample from the file of shipping documents to determine whether

prepared. This test is performed to satisfy the audit objective of

a. Accuracy

b. Control

¢. Completeness

d. Existence

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Fredrick-TDocument7 pagesFredrick-TKathie AlegarmeNo ratings yet

- Douglas McGregors Theories X and YDocument1 pageDouglas McGregors Theories X and YKathie AlegarmeNo ratings yet

- BookDocument2 pagesBookKathie AlegarmeNo ratings yet

- 03 NFJPIA - 2223 - 15thNAQDown - Assigned Codes - Mindanao Hub - XLSX MINDANAO HUBDocument6 pages03 NFJPIA - 2223 - 15thNAQDown - Assigned Codes - Mindanao Hub - XLSX MINDANAO HUBKathie AlegarmeNo ratings yet

- Sunod Nani Na RRL Chapter 2Document19 pagesSunod Nani Na RRL Chapter 2Kathie AlegarmeNo ratings yet

- CELERIAN JournalDocument3 pagesCELERIAN JournalKathie AlegarmeNo ratings yet

- MONEBDocument9 pagesMONEBKathie AlegarmeNo ratings yet

- Alegarme, ENG 227 ACTIVITY 7Document3 pagesAlegarme, ENG 227 ACTIVITY 7Kathie AlegarmeNo ratings yet

- Research 10Document1 pageResearch 10Kathie AlegarmeNo ratings yet